Tax Payment Form Templates

Documents:

681

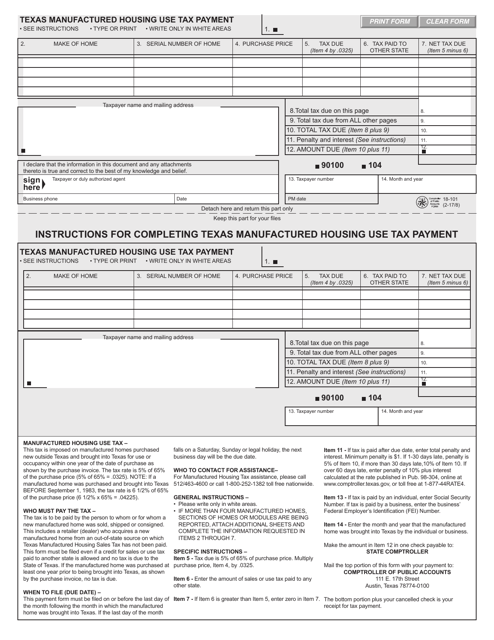

This form is used for making tax payments related to manufactured housing in the state of Texas.

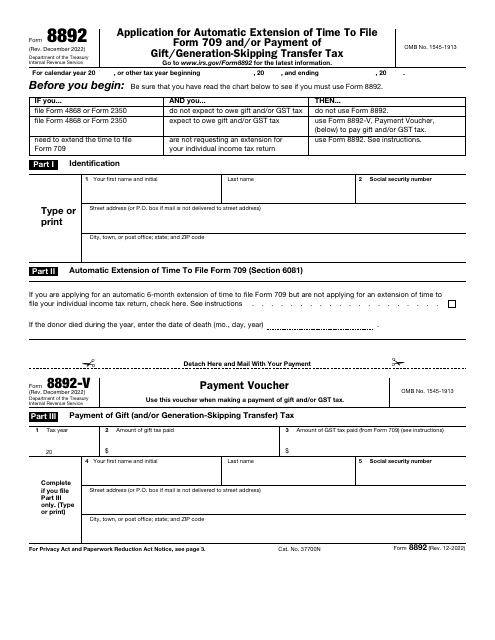

This is a fiscal document generally used by taxpayers in order to request six months of extra time to file IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return.

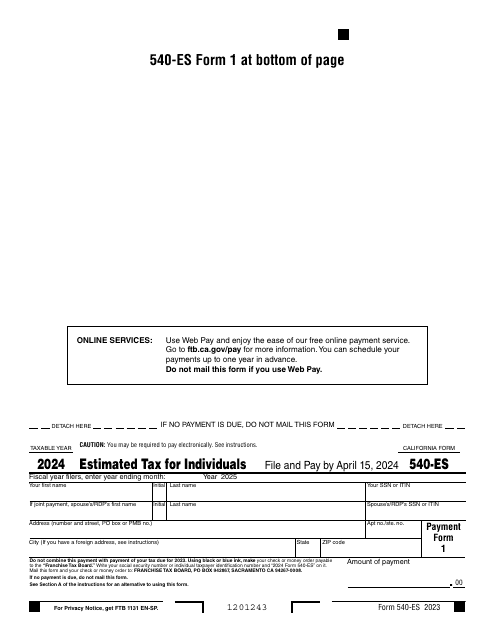

Fill out this form over the course of a year to pay your taxes in the state of California.

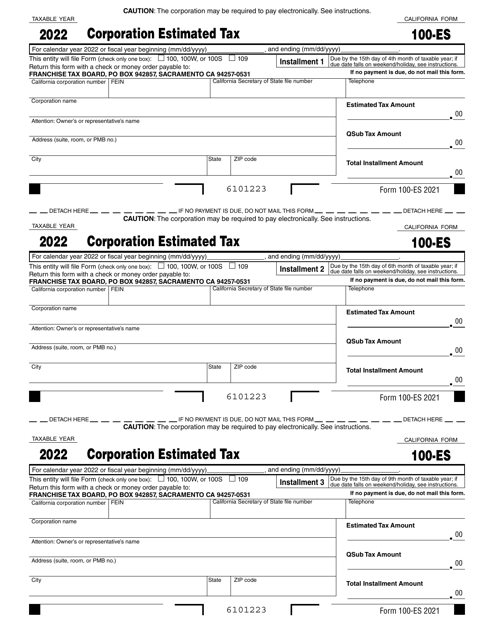

This is a legal document that various financial corporations based in California use to figure estimated tax for a corporation and then mail to the Franchise Tax Board to pay corporate income tax.

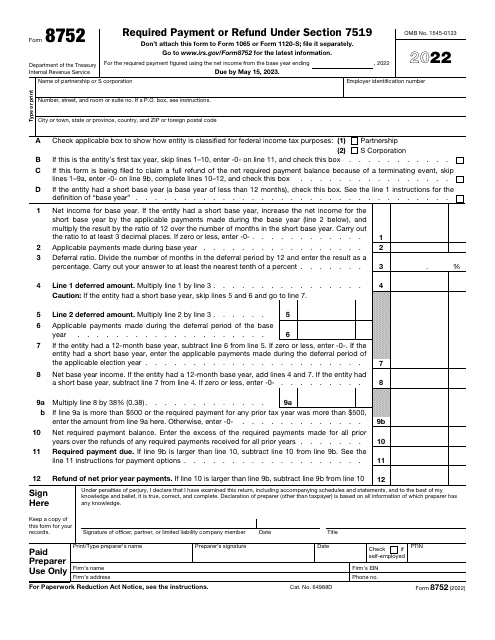

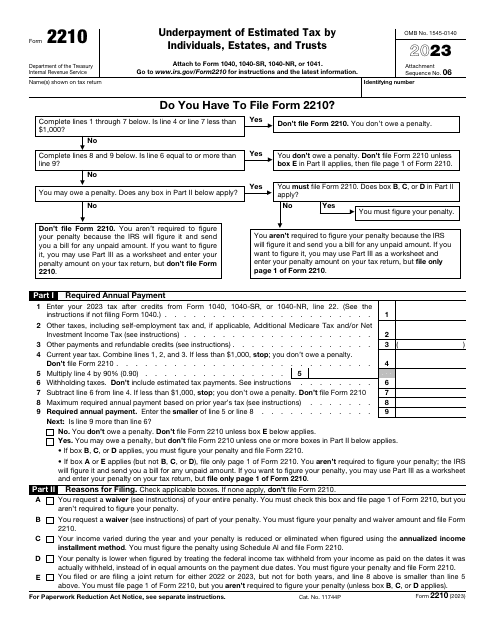

This is an IRS form completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations.

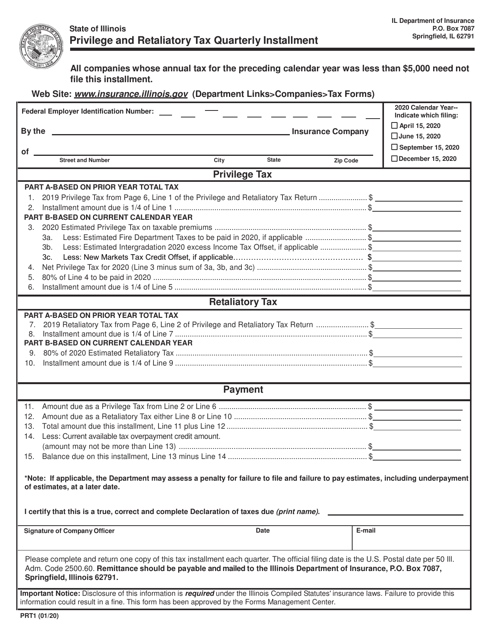

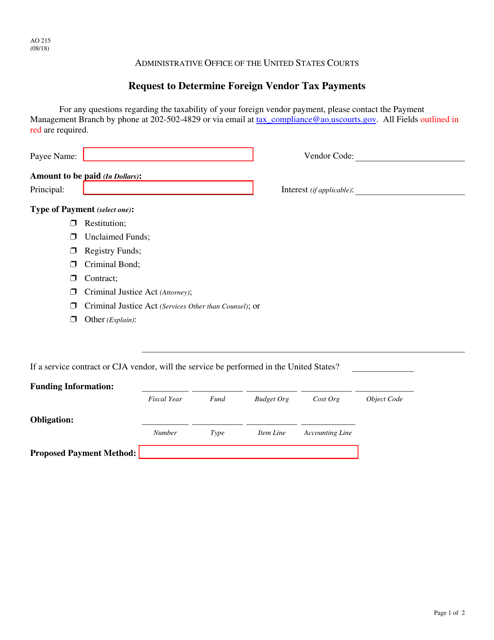

This Form is used for submitting quarterly installment payments for Privilege and Retaliatory Taxes in the state of Illinois.

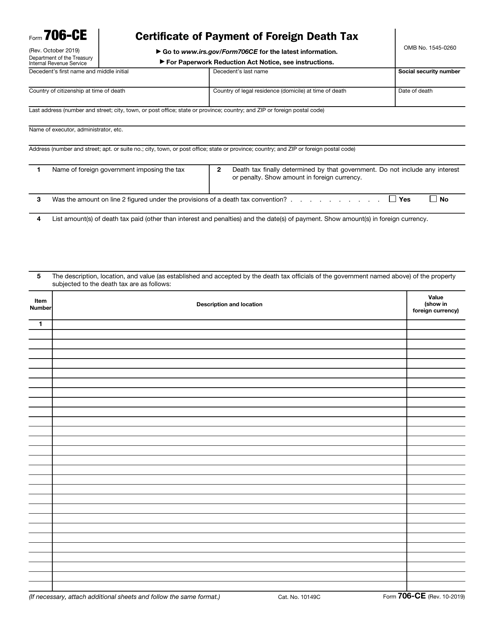

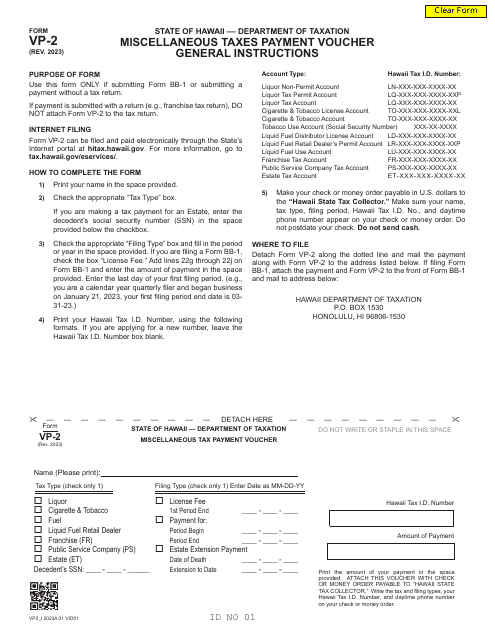

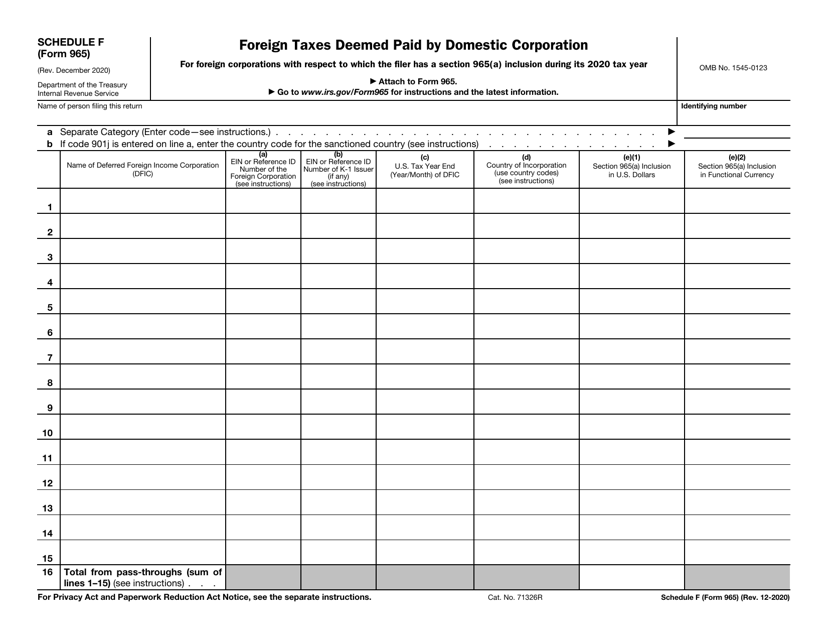

This form is used for requesting the determination of tax payments made by a foreign vendor.

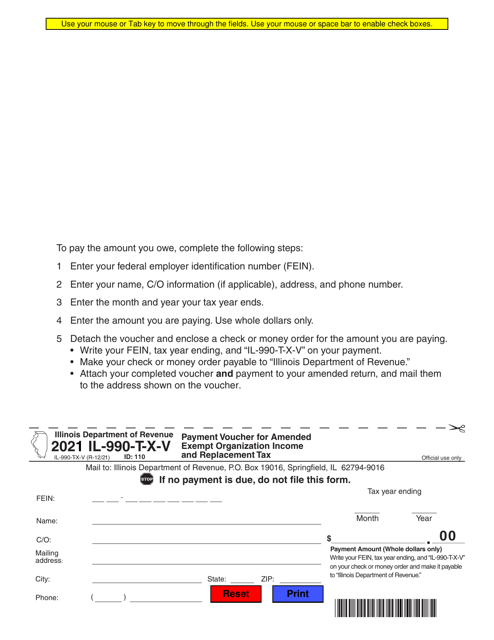

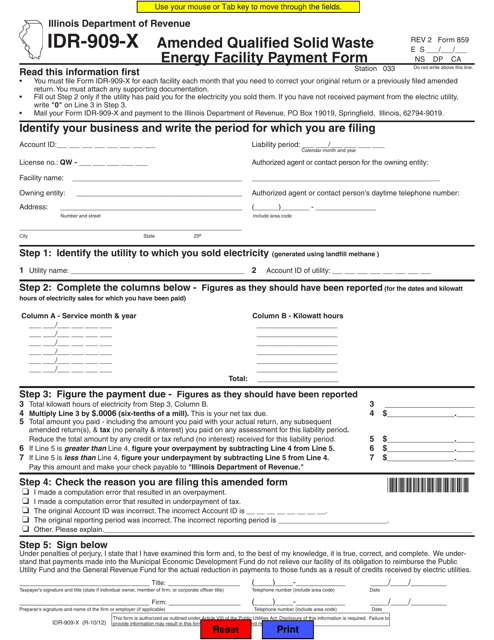

This Form is used for making an amendment to the Qualified Solid Waste Energy Facility Payment Form in the state of Illinois.

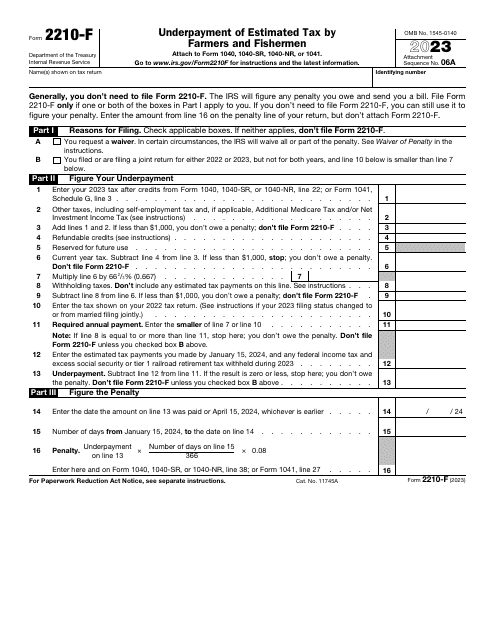

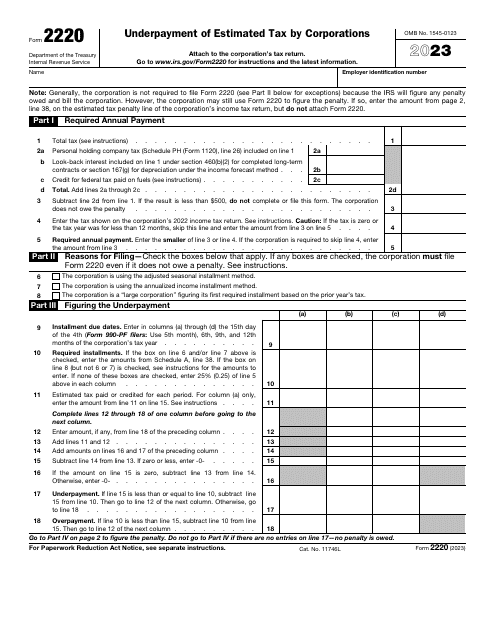

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

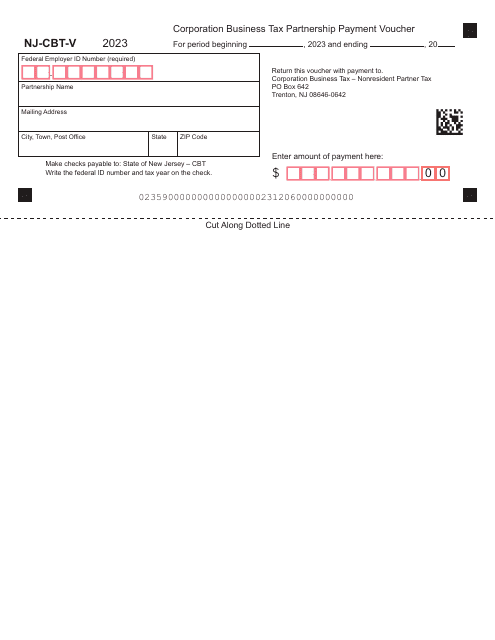

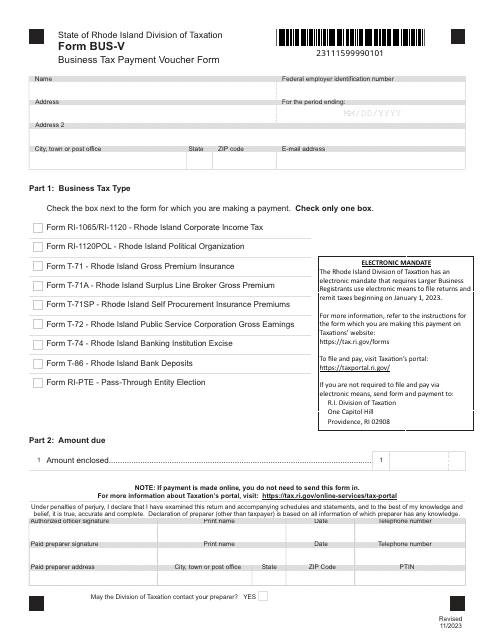

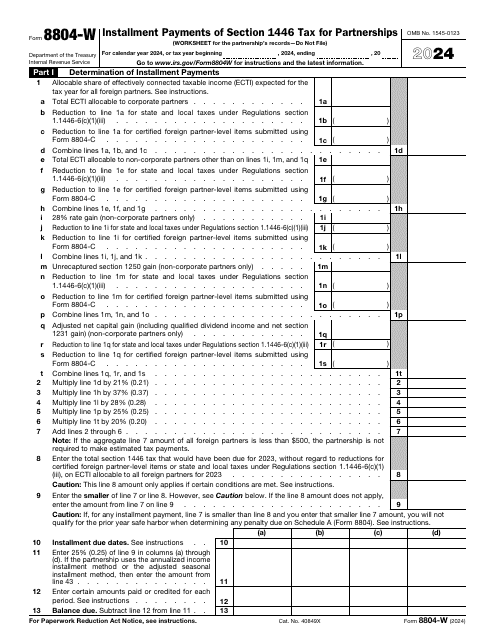

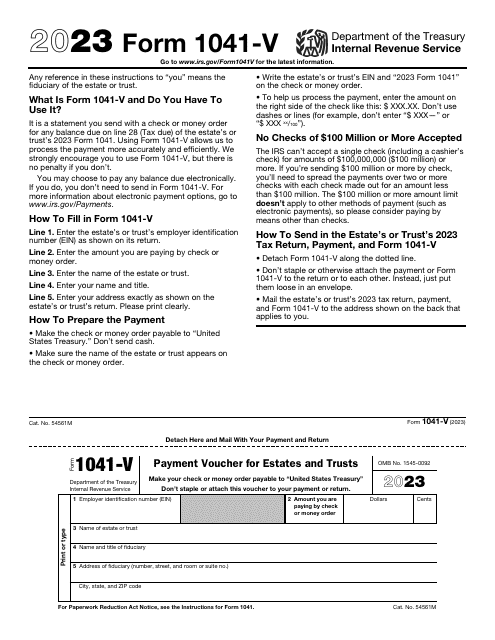

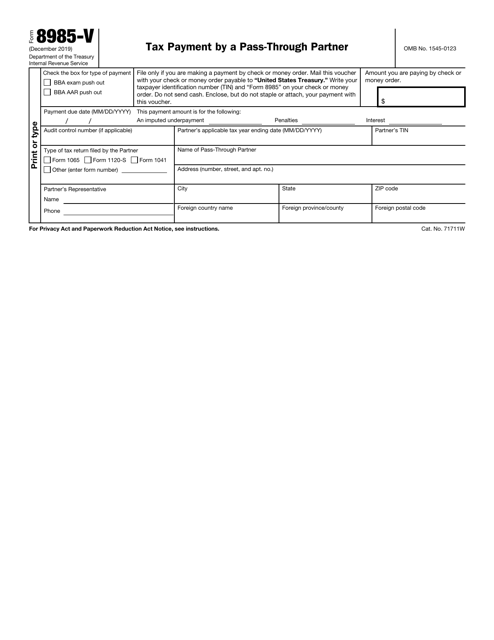

This Form is used for making tax payments by a pass-through partner to the IRS.