Tax Payment Form Templates

Documents:

681

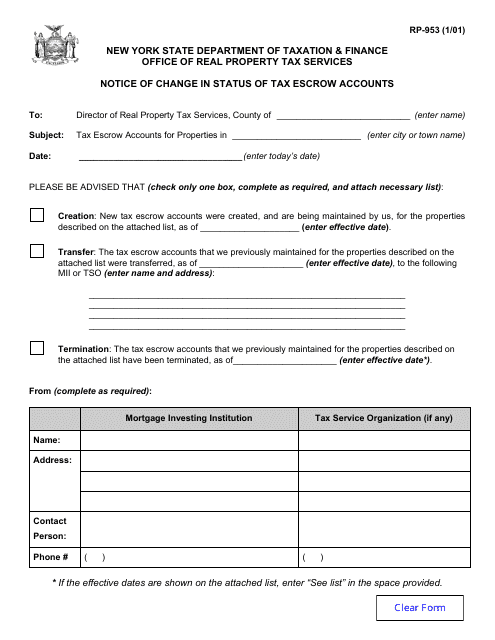

This form is used for notifying the change in status of tax escrow accounts in New York.

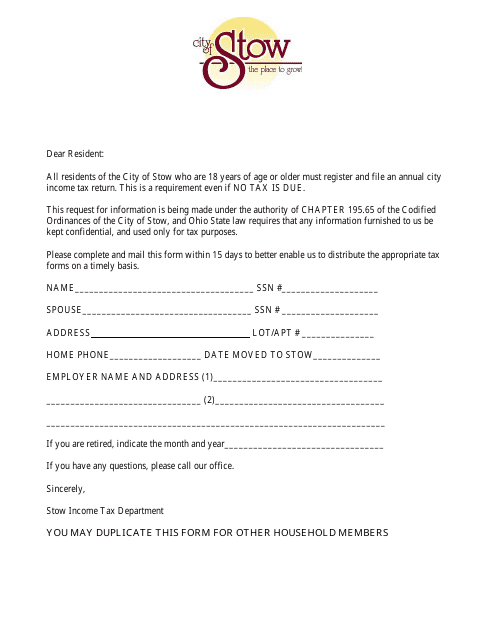

This Form is used for filing your income tax return in the City of Stow, Ohio.

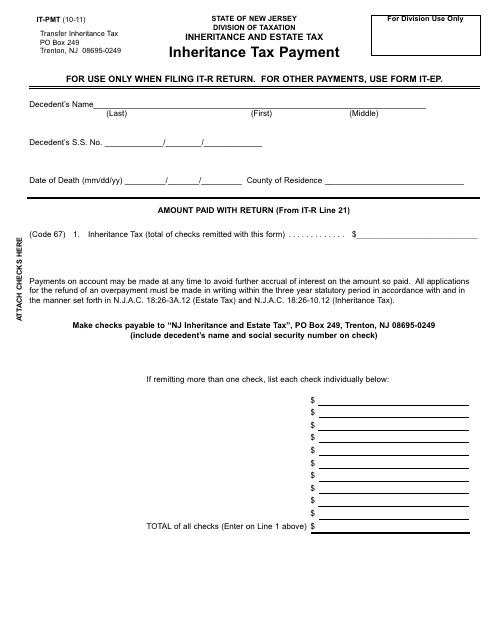

This form is used for making inheritance tax payments in the state of New Jersey.

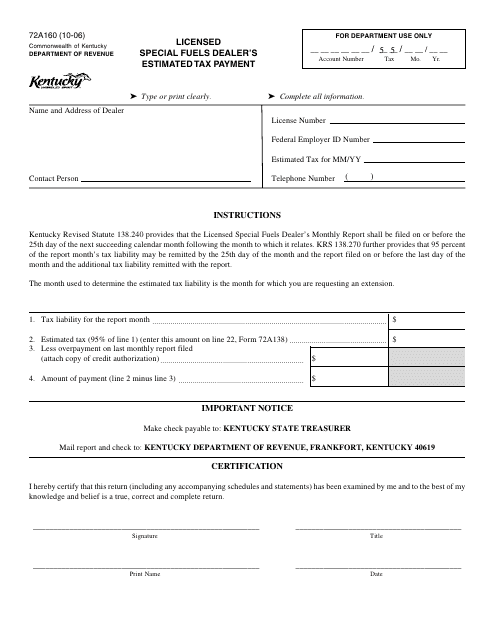

This form is used for licensed special fuels dealers in Kentucky to make estimated tax payments.

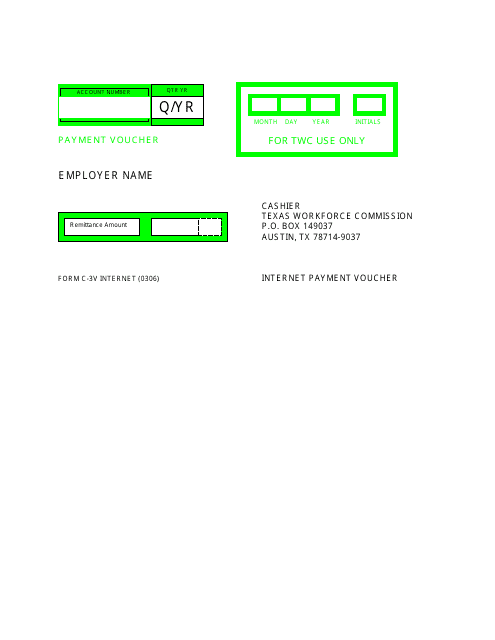

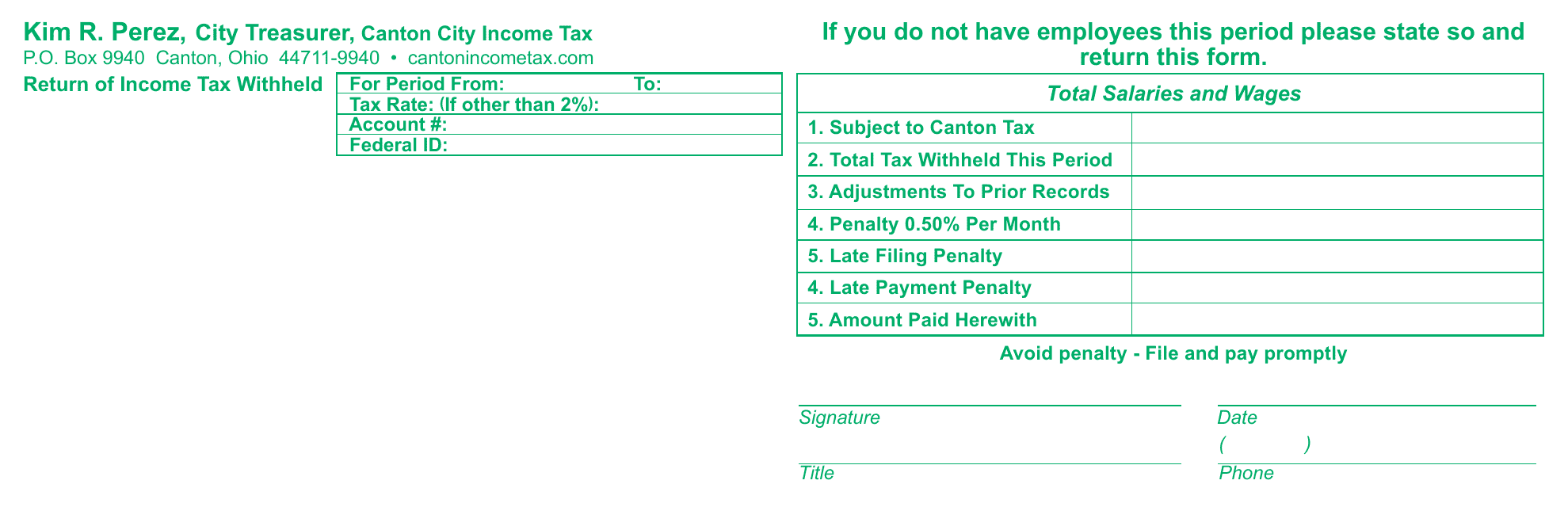

This Form is used for obtaining a withholding coupon from the City of Canton, Ohio.

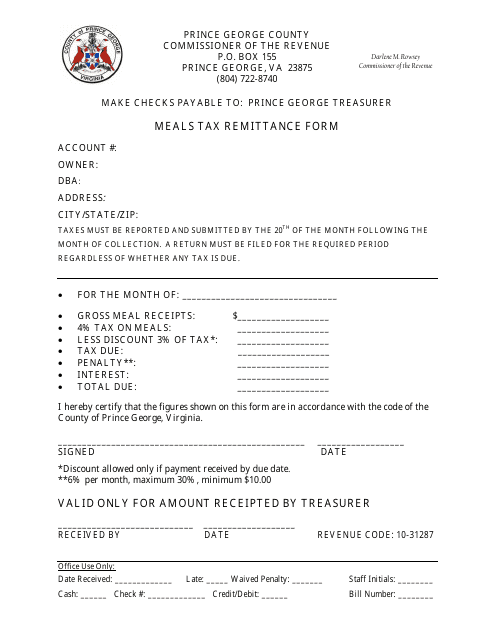

This form is used for remitting the meals tax in Prince George County, Virginia.

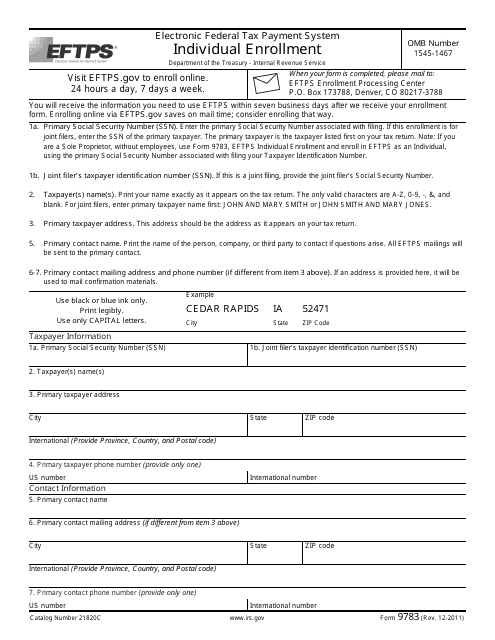

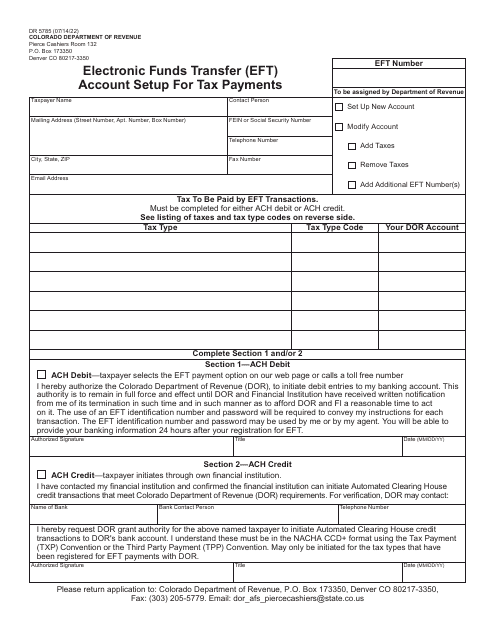

This Form is used for enrolling individuals in the Electronic Federal Tax Payment System (EFTPS). EFTPS allows individuals to make electronic tax payments to the IRS.

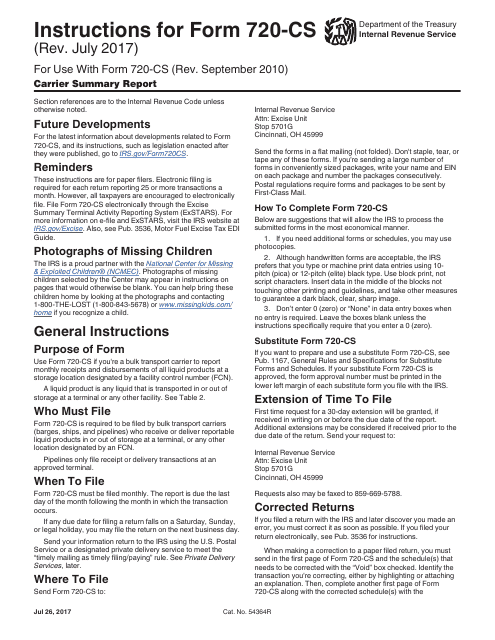

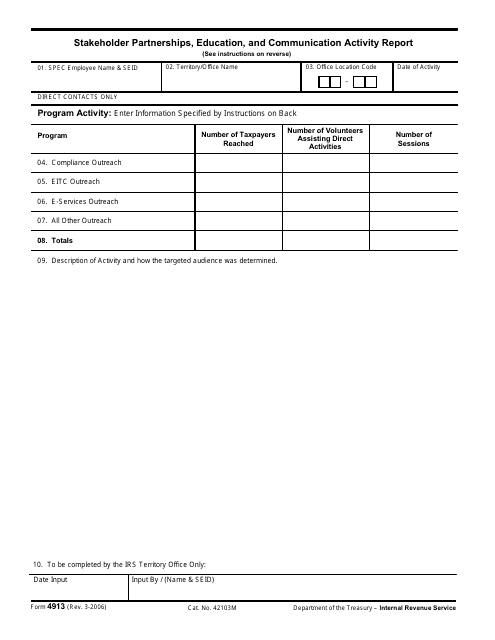

This form is used for providing a summary report of carriers to the Internal Revenue Service (IRS). It includes information such as carrier name, address, and total taxable amounts for various services.

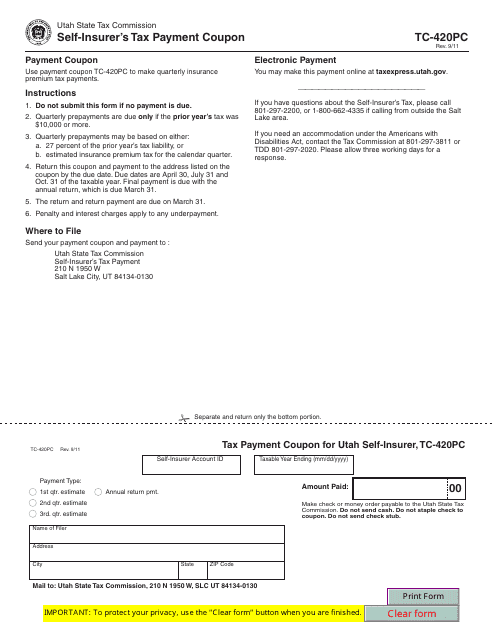

This form is used for self-insurers in Utah to make tax payments.

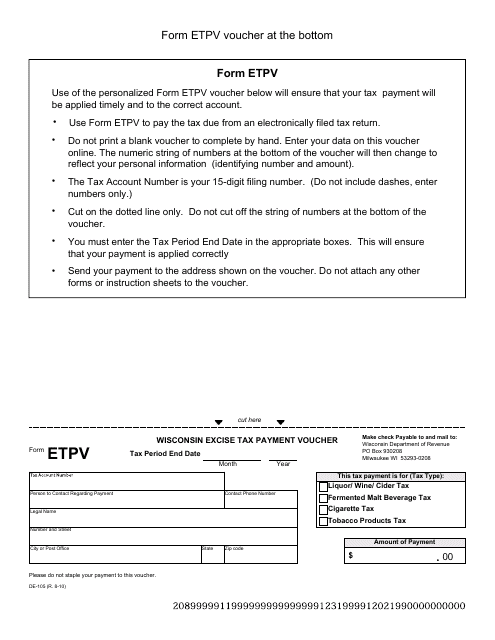

This Form is used for making excise tax payments in the state of Wisconsin.

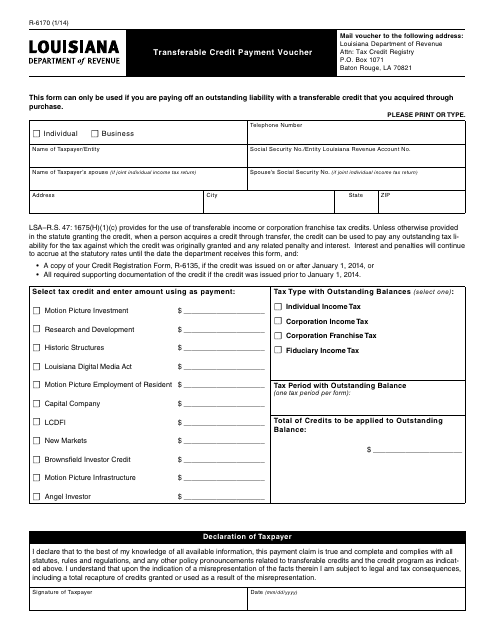

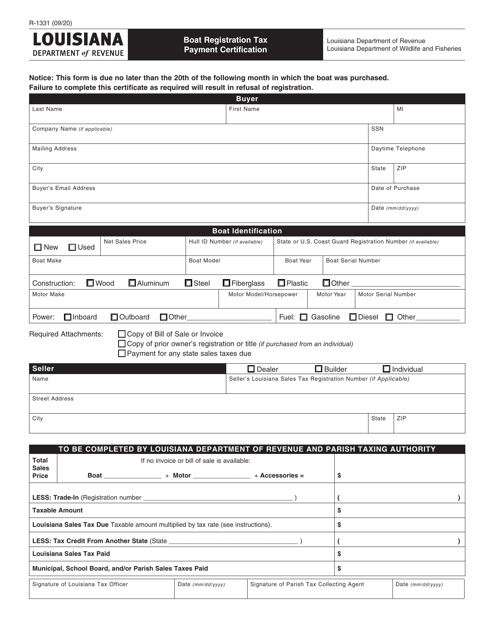

This form is used for making transferable credit payments in the state of Louisiana.

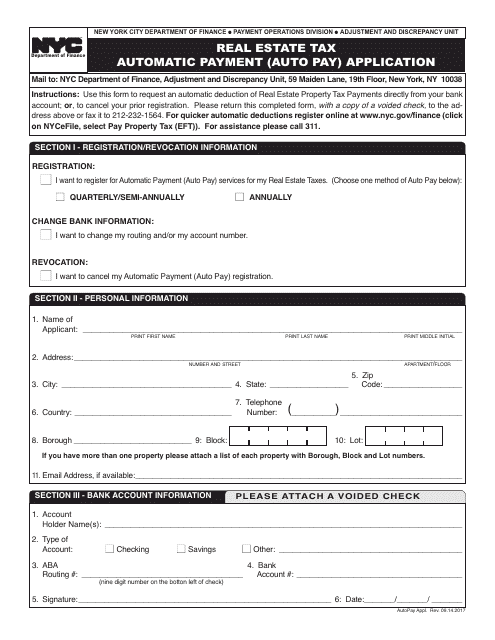

This document is an application form for enrolling in the automated real estate tax payment program in New York City. With this form, residents can apply to have their property taxes automatically deducted from their bank account each month.

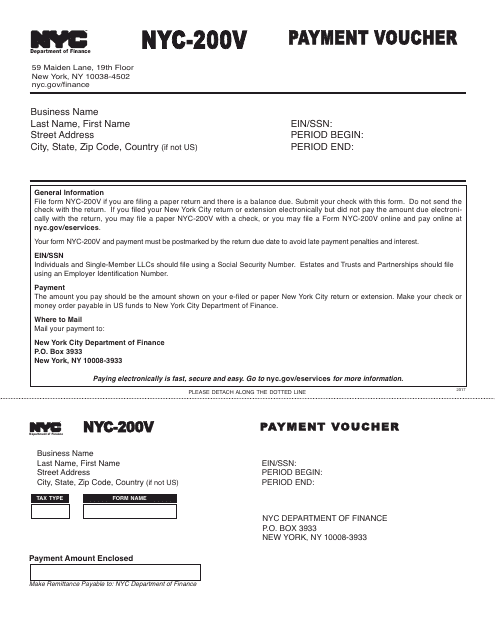

This form is used for making payment to the City of New York.

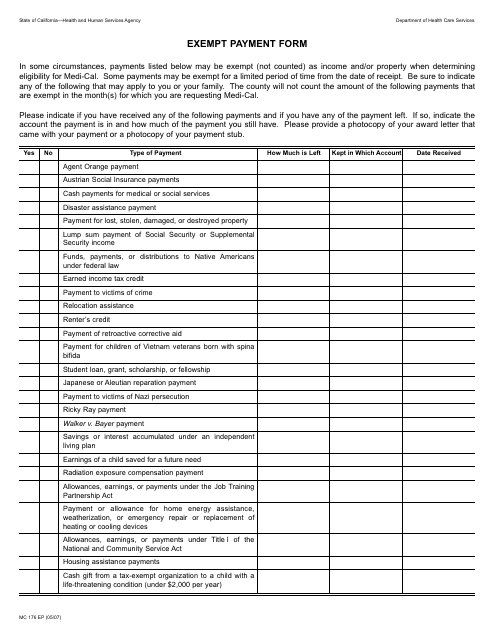

This form is used for reporting exempt payments made in California.

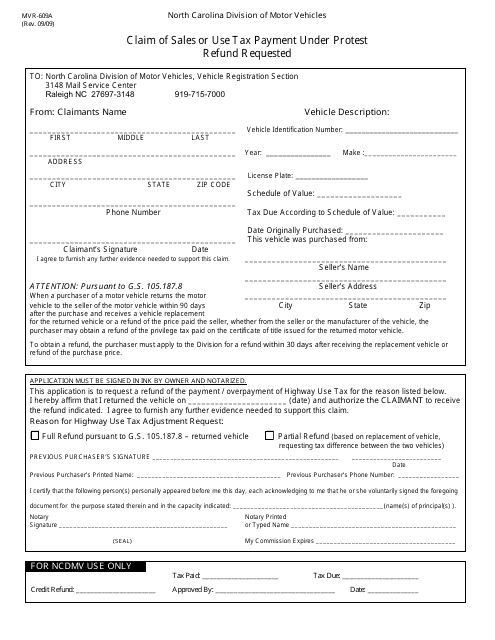

This Form is used for claiming sales or use tax payment made under protest and requesting a refund in the state of North Carolina.

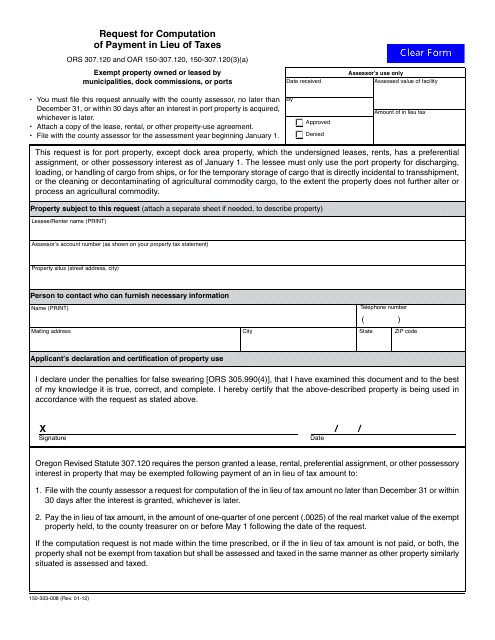

This form is used for requesting the computation of payment in lieu of taxes in the state of Oregon.

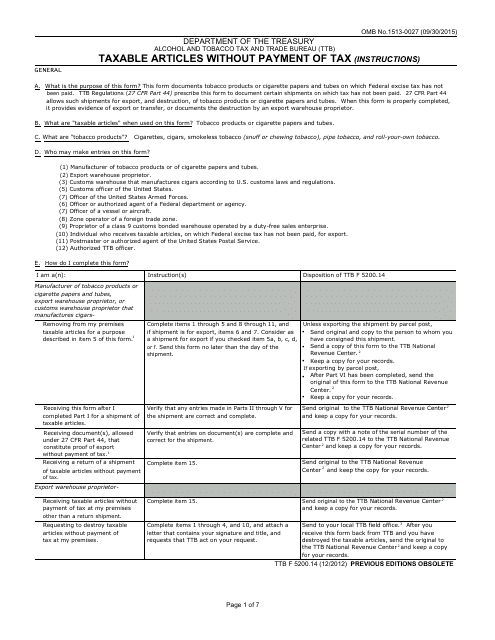

This document is used for reporting the taxable articles that are not paid for with tax.

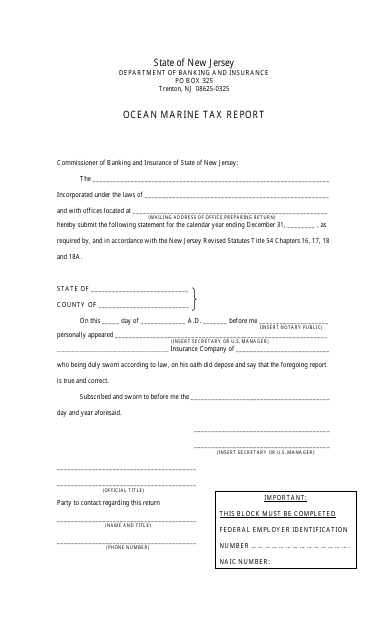

This document is used for reporting taxes related to ocean marine activities in the state of New Jersey.

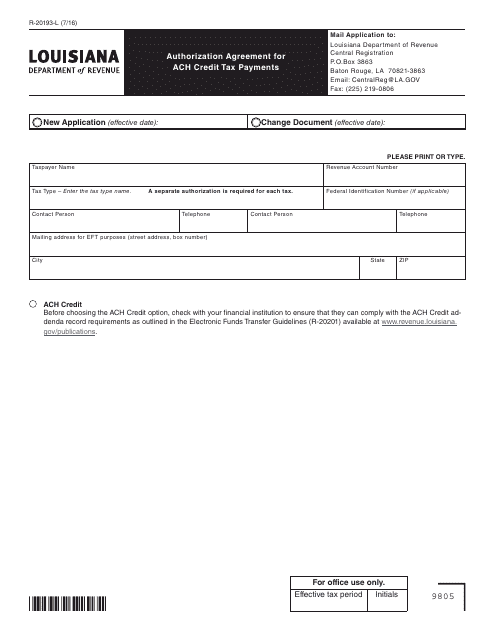

This form is used for authorizing automatic tax payments via ACH credit in the state of Louisiana.

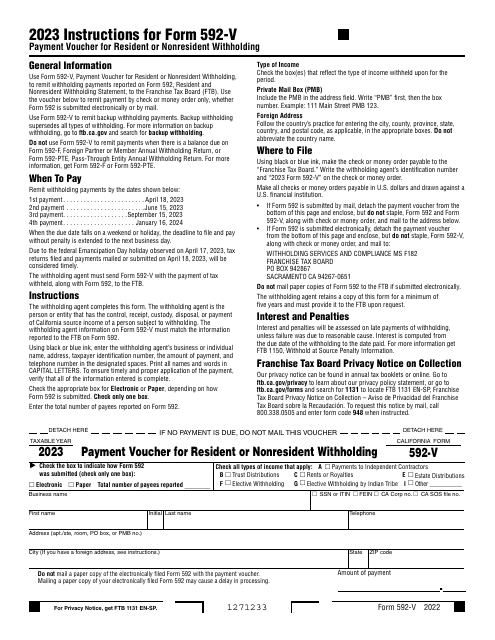

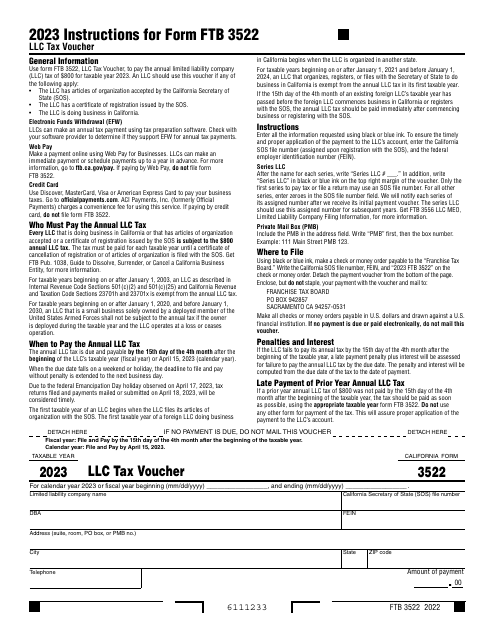

This is a legal document every California-based limited liability company (LLC) needs to submit to pay the annual LLC tax of $800. This form is a tax voucher - it details payment information you need to provide with your check or money order.

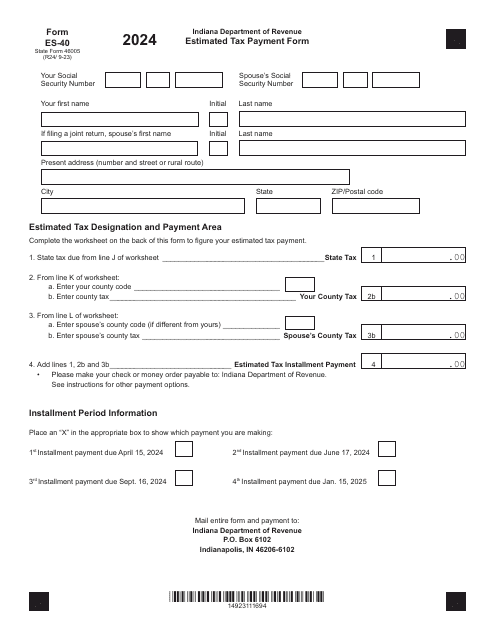

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

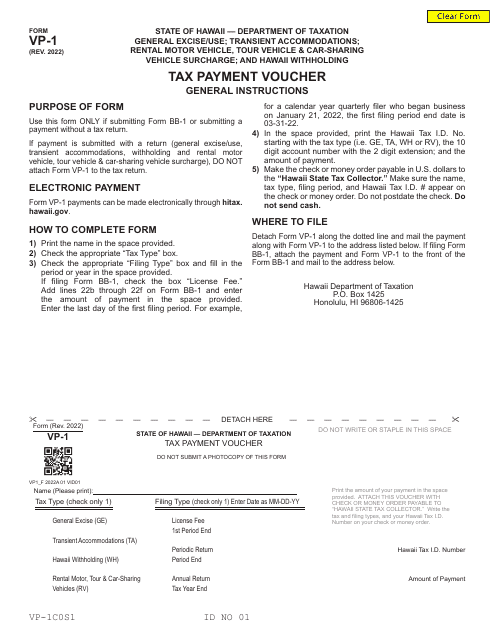

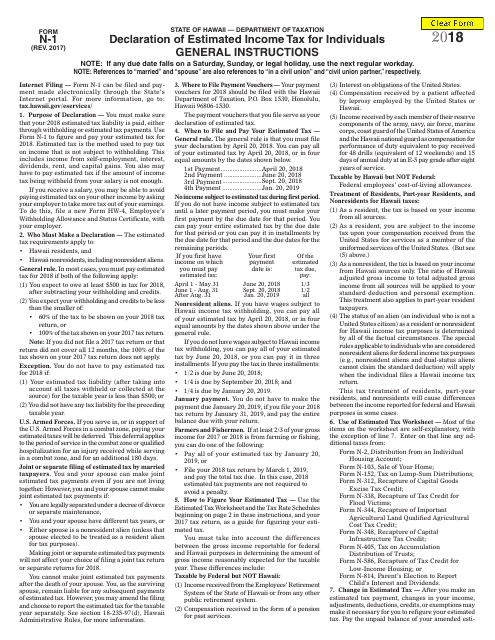

This form is used for individuals in Hawaii to declare their estimated income tax for the year. It is used to estimate and pay taxes throughout the year, rather than waiting until the tax return is due.

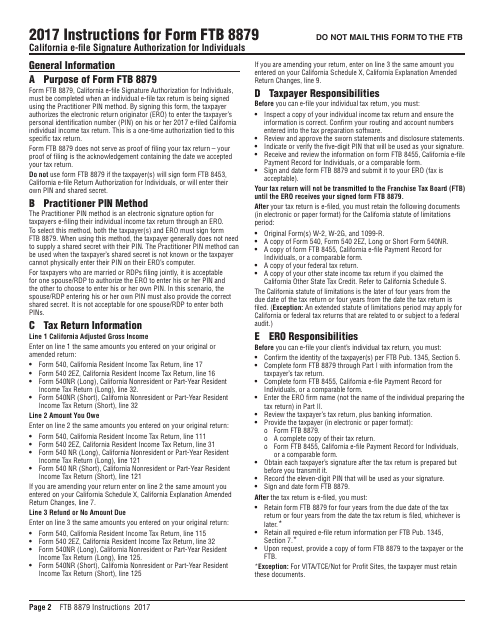

This document is used for authorizing electronic filing of tax returns for individuals in California. It provides instructions on how to complete Form FTB8879 for electronic signature authorization.

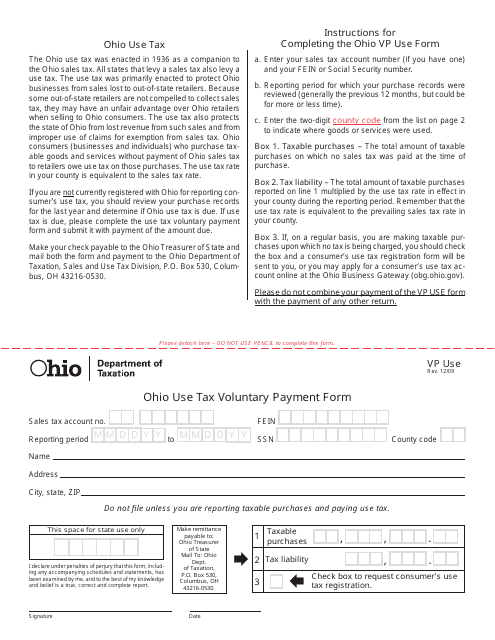

This Form is used for voluntarily paying Ohio Use Tax.