Estate Tax Form Templates

Documents:

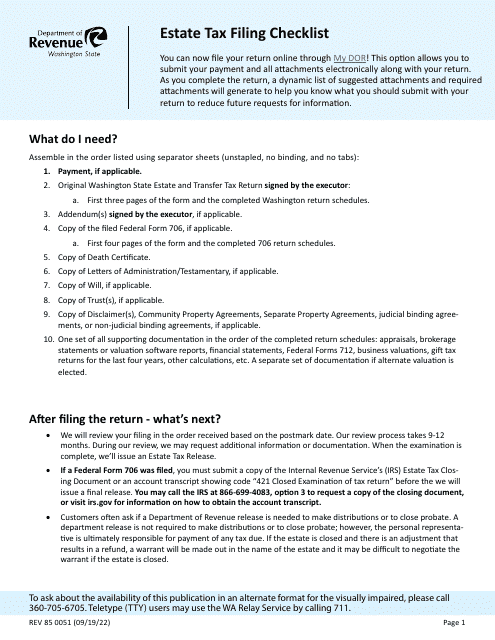

256

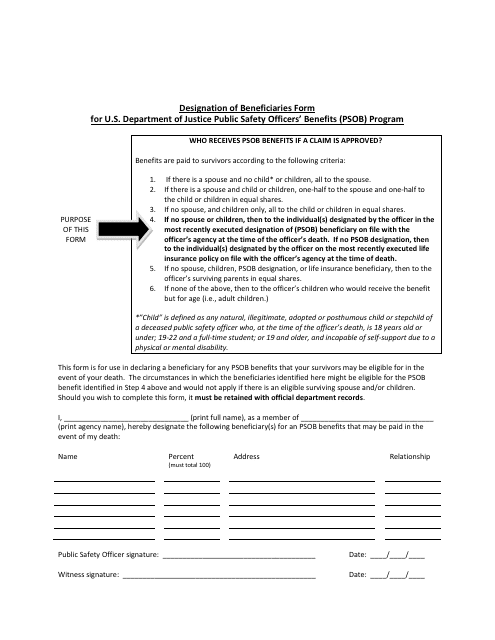

This form is used for designating beneficiaries for a retirement plan, life insurance policy, or other types of financial accounts.

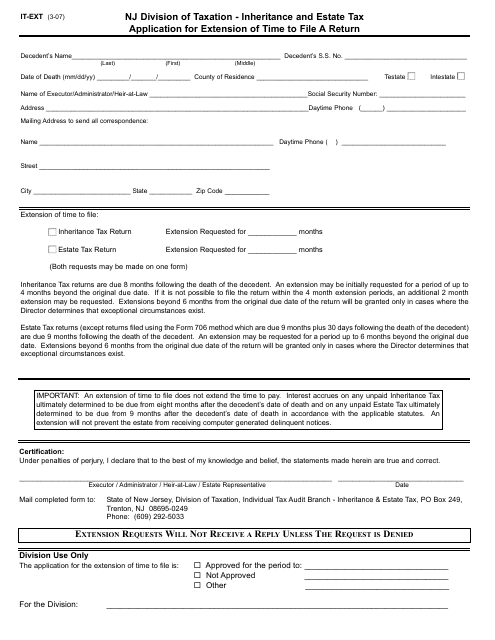

This form is used for applying for an extension of time to file an inheritance and estate tax return in the state of New Jersey.

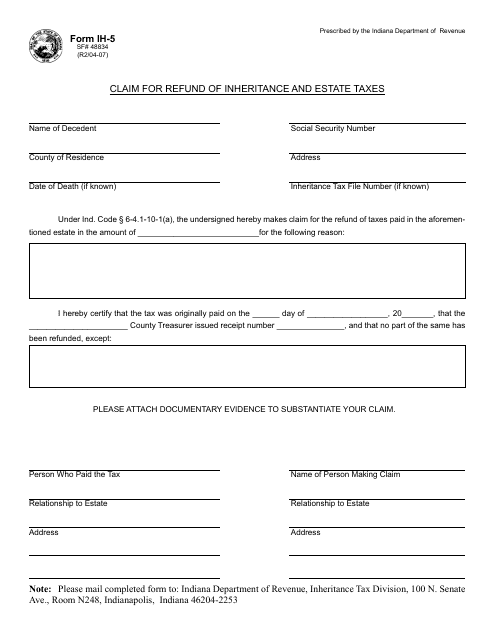

This form is used for claiming a refund of inheritance and estate taxes in the state of Indiana.

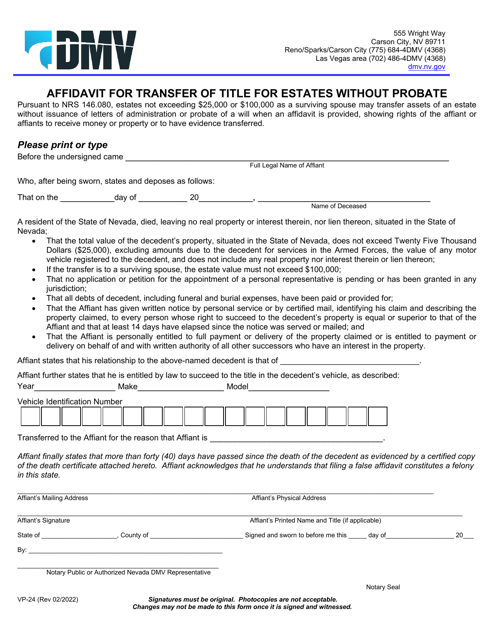

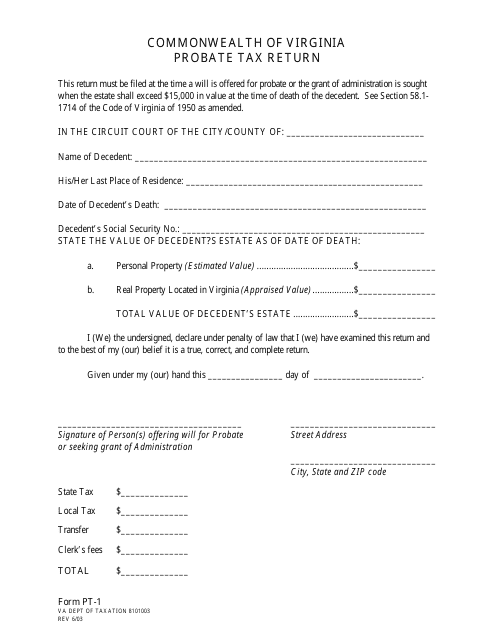

This form is used for filing the probate tax return in the state of Virginia. It is required when dealing with the estate and assets of a deceased individual.

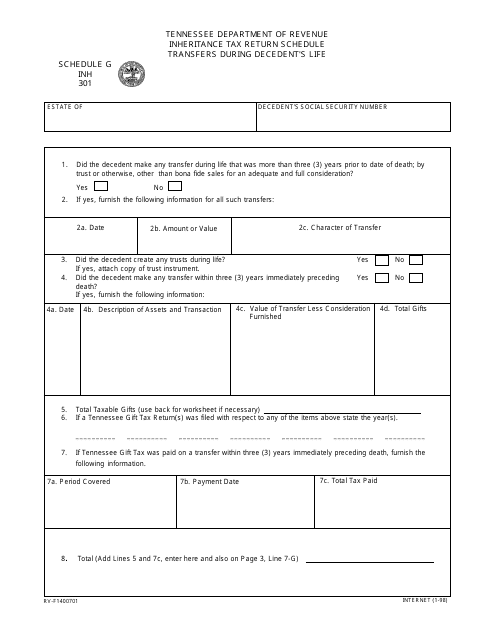

This form is used for reporting transfers made by the deceased person during their lifetime for the purpose of calculating inheritance tax in Tennessee.

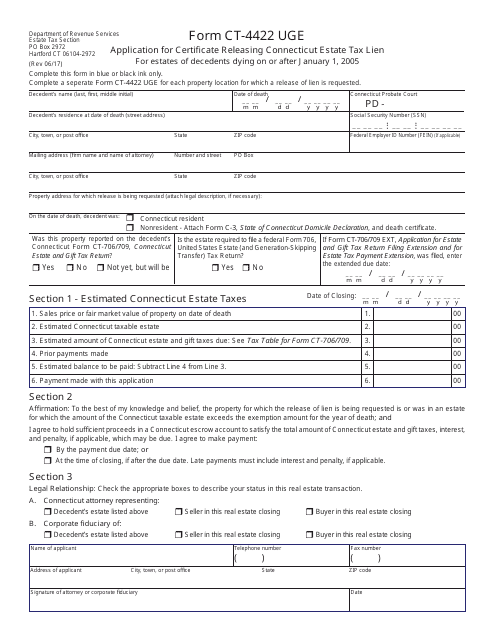

This form is used for applying to release the Connecticut estate tax lien for estates of deceased individuals who passed away on or after January 1, 2005.

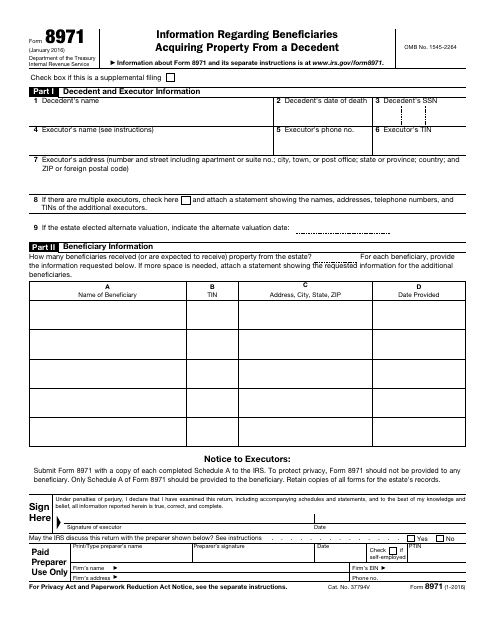

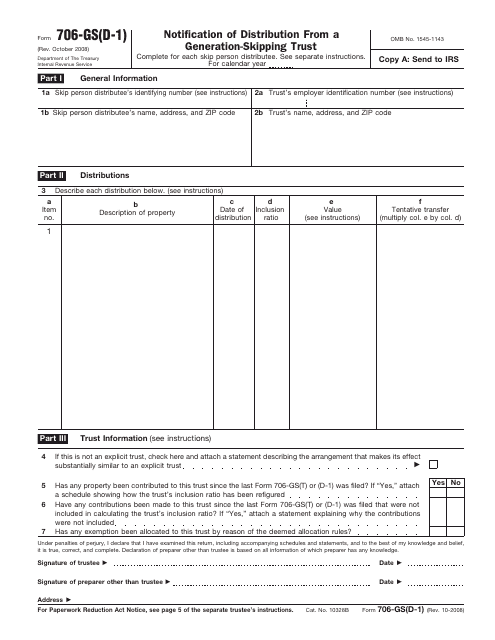

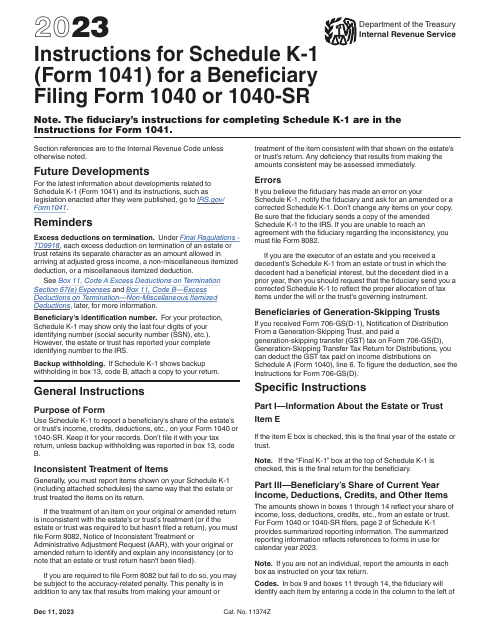

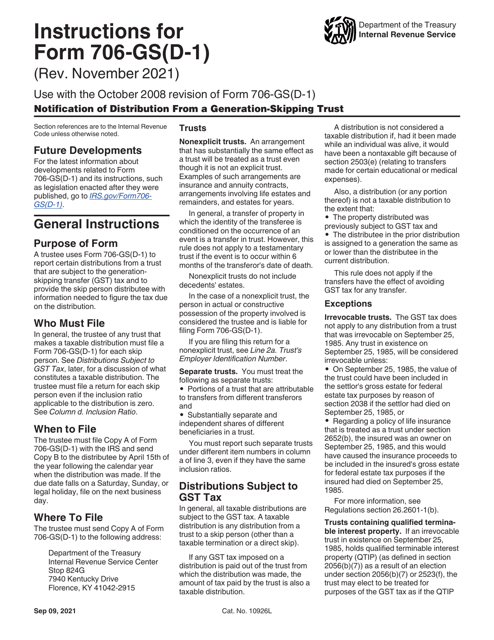

This form is used for providing information about beneficiaries who acquire property from a deceased person.

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

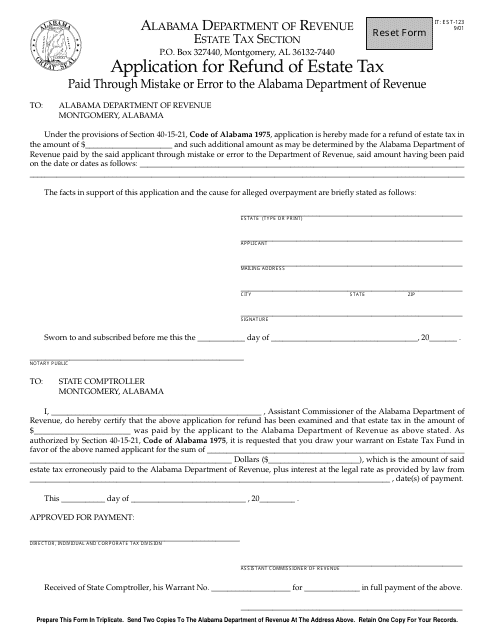

This form is used for filing an application to claim a refund for estate tax paid in Alabama.

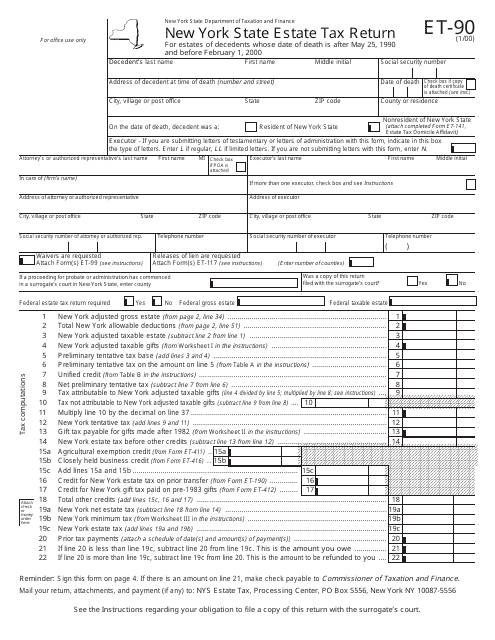

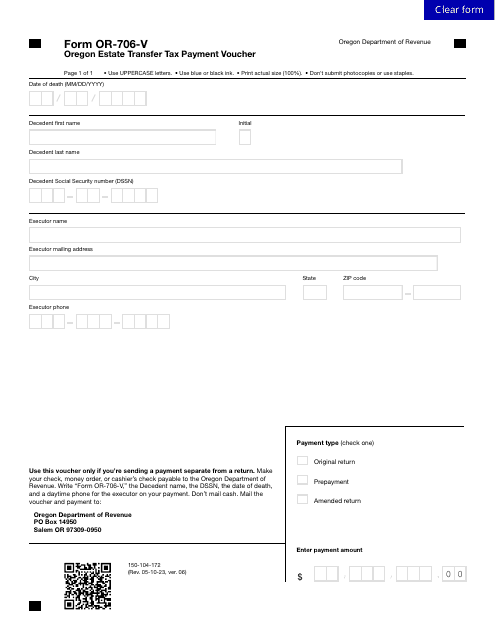

This form is used for reporting and paying estate taxes in the state of New York.

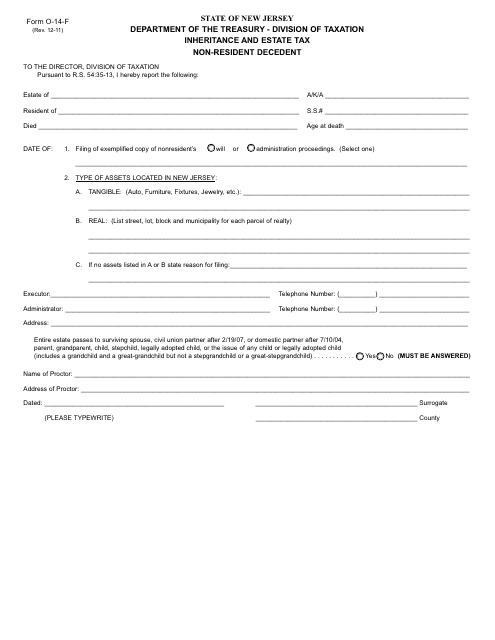

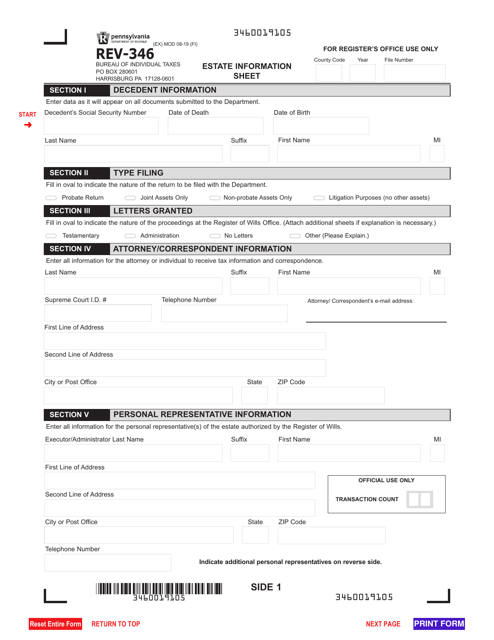

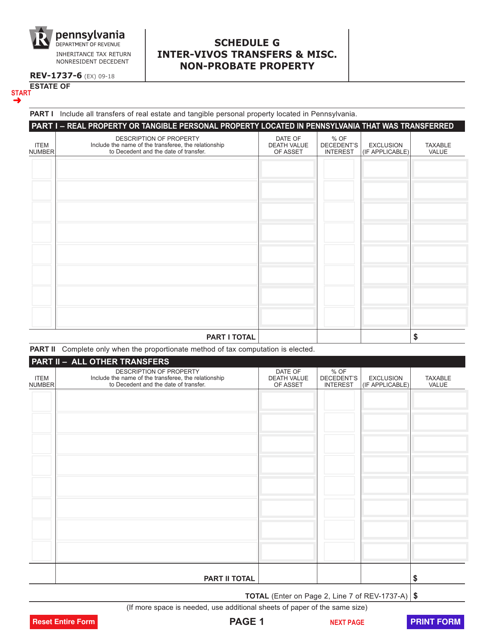

This form is used for reporting inheritance and estate taxes for non-resident decedents in the state of New Jersey.

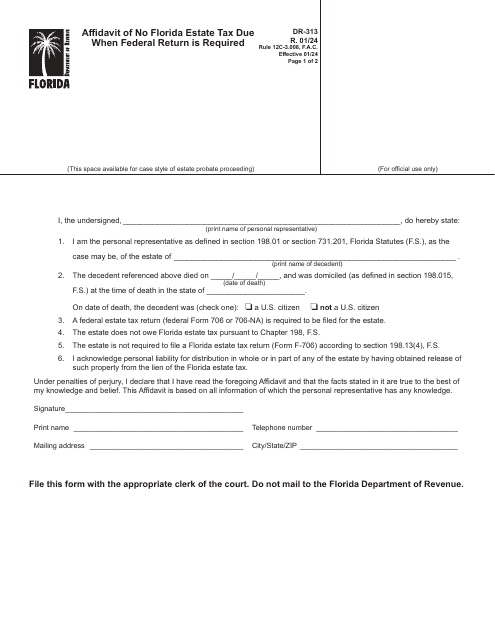

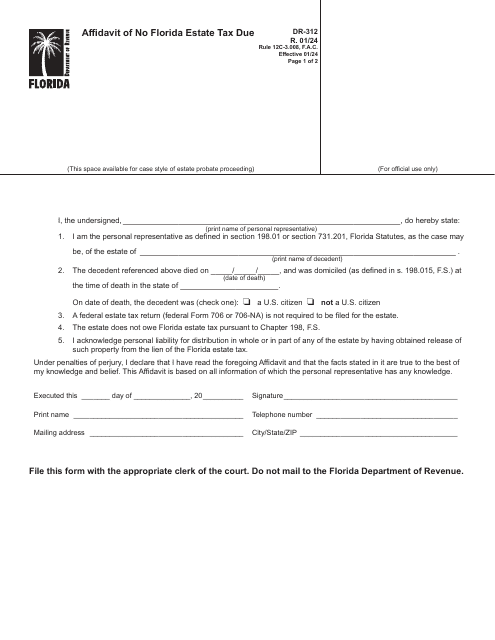

This form is a Florida legal document completed for the estates of decedents who died on or after January 1, 2005, if the estate does not require the filing of a federal estate tax return.

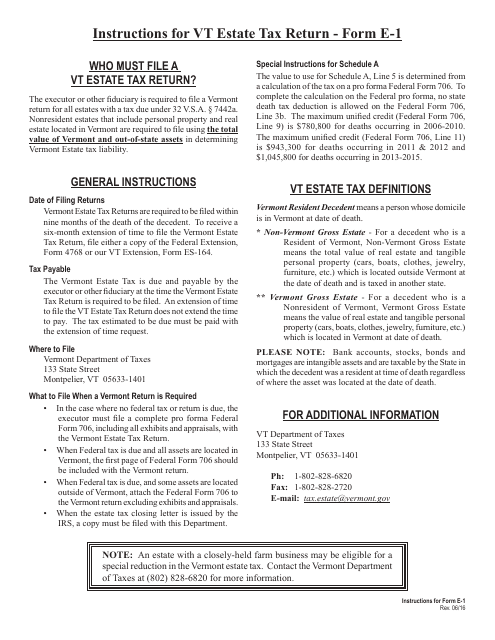

This document is used for filing the Estate Tax Return in the state of Vermont.

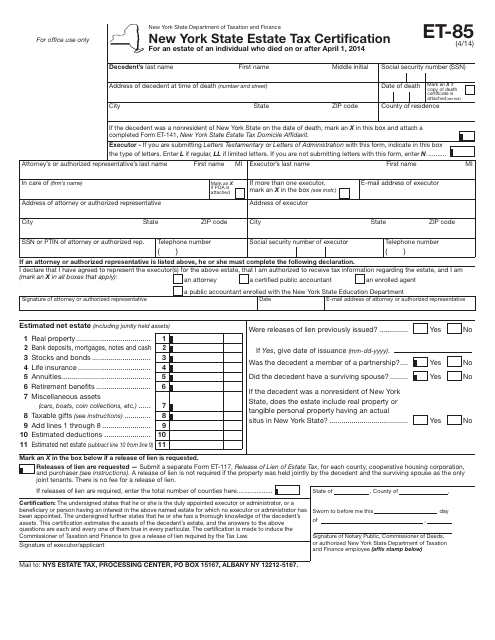

This document is used for certifying the estate tax in the state of New York.

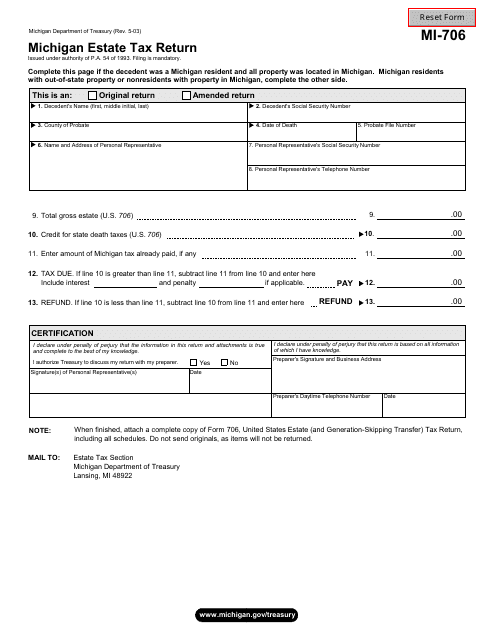

This form is used for filing the Michigan Estate Tax Return in the state of Michigan.

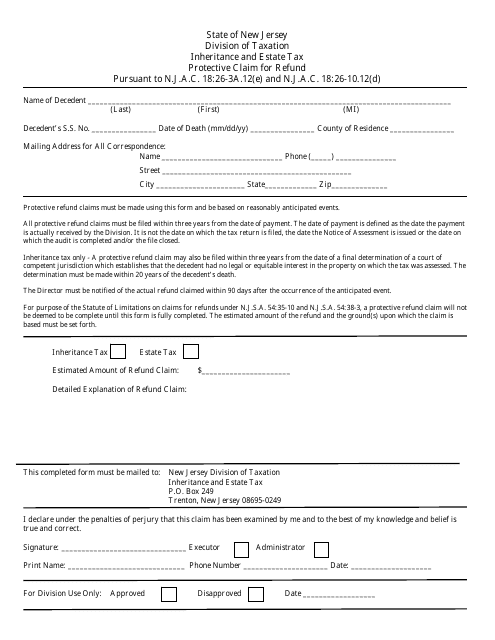

This Form is used for claiming a refund for inheritance and estate taxes paid in New Jersey.

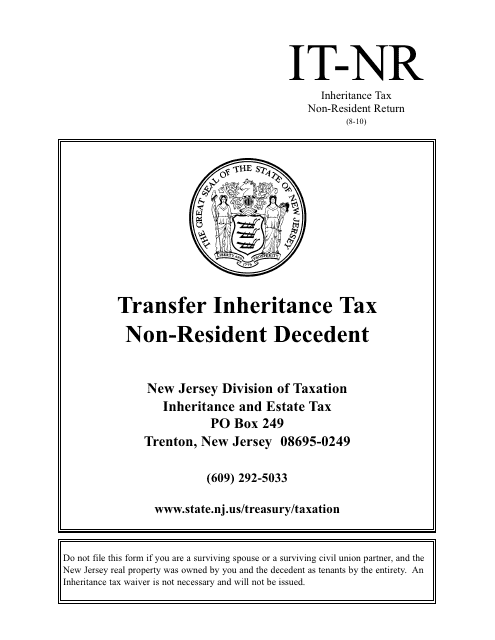

This form is used for transferring inheritance tax for non-resident decedents in New Jersey.

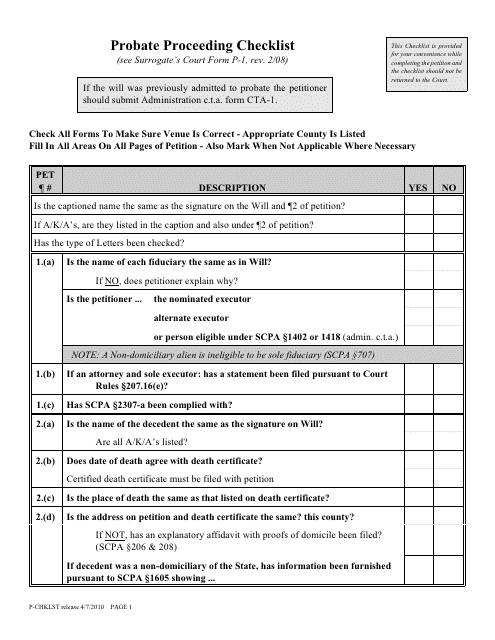

This form is used for a probate proceeding checklist in New York. It helps to ensure that all necessary steps are completed during the probate process.

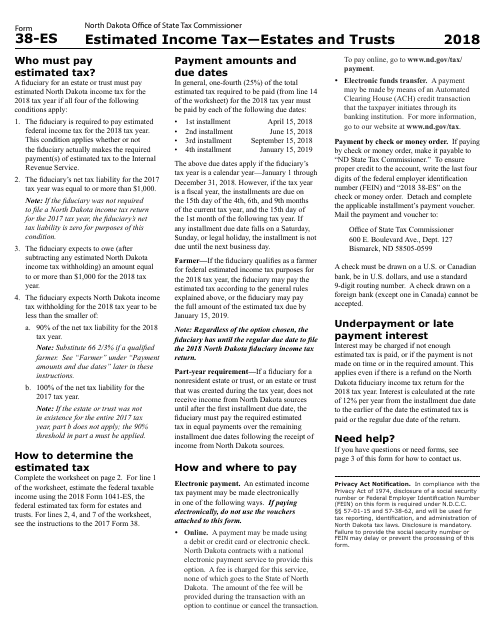

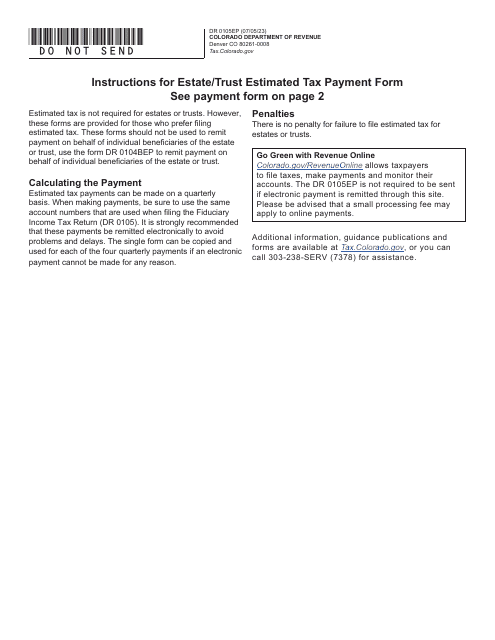

This Form is used for estimating income tax for estates and trusts in North Dakota.

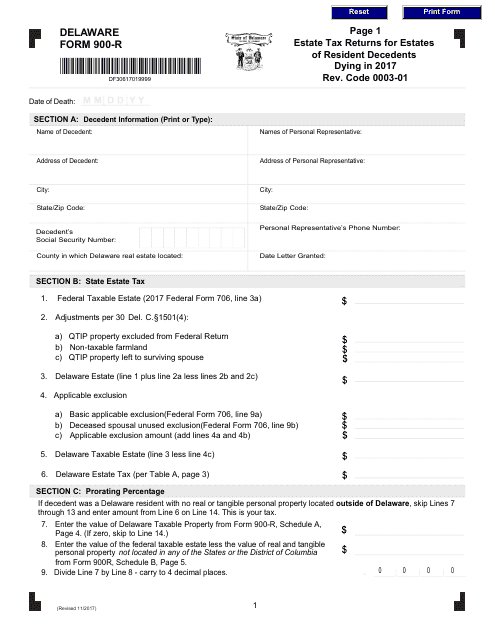

This Form is used for filing estate tax returns for the estates of resident decedents who passed away in 2017 in Delaware.