Property Tax Form Templates

Documents:

720

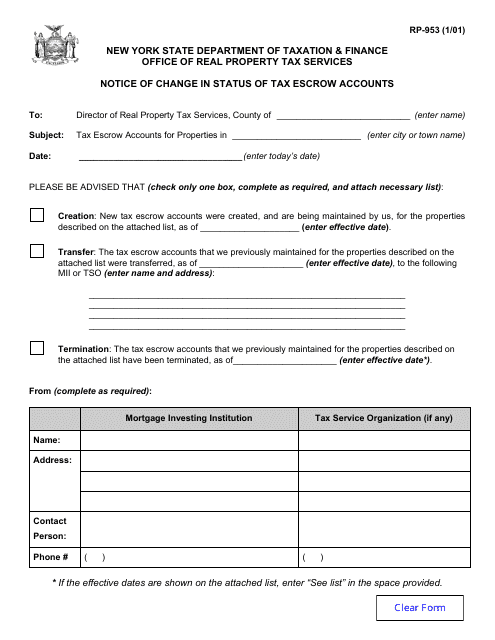

This form is used for notifying the change in status of tax escrow accounts in New York.

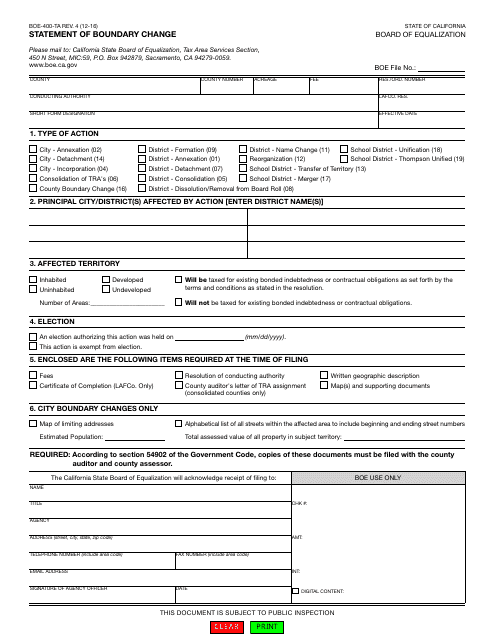

This form is used for reporting boundary changes in California.

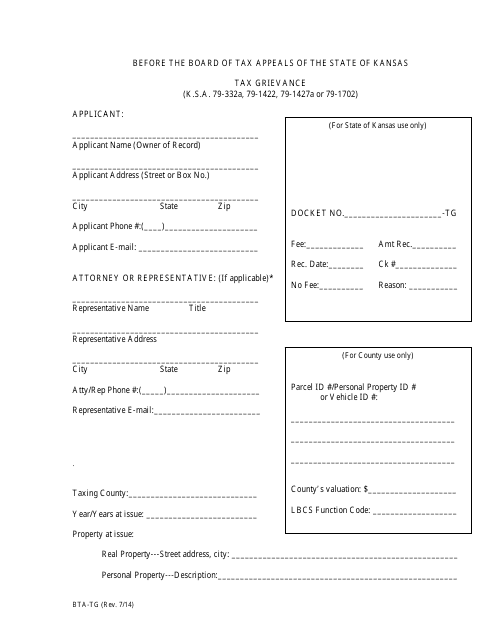

This document is used for filing a tax grievance in the state of Kansas.

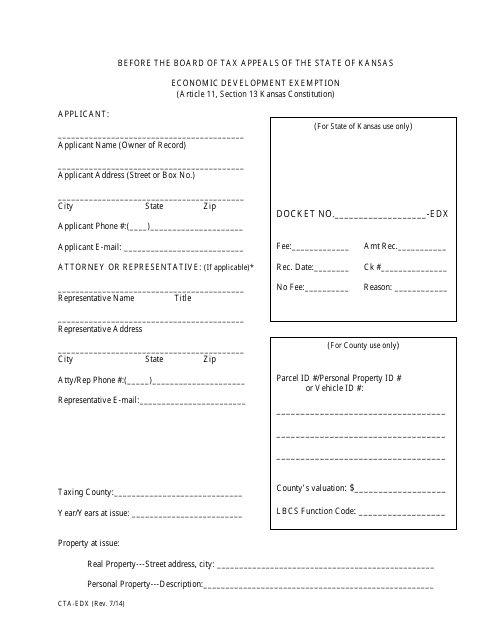

This type of document is used to apply for an economic development exemption in the state of Kansas. It allows businesses to potentially qualify for tax benefits and incentives in order to encourage job creation and investment in the local economy.

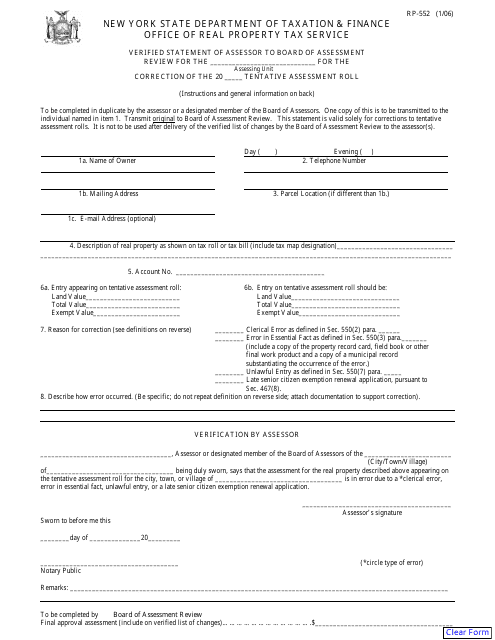

This form is used for the verified statement of the assessor to the Board of Assessment Review in New York. It is to provide accurate and verifiable information regarding assessments.

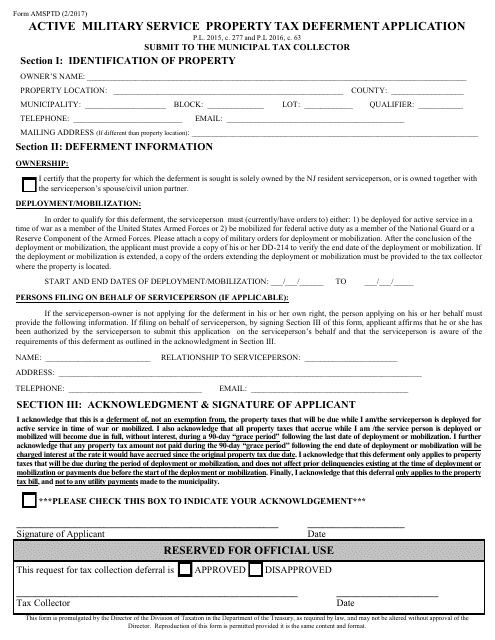

This form is used for applying for a property tax deferment for active military service members in New Jersey.

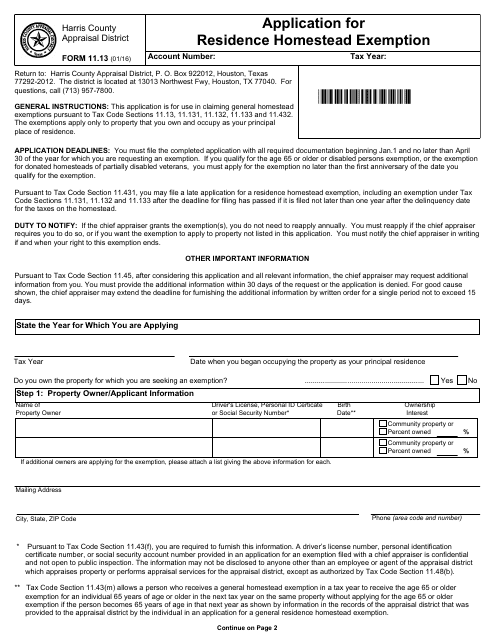

This Form is used for applying for a residence homestead exemption with the Harris County Appraisal District in Texas.

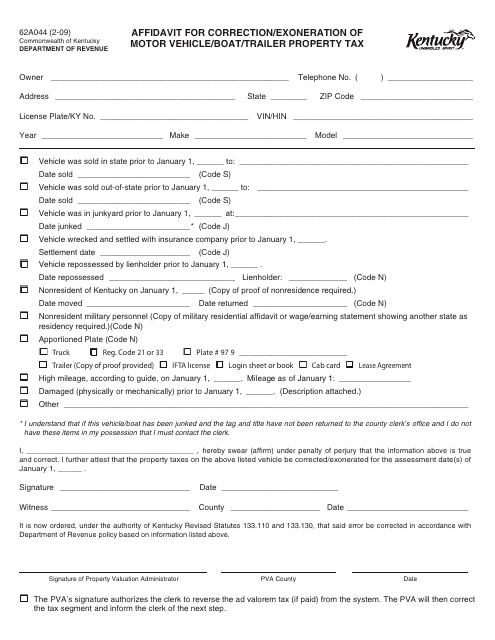

This form is used for correcting or requesting exemption from property tax for motor vehicles, boats, or trailers in Kentucky.

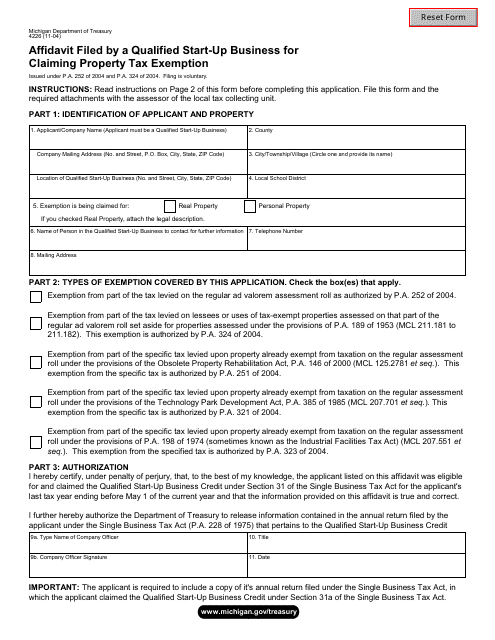

This form is used for filing an affidavit by a qualified start-up business in Michigan to claim a property tax exemption.

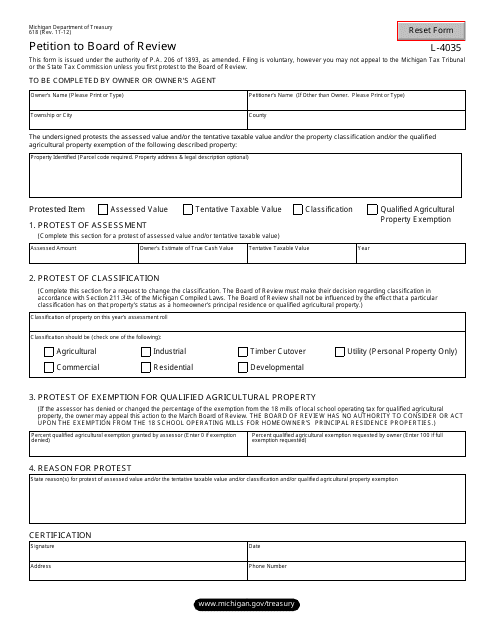

This form is used for filing a petition to the Board of Review in the state of Michigan.

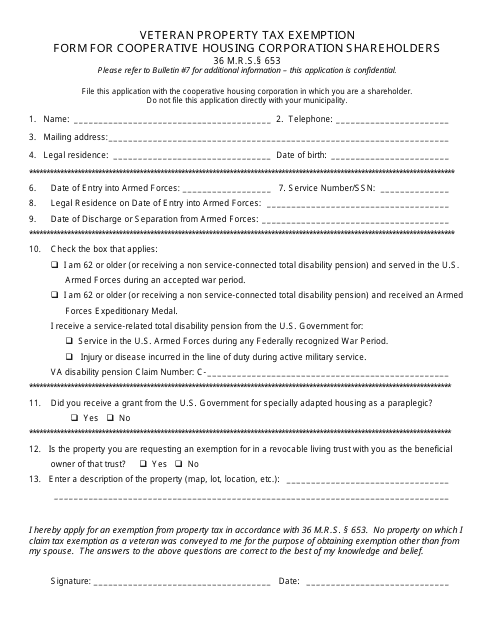

This form is used for cooperative housing corporation shareholders in Maine to apply for a veteran property tax exemption.

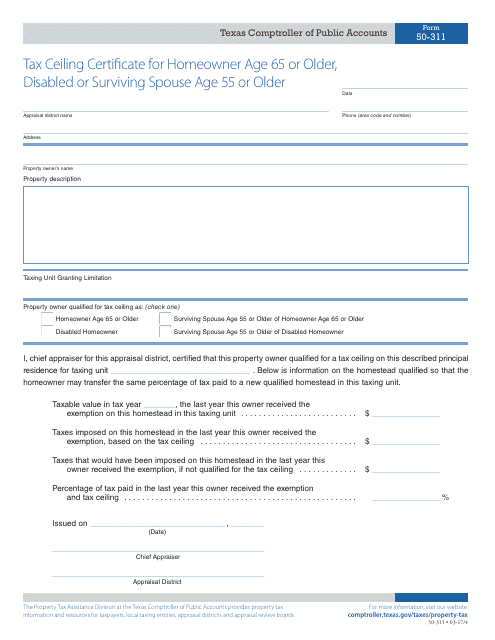

This form is used for homeowners in Texas who are age 65 or older, disabled, or surviving spouse age 55 or older to apply for a tax ceiling certificate. This document helps eligible individuals receive property tax relief.

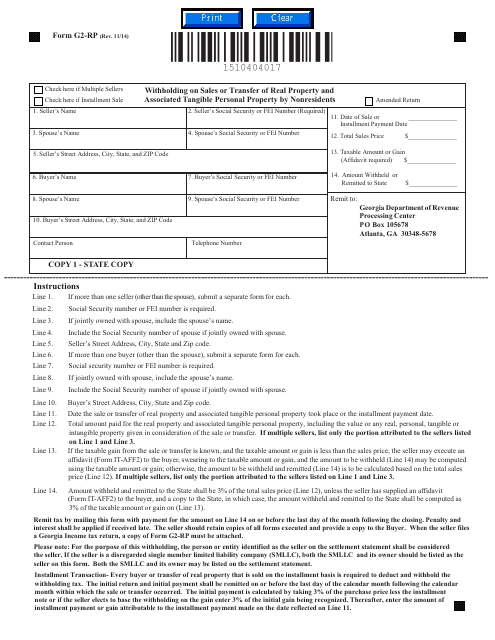

This form is used for reporting and withholding taxes on the sale or transfer of real property and associated tangible personal property by nonresidents in the state of Georgia, United States.

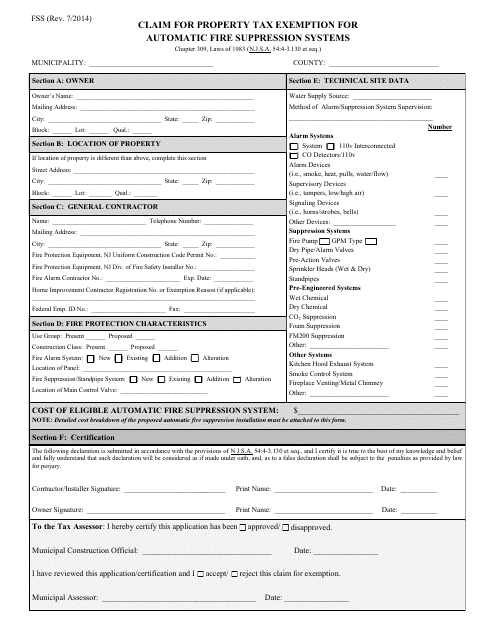

This form is used for claiming a property tax exemption for automatic fire suppression systems in New Jersey.

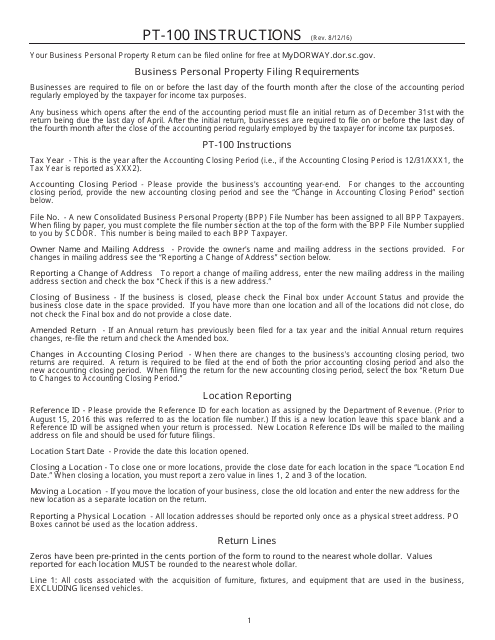

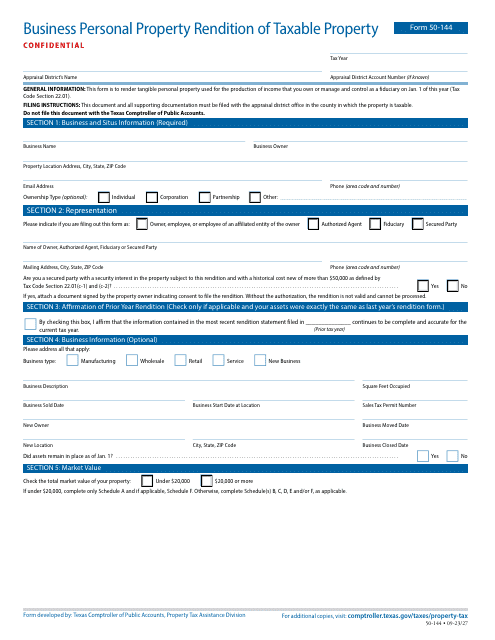

This Form is used for filing the Business Personal Property Return in South Carolina. It provides instructions on how to properly fill out and submit the form for reporting business personal property for taxation purposes.

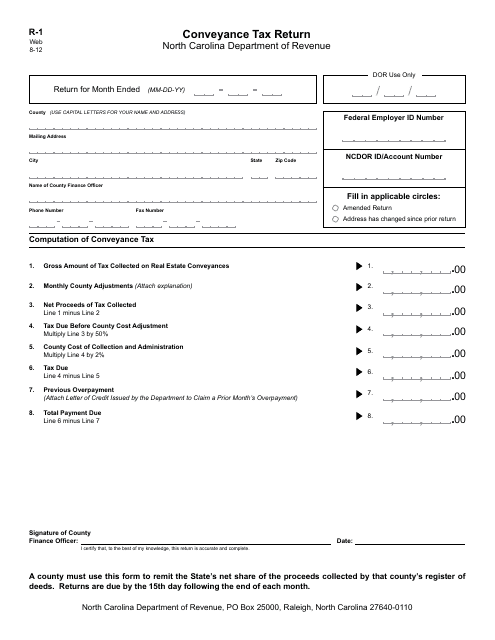

This Form is used for filing a Conveyance Tax Return in North Carolina.

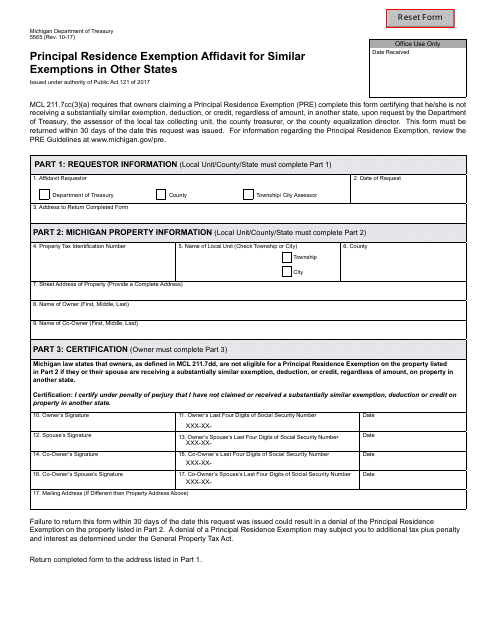

This document is used for claiming principal residence exemption in Michigan and exploring similar exemptions in other states.

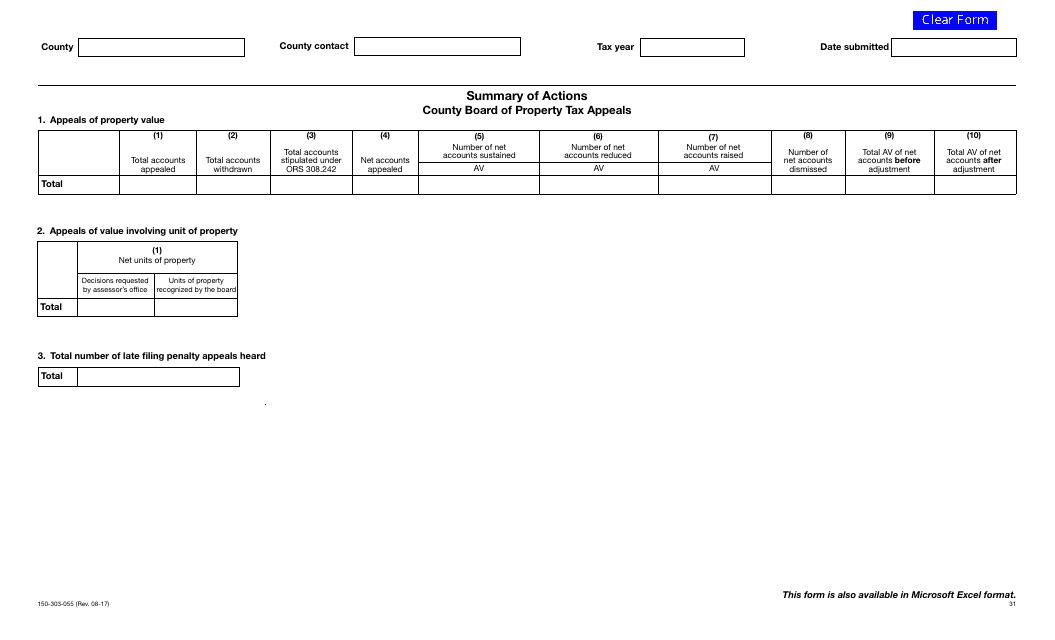

This form is used for submitting a summary of actions for the County Board of Property Tax Appeals in Oregon.

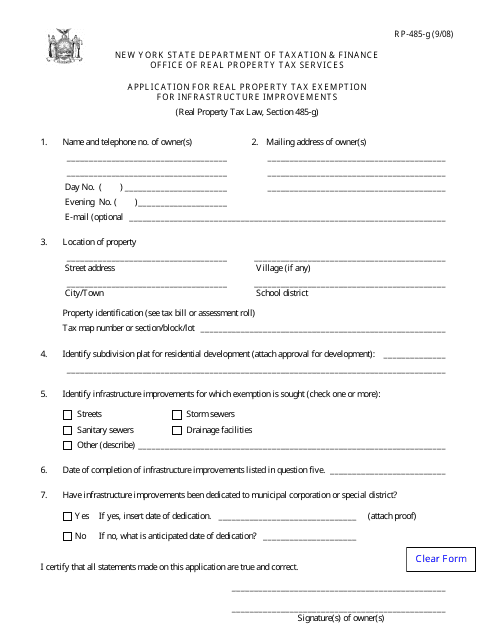

Form RP-485-G Application for Real Property Tax Exemption for Infrastructure Improvements - New York

This Form is used for applying for a real property tax exemption for infrastructure improvements in New York.

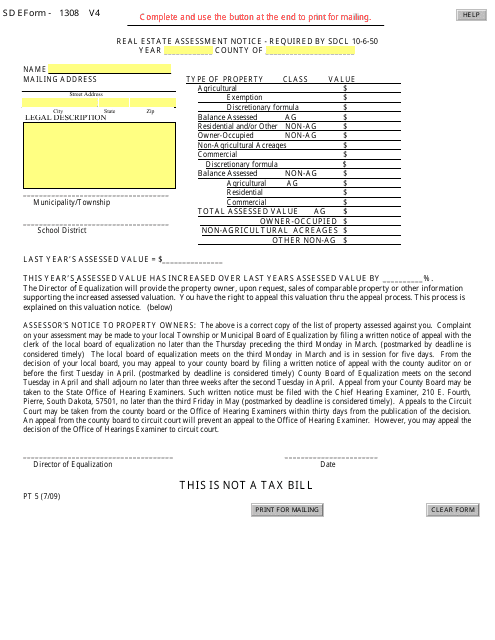

This Form is used for receiving a Real Estate Assessment Notice in South Dakota.

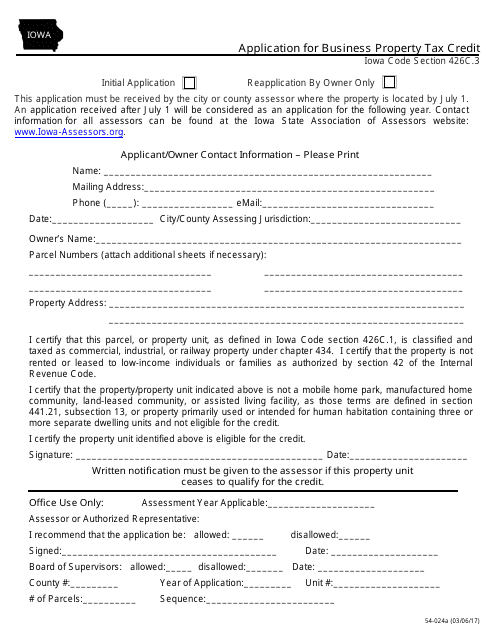

This form is used for applying for the Business Property Tax Credit in Iowa.

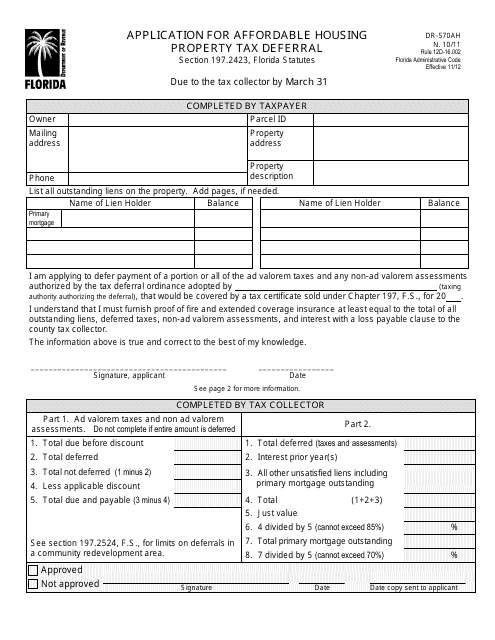

This form is used for applying for a property tax deferral program in Florida. It is specifically designed for affordable housing properties.

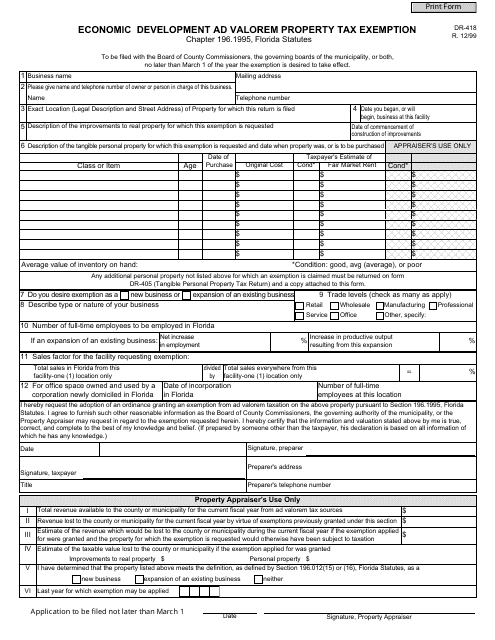

This form is used for applying for an economic development ad valorem property tax exemption in the state of Florida.

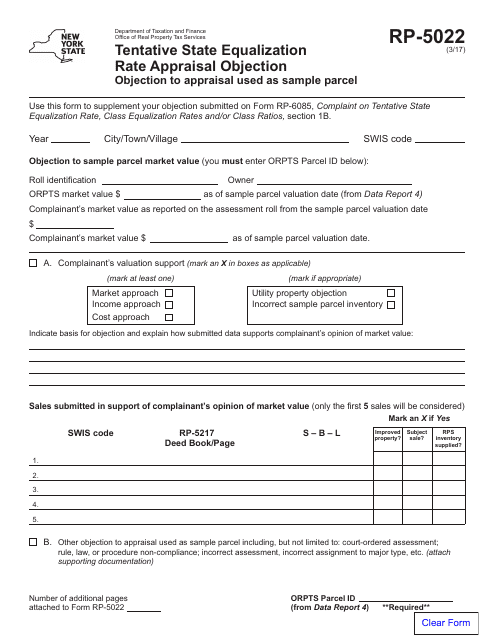

This form is used for filing an objection to the tentative state equalization rate in New York. It allows property owners to challenge the assessed value of their property for tax purposes.

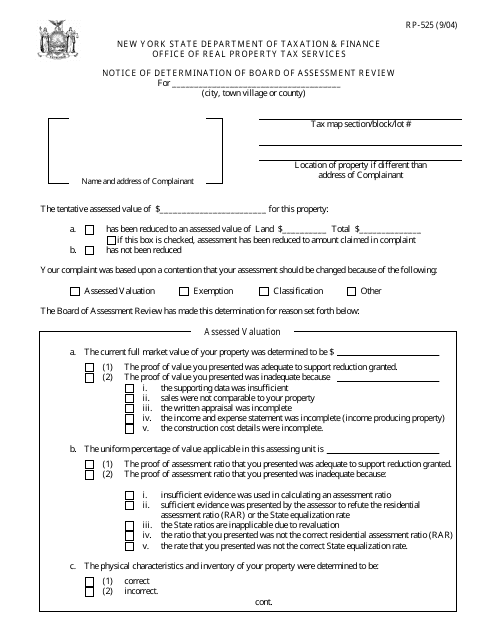

This form is used for notifying property owners in New York about the determination made by the Board of Assessment Review regarding their property assessment.

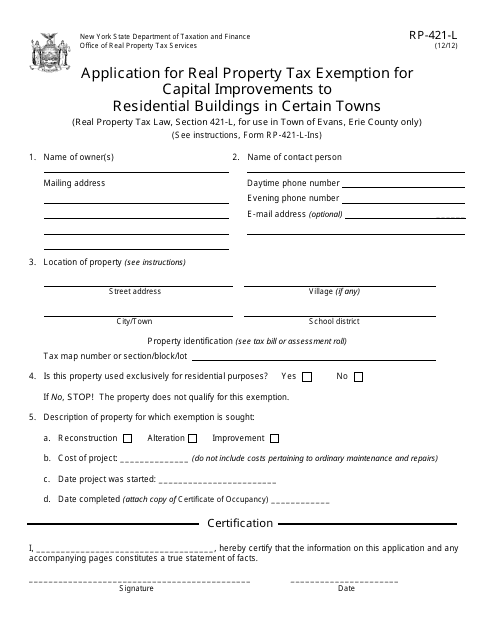

This form is used for applying for a real property tax exemption for capital improvements made to residential buildings in certain towns, specifically the Town of Evans, New York.

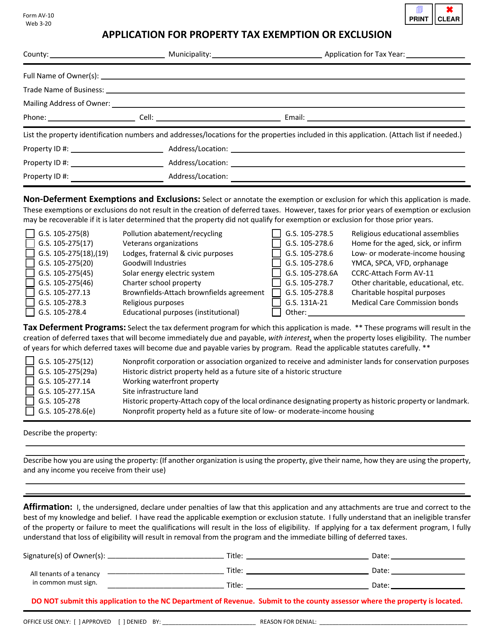

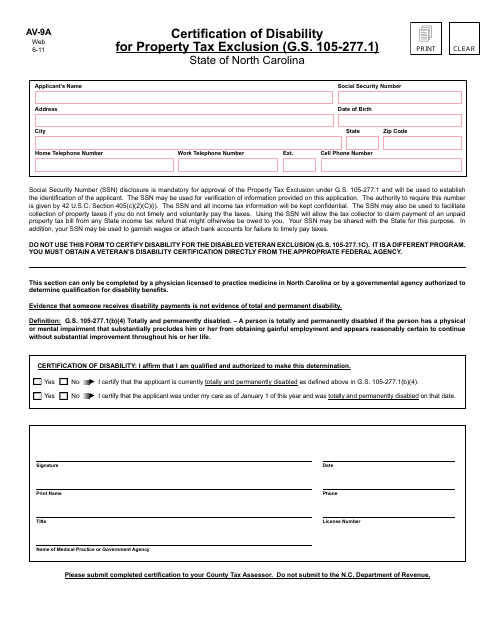

This Form is used for certifying disability for property tax exclusion in North Carolina.

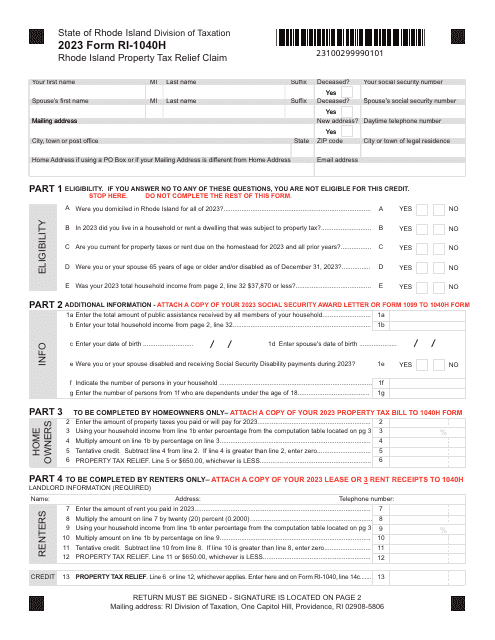

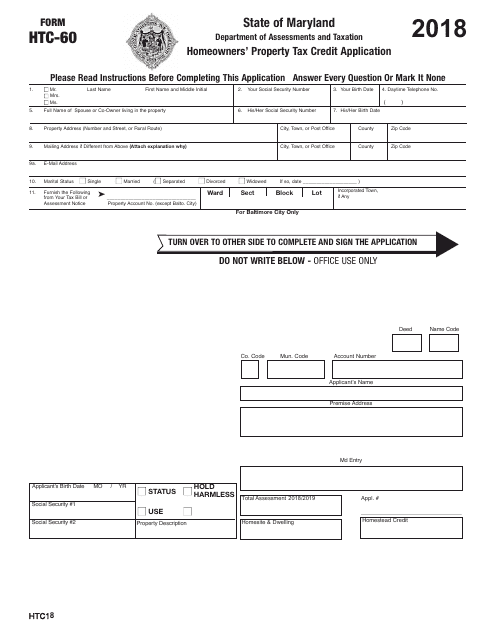

This form is used for homeowners in Maryland to apply for the Property Tax Credit. It helps eligible homeowners reduce their property tax burden.

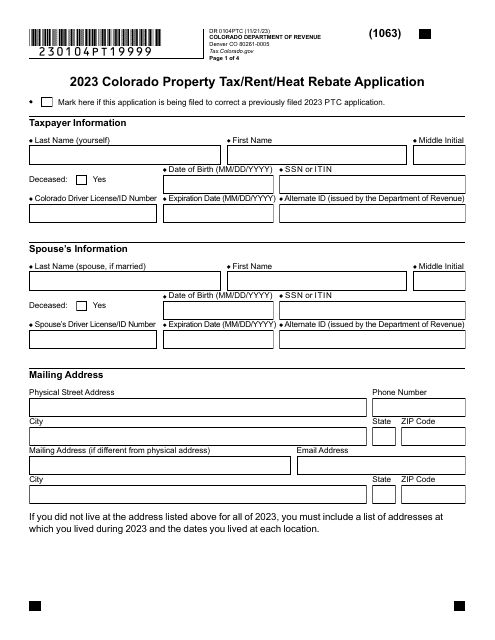

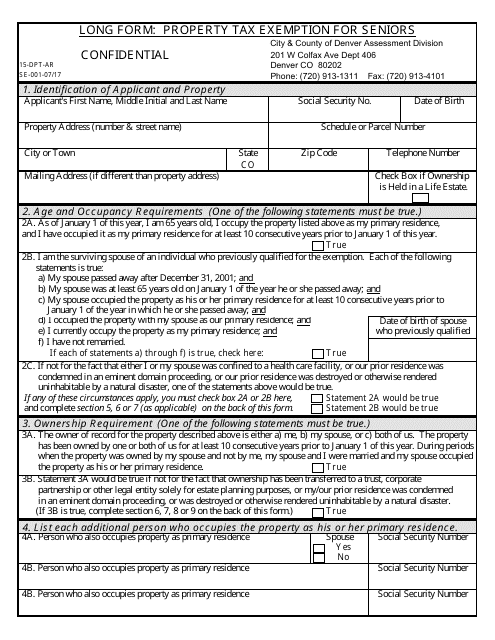

This form is used for applying for property tax exemption for seniors in Colorado. It is the long form version of Form 15-DPT-AR. This document is important for seniors who want to qualify for a property tax exemption in Colorado.

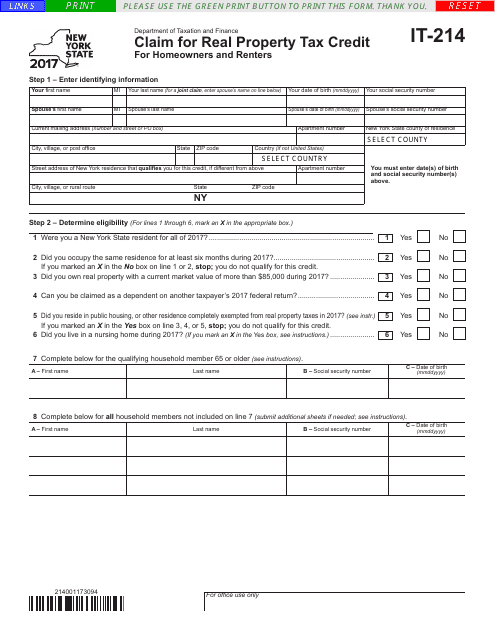

This form is used for claiming a real property tax credit in New York. It allows residents to receive a credit for the taxes they paid on their residential property.