Fill and Sign Pennsylvania Legal Forms

Documents:

4630

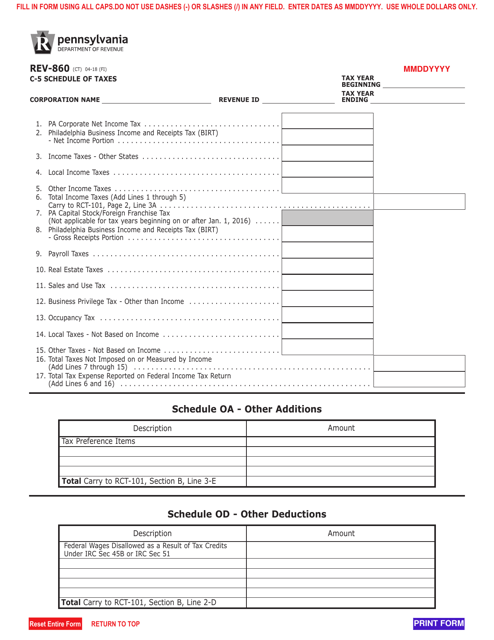

This form is used for reporting and calculating taxes in the state of Pennsylvania. It is called the REV-860 C-5 Schedule of Taxes.

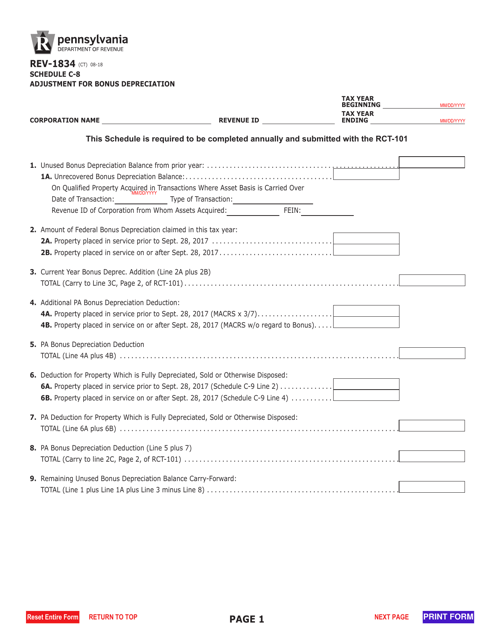

This Form is used for making adjustments for bonus depreciation on Schedule C-8 in the state of Pennsylvania.

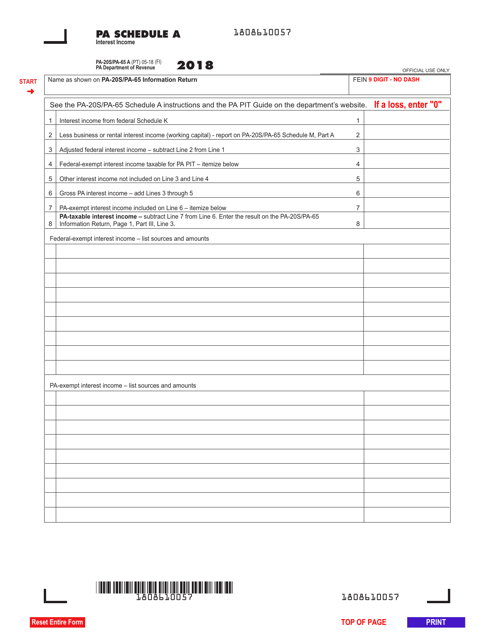

This type of document is used for reporting interest income specifically for residents of Pennsylvania.

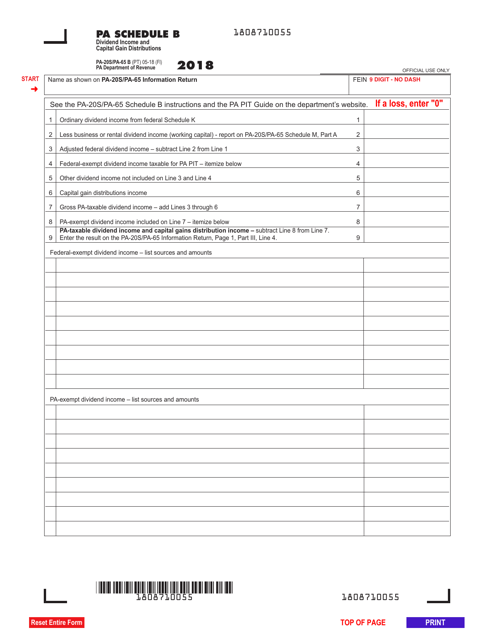

Form PA-20S (PA-65 B) Schedule B Dividend Income and Capital Gain Distributions - Pennsylvania, 2018

This Form is used for reporting dividend income and capital gain distributions in Pennsylvania.

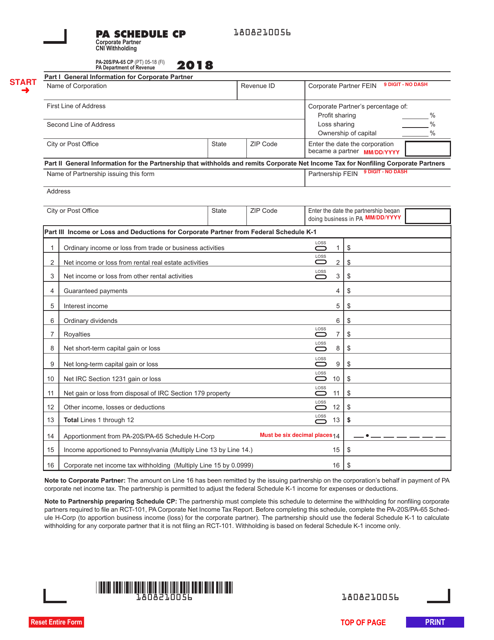

This form is used for reporting corporate partner CNI withholding in Pennsylvania for Schedule CP.

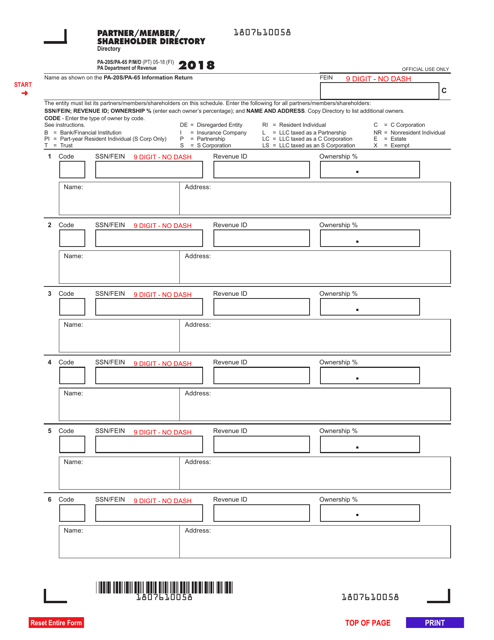

This form is used for reporting the partner/member/shareholder directory for businesses in Pennsylvania. It allows businesses to provide the necessary information about their partners, members, or shareholders.

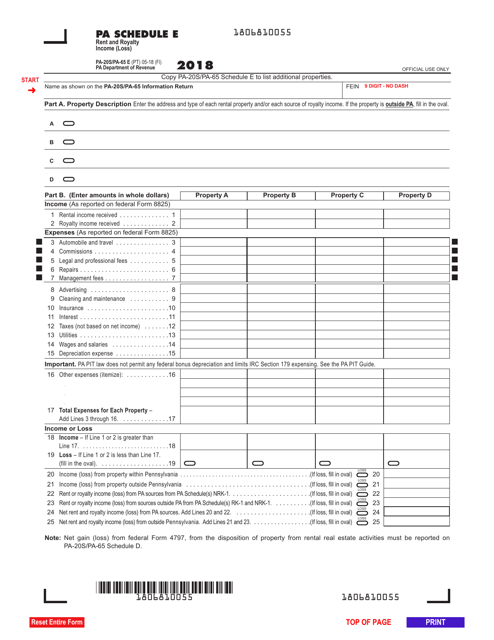

This form is used for reporting rental and royalty income or losses in the state of Pennsylvania.

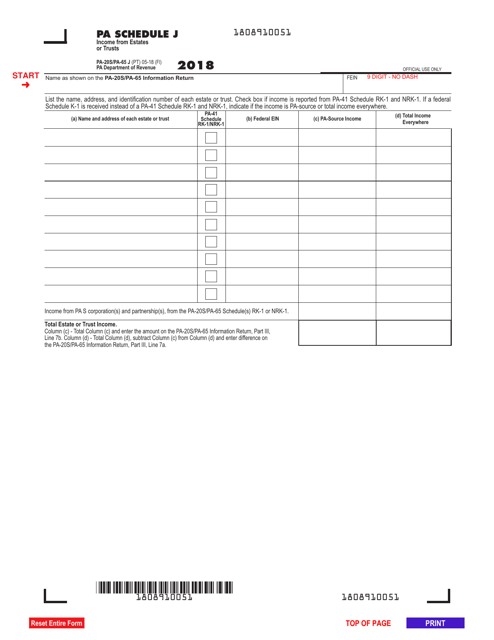

This form is used for reporting income from estates or trusts in the state of Pennsylvania.

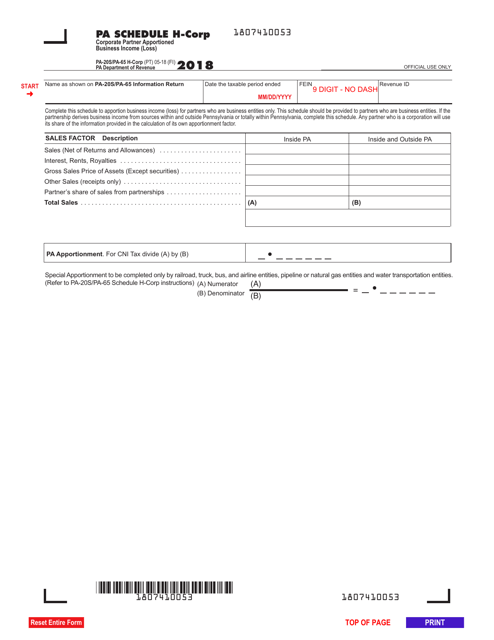

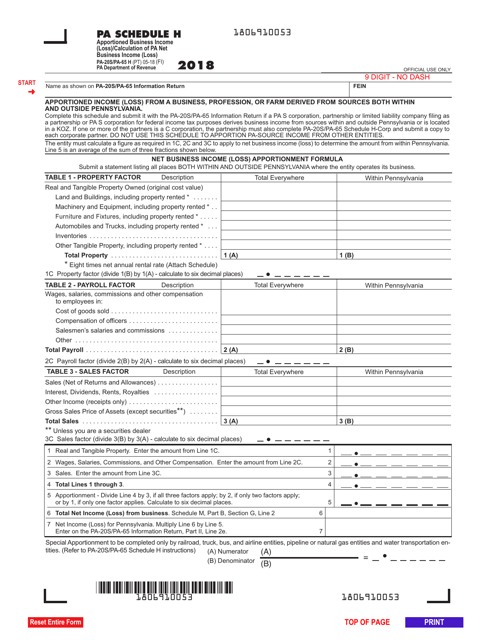

This form is used for reporting the apportioned business income or loss of a corporate partner in Pennsylvania.

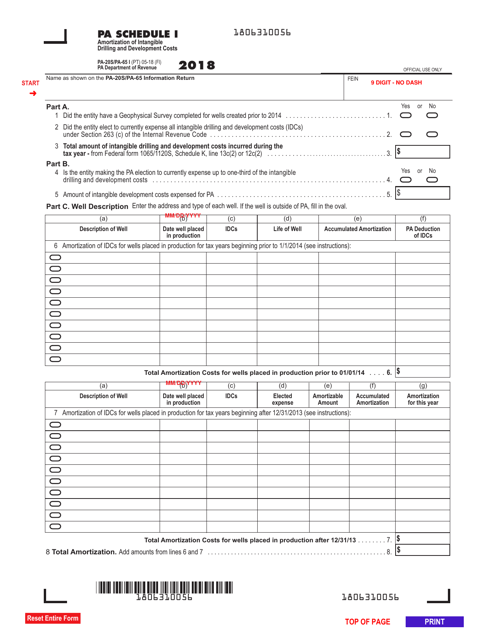

This Form is used for reporting the amortization of intangible drilling and development costs in Pennsylvania for PA-20S (PA-65 I) Schedule I.

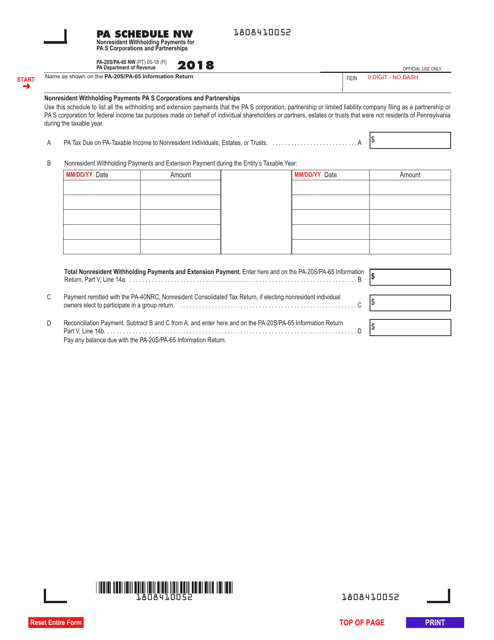

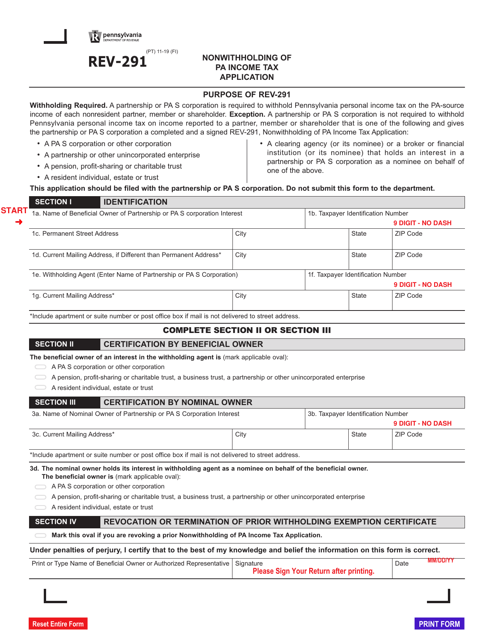

This form is used for reporting nonresident withholding payments for Pennsylvania S corporations and partnerships.

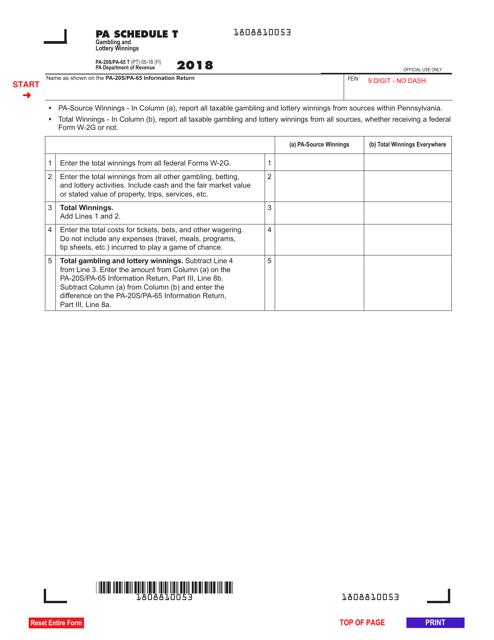

This form is used for reporting gambling and lottery winnings in the state of Pennsylvania.

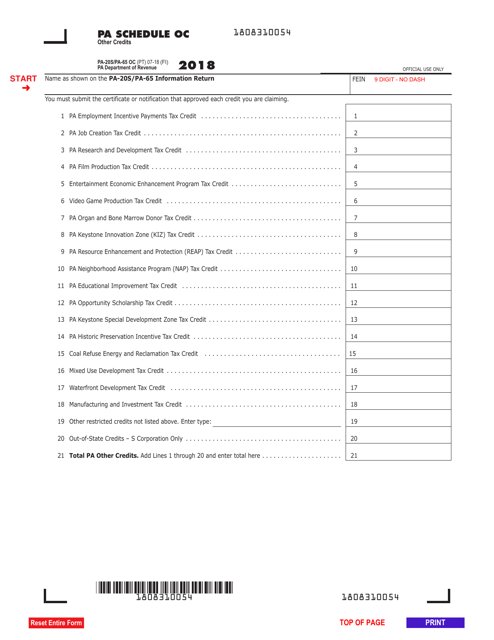

This form is used for reporting other credits on your Pennsylvania state tax return.

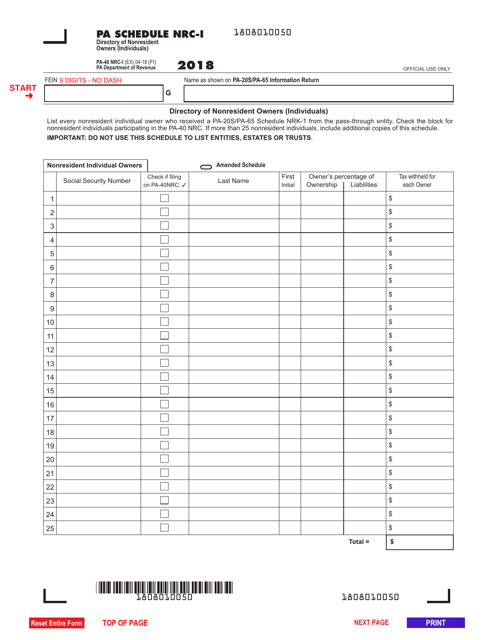

This form is used for listing nonresident individuals who own property in Pennsylvania. It helps in maintaining a directory of nonresident owners for tax and administrative purposes.

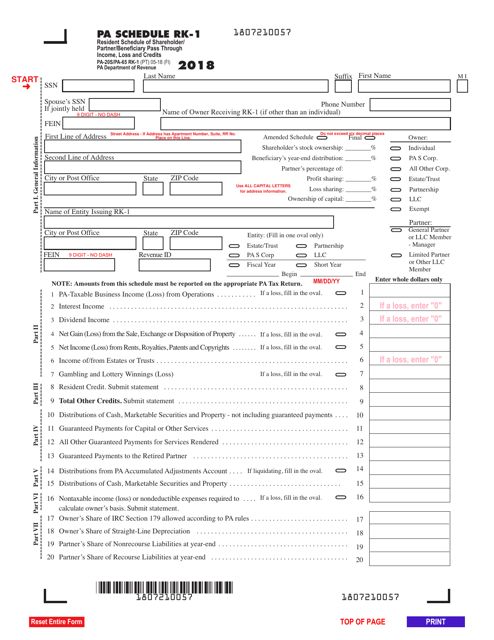

This form is used for reporting the pass-through income, loss, and credits of shareholders, partners, and beneficiaries in Pennsylvania.

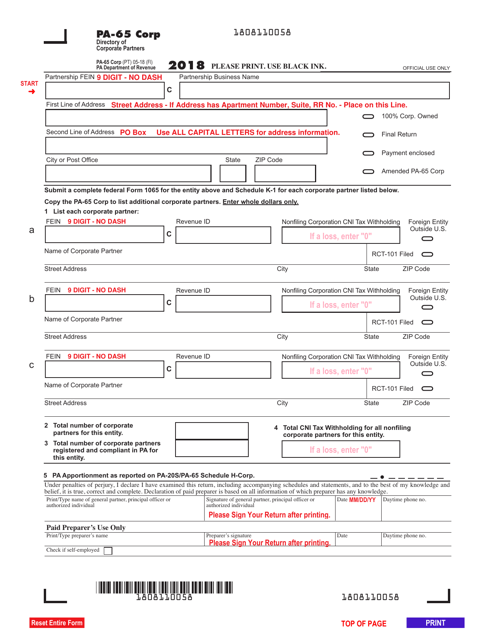

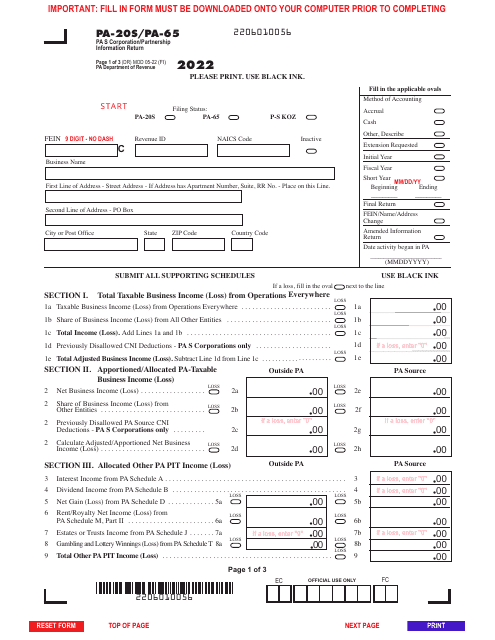

This document is used for submitting information about corporate partners in Pennsylvania.

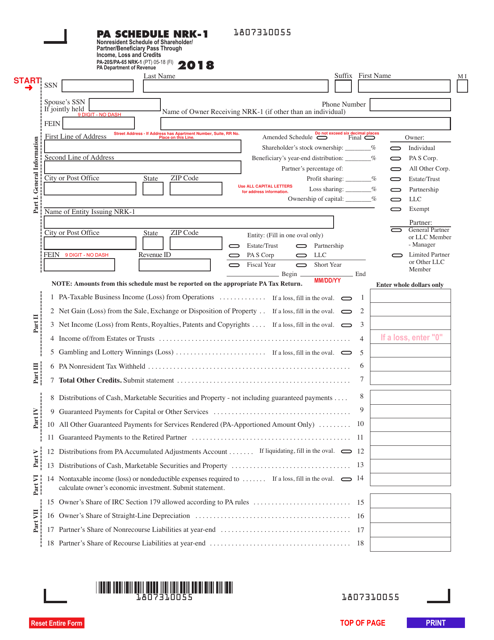

This Form is used for reporting nonresident shareholders/partners/beneficiaries pass through income, loss, and credits in Pennsylvania.

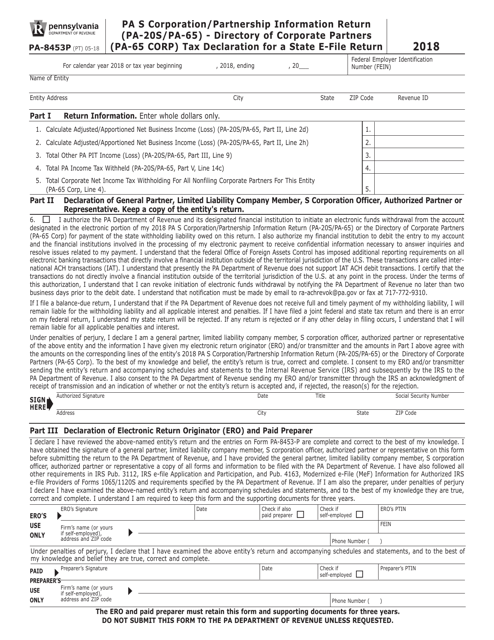

This form is used for Pennsylvania S corporations and partnerships to provide information for their state tax return. It is specifically for the purpose of declaring corporate partners and must be included when filing the PA-20S/PA-65 state e-file return.

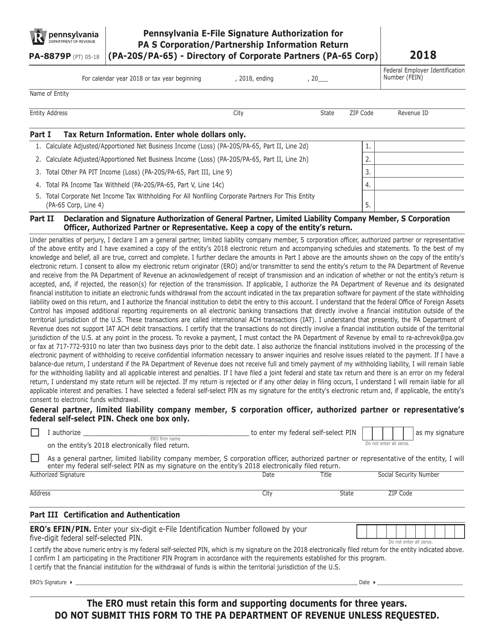

This form is used for Pennsylvania S Corporations and Partnerships to authorize their E-file Signature for their Information Return. It is specifically related to the Directory of Corporate Partners.

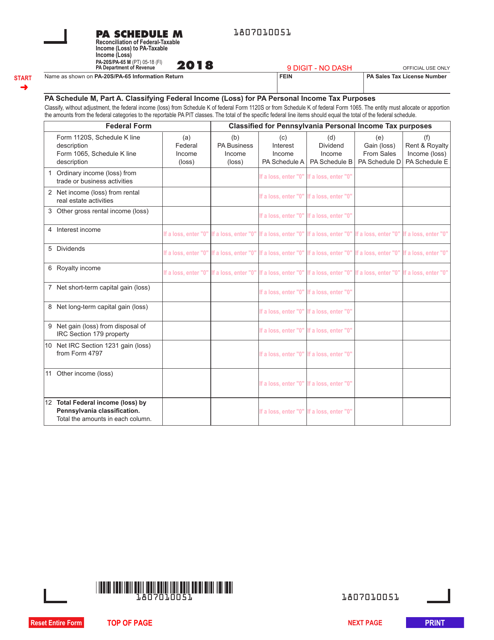

This Form is used for reconciling federal-taxable income (loss) to Pennsylvania taxable income (loss) in Pennsylvania.