Fill and Sign United States Legal Forms

Documents:

235709

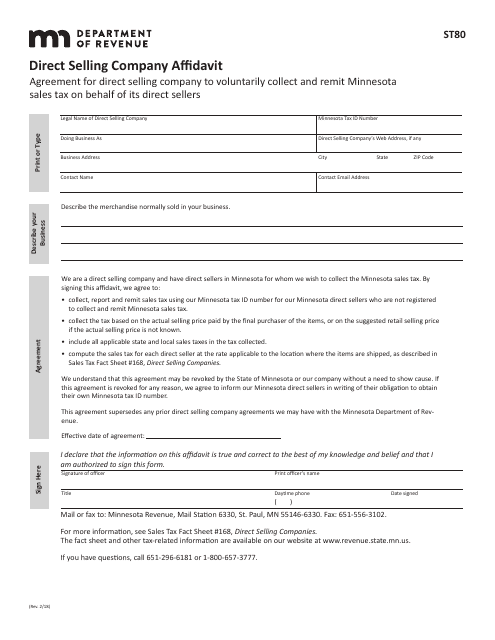

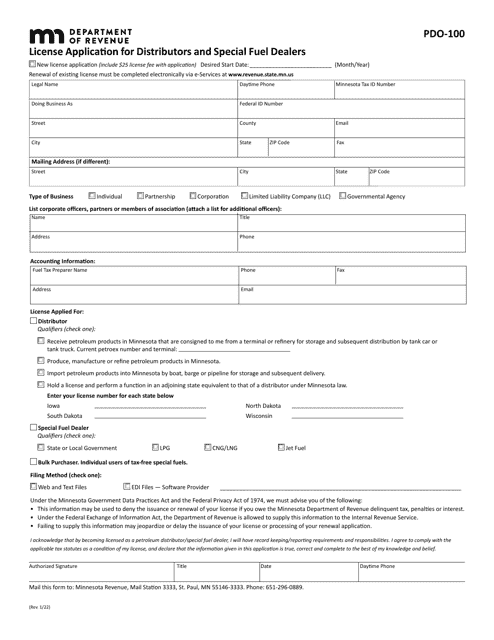

This form is used for submitting an affidavit by a direct selling company in the state of Minnesota. It may be required for registration or other purposes related to the direct selling business.

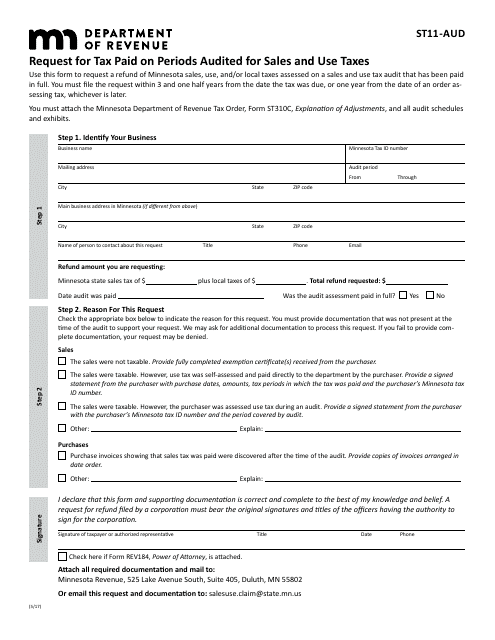

This form is used for requesting tax paid on periods that were audited for sales and use taxes in the state of Minnesota.

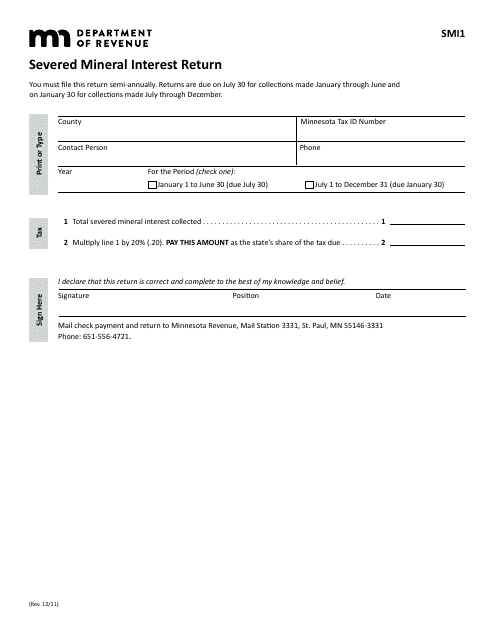

This Form is used for reporting severed mineral interests in Minnesota. It is used to provide information on these interests for assessment and taxation purposes.

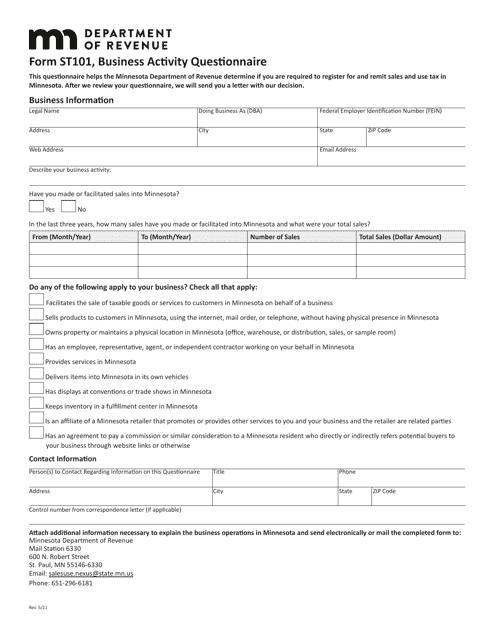

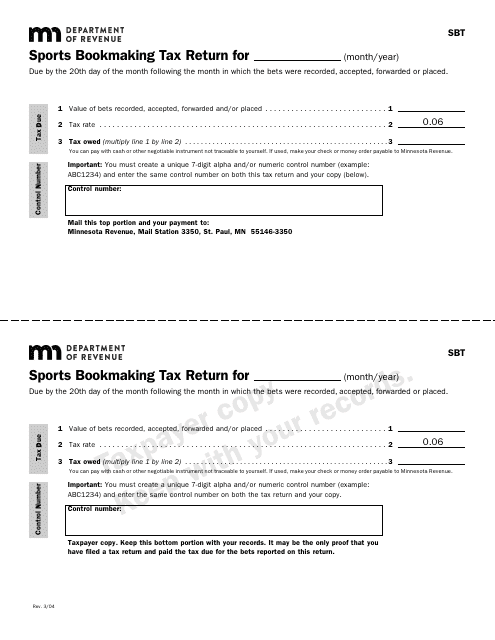

This form is used for reporting sports bookmaking taxes in the state of Minnesota. It is used by businesses or individuals involved in sports bookmaking activities to report their earnings and calculate the amount of tax owed.

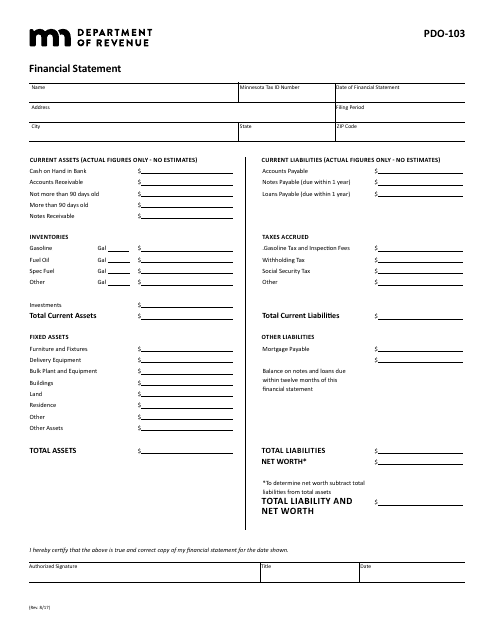

This form is used for submitting a financial statement in the state of Minnesota. It is typically used in legal proceedings or for tax purposes.

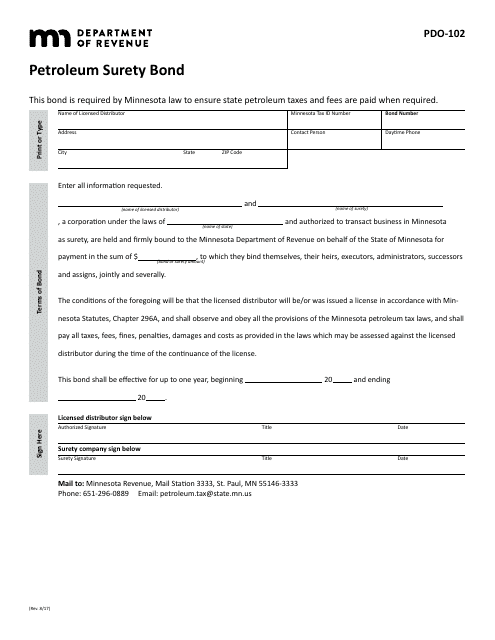

This Form is used for obtaining a surety bond for petroleum related activities in the state of Minnesota.

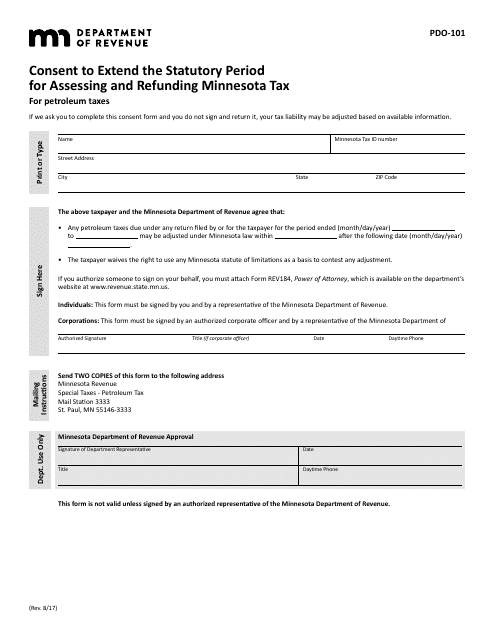

This form is used for requesting to extend the statutory period for assessing and refunding Minnesota tax for petroleum taxes in the state of Minnesota.

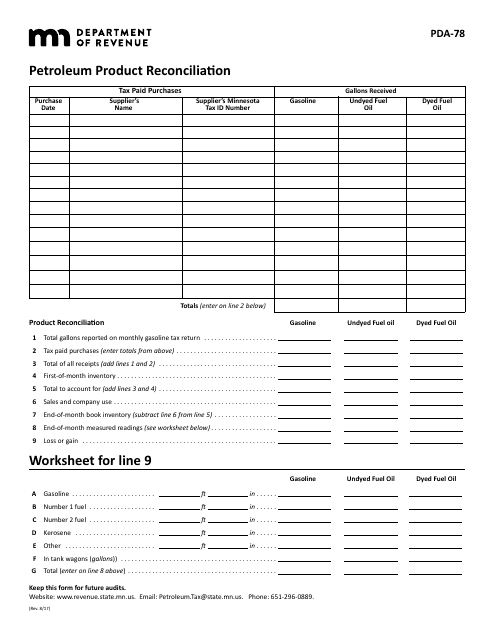

This Form is used for reconciling petroleum product information in Minnesota.

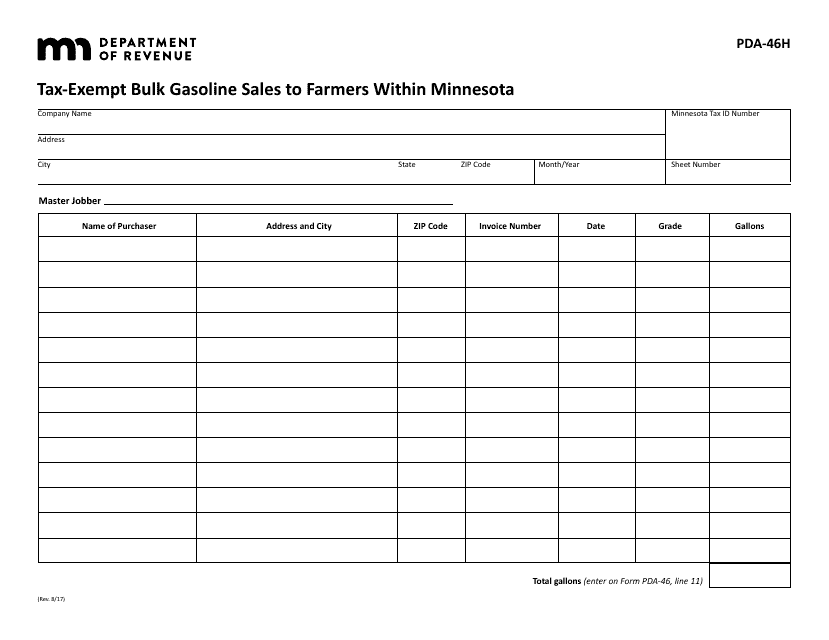

This Form is used for tax-exempt bulk gasoline sales to farmers within Minnesota.

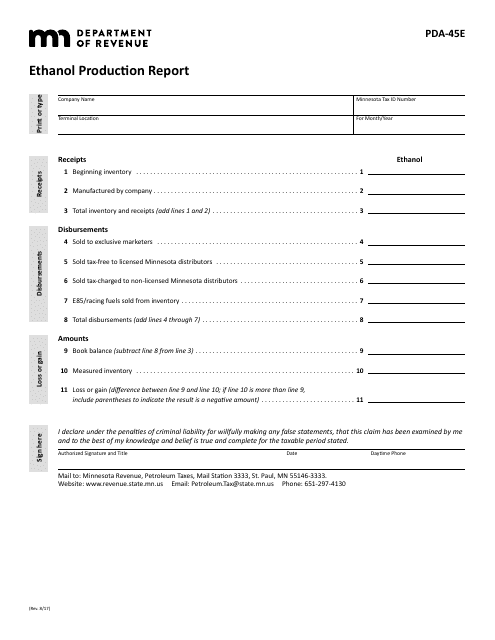

This form is used for reporting ethanol production in Minnesota.

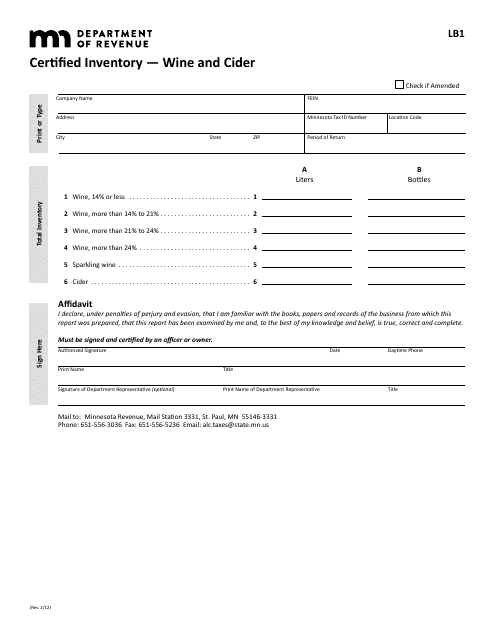

This form is used for certifying the inventory of wine and cider in the state of Minnesota.

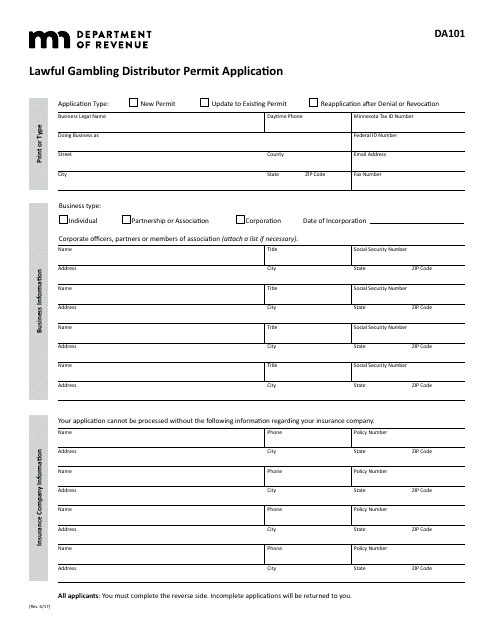

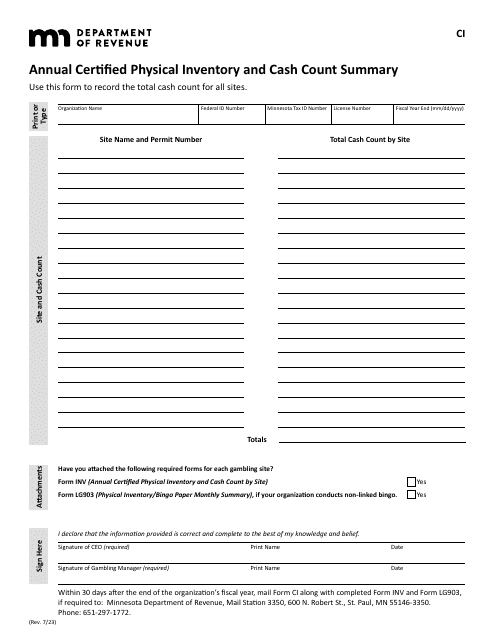

This form is used for applying for a Lawful Gambling Distributor Permit in Minnesota.

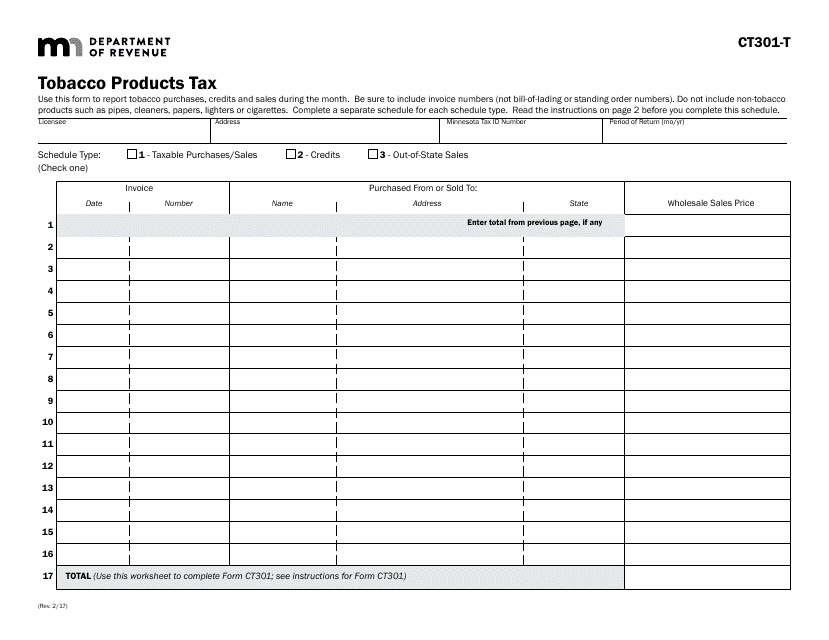

This document is used for reporting and paying tobacco products tax in the state of Minnesota.

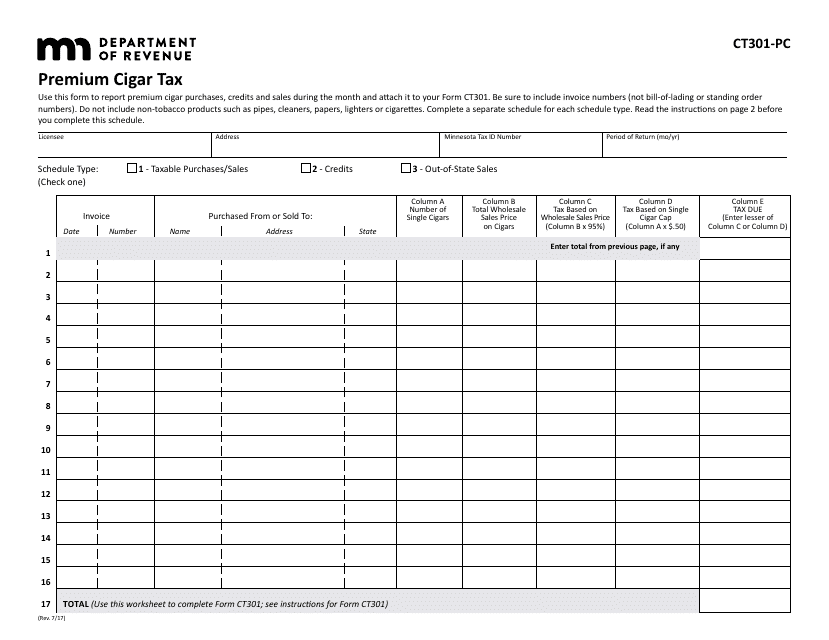

This document provides information and guidelines for paying premium cigar tax in Minnesota. It outlines the schedule and details of CT301-PC.

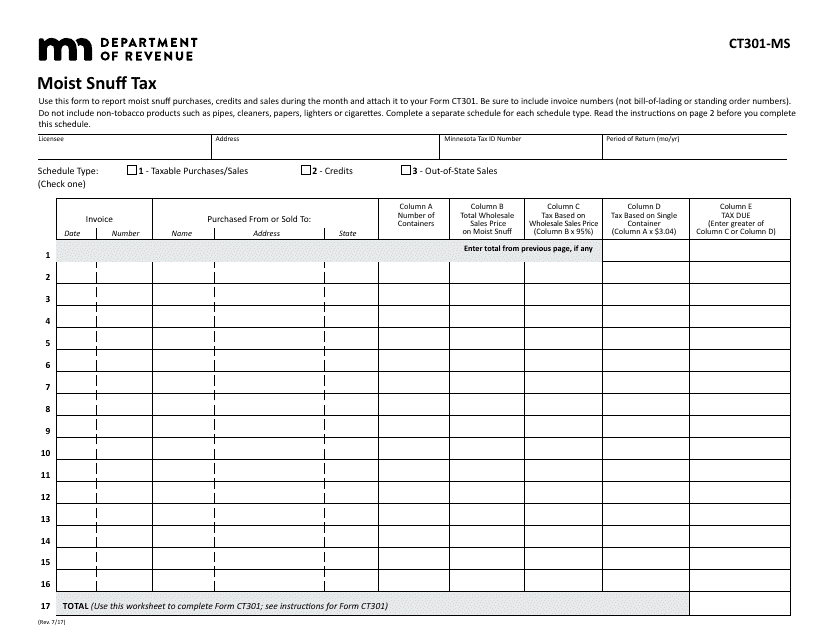

This form is used for reporting and paying the moist snuff tax in the state of Minnesota. It is required for businesses that sell moist snuff products to accurately calculate and remit the appropriate tax amount.

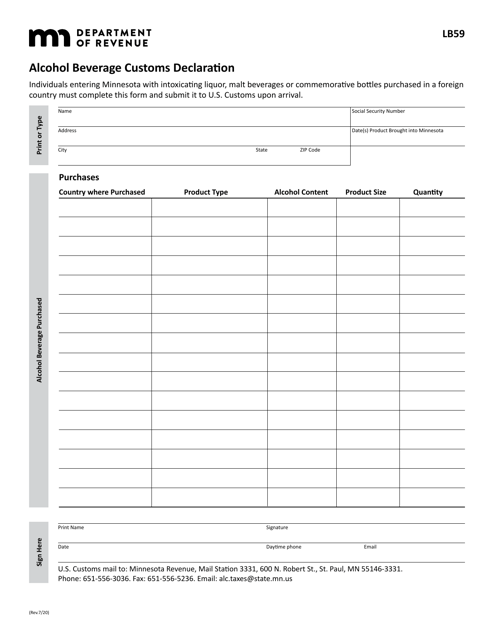

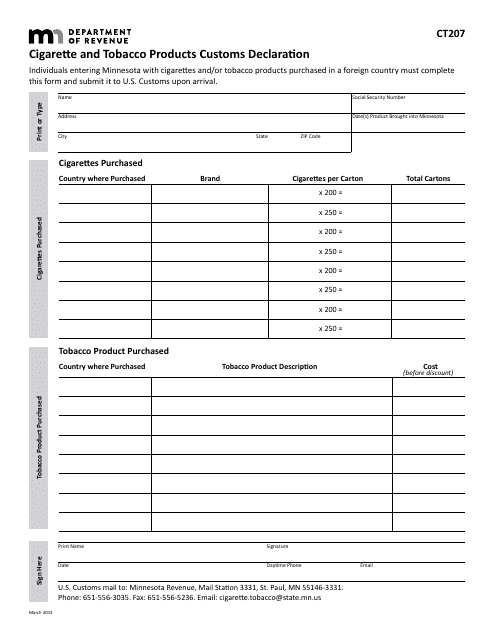

This document is used for declaring cigarette and tobacco products when entering Minnesota from another country.

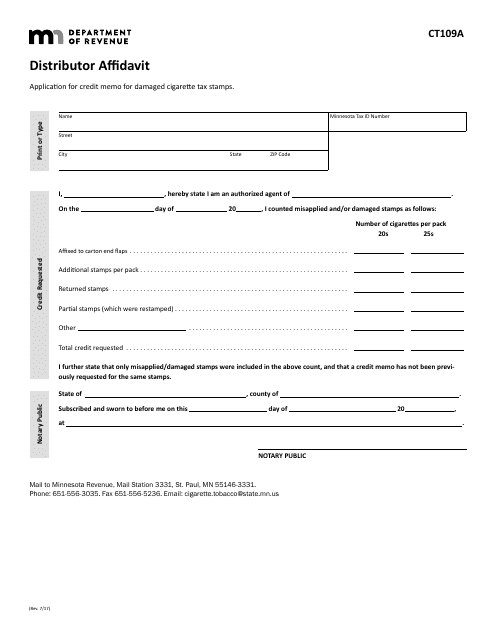

This Form is used for distributors in Minnesota to provide an affidavit.

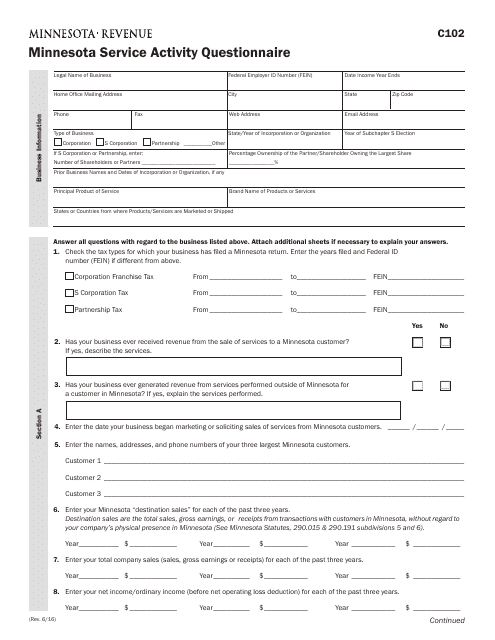

This form is used for collecting information about service activities in Minnesota.

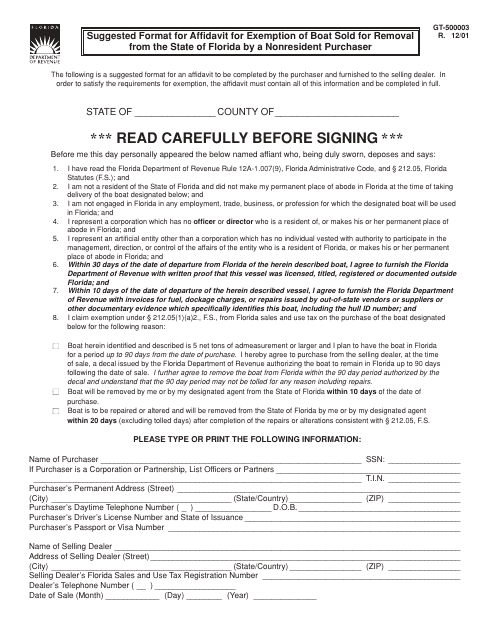

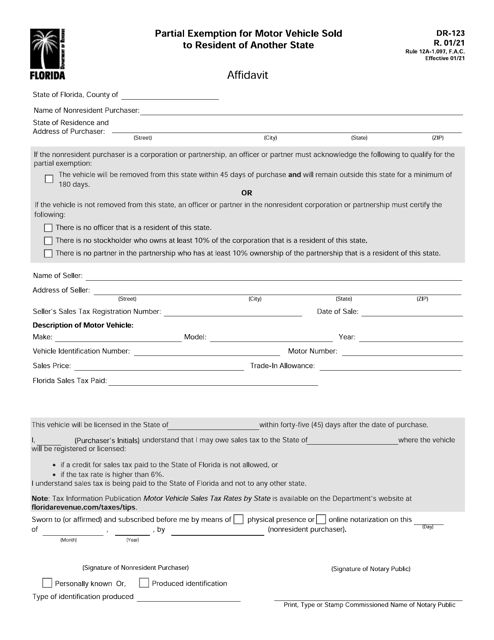

This form is used for providing a suggested format for an affidavit for exemption of a boat sold for removal from the state of Florida by a nonresident purchaser.

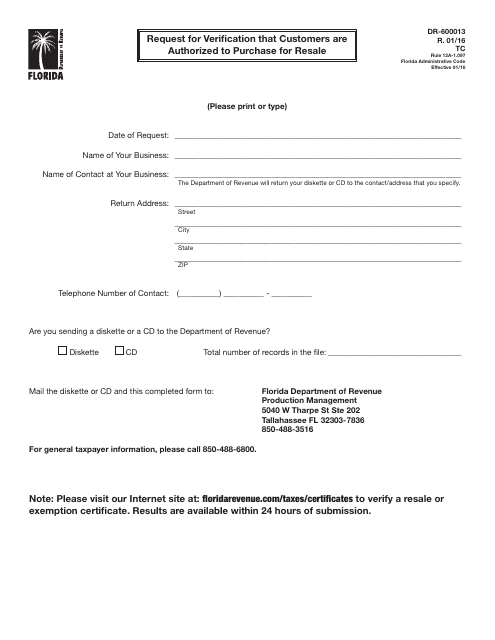

This Form is used for requesting verification that customers in Florida are authorized to purchase items for resale.

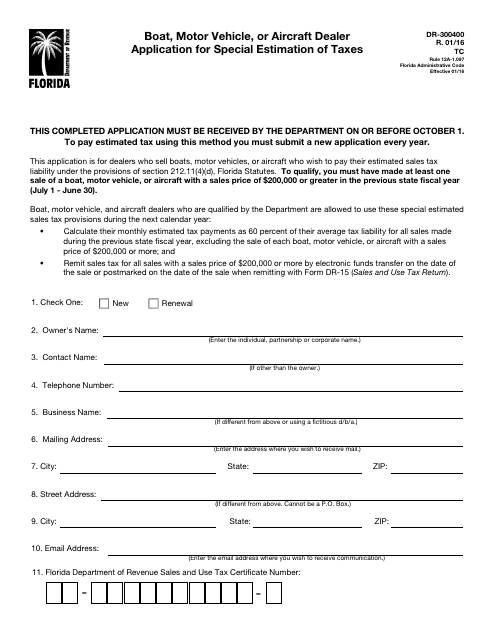

This Form is used for dealers in Florida to apply for a special estimation of taxes for boats, motor vehicles, or aircrafts.

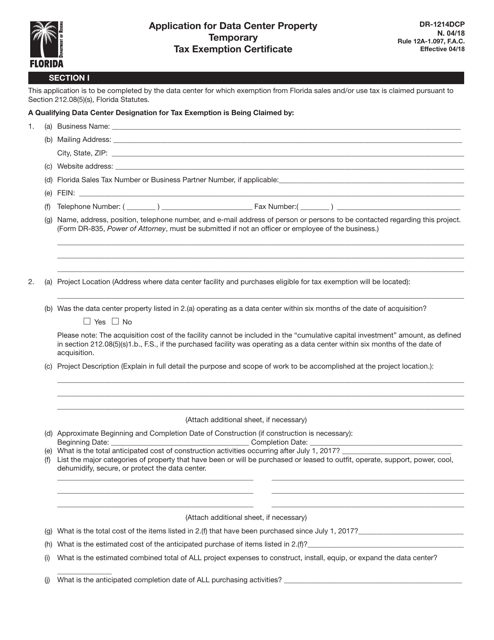

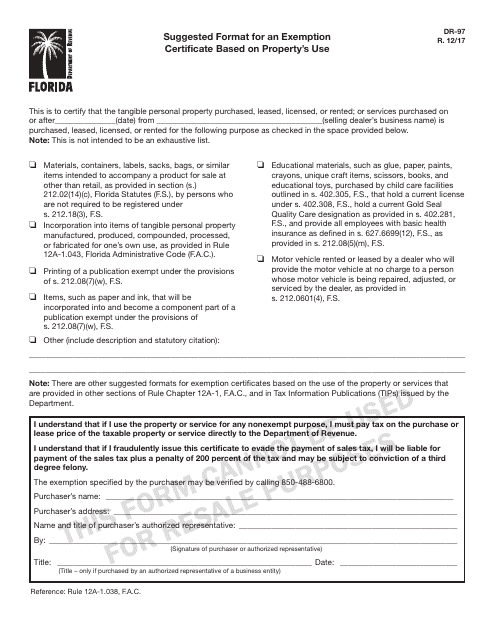

This Form is used for providing a suggested format for an exemption certificate based on the property's use in Florida.

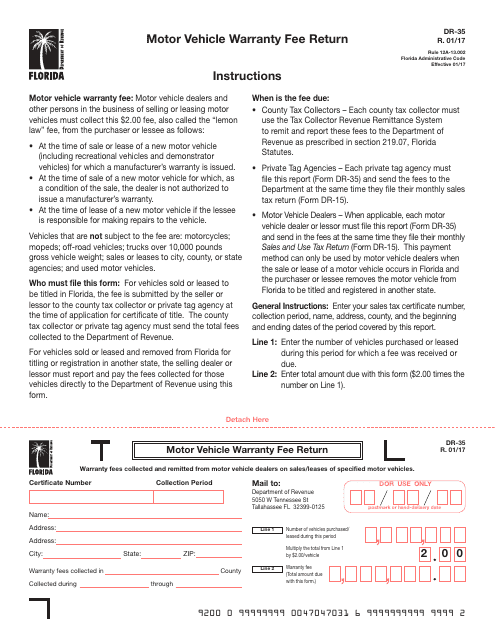

This Form is used for filing the Motor Vehicle Warranty Fee Return in Florida. It is necessary for businesses engaged in the sale of motor vehicles to submit this form and pay the required warranty fee.

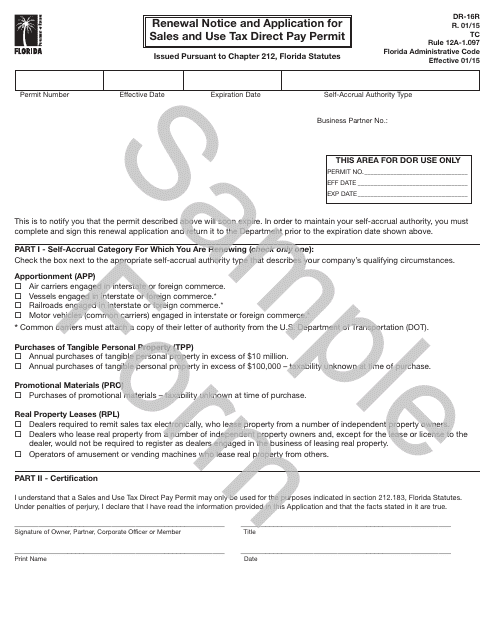

This Form is used for renewing and applying for a Sales and Use Tax Direct Pay Permit in Florida.

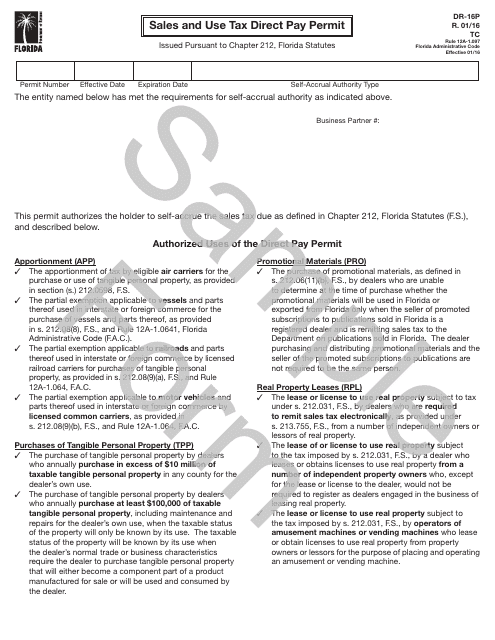

This Form is used for applying for a Sales and Use Tax Direct Pay Permit in the state of Florida. This permit allows businesses to pay sales and use tax directly to the Florida Department of Revenue instead of paying sales tax to their vendors.

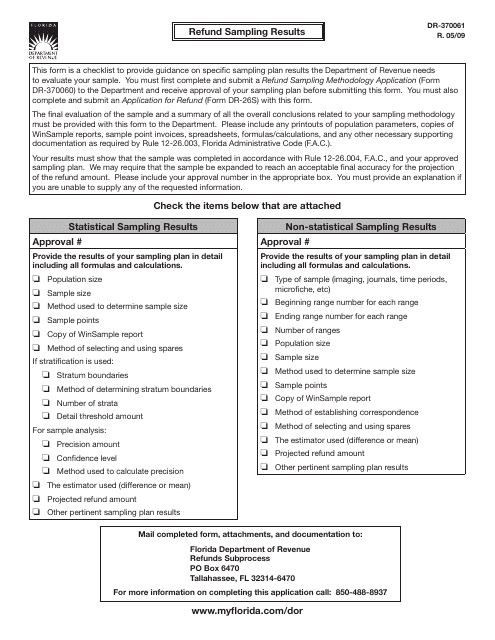

This form is used to report the refund sampling results for businesses in the state of Florida.