Tax Payment Form Templates

Documents:

681

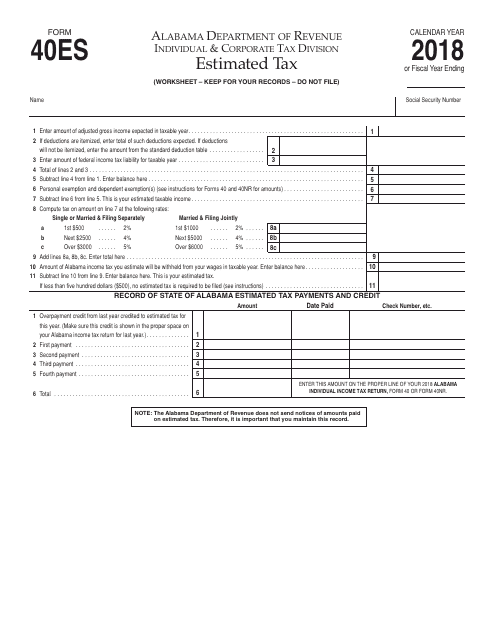

This form is used for individuals in Alabama to report and pay estimated taxes.

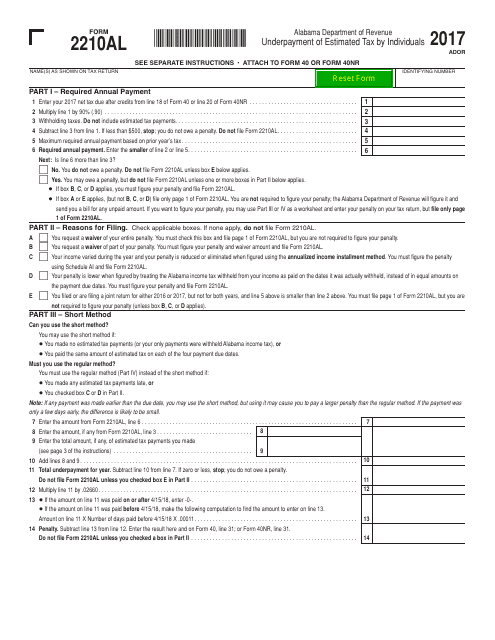

This form is used for reporting underpayment of estimated tax by individuals in Alabama.

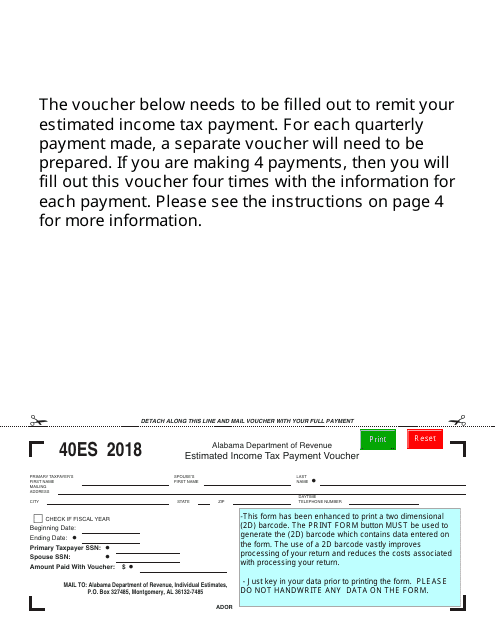

This form is used for making estimated income tax payments in Alabama.

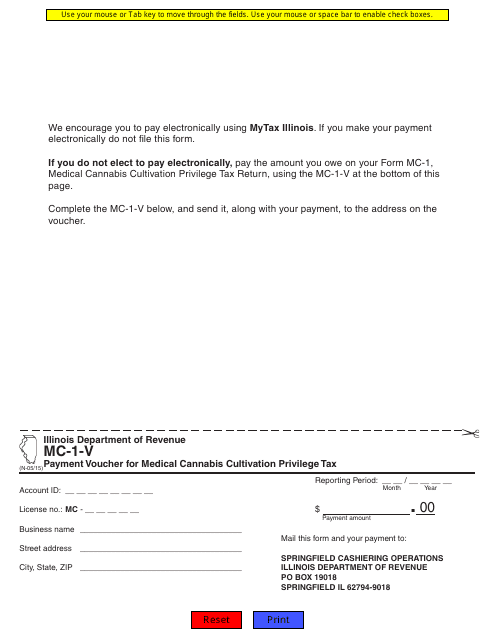

This form is used for submitting payment vouchers for the medical cannabis cultivation privilege tax in Illinois. It is specifically for individuals or businesses involved in the cultivation of medical cannabis and is used to report and remit the tax owed to the state.

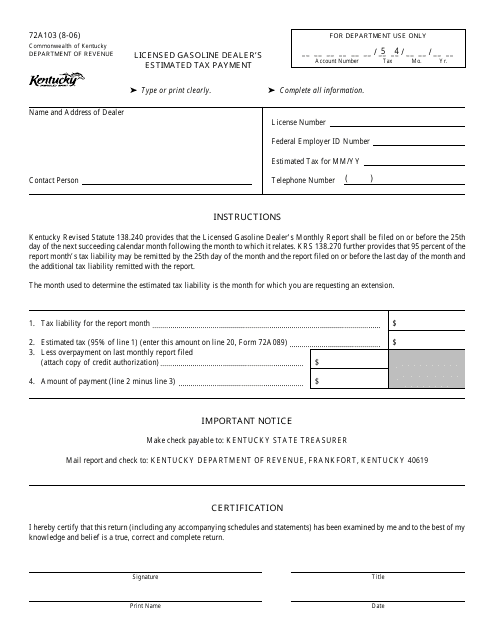

This form is used for licensed gasoline dealers in Kentucky to make estimated tax payments.

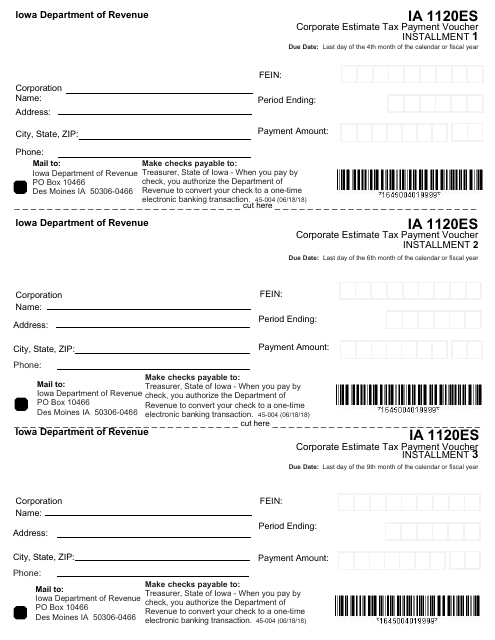

This form is used for making estimated tax payments by corporations in Iowa.

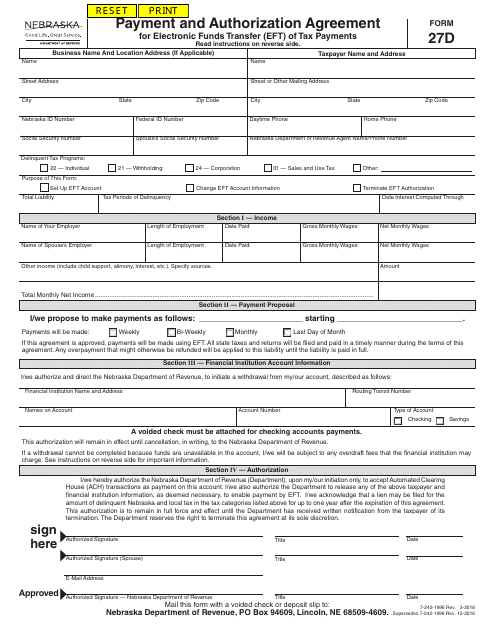

This form is used for authorizing electronic funds transfer for tax payments in Nebraska.

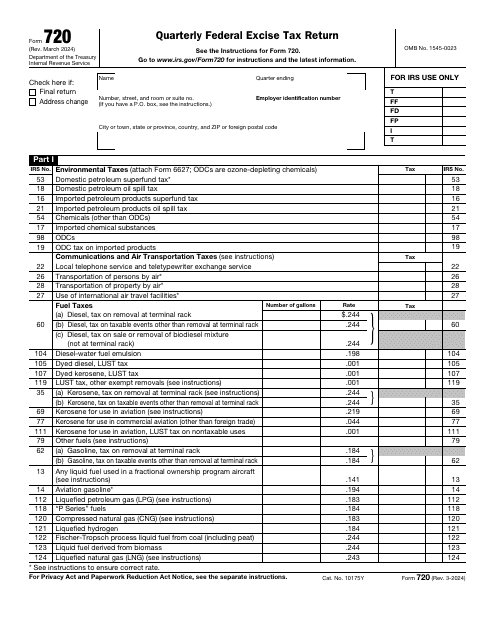

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

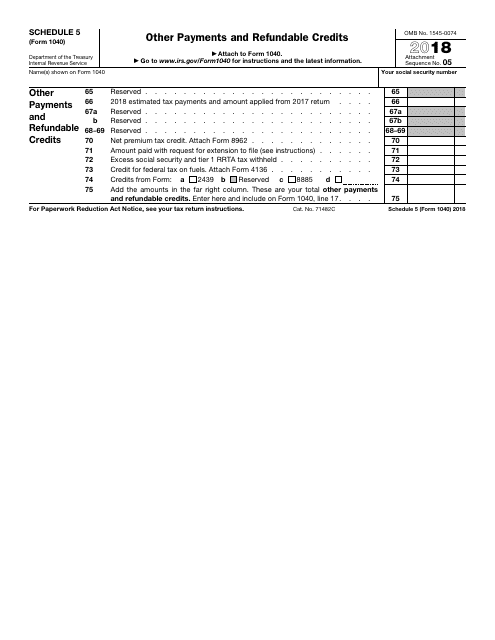

This form is used for reporting other types of payments and refundable credits that are not included in the standard IRS Form 1040.

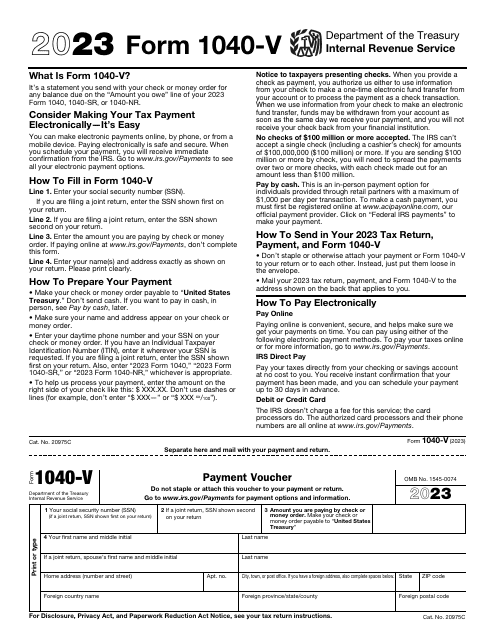

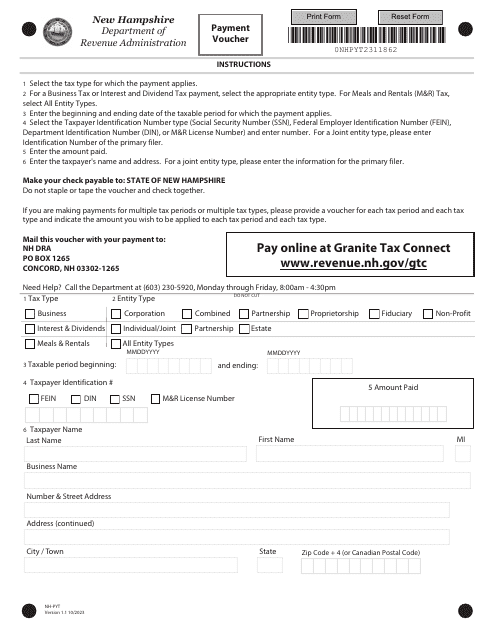

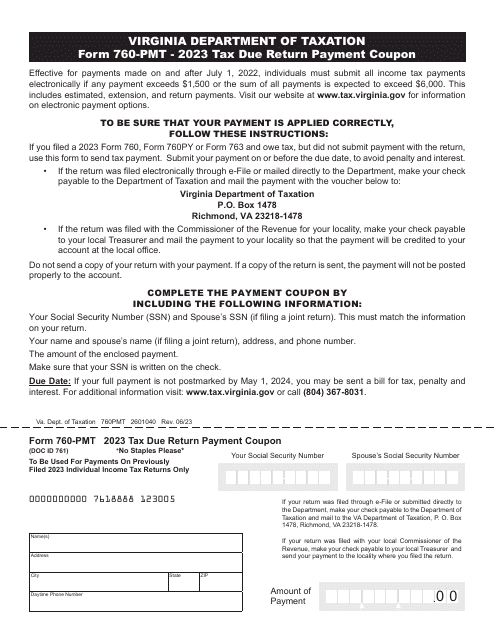

This is a supplementary document completed by taxpayers that chose to fulfill their financial obligations to fiscal organizations with the help of a check or money order.

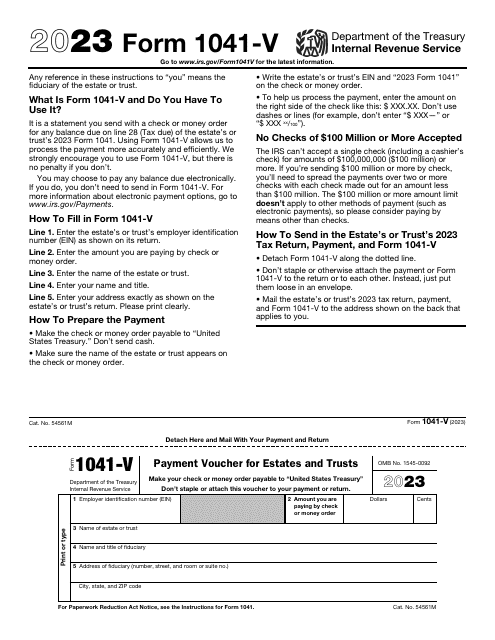

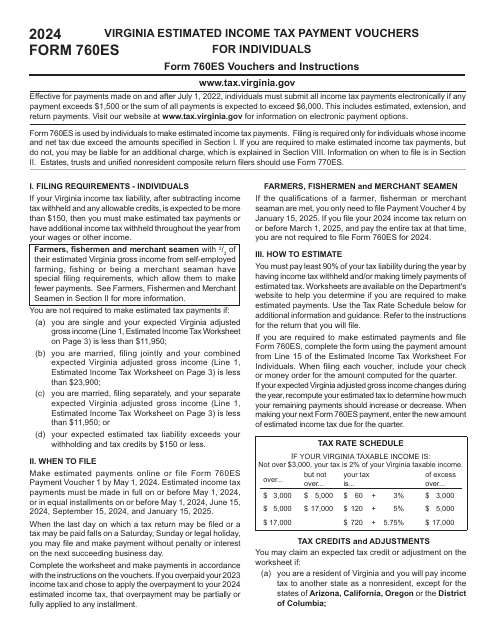

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

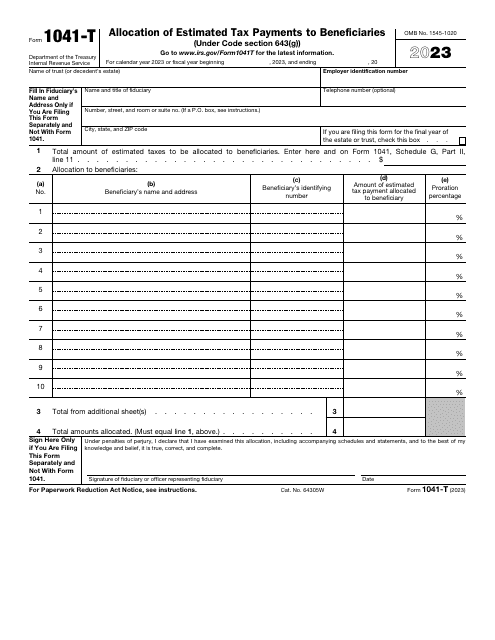

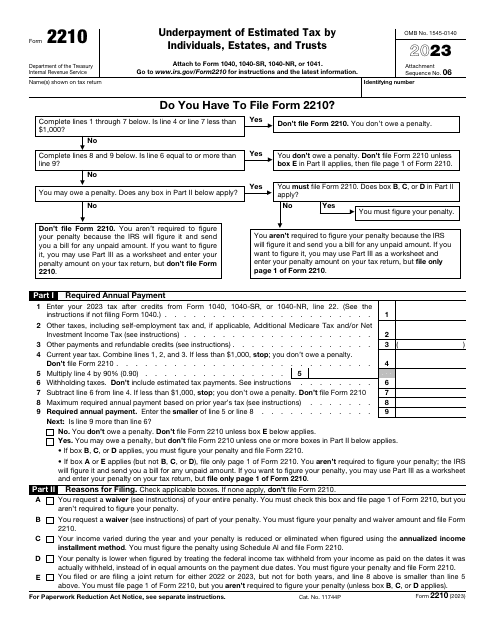

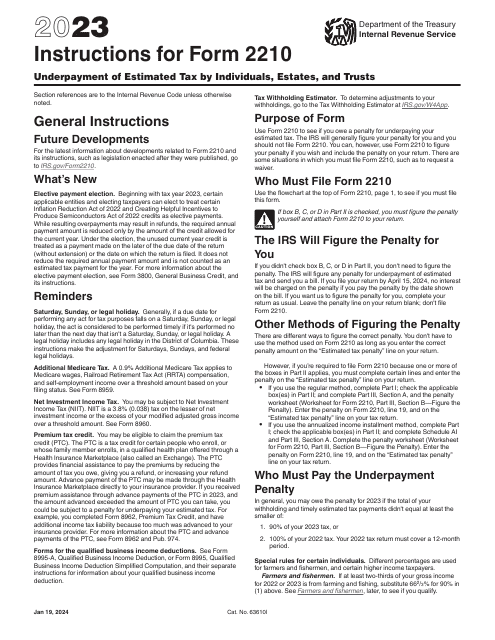

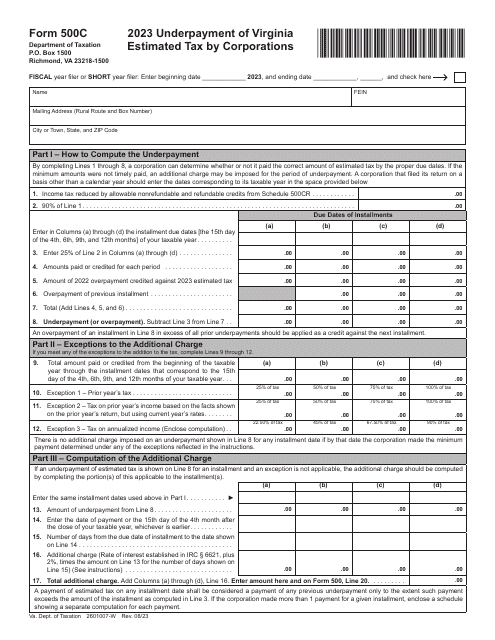

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

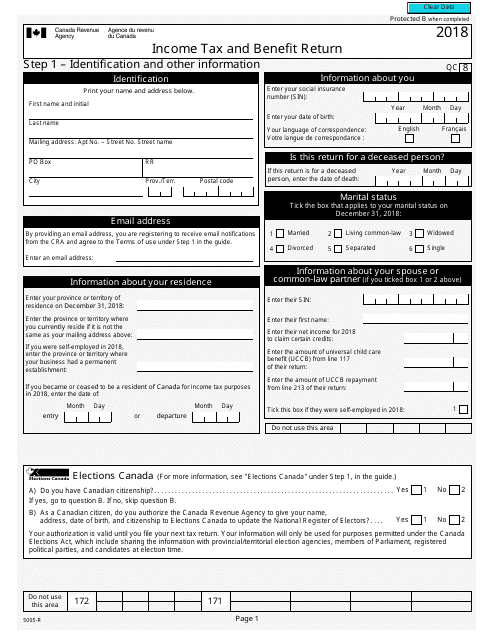

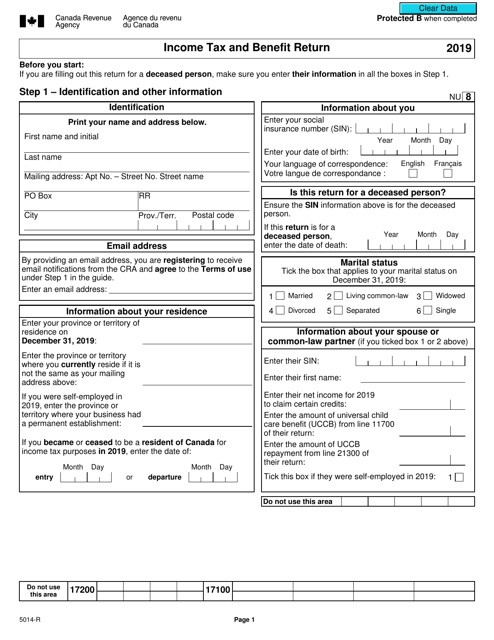

This Form is used for filing your annual income tax and benefit return in Canada. It helps you report your income, claim deductions and credits, and calculate your tax payable or refund.

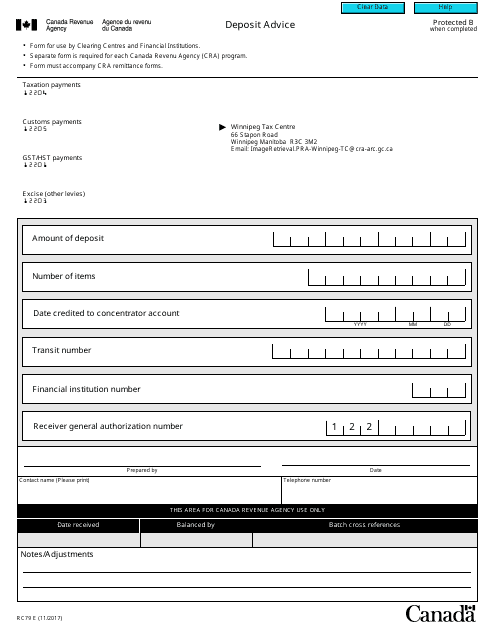

This form is used for providing a deposit advice to individuals or organizations in Canada. It contains information about the deposited amount, the recipient, and other relevant details.

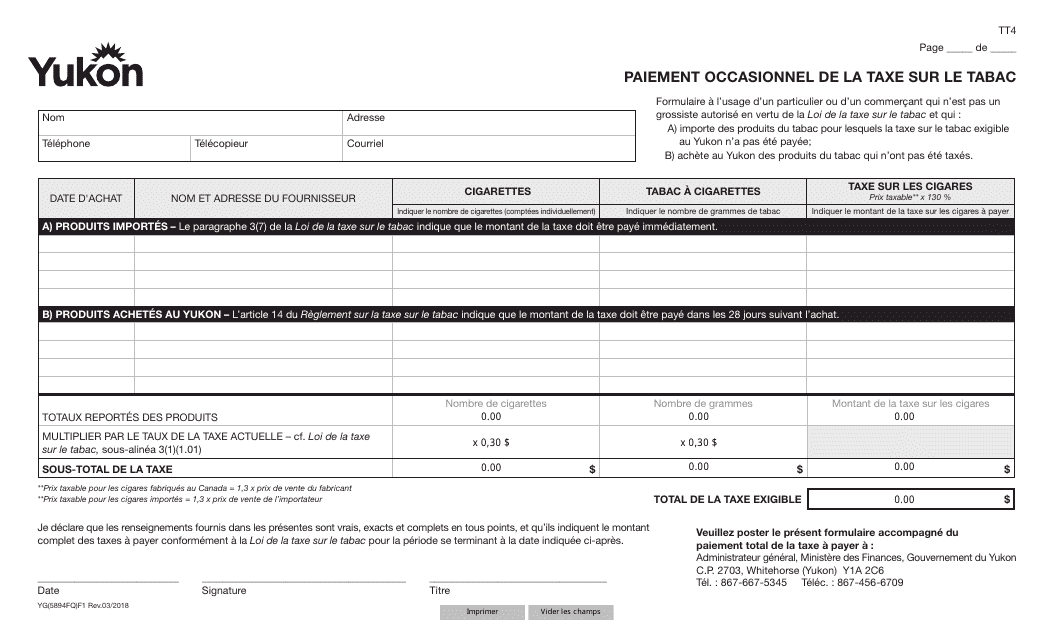

This document is used for making occasional tobacco tax payments in Yukon, Canada. (French)

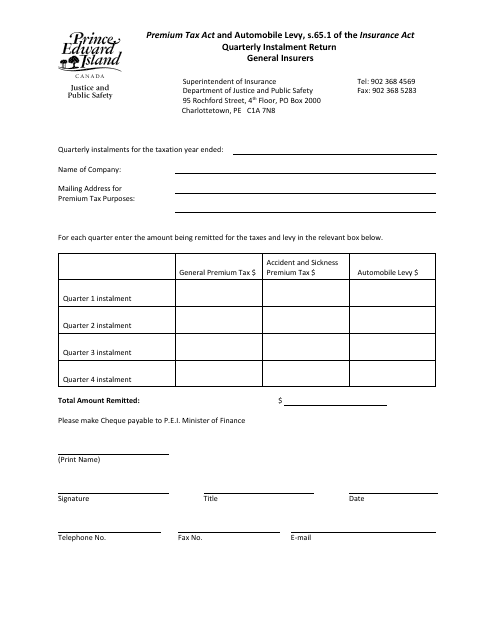

This document is used by businesses in Prince Edward Island, Canada to report their quarterly instalment payments to the government. It is a form that helps businesses calculate and remit the amount they owe for income tax or sales tax on a quarterly basis.

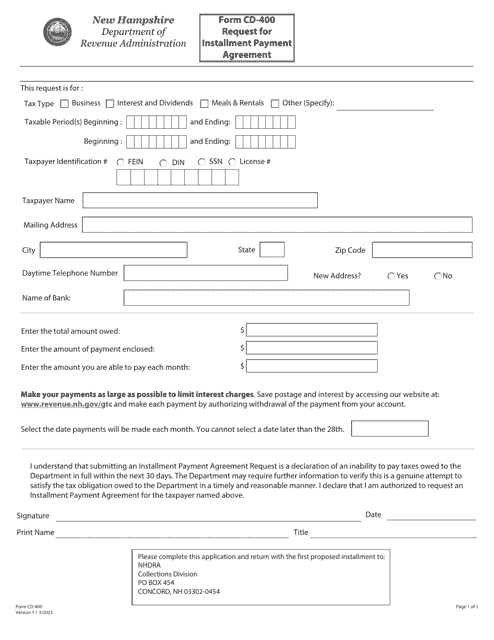

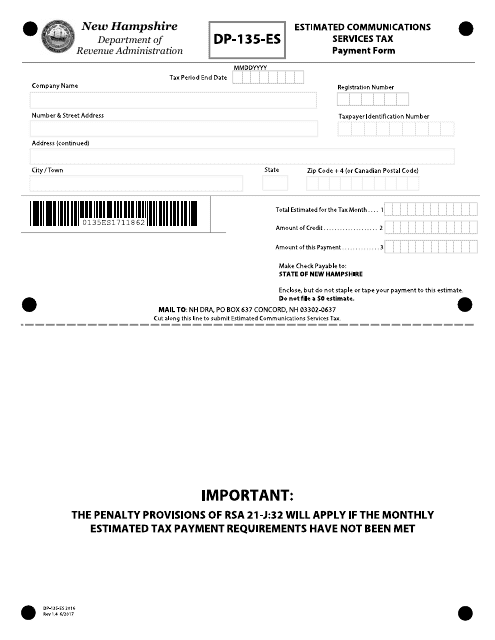

This Form is used for making estimated communications services tax payments in the state of New Hampshire.

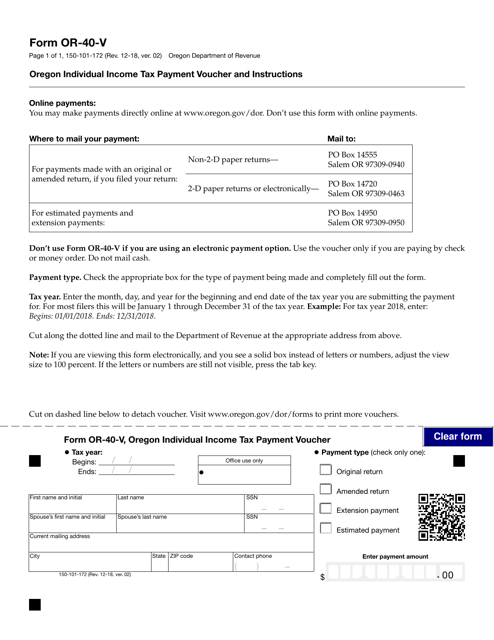

This form is used for making individual income tax payments in the state of Oregon.

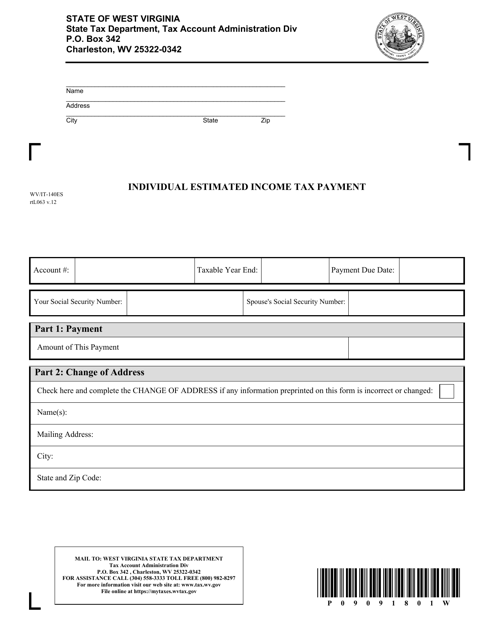

This Form is used for making estimated income tax payments for individuals in West Virginia.

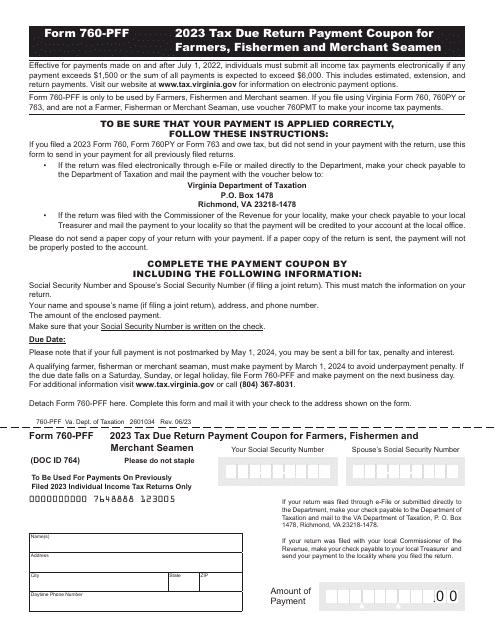

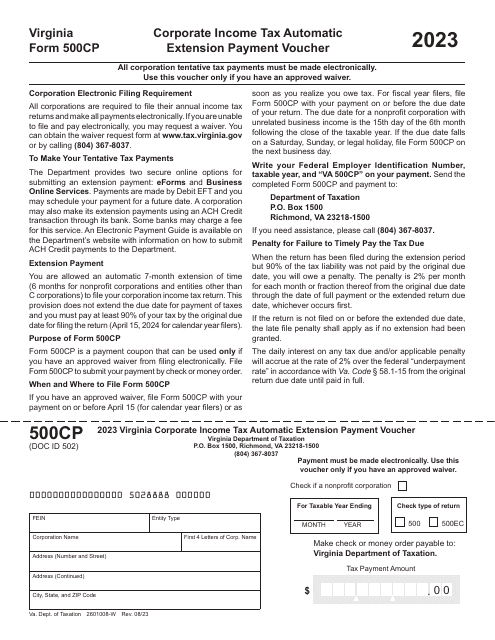

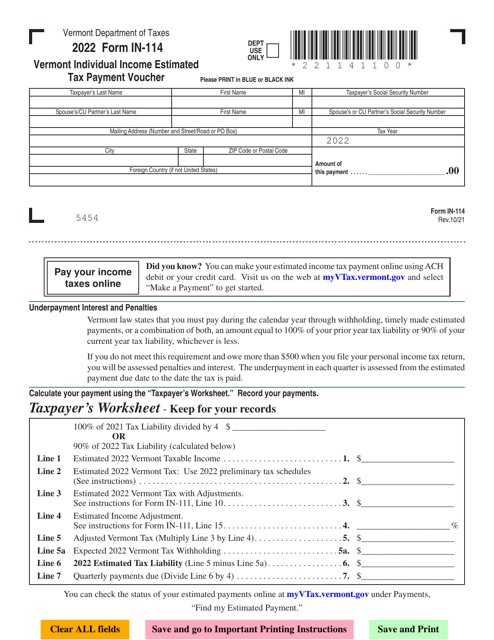

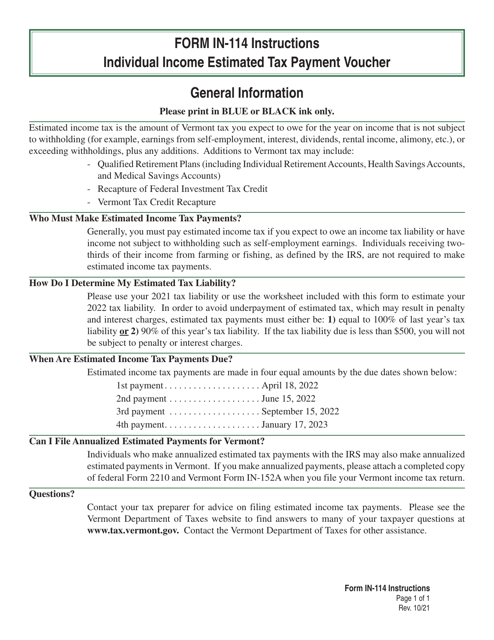

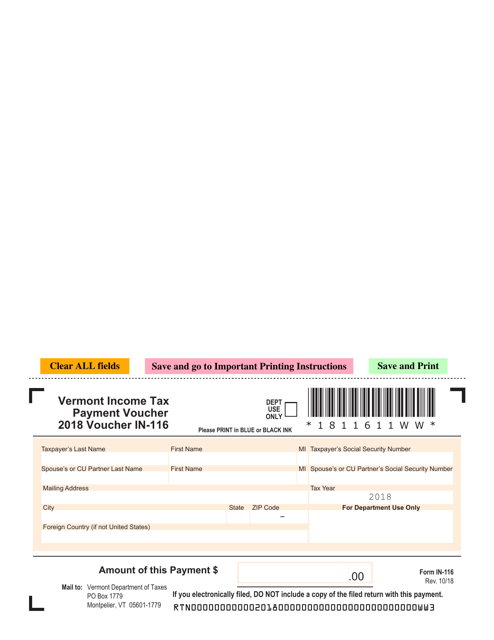

This document is used for making income tax payments in the state of Vermont.

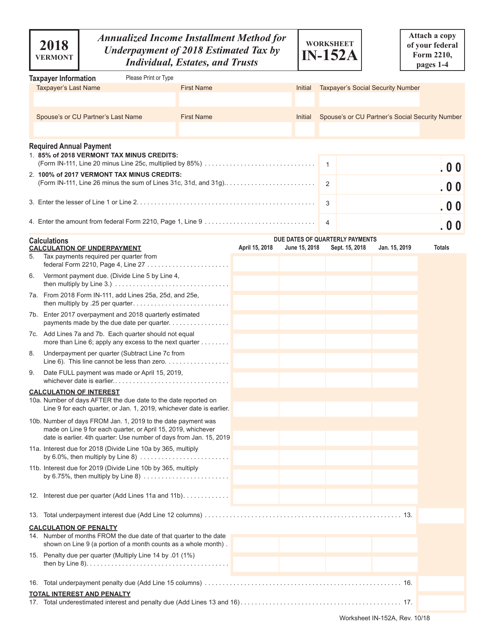

This document is a worksheet that individuals, estates, and trusts in Vermont can use to calculate their annualized income installment for the underpayment of estimated tax for the year 2018. It helps determine if any additional tax needs to be paid to avoid penalties.