Fill and Sign United States Legal Forms

Documents:

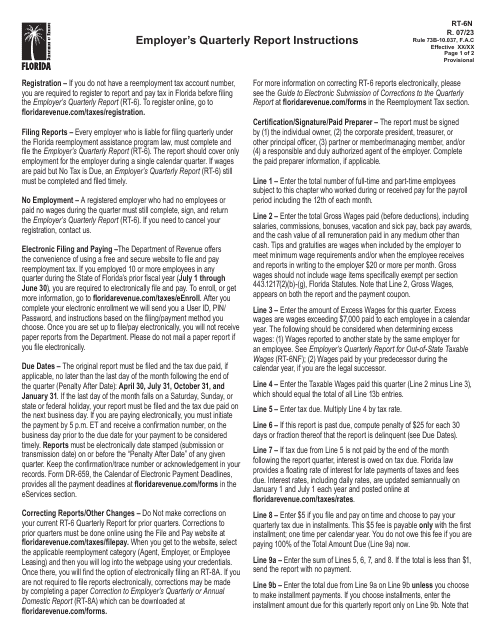

235709

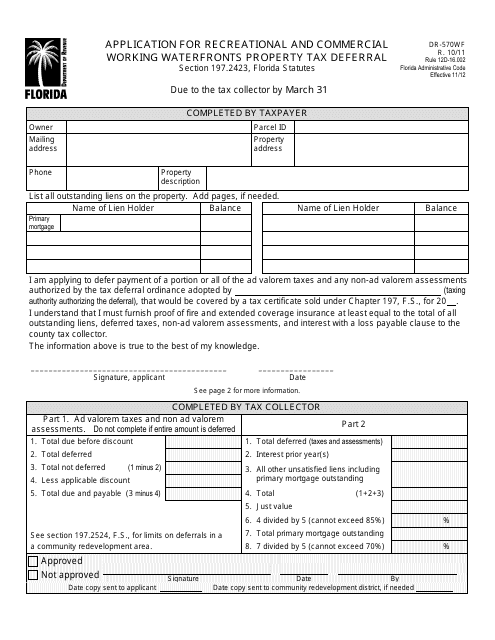

This form is used for applying for a property tax deferral for recreational and commercial working waterfronts in Florida.

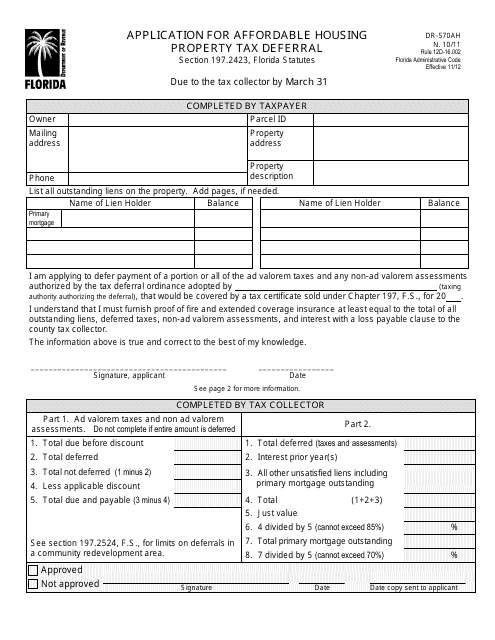

This form is used for applying for a property tax deferral program in Florida. It is specifically designed for affordable housing properties.

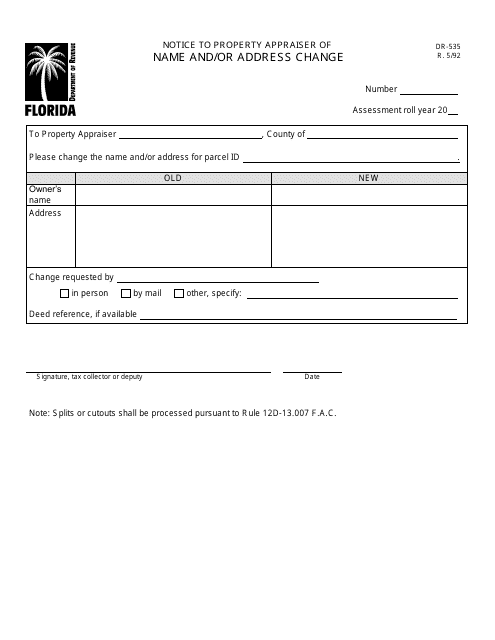

This form is used for notifying the property appraiser in Florida of a change in name and/or address.

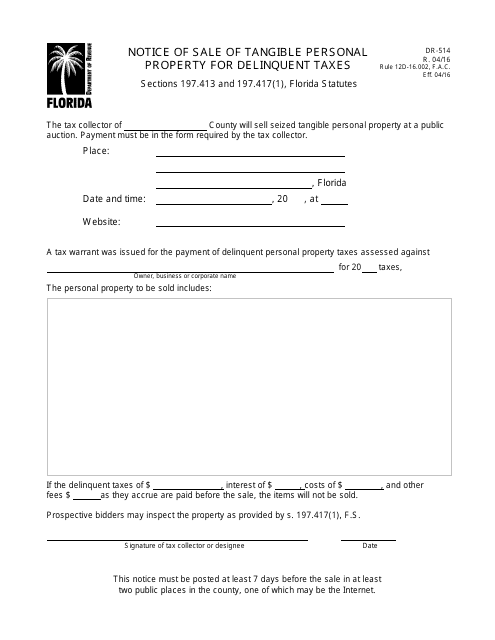

This form is used for notifying the sale of tangible personal property for delinquent taxes in the state of Florida.

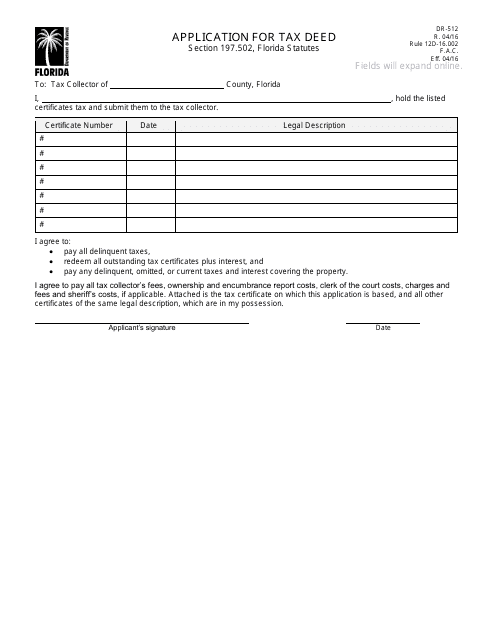

This form is used for applying for a tax deed in the state of Florida.

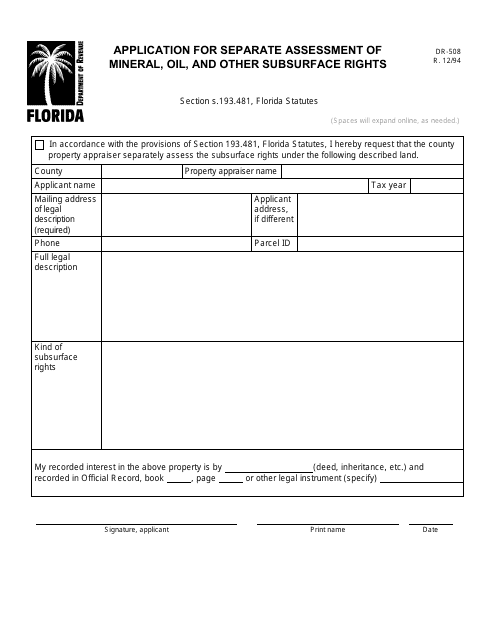

This form is used for submitting an application to request a separate assessment of mineral, oil, and other subsurface rights in Florida.

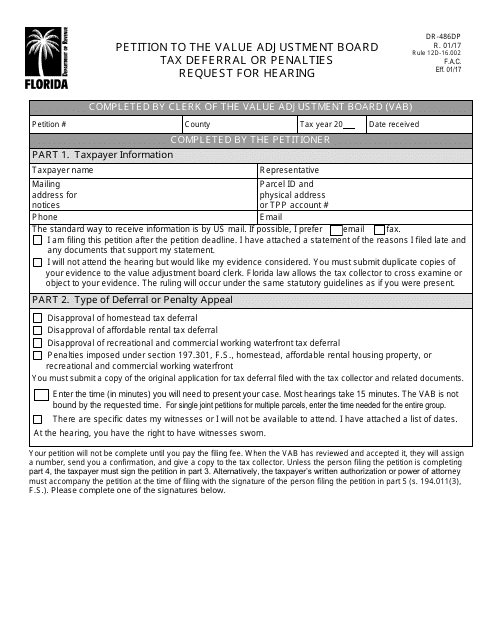

This form is used for submitting a petition to the Value Adjustment Board in Florida. It is specifically for requesting a hearing regarding tax deferral or penalties.

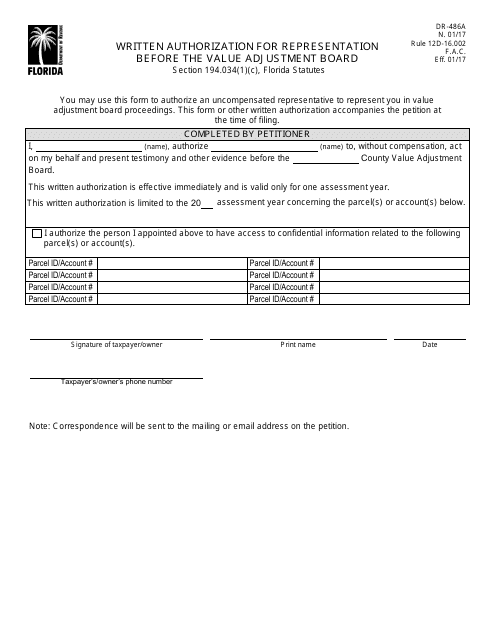

This form is used for granting written authorization to a representative to appear before the Value Adjustment Board in Florida.

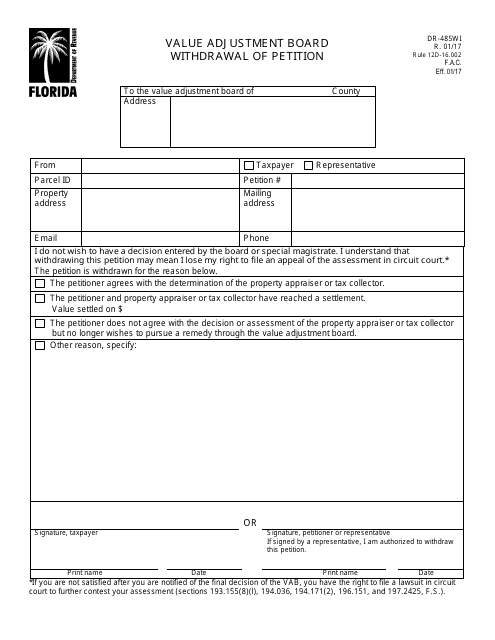

This form is used for withdrawing a petition with the Value Adjustment Board in Florida.

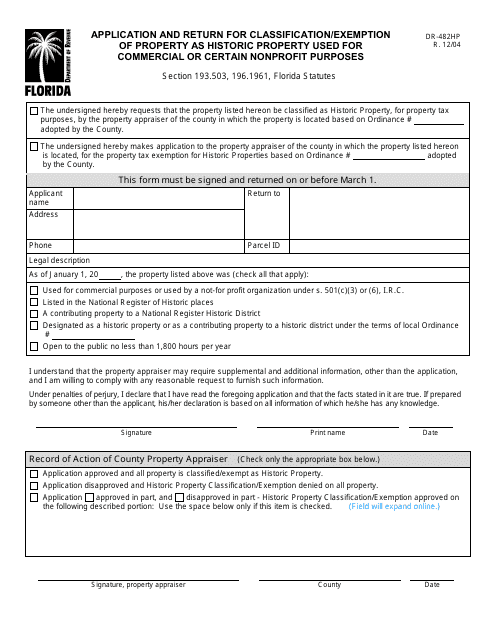

This form is used for applying and returning property for classification or exemption as historic property in Florida, specifically for commercial or certain nonprofit purposes.

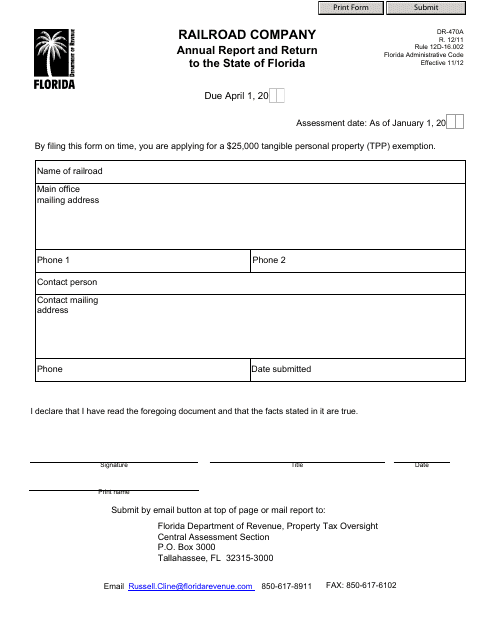

This form is used for railroad companies operating in Florida to submit their annual report and return to the State of Florida. It is a requirement by the state for railroad companies to provide information on their operations and finances.

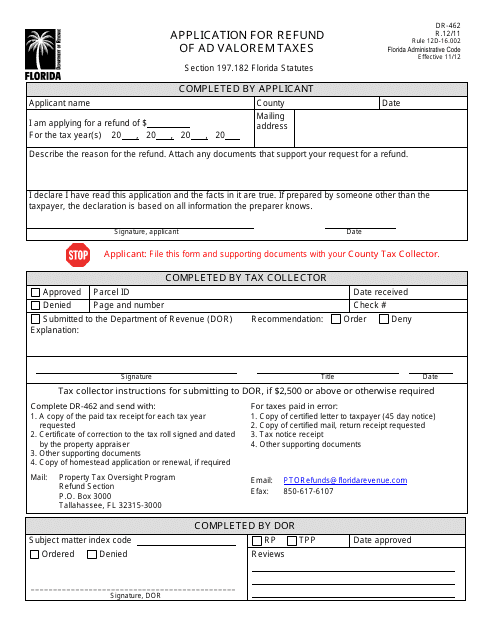

This Form is used for applying for a refund of ad valorem taxes in the state of Florida.

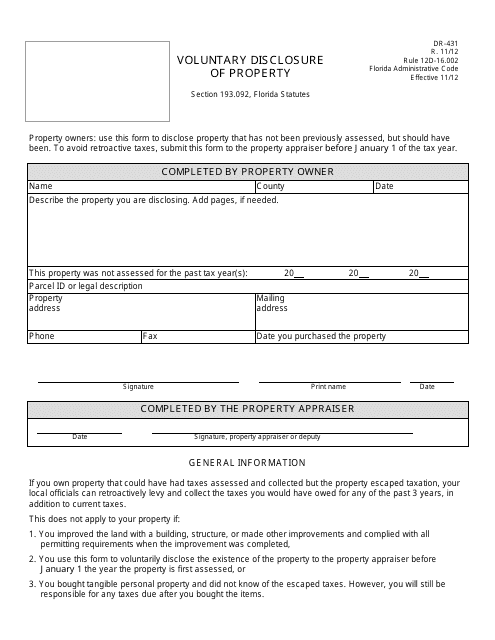

This form is used for voluntary disclosure of property in the state of Florida. It allows individuals to disclose any previously unreported property to the state and avoid potential penalties or legal consequences.

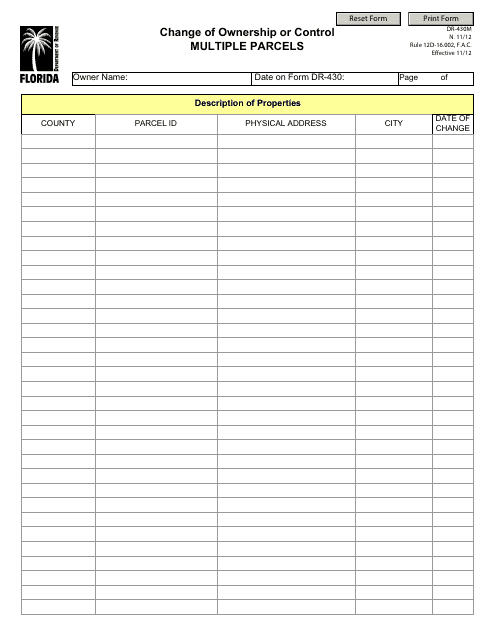

This form is used for reporting a change in ownership or control of multiple parcels in Florida.

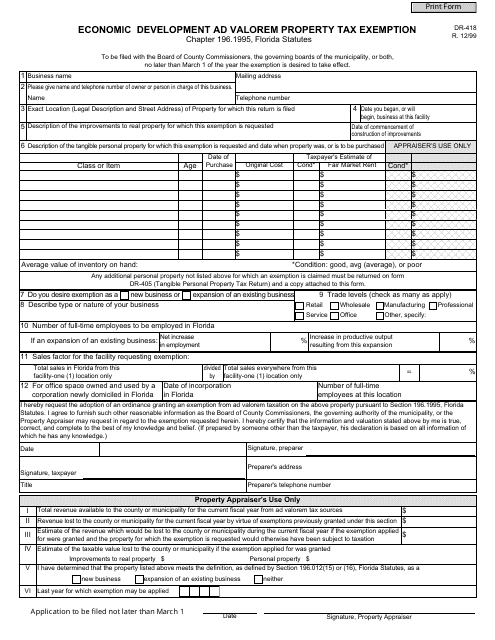

This form is used for applying for an economic development ad valorem property tax exemption in the state of Florida.

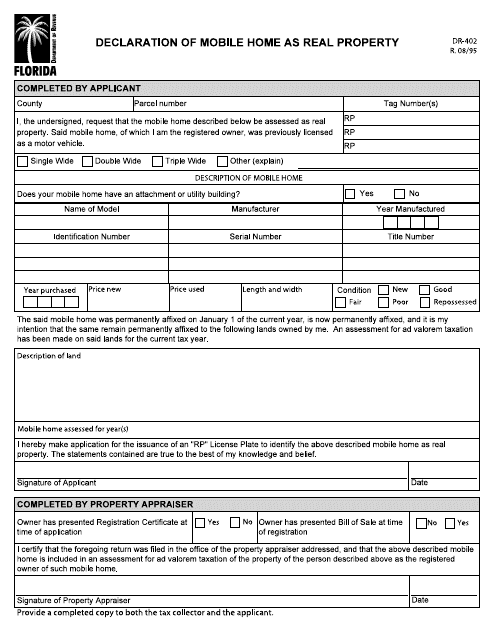

This Form is used for declaring a mobile home as real property in the state of Florida. It is important for mobile home owners to complete this form in order to establish legal ownership and property value.

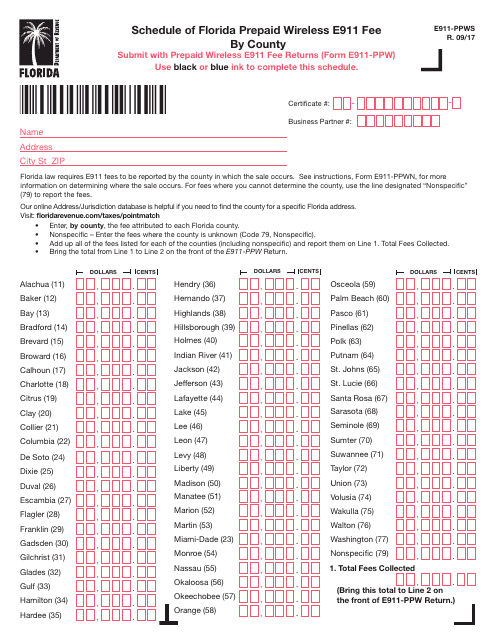

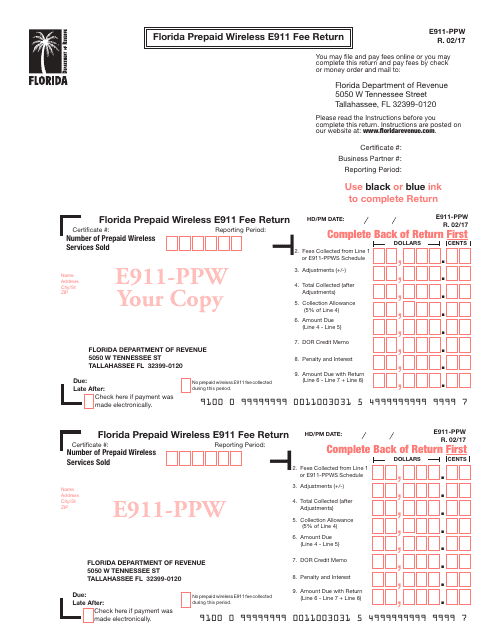

This Form is used for viewing the schedule of Florida Prepaid Wireless E911 Fee by County in Florida.

This form is used for submitting the prepaid wireless E911 fee return in the state of Florida.

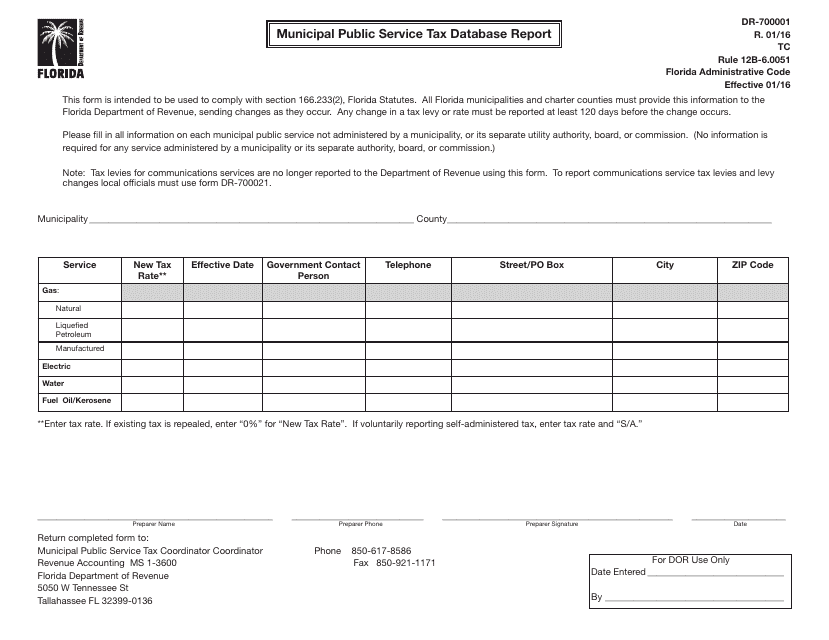

This form is used for generating a report on the municipal public service tax database in Florida. It helps gather information about taxes related to public services provided by municipalities in the state.

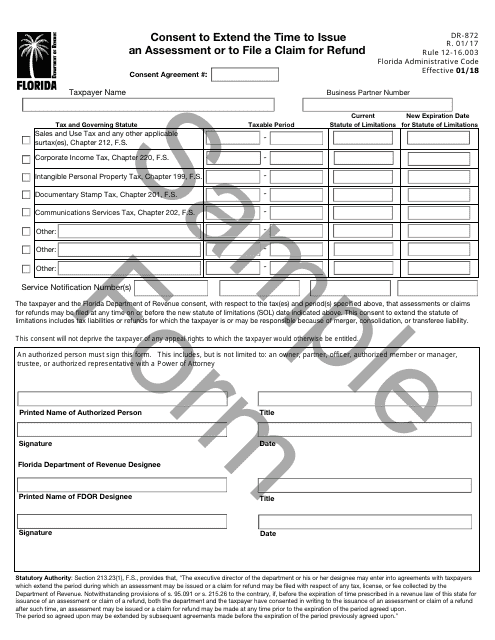

This form is used for consenting to extend the time to issue an assessment or to file a claim for refund in the state of Florida.

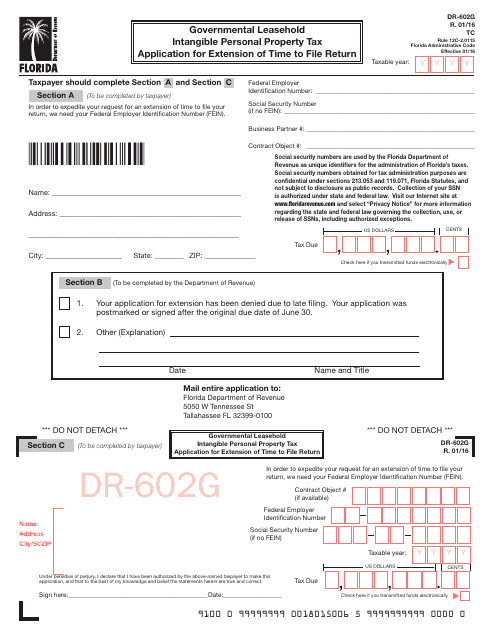

This form is used for requesting an extension of time to file a return for the Governmental Leasehold Intangible Personal Property Tax in Florida.

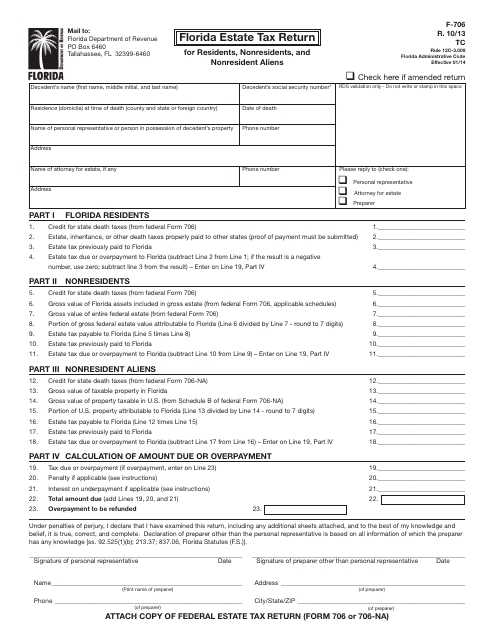

This form is used for filing estate tax returns in Florida by residents, nonresidents, and nonresident aliens.

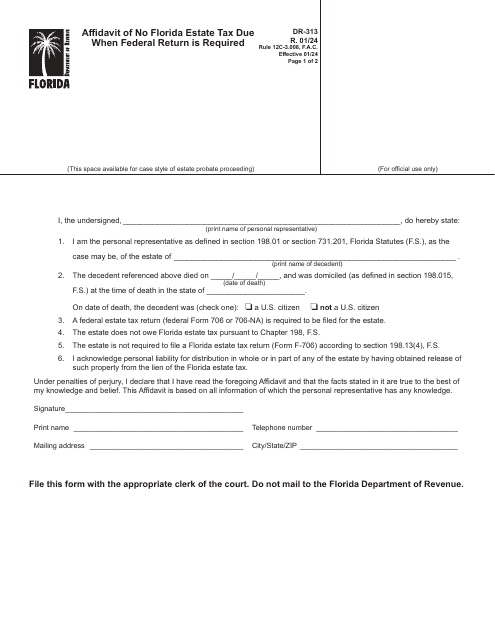

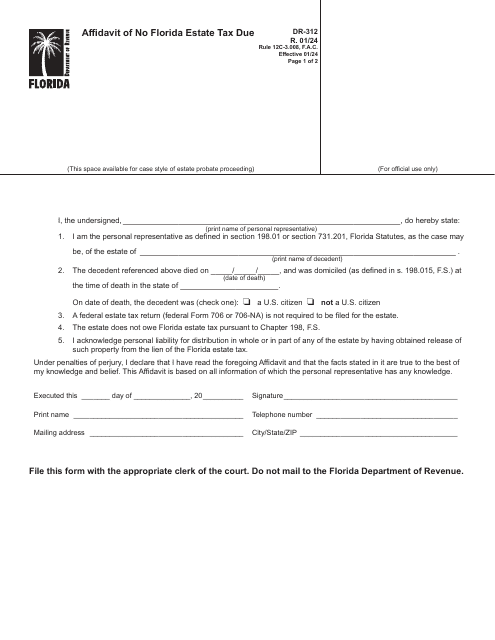

This form is a Florida legal document completed for the estates of decedents who died on or after January 1, 2005, if the estate does not require the filing of a federal estate tax return.