Tax Instructions Templates

Documents:

488

This document provides instructions for completing and filing Form NC-40, which is used by individual residents of North Carolina to estimate and pay their income tax. It guides taxpayers through the process of calculating their estimated tax liability and provides information on deadlines, payment methods, and potential penalties for non-compliance.

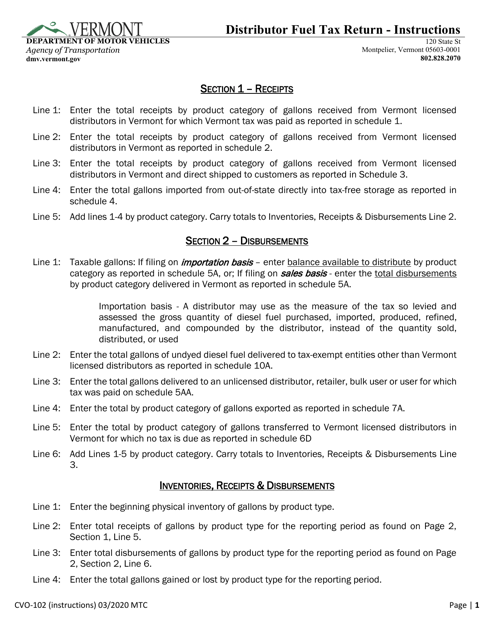

This Form is used for submitting the Distributor Fuel Tax Return in Vermont. It provides instructions on how to properly fill out and submit the form.

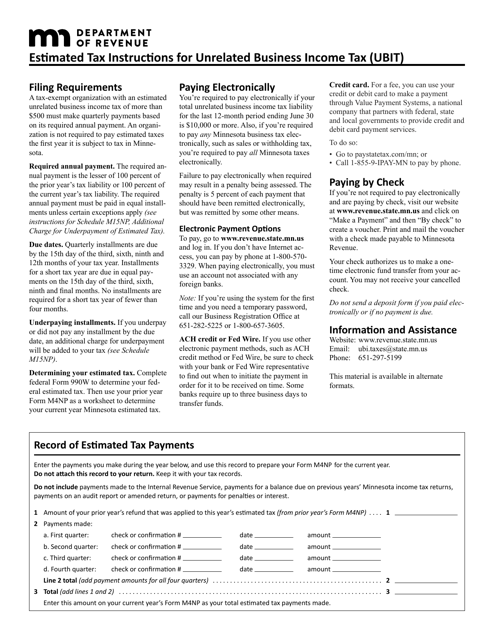

This document provides instructions for estimating and paying unrelated business income tax (UBIT) in the state of Minnesota. It is a guide for organizations that engage in activities unrelated to their exempt purpose and need to report and pay taxes on that income.

This Form is used for filing the individual income tax return and claiming property tax credit or pension exemption in Missouri.

This form is used for filing annual reports for businesses registered in the state of Virginia. It includes instructions on how to complete forms VEN-1, VEN-2, and VEN-3.