Tax Instructions Templates

Documents:

488

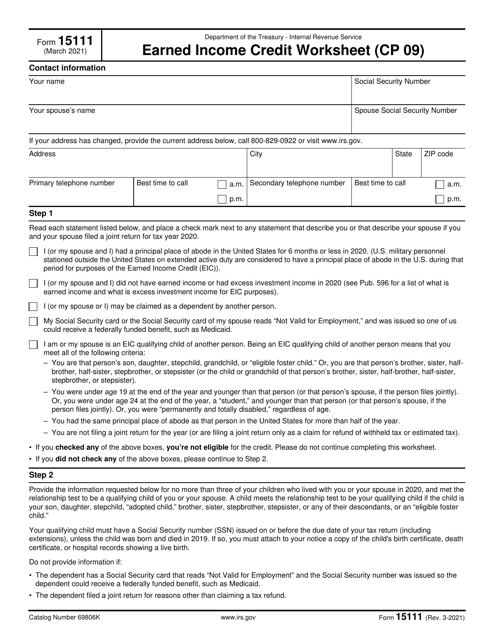

This form is used to calculate the Earned Income Credit for eligible taxpayers.

This form is used for filing the IFTA quarterly tax return in the state of New Mexico. It provides instructions on how to properly complete and submit the form.

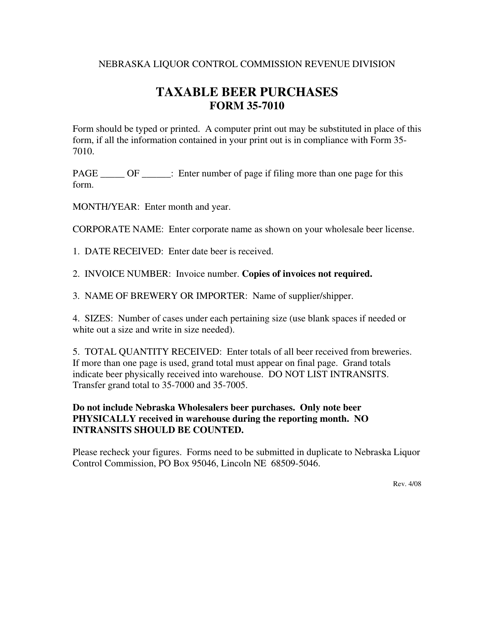

This Form is used for reporting taxable beer purchases in the state of Nebraska. It provides instructions on how to accurately fill out and submit the form to the appropriate tax authority.

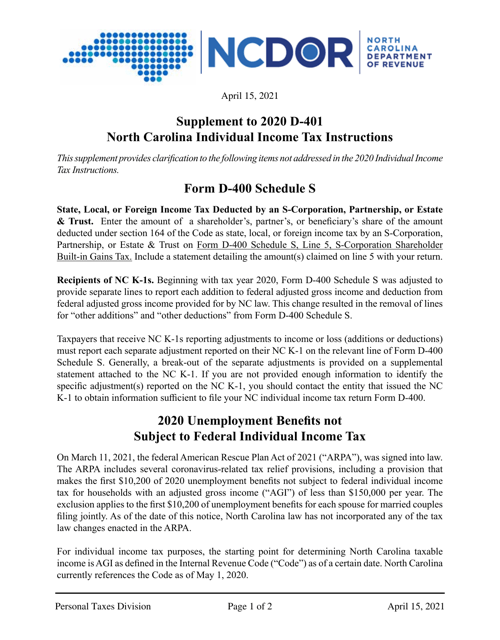

This type of document provides instructions for completing Form D-400, D-400TC Schedule 3, A, AM, PN, PN-1, which are tax forms specific to the state of North Carolina. These forms are used for reporting and calculating taxes owed in the state.

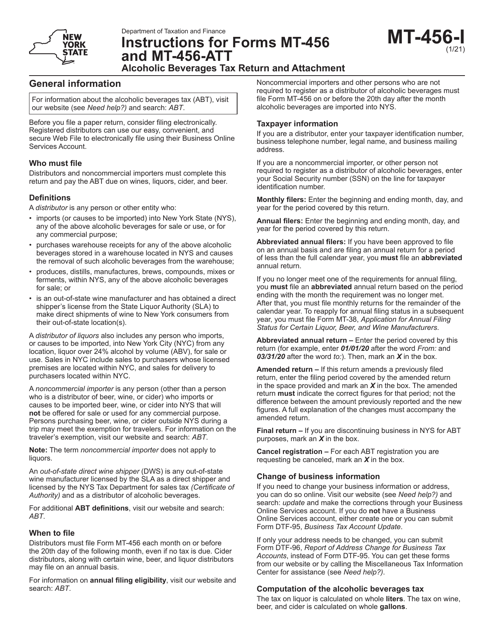

This Form is used for filing instructions for Form MT-456 and MT-456-ATT in the state of New York. It provides guidance on how to fill out and submit these tax forms accurately.

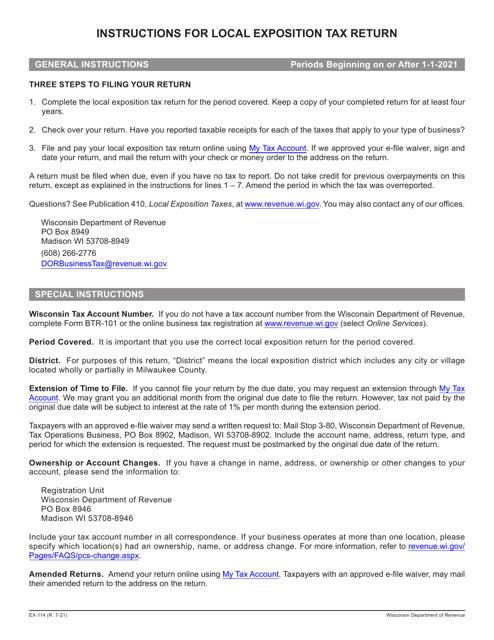

This document is for filing the Local Exposition Tax Return in Wisconsin. It provides instructions on how to complete and submit Form EX-012.

This document provides instructions for various tax forms used by businesses in Connecticut. It includes Form CT-1120, CT-1120 ATT, CT-1120A, CT-1120K, and CT-1120 EXT.

This document is used for filing the Arkansas Partnership Income Tax Return in the state of Arkansas. It provides instructions on how to report partnership income and deductions for tax purposes.

This document provides instructions for individuals in Maine who are initiating their initial deposit tax return. It outlines the requirements and steps for completing the return accurately.

This type of document provides instructions for completing the Form MT-203-W, MT-203-W-A, and MT-203-W-T in the state of New York.

Instructions for Form WT-12, W-012LRR Nonresident Entertainer's Lower Rate Request - Wisconsin, 2024

This Form is used for filing the Transaction Privilege, Use, and Severance Tax Return in the state of Arizona. It provides instructions on how to accurately fill out and submit the form to the Arizona Department of Revenue (ADOR).

This Form is used for claiming the Farmland Preservation Credit in Wisconsin. It provides instructions on how to complete and file Form IC-025AI Schedule FC-A.