Estate Tax Form Templates

Documents:

256

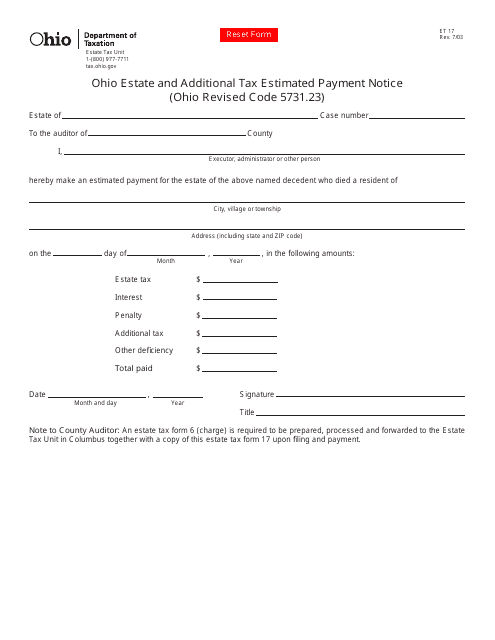

This form is used for submitting estimated tax payments for estate and additional taxes in the state of Ohio.

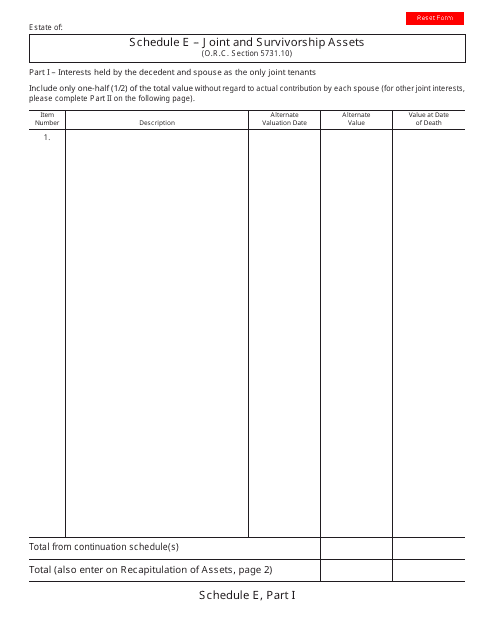

This Form is used for reporting joint and survivorship assets in the state of Ohio.

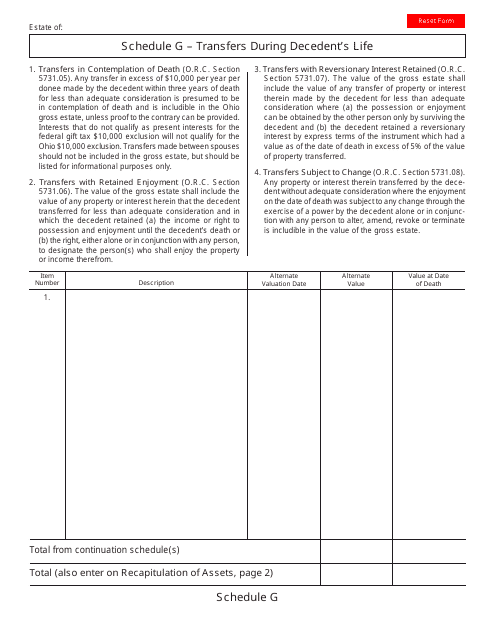

This type of document is used for recording transfers of property made by the decedent while they were still alive in the state of Ohio.

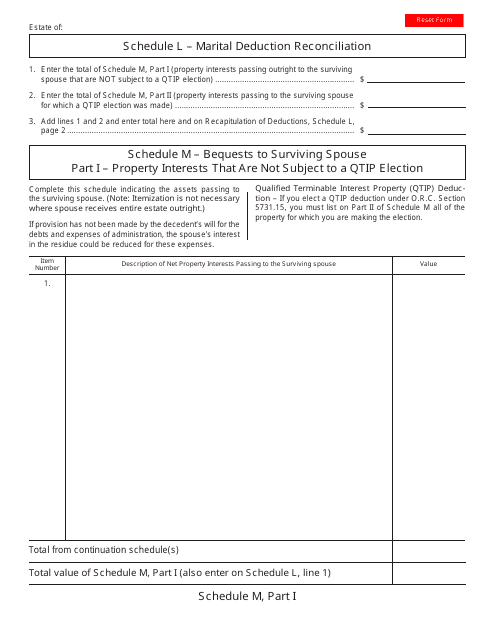

This form is used for reconciling marital deductions in the state of Ohio.

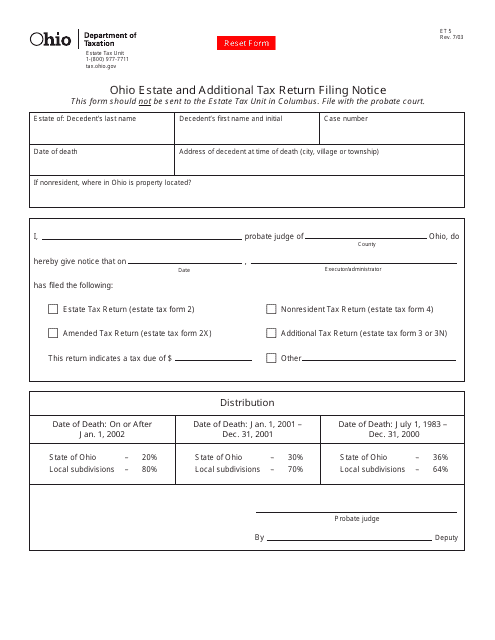

This Form is used for filing the Estate and Additional Tax Return Notice in Ohio. It is required for reporting estate and additional taxes.

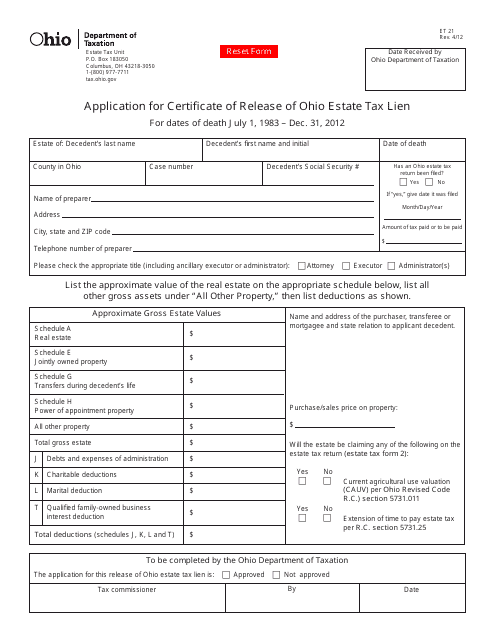

This form is used for applying for a certificate of release of Ohio estate tax lien in Ohio.

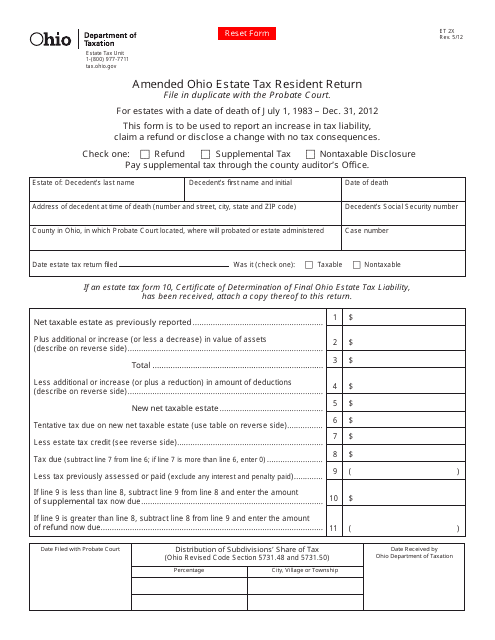

This form is used for filing an amended Ohio Estate Tax Resident Return in the state of Ohio.

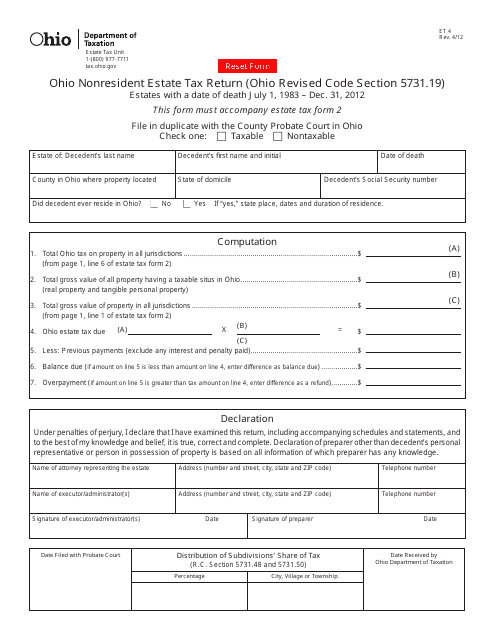

This form is used for filing the Ohio Nonresident Estate Tax Return for estates with a date of death between July 1, 1983, and December 31, 2012, in Ohio.

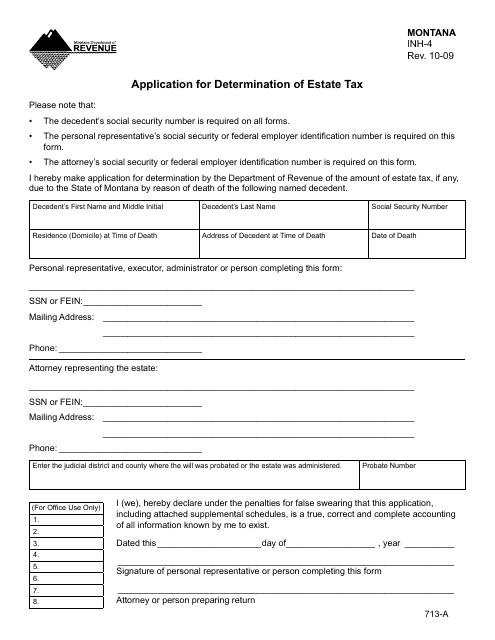

This form is used for applying for a determination of estate tax in the state of Montana.

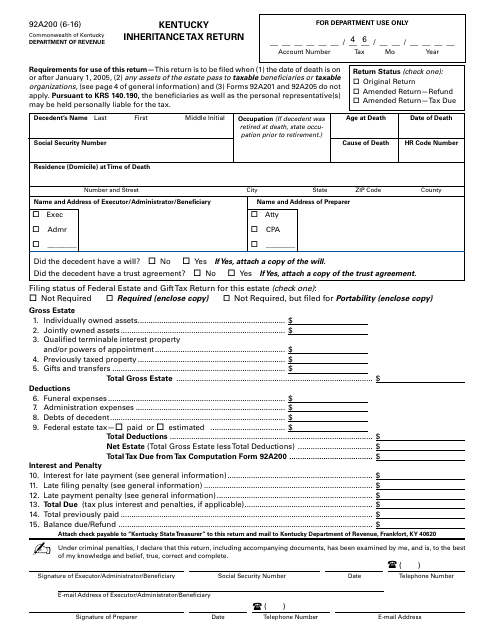

This Form is used for reporting and paying inheritance taxes in Kentucky. It helps determine the amount of tax owed by the estate of a deceased person.

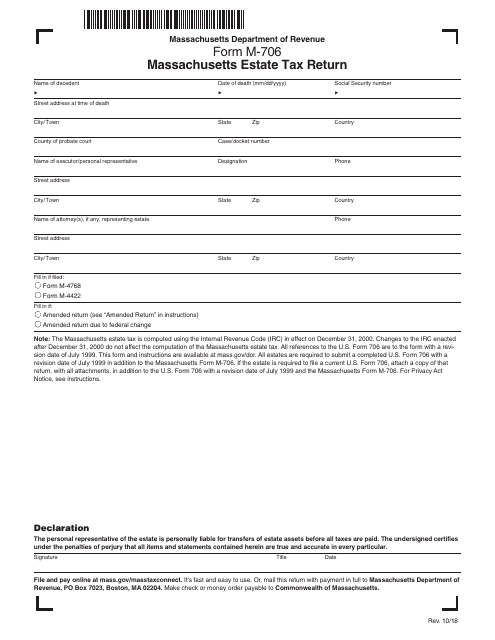

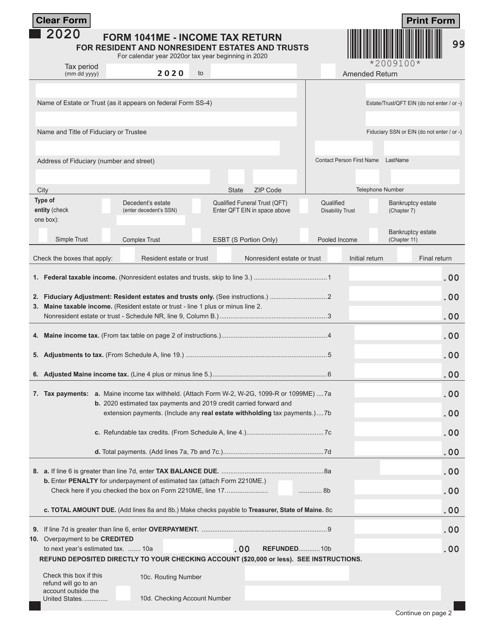

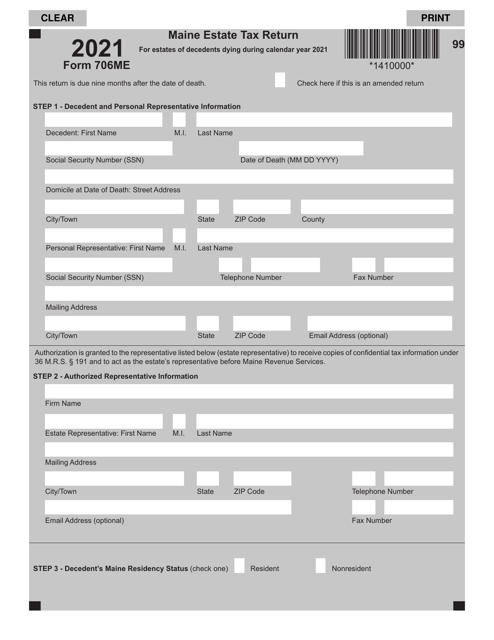

This form is used for filing an estate tax return in the state of Massachusetts.

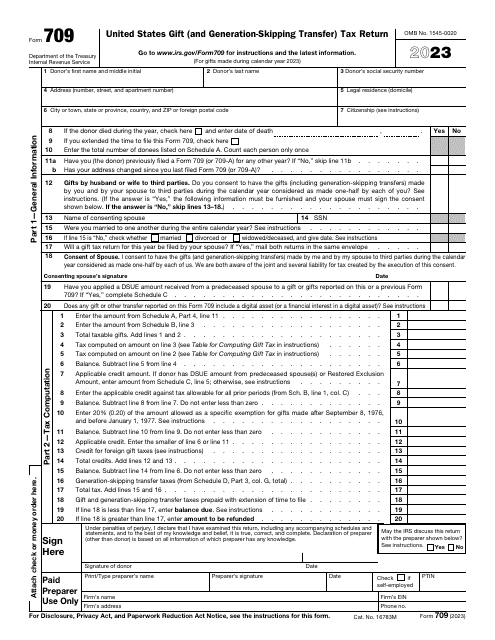

This is a formal document used by taxpayers to outline asset transfers that are considered gifts and are subject to tax.

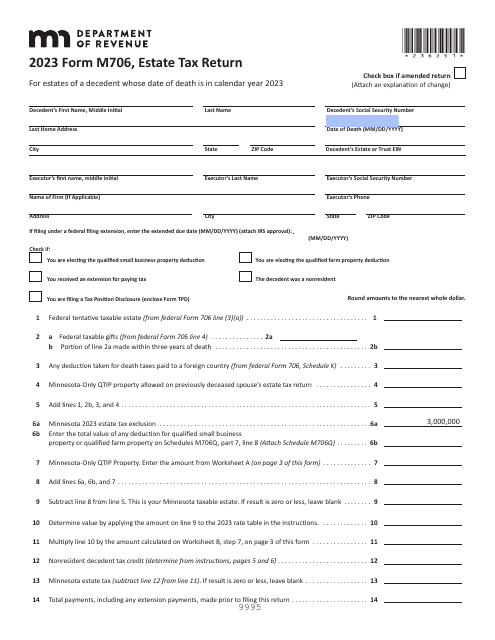

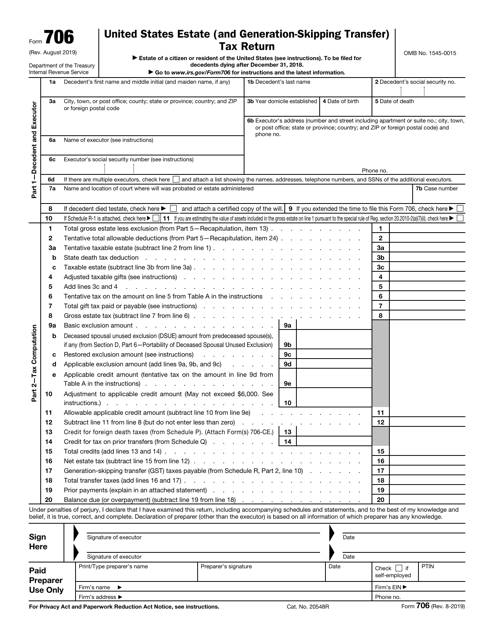

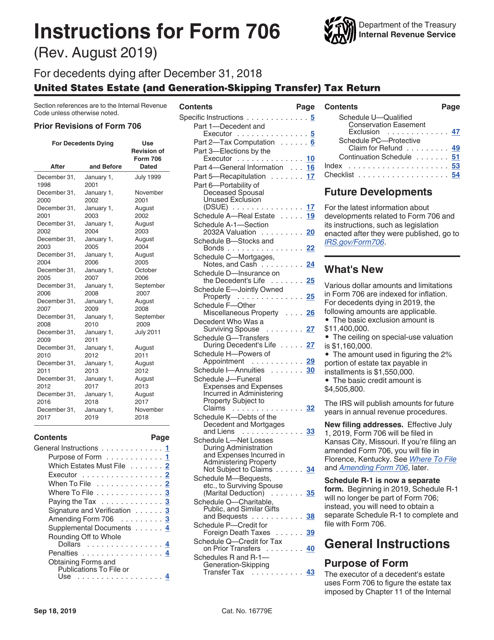

This is a formal statement prepared and submitted by estate administrators to calculate the estate tax liability of the person that recently died.

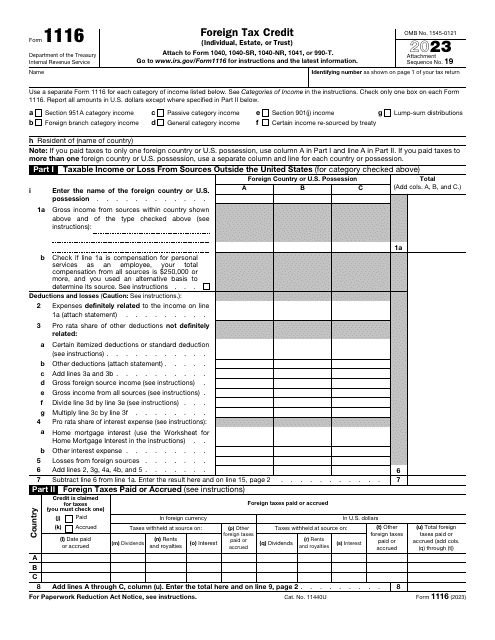

This is a formal document that allows American taxpayers that reside, work, and manage businesses overseas to lower the amount of tax they owe to the U.S. government.

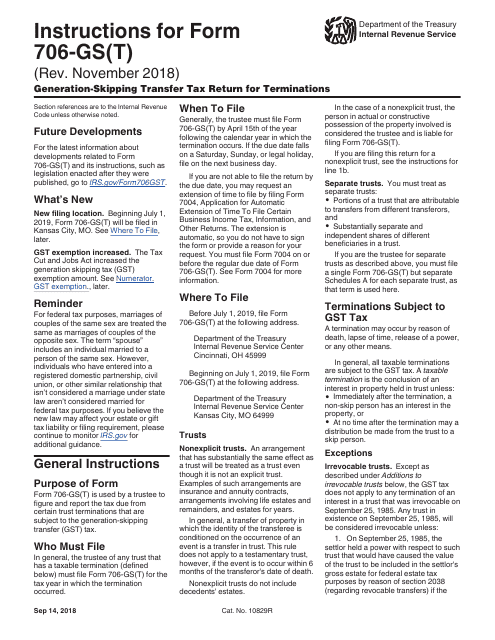

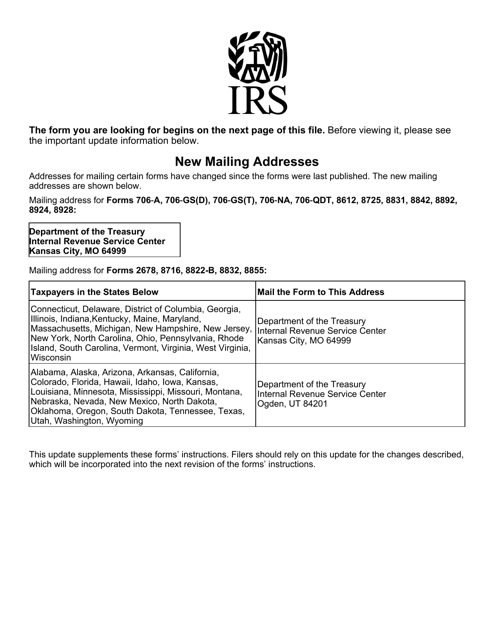

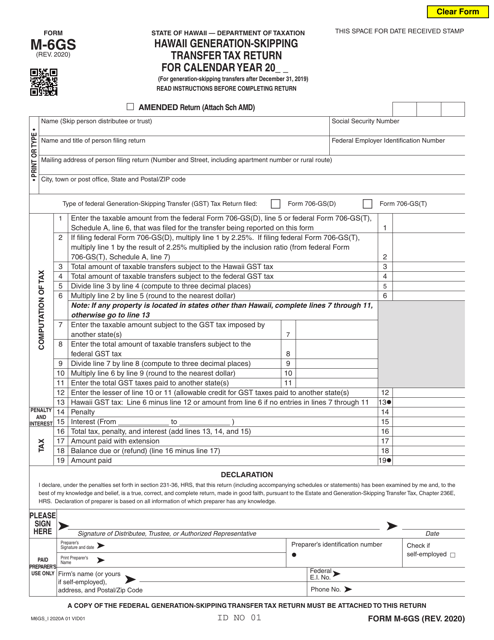

This Form is used for reporting the Generation-Skipping Transfer Tax for terminations on the IRS Form 706-GS (T). It provides instructions on how to fill out the form and report any transfers subject to the tax.

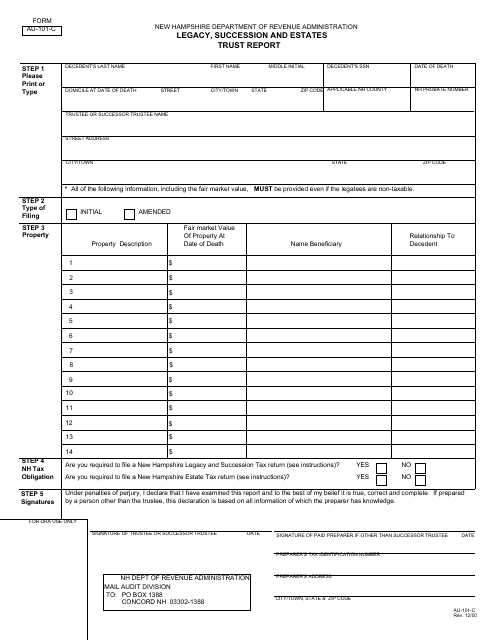

This form is used for reporting legacy, succession, and estate trusts in the state of New Hampshire.

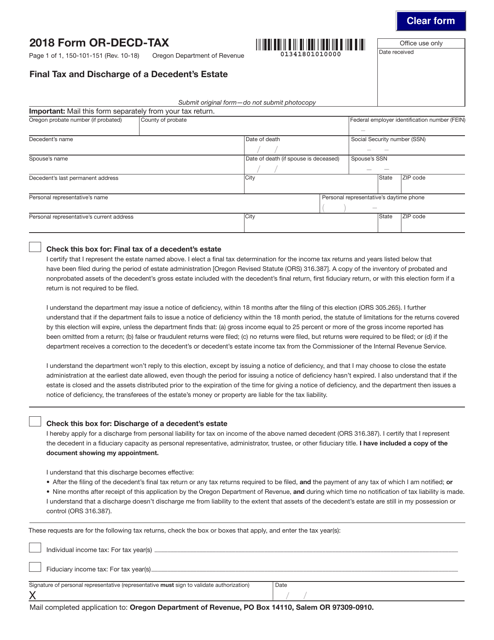

This form is used for the final tax and discharge of a decedent's estate in Oregon.

This Form is used for reporting and paying the generation-skipping transfer tax when there is a termination of a trust.

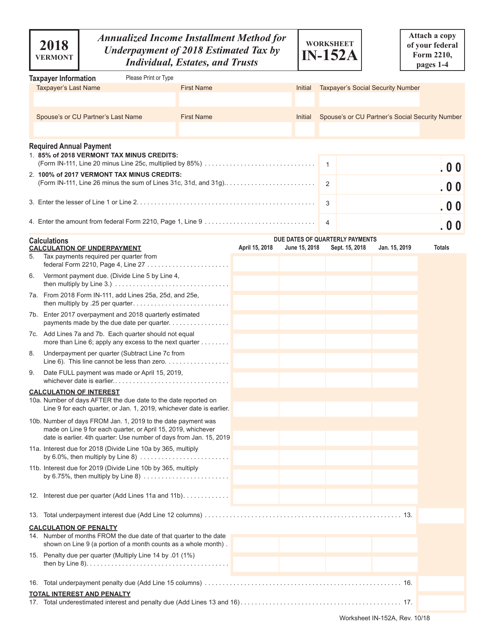

This document is a worksheet that individuals, estates, and trusts in Vermont can use to calculate their annualized income installment for the underpayment of estimated tax for the year 2018. It helps determine if any additional tax needs to be paid to avoid penalties.

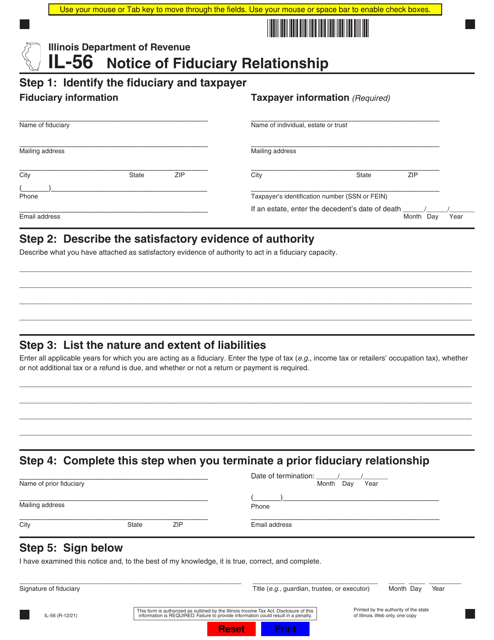

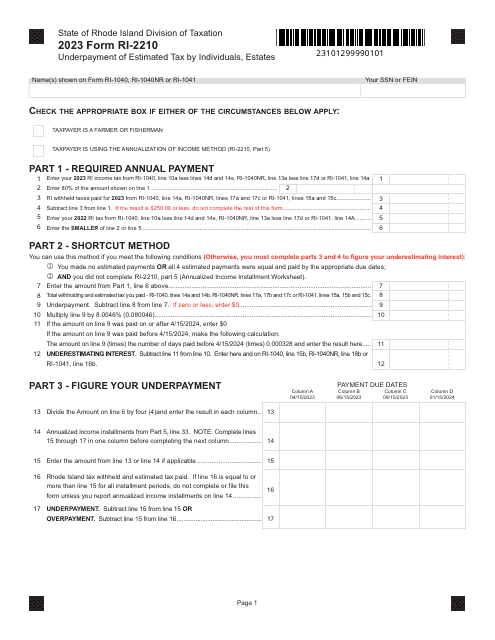

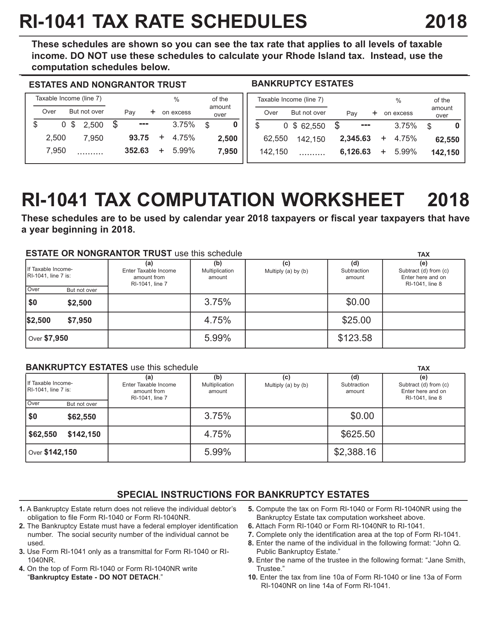

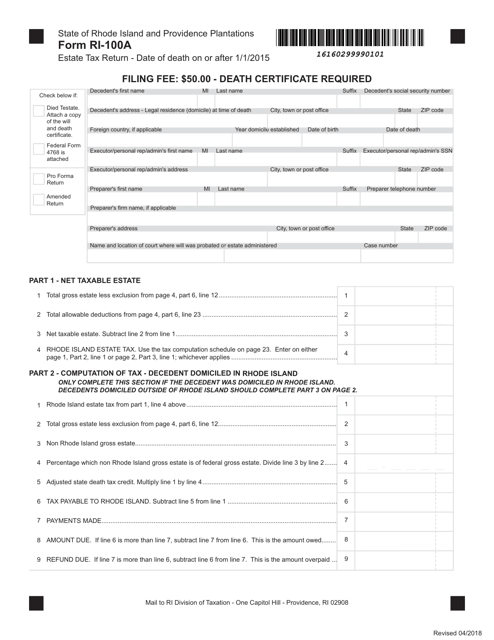

This form is used for calculating the tax rates and liabilities for fiduciaries in Rhode Island.

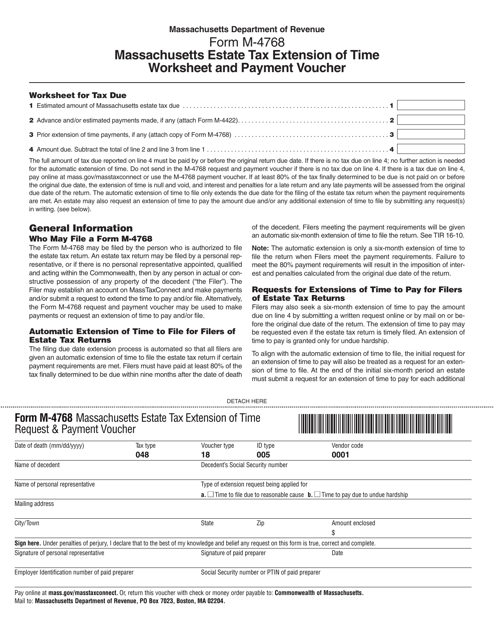

This Form is used for requesting an extension of time to file and pay estate taxes in Massachusetts.

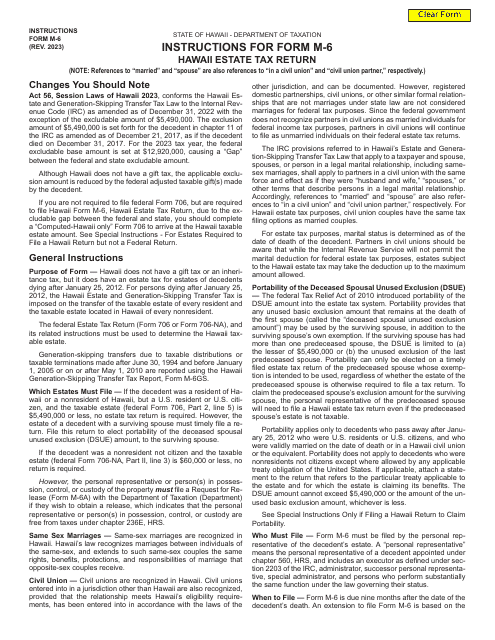

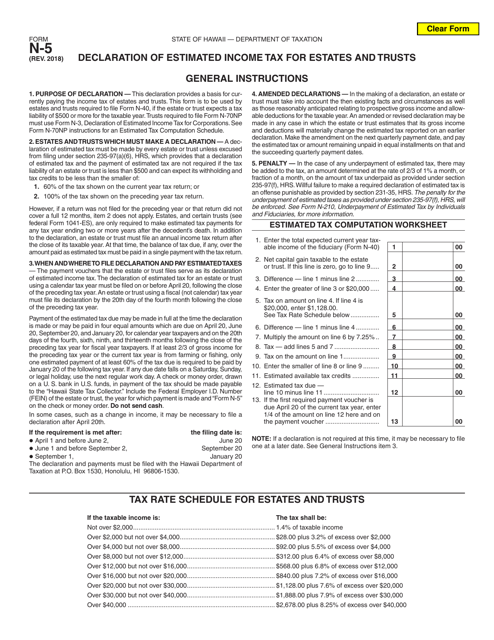

This form is used for estates and trusts in Hawaii to declare their estimated income tax.

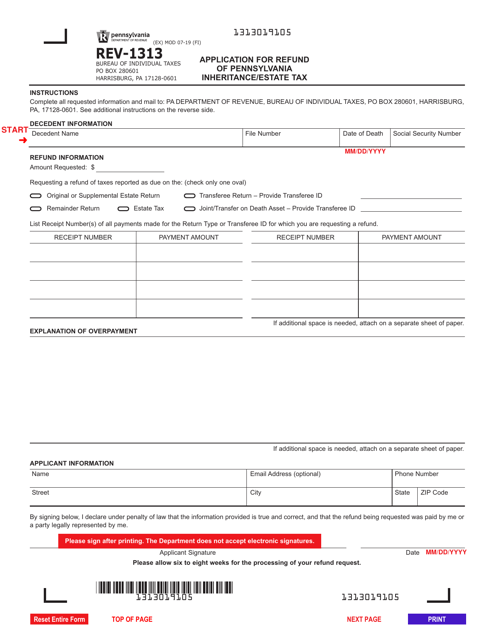

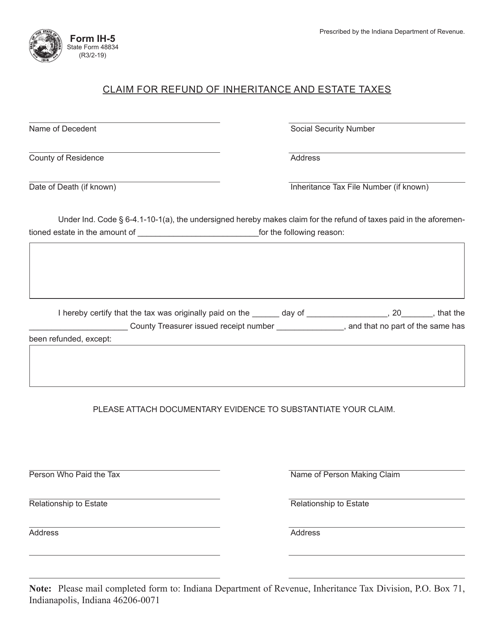

This form is used for claiming a refund of inheritance and estate taxes in the state of Indiana.

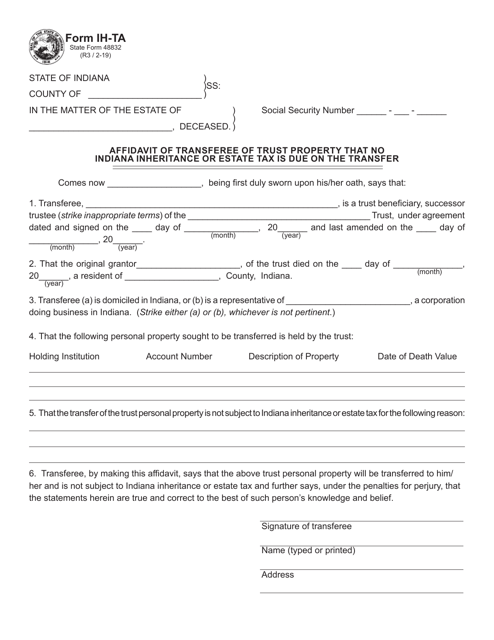

This form is used for filing an Affidavit of Transferee of Trust Property to declare that no Indiana inheritance or estate tax is owed on the transfer.