Tax Relief Form Templates

Documents:

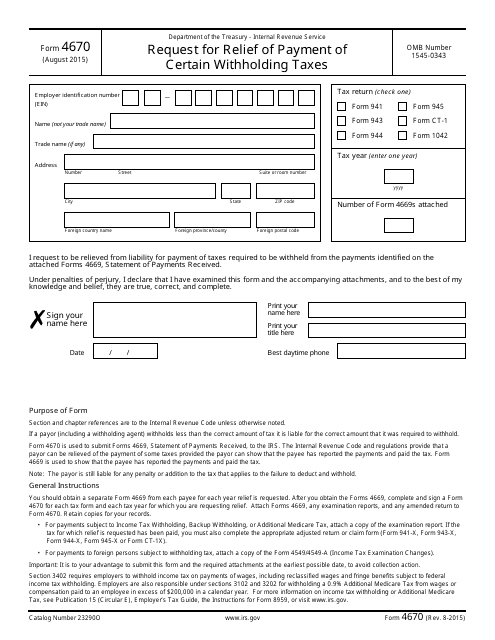

240

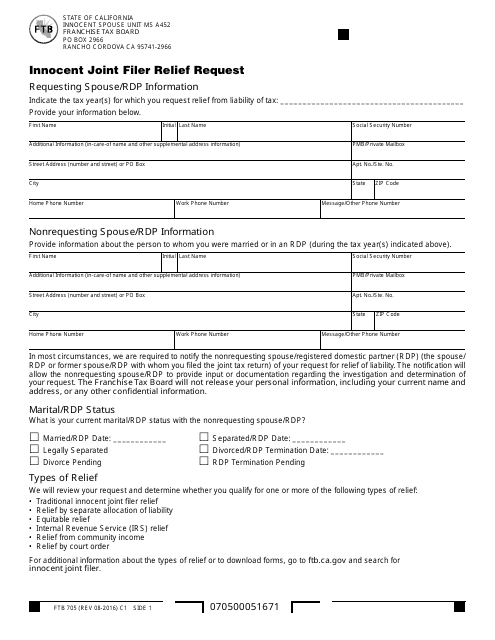

This form is used for requesting innocent joint filer relief in the state of California.

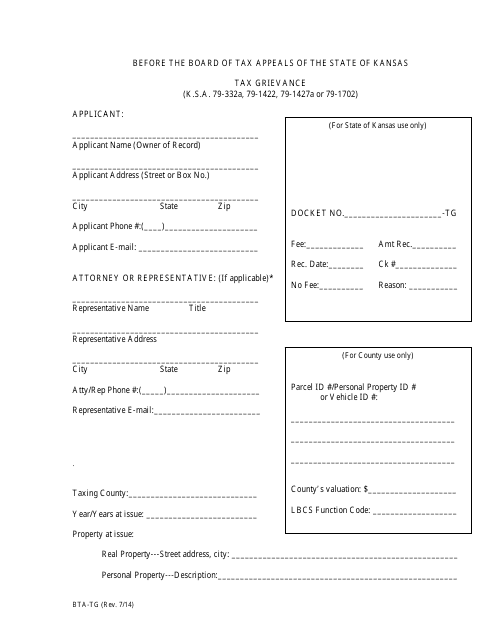

This document is used for filing a tax grievance in the state of Kansas.

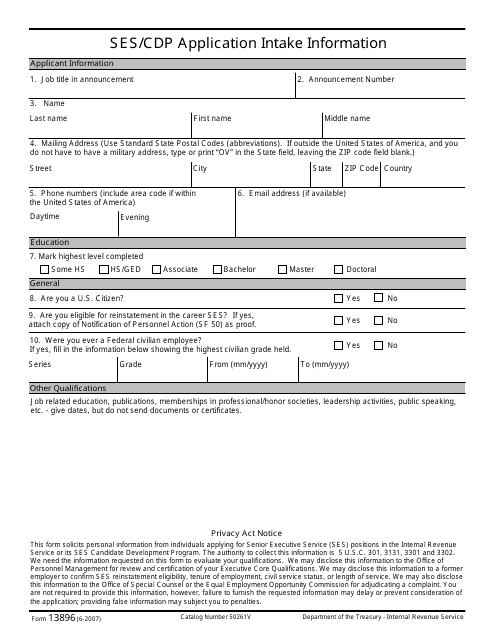

This form is used for applying for a Ses/Cdp Application Intake with the IRS.

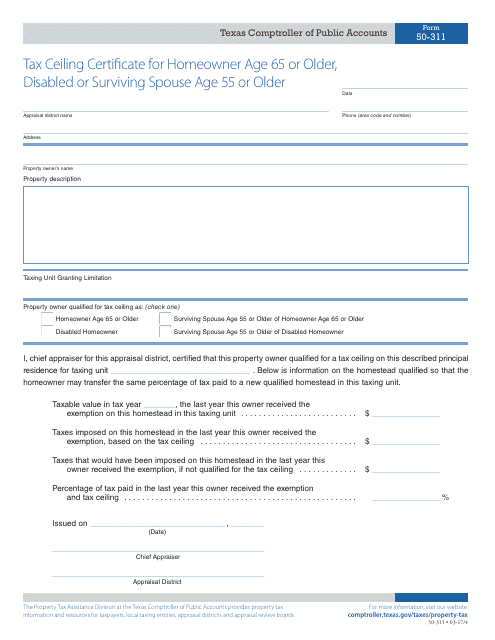

This form is used for homeowners in Texas who are age 65 or older, disabled, or surviving spouse age 55 or older to apply for a tax ceiling certificate. This document helps eligible individuals receive property tax relief.

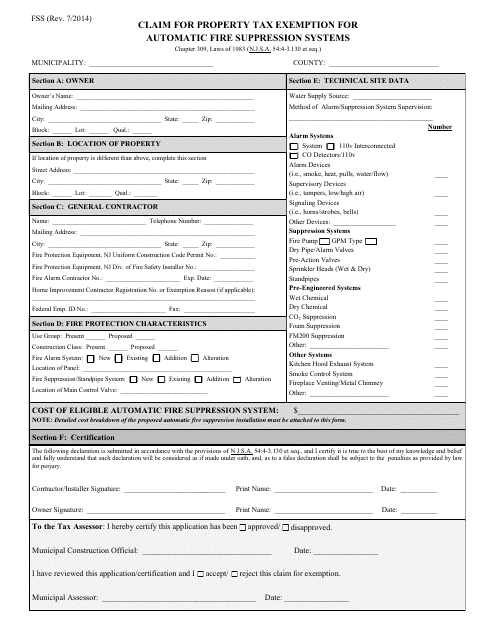

This form is used for claiming a property tax exemption for automatic fire suppression systems in New Jersey.

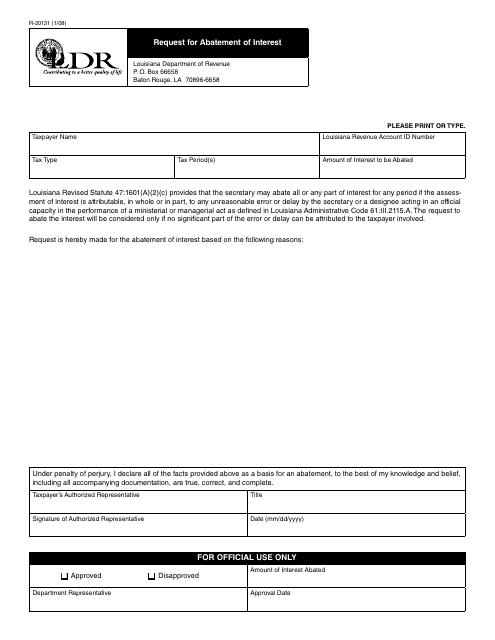

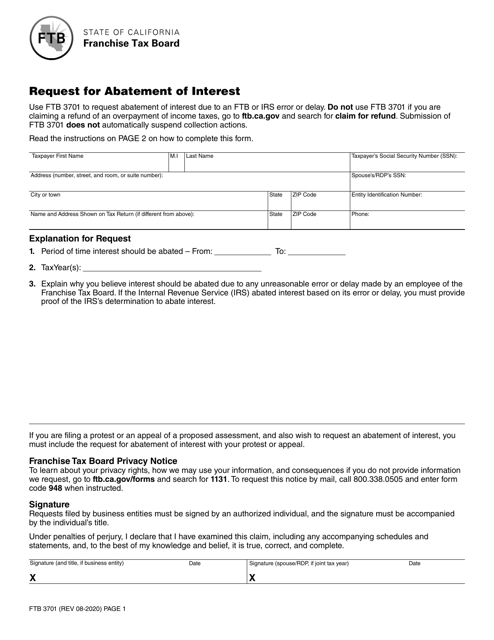

This form is used for requesting the abatement of interest in the state of Louisiana.

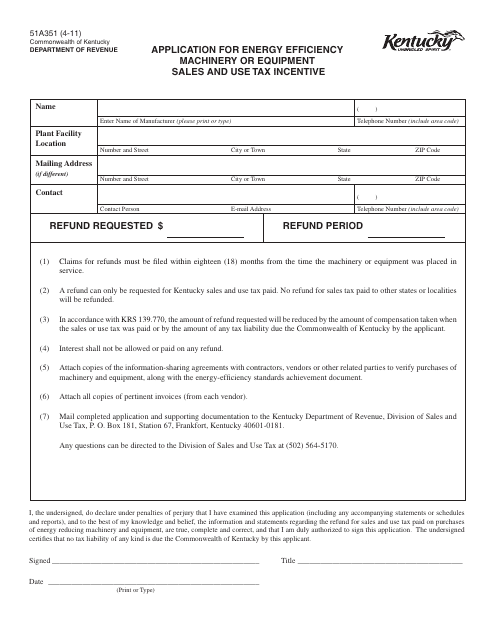

This form is used for applying for the Energy Efficiency Machinery or Equipment Sales and Use Tax Incentive in the state of Kentucky.

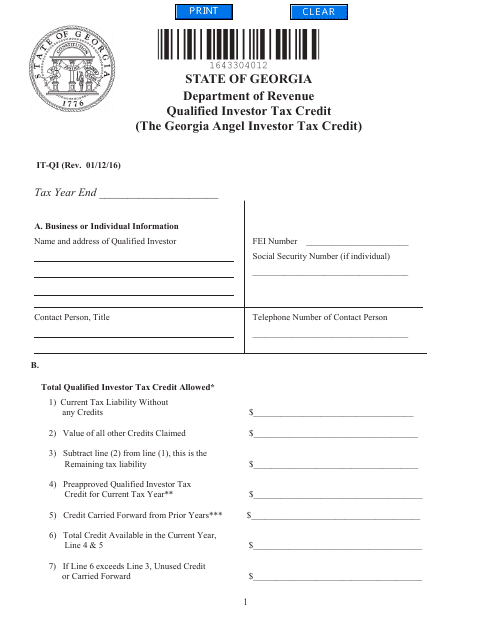

This form is used for claiming the Qualified Investor Tax Credit in the state of Georgia. Residents who meet the qualifying criteria can use this form to claim a tax credit for investing in certain businesses or projects.

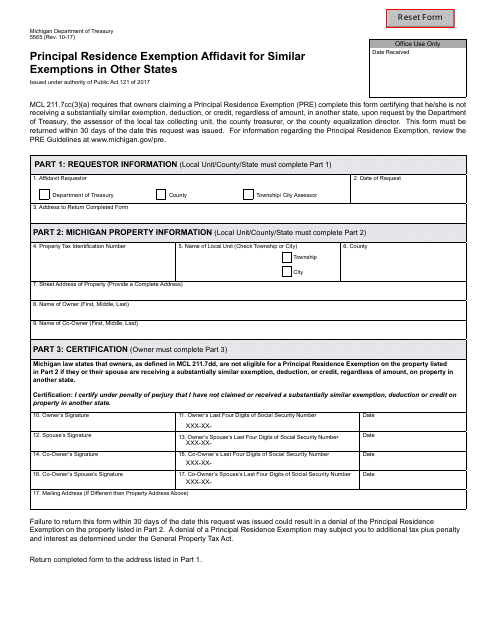

This document is used for claiming principal residence exemption in Michigan and exploring similar exemptions in other states.

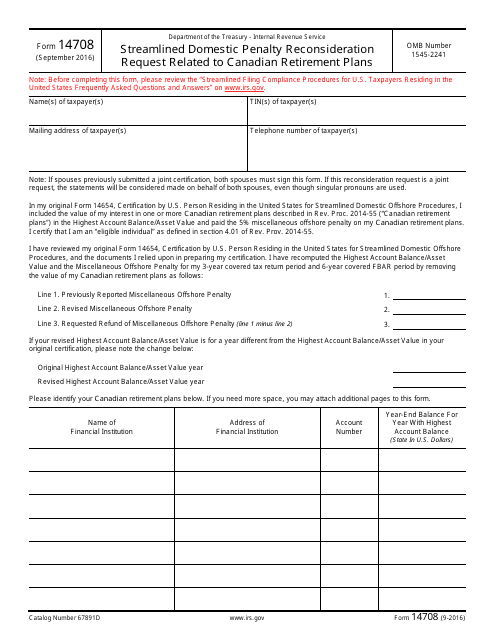

This document is used for requesting a reconsideration of penalties related to Canadian retirement plans under the Streamlined Domestic Offshore Procedures.

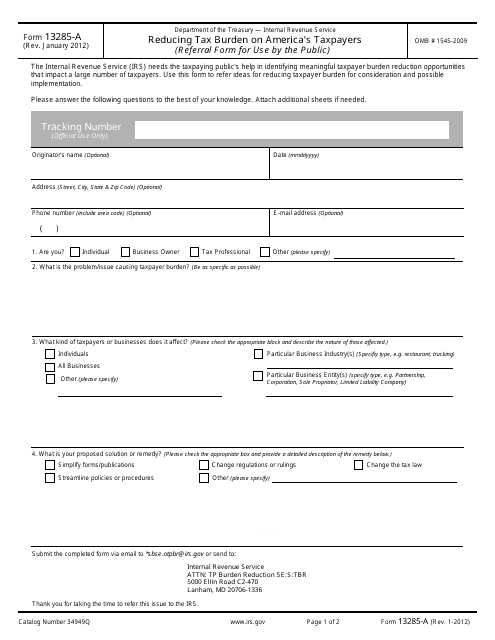

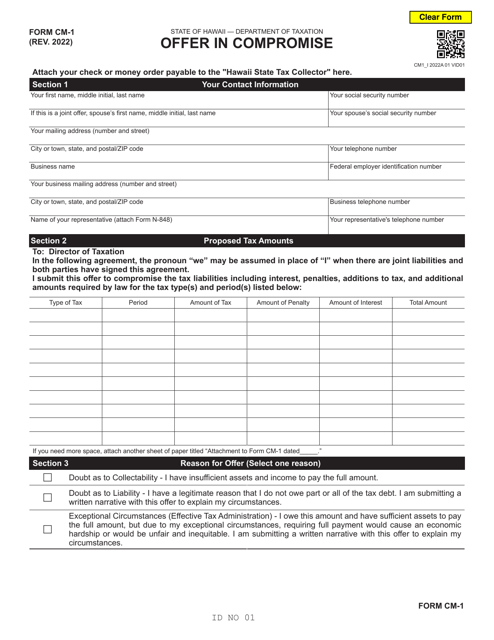

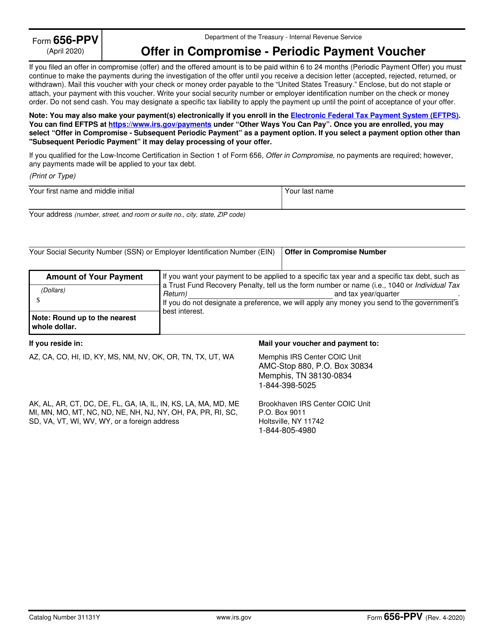

This Form is used for reducing the tax burden on American taxpayers. It provides eligible taxpayers with options to reduce their overall tax liability.

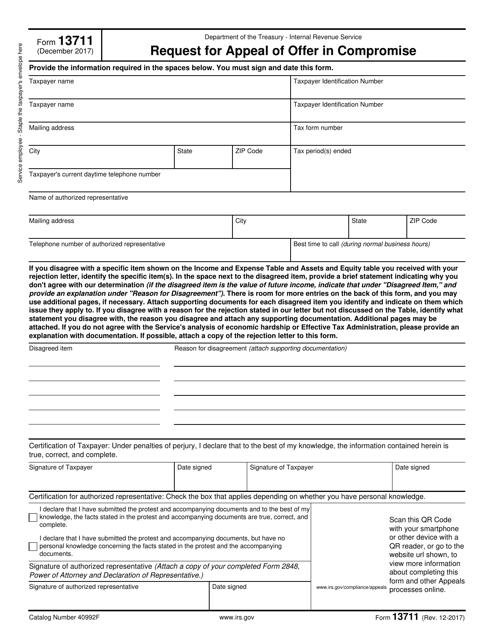

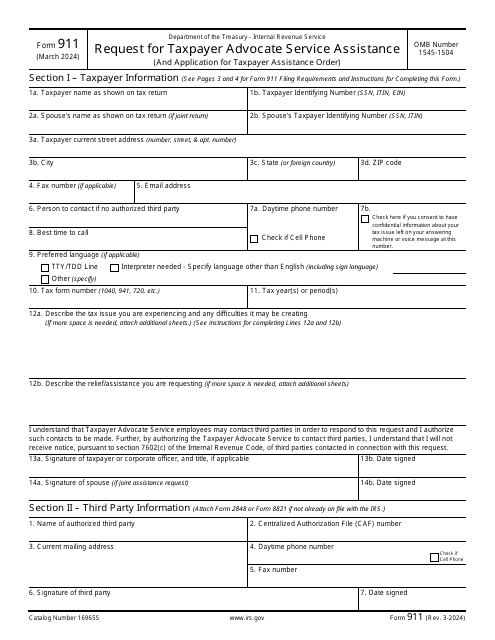

This is a fiscal form used by taxpayers that have already exhausted all other options when dealing with a tax issue.

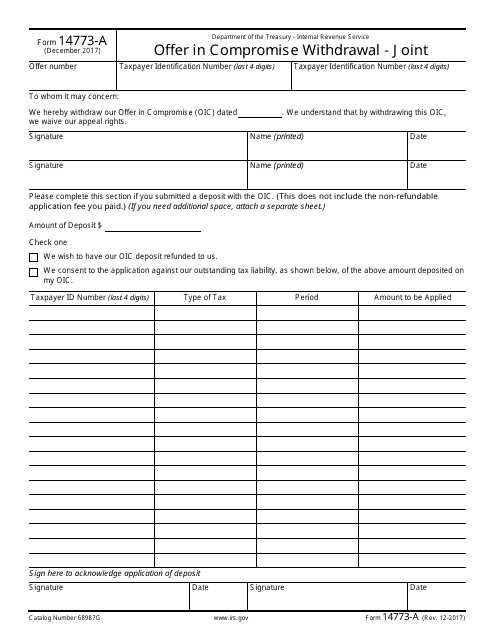

This form is used for withdrawing a joint offer in compromise submission to the IRS.

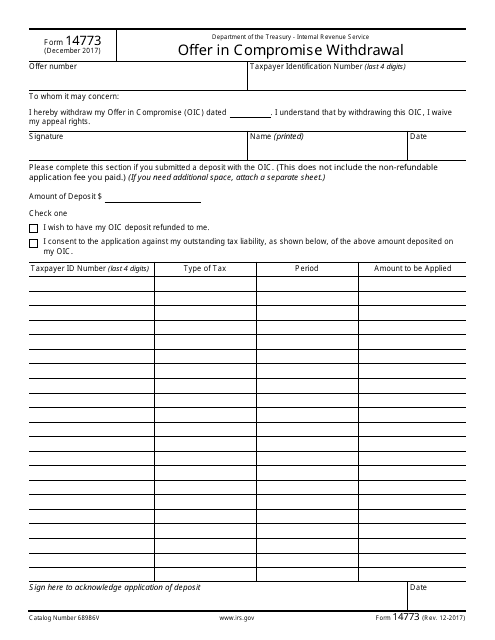

This Form is used for withdrawing an offer in compromise with the Internal Revenue Service (IRS).

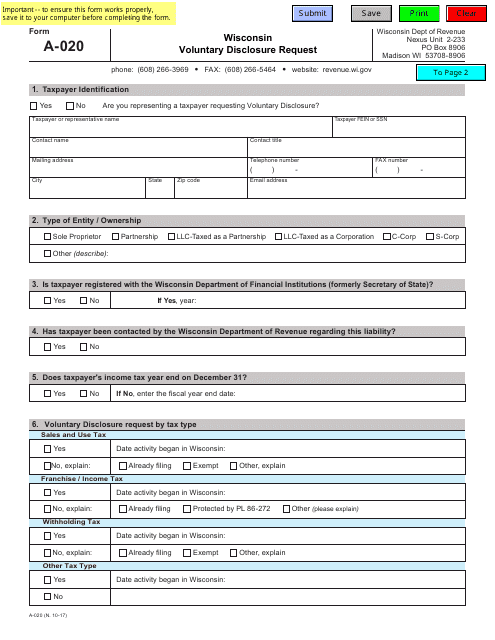

This form is used for individuals or businesses in Wisconsin to request a voluntary disclosure of taxes owed to the state.

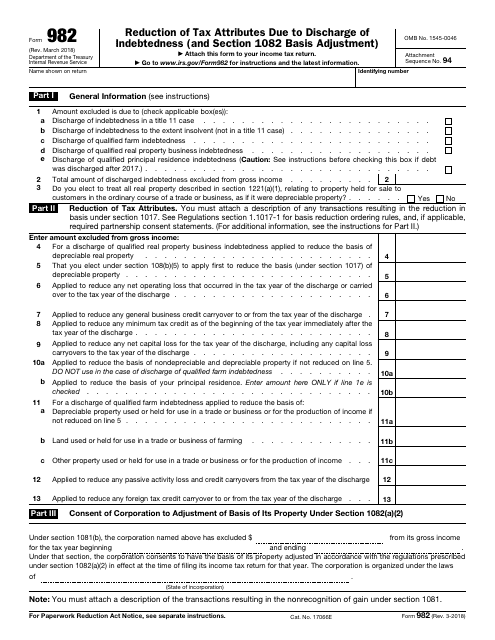

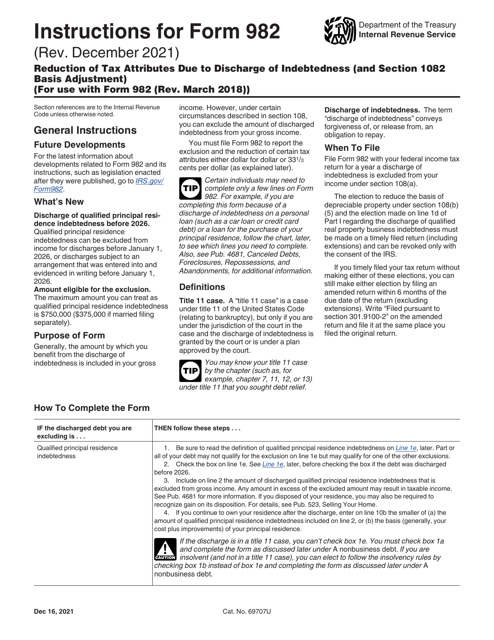

This is a formal instrument used by taxpayers to explain to fiscal authorities why certain debts should not be taken into account as a part of their income.

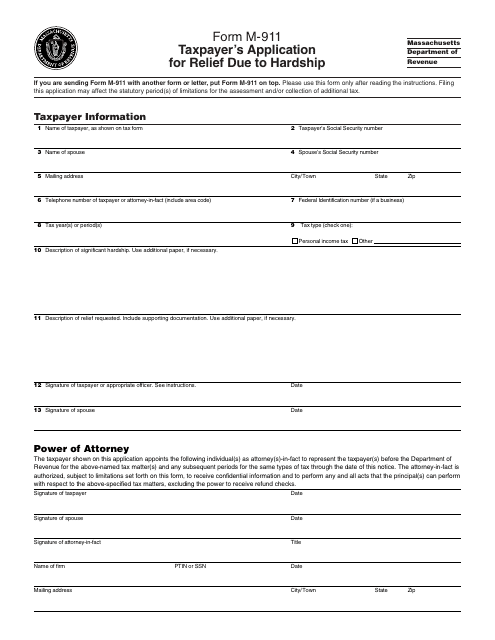

This form is used for Massachusetts taxpayers to apply for relief due to financial hardship.

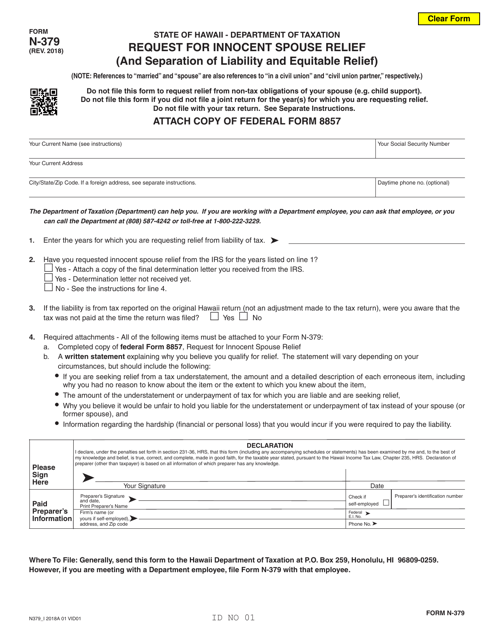

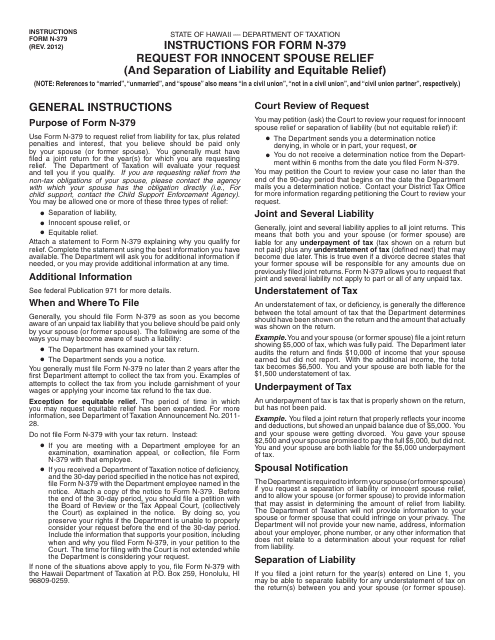

This Form is used for requesting innocent spouse relief in the state of Hawaii. It provides instructions on how to apply for relief from joint tax liability when a spouse or former spouse believes they should not be held responsible for the other spouse's tax obligations.

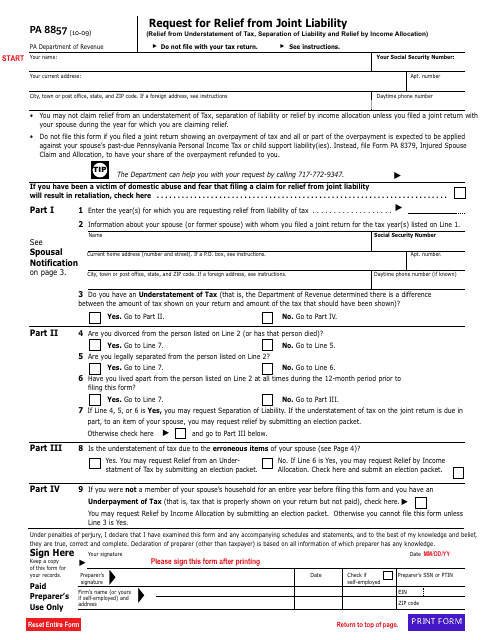

This form is used for requesting relief from joint liability for tax obligations in the state of Pennsylvania.

This Form is used for claiming a partial property tax exemption in New York for individuals with disabilities and limited incomes. It provides instructions on how to apply for the exemption and the documentation required.

This Form is used for applying for real property tax exemption for reconstructed or rehabilitated historic barn in New York.

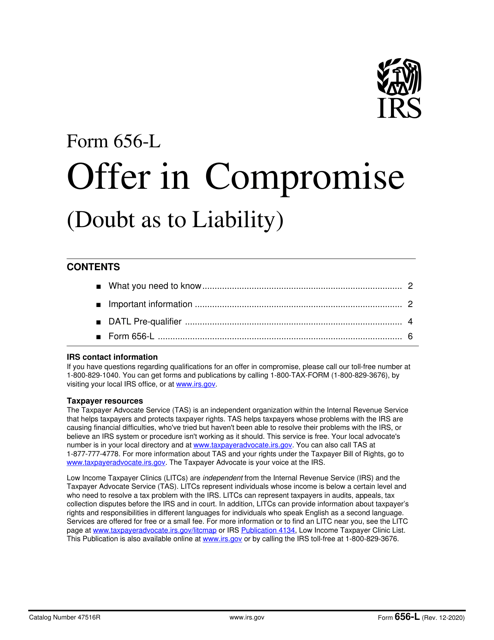

This document provides information and instructions for businesses in California who want to make an offer in compromise to settle their tax debt with the Franchise Tax Board (FTB).

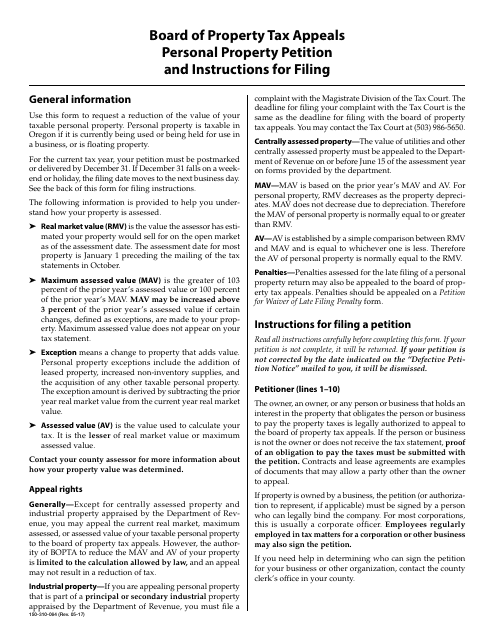

This form is used for filing a personal property petition with the Board of Property Tax Appeals in Oregon. It is used to request a review of the assessed value of personal property for tax purposes.

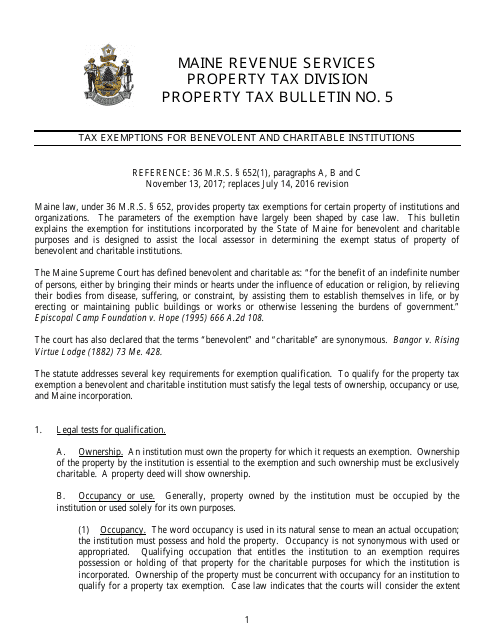

This document provides information about tax exemptions available to benevolent and charitable institutions in the state of Maine. It outlines the eligibility criteria and the process for obtaining these exemptions.

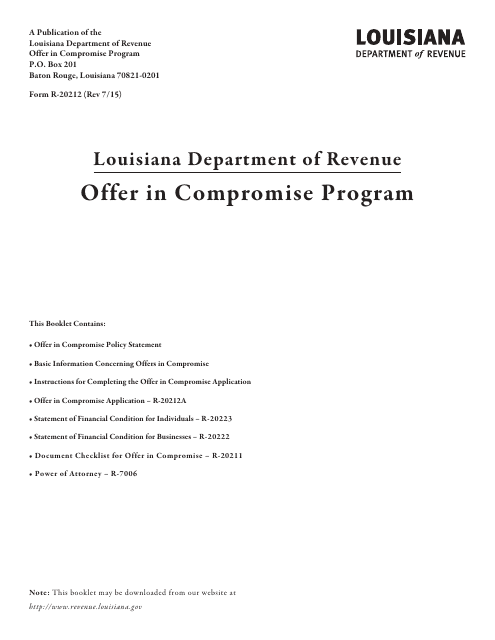

This form is used for the Offer in Compromise Program in the state of Louisiana. It allows taxpayers to settle their tax debts with the state for a reduced amount.

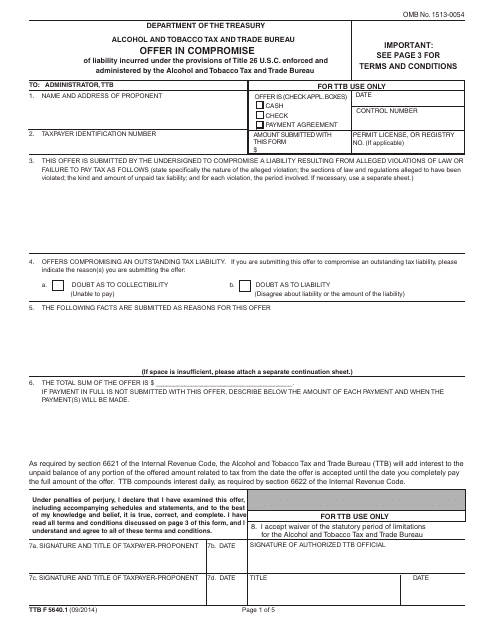

This document is used for making an offer in compromise to the Internal Revenue Service (IRS) for violations of the Internal Revenue Code (IRC).

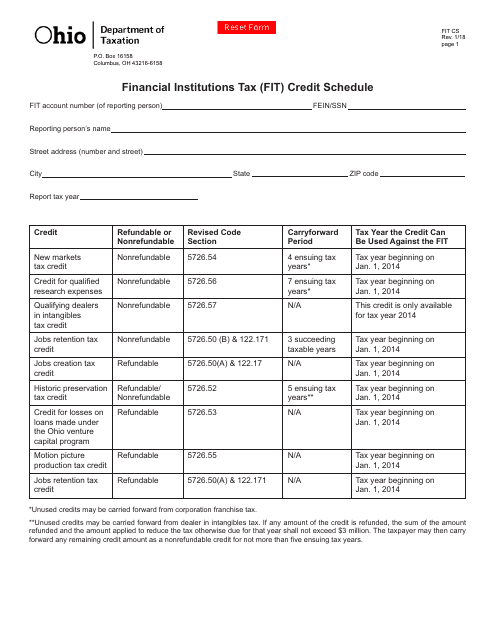

This Form is used for reporting and claiming the Financial Institutions Tax (FIT) Credit in Ohio.