Partnership Tax Form Templates

Documents:

129

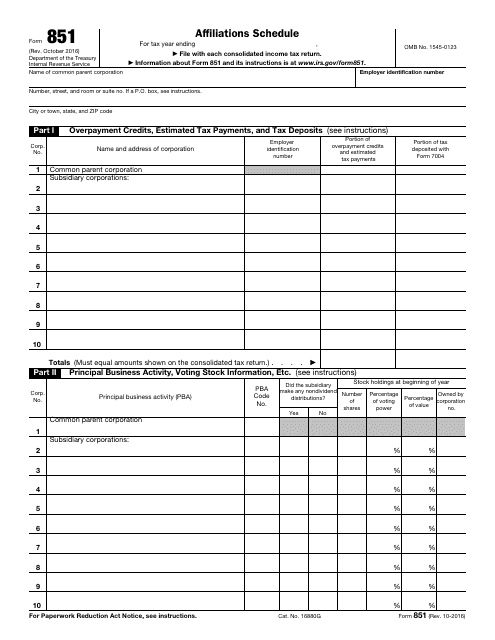

The purpose of submitting Form 851 is to report information about overpayment credits, estimated tax payments, and tax deposits, related to a common parent corporation and their subsidiary corporations.

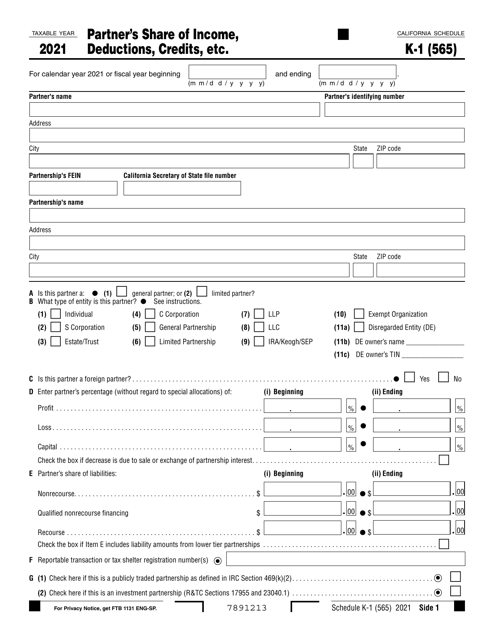

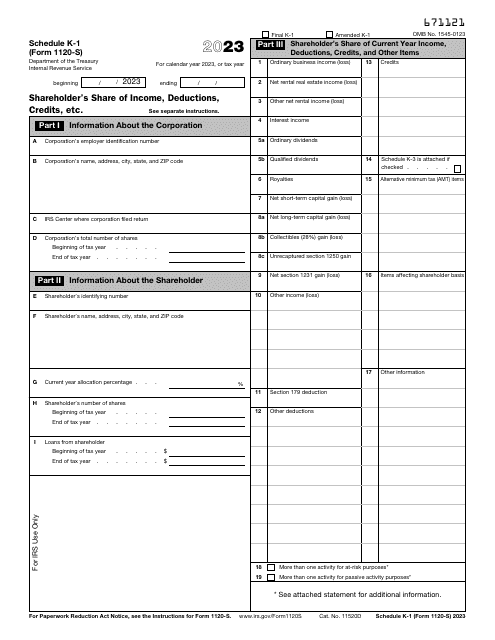

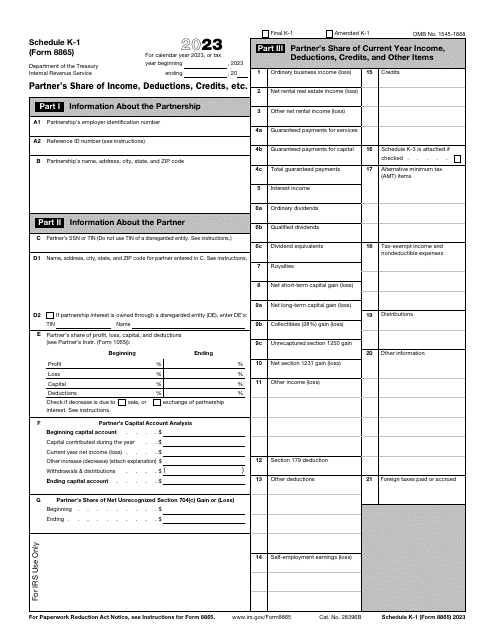

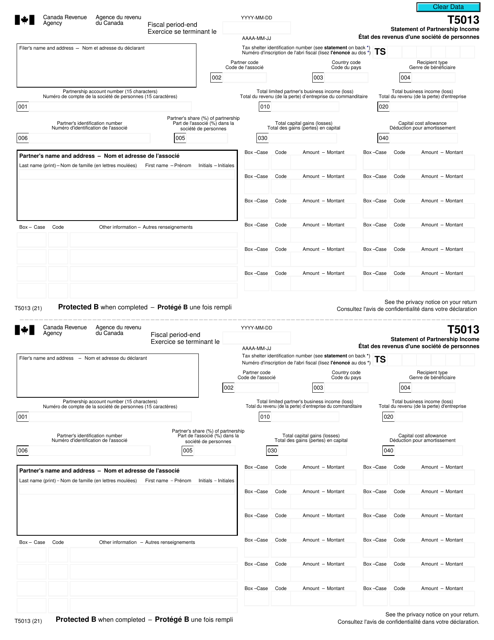

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

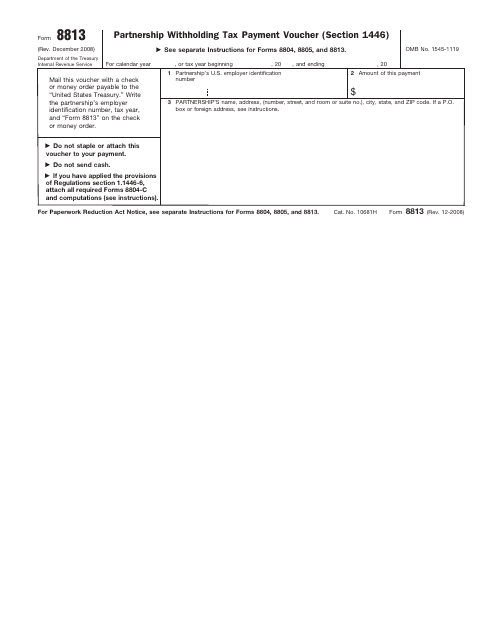

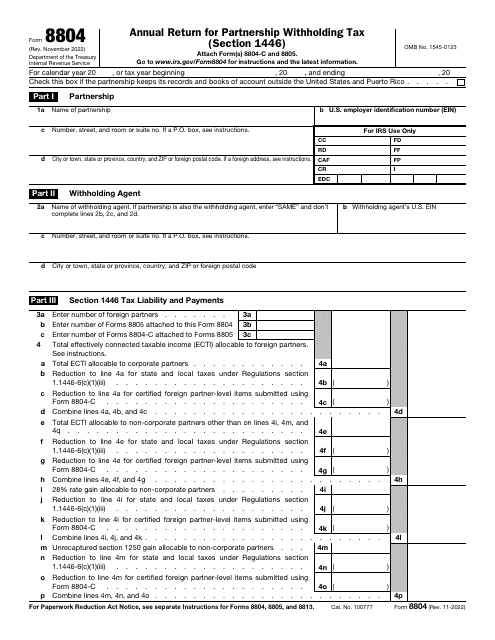

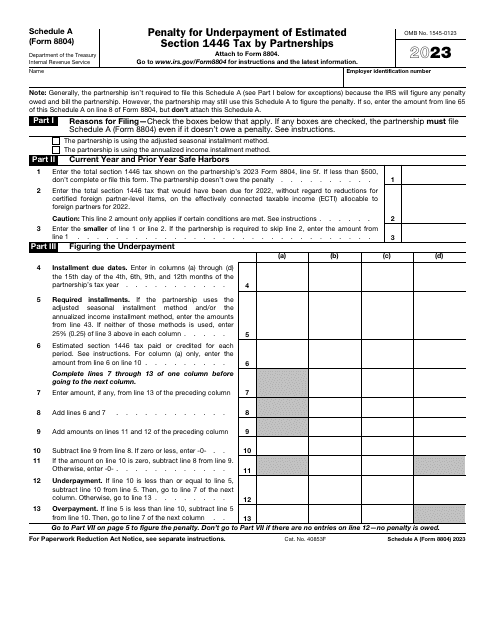

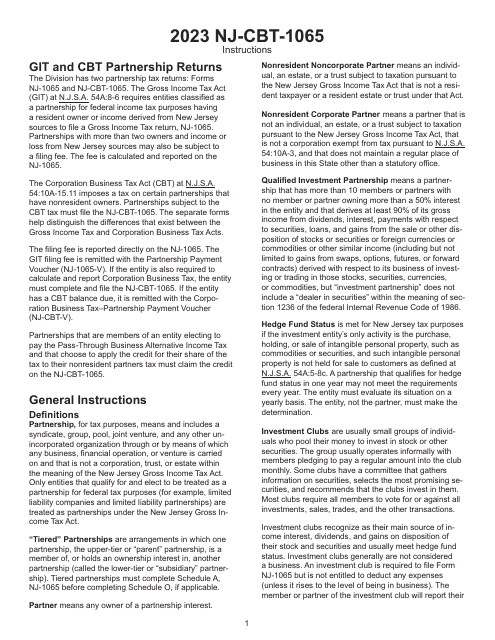

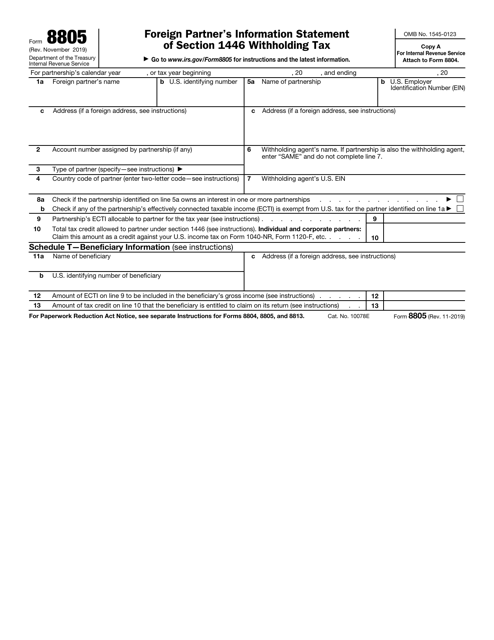

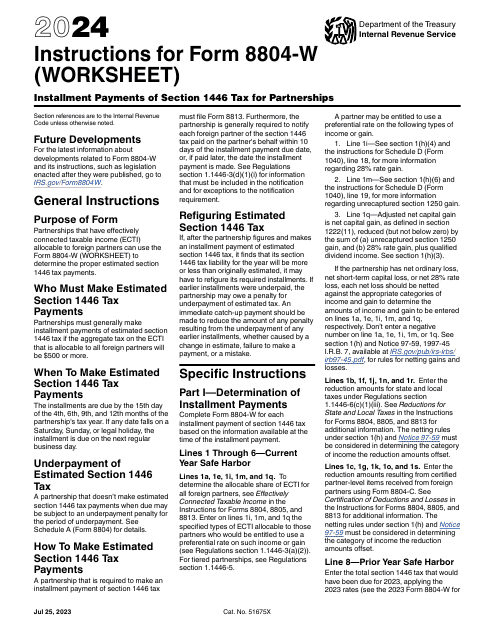

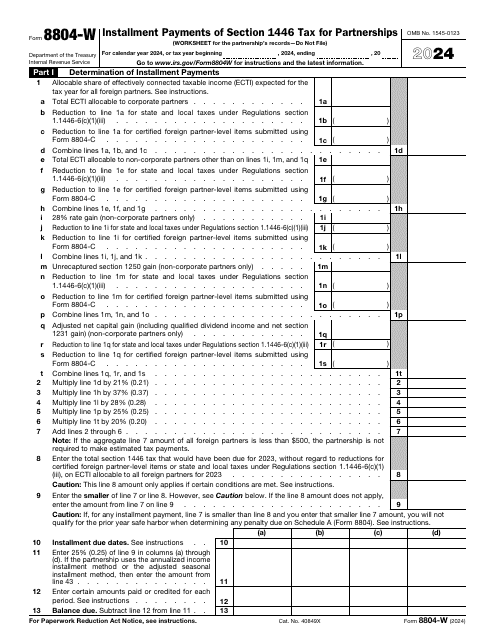

This form is used for making tax payments by partnerships to comply with Section 1446 of the Internal Revenue Code.

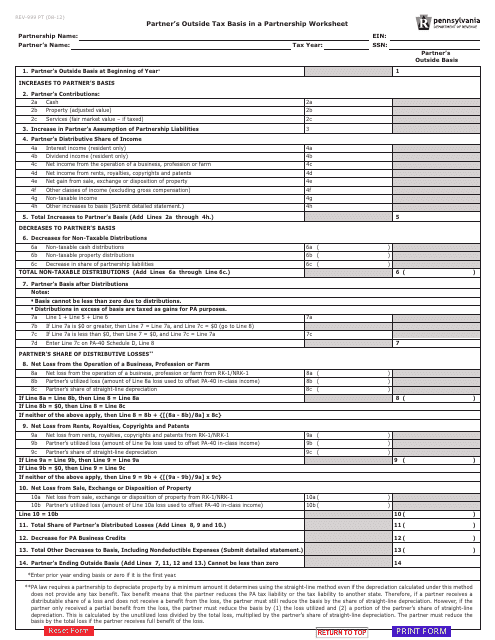

This form is used for calculating the partner's outside tax basis in a partnership in Pennsylvania.

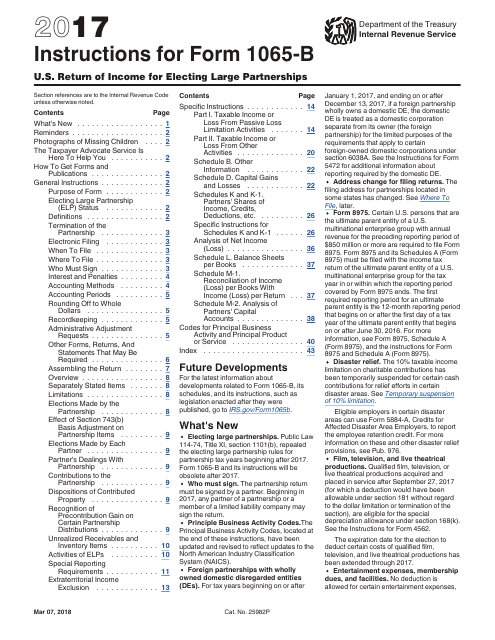

This Form is used for reporting income and expenses of electing large partnerships in the United States.

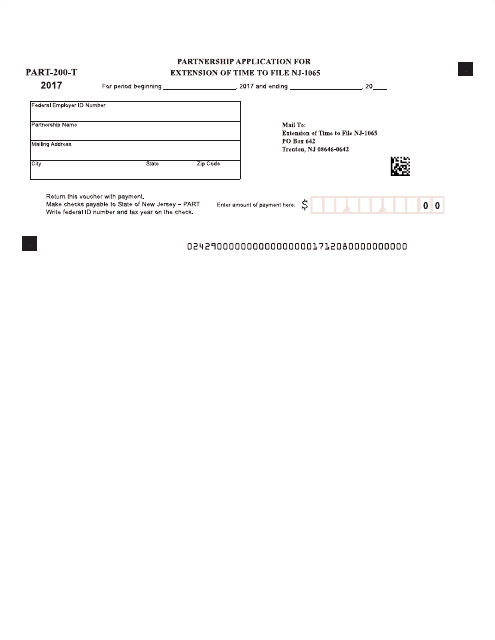

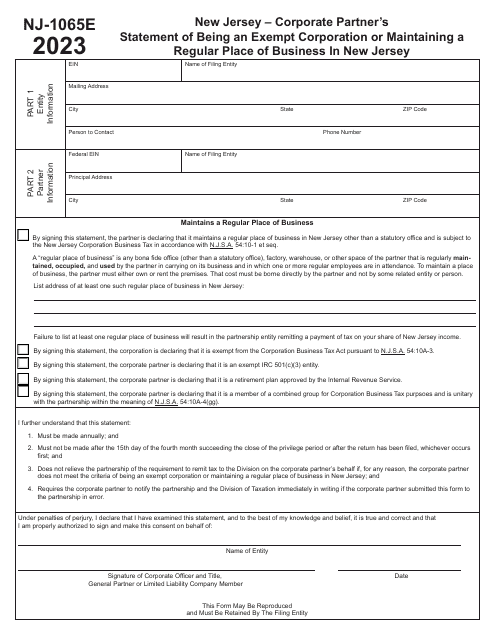

This Form is used to request an extension of time to file the New Jersey Partnership Return (Form NJ-1065).

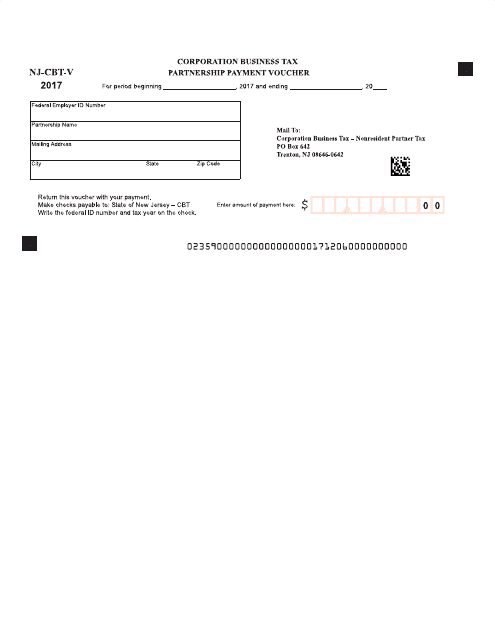

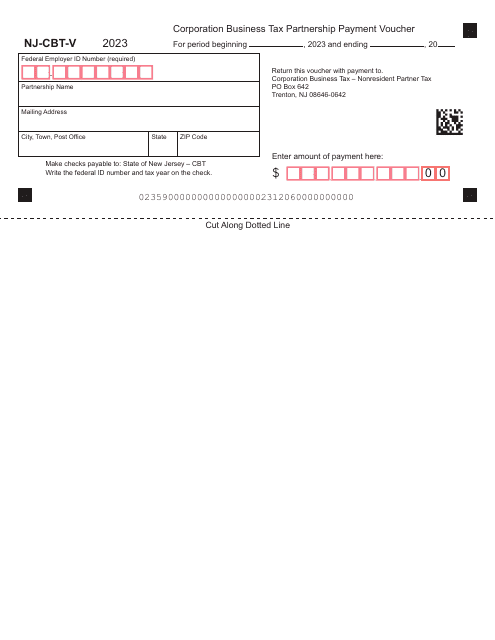

This form is used for making payment vouchers for partnerships in the state of New Jersey

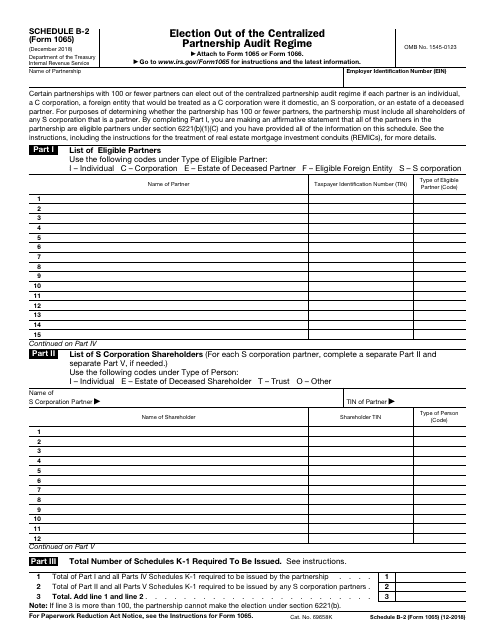

This is form is used by partnerships to inform the tax authorities they choose not to be subject to a partnership audit regime prescribed by current fiscal legislation.

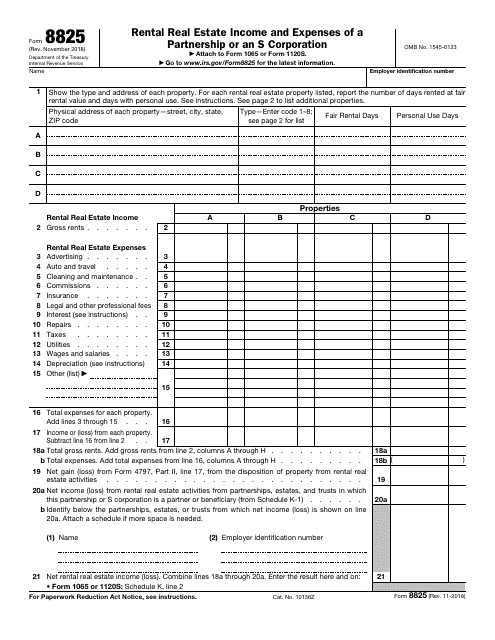

This is a tax statement prepared by S corporations and partnerships to calculate and notify the fiscal authorities about the income they have earned by renting out real estate as well as deductible expenses related to those activities such as maintenance, repairs, advertising, and legal fees.

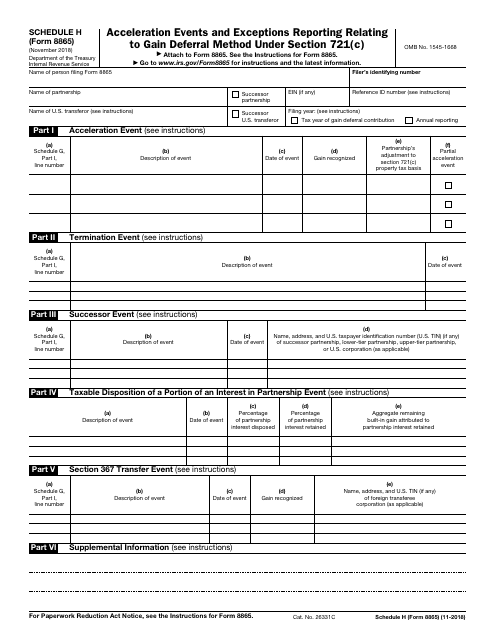

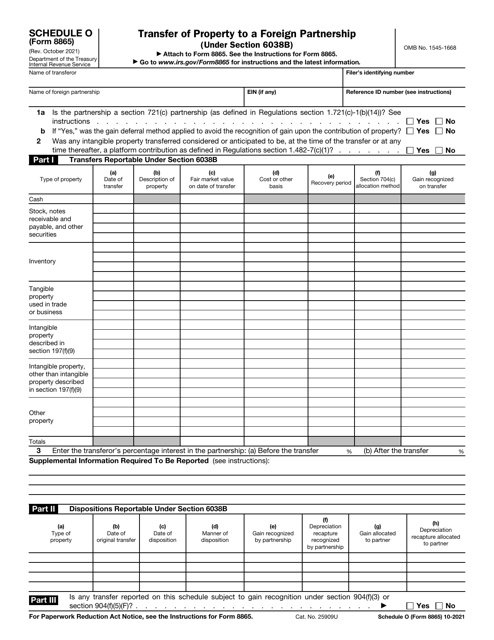

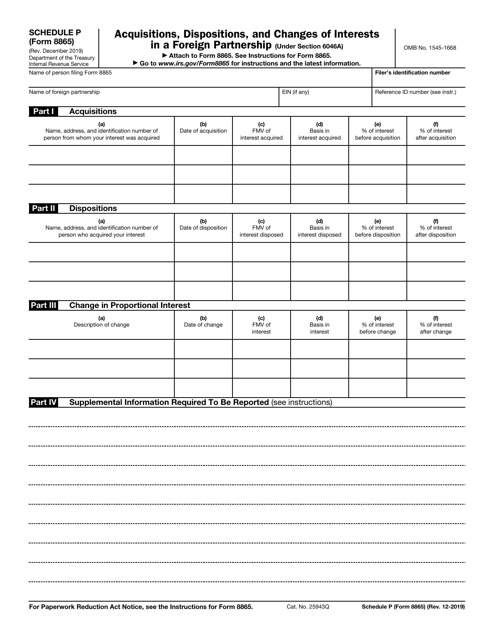

This document is used for reporting acceleration events and exceptions related to the gain deferral method under Section 721(c) on IRS Form 8865 Schedule H.

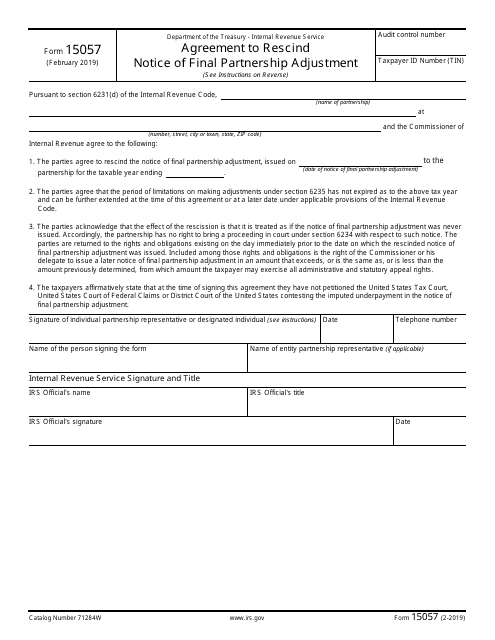

This form is used for agreeing to cancel a notification of final partnership adjustment issued by the IRS.

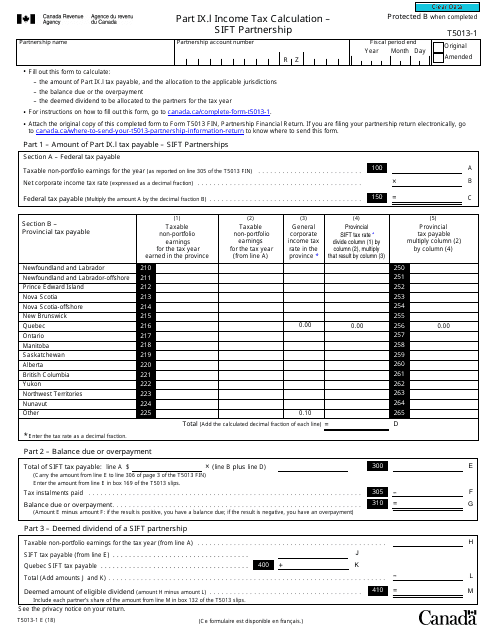

This form is used for calculating the income tax for a Sift Partnership in Canada.

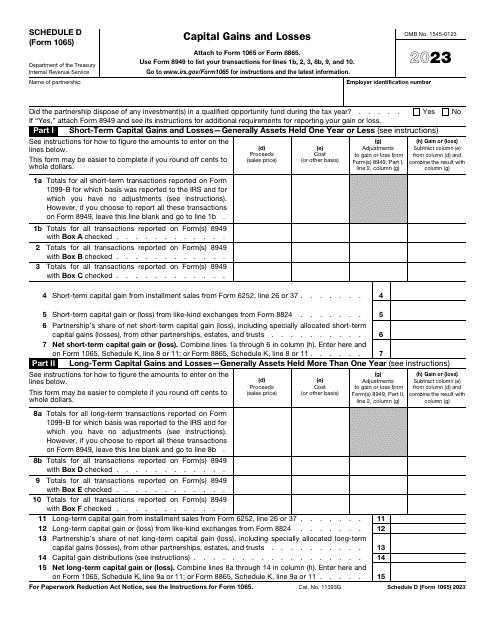

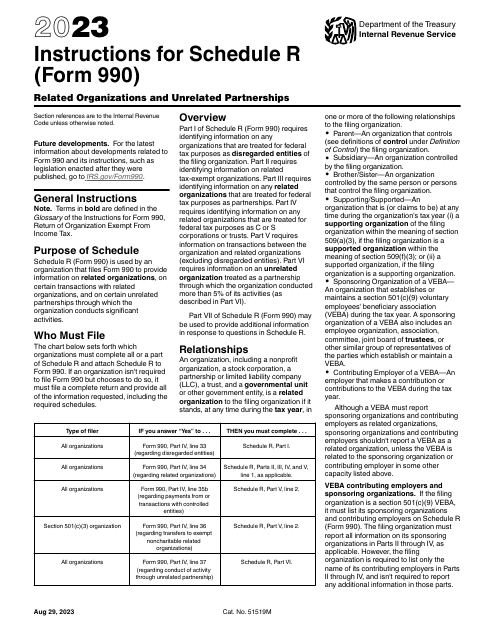

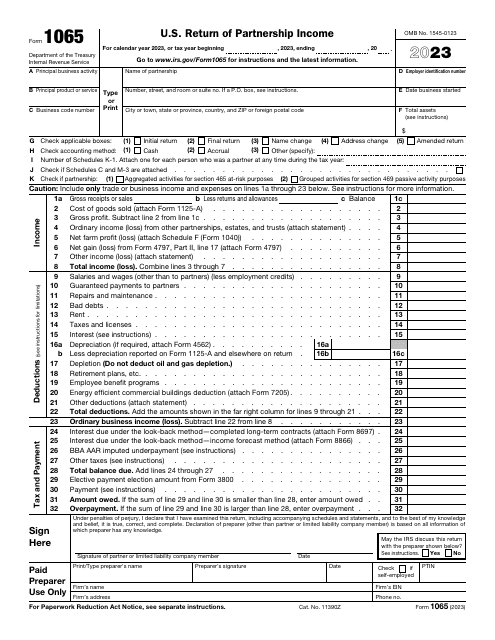

Use this form to report information on deductions, credits, and income relevant to the operation of a partnership to the Internal Revenue Service (IRS).