Tax Payment Form Templates

Documents:

681

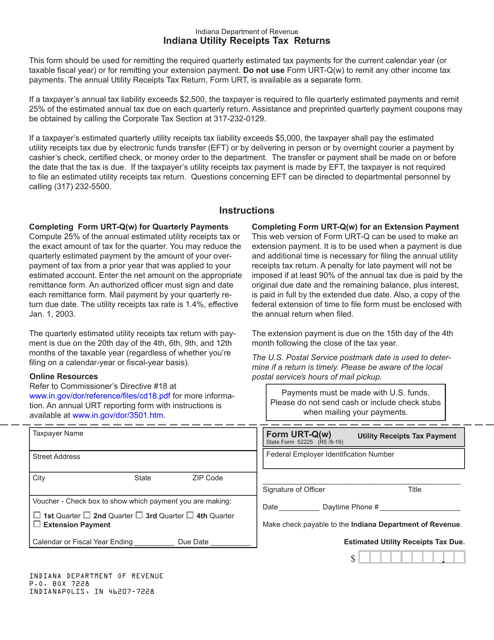

This Form is used for making Utility Receipts Tax payment in the state of Indiana.

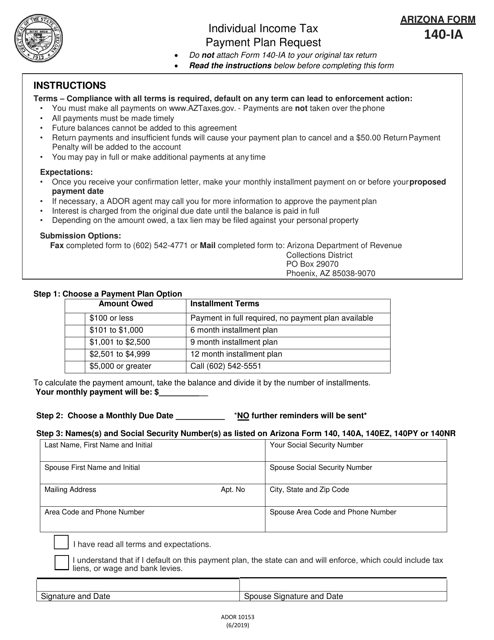

This Form is used for requesting an individual income tax payment plan in Arizona.

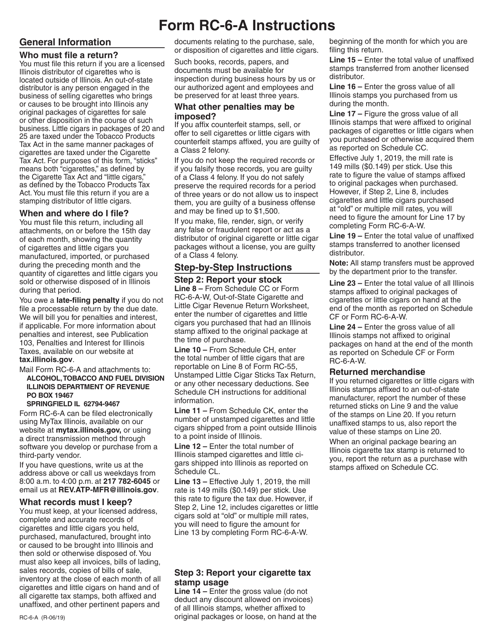

This Form is used for reporting cigarette and little cigar revenue generated out-of-state. It is specific to the state of Illinois.

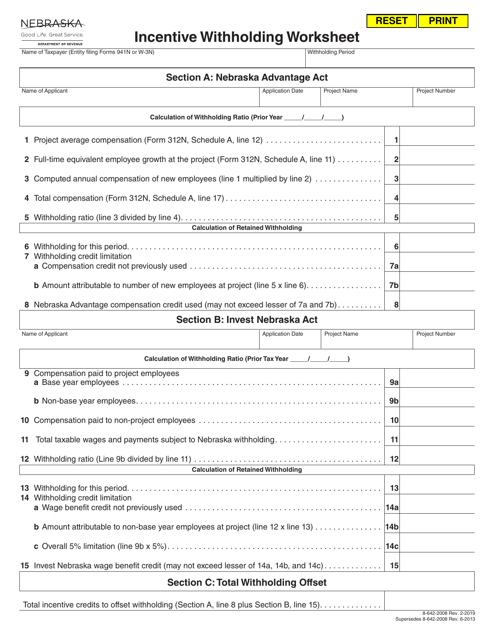

This document is used for calculating and withholding incentives in the state of Nebraska. It helps employers accurately determine the amount of incentives to withhold from employees' paychecks.

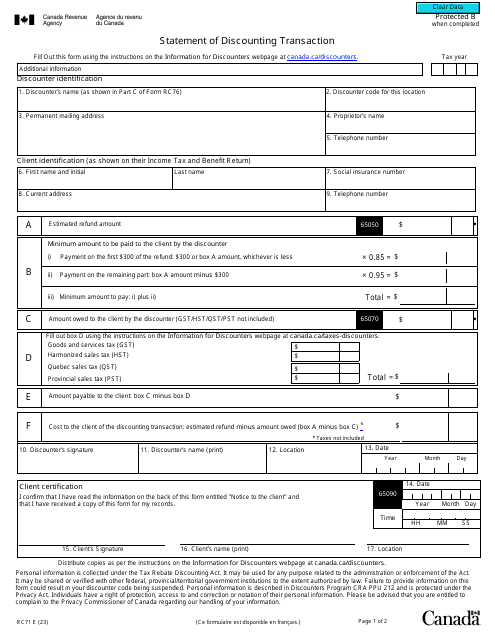

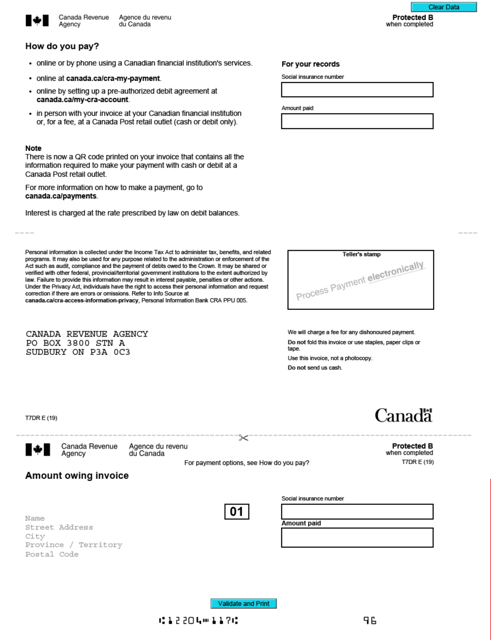

This form is used for making a payment to the Canada Revenue Agency when there is an amount owing on a tax return. It serves as a remittance voucher for submitting the payment.

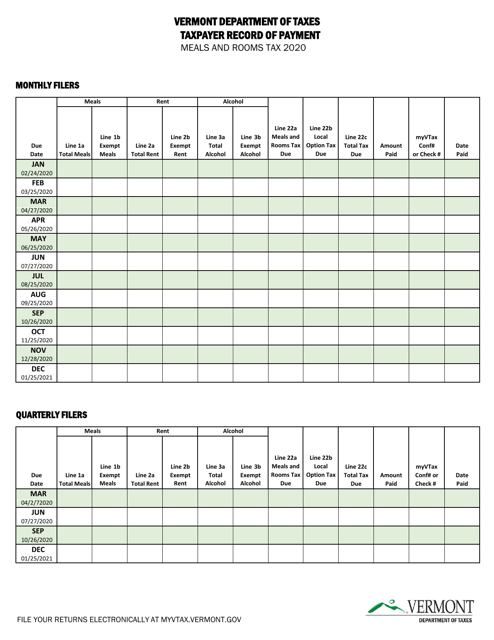

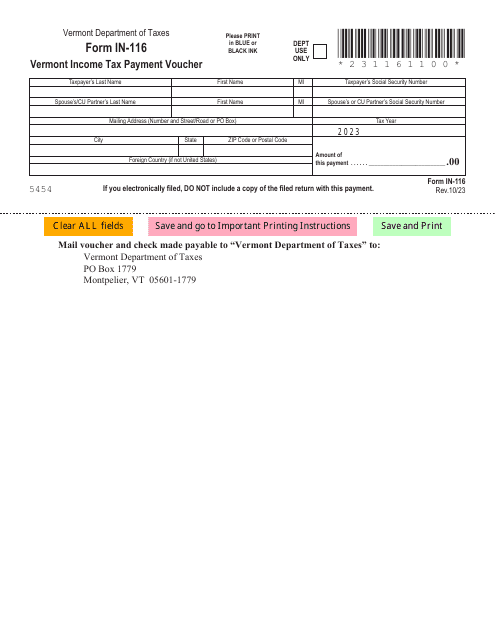

This document is used to record payments for the meals and rooms tax in the state of Vermont.

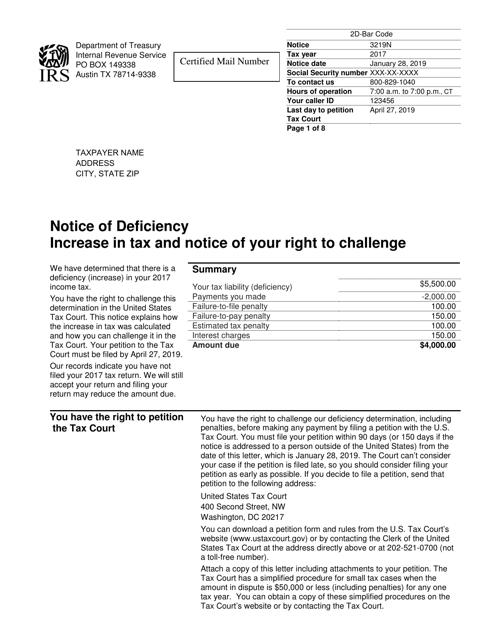

This document is a Notice of Deficiency from the Internal Revenue Service (IRS). It is sent to taxpayers who have underreported their income or have other tax liabilities. The notice provides information about the proposed changes to the tax return and the options available to the taxpayer to respond.

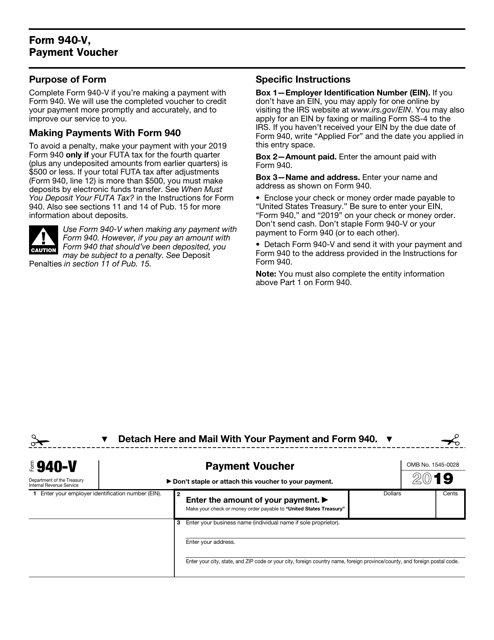

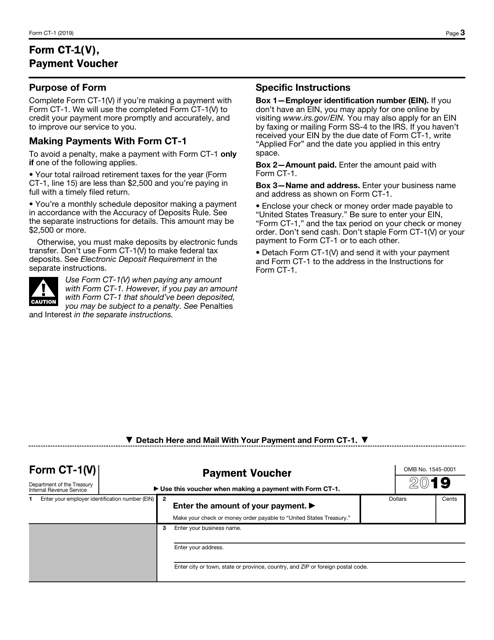

This form is used for submitting payment to the IRS for your Form 940 tax return.

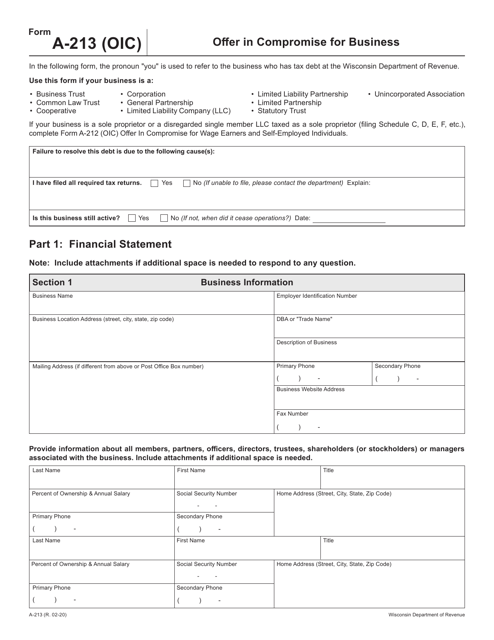

This form is used for making an offer in compromise for a business located in Wisconsin.

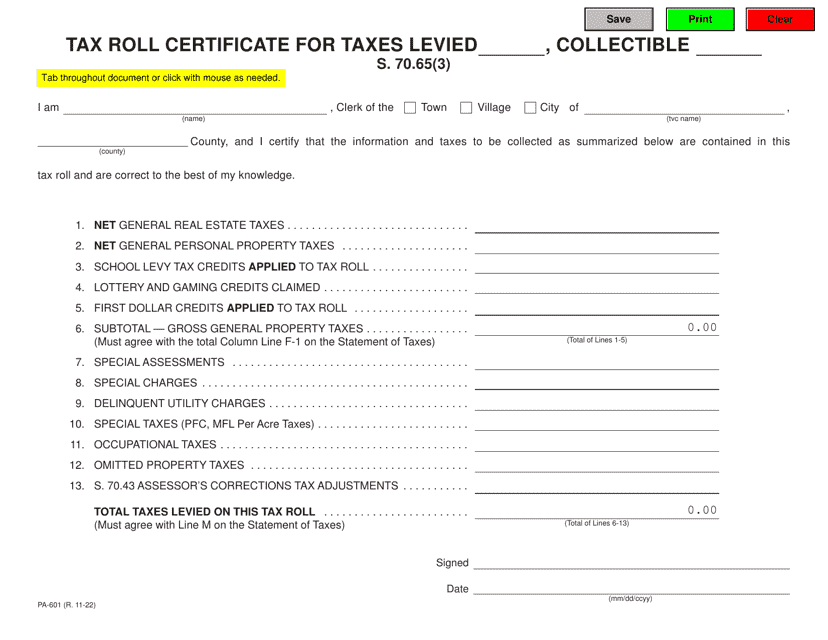

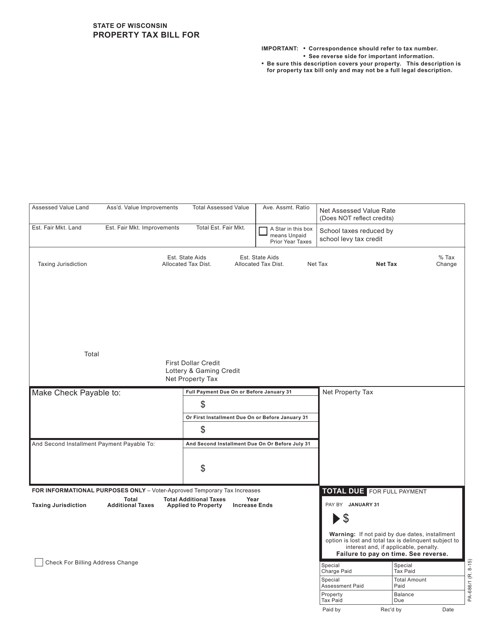

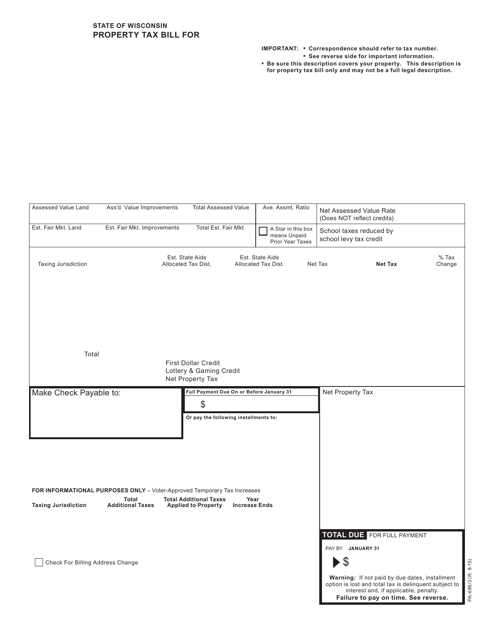

This form is used to send property tax bills to residents in Wisconsin.

This form is used for paying property tax bills in the state of Wisconsin.

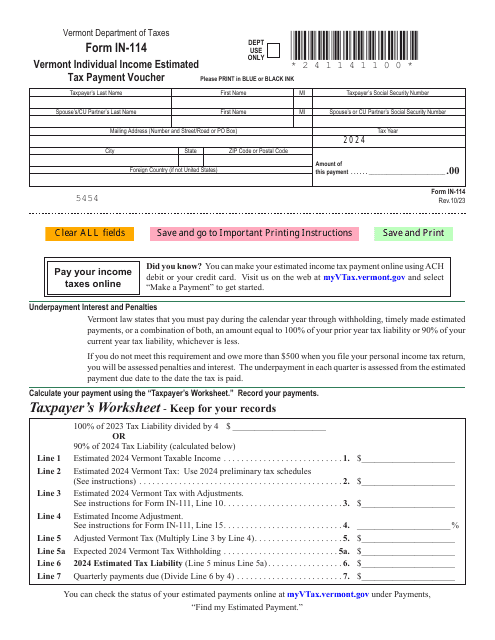

Instructions for Form IN-114 Vermont Individual Income Estimated Tax Payment Voucher - Vermont, 2024

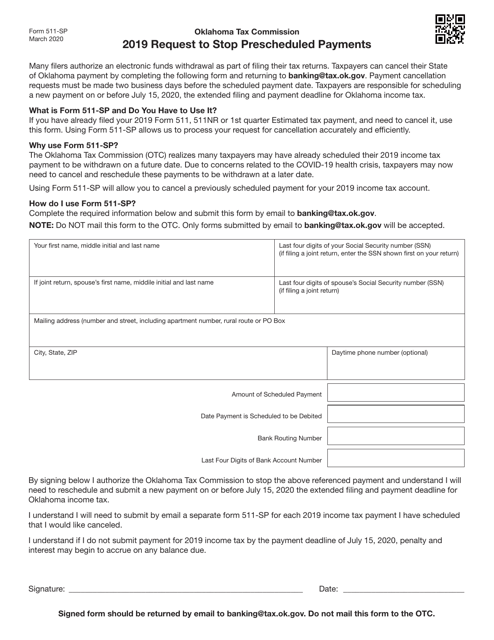

This Form is used for requesting to stop prescheduled payments in the state of Oklahoma. It is used to halt any automatic payments that have been set up.

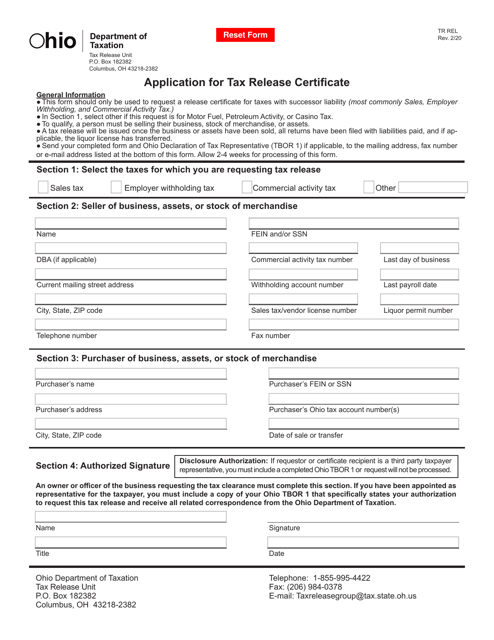

This form is used for acquiring a tax release certificate in Ohio. It helps individuals to request the release of their tax liabilities.