Tax Refund Form Templates

Documents:

569

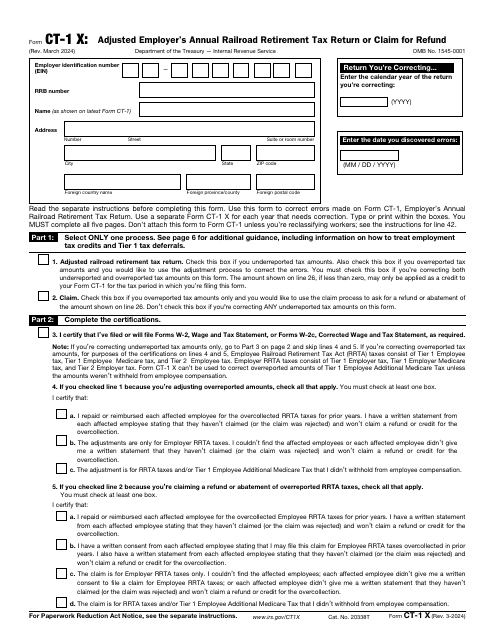

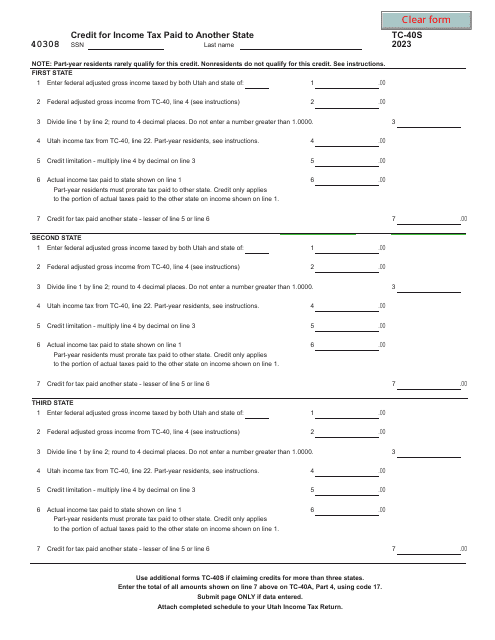

This is a formal document used by railroad industry employers to correct errors they have noticed upon filing IRS Form CT-1, Employer's Annual Railroad Retirement Tax Return.

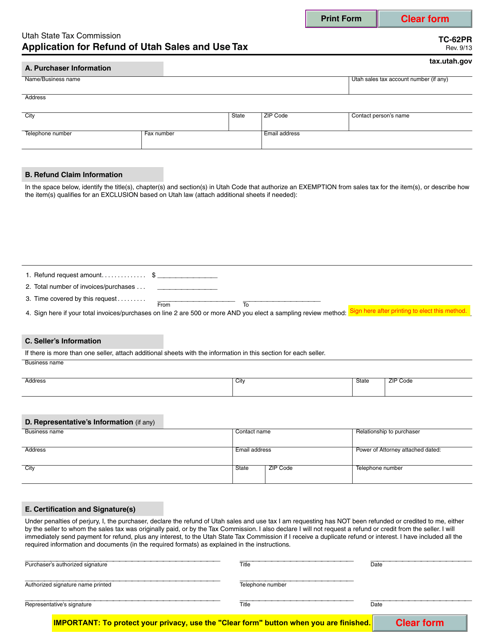

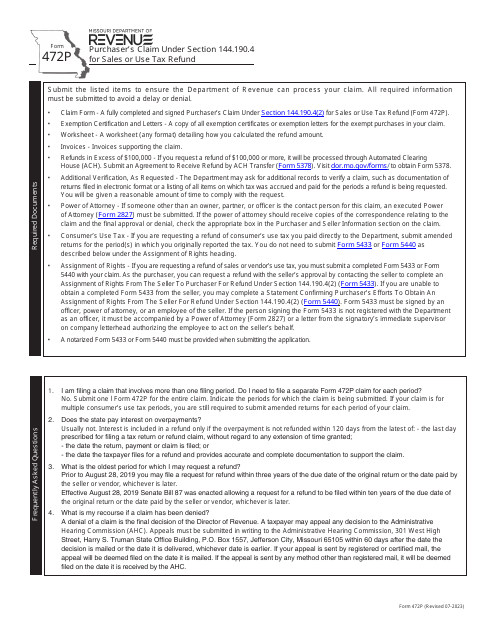

This form is used for applying for a refund of sales and use tax in the state of Utah.

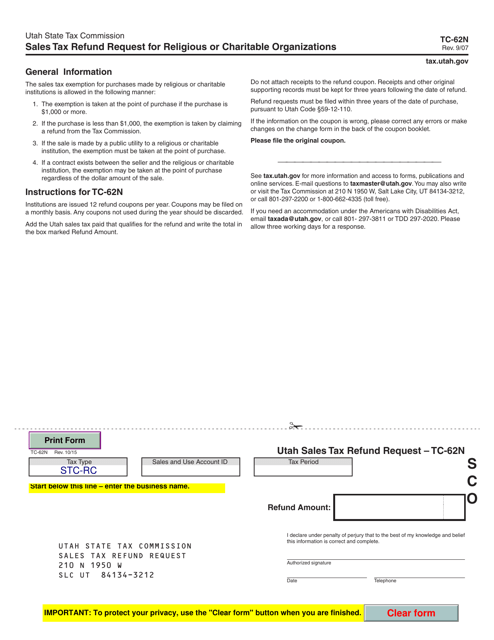

This form is used for religious or charitable organizations in Utah to request a sales tax refund.

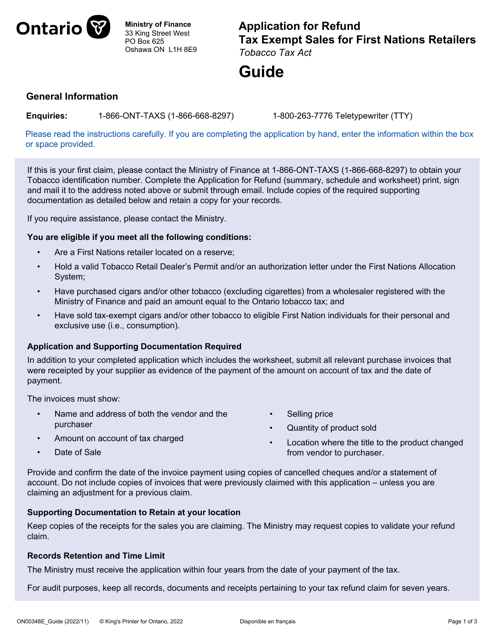

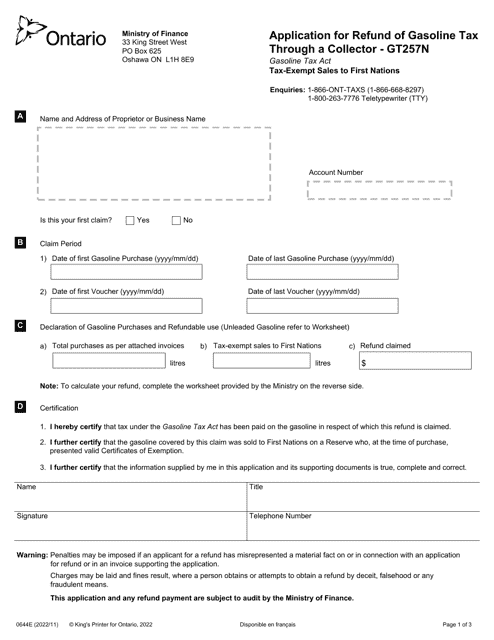

This form is used for applying for a refund of tax-exempt sales for First Nations retailers in Ontario, Canada. It provides instructions on how to properly complete and submit the application.

This Form is used for applying for a refund of gasoline tax in Ontario, Canada, through a designated collector.

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

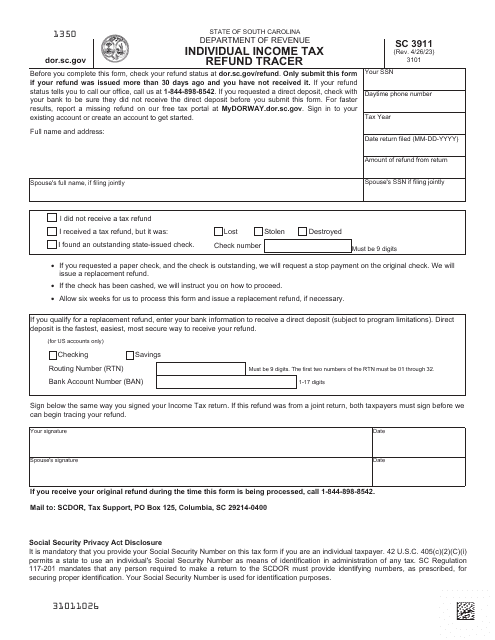

This form is used for tracking the status of individual income tax refunds in North Carolina.

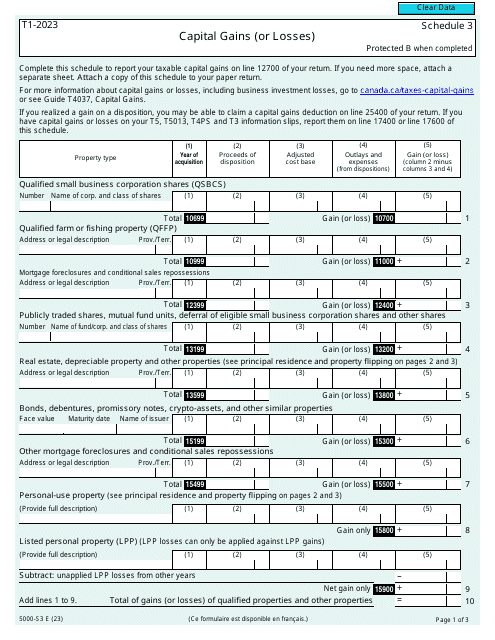

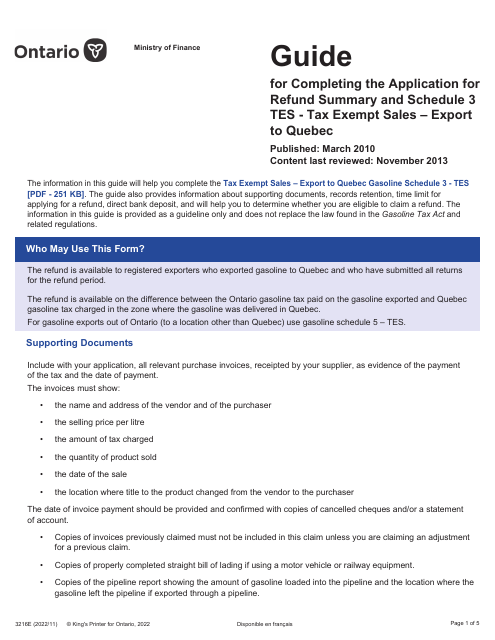

This form is used for providing a guide on how to complete the Application for Refund Summary and Schedule 3 Tes for tax exempt sales made to Quebec and Ontario, Canada.

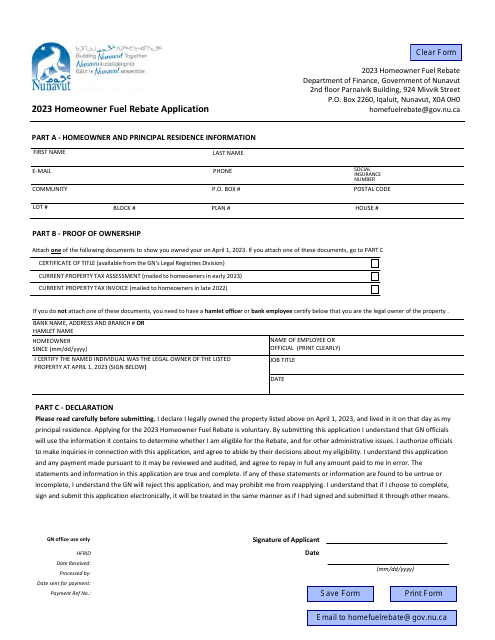

This document is for Nunavut, Canada residents who are homeowners and want to apply for a fuel rebate. The rebate is designed to help homeowners with the costs of fuel for heating their homes.

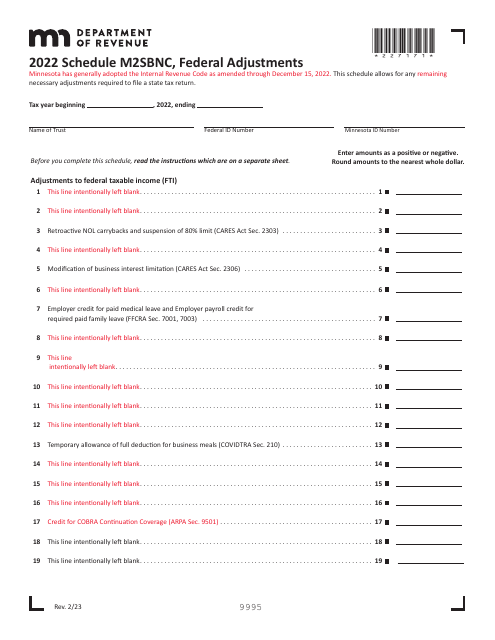

This document is used for reporting federal adjustments made on the Minnesota state tax return. It is specifically for businesses (M2SBNC) in Minnesota.

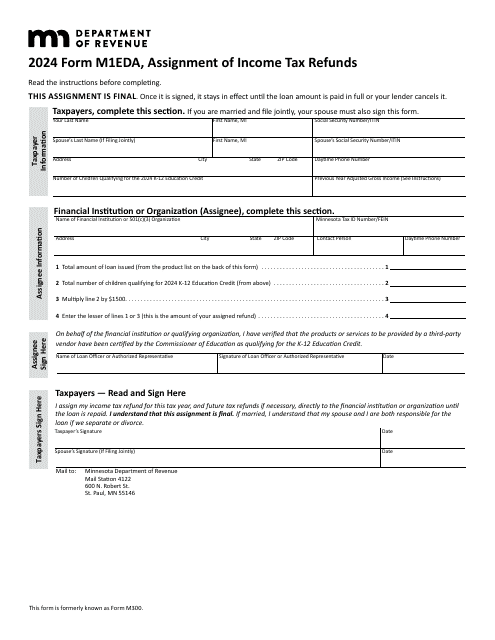

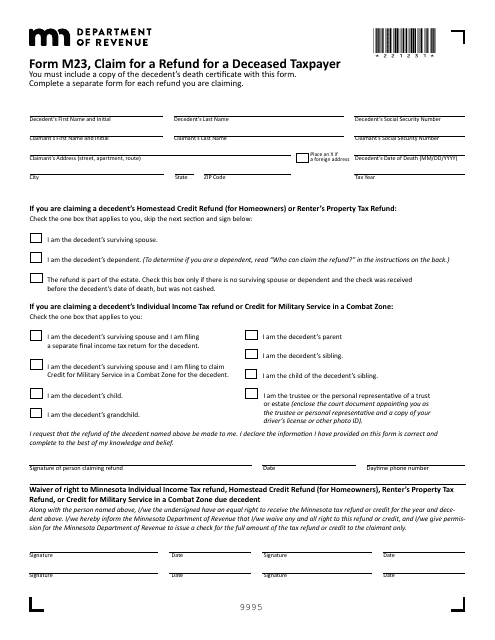

This form is used for claiming a refund on behalf of a deceased taxpayer in the state of Minnesota.

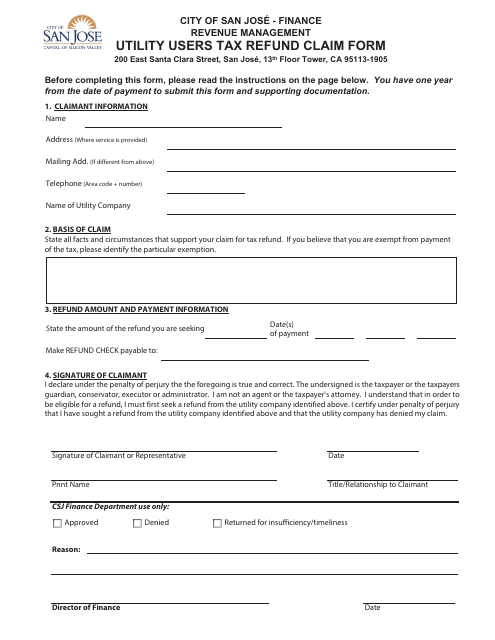

This document is used for claiming a refund on the Utility Users Tax in the City of San Jose, California.

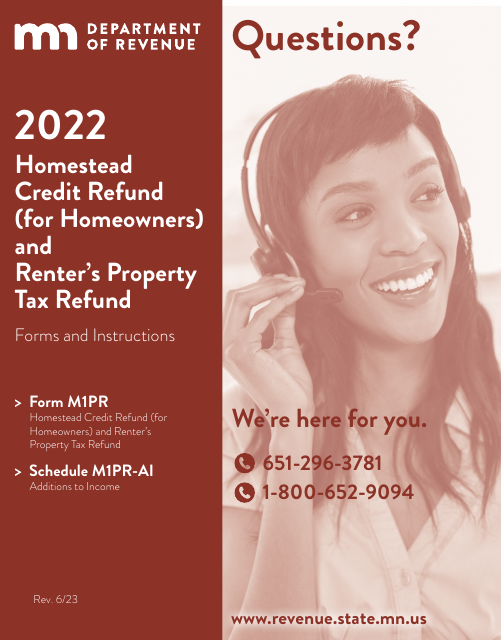

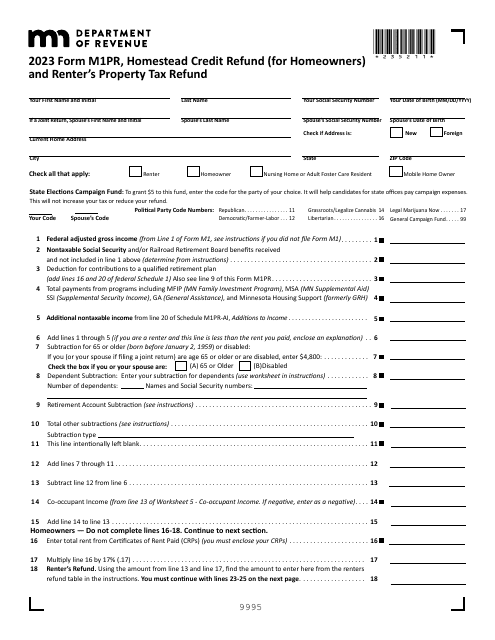

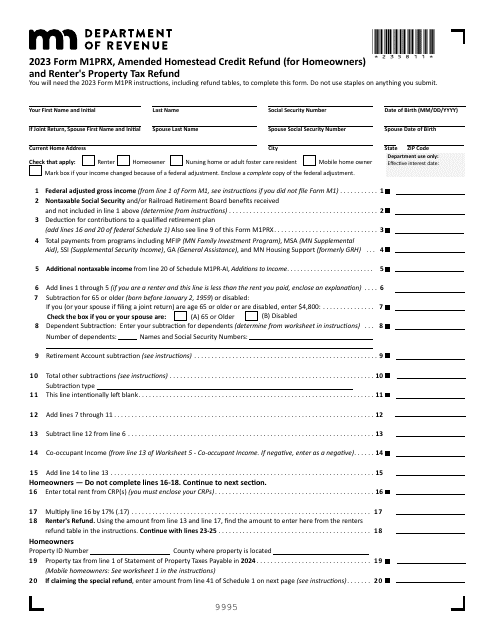

The purpose of this document is to let Minnesota taxpayers get a refund based on their household income and the property taxes or rent paid on their primary residence if they qualify.