Tax Exempt Form Templates

Documents:

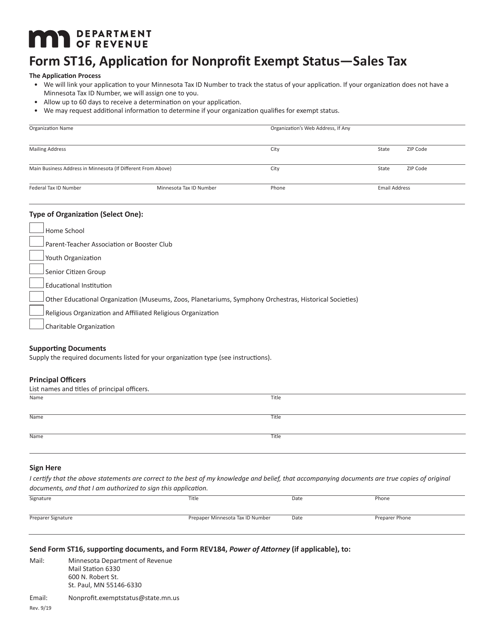

1303

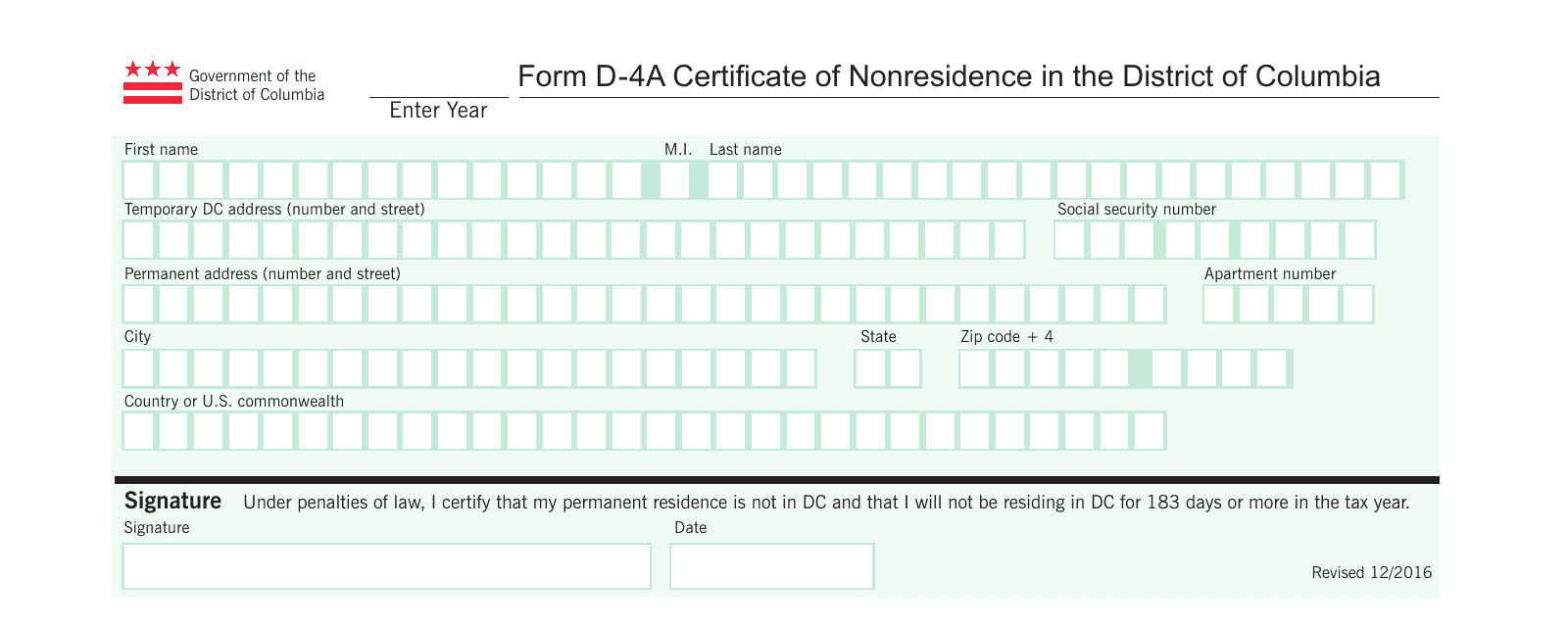

This Form is used for declaring nonresidence status in the District of Columbia for tax purposes.

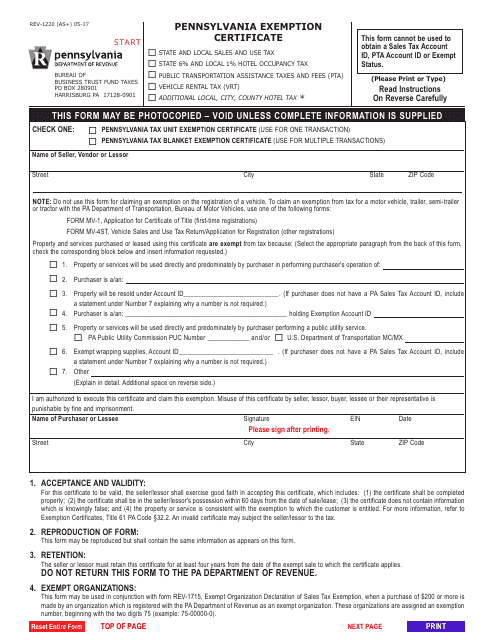

This document is a Pennsylvania Exemption Certificate used for tax purposes in the state of Pennsylvania. It is used to claim exemptions from certain types of taxes.

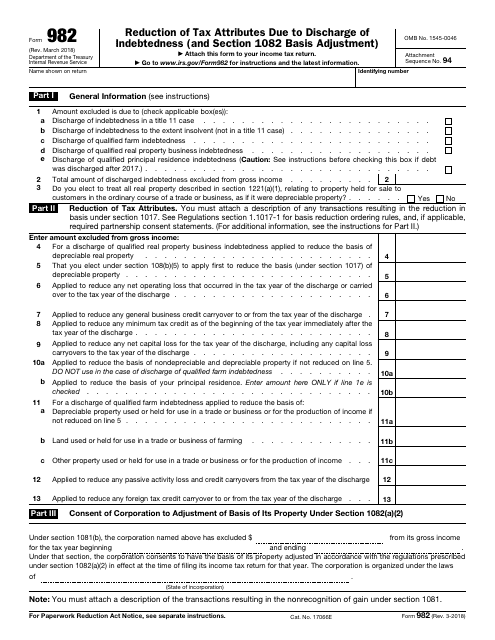

This is a formal instrument used by taxpayers to explain to fiscal authorities why certain debts should not be taken into account as a part of their income.

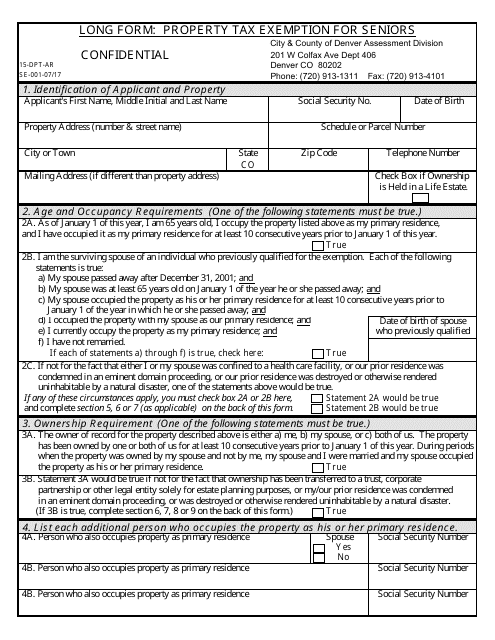

This form is used for applying for property tax exemption for seniors in Colorado. It is the long form version of Form 15-DPT-AR. This document is important for seniors who want to qualify for a property tax exemption in Colorado.

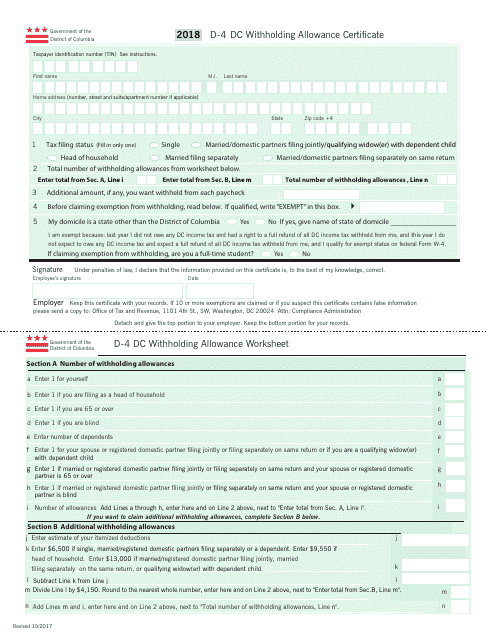

This form is used for Washington, D.C. residents to determine the amount of tax to be withheld from their paycheck.

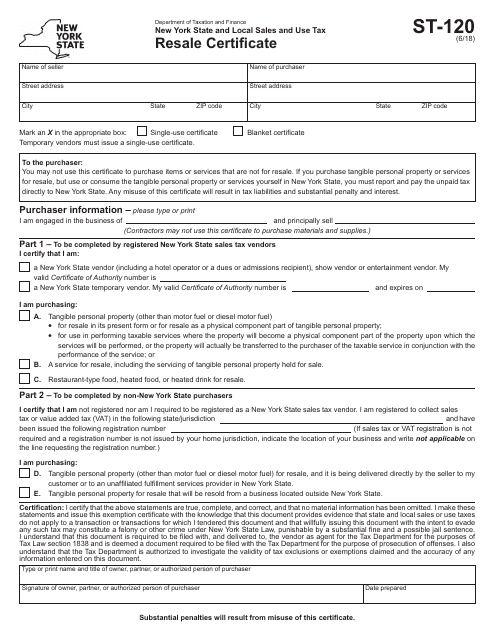

This Form is used for businesses in New York to provide a resale certificate for tax-exempt purchases.

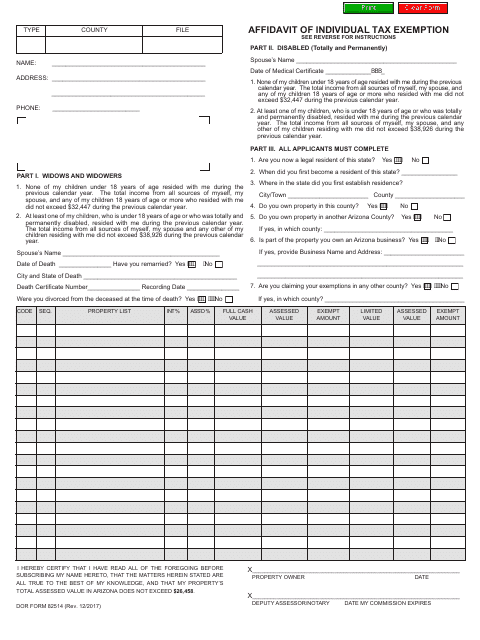

This form is used for individuals in Arizona to claim a tax exemption.

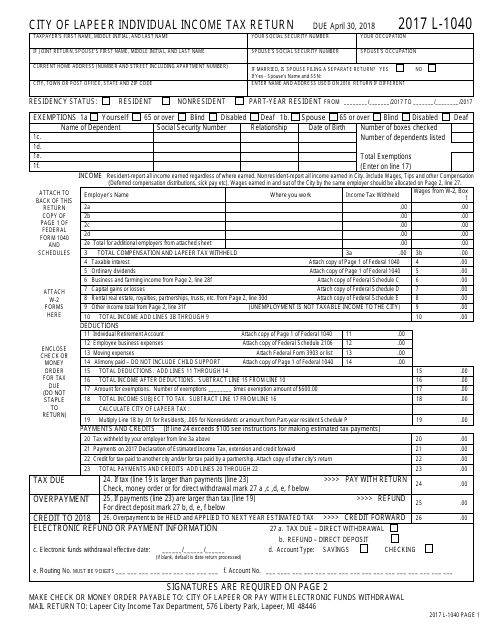

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

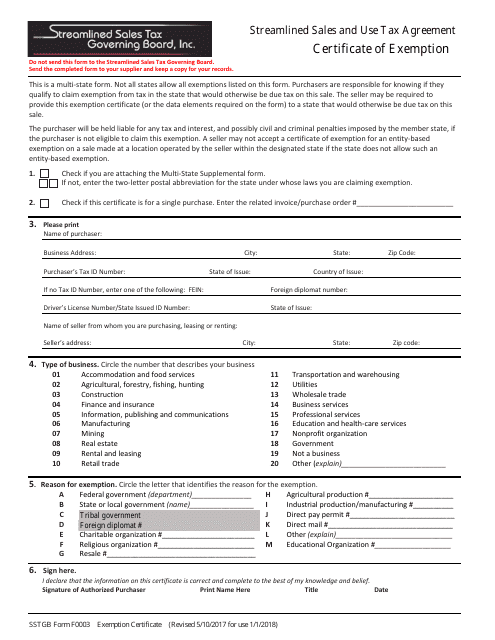

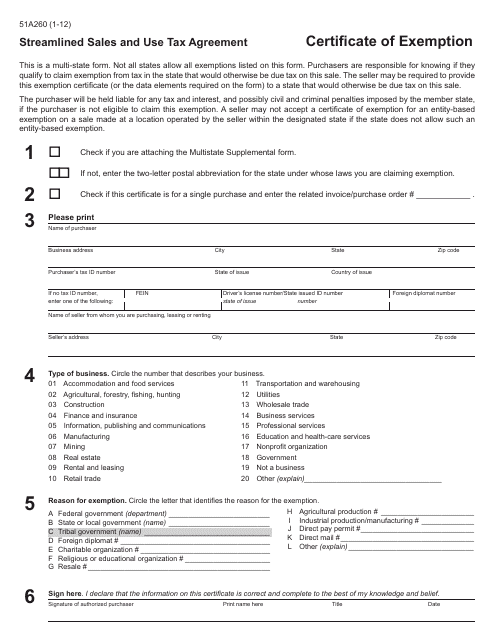

This form is used for applying for a Certificate of Exemption under the Streamlined Sales and Use Tax Agreement in West Virginia.

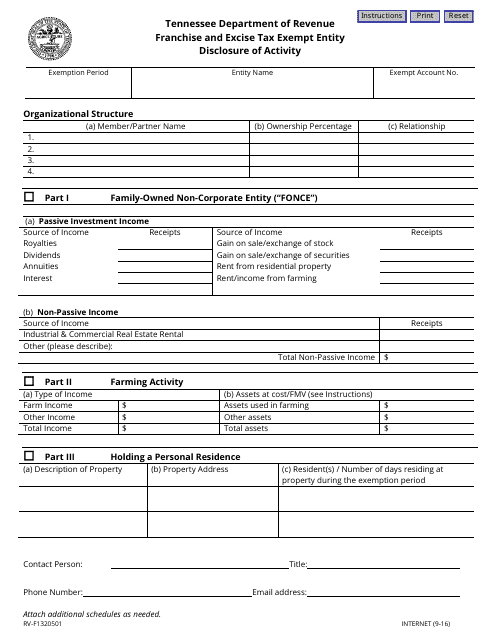

This Form is used for Tennessee businesses to disclose their activity as an exempt entity for franchise and excise tax purposes.

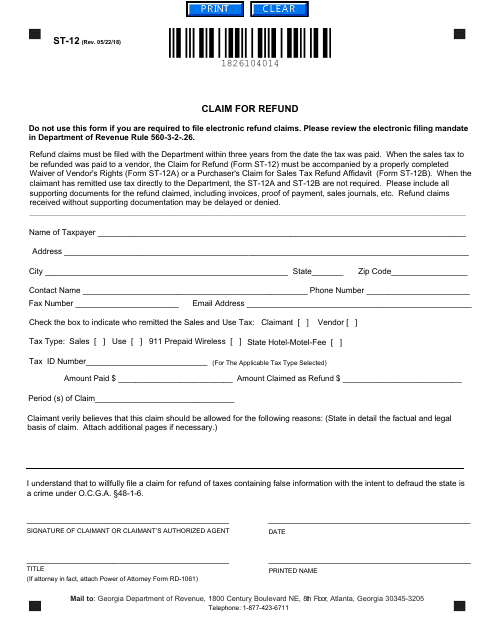

This Form is used for claiming a refund in the state of Georgia, United States.

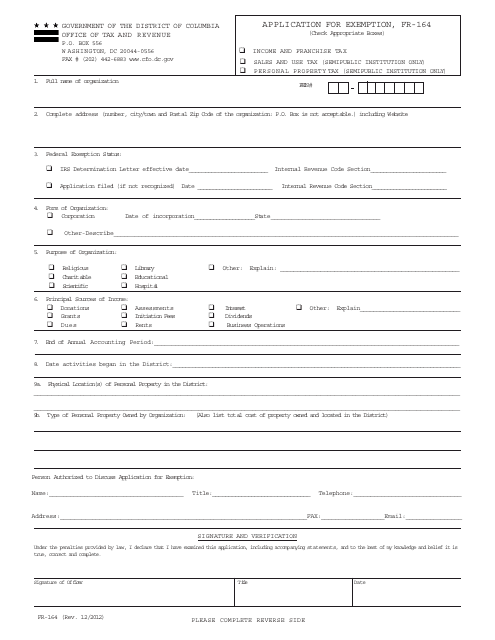

This Form is used for applying for an exemption in Washington, D.C.

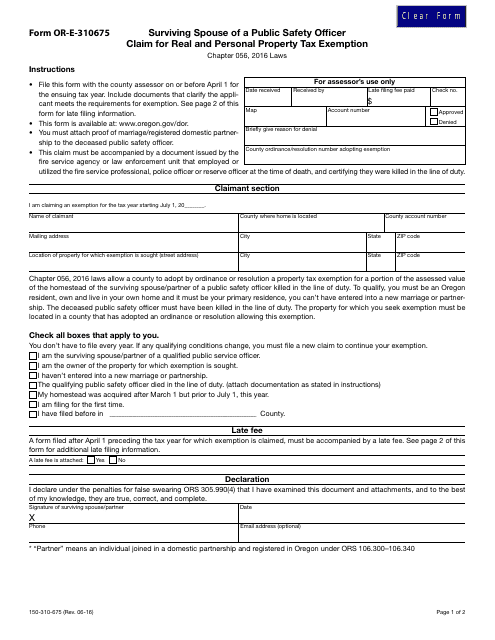

This form is used for a surviving spouse of a public safety officer to claim a real and personal property tax exemption in the state of Oregon.

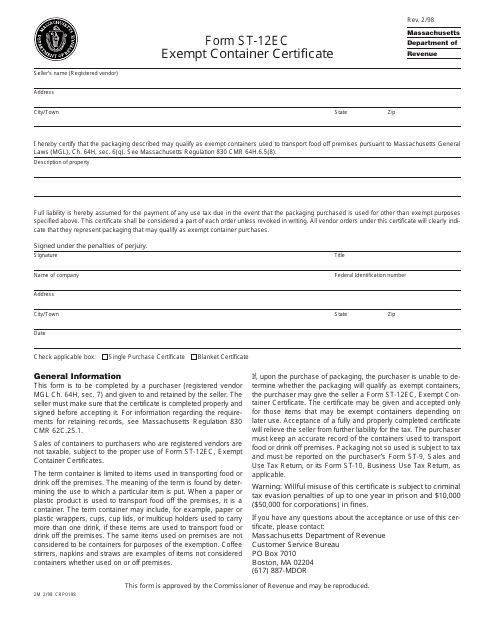

This form is used for obtaining an exempt container certificate in Massachusetts.

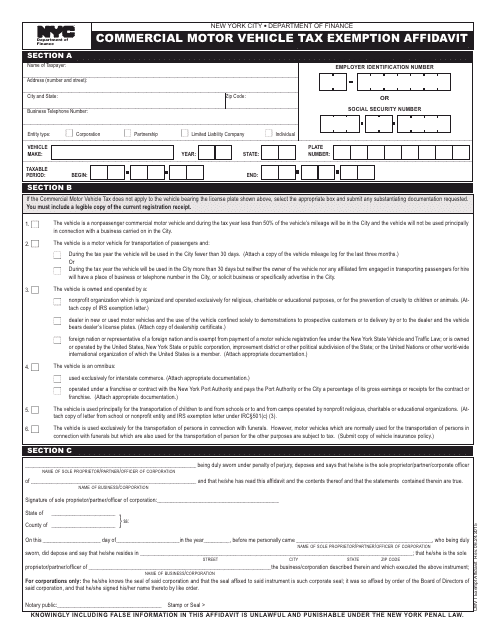

This form is used for applying for a tax exemption for commercial motor vehicles in New York City.

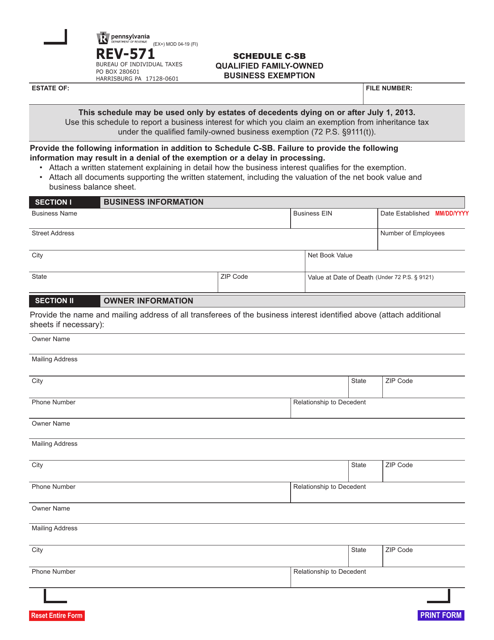

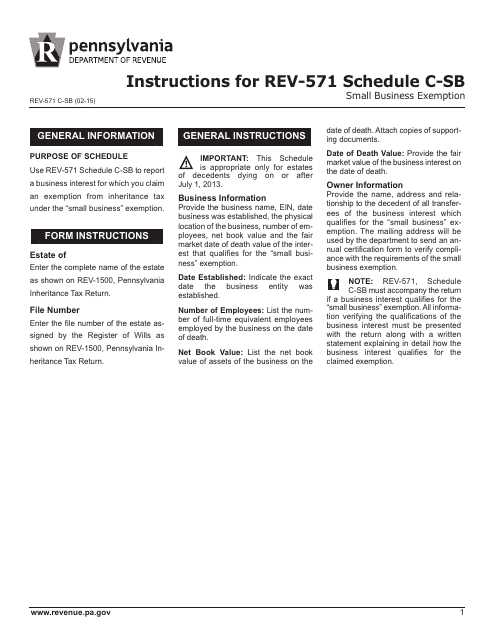

This Form is used for claiming small business exemption in Pennsylvania. It provides instructions on filling out Schedule C-SB.

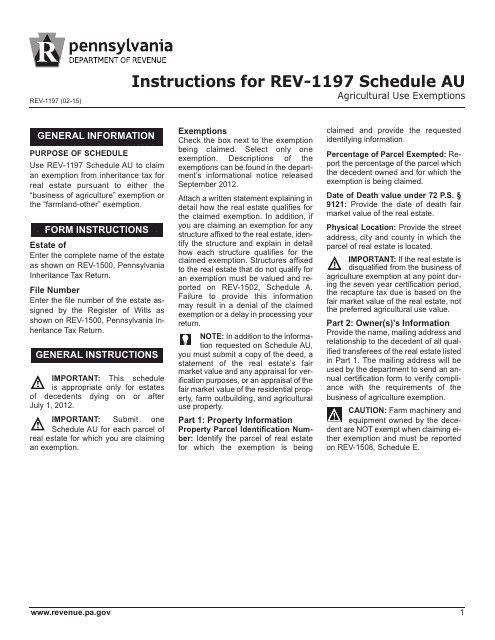

This Form is used for reporting agricultural use exemptions in Pennsylvania. It provides instructions on how to fill out Schedule AU for claiming tax exemptions on agricultural properties.

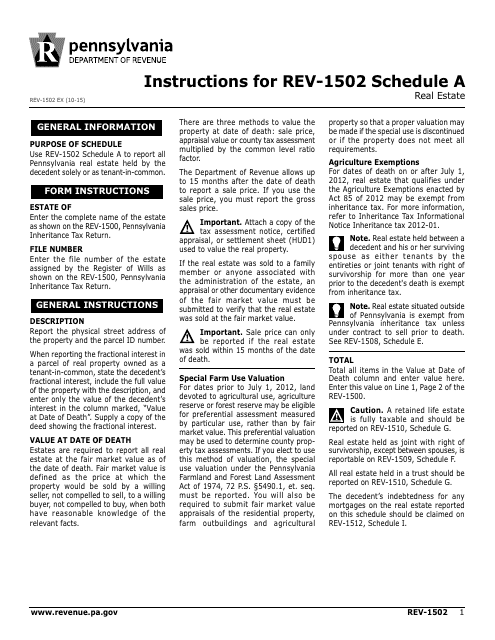

This document provides instructions for completing Form REV-1502 Schedule A, which is a real estate schedule in Pennsylvania. It guides taxpayers on how to report their real estate income and expenses accurately.

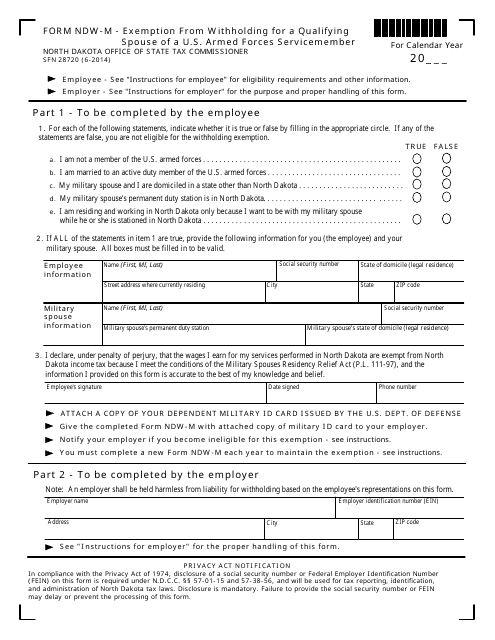

This form is used for claiming exemption from withholding for a qualifying spouse of a U.S. Armed Forces servicemember in North Dakota.

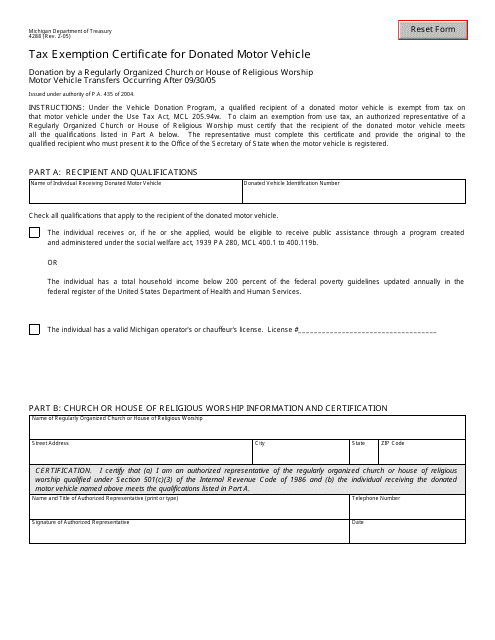

This form is used for obtaining a tax exemption for donating a motor vehicle in Michigan.

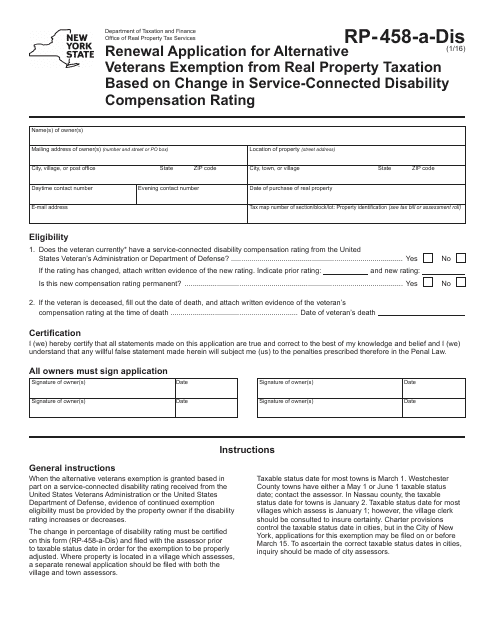

This form is used for renewing the Alternative Veterans Exemption from Real Property Taxation for residents of New York based on a change in their service-connected disability compensation rating.

This form is used for claiming exemption from sales and use tax in Kentucky under the Streamlined Sales and Use Tax Agreement.

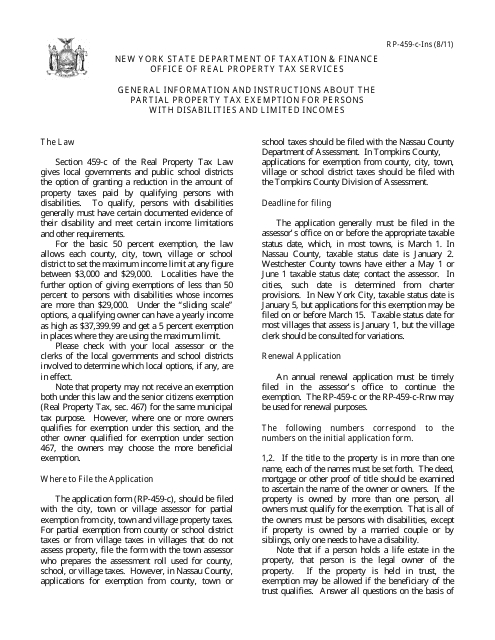

This Form is used for claiming a partial property tax exemption in New York for individuals with disabilities and limited incomes. It provides instructions on how to apply for the exemption and the documentation required.

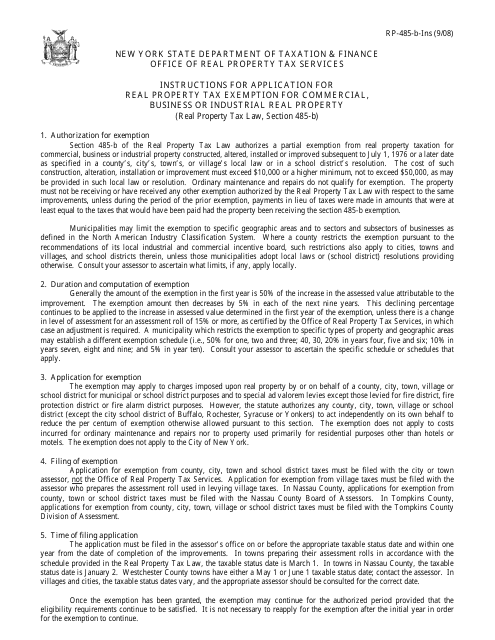

This Form is used for applying for a real property tax exemption for commercial, business or industrial real property in New York.

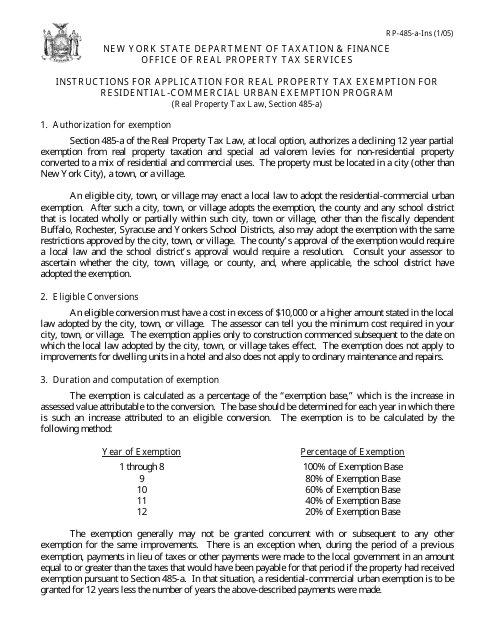

This Form is used for applying for a real property tax exemption under the Residential-Commercial Urban Exemption Program in New York. It provides instructions for completing the application.

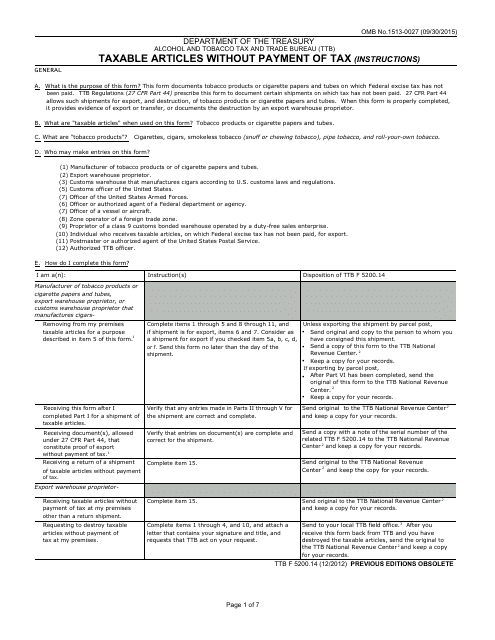

This document is used for reporting the taxable articles that are not paid for with tax.

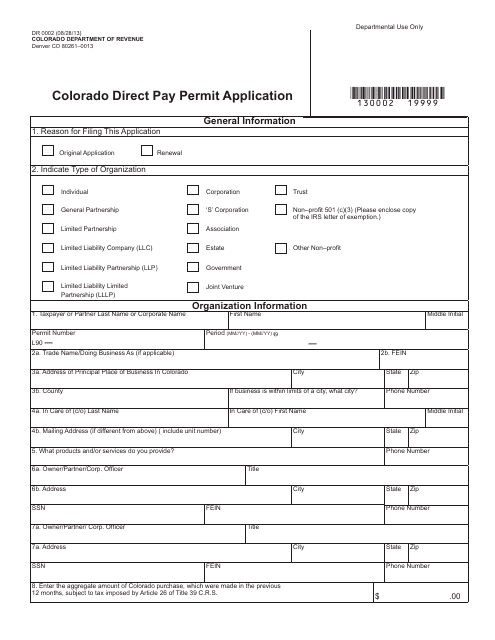

This form is used for applying for a direct pay permit in the state of Colorado.