Partnership Tax Form Templates

Documents:

129

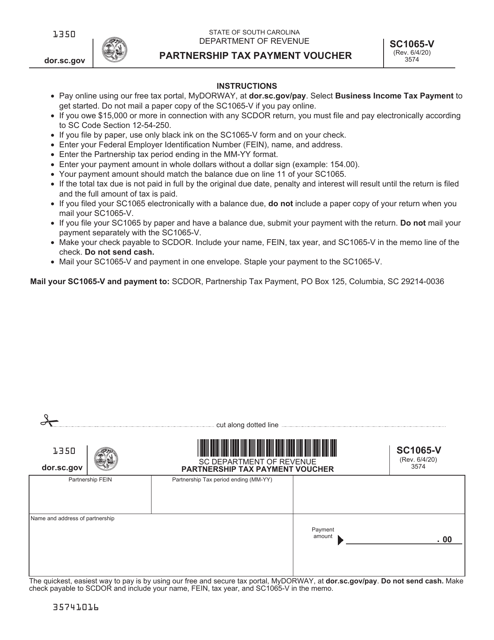

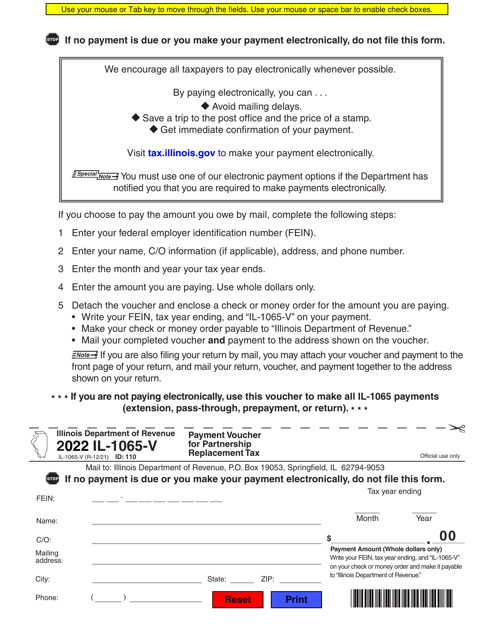

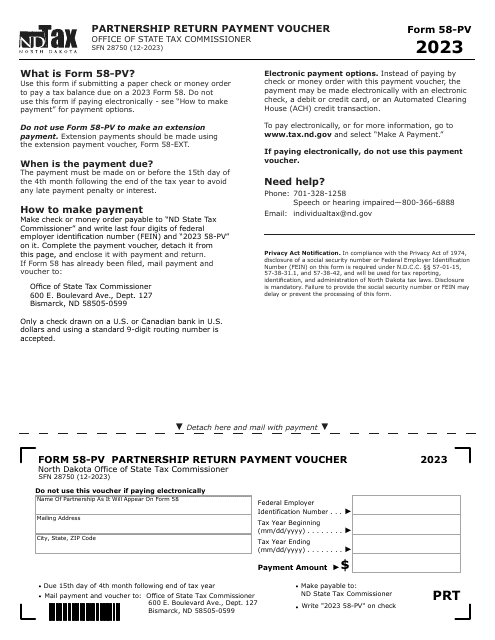

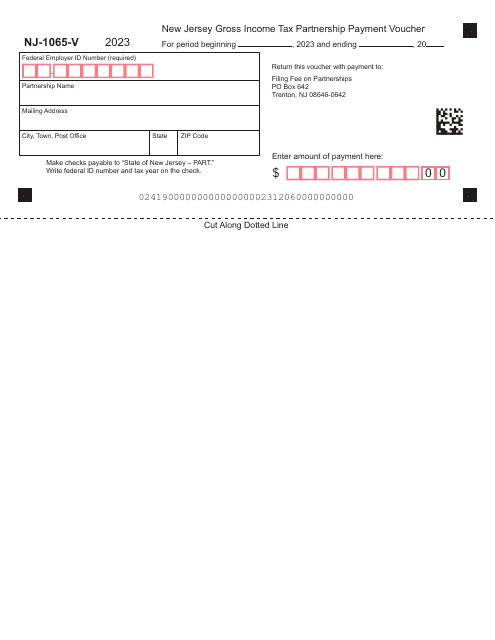

This form is used for submitting tax payments for partnerships in South Carolina.

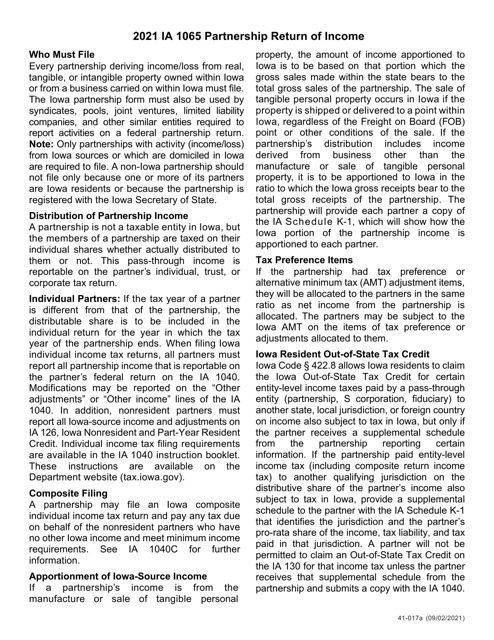

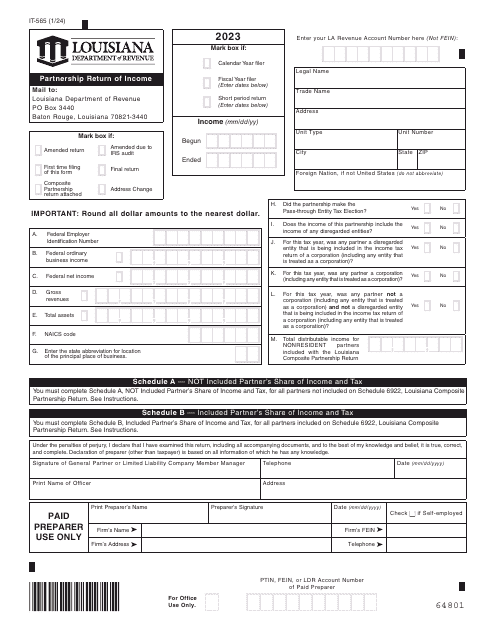

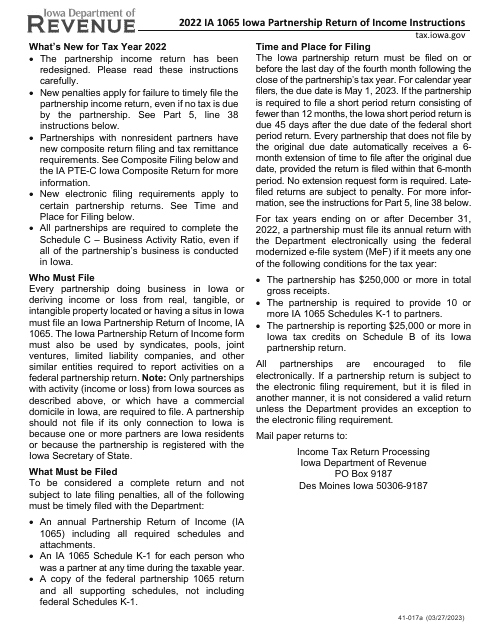

This document is used for filing the Iowa Partnership Return of Income for partnership businesses in Iowa. It includes instructions on how to fill out Form IA1065, providing guidance on reporting income, deductions, and credits specific to Iowa state tax laws.

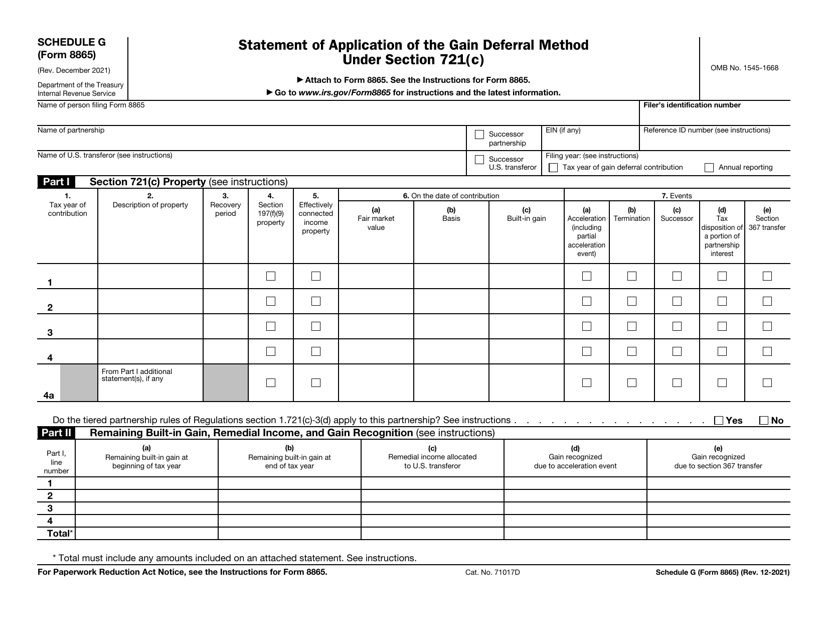

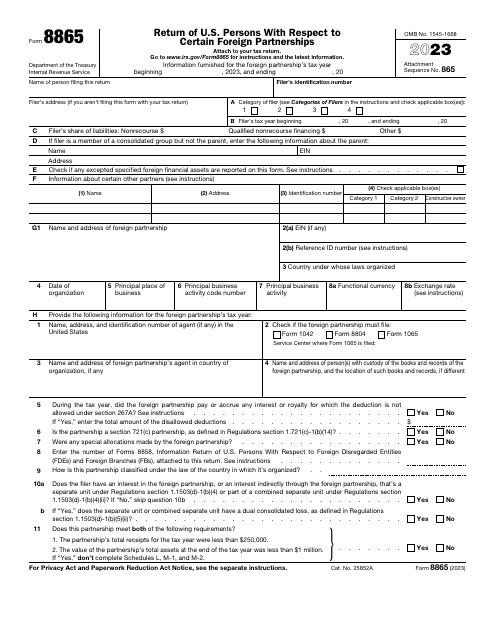

This form is used for reporting the application of the gain deferral method under Section 721(c) for certain contributions of property to a partnership.

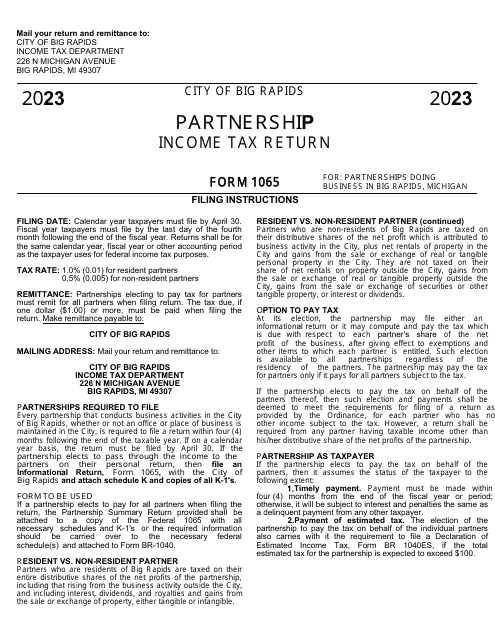

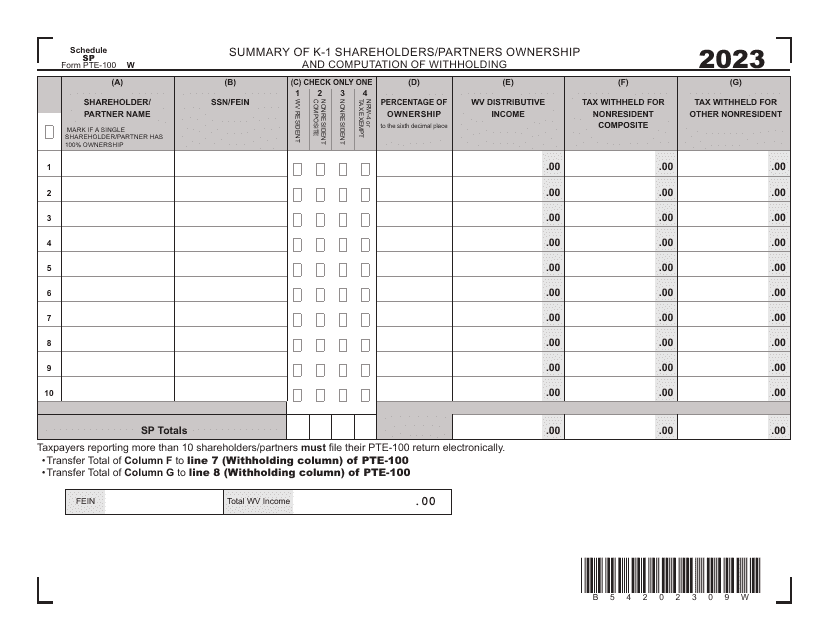

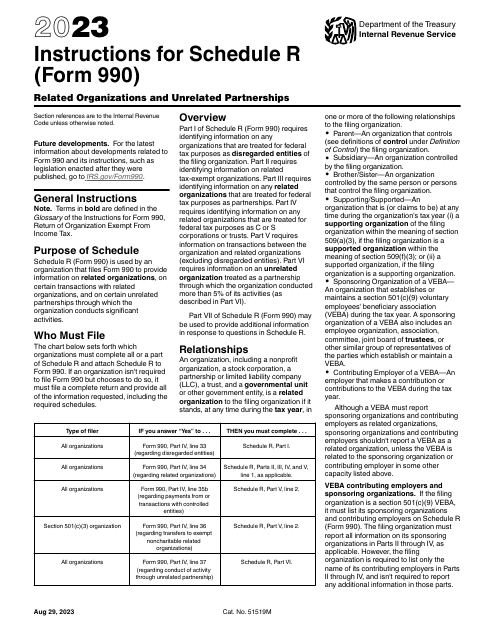

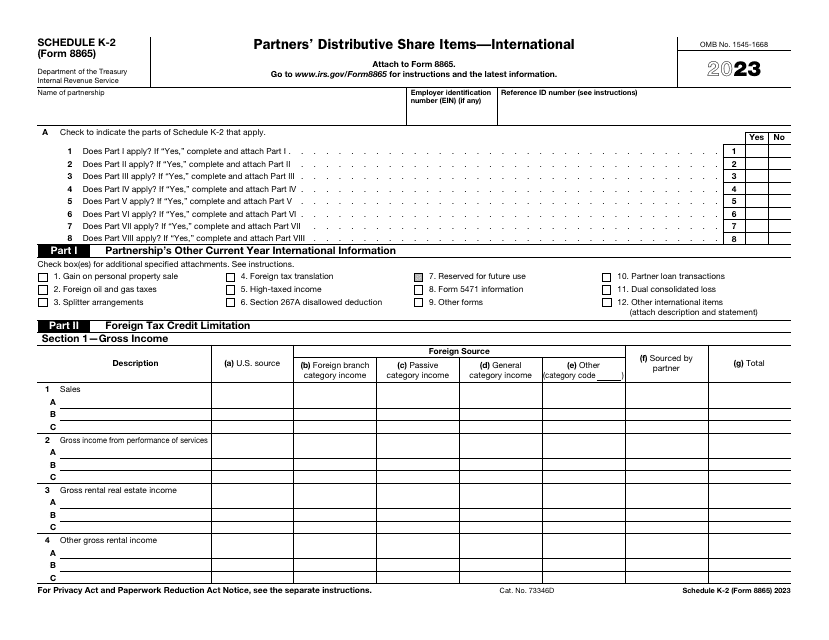

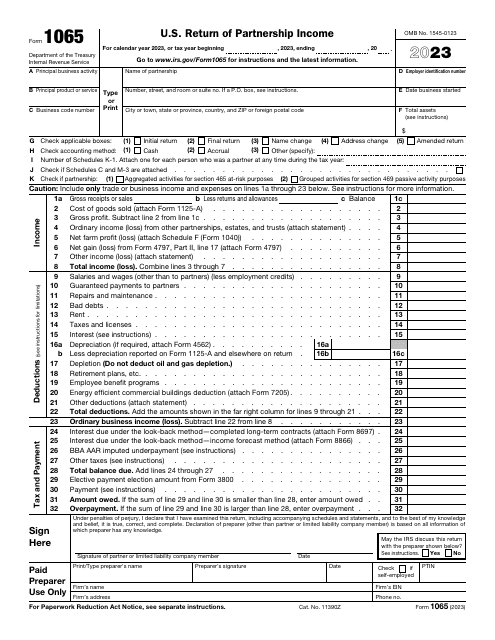

Use this form to report information on deductions, credits, and income relevant to the operation of a partnership to the Internal Revenue Service (IRS).

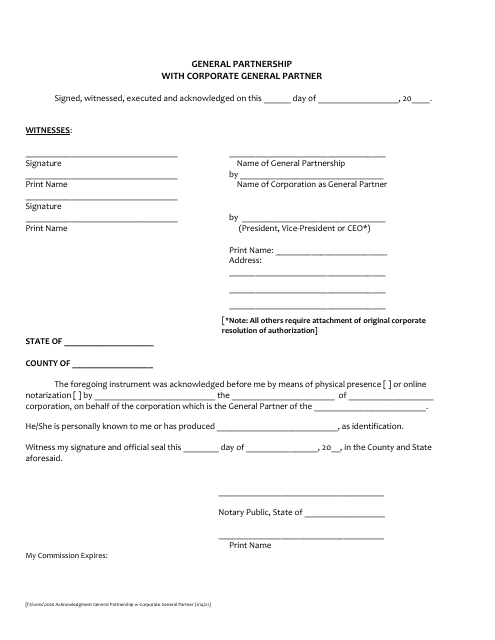

This Form is used for establishing a general partnership in Miami-Dade County, Florida, where the general partner is a corporation instead of an individual.

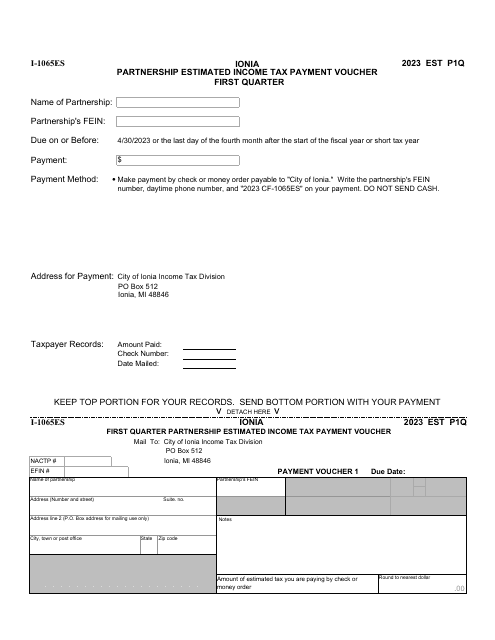

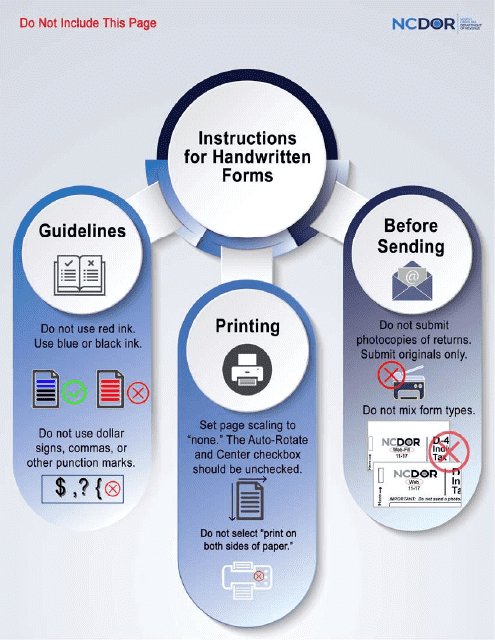

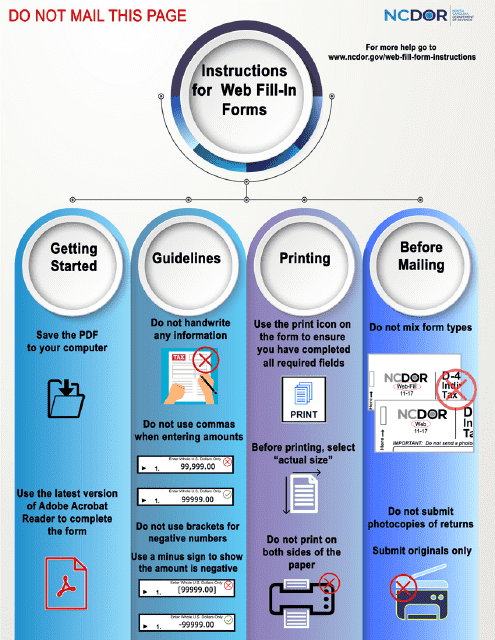

This form is used for submitting estimated income tax for partnerships that are subject to taxation in North Carolina.