Fill and Sign Pennsylvania Legal Forms

Documents:

4630

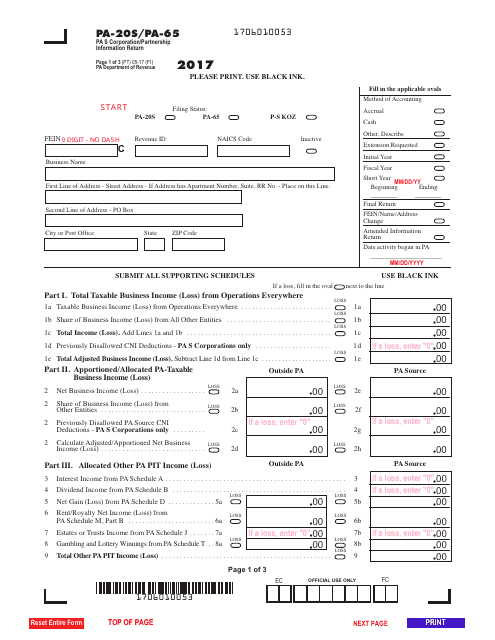

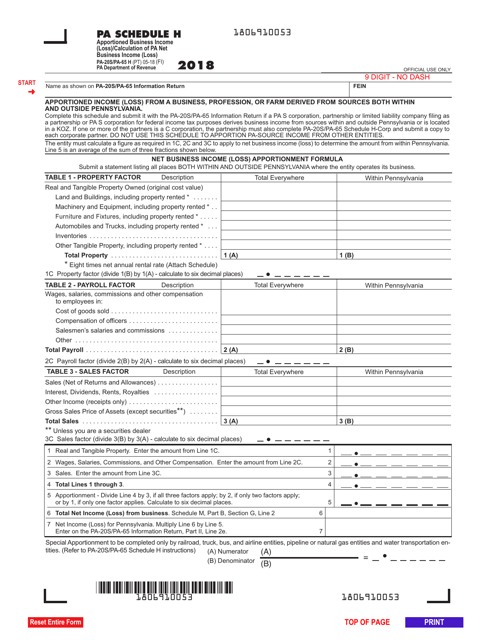

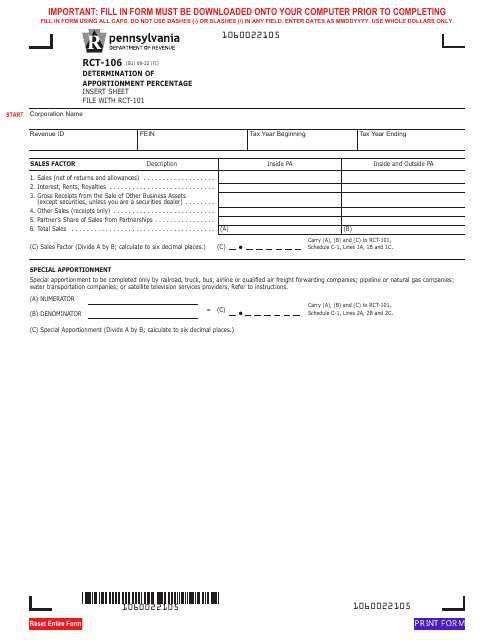

This Form is used for Pennsylvania S corporations and partnerships to file their annual information return.

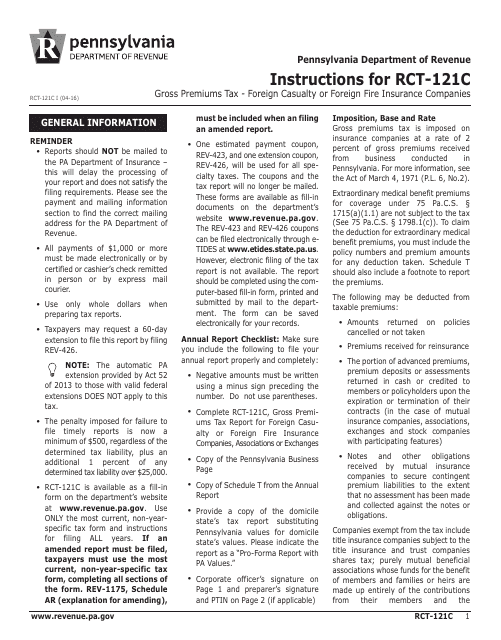

This Form is used for reporting the gross premiums tax for foreign casualty or foreign fire insurance companies operating in Pennsylvania. It provides instructions on how to fill out the RCT-121C Gross Premiums Tax Report accurately and comply with state regulations.

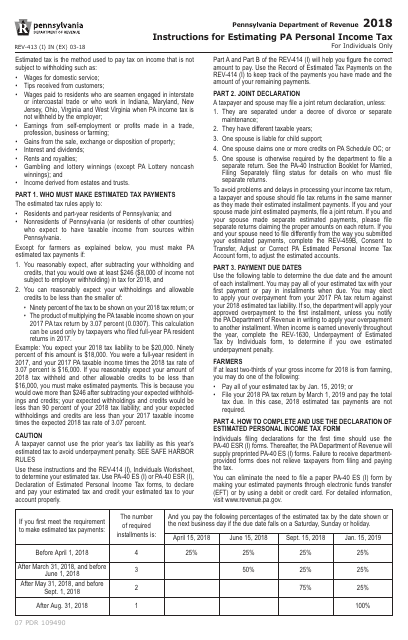

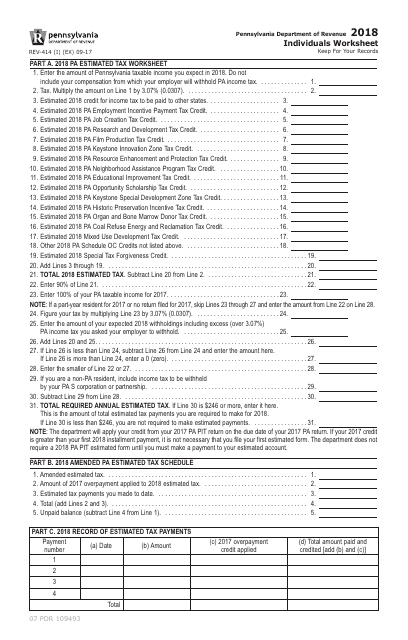

This document provides instructions for estimating Pennsylvania personal income tax. It guides taxpayers on how to accurately calculate and report their estimated tax liability.

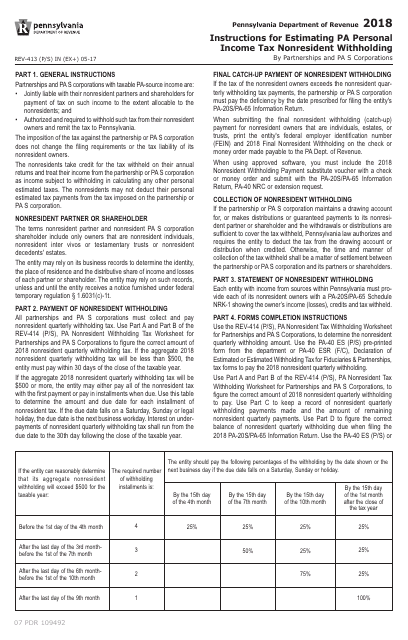

This Form is used for estimating the Pennsylvania personal income tax nonresident withholding for individuals. It provides instructions on how to calculate and pay the appropriate amount of withholding tax for nonresident individuals in Pennsylvania.

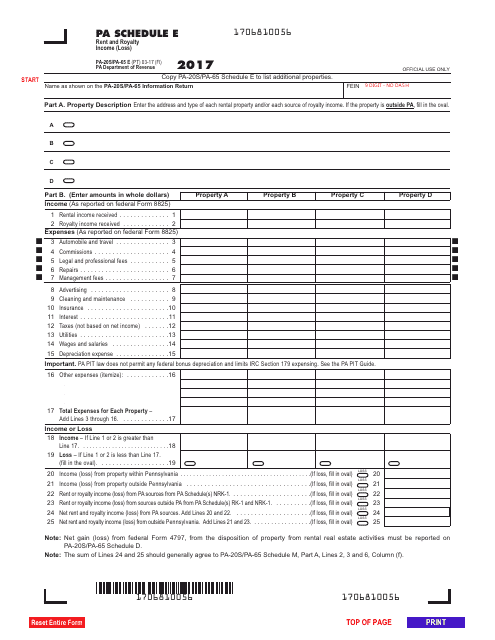

This form is used for reporting rental and royalty income or loss in the state of Pennsylvania for partnerships or S corporations.

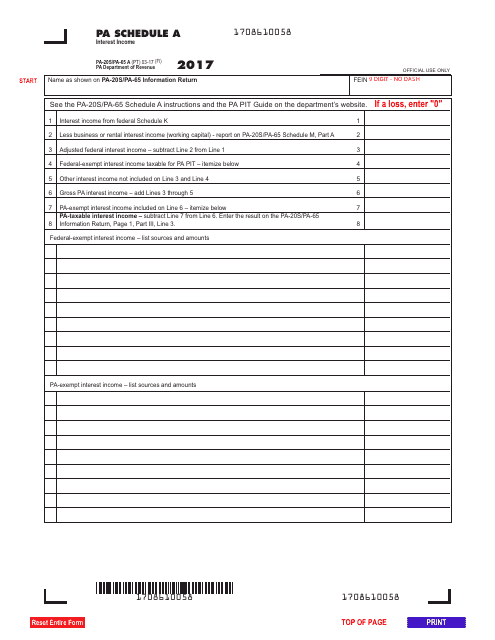

This form is used for reporting interest income in the state of Pennsylvania.

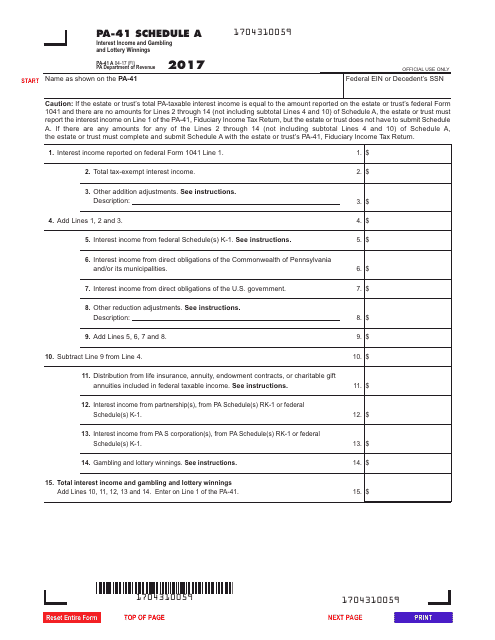

This Form is used for reporting interest income and gambling and lottery winnings in Pennsylvania.

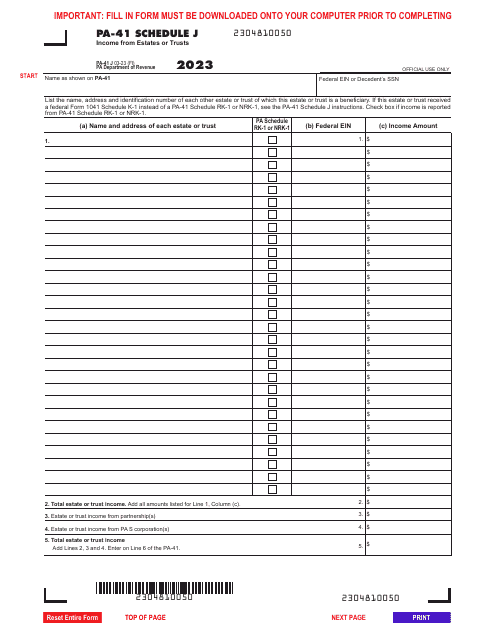

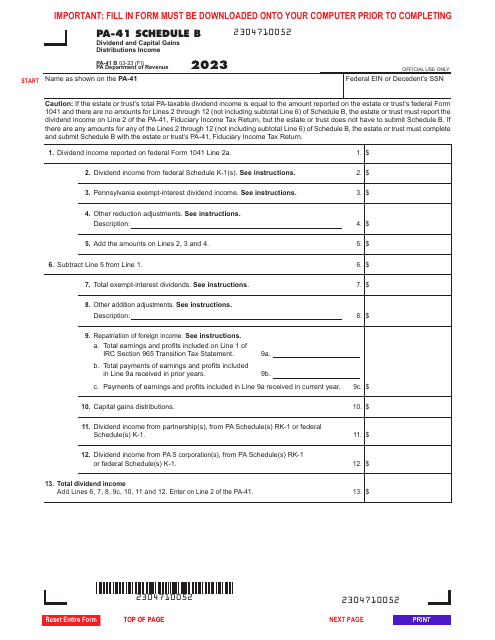

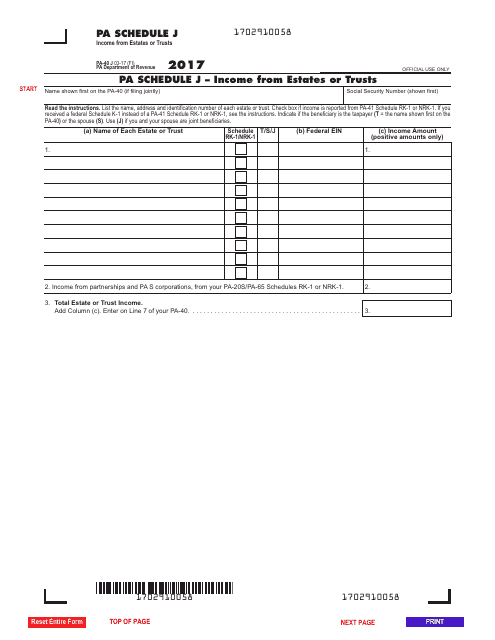

This form is used for reporting income from estates or trusts in Pennsylvania. It helps individuals to calculate and report their income from these sources for tax purposes.

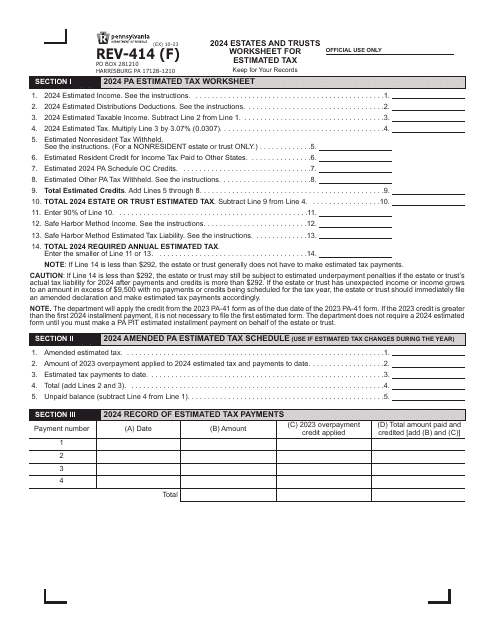

This form is used for individuals in Pennsylvania to complete a worksheet related to their taxes.

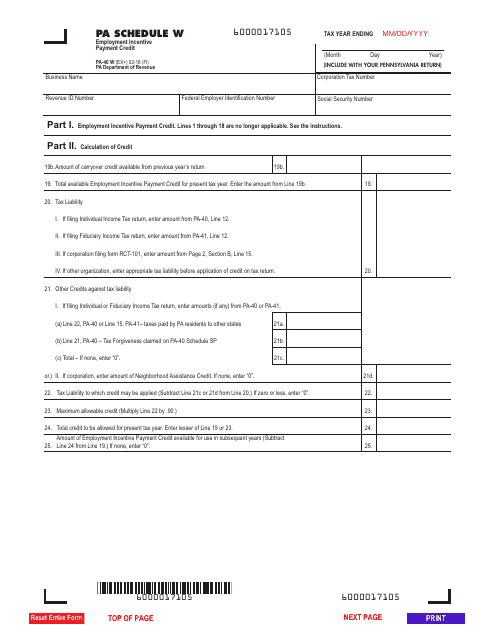

This form is used for reporting the Employment Incentive Payment Credit in Pennsylvania.

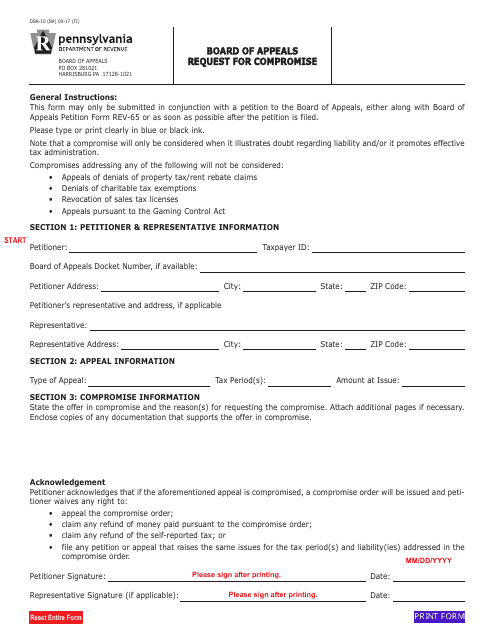

This Form is used for filing a request for compromise with the Board of Appeals in Pennsylvania.

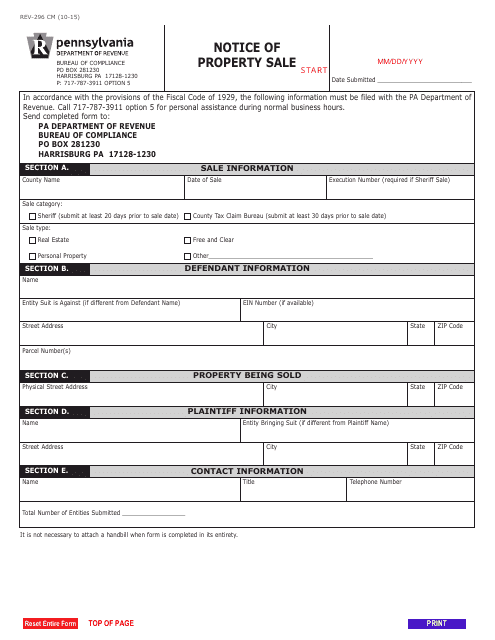

This form is used for notifying the state of Pennsylvania about the sale of a property. It is important to complete and submit this form to comply with state regulations.

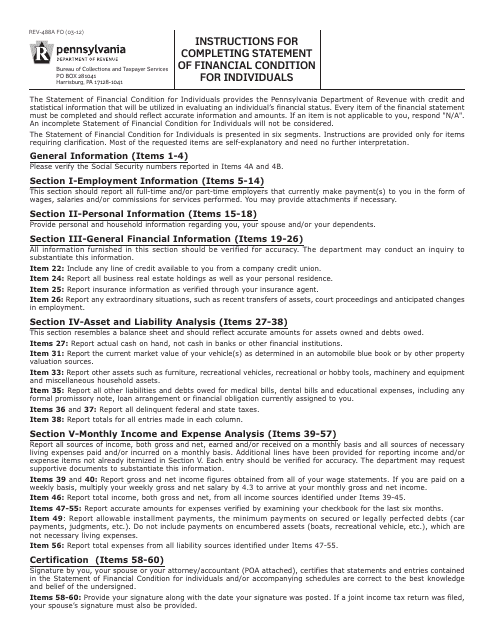

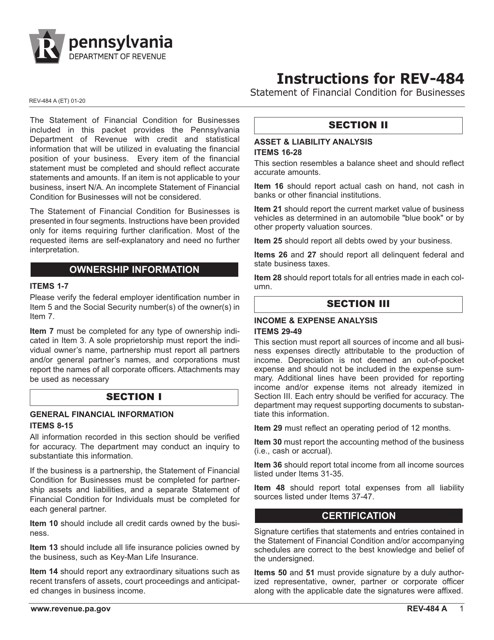

This Form is used for individuals in Pennsylvania to provide their financial condition statement.

This form is used for submitting an official appeal waiver in the state of Pennsylvania.

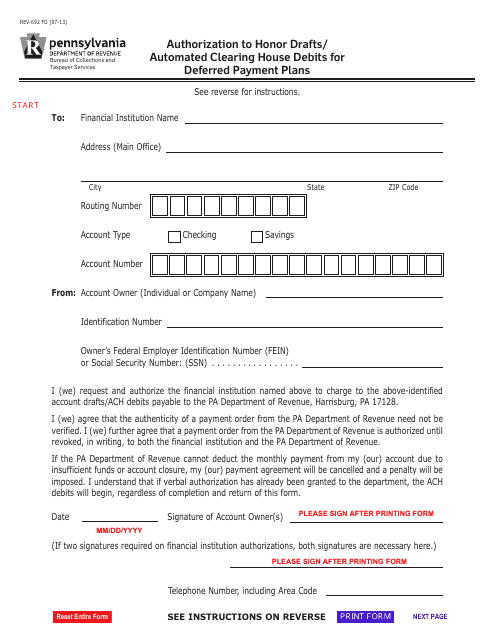

This Form is used in Pennsylvania to authorize the honoring of drafts or Automated Clearing House (ACH) debits for deferred payment plans.

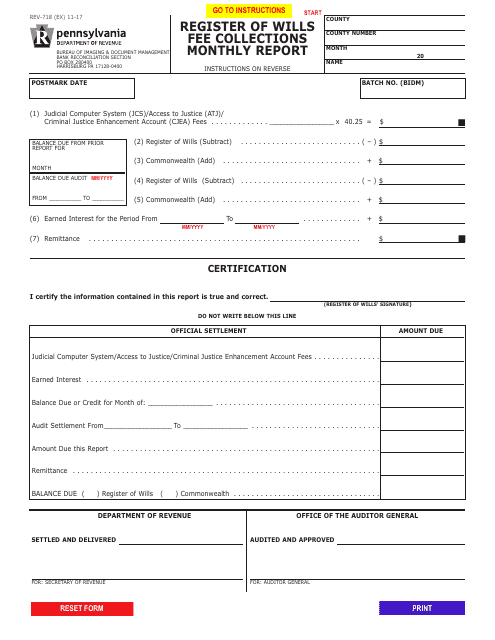

This Form is used for reporting monthly fee collections by the Register of Wills in Pennsylvania. It assists in keeping track of the fees collected each month.

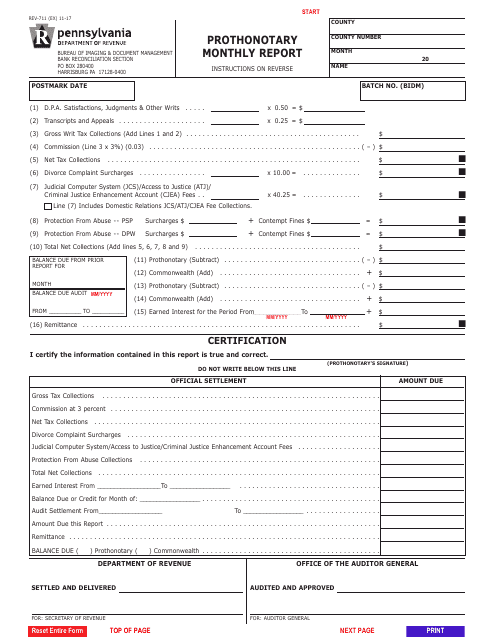

This form is used for submitting the monthly report of the Prothonotary in Pennsylvania. It contains important information about the activities and caseload of the Prothonotary's office during the month.

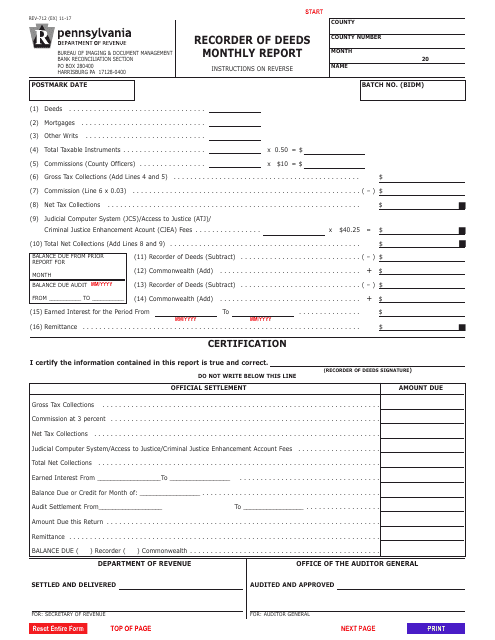

This form is used for submitting a monthly report to the Recorder of Deeds in Pennsylvania. It provides information on property transactions recorded during the specified month.

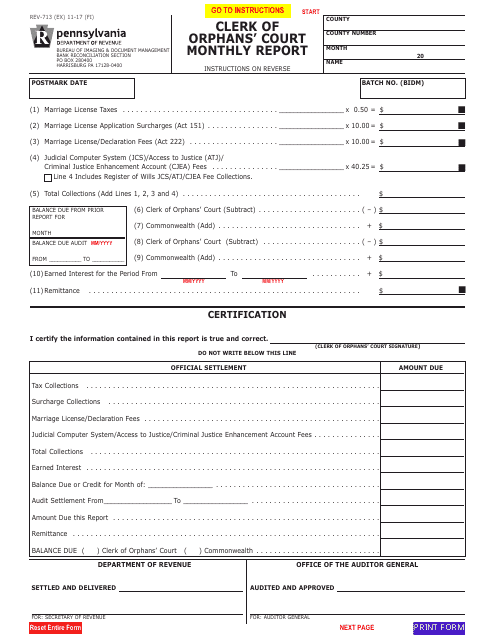

This form is used for the monthly report that is submitted by the Clerk of Orphans' Court in Pennsylvania. It provides information on the court's activities and proceedings.

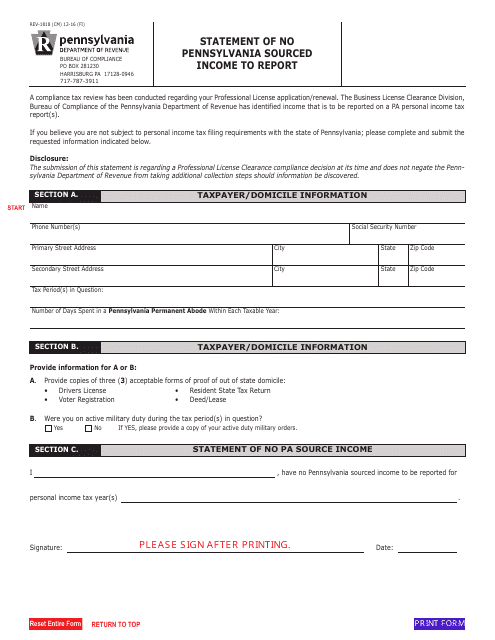

This form is used for residents of Pennsylvania to declare that they have no income from Pennsylvania sources to report.

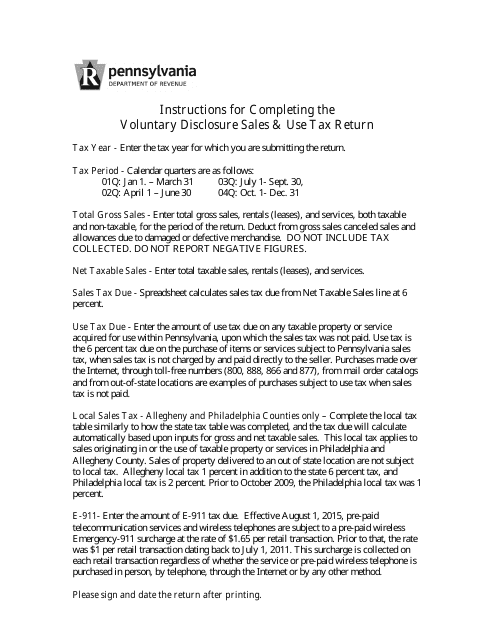

This document provides instructions for filing a Voluntary Disclosure Sales & Use Tax Return in Pennsylvania. It guides individuals on how to report and pay their sales and use taxes through the voluntary disclosure program.

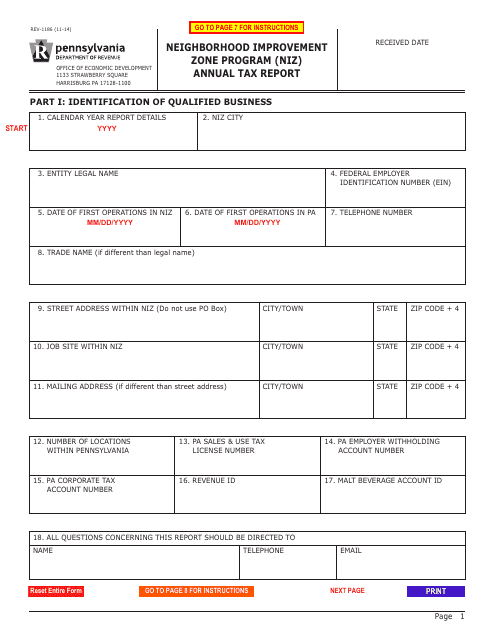

This form is used for reporting annual taxes under the Neighborhood Improvement Zone (NIZ) Program in Pennsylvania.

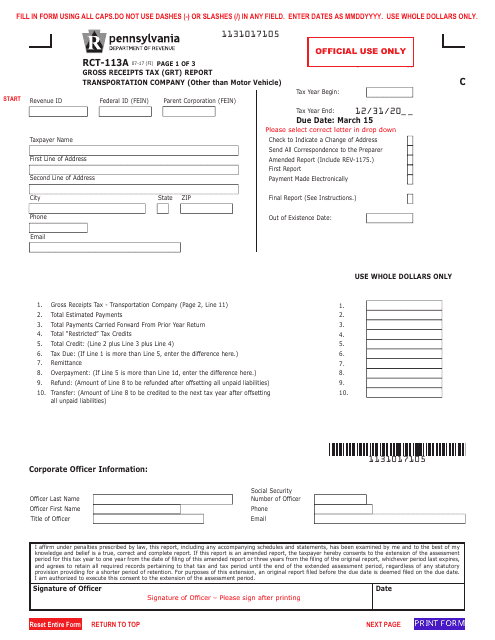

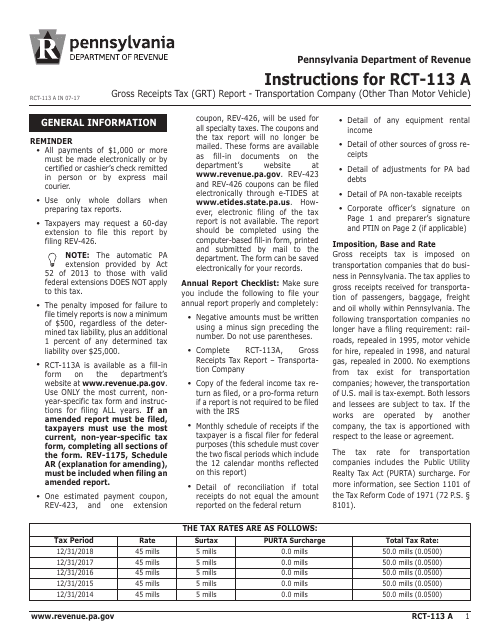

This form is used for reporting gross receipts tax for transportation companies in Pennsylvania that are not motor vehicle companies.

This Form is used for reporting Gross Receipts Tax (GRT) for transportation companies in Pennsylvania, excluding those operating motor vehicles. It provides instructions on how to accurately report and pay the tax.

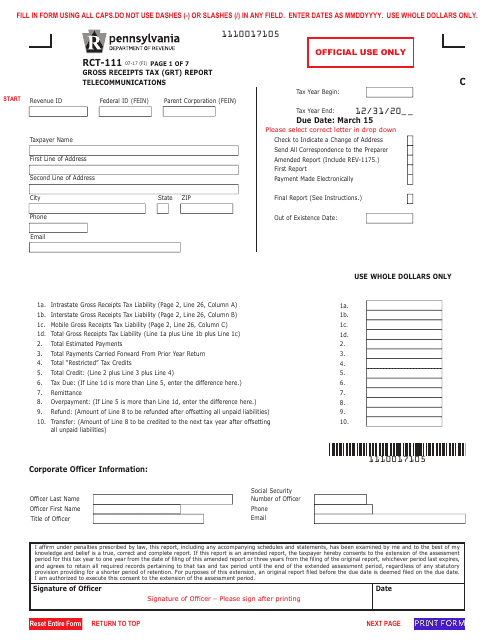

This form is used for reporting gross receipts tax (GRT) in the telecommunications industry in Pennsylvania.

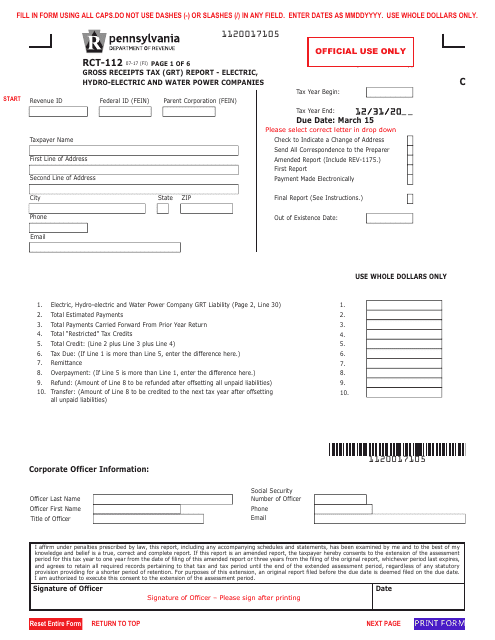

This Form is used for reporting the gross receipts tax for electric, hydro-electric, and water power companies in Pennsylvania.

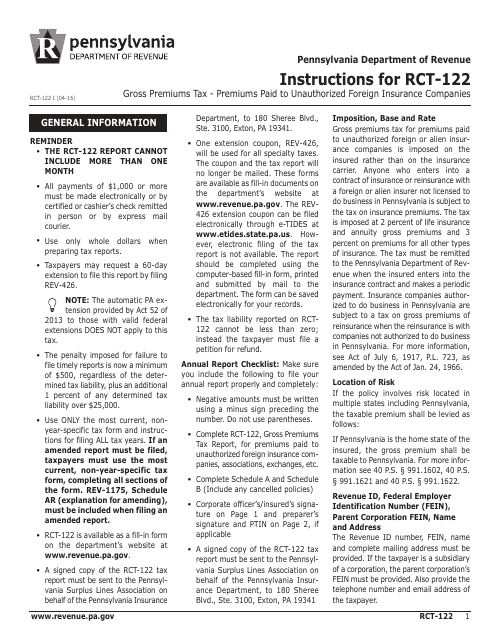

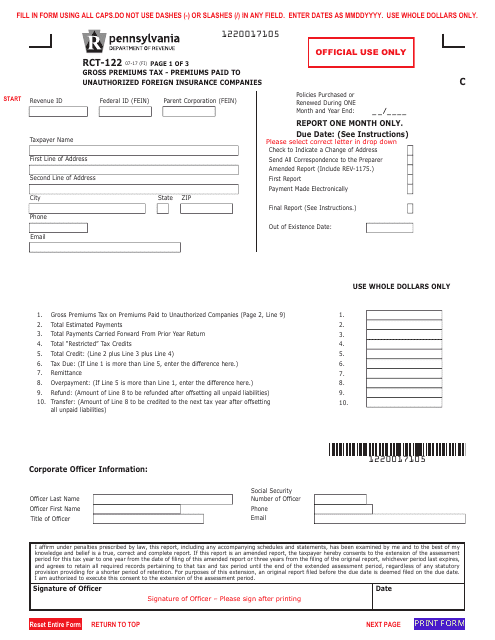

This Form is used for reporting and paying gross premiums tax on premiums paid to unauthorized foreign insurance companies in Pennsylvania.

This form is used for reporting gross premiums paid to unauthorized foreign insurance companies in Pennsylvania for tax purposes.