Tax Instructions Templates

Documents:

488

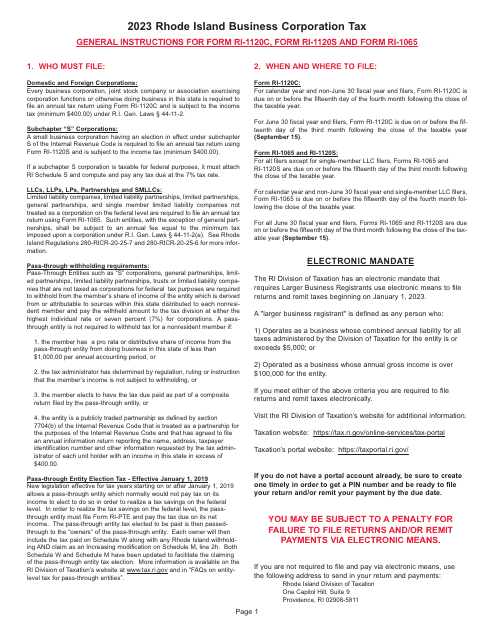

This form is used for filing the General Corporation Tax Return for businesses in New York City. It provides instructions on how to complete the form and pay the appropriate taxes.

This Form is used for providing instructions on how to fill out forms NYC-3A, NYC-3A/B, and NYC-3A/ATT for New York City residents. It provides guidance on completing these tax forms correctly.

This Form is used for filing the General Corporation Tax Return for businesses in New York City. It provides instructions on how to complete the form and file taxes properly.

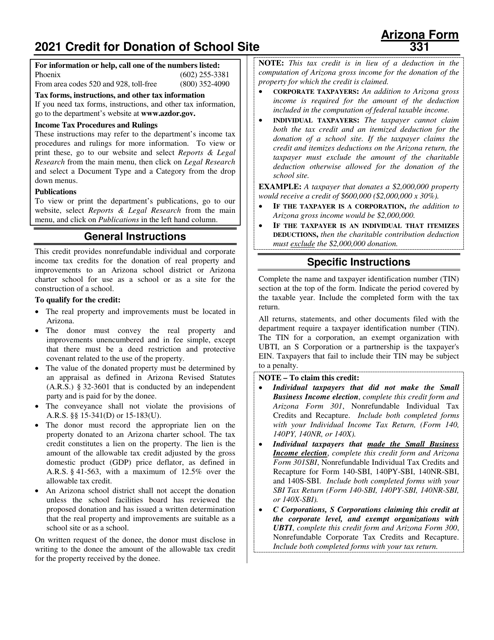

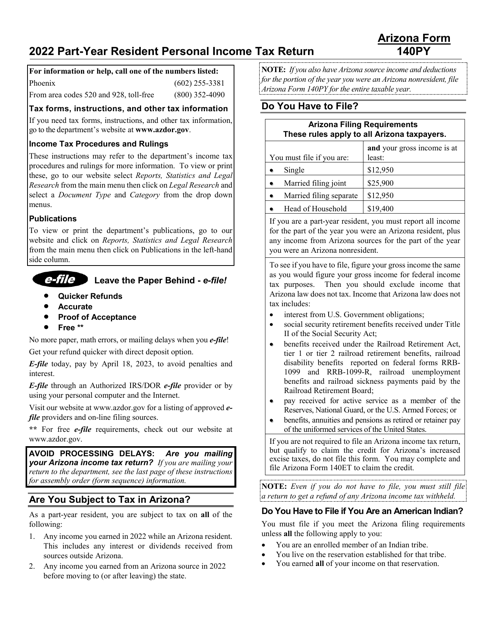

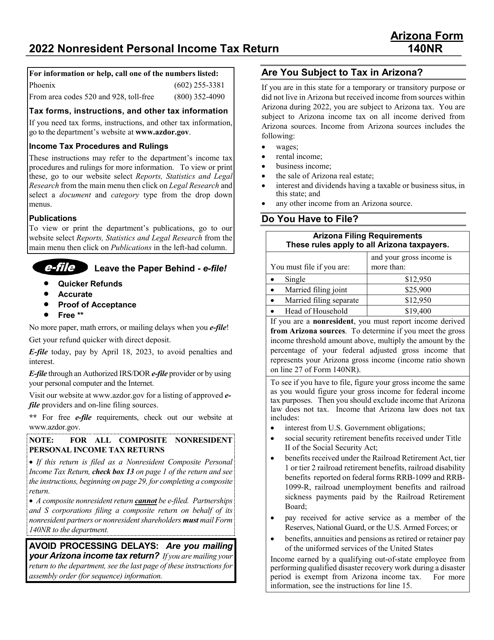

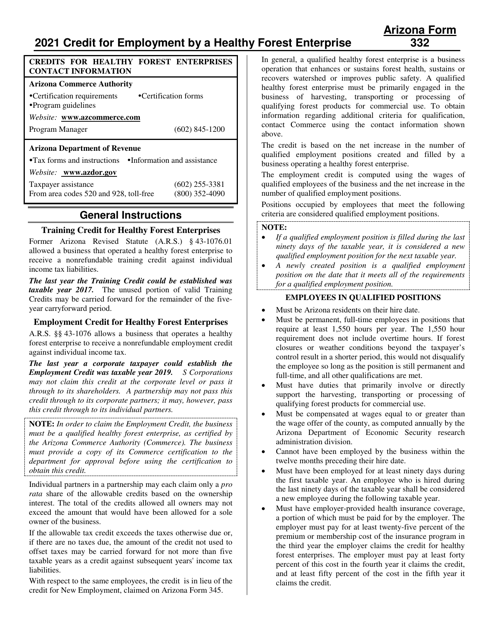

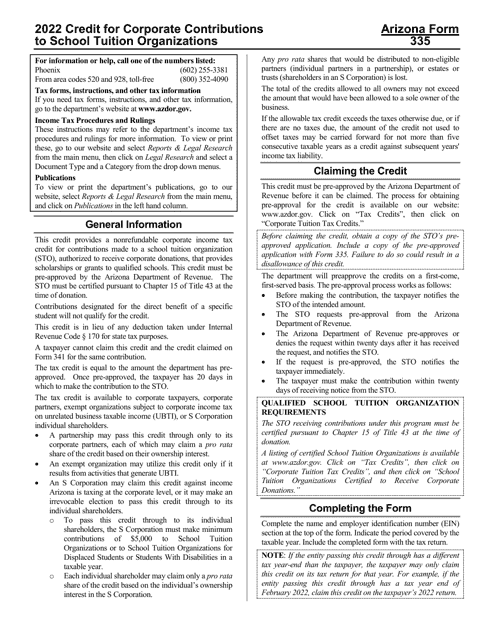

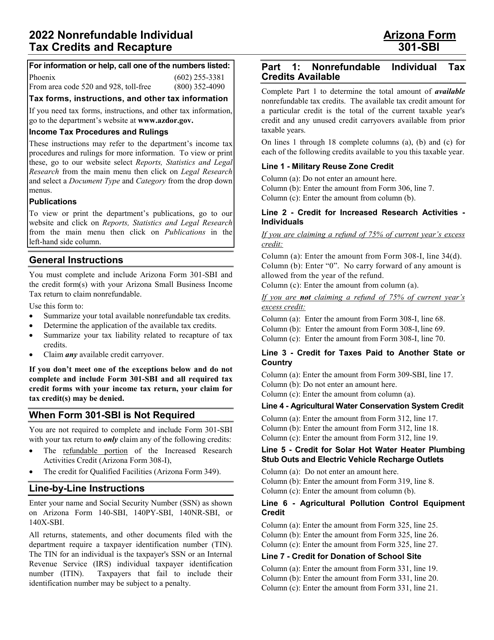

This type of document provides instructions for filling out Arizona Form 332 and 332-P. These forms are used for specific tax purposes in the state of Arizona.

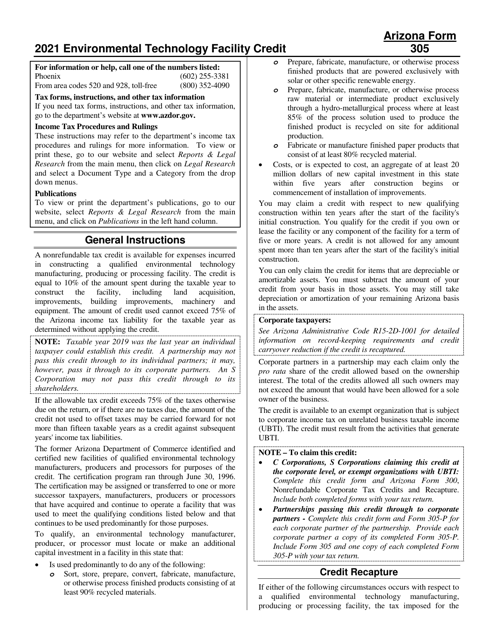

This type of document provides instructions for filling out Arizona Form 305, Arizona Form 305-P, ADOR10132, and ADOR11323 in Arizona.

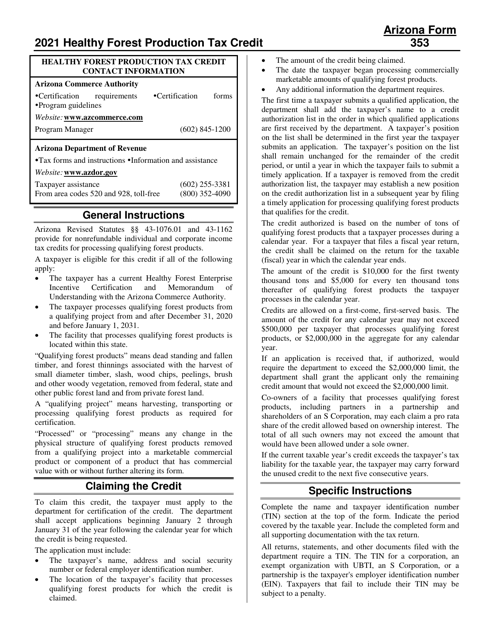

This document provides instructions for filling out various forms related to tax reporting in Arizona. It includes information for Form 353, ADOR11394, Form 353-P, ADOR111395, and Form 353-S, ADOR111396. The instructions will help individuals and businesses accurately complete these forms and fulfill their tax obligations in Arizona.

This document provides instructions for filing the Tourist Development Tax Return in Broward County, Florida. It guides tourists and businesses on how to accurately complete and submit their tax return to comply with local regulations.

This Form is used for reporting miscellaneous income, such as freelance earnings or rental income, to the IRS.

This Form is used for filing the Corporation Income Tax Return for businesses in the City of Ionia, Michigan. It includes instructions on how to accurately report income, deductions, and credits for the tax year.

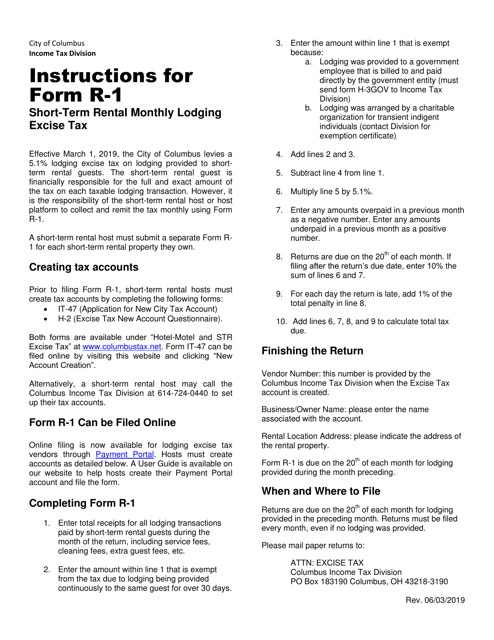

This form is used for reporting and paying the monthly lodging excise tax for short-term rentals in the City of Columbus, Ohio. It provides instructions on how to accurately complete the form and submit the tax payment.

This document provides instructions for filing the Corporation Income Tax Return specifically for businesses located in the City of Grand Rapids, Michigan. It explains how to report and calculate corporate income tax owed to the city.

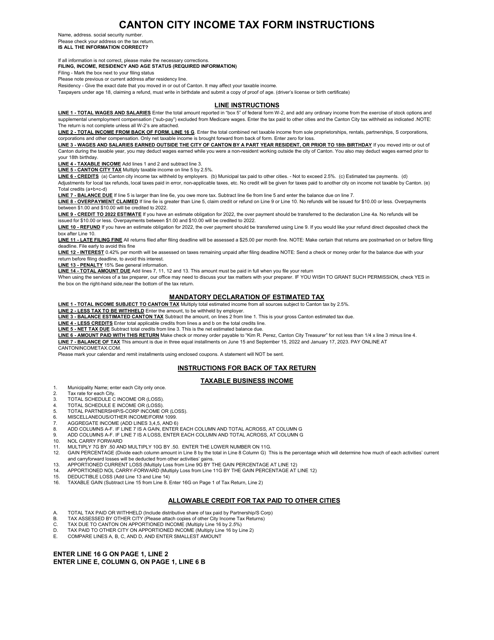

This Form is used for filing your Individual Income Tax Return with the City of Canton, Ohio. It provides step-by-step instructions for completing your tax return and ensures that you accurately report your income and claim any applicable deductions and credits.

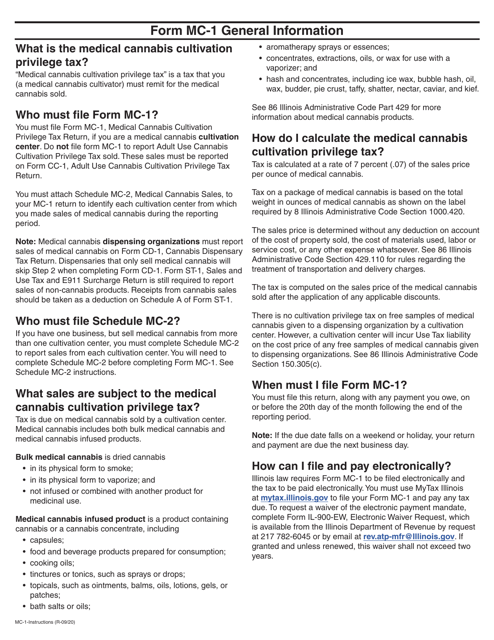

This document is used for filing the Medical Cannabis Cultivation Privilege Tax Return in the state of Illinois. It provides instructions on how to correctly fill out and submit the form.

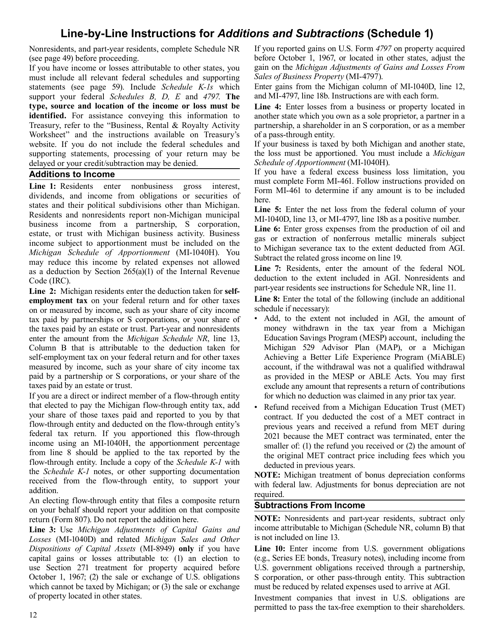

This document provides instructions for completing Schedule 1, which is used to report any additions or subtractions to your Michigan income tax return. It guides you through the process of determining what types of income or deductions should be included, and how to fill out the necessary forms.

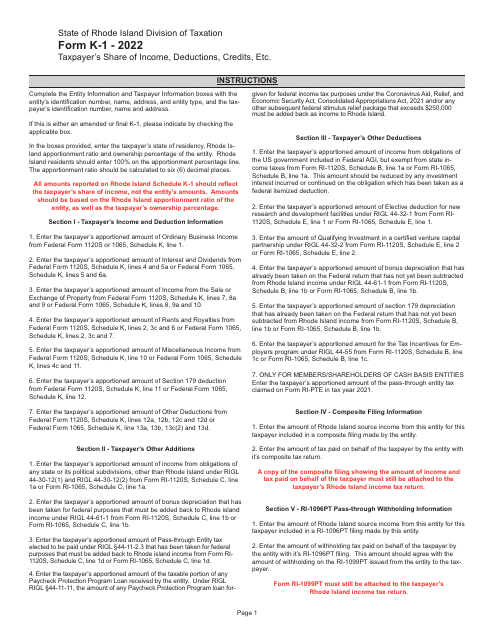

Instructions for Form K-1 Taxpayer's Share of Income, Deductions, Credits, Etc. - Rhode Island, 2022

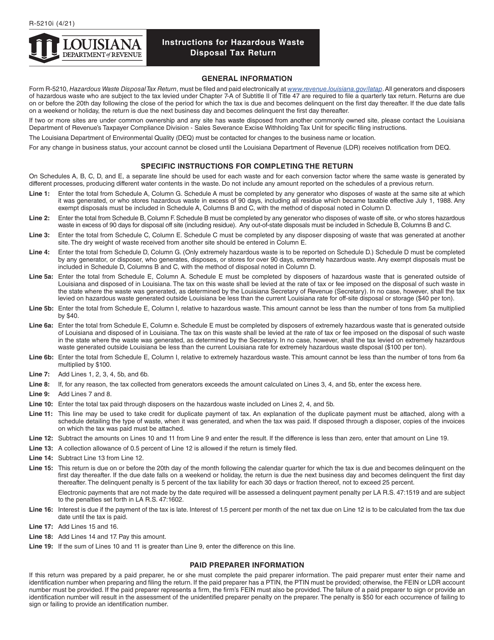

This form is used for filing the Hazardous Waste Disposal Tax Return in Louisiana. It provides instructions on how to report and pay the tax on the disposal of hazardous waste.

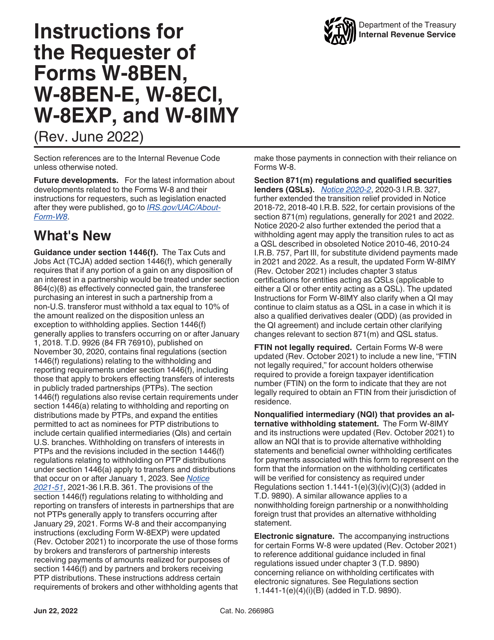

This document provides instructions for individuals or entities requesting Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. It explains how to complete these forms necessary for tax purposes.