Fill and Sign Pennsylvania Legal Forms

Documents:

4630

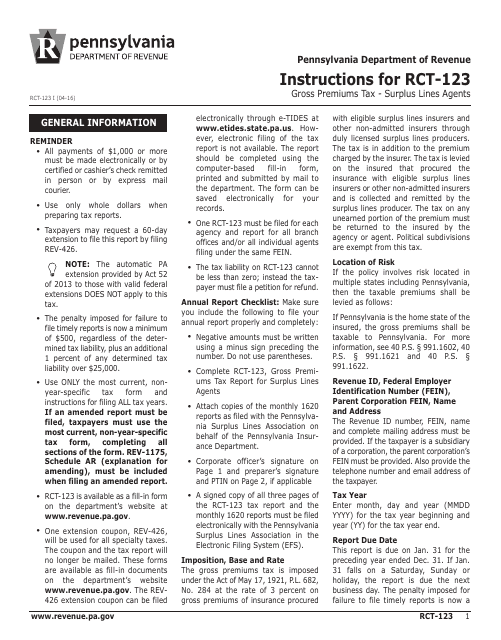

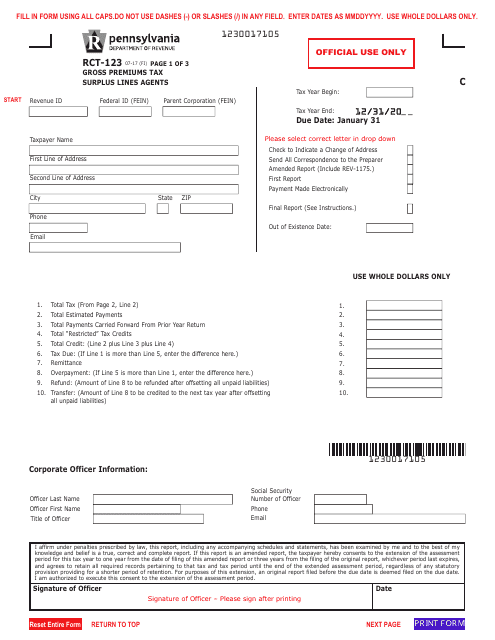

This Form is used for filing gross premiums tax by surplus lines agents in Pennsylvania.

This form is used for reporting gross premiums tax for surplus lines agents in Pennsylvania.

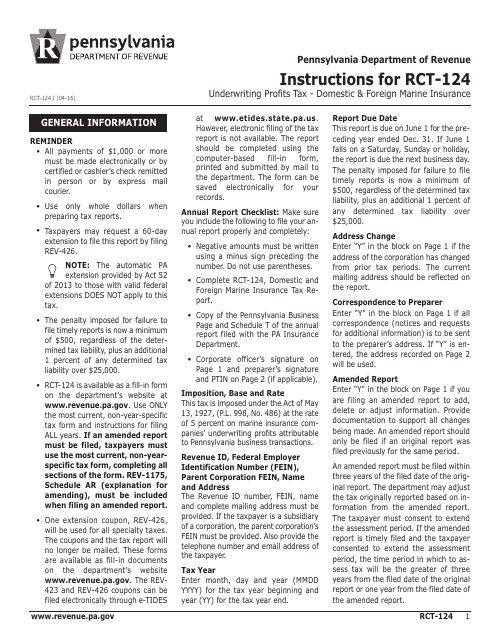

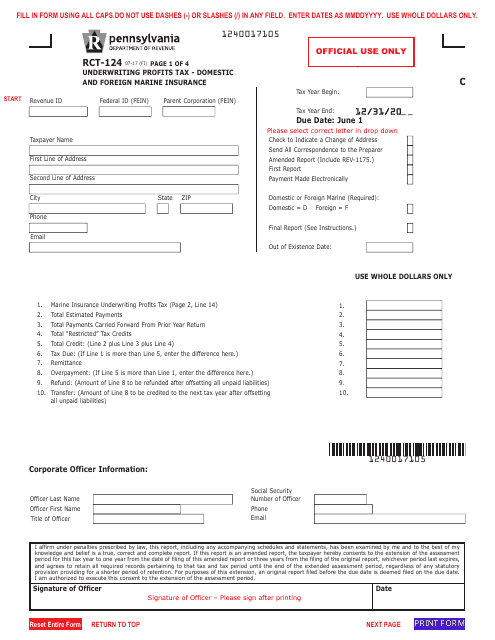

This Form is used for reporting underwriting profits tax for domestic and foreign marine insurance companies in Pennsylvania. It provides instructions on how to accurately complete and file Form RCT-124.

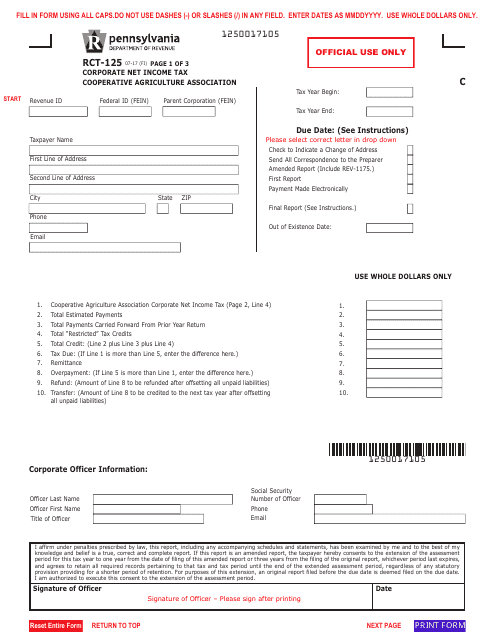

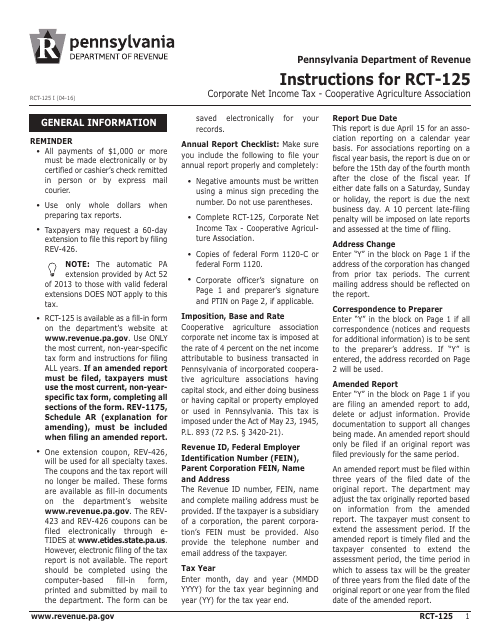

This form is used for reporting the corporate net income tax of Cooperative Agriculture Associations in Pennsylvania.

This Form is used for filing corporate net income tax for Cooperative Agriculture Associations in Pennsylvania. It provides instructions on how to accurately complete the form and submit it to the appropriate authorities.

This form is used for reporting underwriting profits tax for domestic and foreign marine insurance in Pennsylvania.

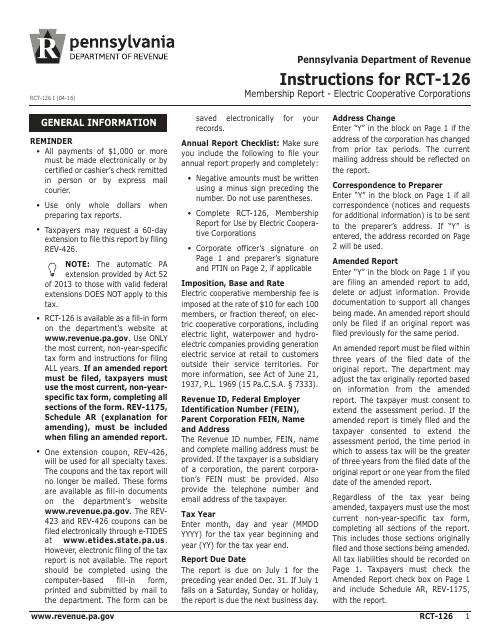

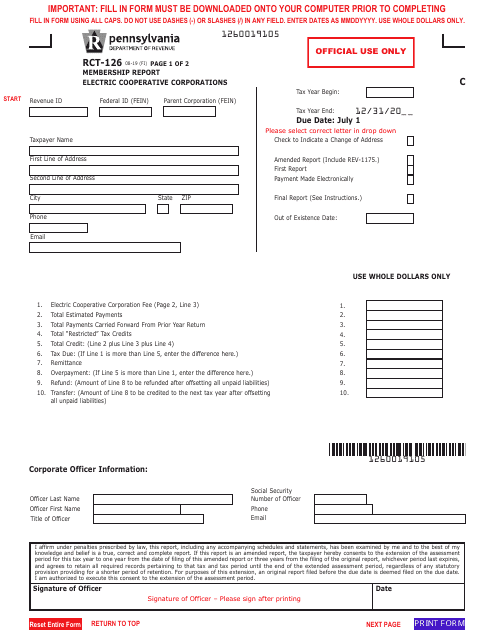

This Form is used for reporting membership information for electric cooperative corporations in Pennsylvania. It provides instructions on how to complete and submit the Form RCT-126 Membership Report.

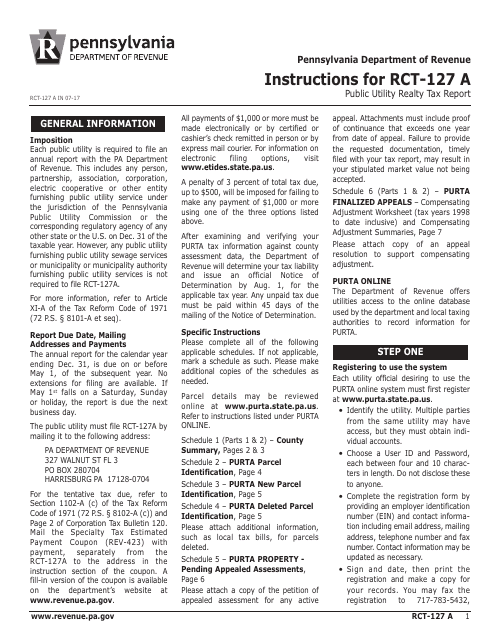

This document provides instructions for completing Form RCT-127, which is used to report public utility realty tax in Pennsylvania.

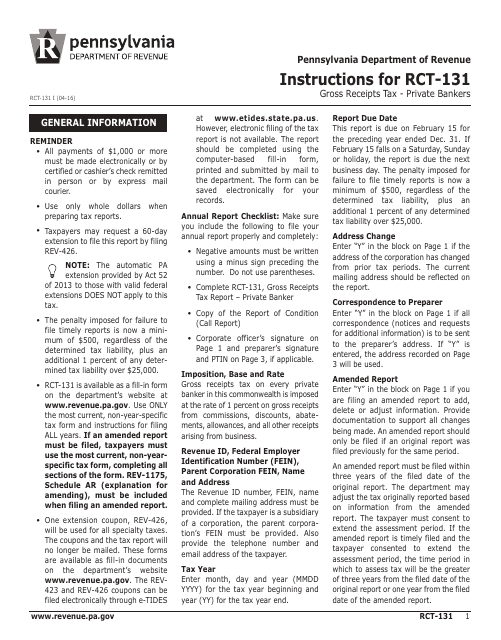

This Form is used for reporting and paying the Gross Receipts Tax for private bankers in the state of Pennsylvania. It provides instructions on how to calculate and submit the tax owed.

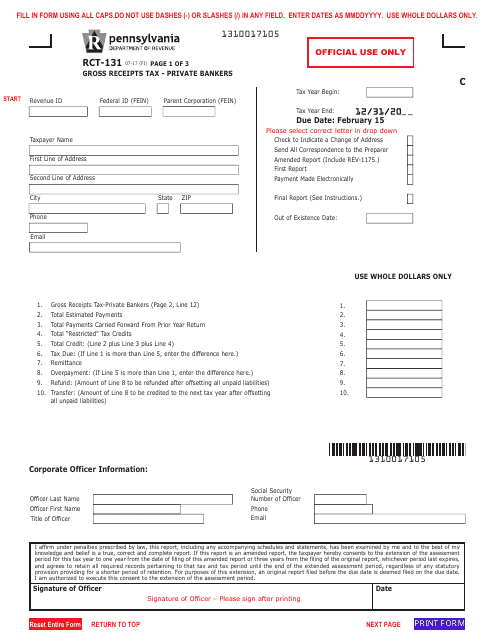

This Form is used for reporting gross receipts tax for private bankers in Pennsylvania.

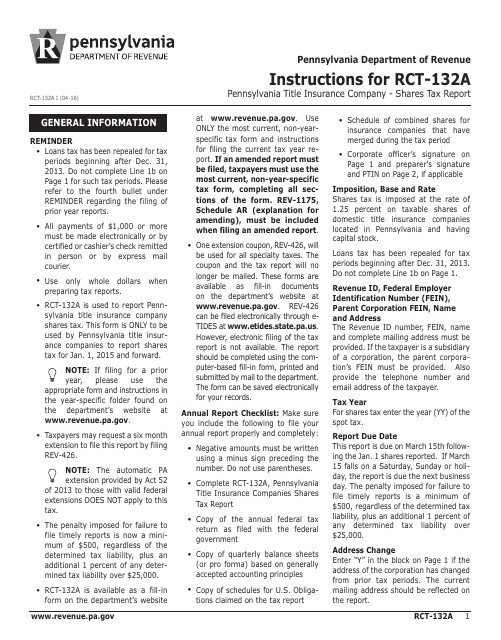

This Form is used for reporting shares tax by Pennsylvania title insurance companies. It provides instructions for completing Form RCT-132A.

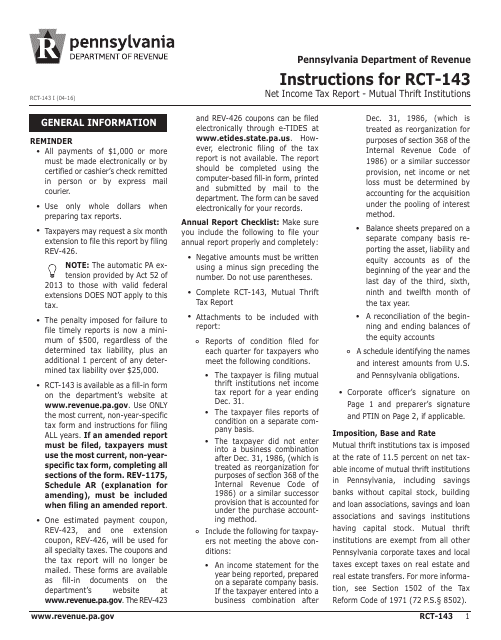

This Form is used for reporting the net income tax for mutual thrift institutions in Pennsylvania. It provides instructions for properly filling out Form RCT-143.

This form is used for reporting net income tax for mutual thrift institutions in Pennsylvania.

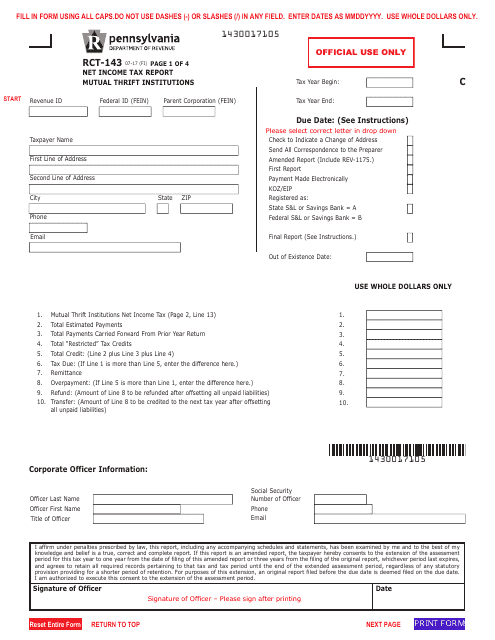

This Form is used for assigning tax credits in Pennsylvania (PA). It allows individuals or businesses to transfer their tax credits to another party.

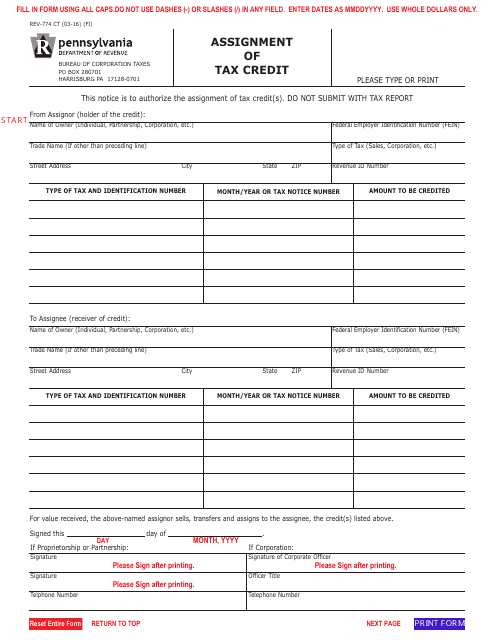

This form is used for reporting Pennsylvania Bank and Trust Company shares tax information in Pennsylvania.

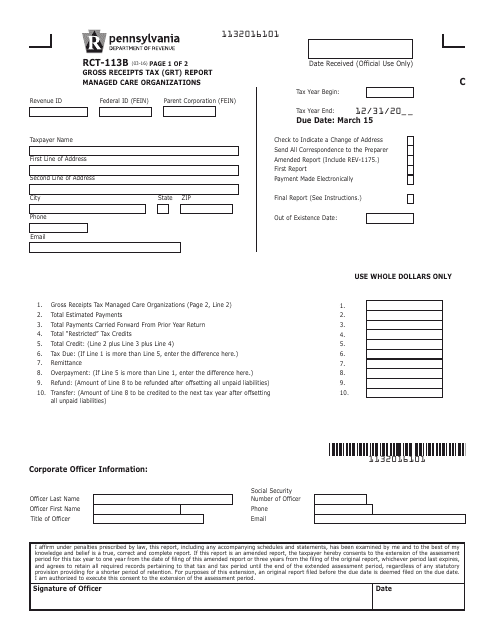

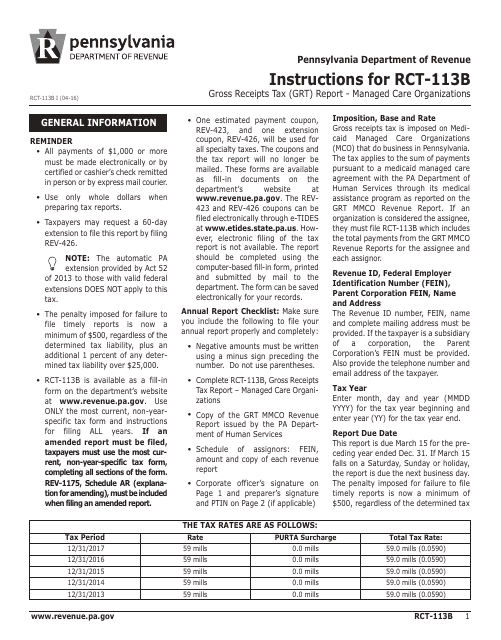

This form is used for reporting Gross Receipts Tax (GRT) for managed care organizations in Pennsylvania.

This Form is used for reporting gross receipts tax for managed care organizations in Pennsylvania. It provides instructions on how to fill out the RCT-113B Gross Receipts Tax (GRT) Report.

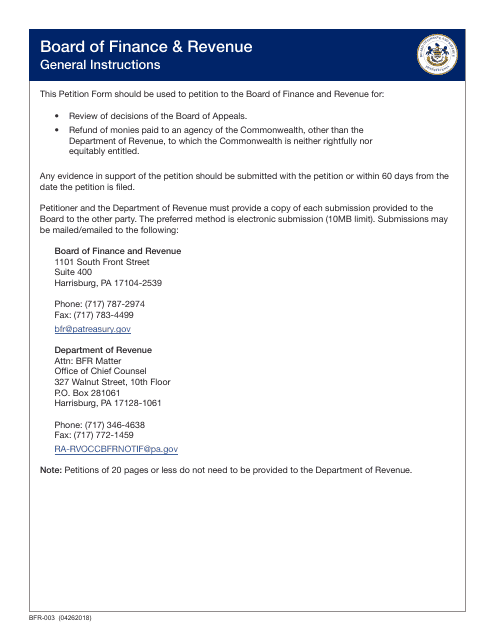

This Form is used for filing a petition in the state of Pennsylvania.

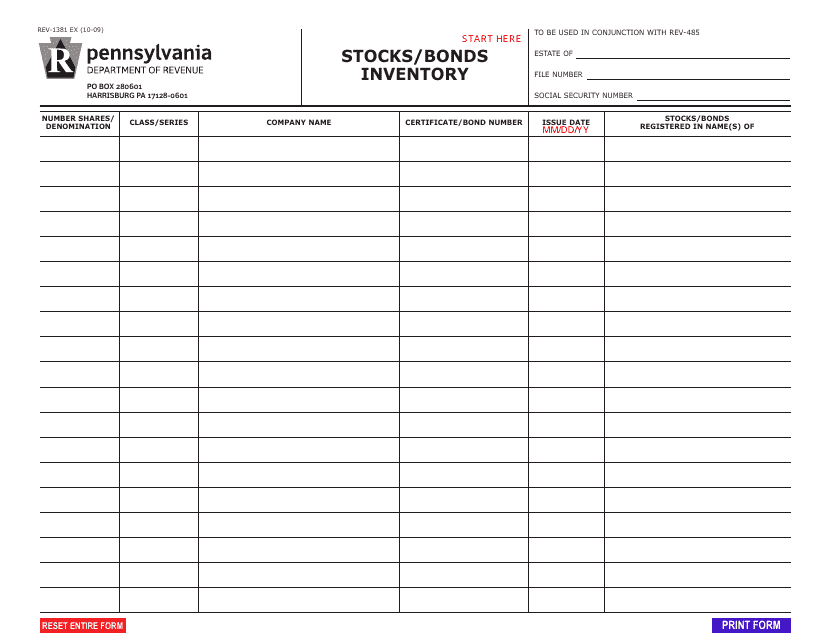

This Form is used for reporting and documenting stocks and bonds inventory in the state of Pennsylvania.

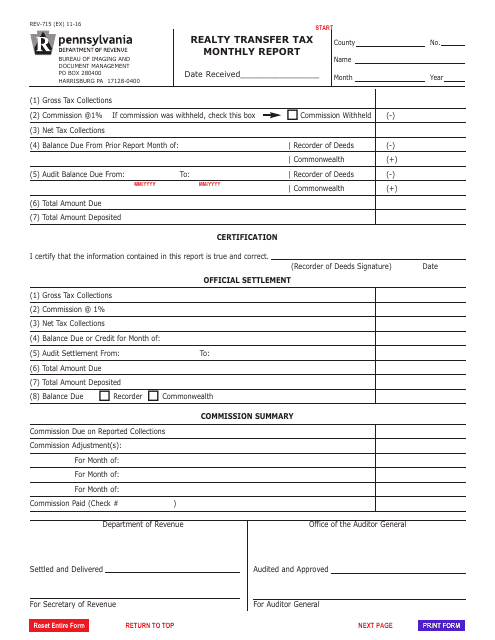

This form is used for reporting monthly realty transfer tax in Pennsylvania. It is used by individuals and businesses to report and pay taxes related to property transfers.

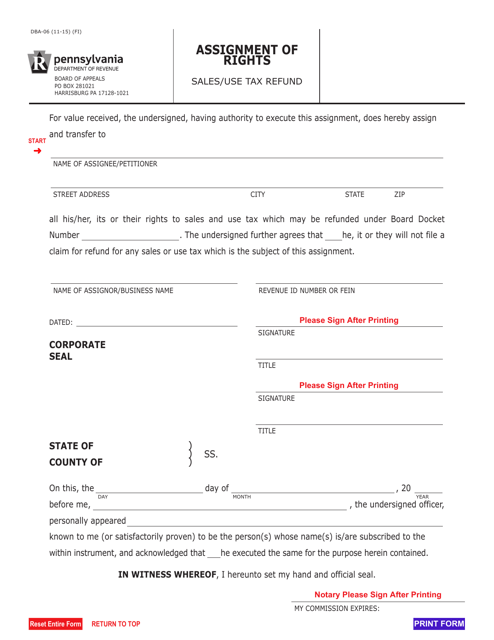

This form is used for assigning the rights to a sales/use tax refund in the state of Pennsylvania.

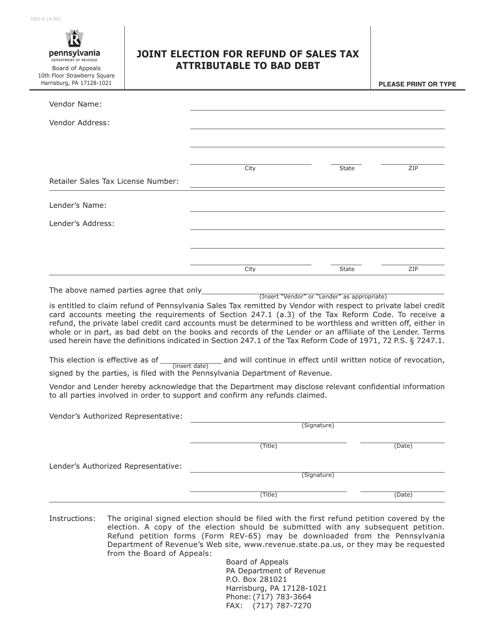

This form is used for joint election for refund of sales tax attributable to bad debt in Pennsylvania.

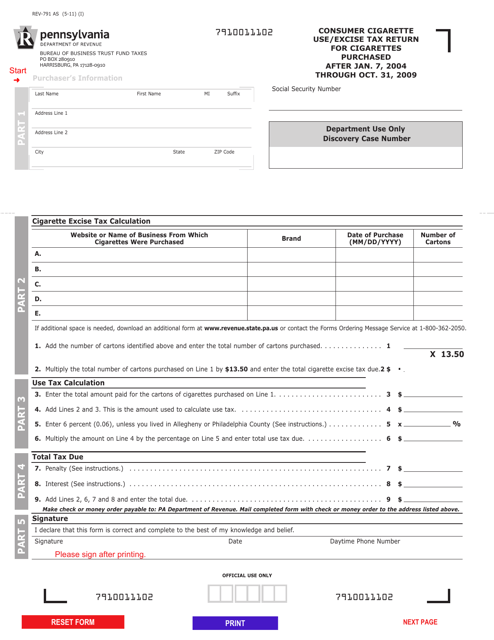

This Form is used for reporting the consumer cigarette use and excise tax return for cigarettes purchased in Pennsylvania from January 7, 2004, to October 31, 2009.