Income Tax Form Templates

Documents:

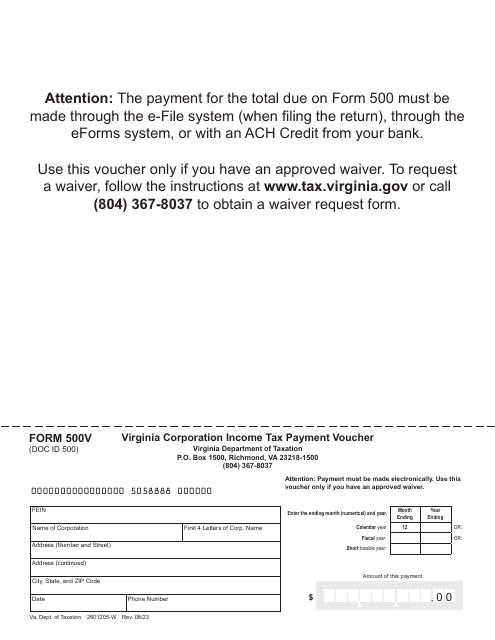

2505

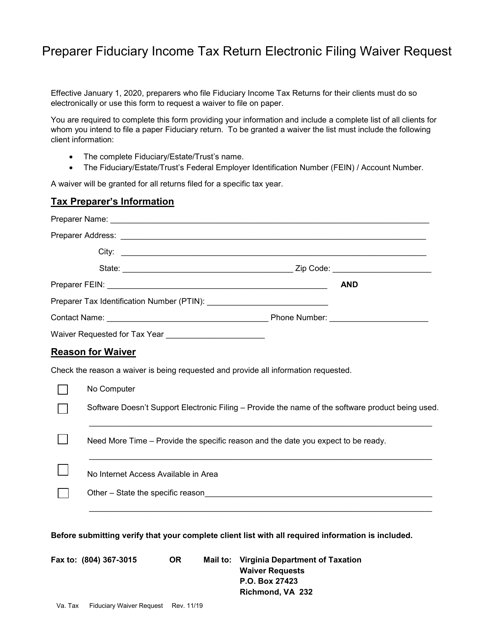

This Form is used to request a waiver from electronically filing a fiduciary income tax return in the state of Virginia.

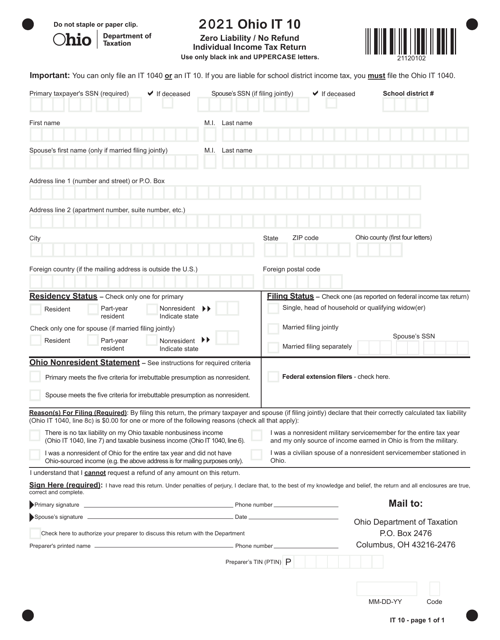

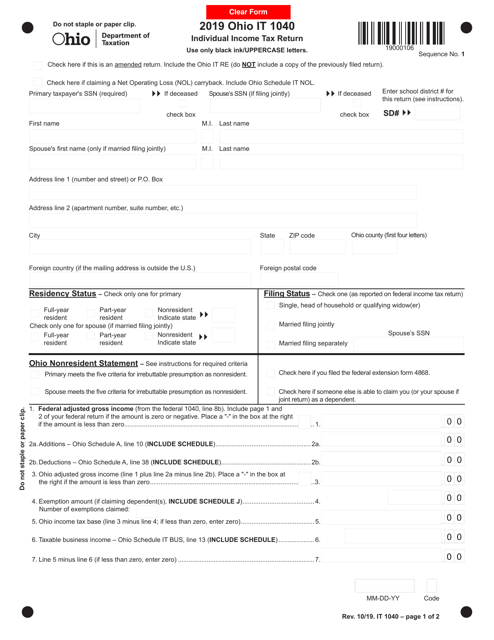

This Form is used for filing the Individual Income Tax Return in the state of Ohio. It is used to report and pay the taxes owed on your income for the tax year.

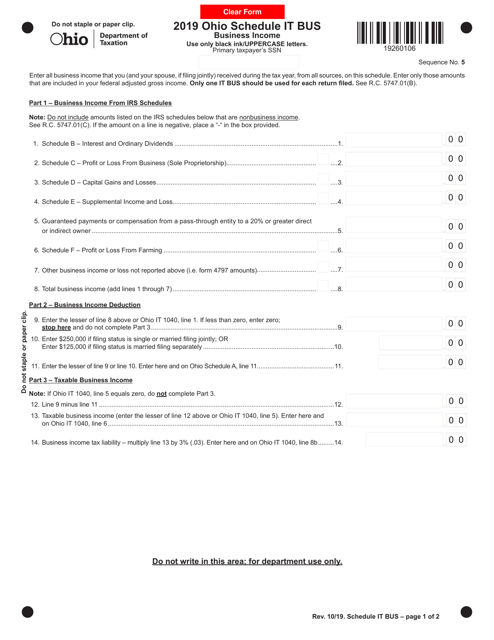

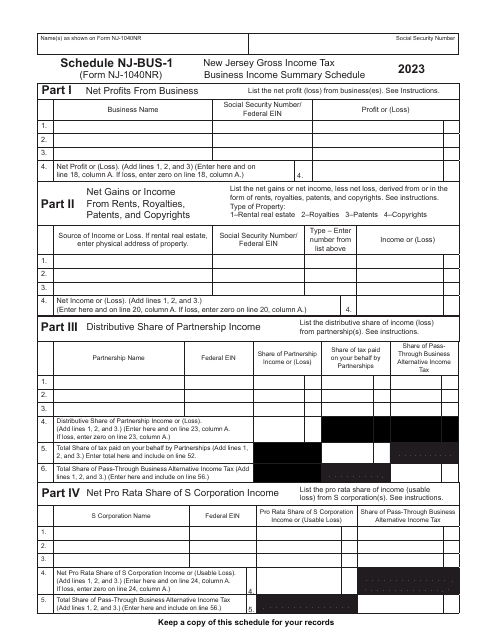

This document is used for reporting the business income of an IT company in the state of Ohio. It is necessary for tax purposes and helps the company accurately calculate their taxable income.

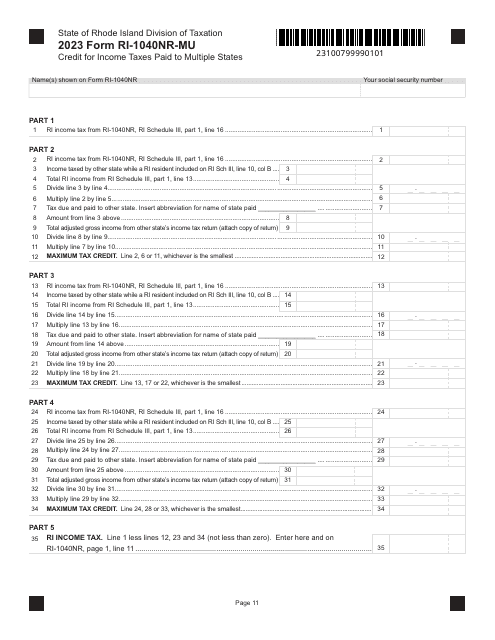

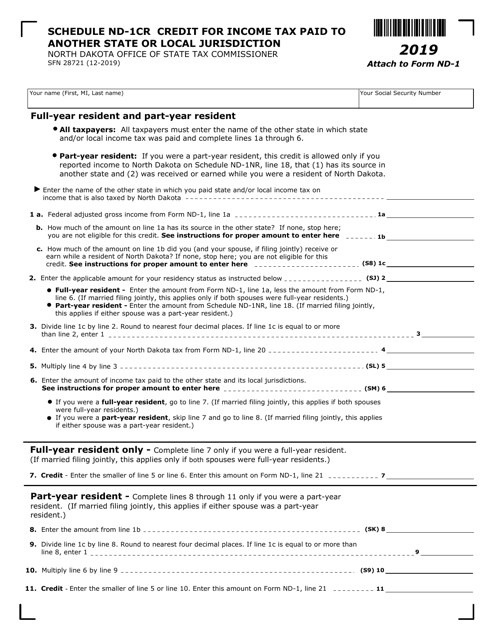

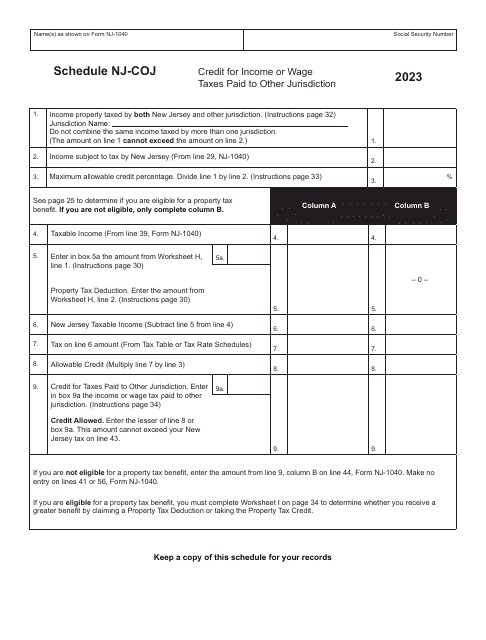

This Form is used for residents of North Dakota to claim a credit for income taxes paid to another state.

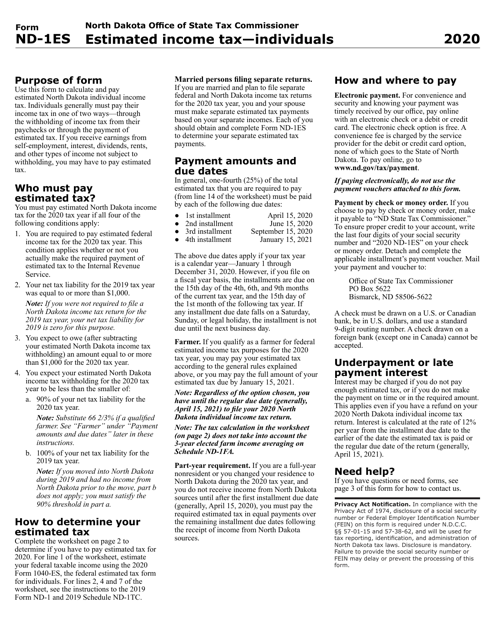

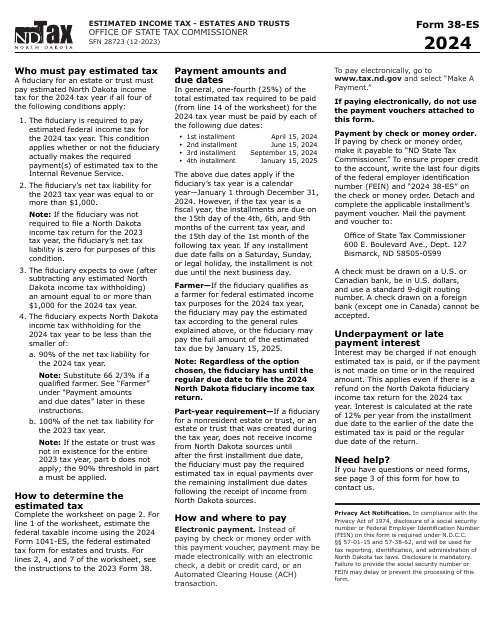

This Form is used for individuals in North Dakota to calculate and pay their estimated state income taxes.