Property Tax Form Templates

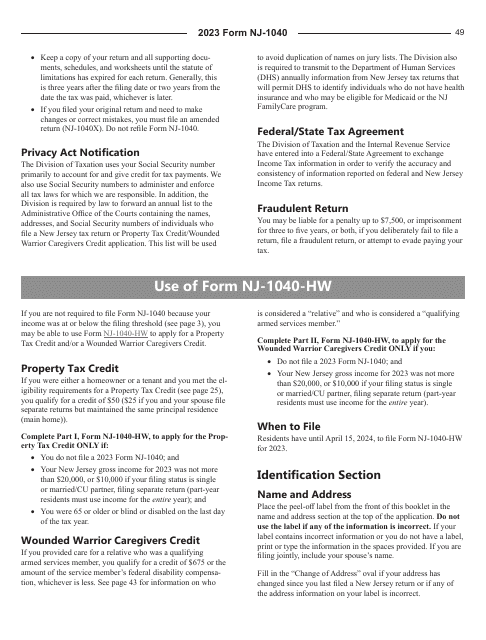

Documents:

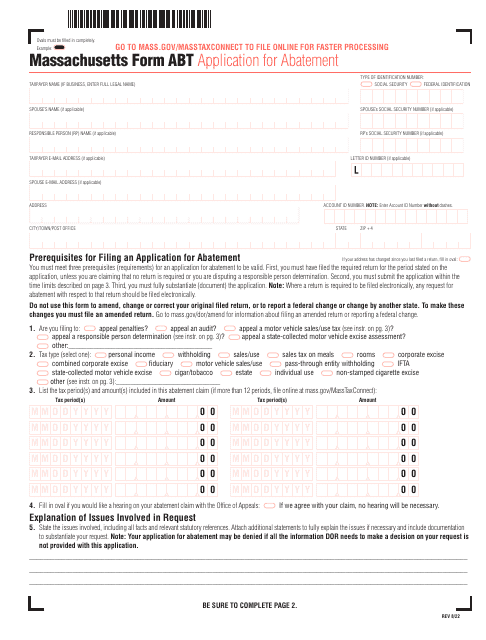

720

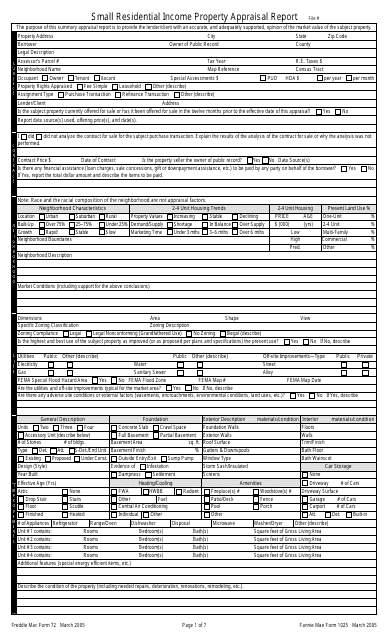

This document is used to assess the value of a small residential income property. It is typically used by lenders to make informed decisions about loans related to such properties.

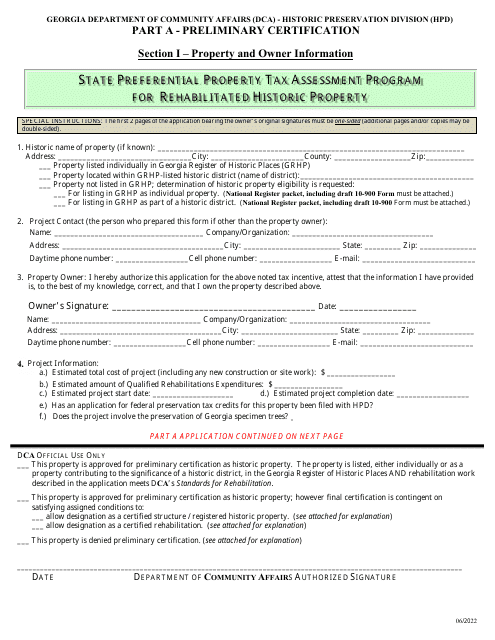

This document certifies that a historic property in Georgia is eligible for preferential property tax assessment. It is part of the state's program to encourage the rehabilitation of historic properties.

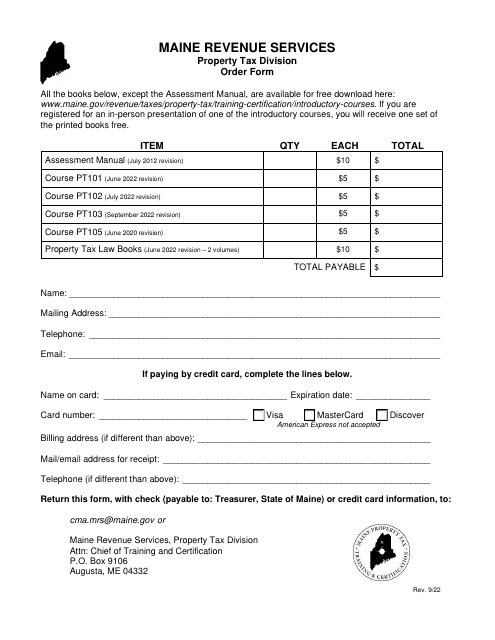

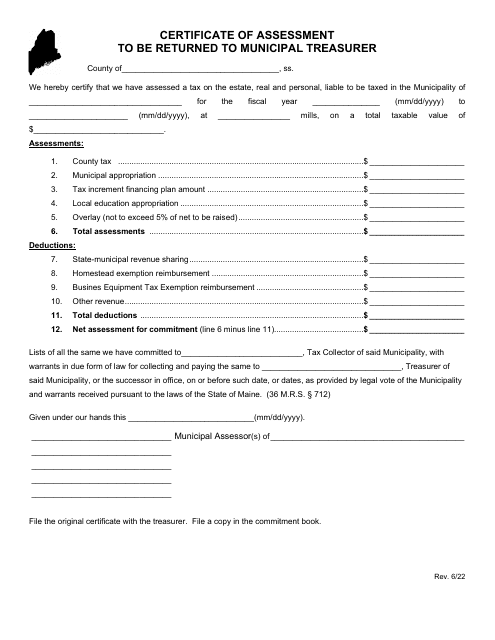

This document is for the return of a Certificate of Assessment to the Municipal Treasurer in the state of Maine. It is used to update and provide accurate information about the assessed value of a property for tax purposes.

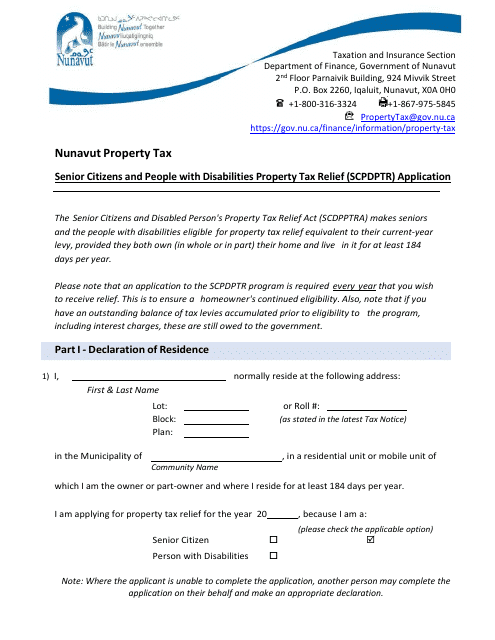

This document is for residents of Nunavut, Canada who are senior citizens or people with disabilities. It is an application for property tax relief.

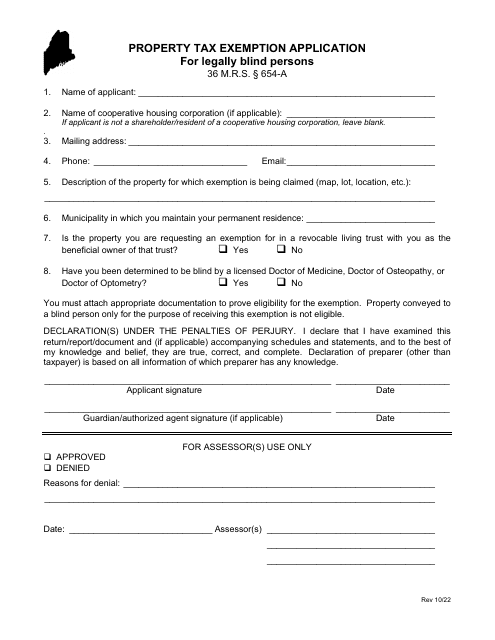

This document is an application for property tax exemption for legally blind persons in the state of Maine. It allows eligible individuals to apply for a reduced property tax rate based on their visual impairment.

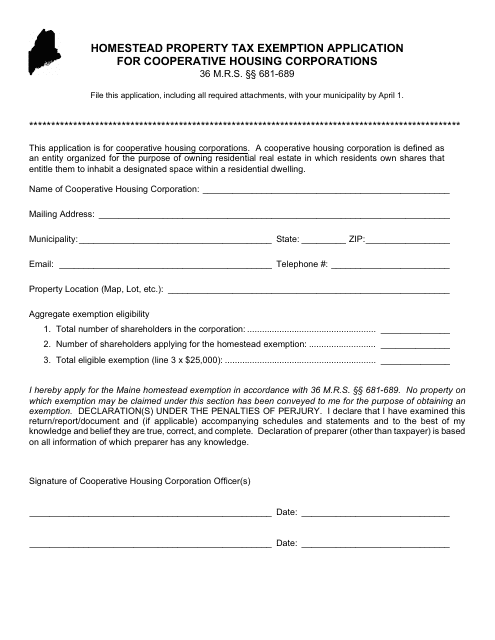

This type of document is used for applying for a property tax exemption for cooperative housing corporations in the state of Maine.

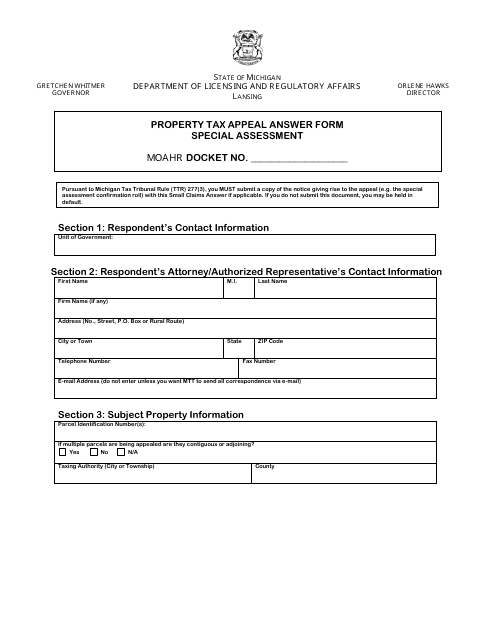

This form is used for appealing property tax assessments related to special assessments in Michigan. It helps taxpayers contest their property tax bills for special assessments.

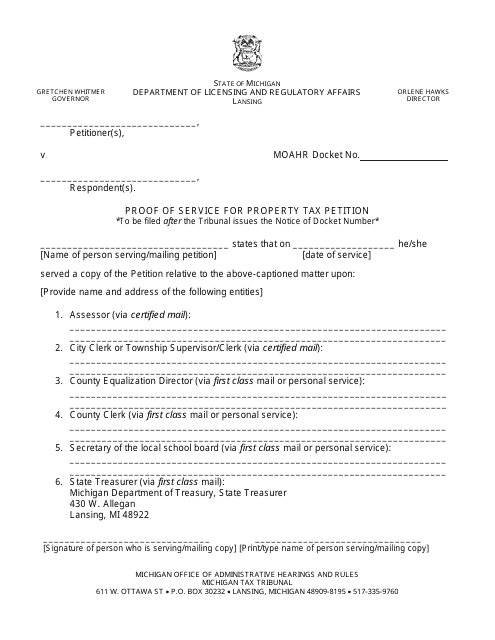

This document is used to provide proof of service for a property tax petition in Michigan.

This document is for obtaining a homestead permit in the City of Fort Worth, Texas. It serves as an affidavit to verify residency and eligibility for the homestead exemption.

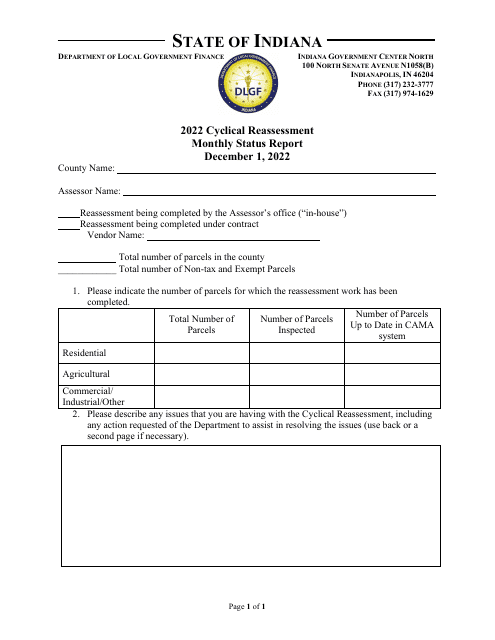

This document provides a monthly status report for the cyclical reassessment process in Indiana for the month of December.

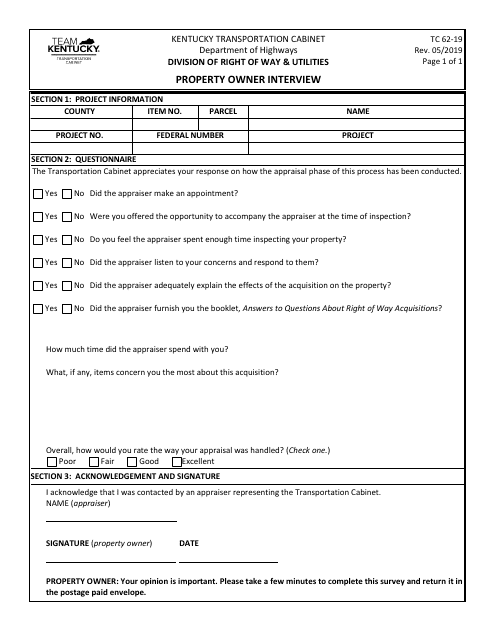

This form is used for conducting an interview with property owners in Kentucky. It is used to gather information about the property and its ownership.

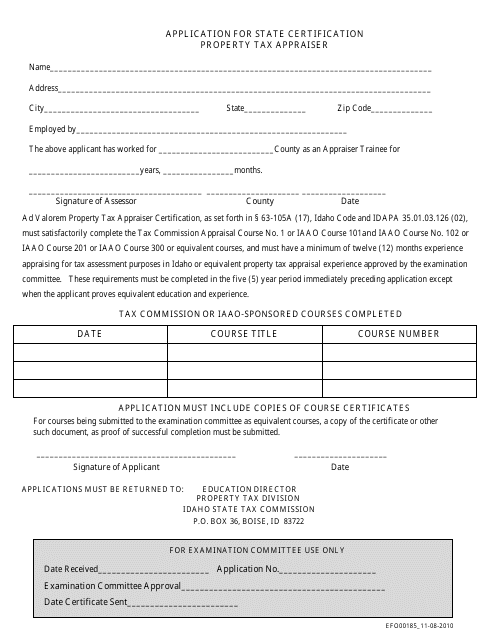

This form is used for individuals in Idaho who want to apply for state certification as a property tax appraiser.

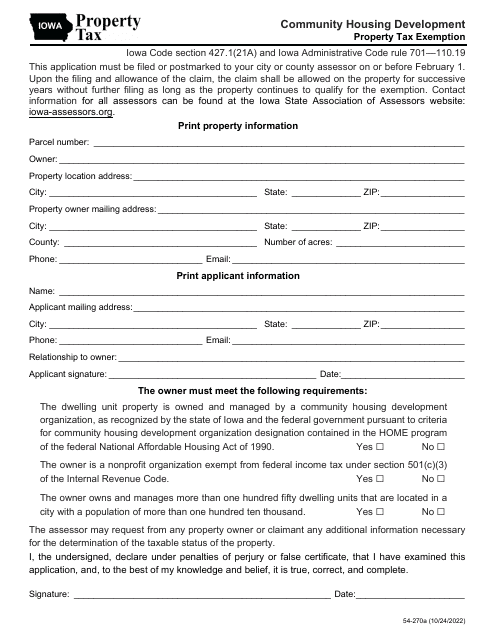

This Form is used for applying for a property tax exemption for community housing development in Iowa.

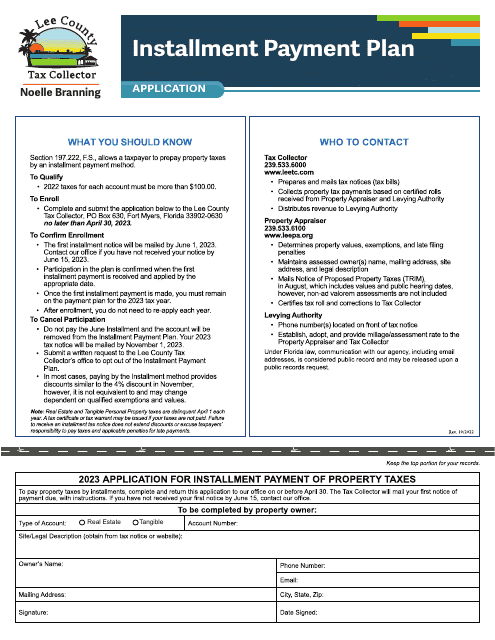

This document is for residents of Lee County, Florida who want to apply for an installment payment plan for their property taxes.

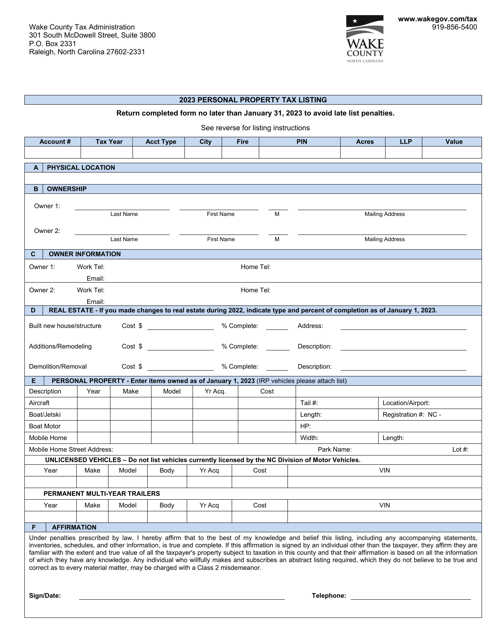

This document is used for listing personal property taxable in North Carolina. It provides a detailed record of personal property that is subject to tax in the state.

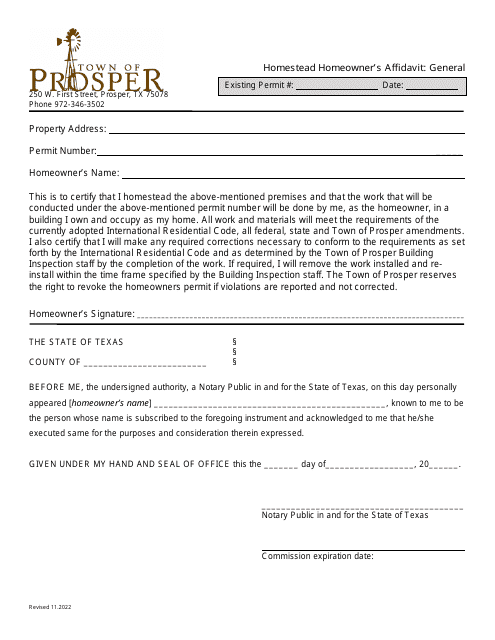

This document is used by homeowners in the town of Prosper, Texas to declare that their property is their primary residence.