Estate Tax Form Templates

Documents:

256

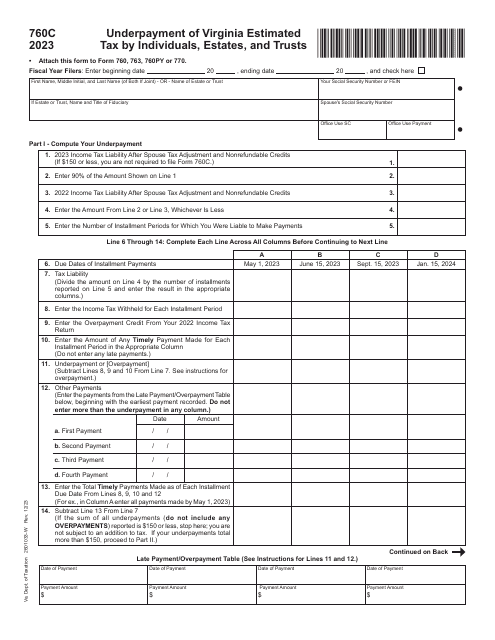

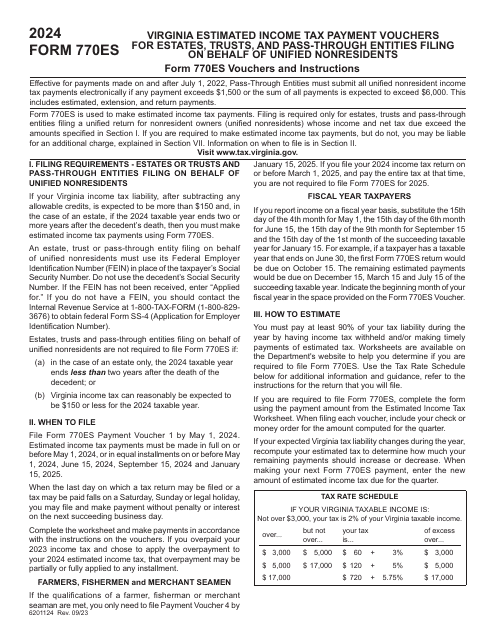

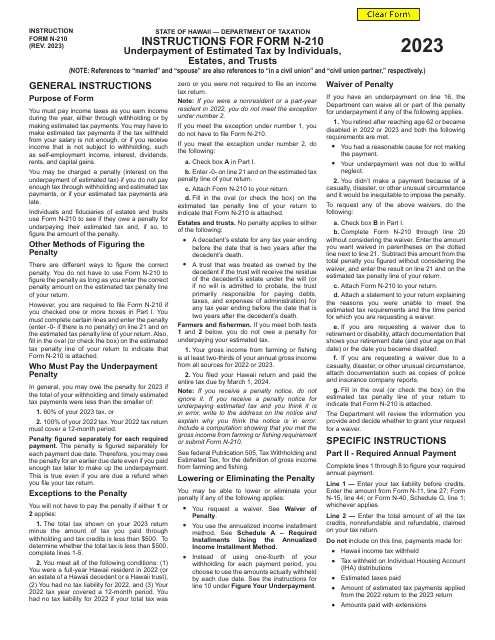

Form 760C Underpayment of Virginia Estimated Tax by Individuals, Estates and Trusts - Virginia, 2023

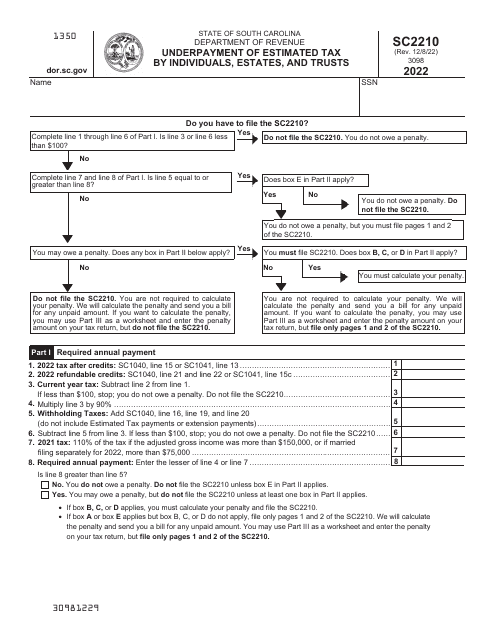

Form SC2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts - South Carolina, 2022

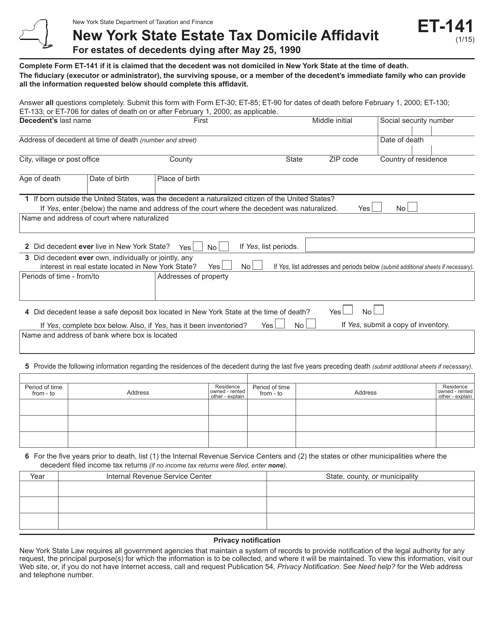

This Form is used for declaring domicile status in the state of New York for estate tax purposes.

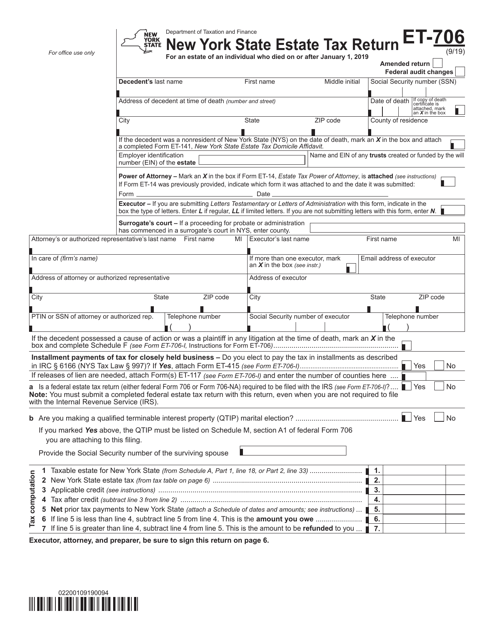

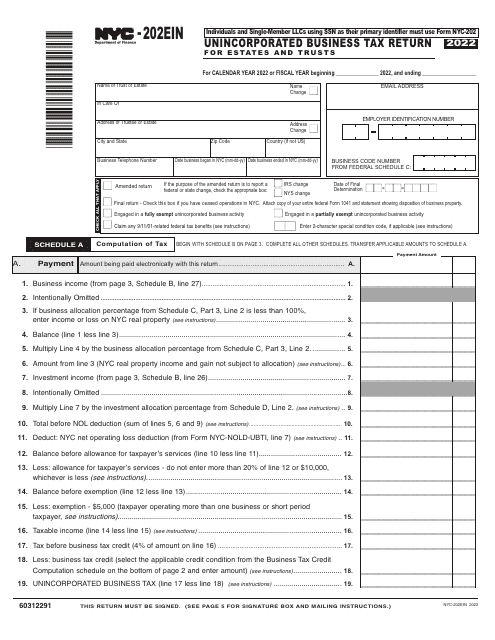

This form is used for filing the New York State Estate Tax Return in New York.

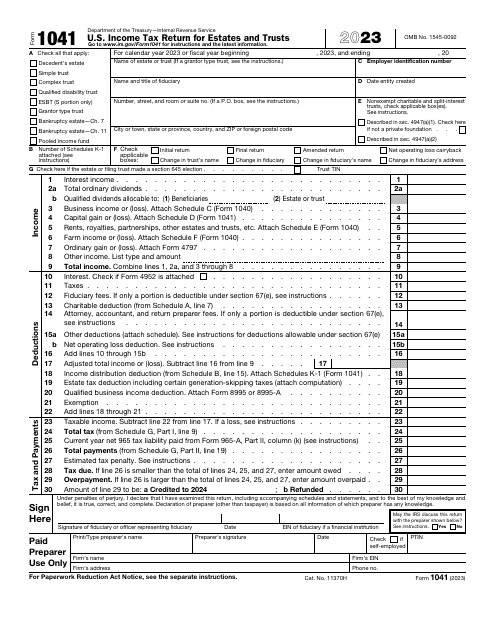

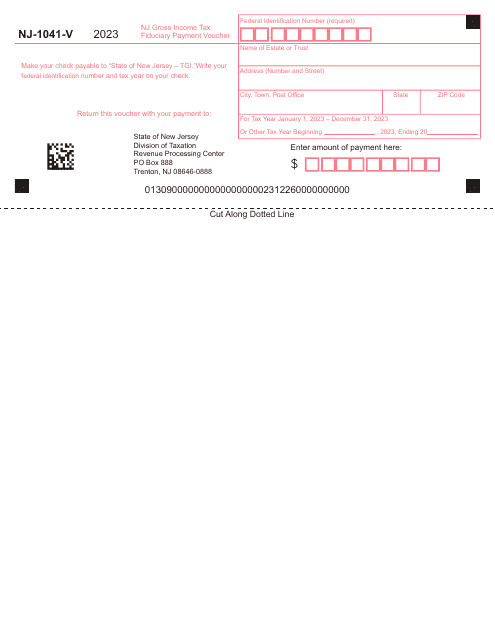

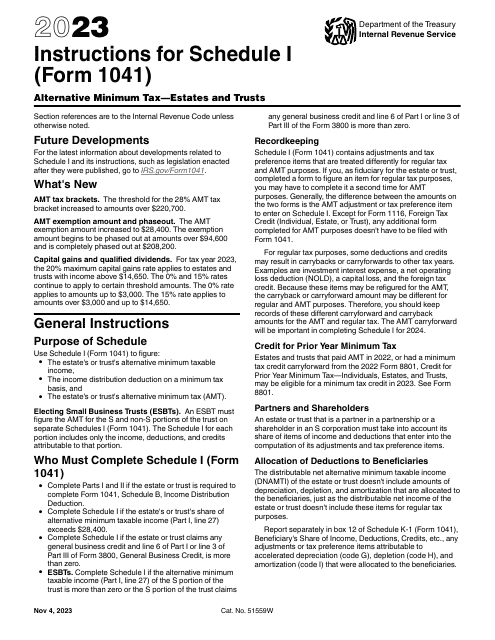

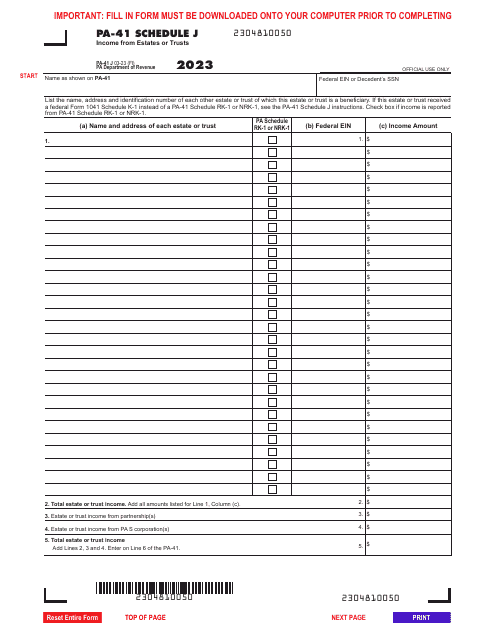

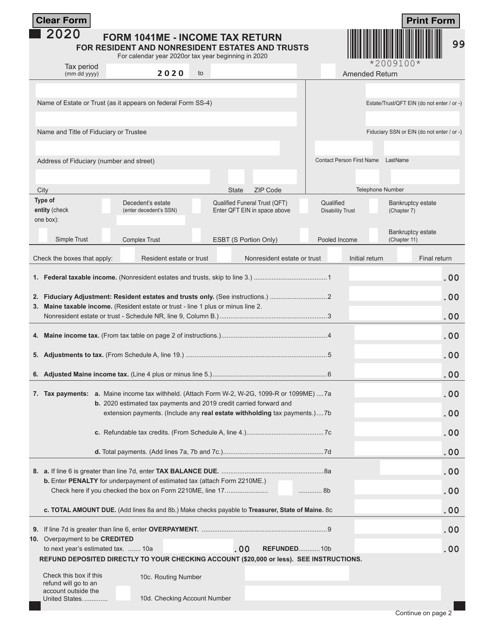

File this document, also known as the Estates and Trusts Tax Return, as an income tax return to the Internal Revenue Service (IRS) if you are a fiduciary of a bankruptcy estate, domestic decedent's estate, or a trust.

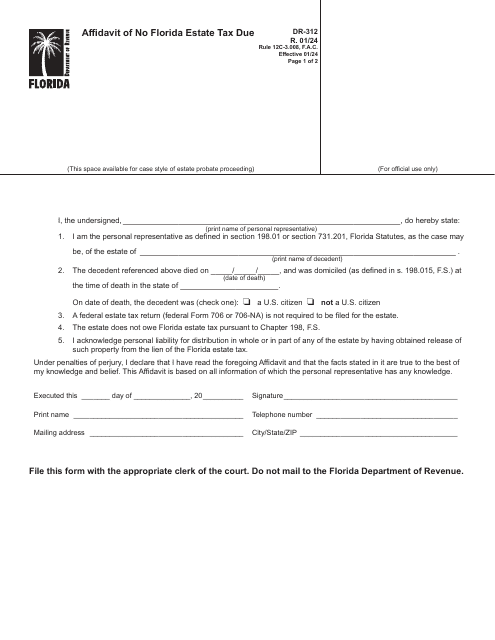

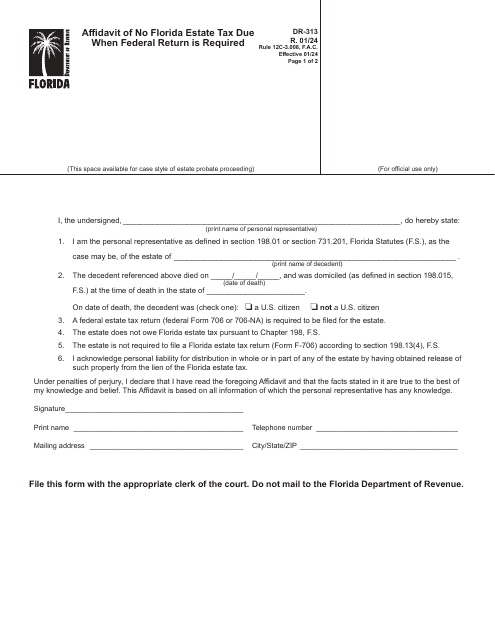

This form is a Florida legal document completed for the estates of decedents who died on or after January 1, 2005, if the estate does not require the filing of a federal estate tax return.

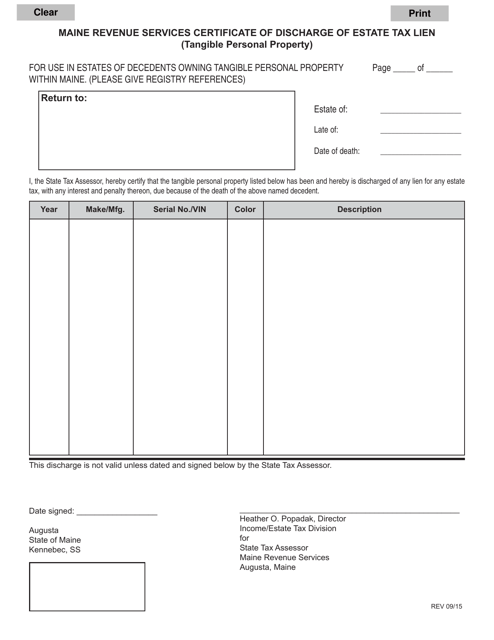

This document is a certificate issued by the Maine Revenue Services to discharge a lien on tangible personal property for estate taxes in the state of Maine.