Tax Instructions Templates

Documents:

488

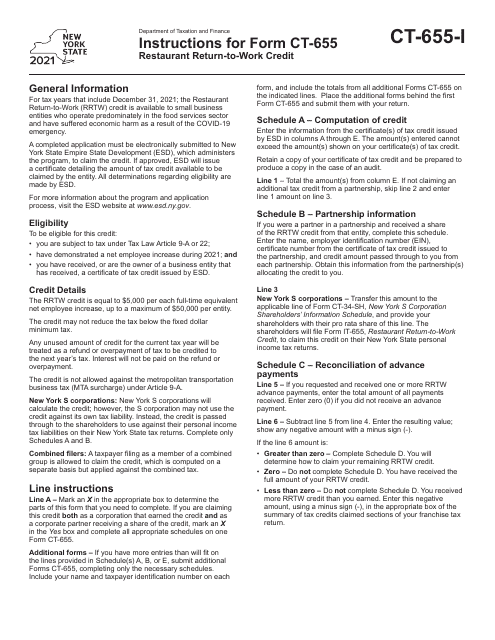

This Form is used for claiming the Restaurant Return-To-Work Credit in New York. It provides instructions for completing the form and claiming the credit.

This Form is used for reporting and paying beer tax for received products in the state of Louisiana, broken down by state, parish, and municipality.

This type of document provides instructions for completing Form R-5621T, which is used for reporting beer tax schedule for transferred products in the state of Louisiana, including state, parish, and municipality taxes.

This Form is used for reporting and paying taxes on residual petroleum product businesses in the state of New York. It provides instructions on how to accurately complete the form and calculate the amount of tax owed.

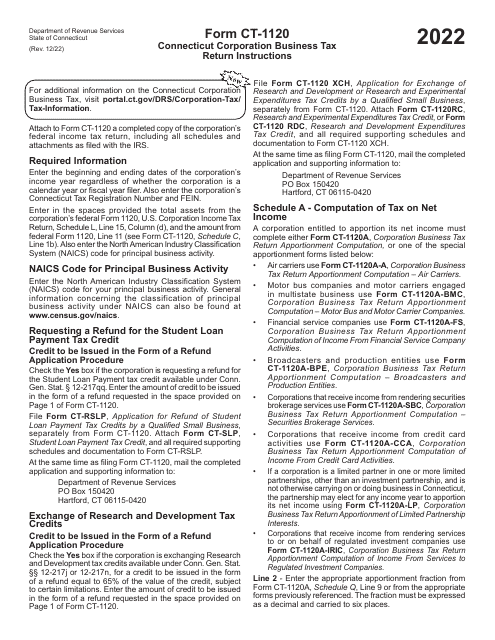

This document provides instructions for completing the Form CT-1120 Corporation Business Tax Return. It is used by corporations in the state of Connecticut to report and calculate their business tax liability. The instructions guide taxpayers on how to properly fill out the form and report their income, deductions, and credits.