Property Tax Form Templates

Documents:

720

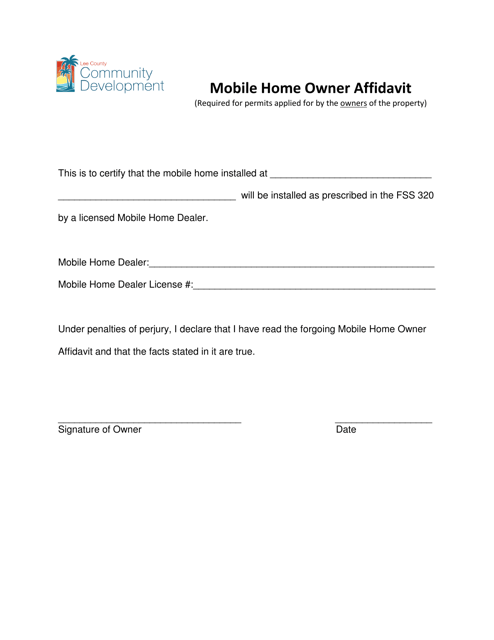

This document is used for mobile home owners in Lee County, Florida to provide a sworn statement regarding ownership.

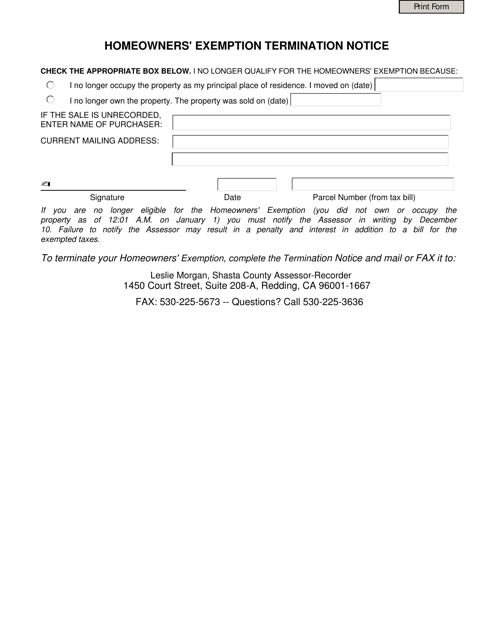

This Form is used for terminating the homeowners' exemption in Shasta County, California.

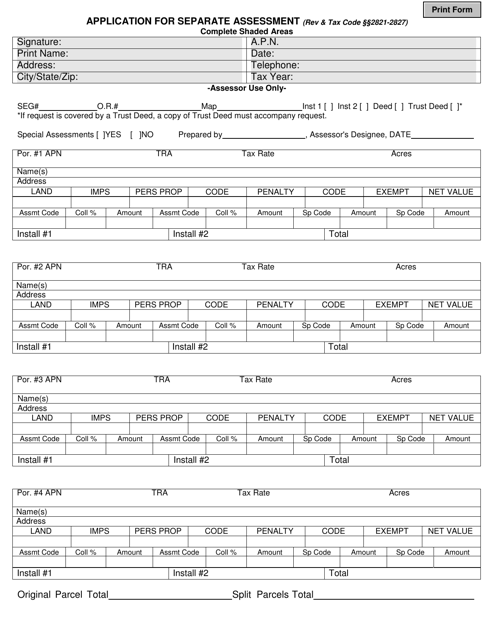

This type of document is used for applying for separate assessment in Shasta County, California. Separate assessment refers to the process of assessing property or land separately from adjacent parcels.

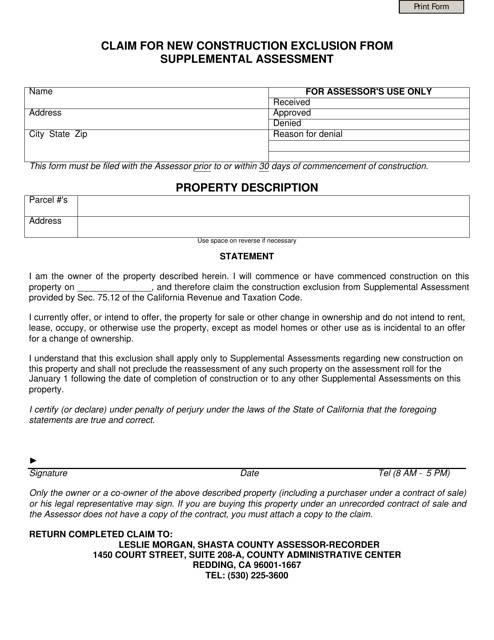

This form is used for claiming a new construction exclusion from supplemental assessment in Shasta County, California

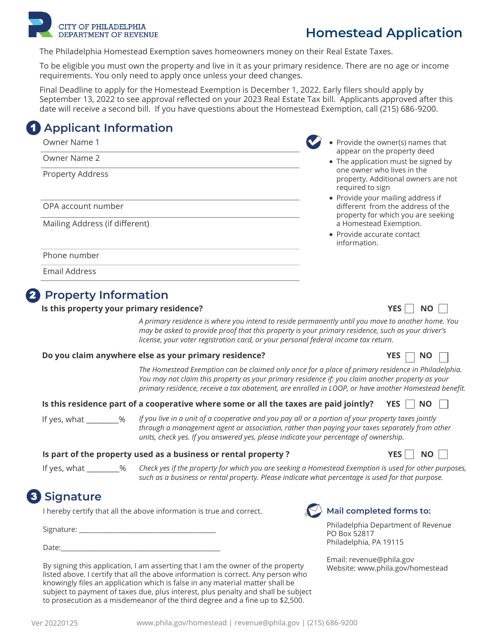

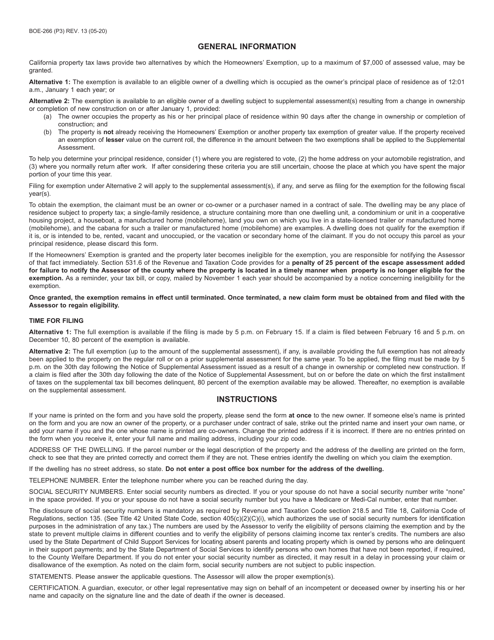

This form is used for applying for the Homestead Exemption in the City of Philadelphia, Pennsylvania. The Homestead Exemption provides a reduction in property taxes for eligible homeowners.

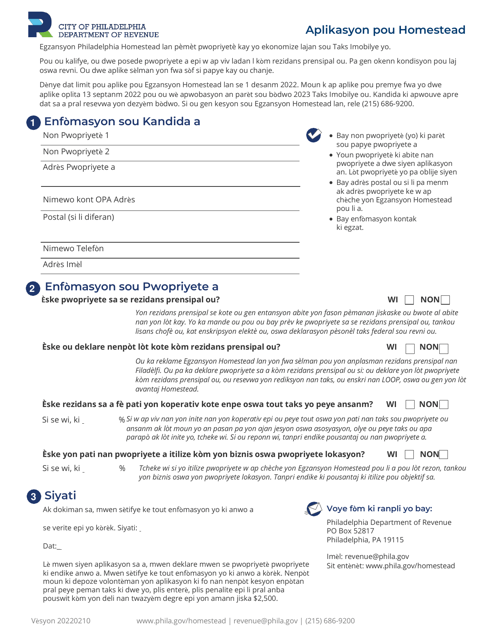

This document is an application for the Homestead Exemption in the City of Philadelphia, Pennsylvania. It is available in Haitian Creole language. The Homestead Exemption provides property tax relief for homeowners in Philadelphia.

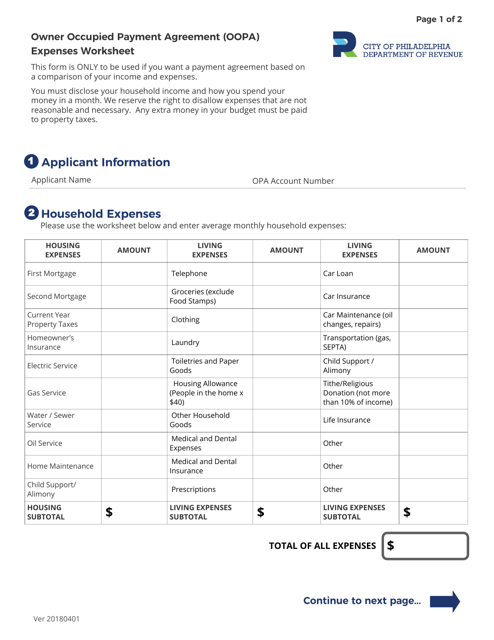

This document is for calculating and tracking expenses related to an Owner Occupied Payment Agreement (OOPA) in the City of Philadelphia, Pennsylvania. It helps homeowners keep record of their payments and ensure they can afford their OOPA expenses.

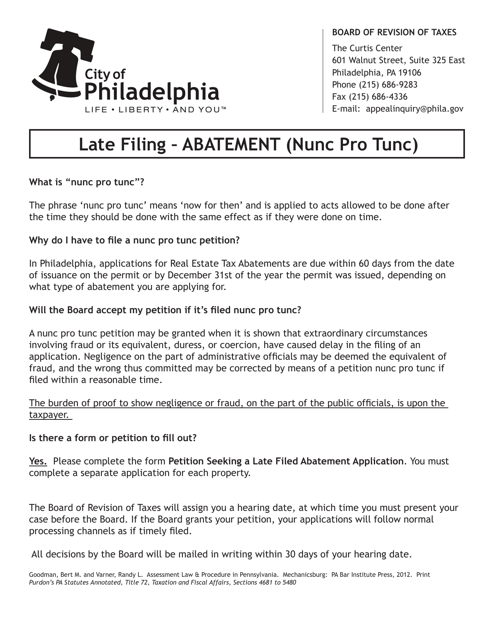

This type of document is a petition used to request a late filed abatement application in the City of Philadelphia, Pennsylvania.

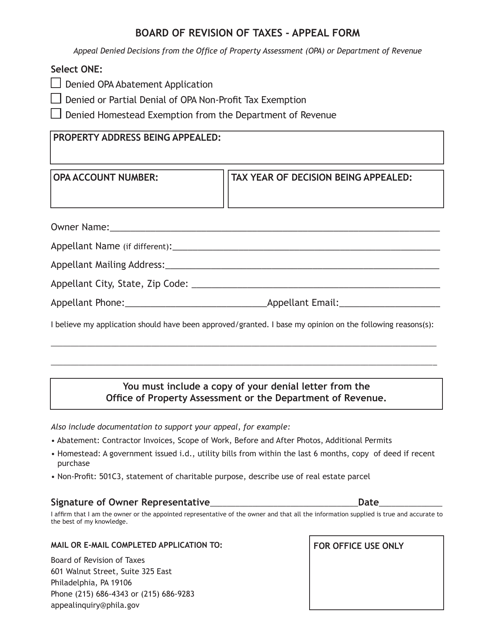

This Form is used for appealing a denied abatement or exemption in the City of Philadelphia, Pennsylvania.

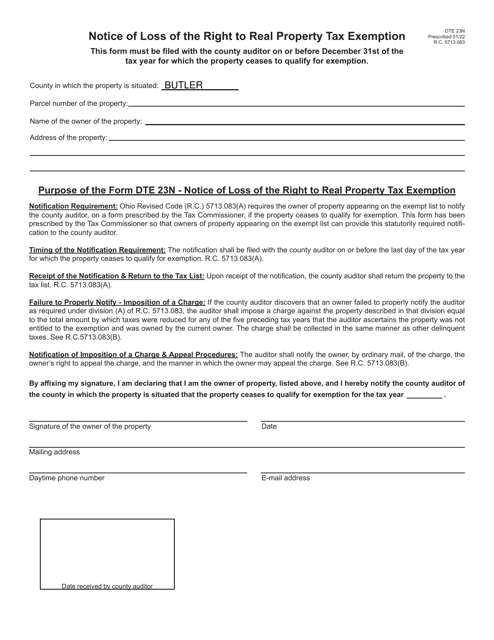

This form is used to notify the Butler County, Ohio, authorities about the loss of the right to a tax exemption on real property.

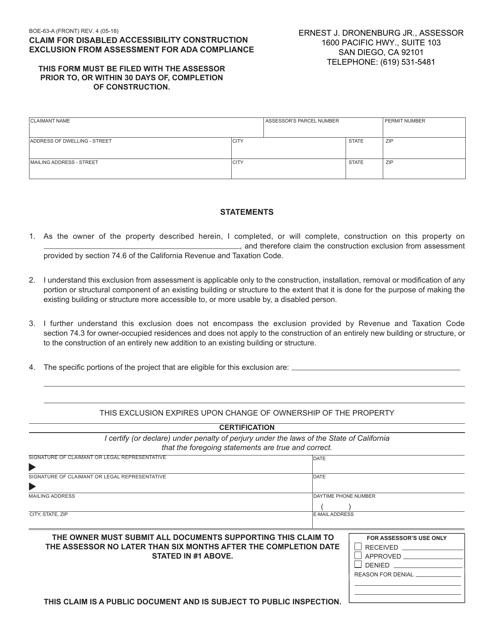

This form is used to claim a disabled accessibility construction exclusion from assessment for ADA compliance in the County of San Diego, California. It is for property owners who have made improvements to their property to comply with ADA accessibility standards for disabled individuals.

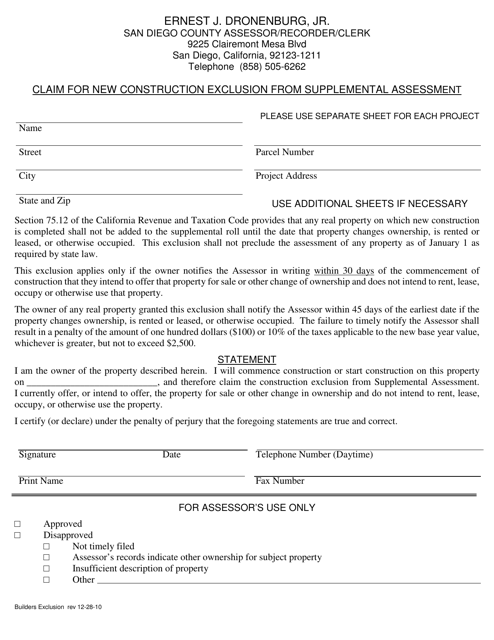

This form is used for claiming the exclusion from supplemental assessment for new construction in San Diego County, California. It allows property owners to request a reassessment of their property value due to new construction, which may result in a lower tax assessment.

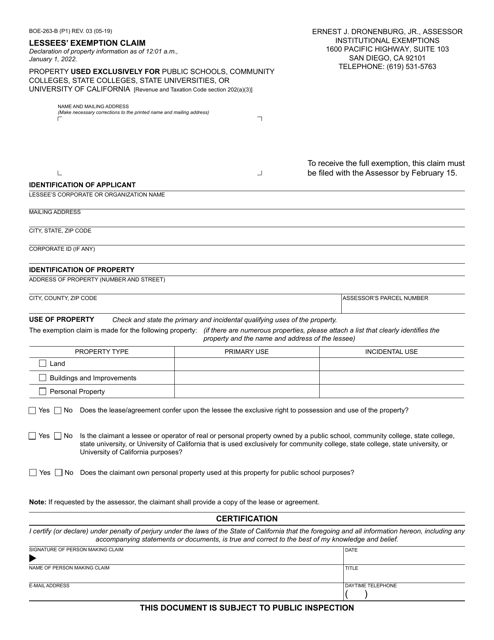

This form is used for lessees in San Diego County, California to claim an exemption.

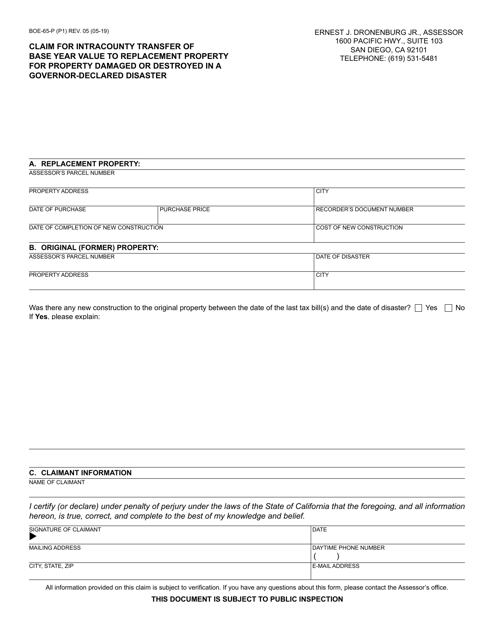

This form is used for claiming the transfer of base year value to replacement property for property that has been damaged or destroyed in a governor-declared disaster in San Diego County, California.

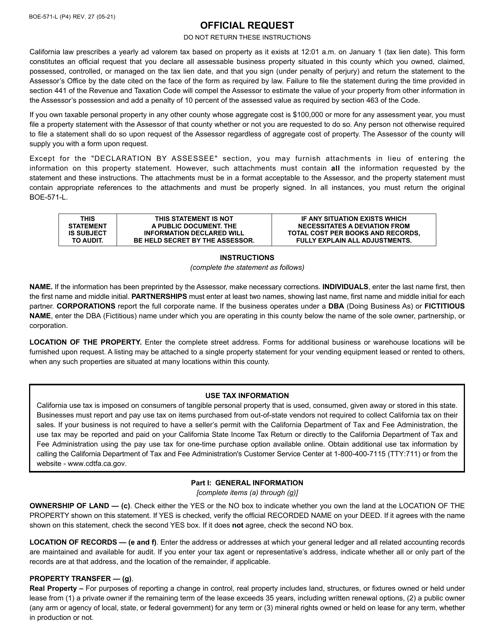

This document provides instructions for completing and submitting Form BOE-571-L, which is the Business Property Statement Form required by the County of San Diego, California.

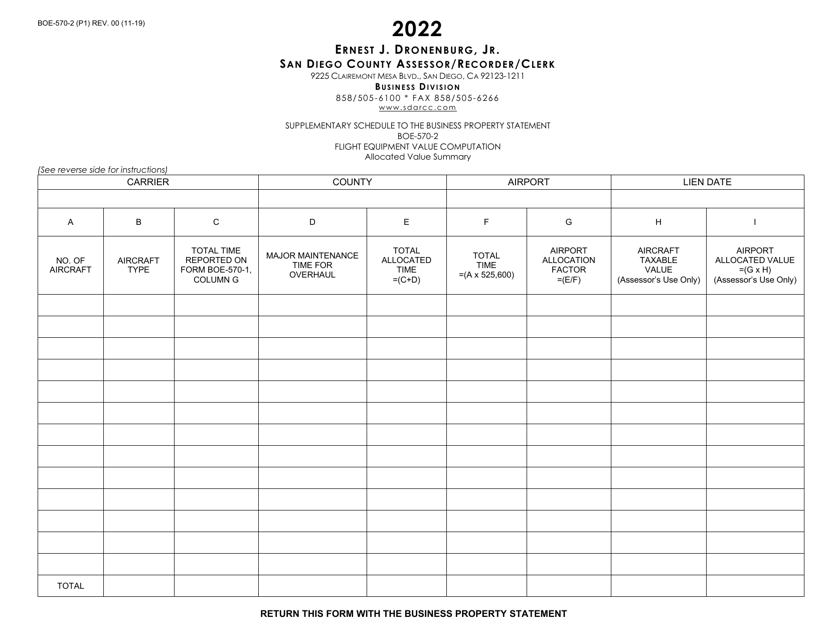

This form is used for calculating the value of flight equipment in San Diego County, California.

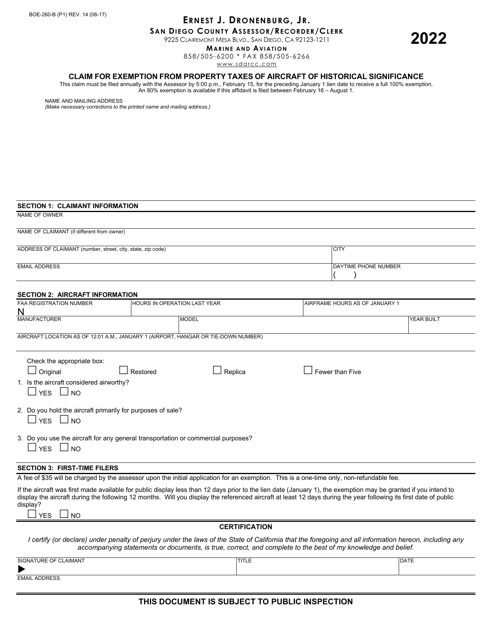

This form is used for claiming exemption from property taxes for historical aircraft in San Diego County, California.

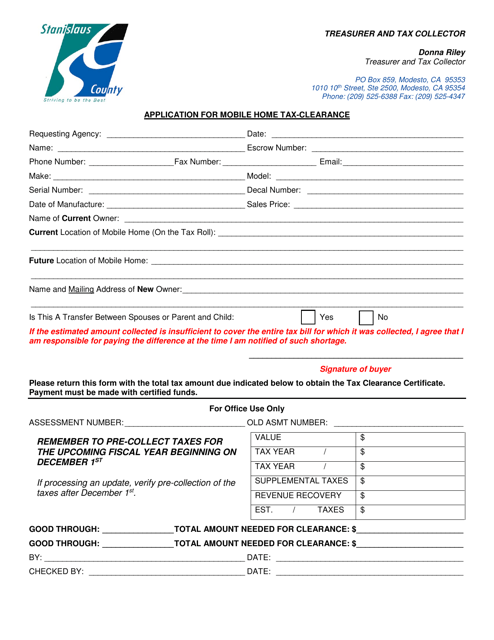

This document is used for applying for a tax-clearance for a mobile home in Stanislaus County, California.

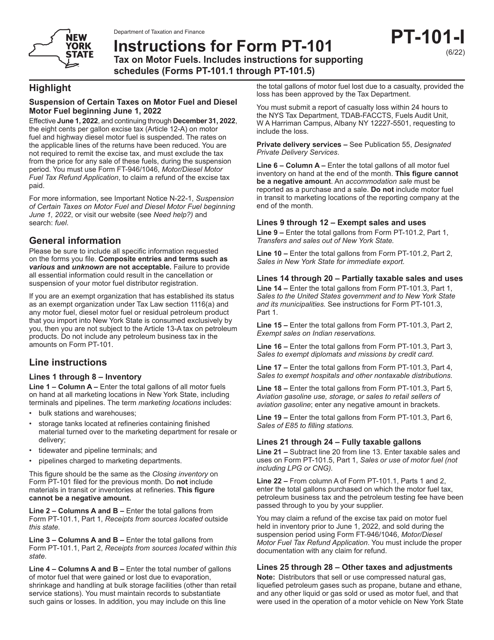

This Form is used for providing instructions for different versions of Form PT-101 in New York.

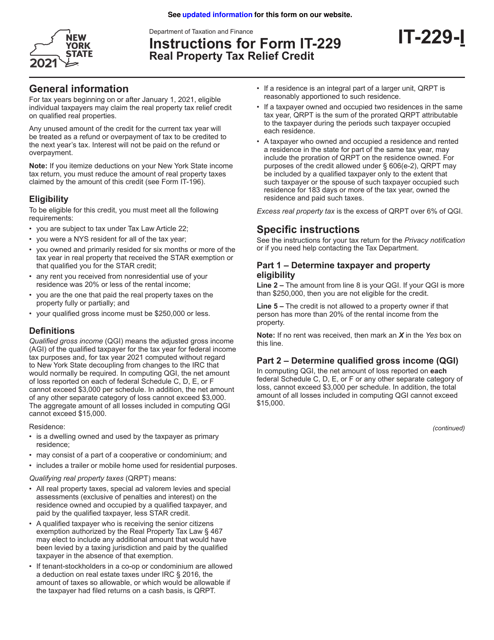

This document is used to provide instructions for Form IT-229 Real Property Tax Relief Credit in the state of New York. It helps taxpayers understand how to claim a credit for property taxes paid on their primary residence.

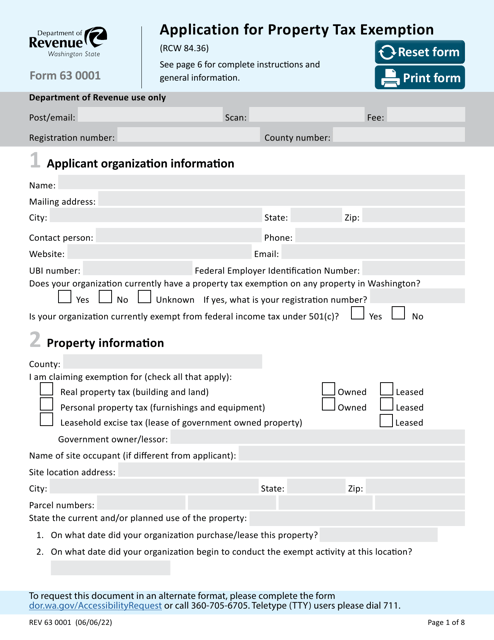

This form is used for applying for property tax exemption in the state of Washington.

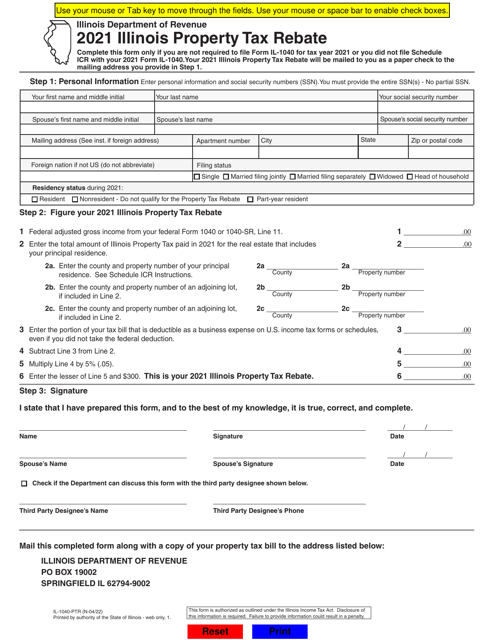

This form is used for applying for the Illinois Property Tax Rebate in the state of Illinois.

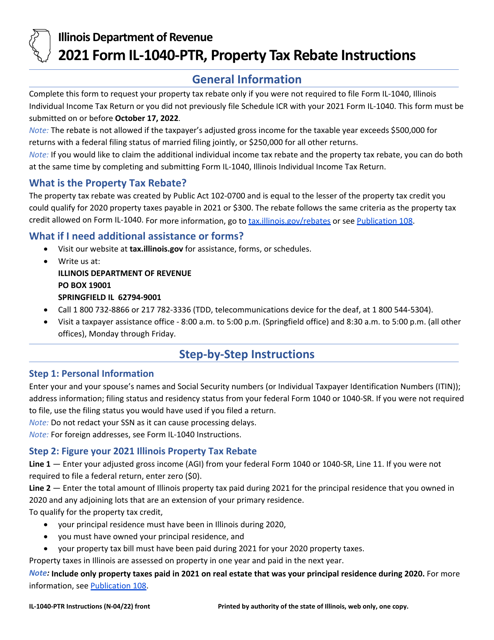

This form is used for applying for the Illinois Property Tax Rebate in the state of Illinois. It provides instructions on how to fill out the form and submit it to claim the rebate.

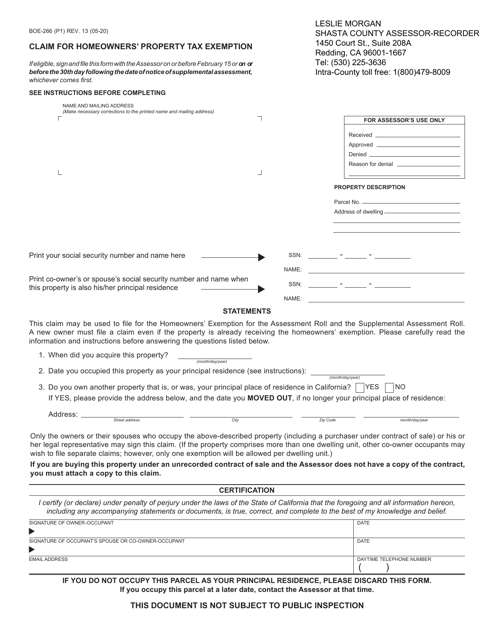

This form is used for claiming a homeowners' property tax exemption in Shasta County, California.

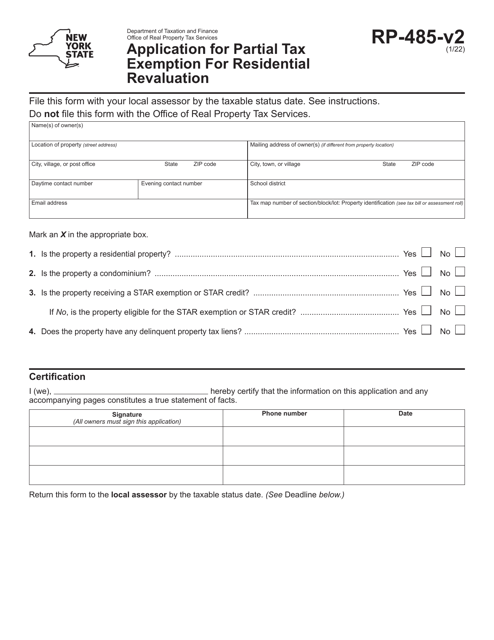

This form is used to apply for a partial tax exemption for residential revaluation in New York. It allows homeowners to potentially reduce their property taxes based on the changes in market value of their residential property.

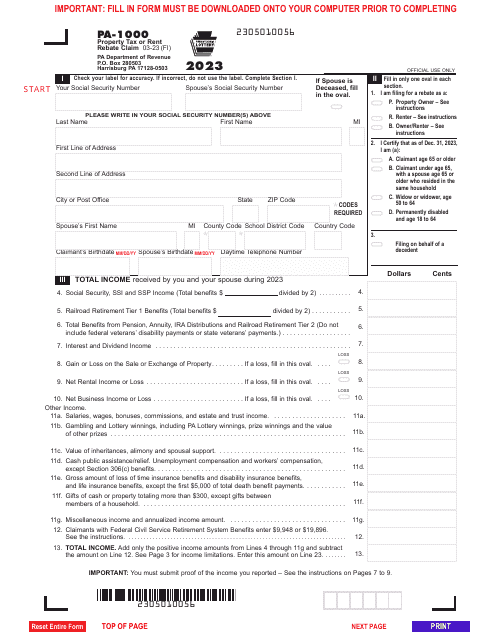

Pennsylvania residents may fill in this legal document if they wish to get a refund for a portion of rent or property tax paid on their residence.