Partnership Tax Form Templates

Documents:

129

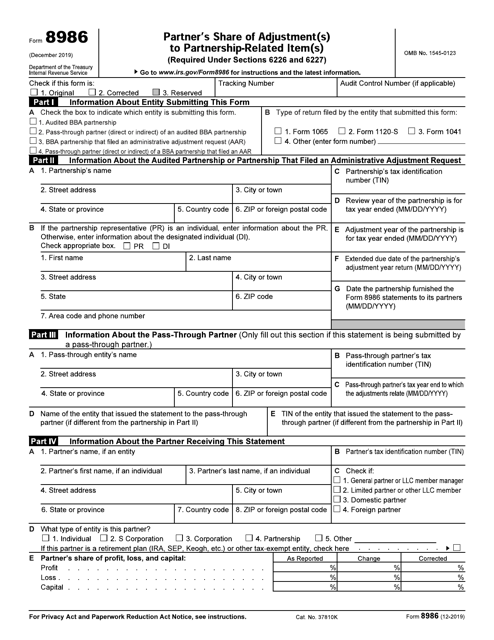

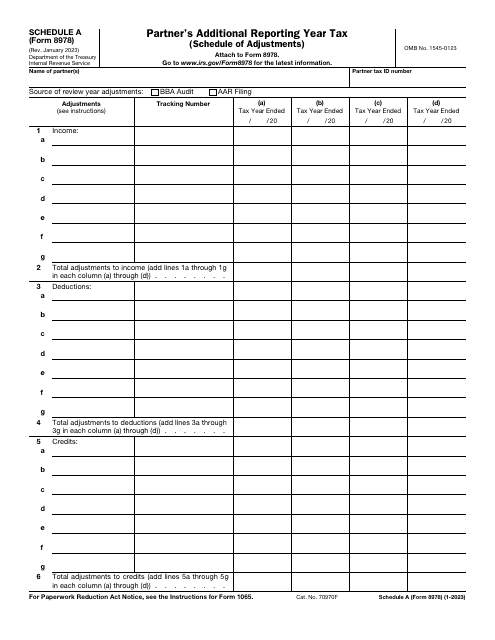

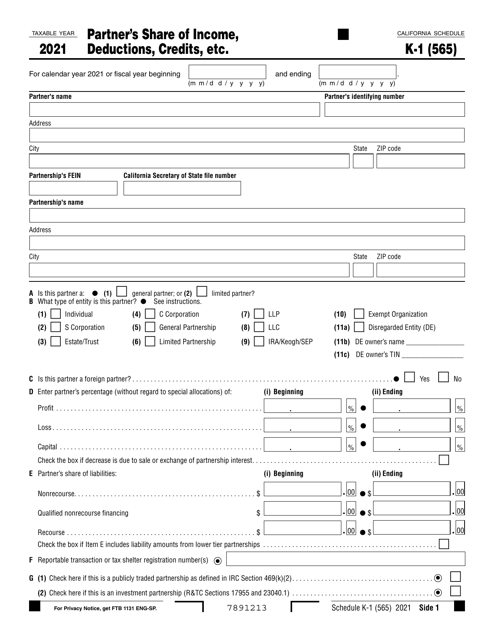

This Form is used for reporting a partner's share of adjustments or items related to a partnership. It is required by sections 6226 and 6227 of the Internal Revenue Code.

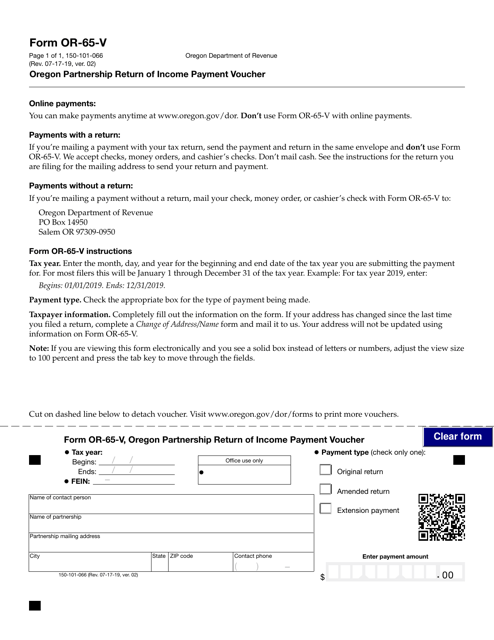

This form is used for making payments towards the Oregon Partnership Return of Income.

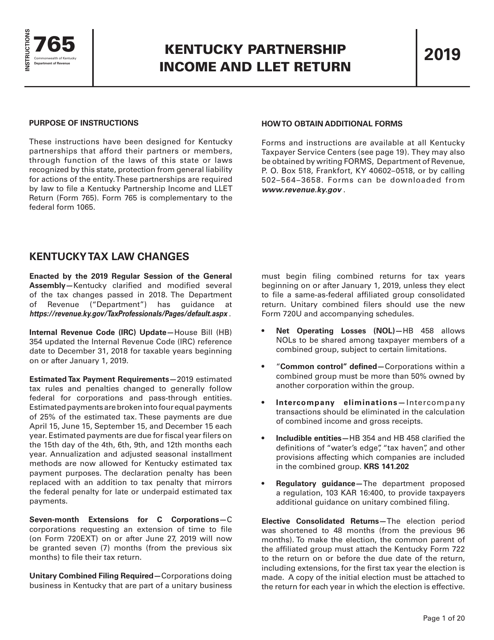

This Form is used for filing the Kentucky Partnership Income and Llet Return for partnerships in Kentucky. Follow the instructions to accurately report partnership income and determine tax liability.

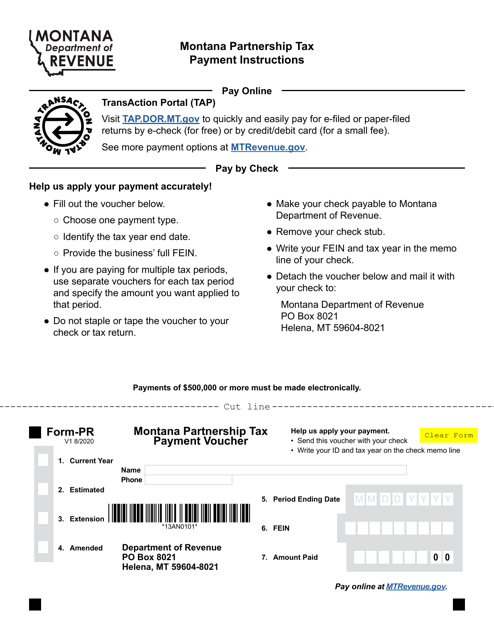

This Form is used for making tax payments for partnerships in the state of Montana.

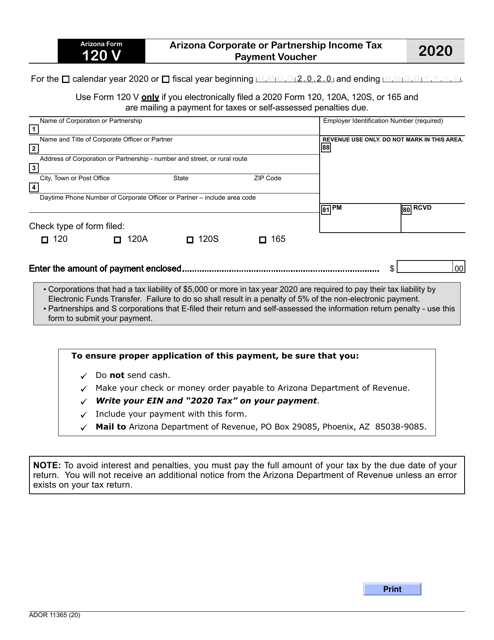

This form is used for making tax payments for corporate or partnership income tax in Arizona.

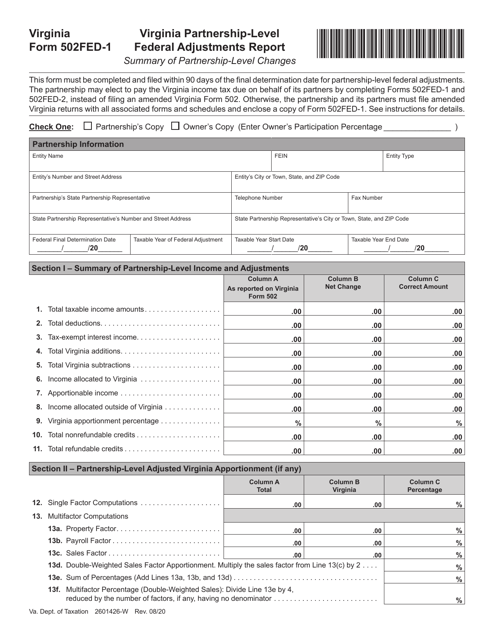

This form is used for reporting federal adjustments for partnerships in Virginia. It is specific to the state of Virginia and is used to report partnership-level federal adjustments.

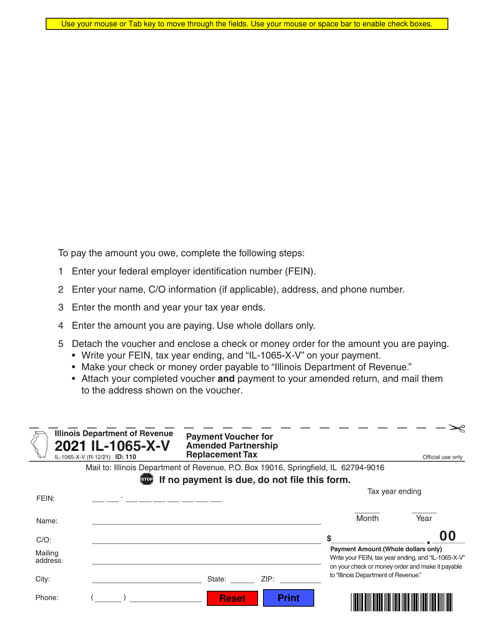

Form IL-1065-X-V Payment Voucher for Amended Corporation Income and Replacement Tax - Illinois, 2021

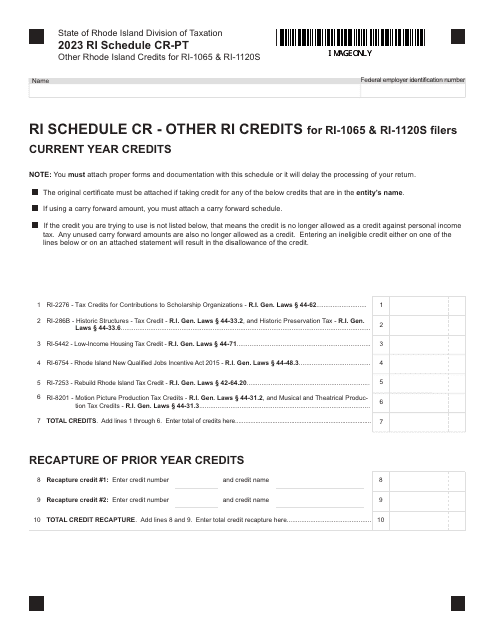

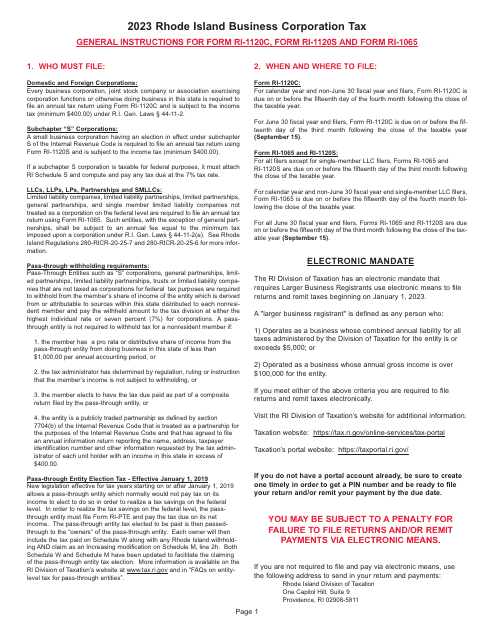

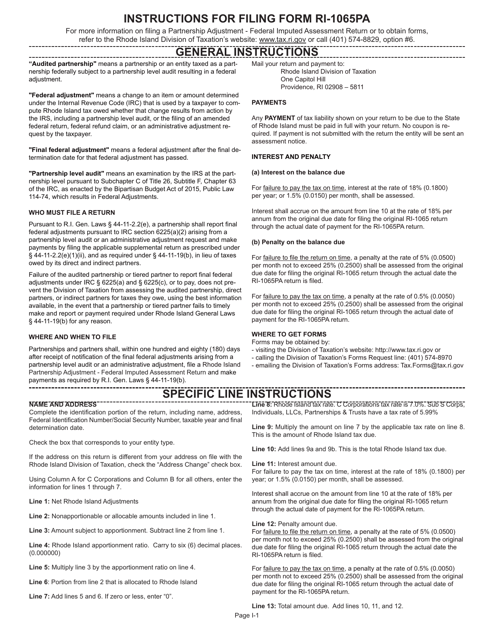

This document provides instructions for completing Form RI-1065PA Partnership Adjustment for Federal Imputed Assessment in Rhode Island.

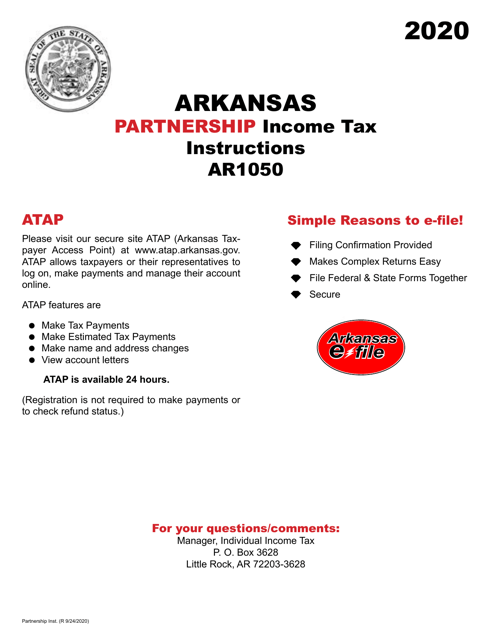

This document is used for filing the Arkansas Partnership Income Tax Return in the state of Arkansas. It provides instructions on how to report partnership income and deductions for tax purposes.

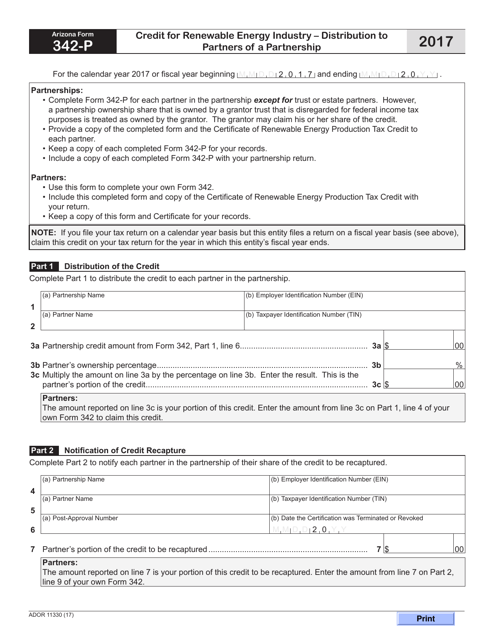

This form is used for claiming the Credit for Renewable Energy Industry - Distribution to Partners of a Partnership in the state of Arizona.