Tax Payment Form Templates

Documents:

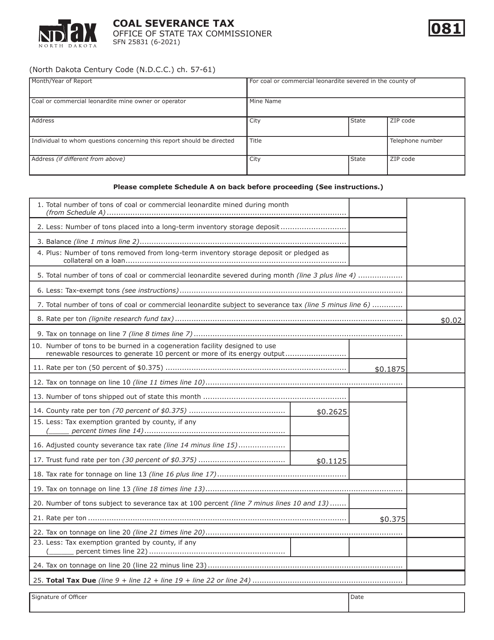

681

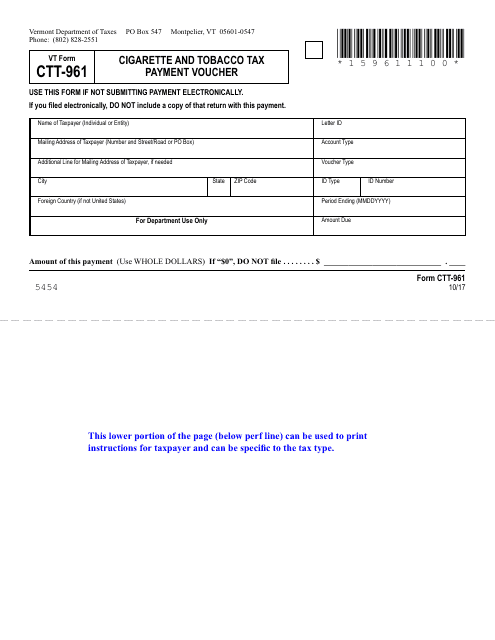

This form is used for making cigarette and tobacco tax payments in Vermont.

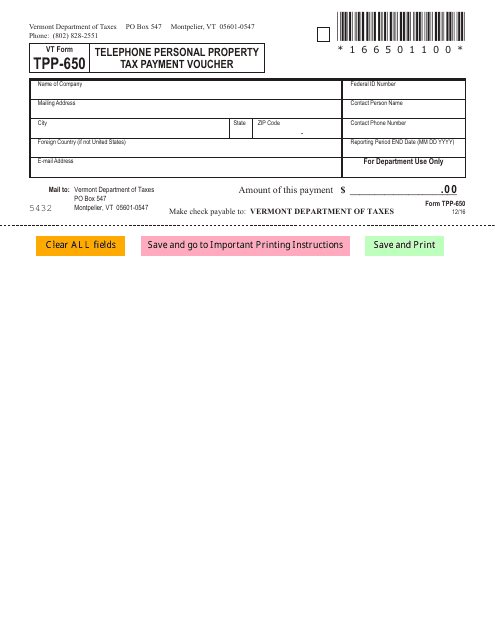

This Form is used for making telephone personal property tax payments in the state of Vermont.

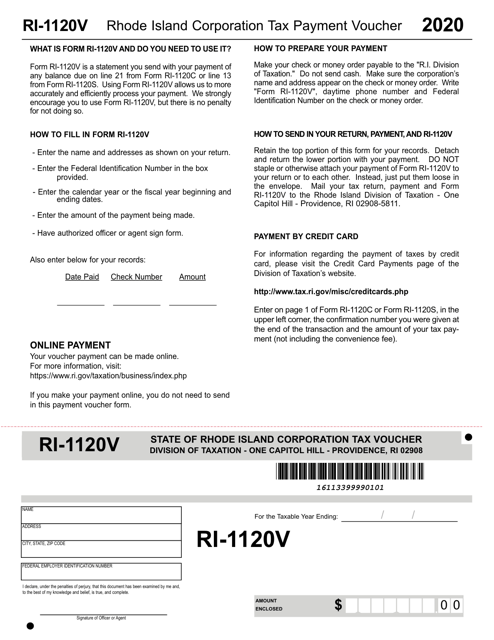

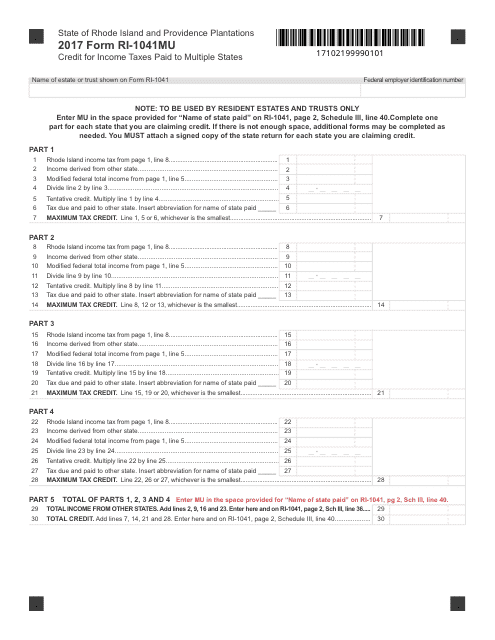

This form is used for claiming a credit for income taxes paid to multiple states when filing taxes in Rhode Island.

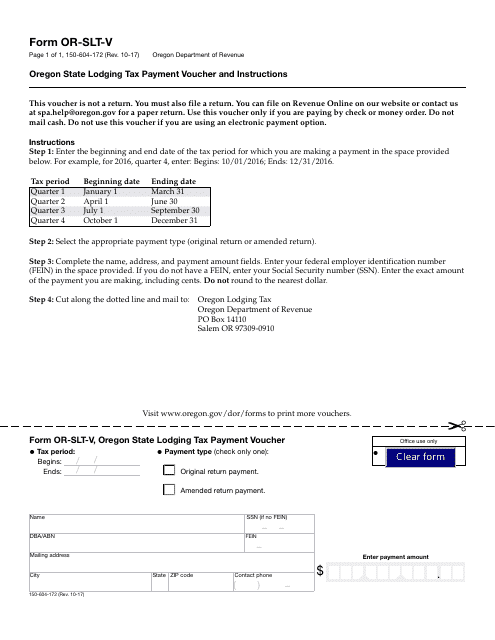

This Form is used for making lodging tax payments in the state of Oregon. It includes instructions on how to fill out the form and submit the payment.

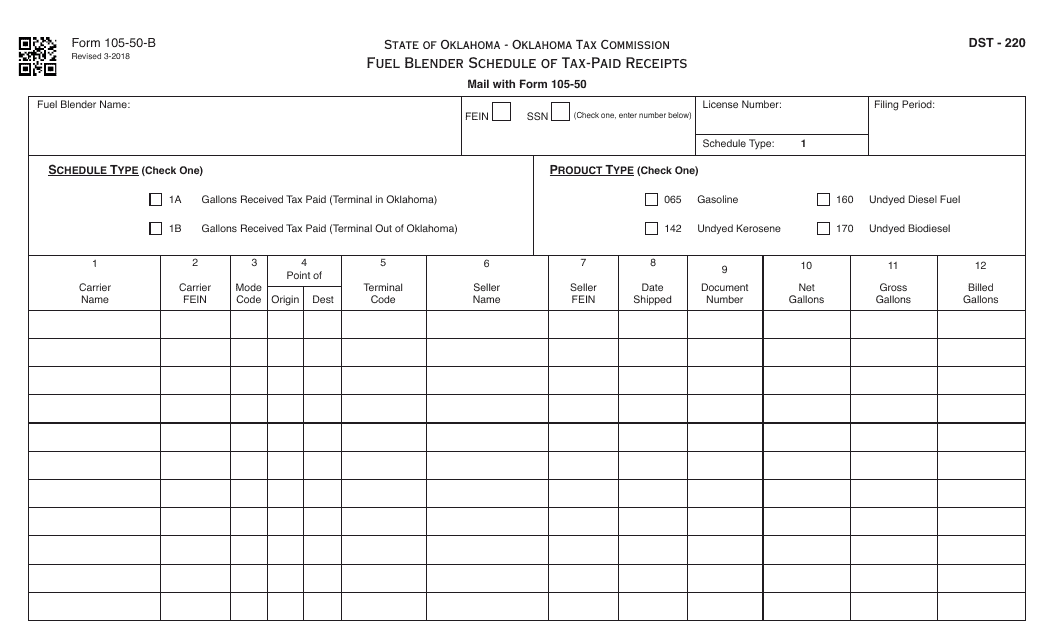

This form is used for reporting tax-paid receipts for fuel blending in Oklahoma.

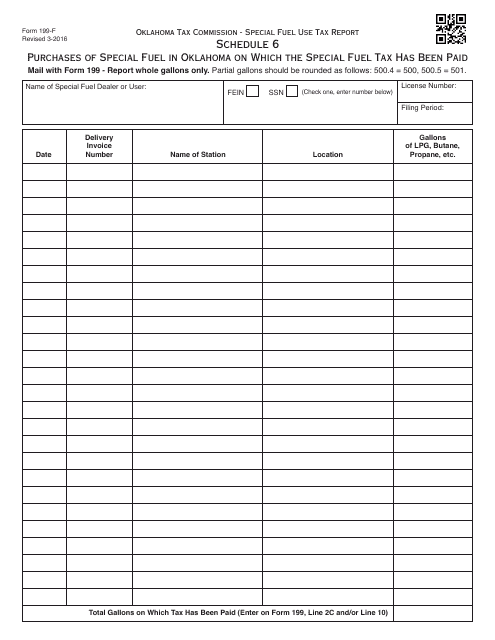

This form is used for reporting purchases of special fuel in Oklahoma on which the special fuel tax has already been paid.

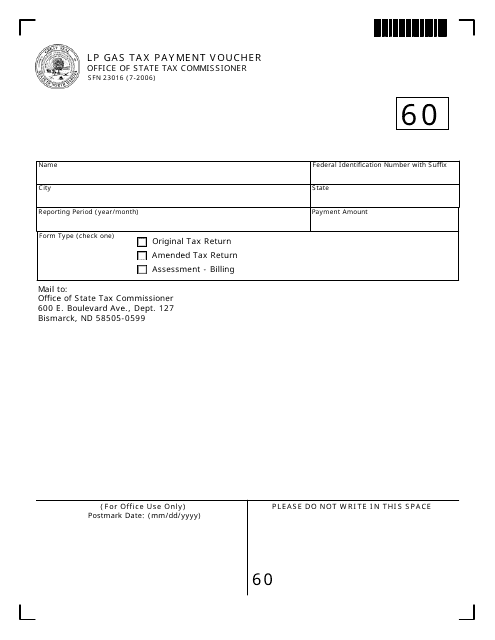

This form is used for making LP gas tax payments in North Dakota.

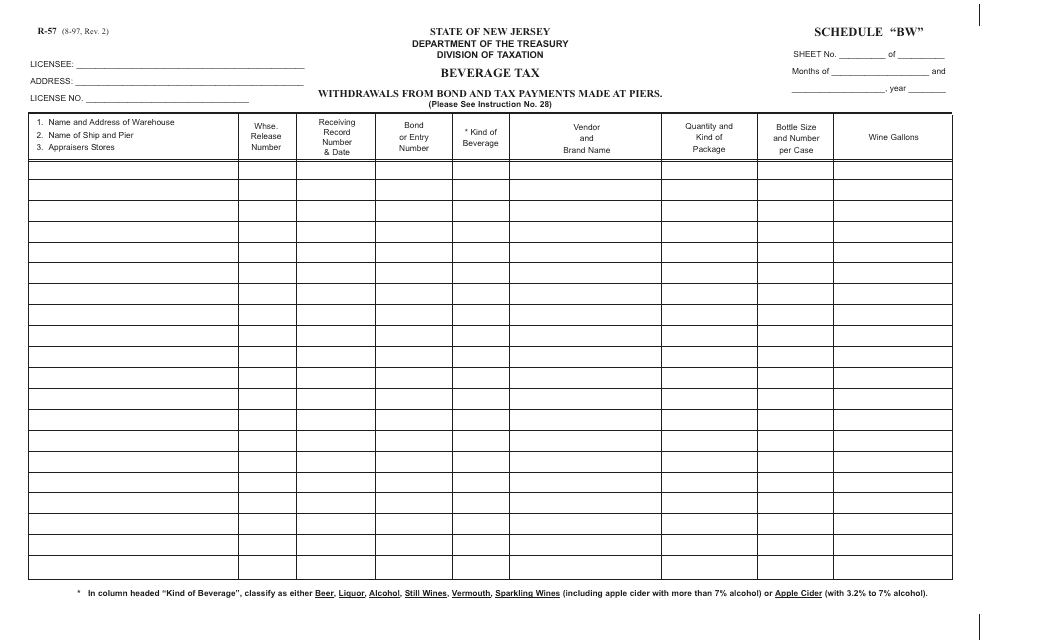

This Form is used for reporting withdrawals from bonds and tax payments made at piers in New Jersey.

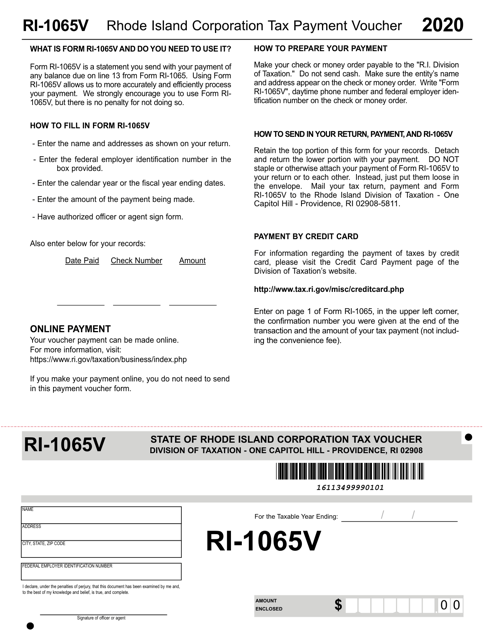

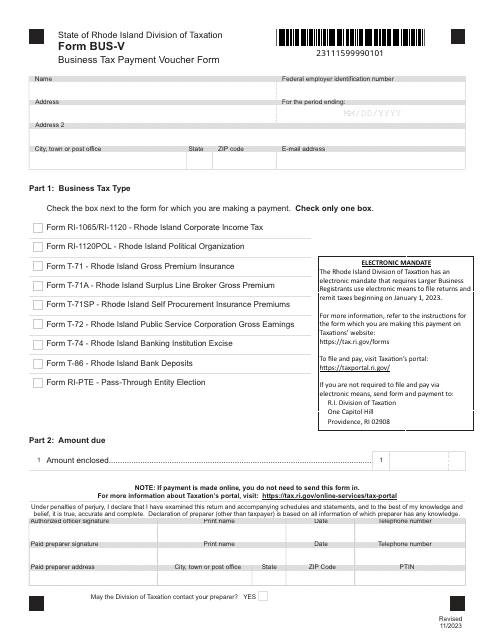

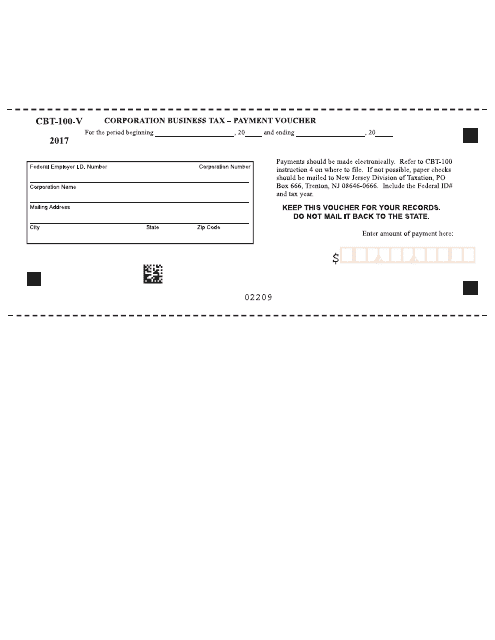

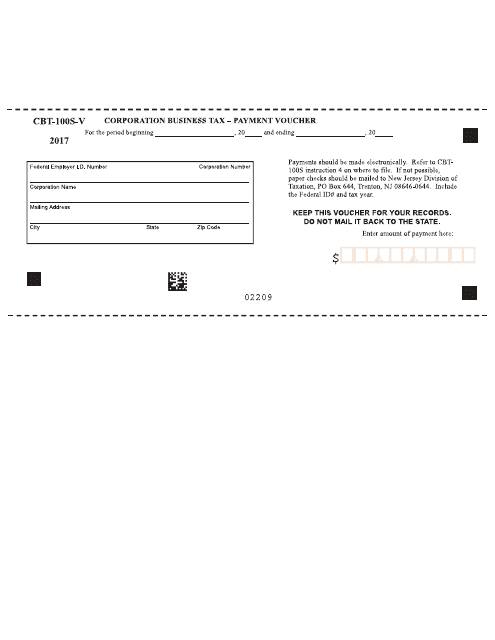

This document is a payment voucher for corporations to pay their business tax in the state of New Jersey.

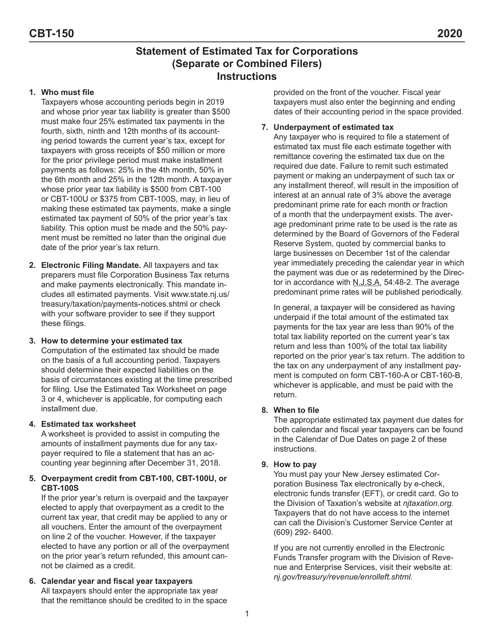

This form is used for making payments towards corporation business tax in the state of New Jersey.

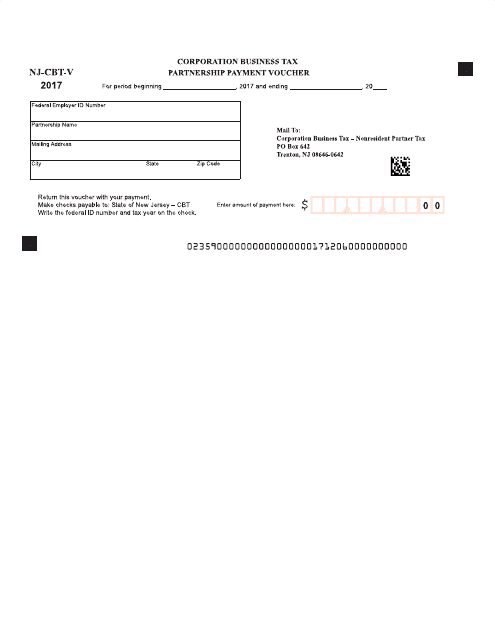

This form is used for making payment vouchers for partnerships in the state of New Jersey

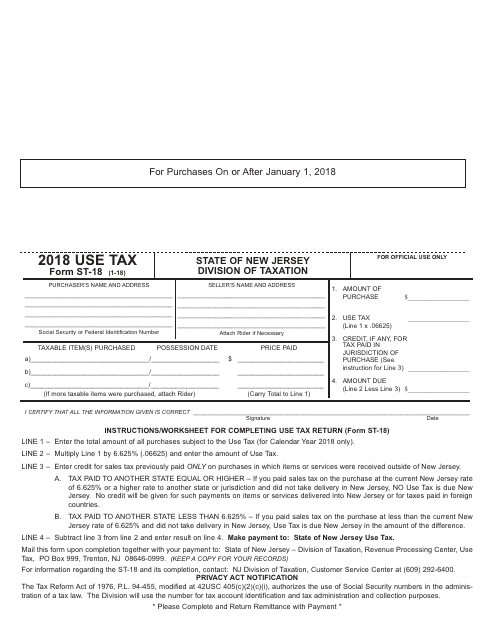

This form is used for reporting and paying use tax in the state of New Jersey. Use tax is a tax on goods purchased out-of-state and used within New Jersey. Use this form to calculate and remit the appropriate tax amount.

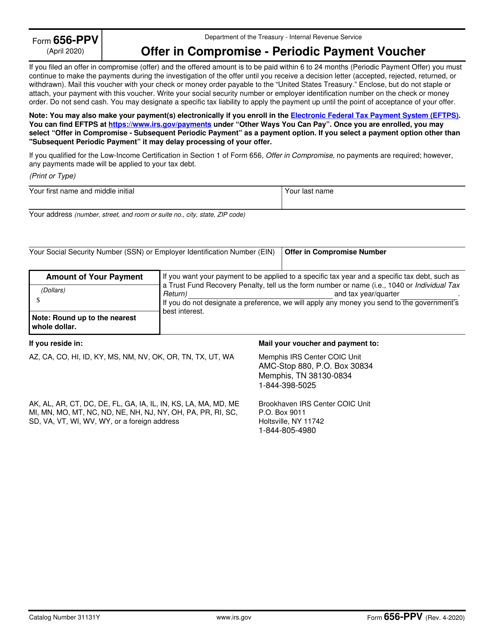

This form is used for the Offer in Compromise Program in the state of Louisiana. It allows taxpayers to settle their tax debts with the state for a reduced amount.

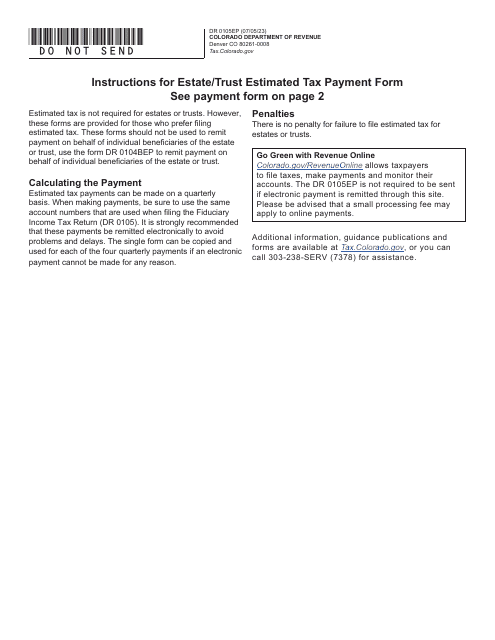

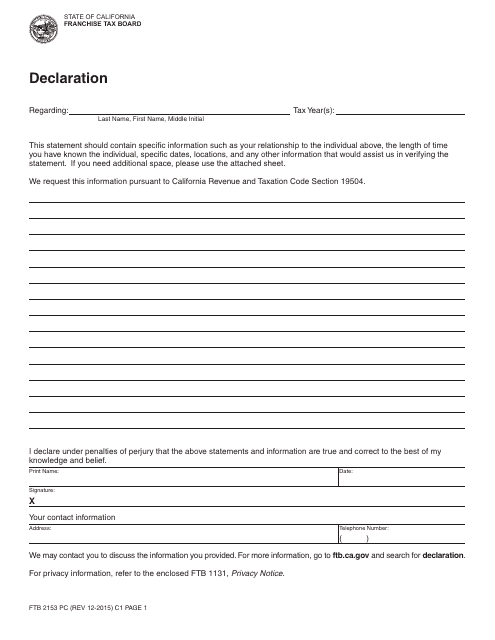

This form is used for filing a declaration of payment and/or communication of your personal income tax with the California Franchise Tax Board.

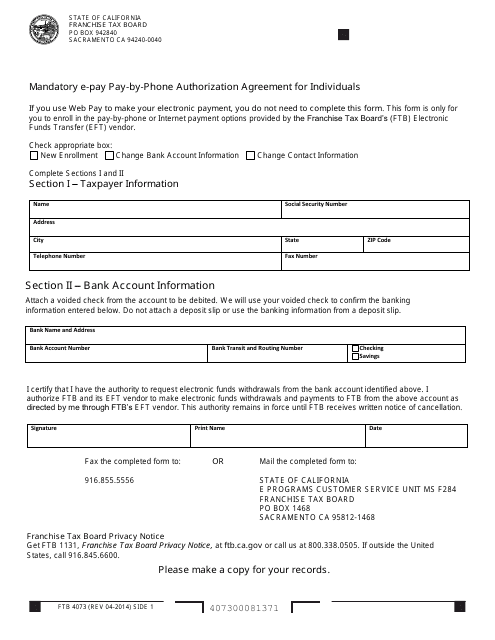

This form is used for individuals in California to authorize mandatory electronic payments via phone.

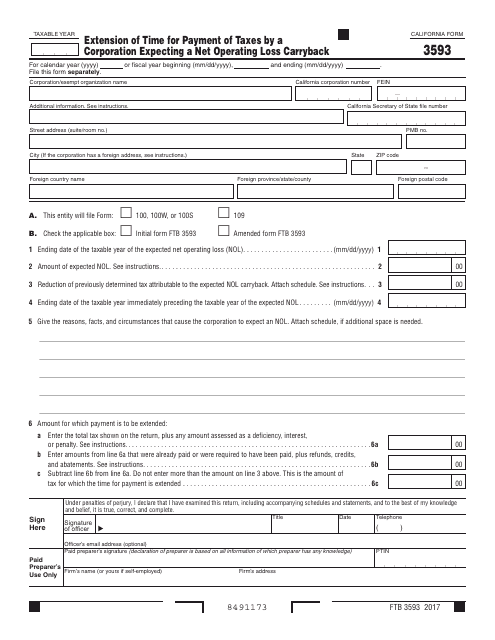

This form is used for corporations in California that are expecting a net operating loss carryback and need an extension of time to pay their taxes.

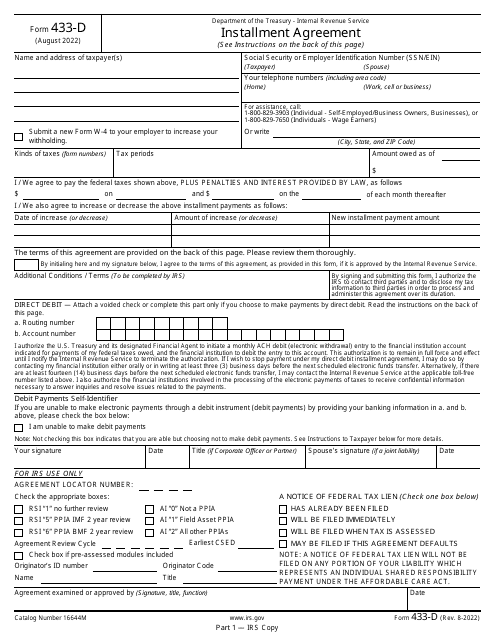

This is a fiscal form used by a taxpayer to express their intention to pay off their tax debt via a direct debit payment.

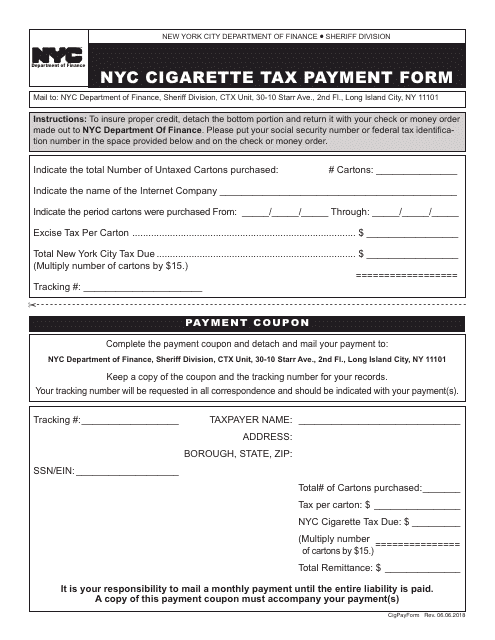

This form is used for making cigarette tax payments in New York City.

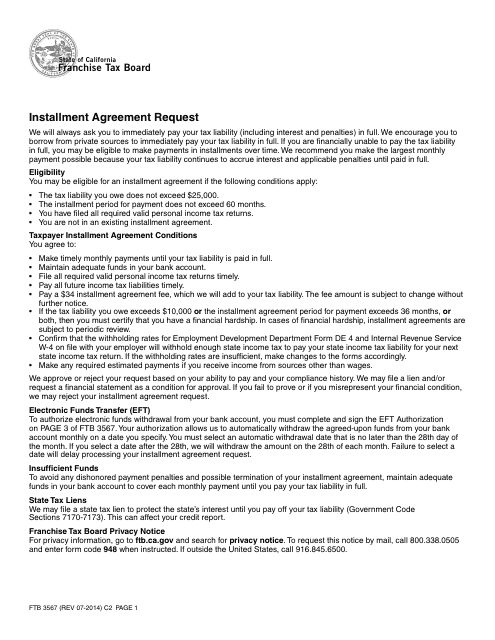

This Form is used for requesting an installment agreement with the California Franchise Tax Board (FTB) to pay taxes owed over time.

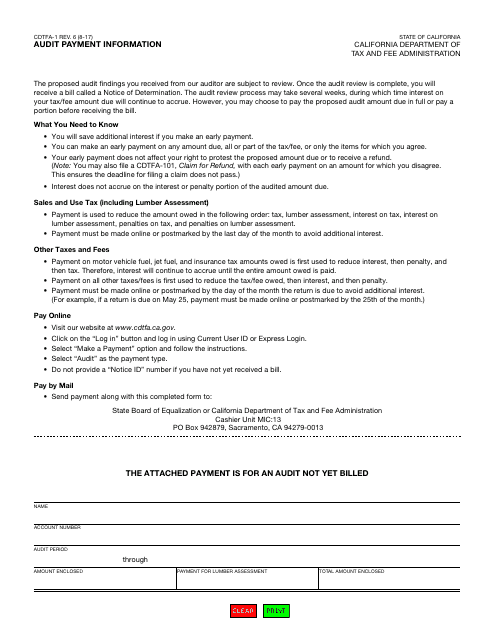

This Form is used for providing audit payment information to the California Department of Tax and Fee Administration (CDTFA).