Estate Tax Form Templates

Documents:

256

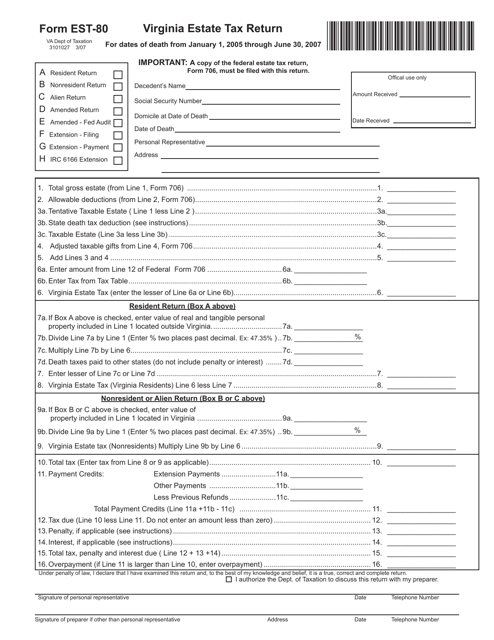

This form is used for filing the Virginia Estate Tax Return for individuals who have passed away between January 1, 2005, and June 30, 2007 in the state of Virginia.

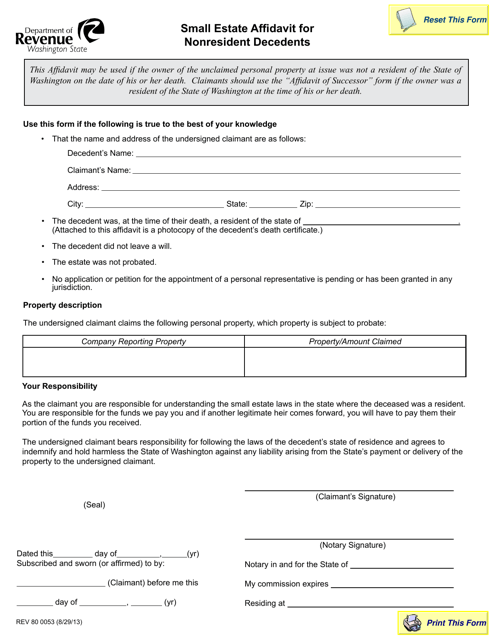

This Form is used for filing a Small Estate Affidavit for Nonresident Decedents in Washington state. It allows nonresident individuals to settle the estate of a deceased person with a smaller value of assets.

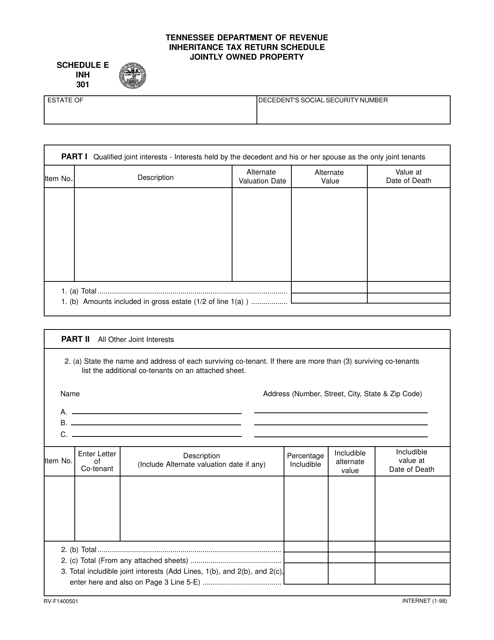

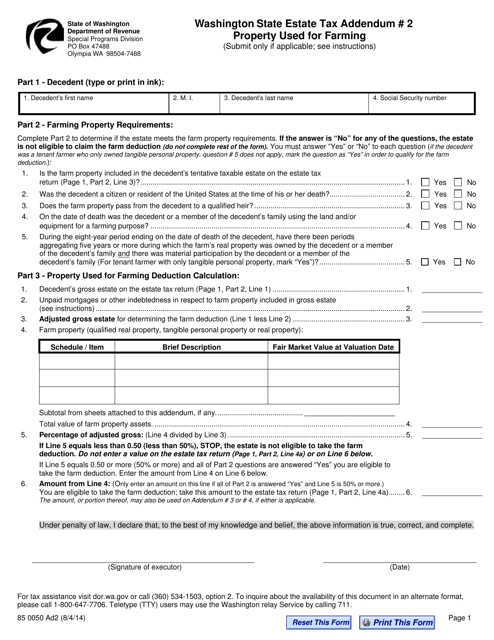

This document is used for reporting inheritance tax on jointly owned property in Tennessee.

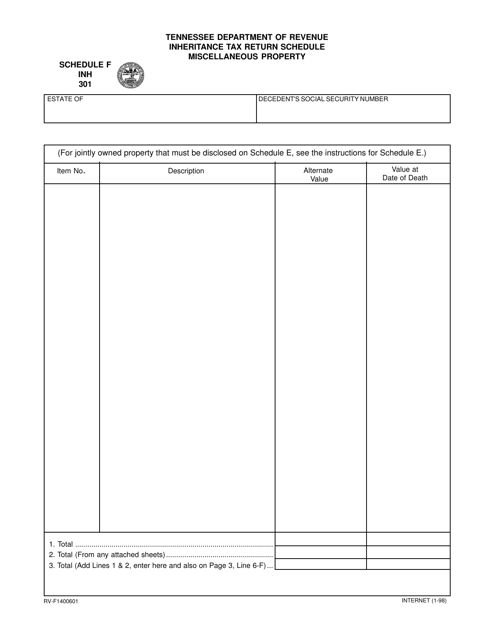

This Form is used for reporting miscellaneous inheritance properties on the Tennessee Inheritance Tax Return Schedule F.

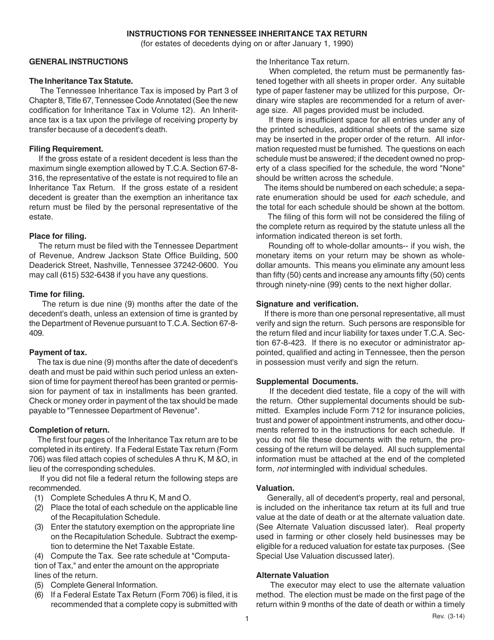

This form is used for reporting qualified family-owned business interests for Washington State Estate Tax purposes.

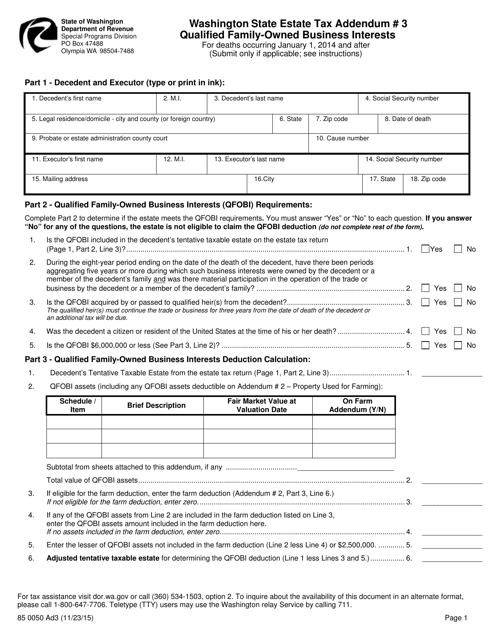

This form is used for apportioning out-of-state property for estate tax purposes in Washington State.

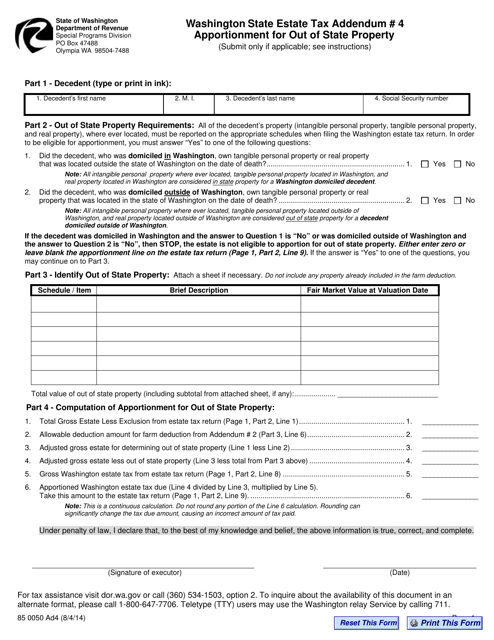

This form is used for reporting additional property used for farming in Washington state for estate tax purposes.

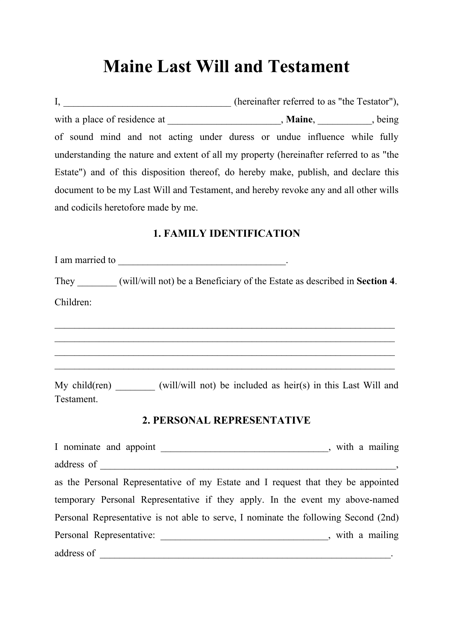

Download this Maine-specific document that is used for defining how a person's possessions and property should be distributed after their death.

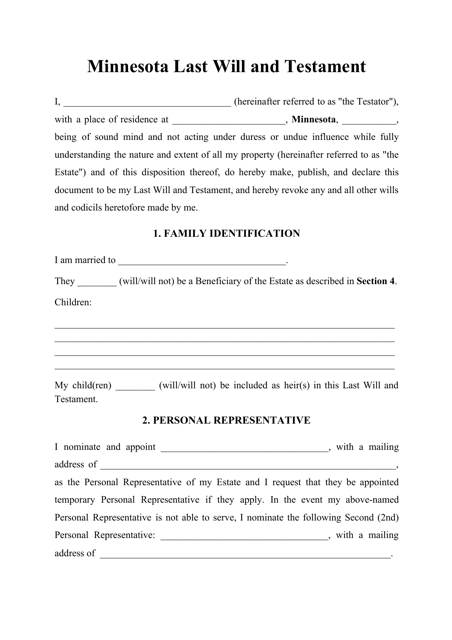

This is a document that is used in the state of Minnesota to describe the distribution of the property of the deceased.

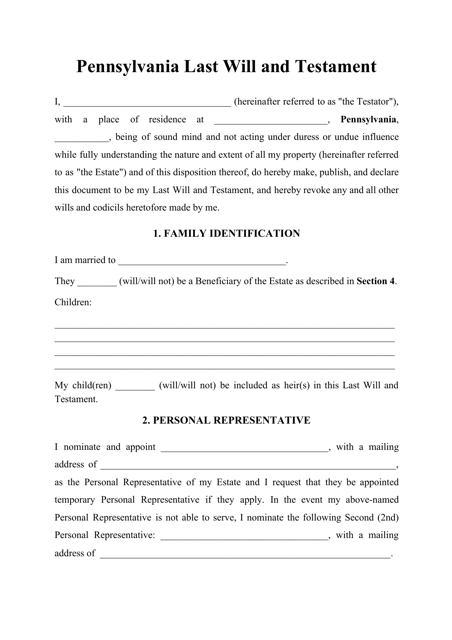

Use this Pennsylvania-specific form if you need a document that determines the distribution of the deceased person's possessions and property.

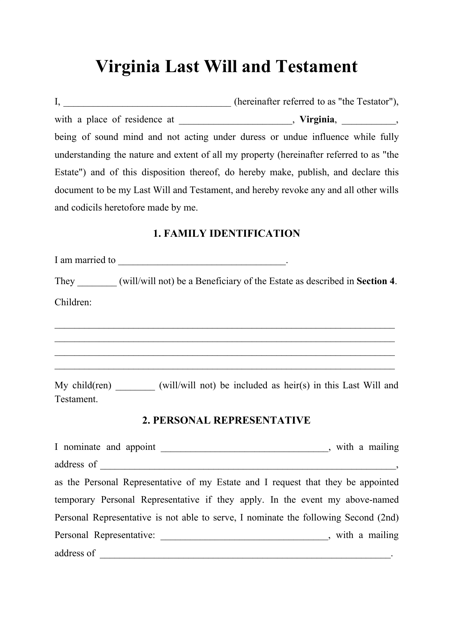

This Virginia-specific form lists the terms for distribution of the deceased person's property in the state.

This is a document used in the state of New Jersey to describe the distribution of the personal and residential property of the deceased.

Download this Vermont-specific form if you need to create a document that would outline the terms and conditions for the distribution of the deceased person's possessions and property.

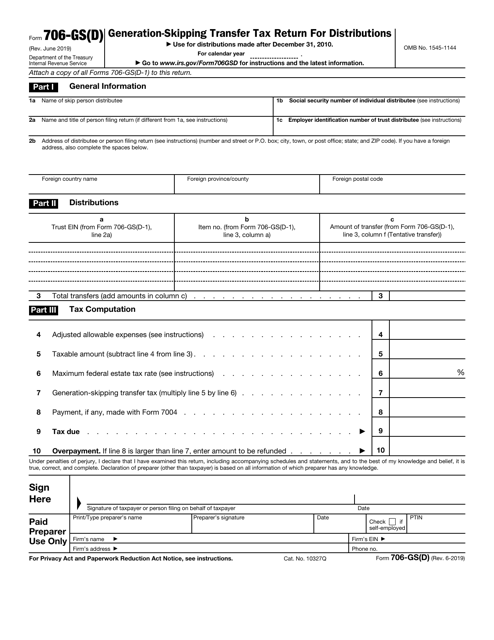

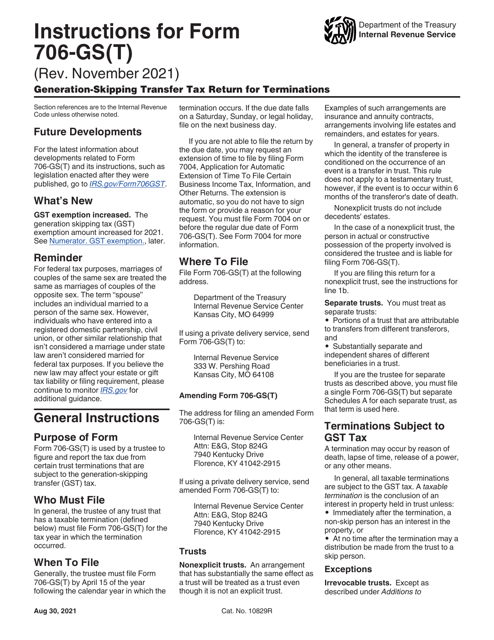

This form is used for reporting generation-skipping transfer tax returns for distributions. It provides instructions on how to accurately complete IRS Form 706-GS(D).

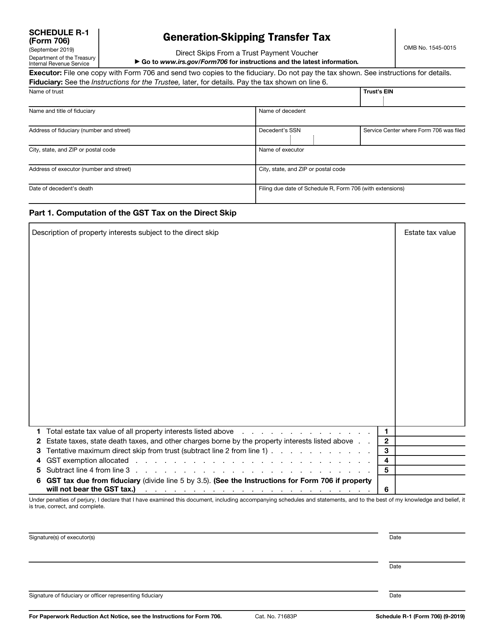

This form is used for reporting and paying the generation-skipping transfer tax on distributions from certain trusts.

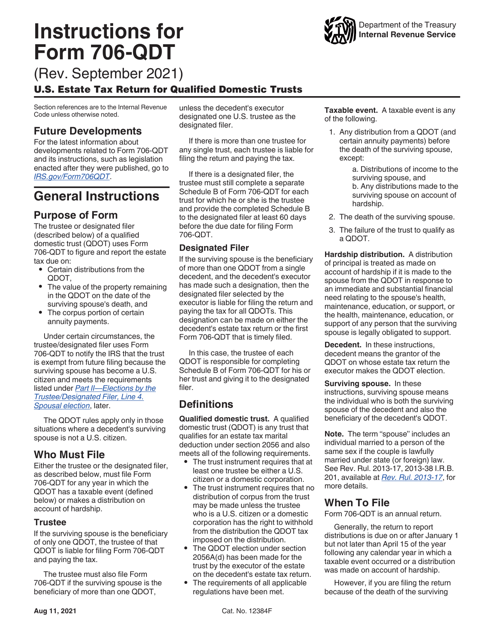

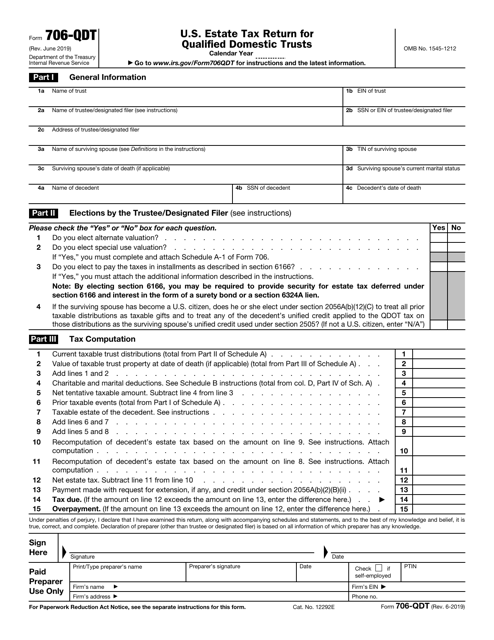

This form is used for reporting and paying estate tax for qualified domestic trusts in the United States.

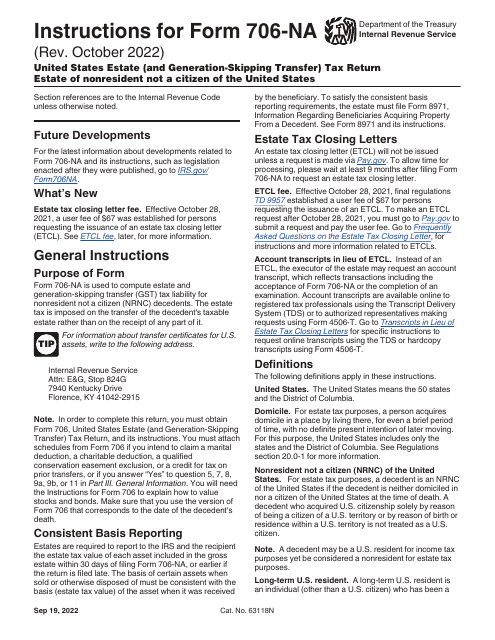

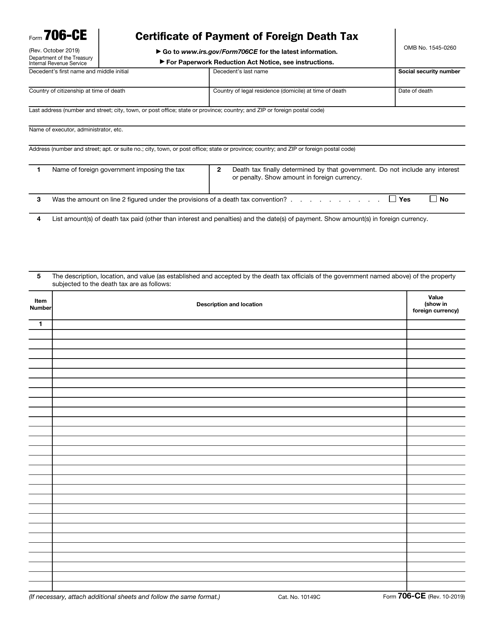

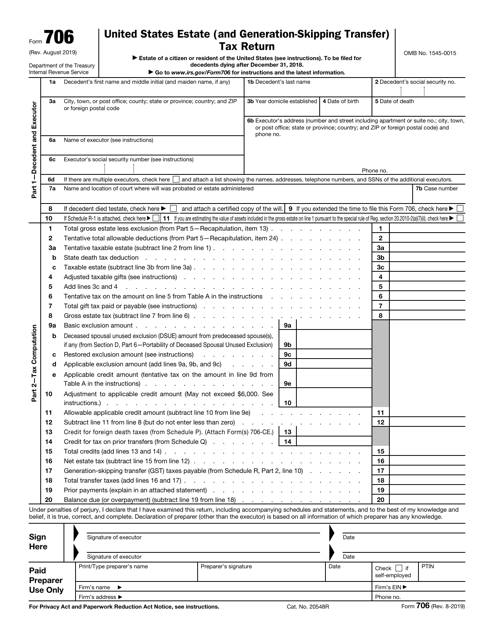

This is a formal statement prepared and submitted by estate administrators to calculate the estate tax liability of the person that recently died.

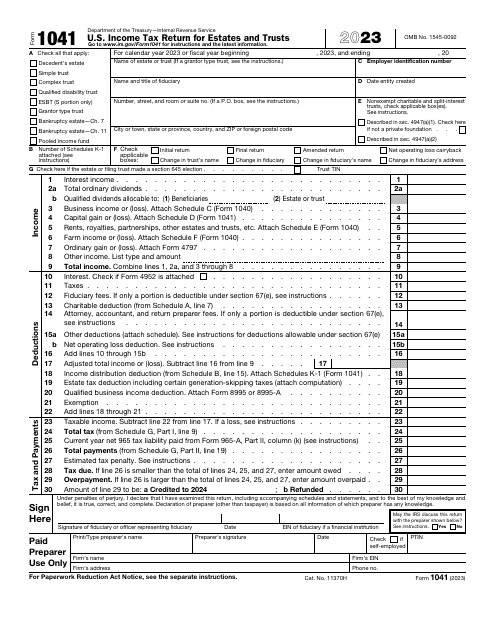

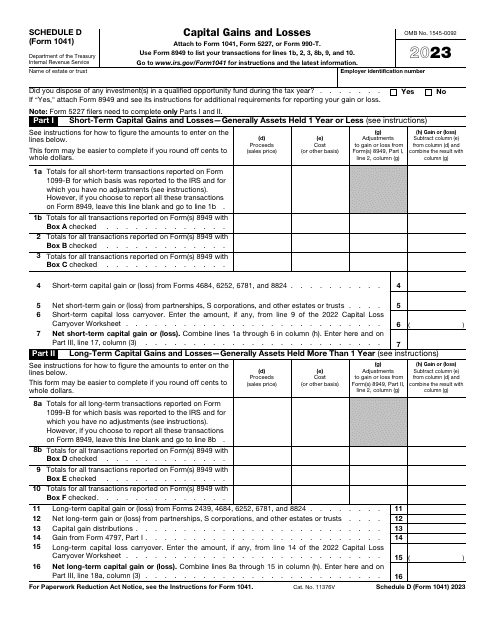

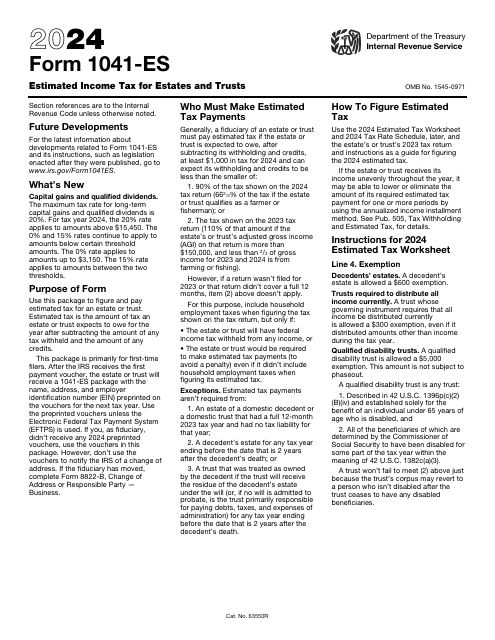

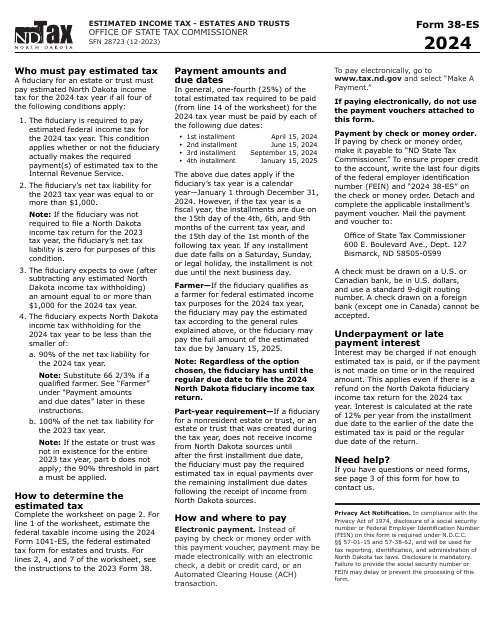

File this document, also known as the Estates and Trusts Tax Return, as an income tax return to the Internal Revenue Service (IRS) if you are a fiduciary of a bankruptcy estate, domestic decedent's estate, or a trust.

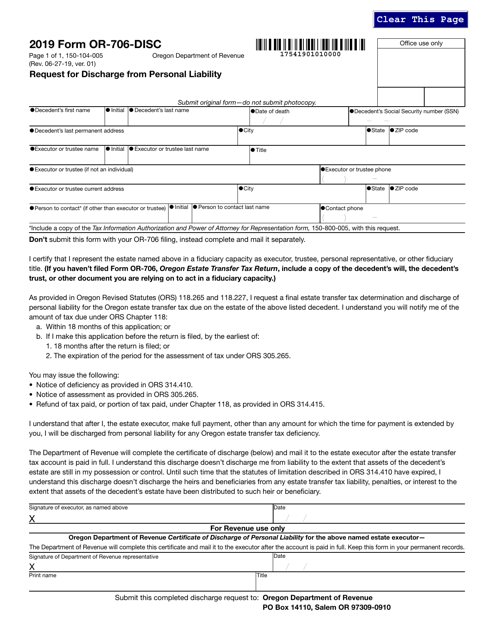

This Form is used for requesting discharge from personal liability in Oregon.

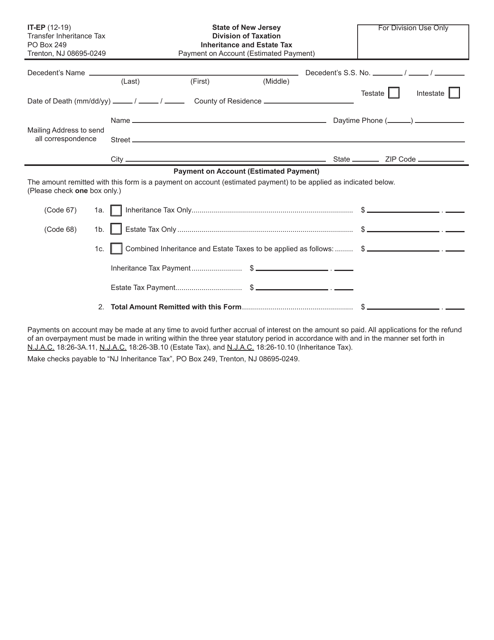

This Form is used for making estimated payments for inheritance and estate taxes in New Jersey.

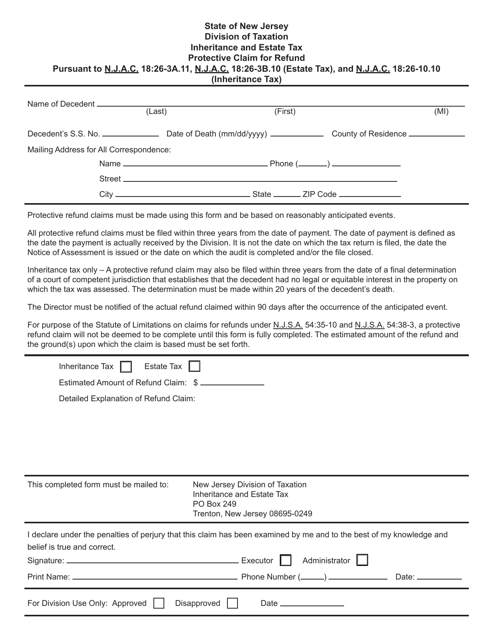

This form is used for individuals in New Jersey to file a protective claim for refund of inheritance and estate taxes.

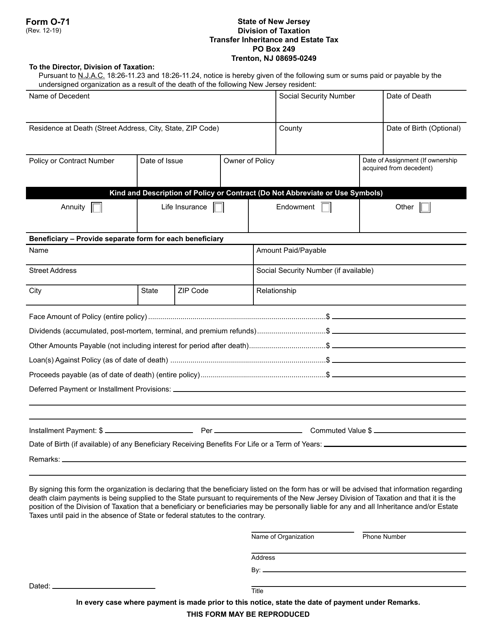

This form is used for transferring inheritance and estate tax in the state of New Jersey.