Fill and Sign Pennsylvania Legal Forms

Documents:

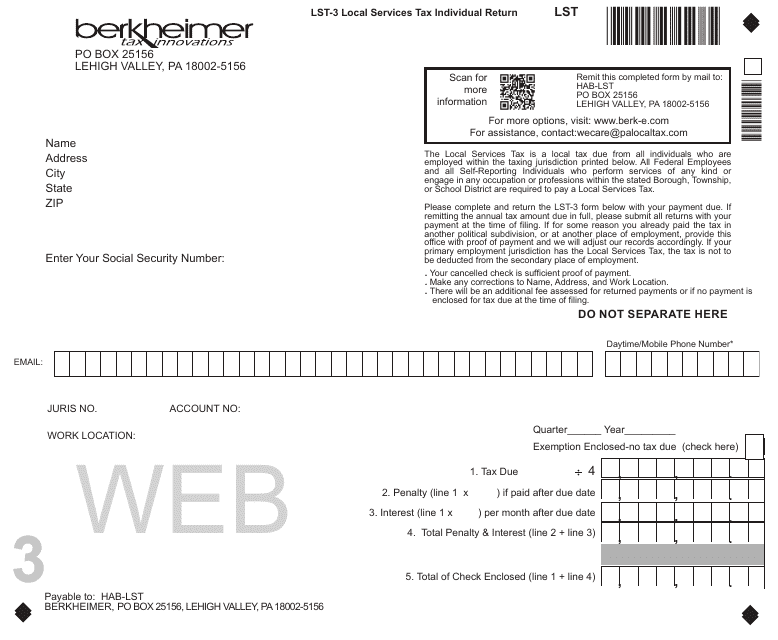

4630

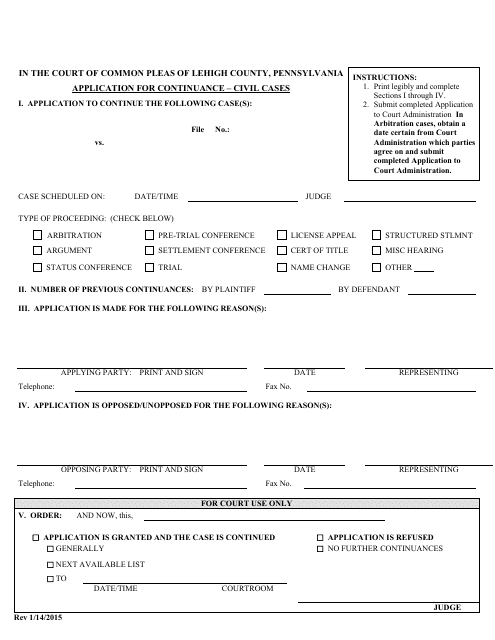

This document is used for requesting a continuance of civil cases in Lehigh County, Pennsylvania.

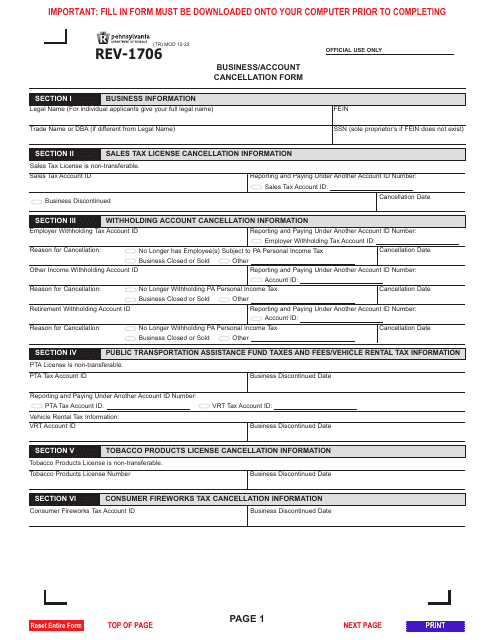

This is a legal document you need to fill out if you discontinue or sell your business, and if you cease all business operations of an entity situated in Pennsylvania.

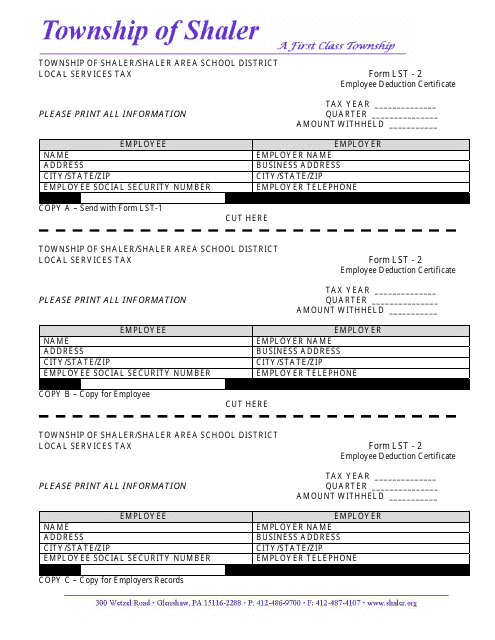

This form is used for obtaining an Employee Deduction Certificate from the Township of Shaler, Pennsylvania.

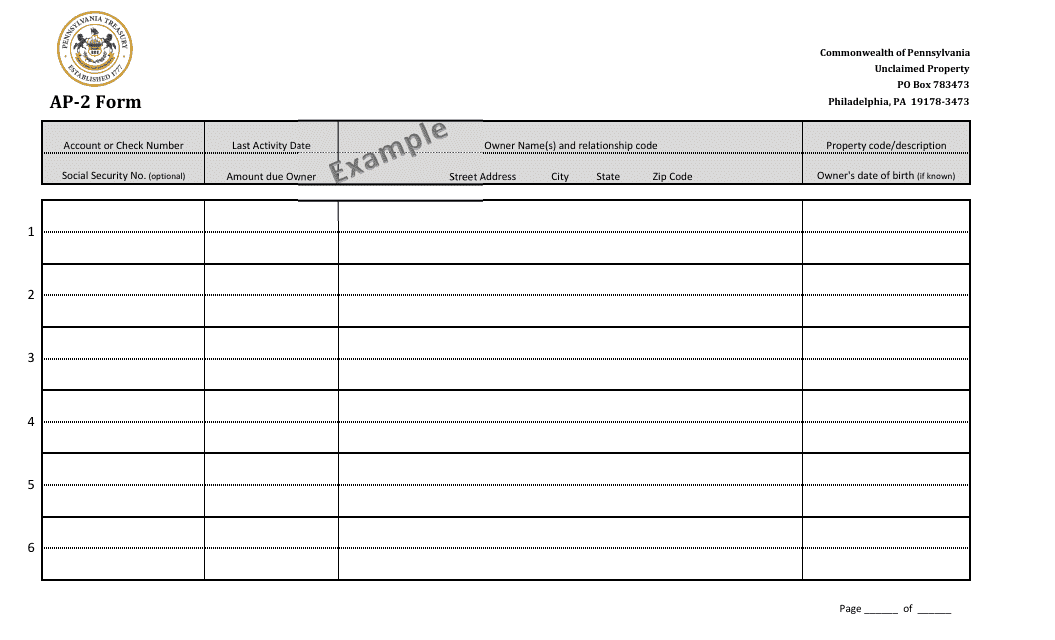

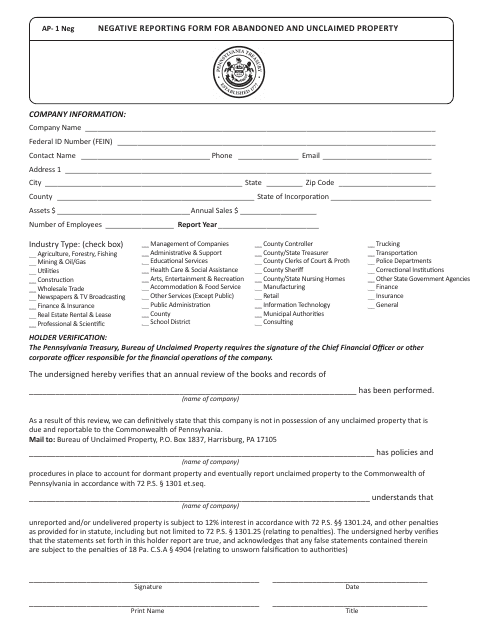

This is a report for abandoned and unclaimed property issued by the Pennsylvania Treasury Department. This state-specific form is submitted by every company, business, or institution that is not in possession of any unclaimed property abandoned by its owner.

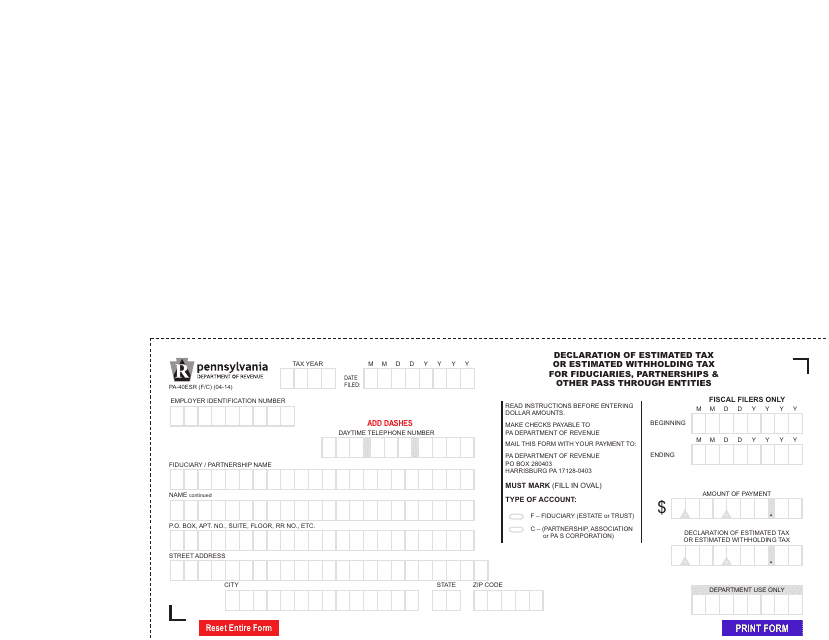

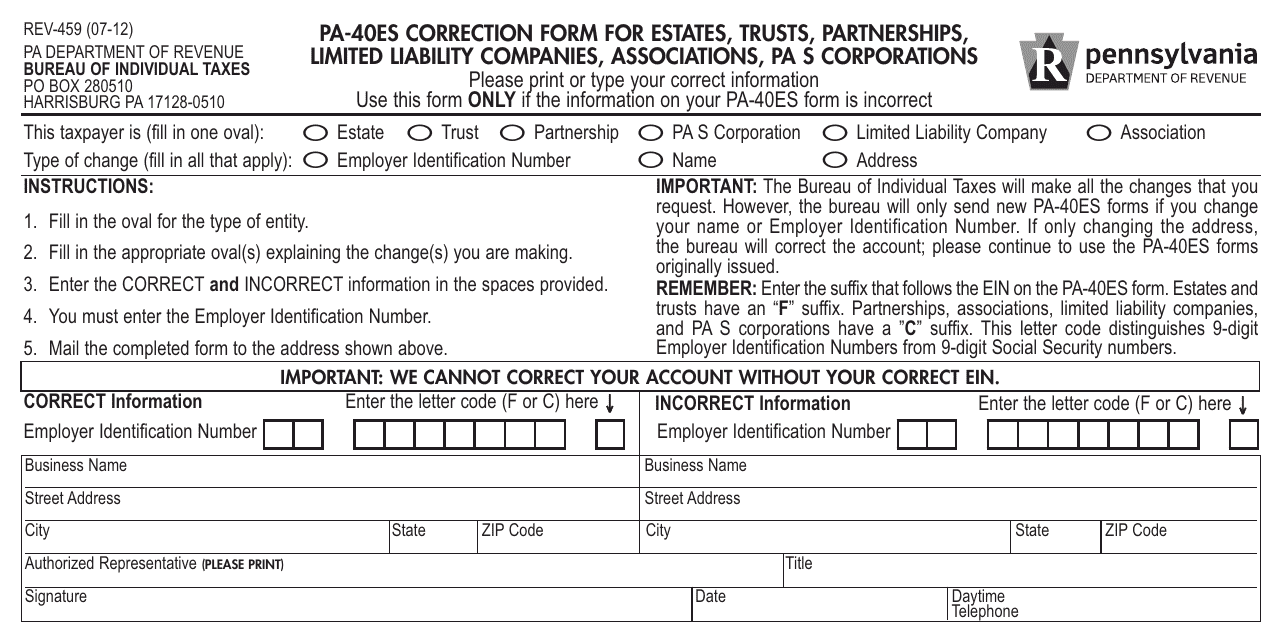

This form is used for fiduciaries, partnerships, and other pass-through entities in Pennsylvania to declare their estimated tax or estimated withholding tax.

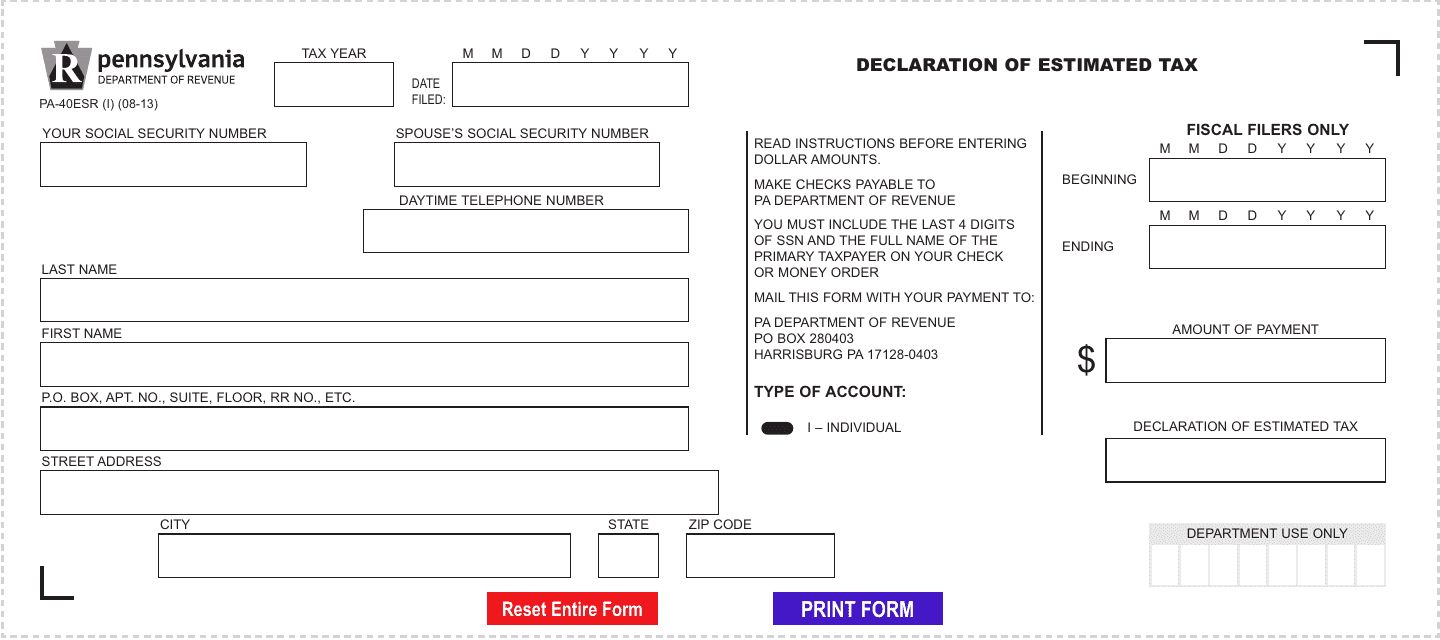

This form is used for declaring estimated tax in the state of Pennsylvania.

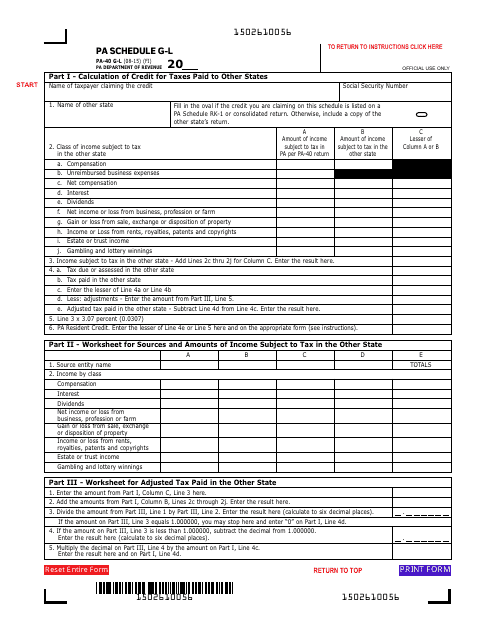

This form is used for claiming the Resident Credit for Taxes Paid in Pennsylvania for individuals filing their Pennsylvania state income tax return.

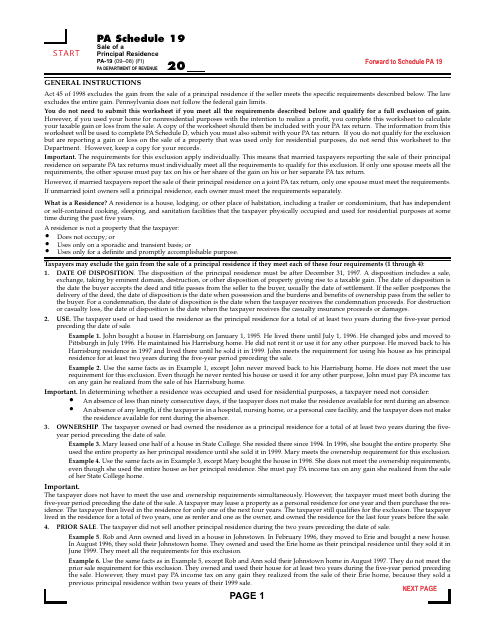

This document is used for reporting the sale of a primary residence in Pennsylvania for tax purposes. It is specific to Pennsylvania residents.

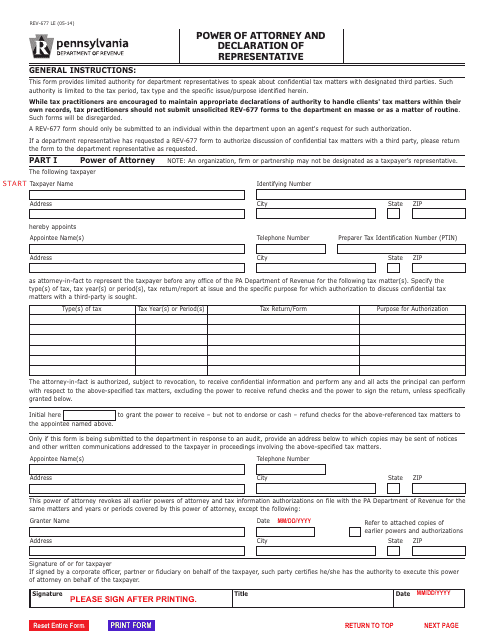

This form is used for creating a power of attorney and declaring a representative in the state of Pennsylvania.

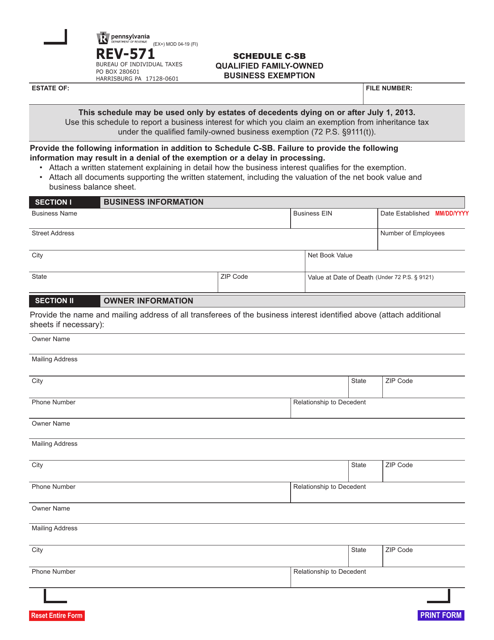

This Form is used for claiming small business exemption in Pennsylvania. It provides instructions on filling out Schedule C-SB.

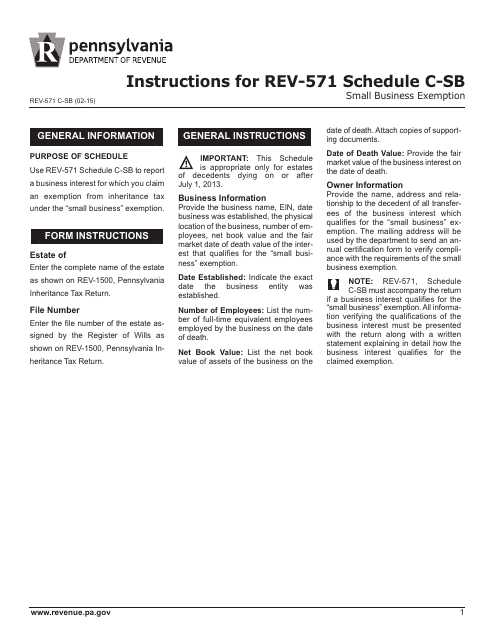

This form is used for submitting a monthly report to the Register of Wills in Pennsylvania. It provides information about the activities and transactions handled by the Register of Wills office.

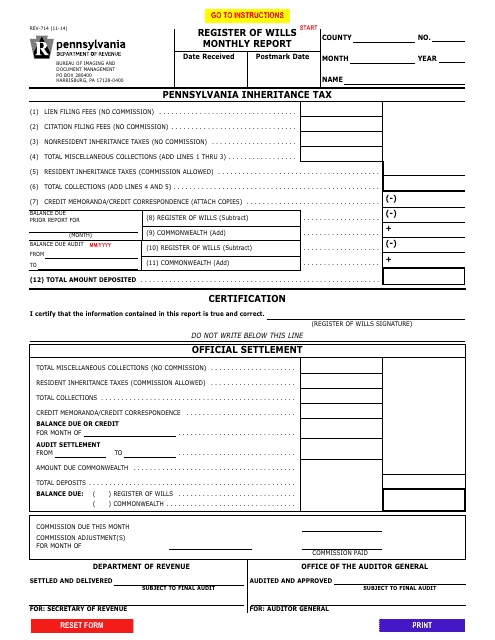

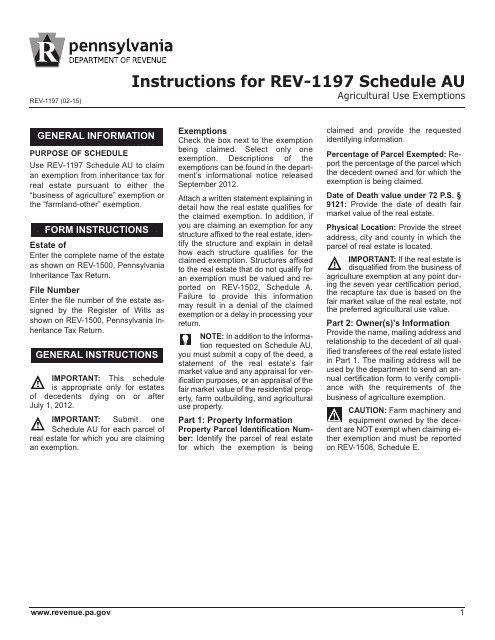

This Form is used for reporting agricultural use exemptions in Pennsylvania. It provides instructions on how to fill out Schedule AU for claiming tax exemptions on agricultural properties.

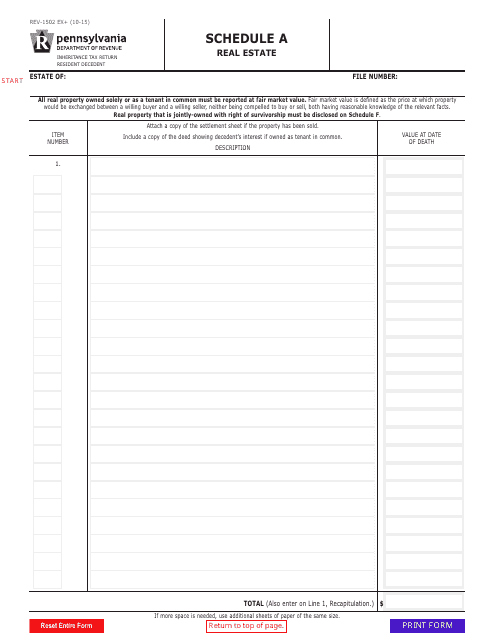

This form is used for reporting real estate information in Pennsylvania. It is known as Schedule A of Form REV-1502.

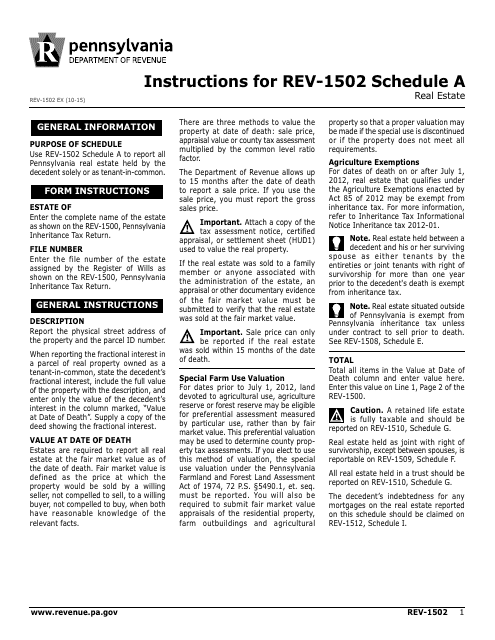

This document provides instructions for completing Form REV-1502 Schedule A, which is a real estate schedule in Pennsylvania. It guides taxpayers on how to report their real estate income and expenses accurately.

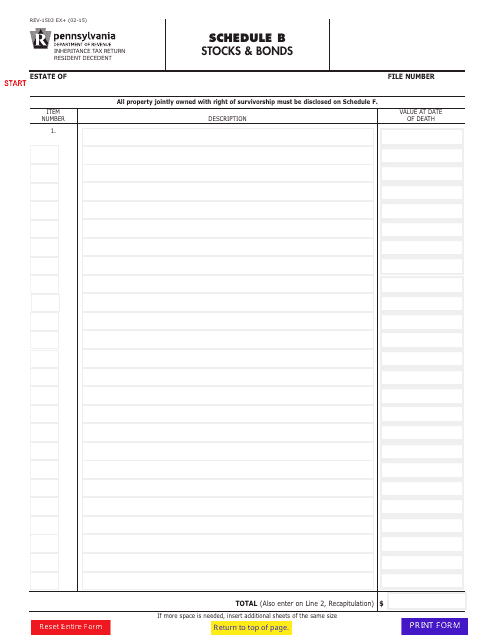

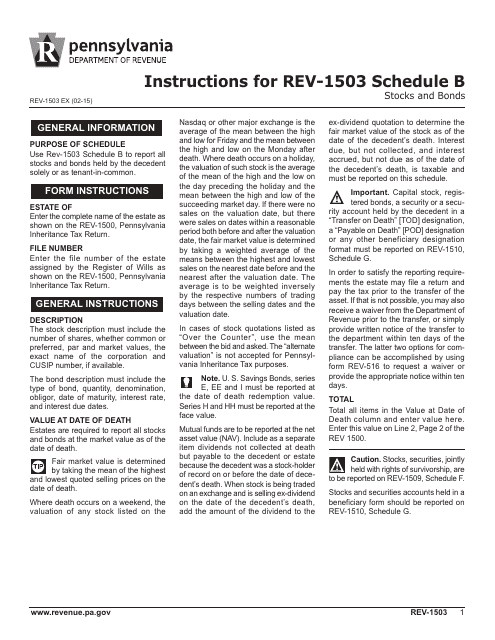

This form is used for reporting stocks and bonds in the state of Pennsylvania.

This Form is used for reporting stocks and bonds held by individuals or businesses in Pennsylvania for tax purposes. It provides instructions for completing Schedule B, which is a separate attachment to the Pennsylvania tax return.

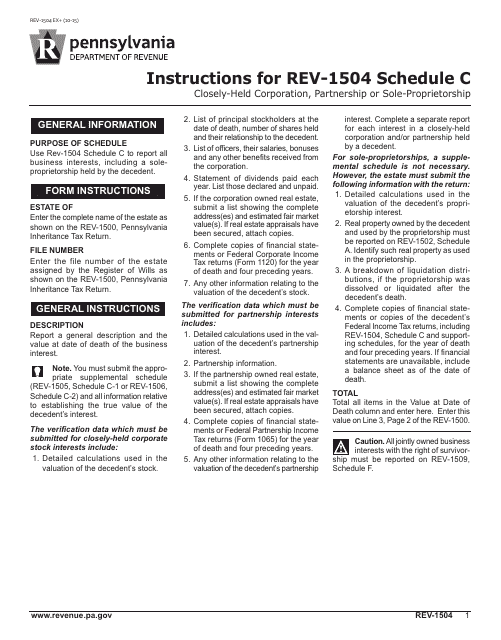

This Form is used for reporting income and deductions for a closely-held corporation, partnership, or sole-proprietorship in the state of Pennsylvania. It provides specific instructions on how to fill out Schedule C of Form REV-1504.

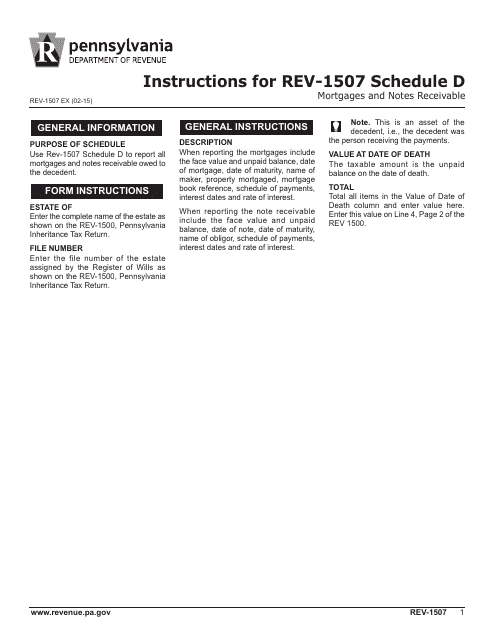

This Form is used for reporting mortgages and notes receivable in Pennsylvania. It provides instructions on how to accurately fill out Schedule D.

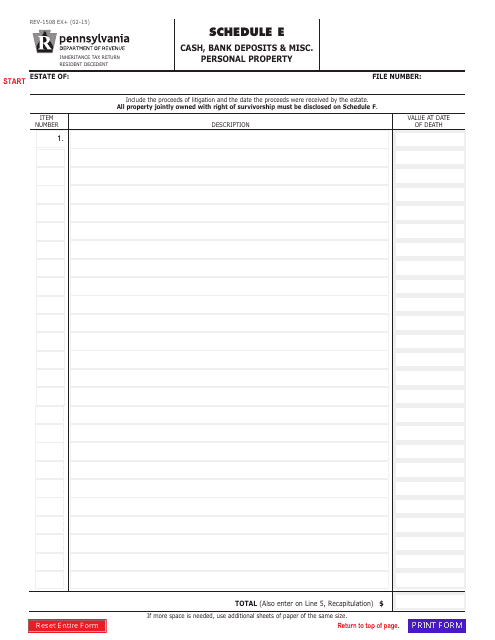

This form is used for reporting cash, bank deposits, and miscellaneous personal property in Pennsylvania.

This Form is used for reporting cash, bank deposits, and miscellaneous personal property in Pennsylvania. It provides instructions for filling out the Schedule E section of Form REV-1508.

This form provides instructions for reporting jointly-owned property in Pennsylvania on Schedule F.

This Form is used for reporting inter-vivos transfers and non-probate property in Pennsylvania. It provides instructions for filling out Schedule G of Form REV-1510.

This form is used for reporting funeral expenses and administrative costs in Pennsylvania. It provides instructions on how to fill out Schedule H of Form REV-1511.

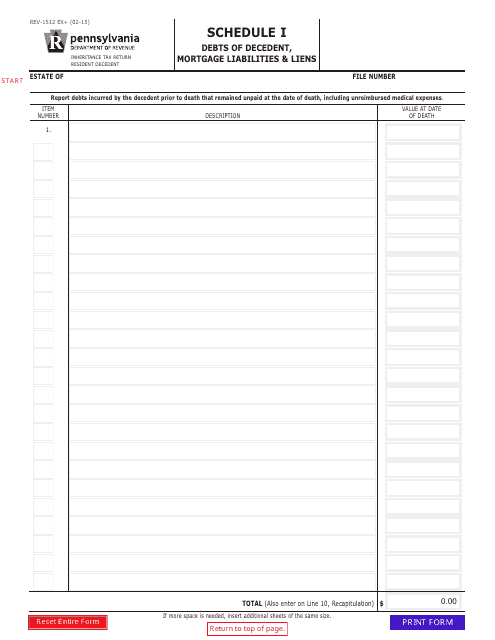

This form is used for reporting the debts, mortgage liabilities, and liens of a deceased individual in Pennsylvania.

This Form is used for reporting the debts of a deceased person, including mortgage liabilities and liens, in the state of Pennsylvania. It provides instructions on how to accurately fill out the Schedule I section of Form REV-1512.

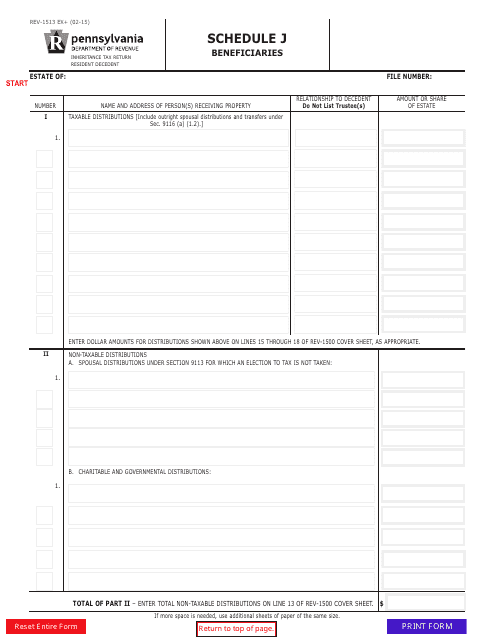

This form is used for reporting beneficiaries in the state of Pennsylvania.

This Form REV-1513 Schedule J Beneficiaries is used for reporting beneficiaries in Pennsylvania. It provides instructions for completing the schedule and ensuring accurate reporting.