Property Tax Form Templates

Documents:

720

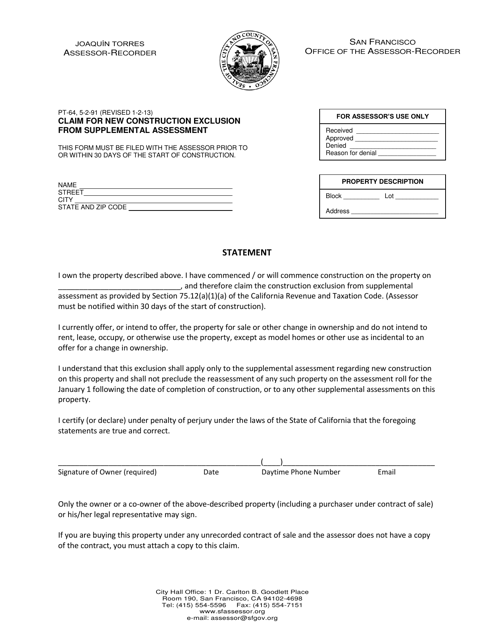

This form is used for claiming an exclusion from supplemental assessment for newly constructed property in the City and County of San Francisco, California.

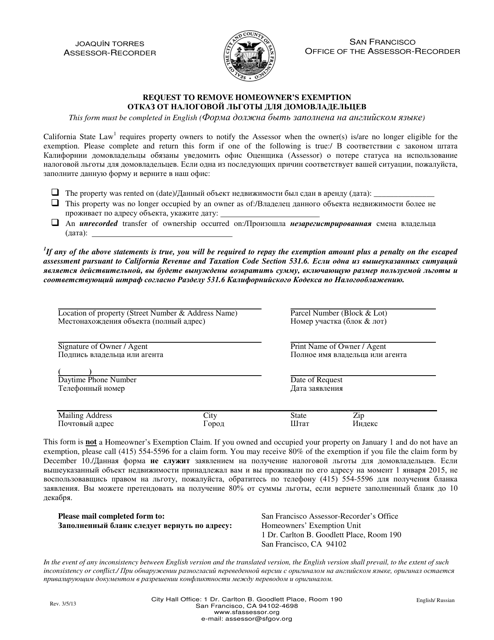

This document is a request form used in the City and County of San Francisco, California to remove the homeowner's exemption. The form is available in both English and Russian languages. It can be used by homeowners who no longer qualify for the exemption and need to have it removed from their property tax assessment.

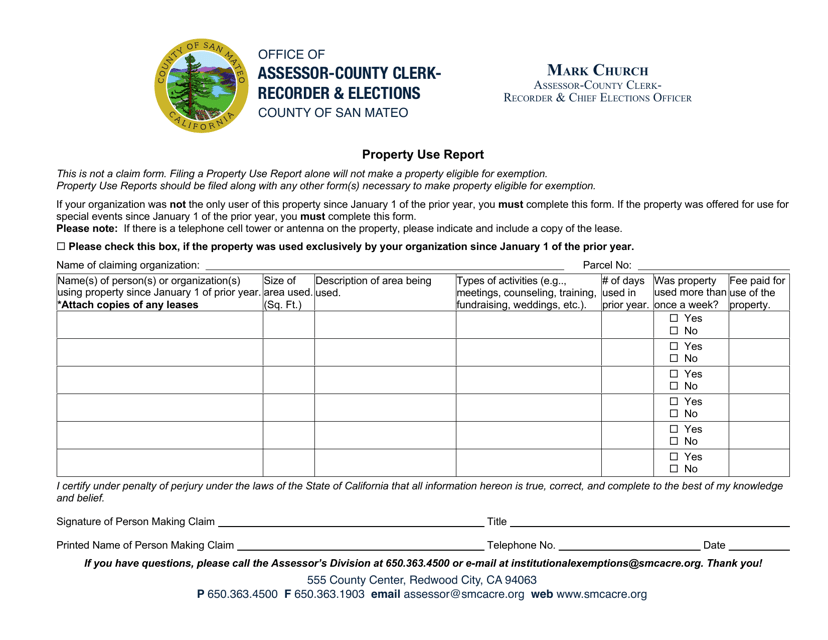

This document provides a report on the use of properties in San Mateo County, California. It gives information about how the properties are being used and can be useful for research or planning purposes.

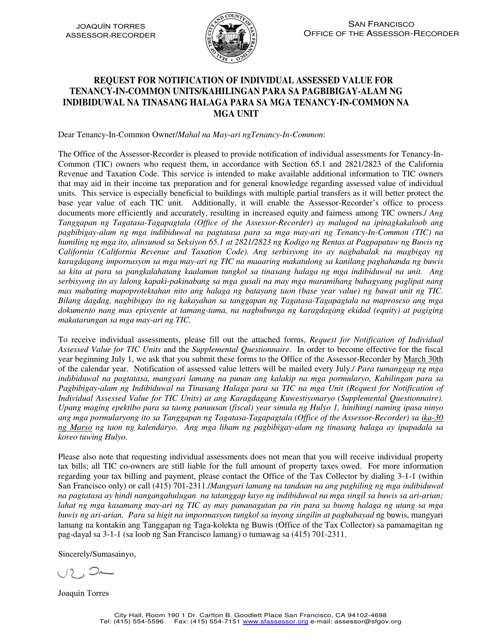

This document is a request form for receiving notifications about the assessed value of individual Tic units in the City and County of San Francisco, California. Available in English and Tagalog.

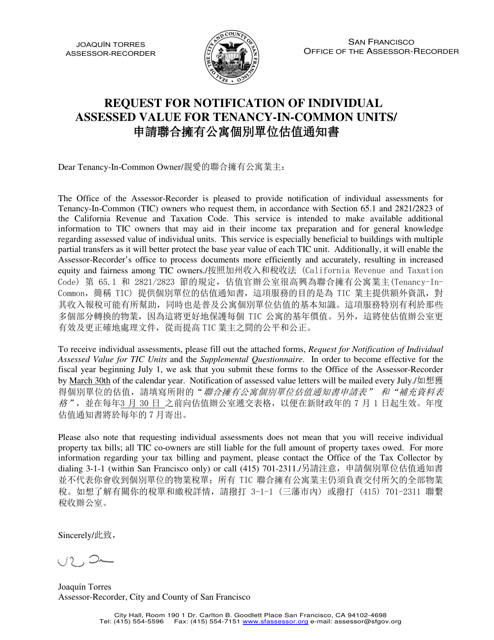

This document is a request for notification of the individual assessed value for tenancy-in-common units in San Francisco, California. It is available in both English and Chinese languages.

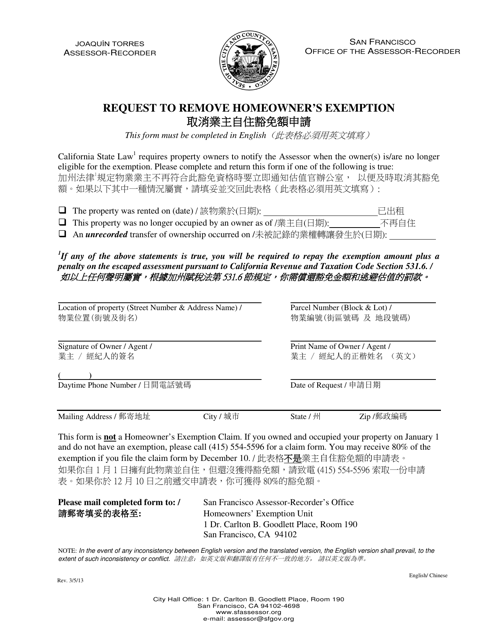

This form is used for requesting the removal of the homeowner's exemption in San Francisco, California. It is available in both English and Chinese.

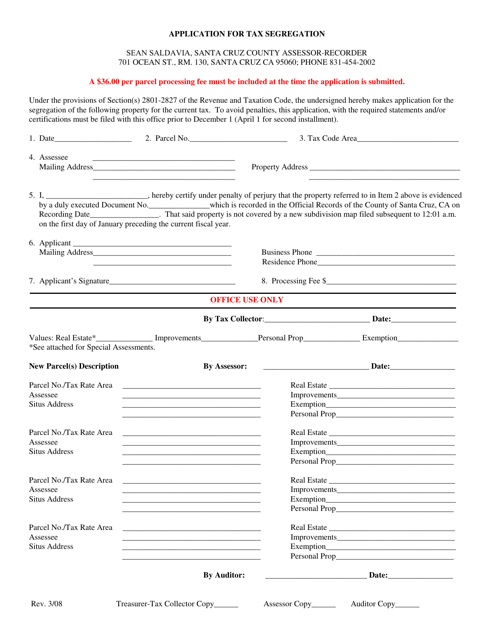

This document is an application form used in Santa Cruz County, California for requesting tax segregation. Tax segregation is a method of allocating costs of real property between different asset classes to optimize tax deductions.

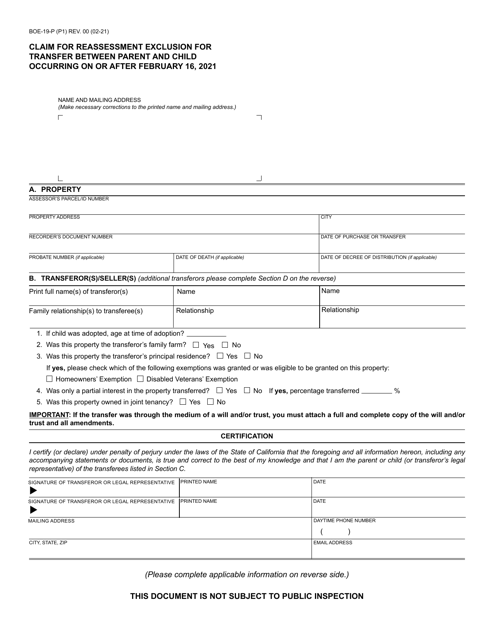

This form is used for claiming reassessment exclusion for transfers between parents and children in California that occurred on or after February 16, 2021.

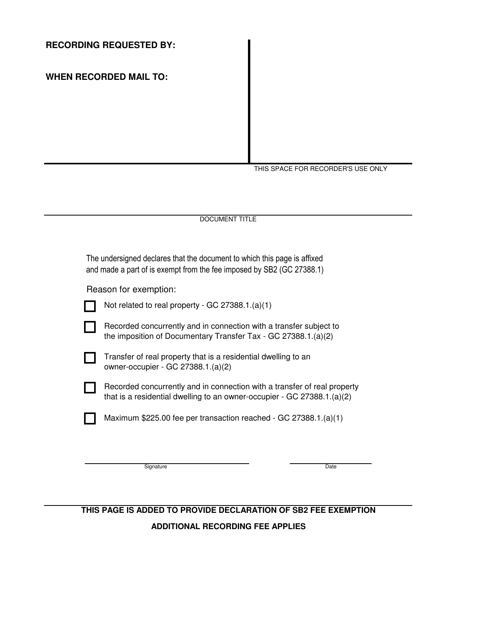

This document provides information on the exemptions available in the County of Santa Cruz, California for the Sb2 program. It outlines the criteria and process for applying for these exemptions.

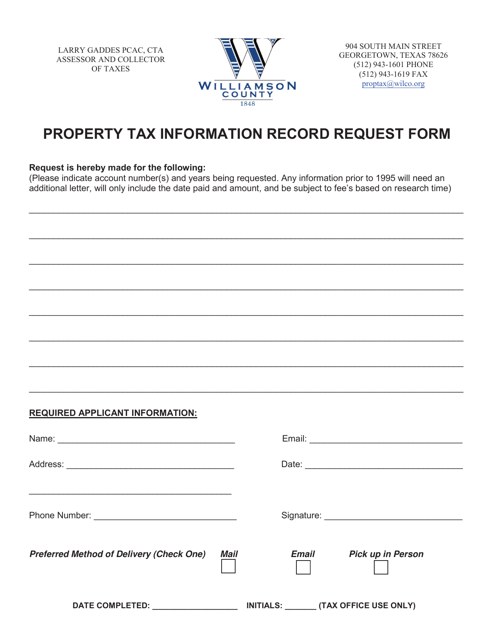

This form is used for requesting property tax information records in Williamson County, Texas.

This document is for objecting to taxation or notifying about re-taxation in Westchester County, New York. It allows residents to voice their concerns or request a review of their property taxes.

This is a form used in Massachusetts to authorize an individual to represent another person's interests in transactions that involve the sale, purchase, and management of real property.

The owner of a property in Colorado may use this template in order to give another person the authority and legal power to manage a property belonging to the owner.

This is a legally binding template used in North Carolina and signed between the property owner and the company or individual they have hired to maintain their property.

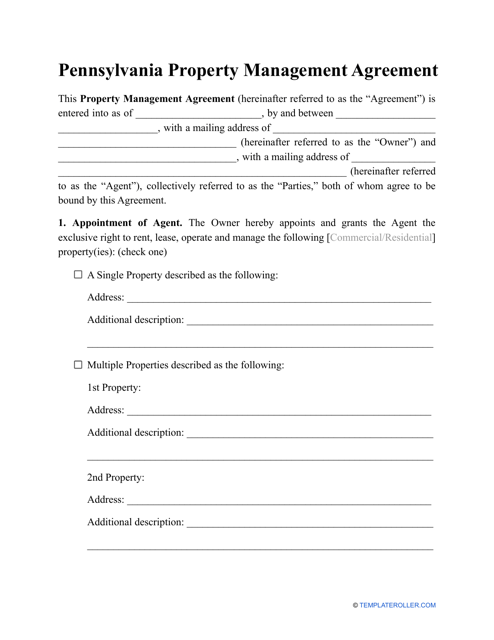

This template permits another party to legally manage a property with full permission from the owner of the property in the state of Pennsylvania.

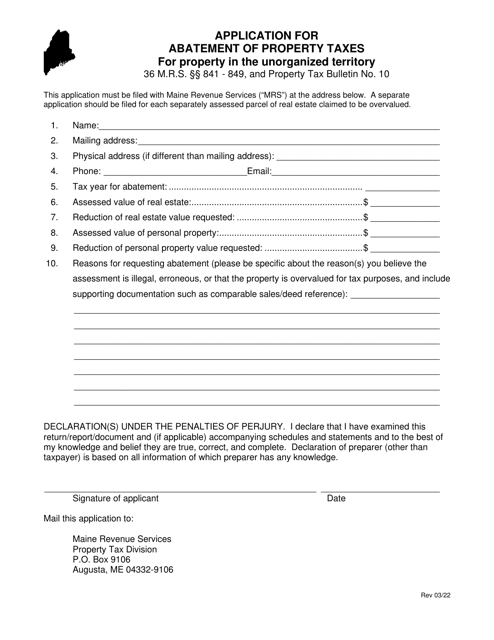

This document is for property owners in Maine who want to apply for a reduction in property taxes for property located in the unorganized territories.

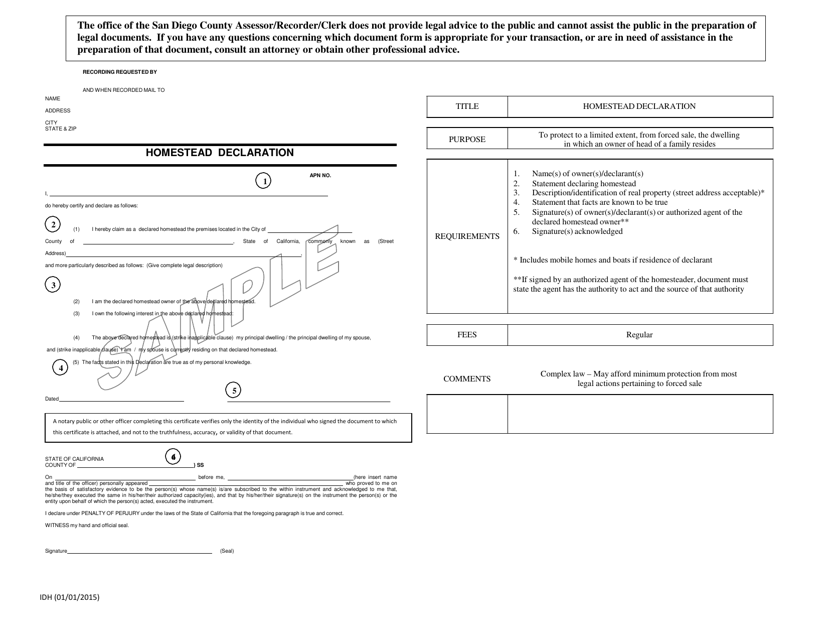

This document is used to declare a property as a homestead in San Diego County, California. It provides instructions on how to complete and file the declaration to protect the property from certain types of creditors.

This document is used to apply for a homestead exemption in the City of Austin, Texas. It confirms that the property owner is claiming the property as their primary residence for tax purposes.

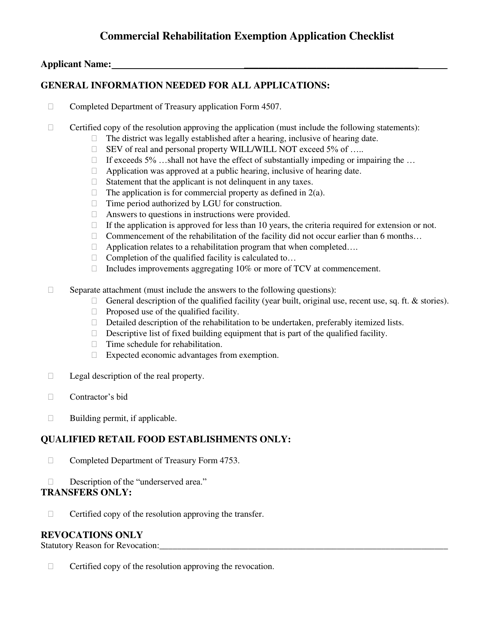

This document is a checklist for applying for a commercial rehabilitation exemption in Michigan. It provides a list of the necessary documents and steps required for the application process.

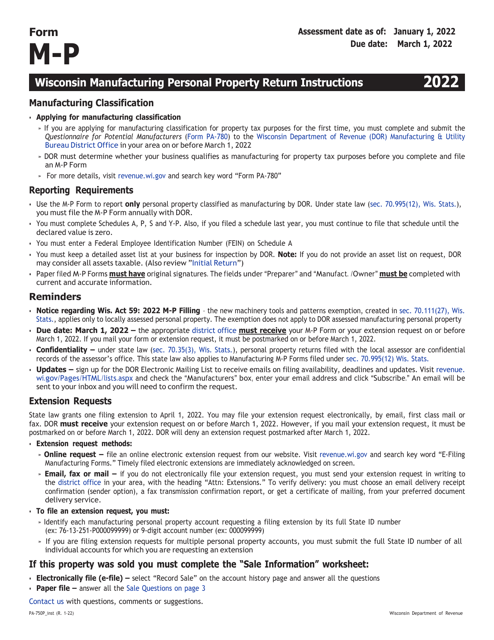

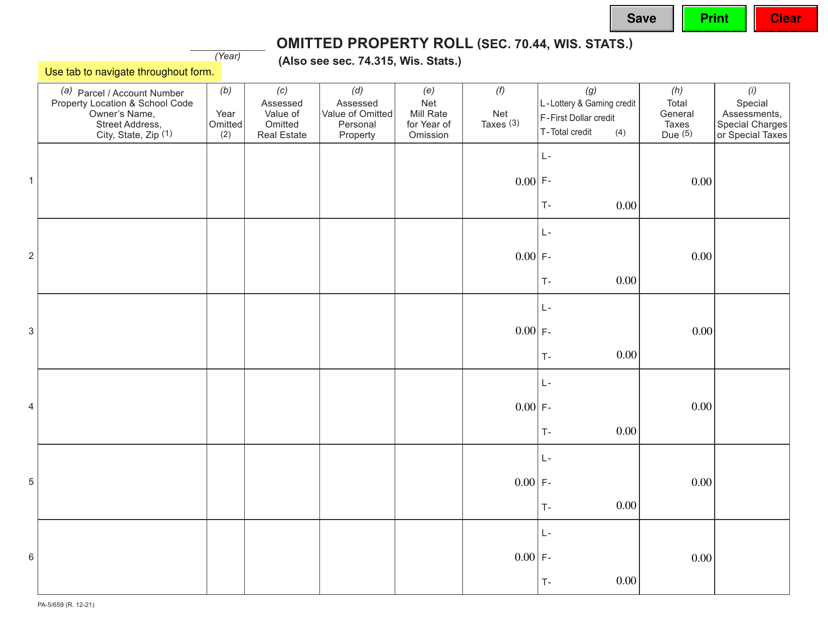

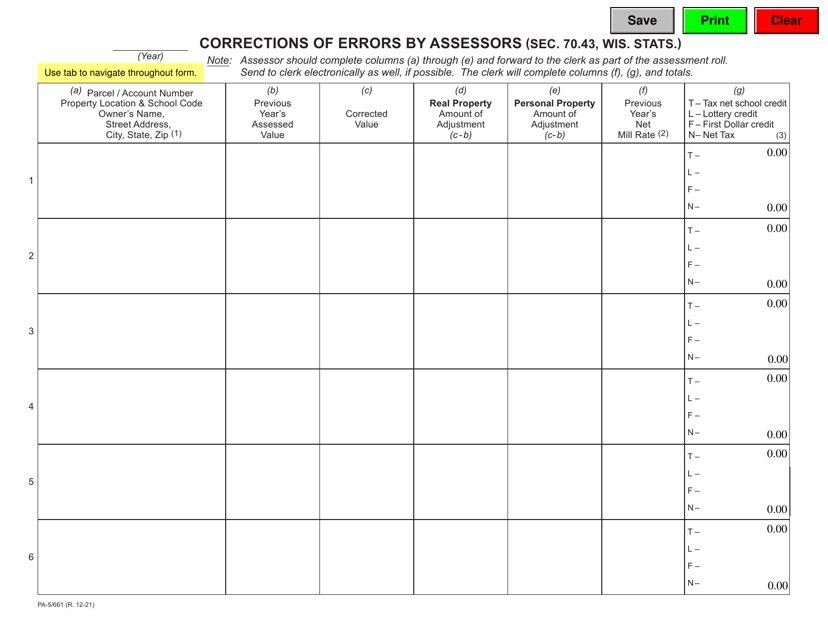

This Form is used for filing the Wisconsin Manufacturing Personal Property Return, which is required for businesses to report their manufacturing personal property in Wisconsin.

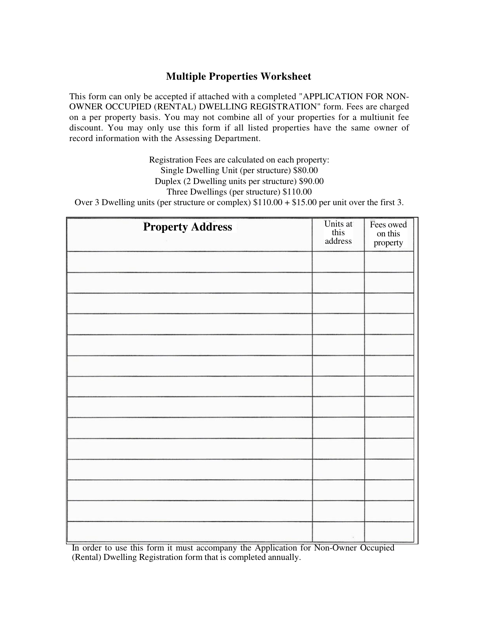

This document is a Multiple Properties Worksheet for the City of Muskegon, Michigan. It is used to record information about multiple properties in the city.

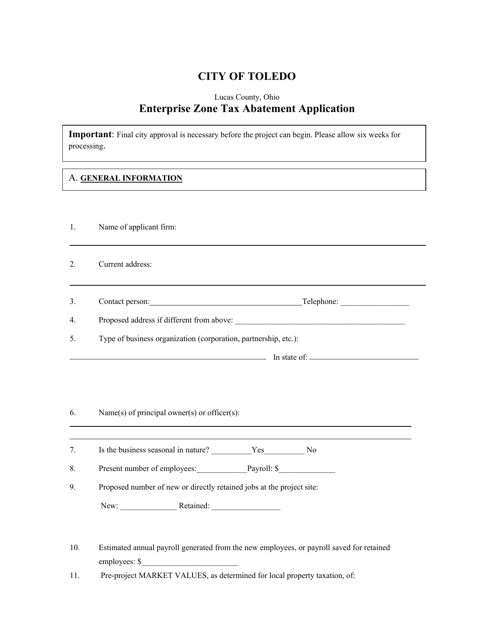

This document is an application for a tax abatement in the Enterprise Zone in Toledo, Ohio. The tax abatement is a program that allows businesses to receive a reduction or exemption from certain taxes for a specified period of time in order to promote economic development in the designated area.

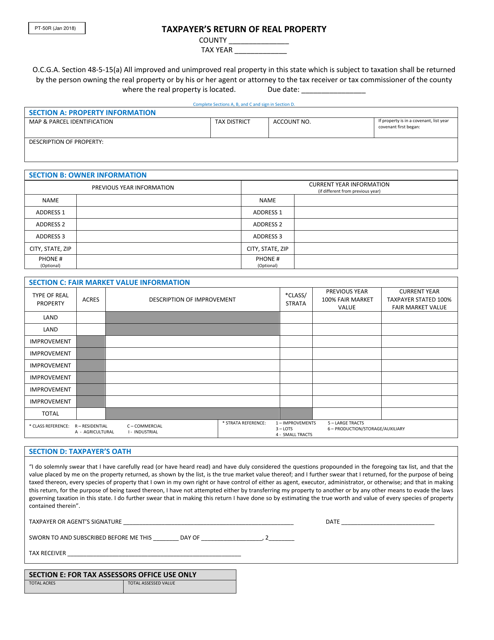

This document is used for filing the Taxpayer's Return of Real Property in the state of Georgia, United States. It is used by property owners to report and pay taxes on their real estate holdings.

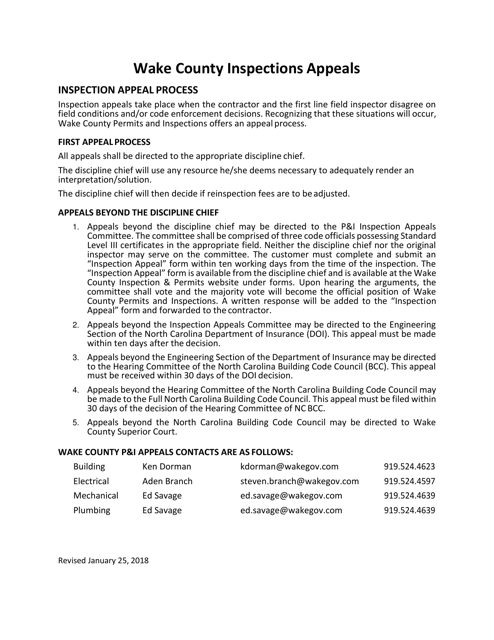

This document is used for appealing the results of an inspection in Wake County, North Carolina.

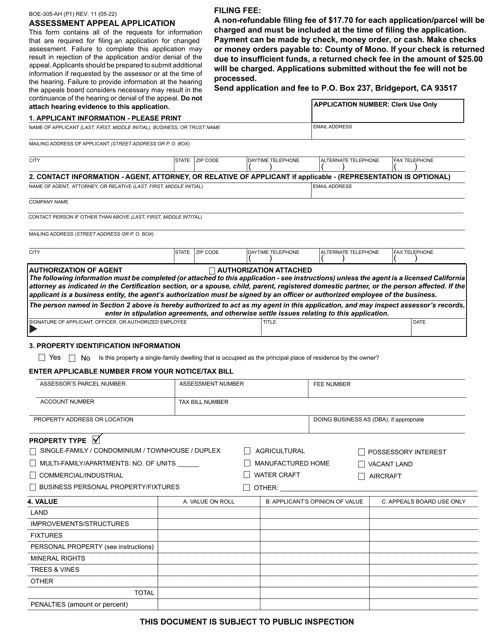

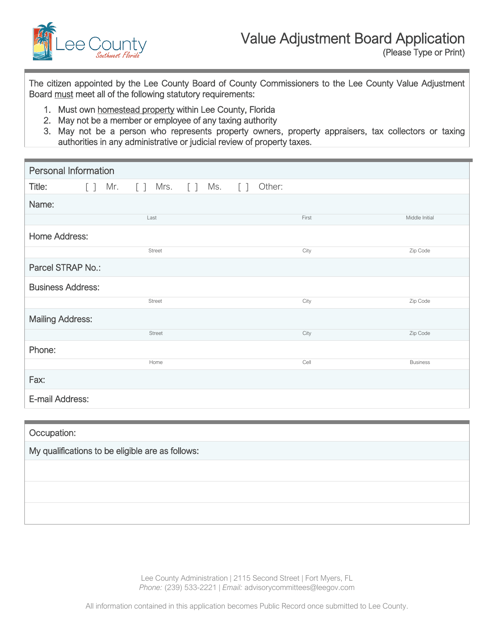

This document is for applying to the Value Adjustment Board in Lee County, Florida.