Property Tax Form Templates

Documents:

720

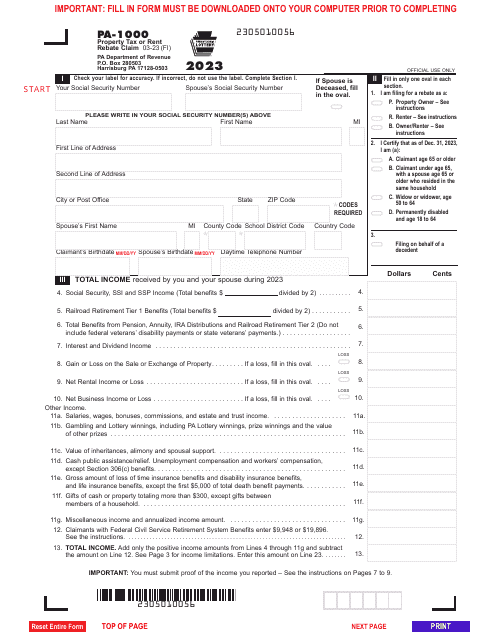

Pennsylvania residents may fill in this legal document if they wish to get a refund for a portion of rent or property tax paid on their residence.

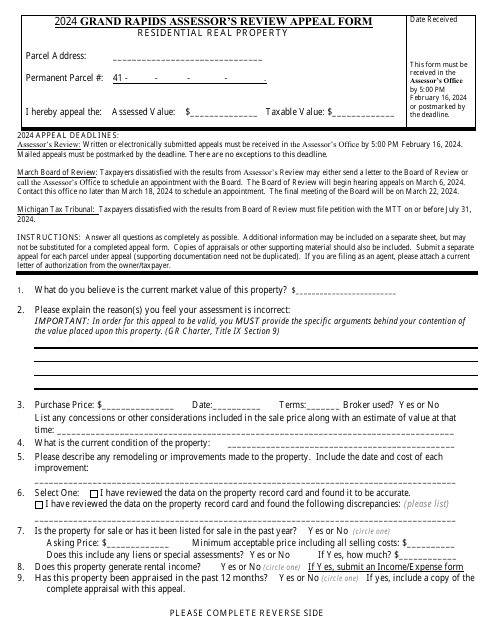

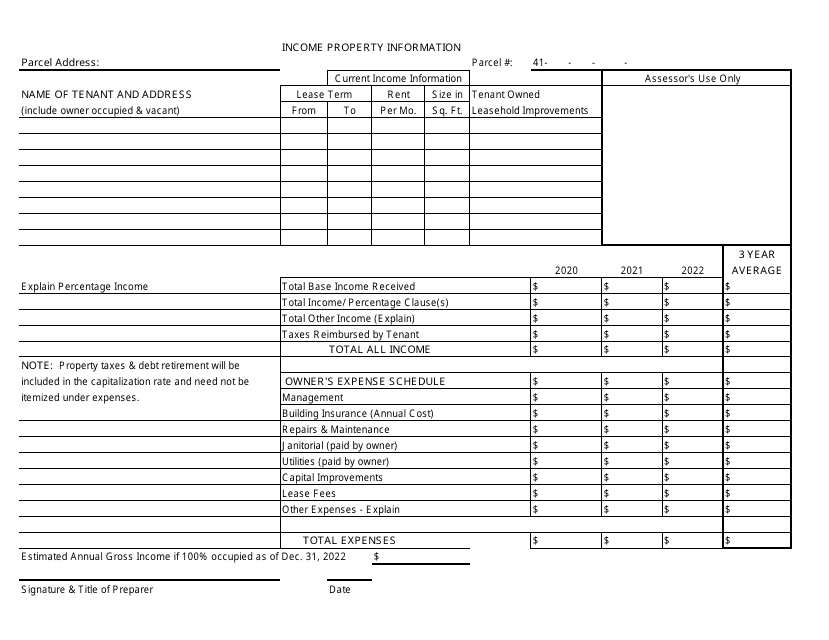

This document is used for reporting income and expenses related to a property in Grand Rapids, Michigan. It is used for assessment purposes by the city's assessor.

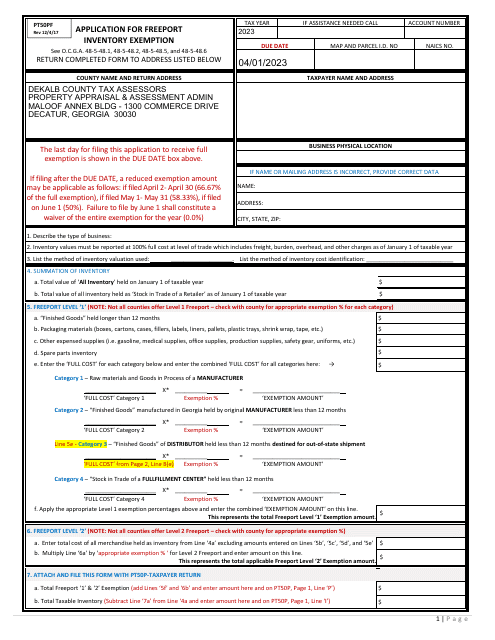

This Form is used for applying for a Freeport Inventory Exemption in DeKalb County, Georgia, which allows certain types of inventory to be exempt from property taxes.

This document is used for filing personal property taxes on business assets in DeKalb County, Georgia.

This document is used for filing a petition related to property tax assessment in Michigan. It allows taxpayers to contest their property tax assessment before the Tribunal.

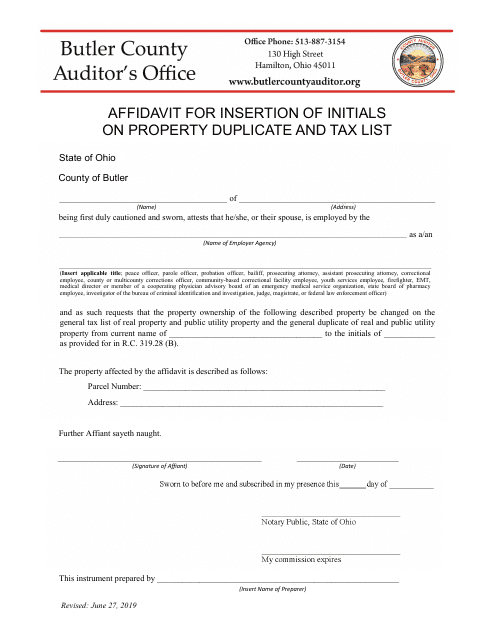

This document is used for requesting the insertion of initials on a property duplicate and tax list in Butler County, Ohio.

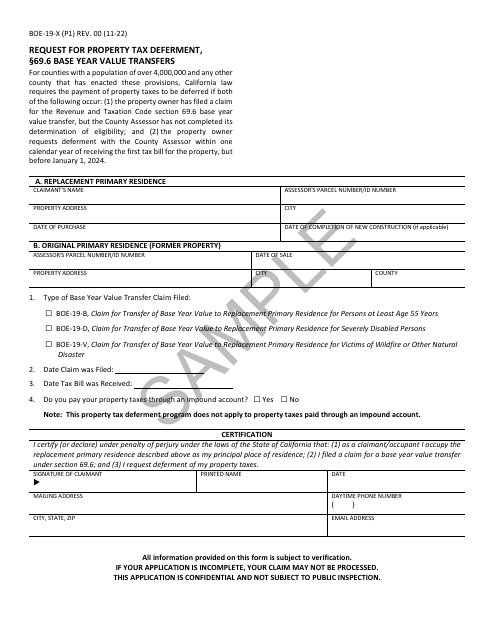

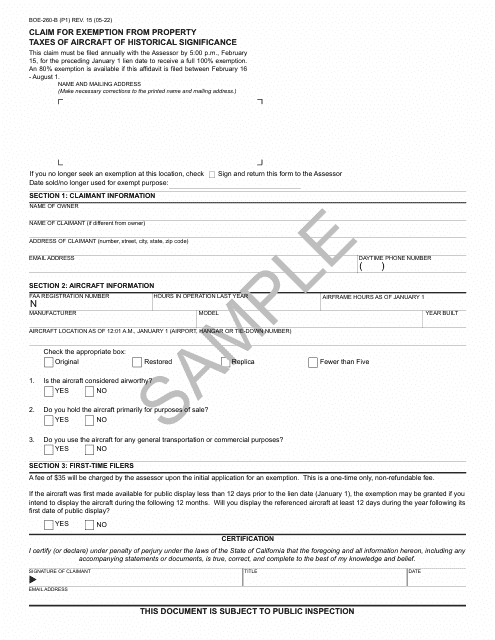

This form is used for requesting property tax deferment and base year value transfers in California. It provides a sample of the BOE-19-X form.

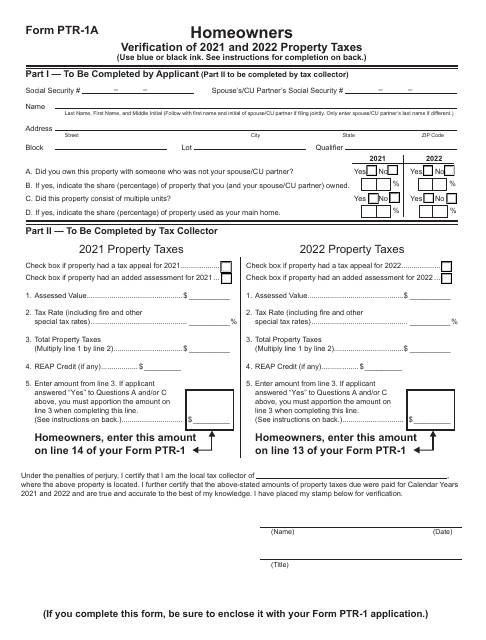

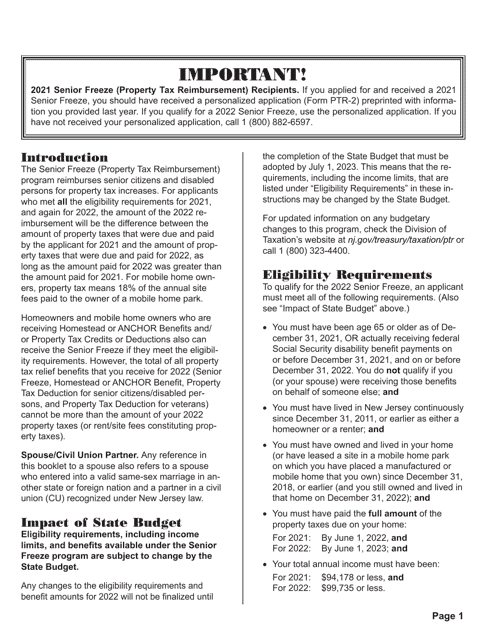

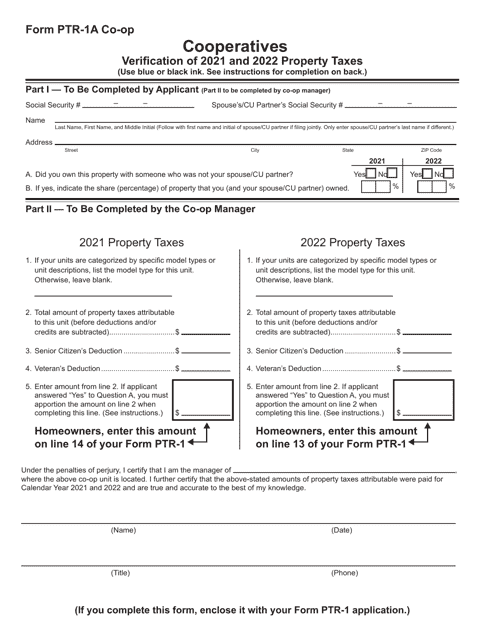

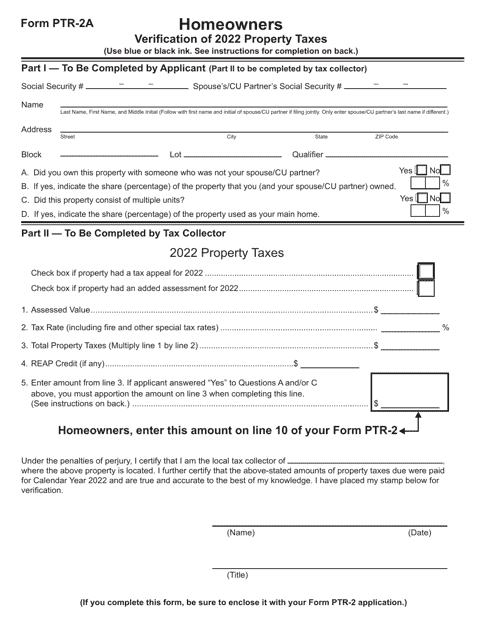

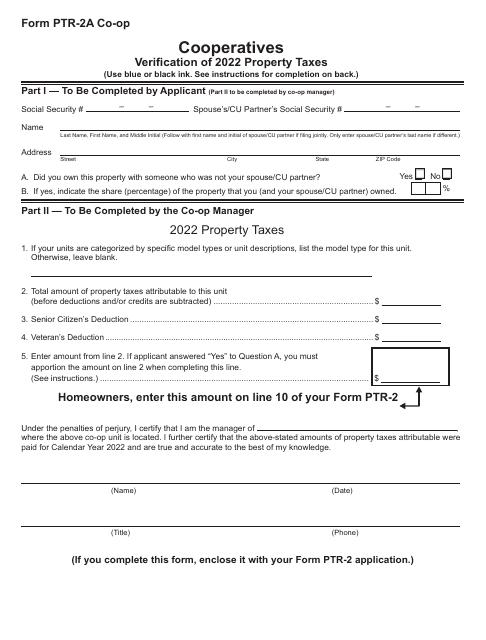

This Form is used for applying for the Property Tax Reimbursement program, also known as the Senior Freeze, in the state of New Jersey. It provides instructions on how to fill out the PTR-1 application.

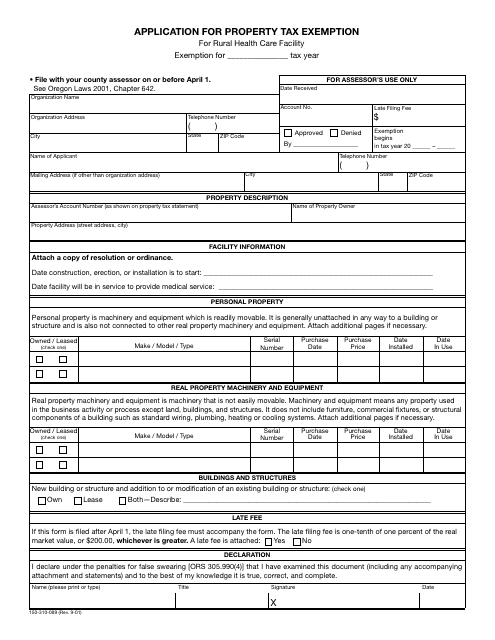

This form is used for applying for a property tax exemption in the state of Oregon.

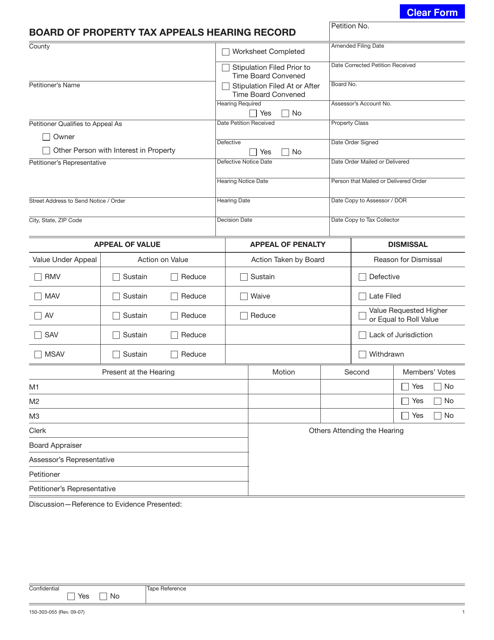

This document is used for recording the proceedings of a Board of Property Tax Appeals hearing in Oregon.