Fill and Sign United States Legal Forms

Documents:

235709

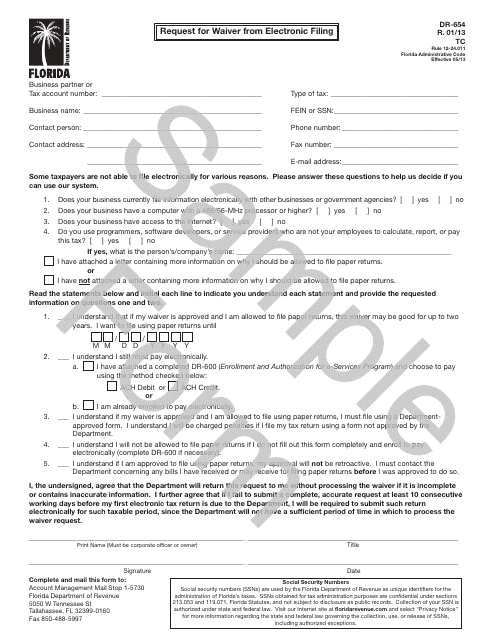

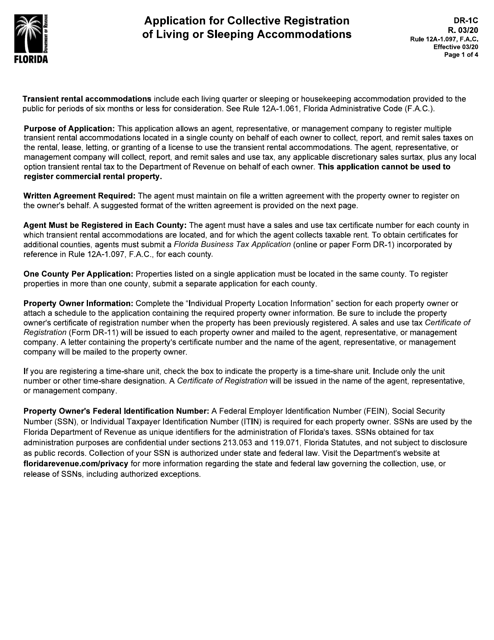

This form is used for requesting a waiver from electronic filing in the state of Florida.

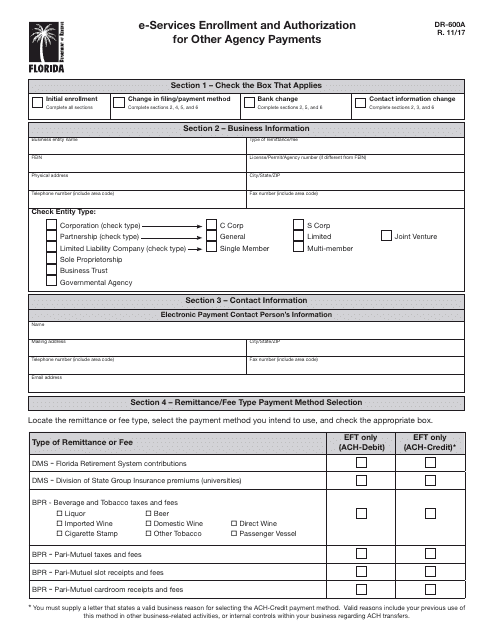

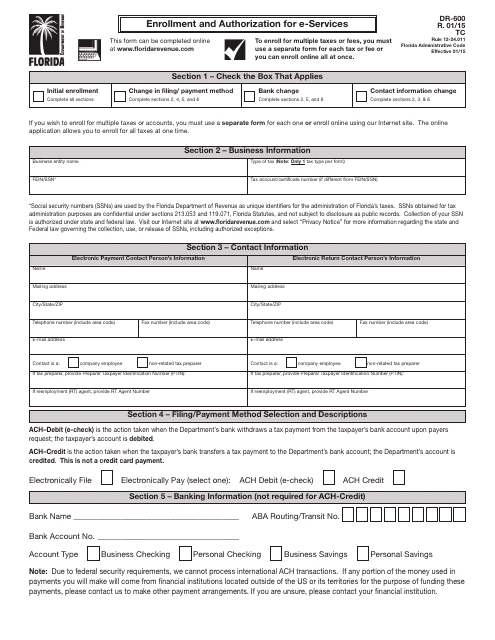

This form is used for enrolling in and authorizing e-services for making payments to other agencies in the state of Florida.

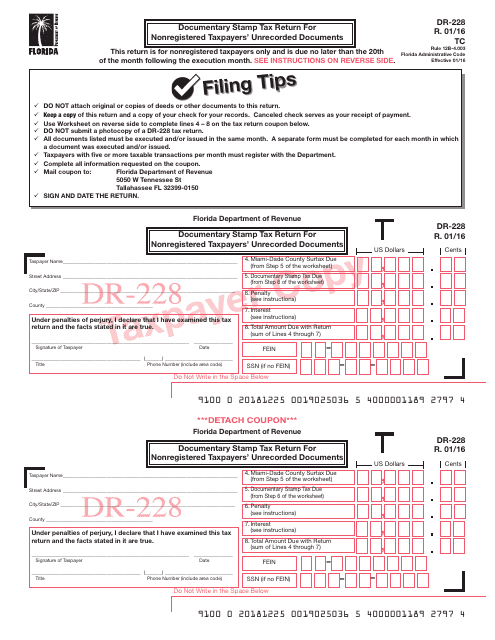

Form DR-228 Documentary Stamp Tax Return for Nonregistered Taxpayers' Unrecorded Documents - Florida

This form is used for nonregistered taxpayers in Florida to report and pay documentary stamp tax on unrecorded documents.

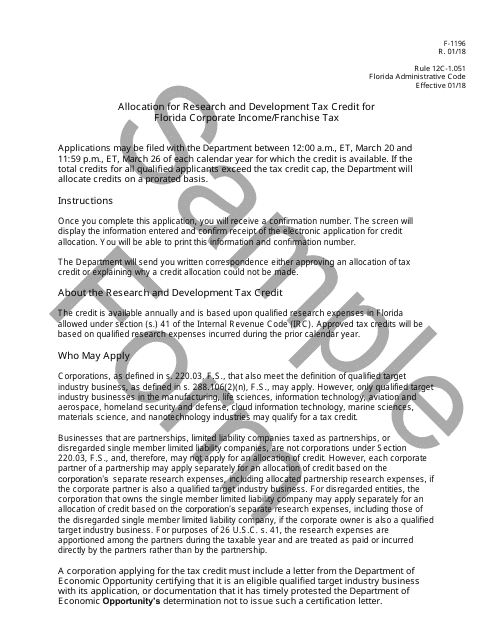

This form is used for allocating the research and development tax credit for Florida corporate income/franchise tax in the state of Florida.

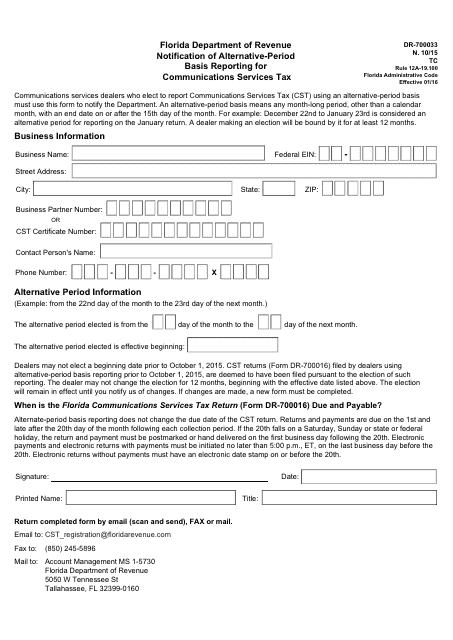

This form is used for notifying the Florida Department of Revenue about alternative-period basis reporting for communications services tax.

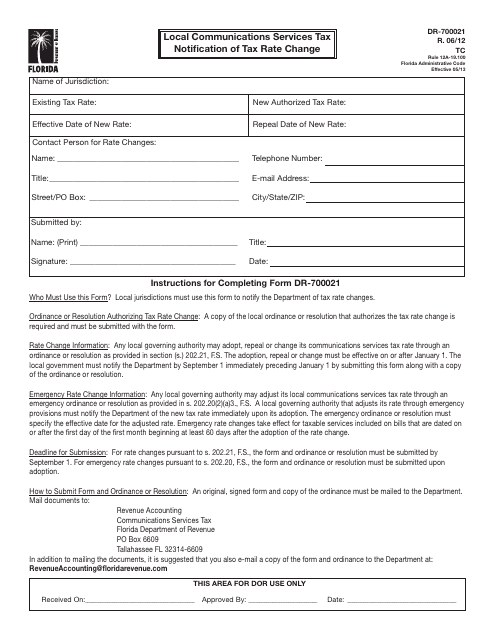

This document is used for notifying residents of Florida about a change in the tax rate for local communication services.

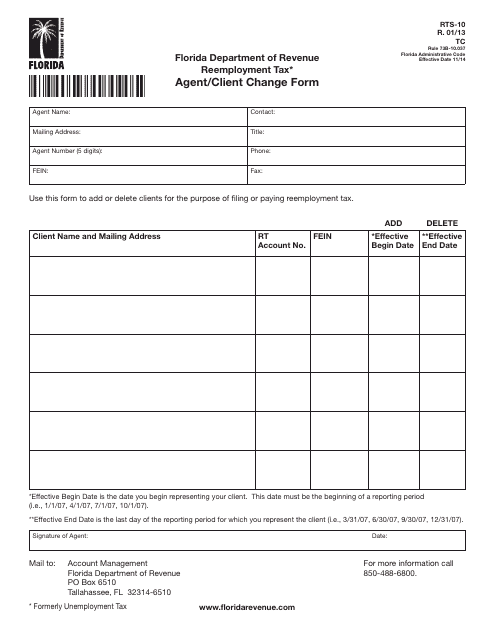

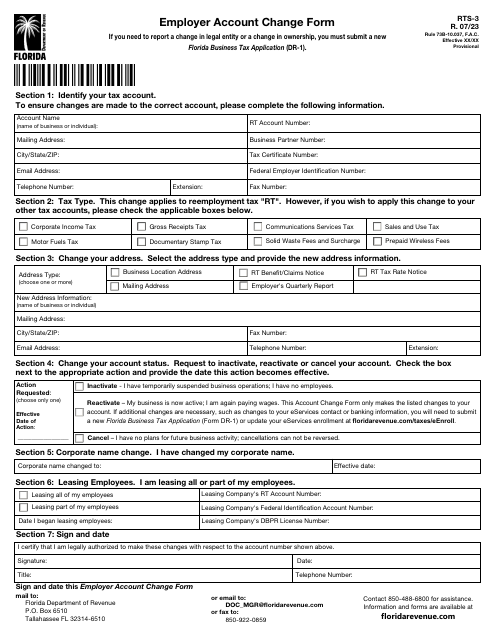

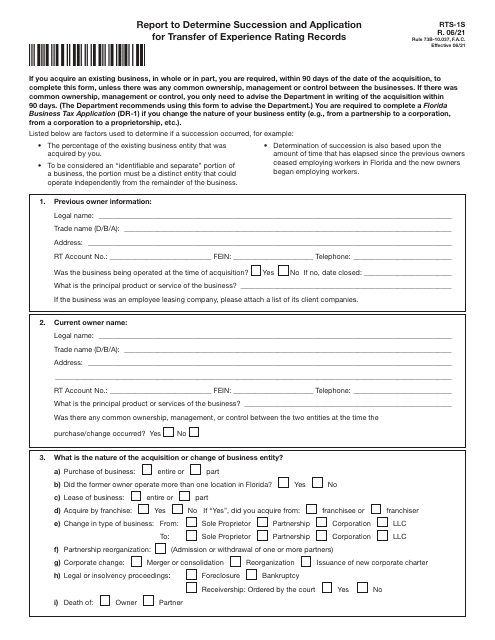

This Form is used for changing a Reemployment Tax Agent or Client in Florida.

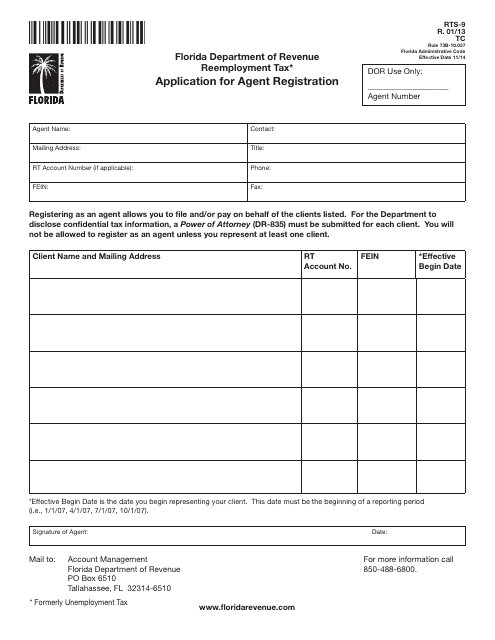

This form is used for agent registration for reemployment tax in Florida.

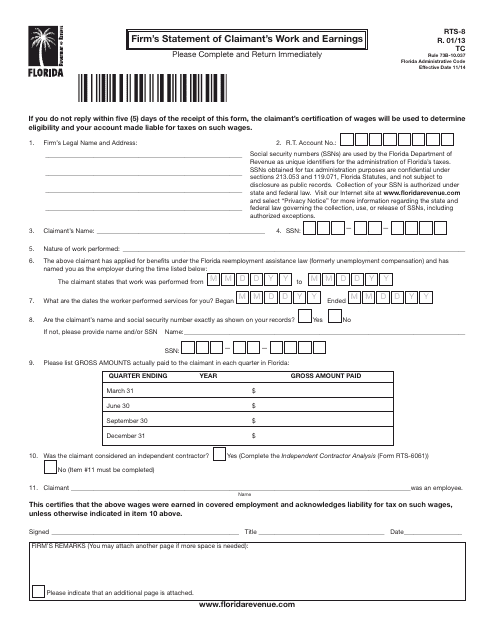

This Form is used for filing a statement of claimant's work and earnings by a firm in Florida.

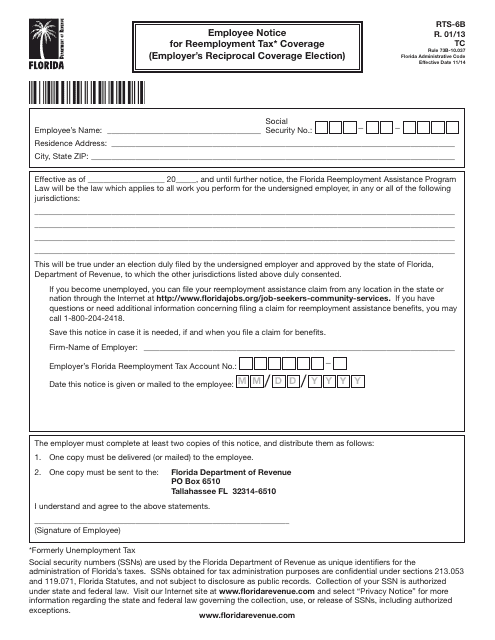

This form is used for informing employees about reemployment tax coverage and the employer's reciprocal coverage election in the state of Florida.

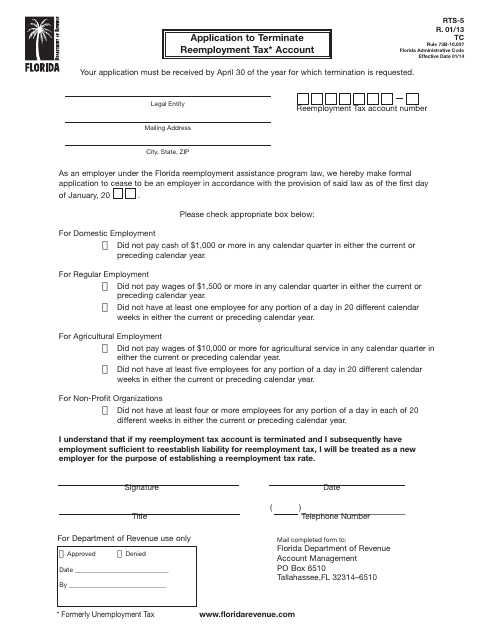

This form is used for terminating a reemployment tax account in the state of Florida.

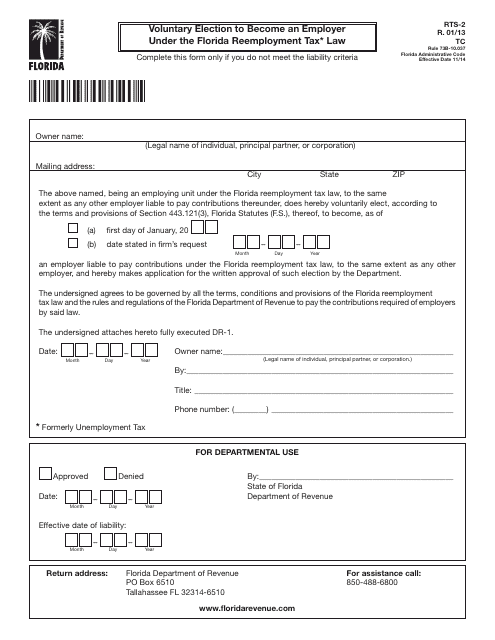

Form RTS-2 Voluntary Election to Become an Employer Under the Florida Reemployment Tax Law - Florida

This form is used for employers in Florida to voluntarily elect to become subject to the Florida Reemployment Tax Law.

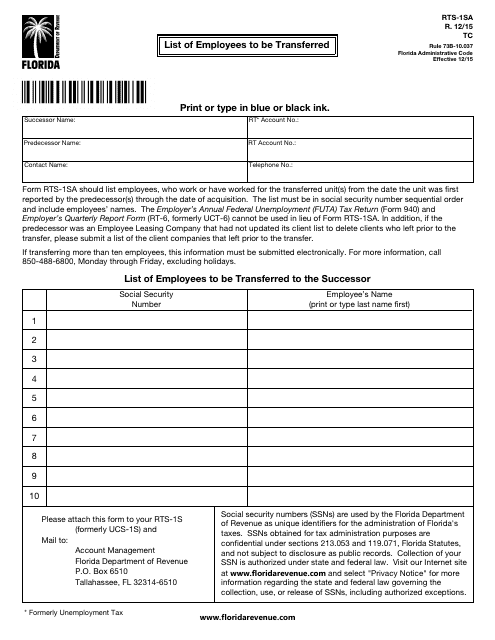

This Form is used for listing employees who are to be transferred in the state of Florida.

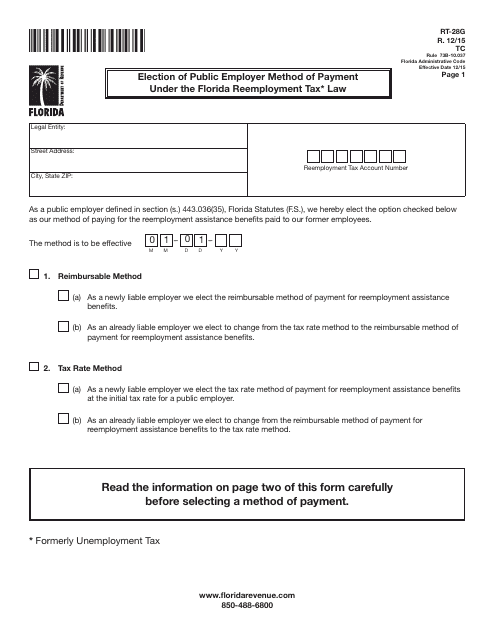

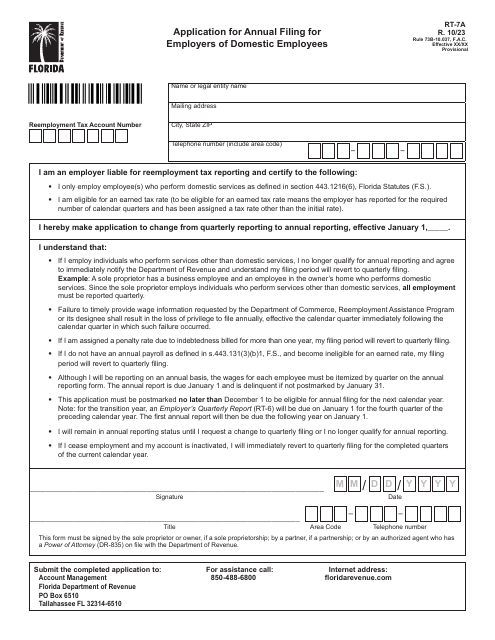

This form is used for employers in Florida to elect their method of payment for reemployment tax under the Florida Reemployment Tax Law.

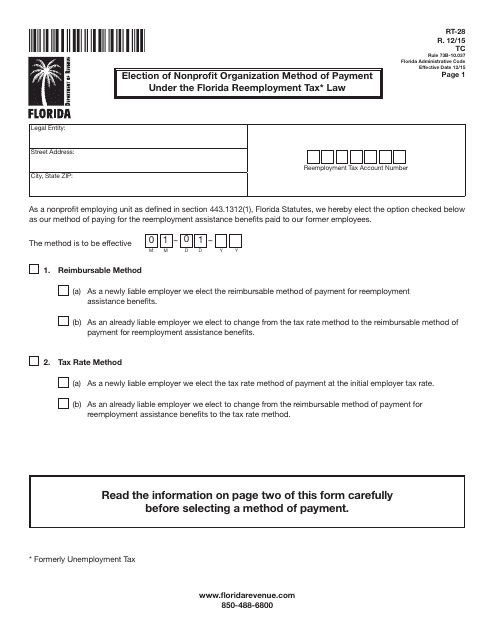

This Form is used for nonprofit organizations in Florida to choose a payment method for reemployment taxes under the Florida Reemployment Tax Law.

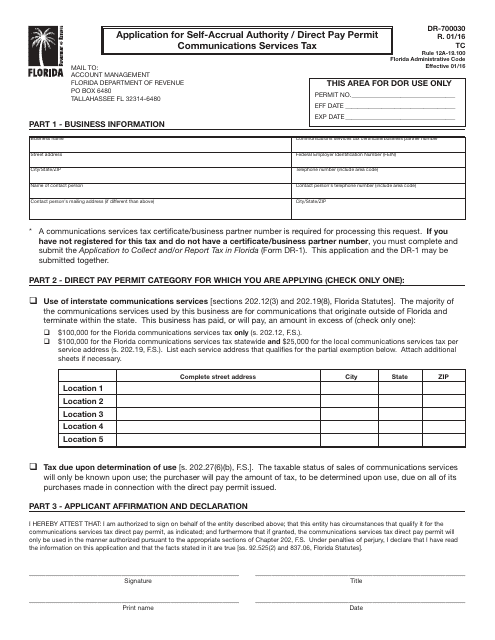

This form is used for applying for self-accrual authority or direct pay permit for the communications services tax in Florida.

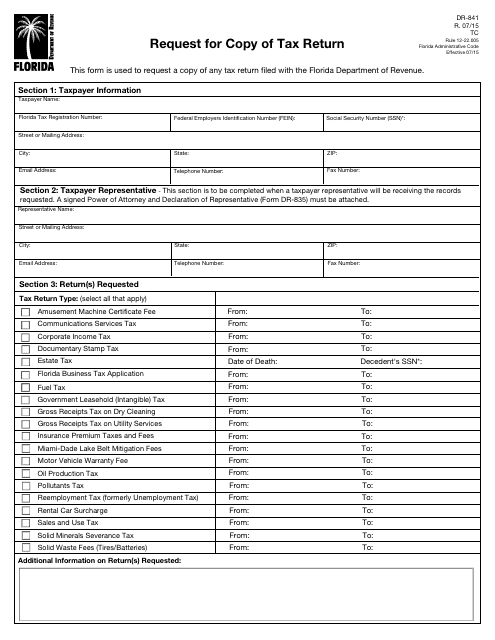

This form is used for requesting a copy of a tax return in the state of Florida. It is necessary to provide specific information about the return, such as the year and type of return, to facilitate the request process.

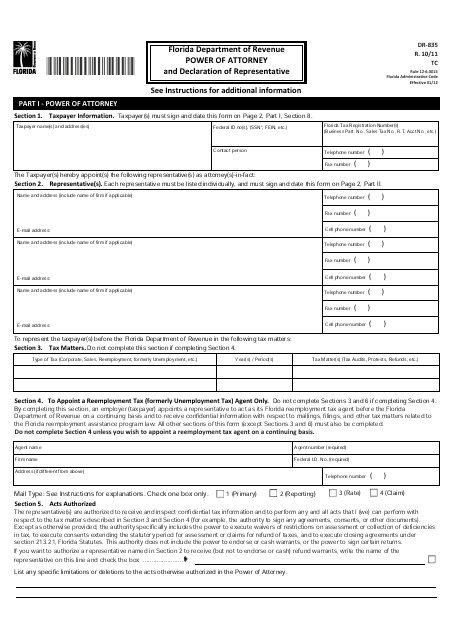

This form is used for appointing a representative to act on your behalf for tax matters in the state of Florida.

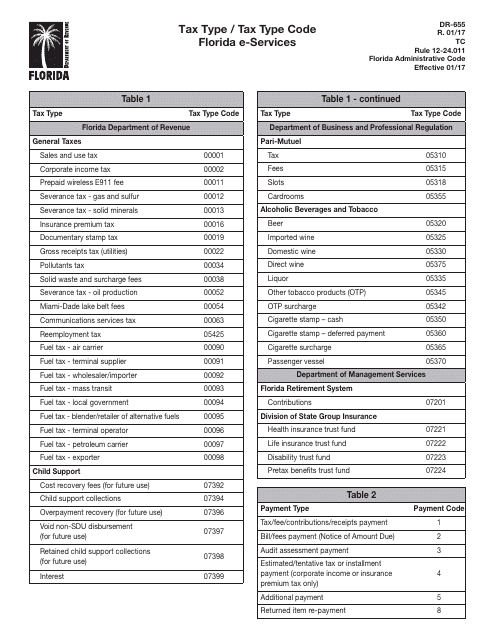

This Form is used for submitting tax type and tax type code information for Florida E-Services in the state of Florida.

This form is used for enrolling and authorizing access to e-services in the state of Florida.

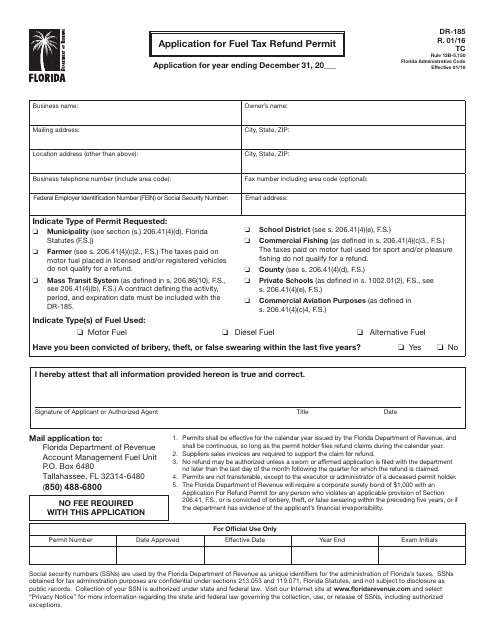

This form is used for applying for a fuel tax refund permit in the state of Florida.

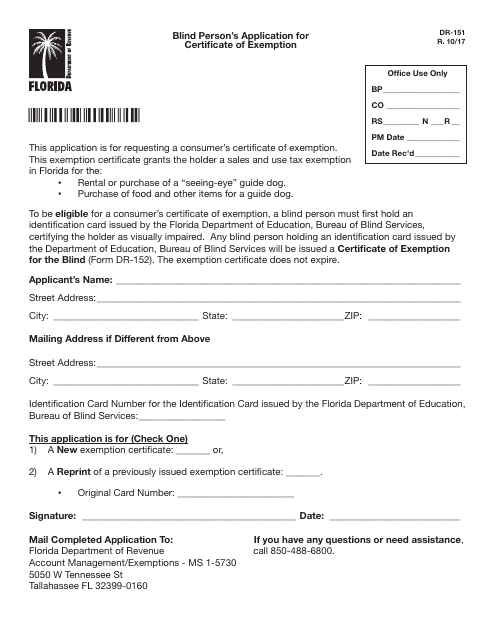

This form is used for blind individuals in Florida to apply for a Certificate of Exemption. The Certificate of Exemption grants the individual certain tax benefits and exemptions.

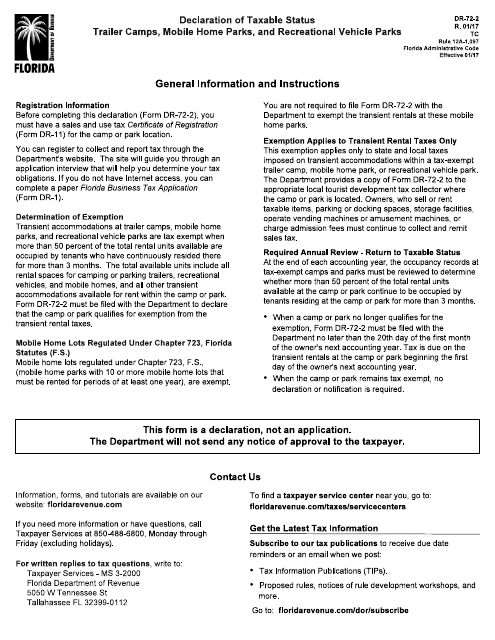

This form is used for declaring the taxable status of trailer camps, mobile home parks, and recreational vehicle parks in Florida.

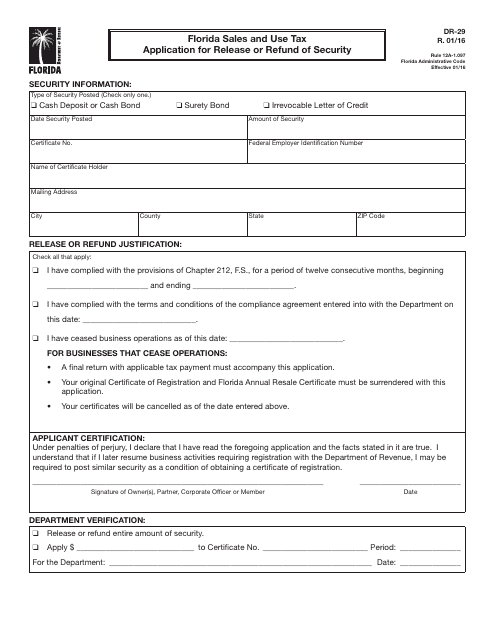

This form is used for applying for the release or refund of security for Florida sales and use tax.

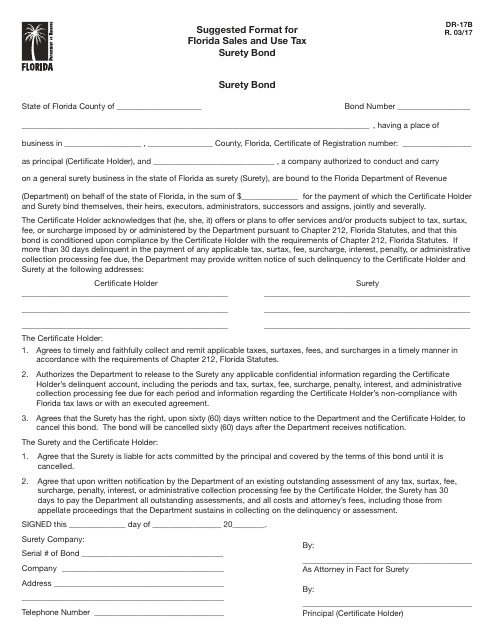

This form is used for obtaining a surety bond for Florida sales and use tax purposes. It provides a suggested format for the bond.

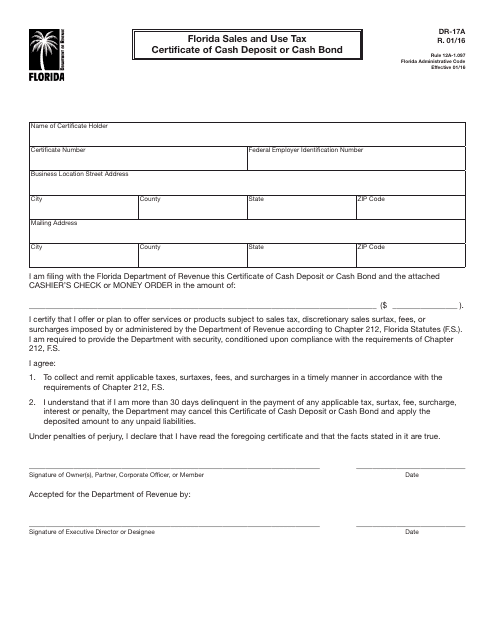

This form is used for submitting a cash deposit or cash bond for the Florida Sales and Use Tax. It is required for businesses to ensure compliance with tax regulations in the state of Florida.

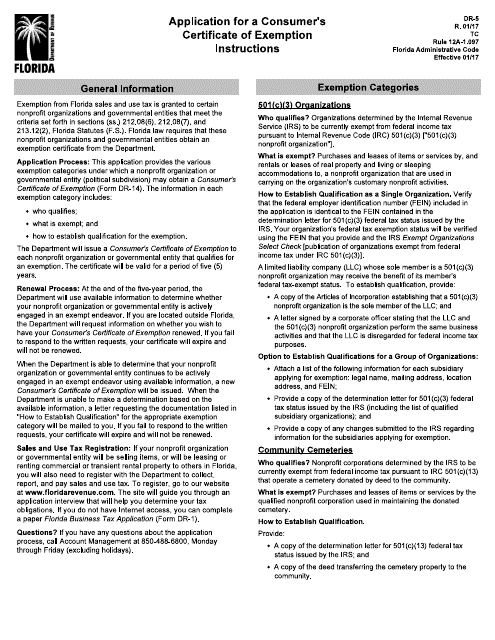

This Form is used for applying for a Consumer's Certificate of Exemption in Florida. It is required for individuals and organizations that qualify for sales tax exemptions for certain purchases.

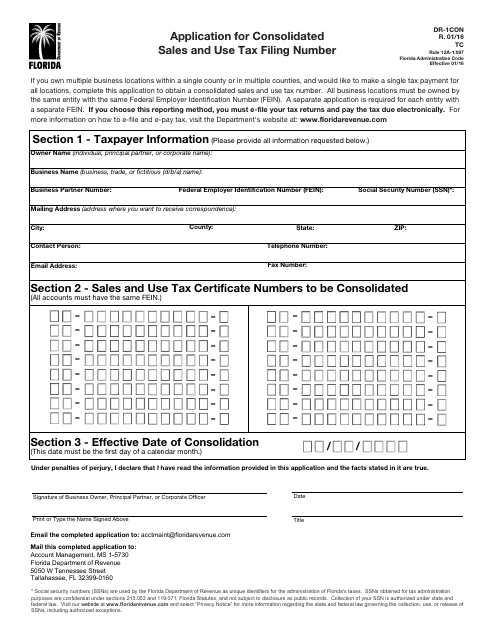

This Form is used for applying for a Consolidated Sales and Use Tax Filing Number in the state of Florida.

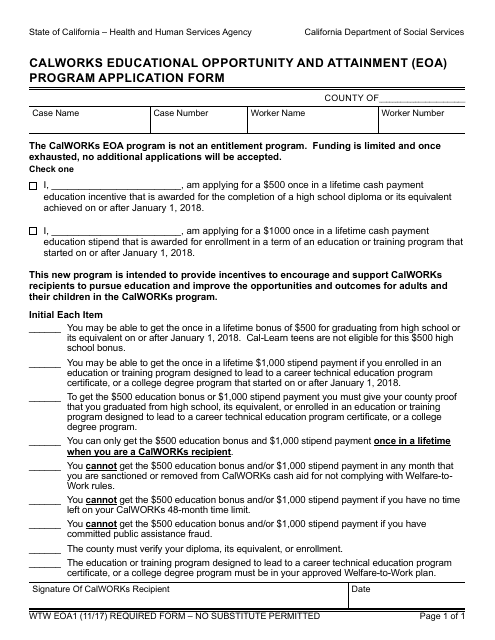

This form is used for applying to the CalWORKs Educational Opportunity and Attainment (EOA) Program in California.

This Form is used for Online CalWORKs Appraisal Tool Rights and Privacy in California.

This form is used for the End of Welfare-To-Work 24-month Time Clock Review Appointment Letter in California.