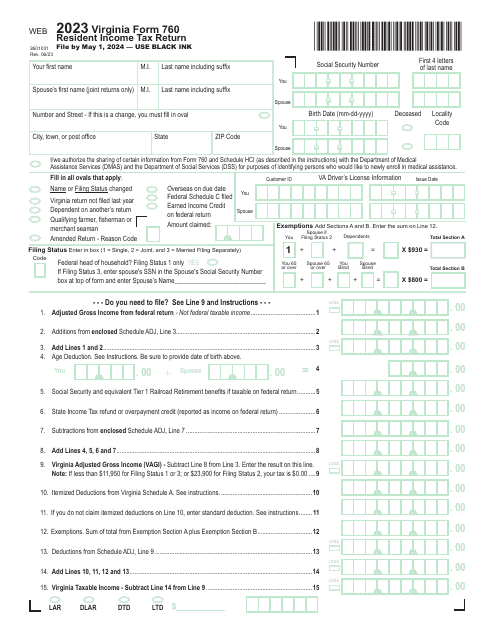

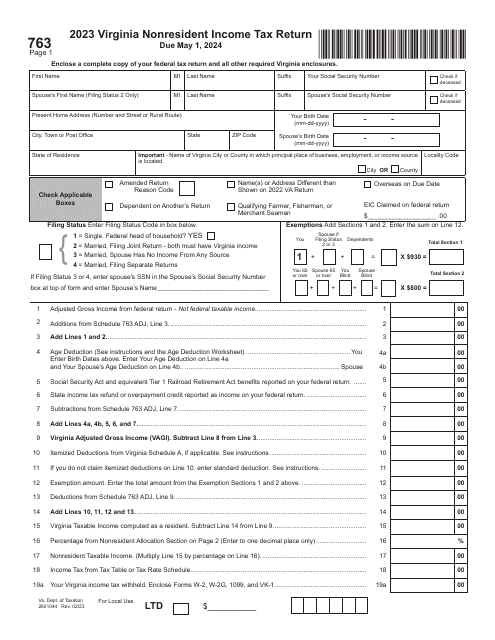

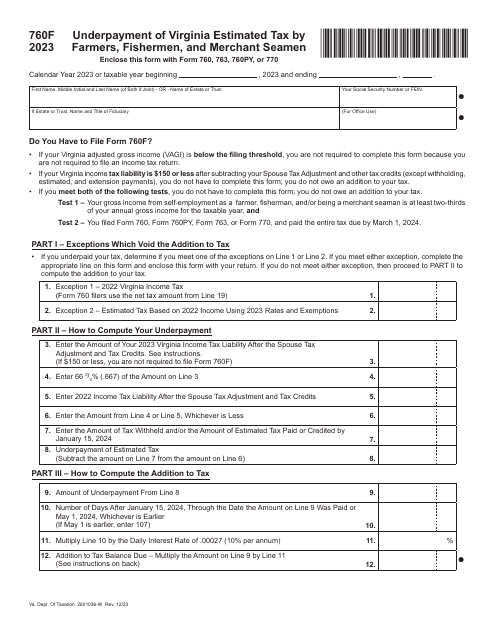

Income Tax Form Templates

Documents:

2505

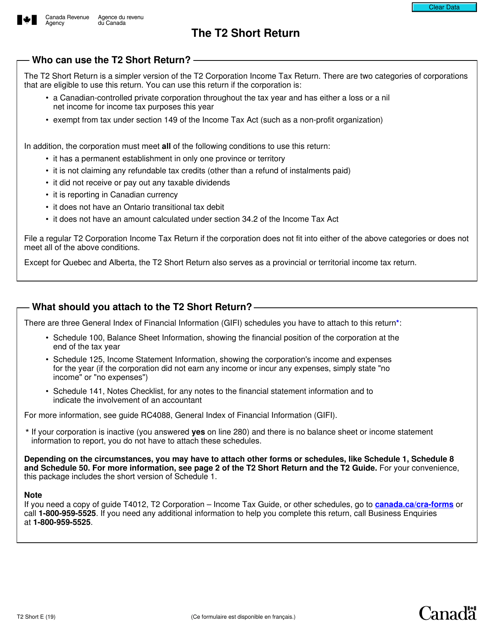

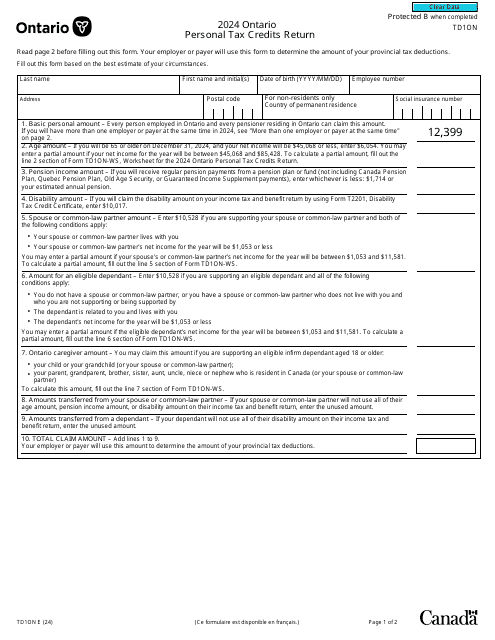

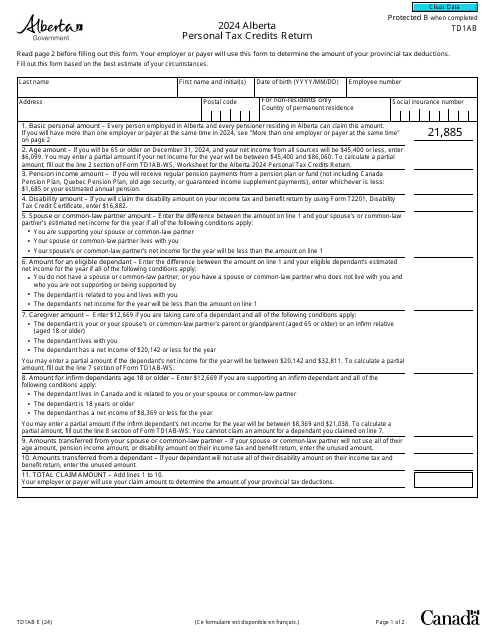

Certain categories of Canadian corporations can complete this formal document to report their income during the year.

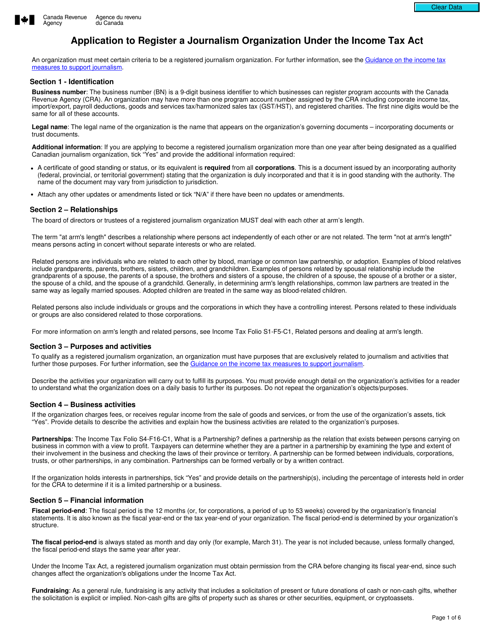

This form is used for registering a journalism organization under the Income Tax Act in Canada. It is required for organizations seeking to qualify for tax exemptions and benefits for their activities in the field of journalism.

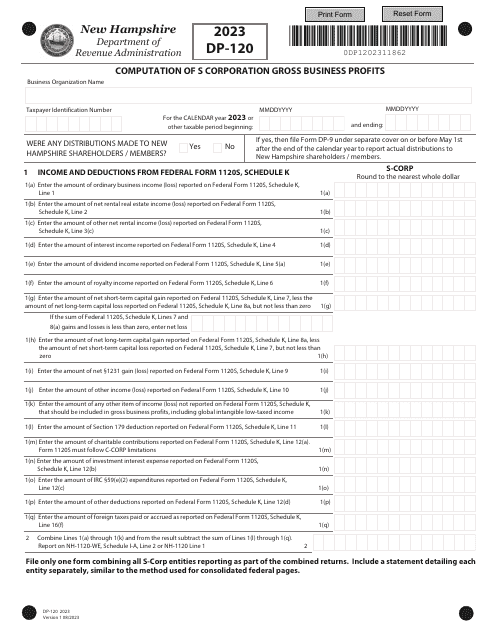

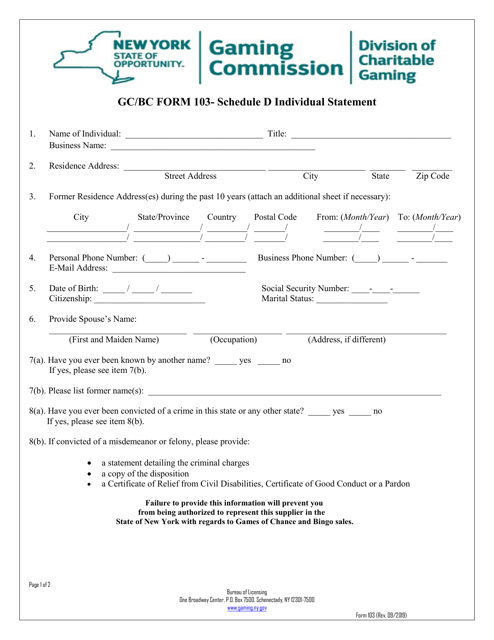

This Form is used for filing an individual statement for individuals residing in New York for Schedule D purposes.

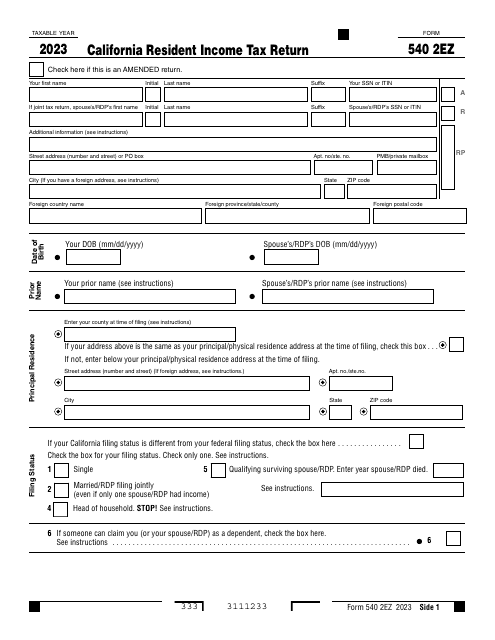

If you are a California resident you should use this form to report your income tax return. See here to check the requirements.

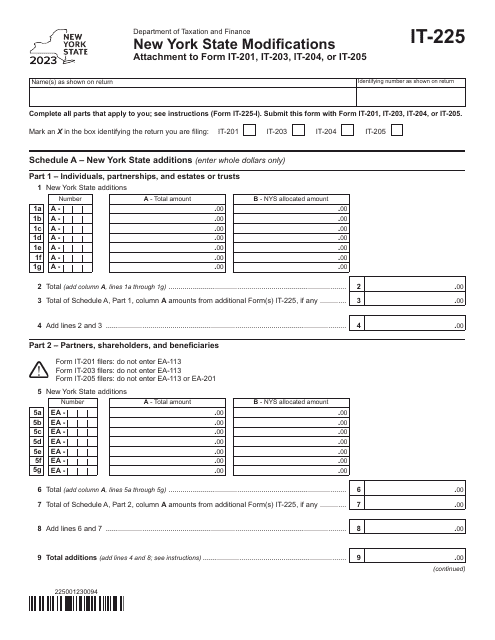

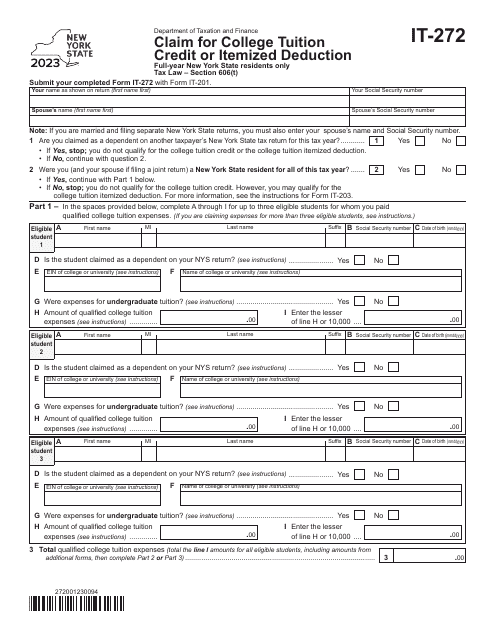

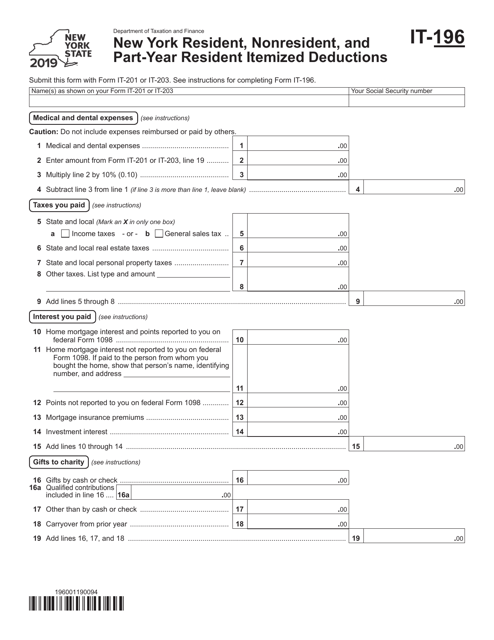

This Form is used for reporting itemized deductions for New York state residents, nonresidents, and part-year residents on their tax return.

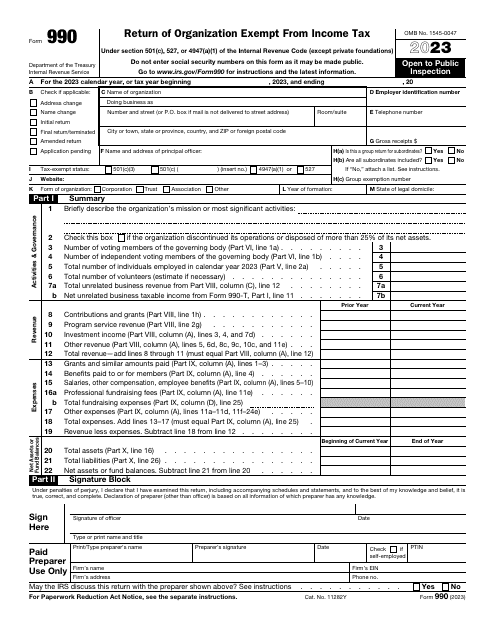

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.