Tax Exempt Form Templates

Documents:

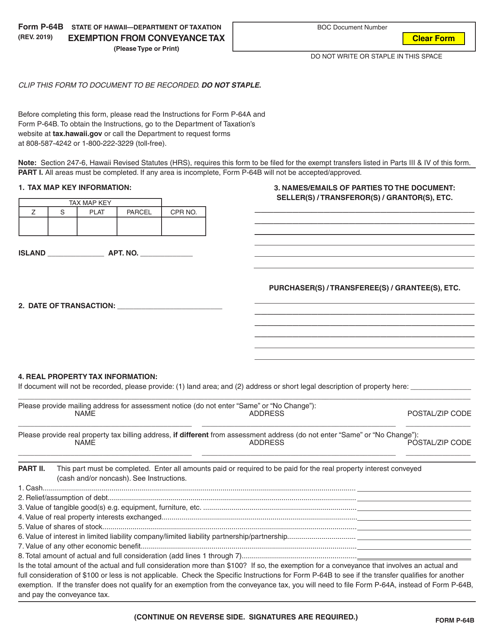

1303

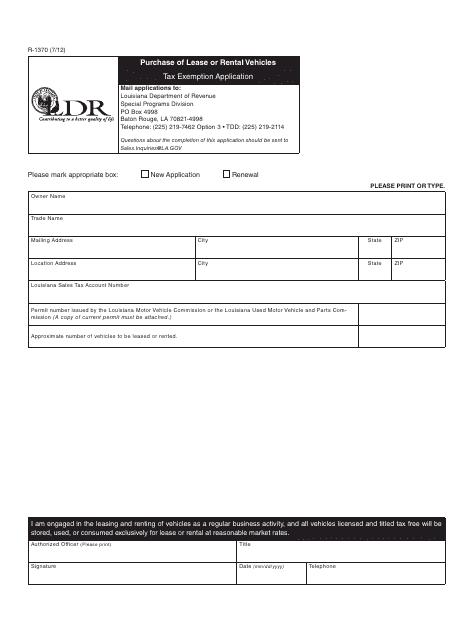

This form is used for applying for a tax exemption on the purchase of lease or rental vehicles in the state of Louisiana.

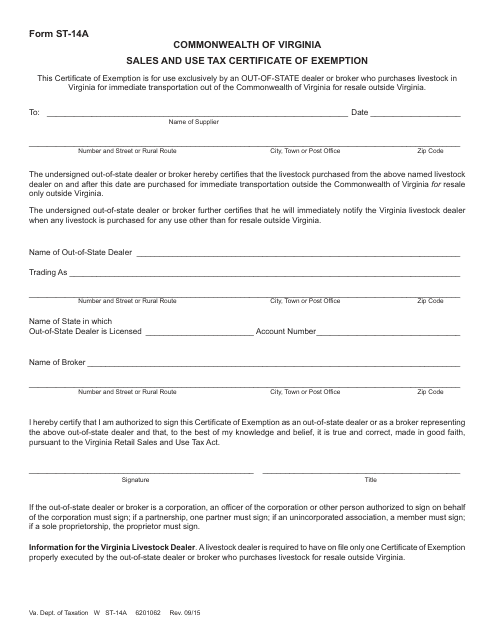

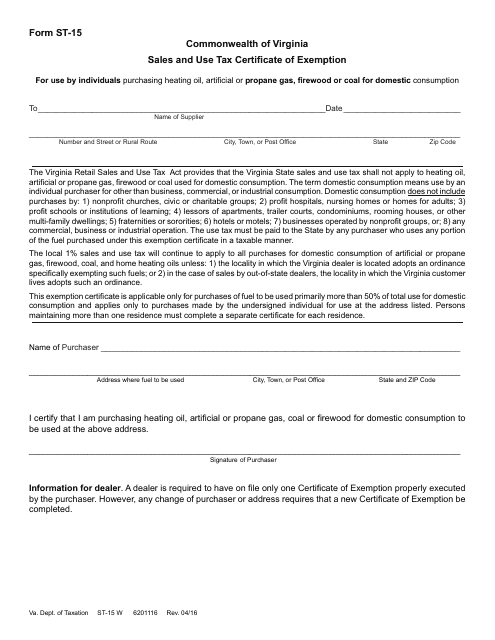

This form is used for claiming sales and use tax exemption in the state of Virginia.

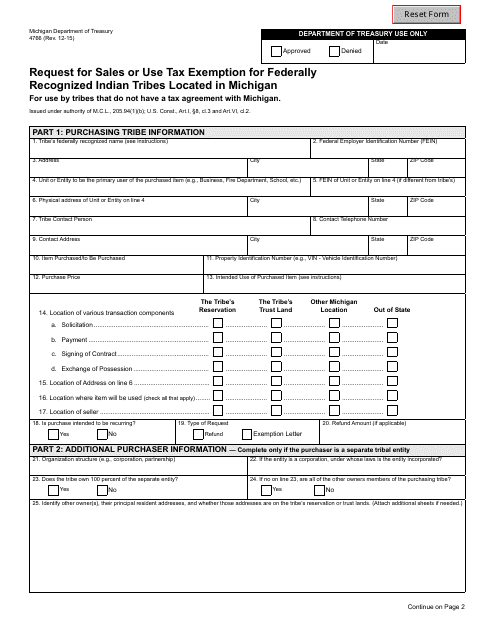

This form is used for requesting sales or use tax exemption for federally recognized Indian tribes located in Michigan.

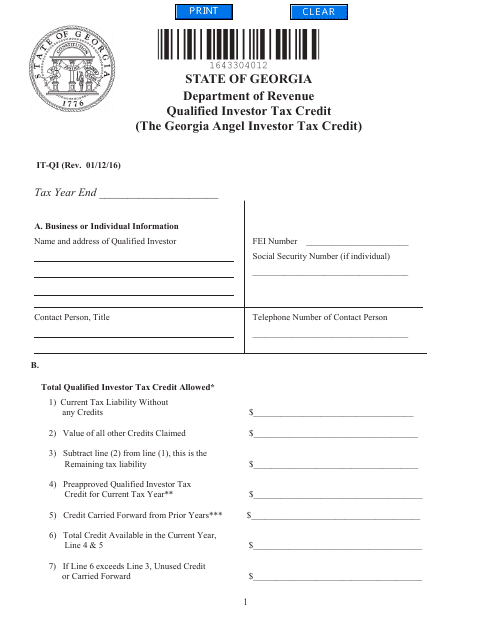

This form is used for claiming the Qualified Investor Tax Credit in the state of Georgia. Residents who meet the qualifying criteria can use this form to claim a tax credit for investing in certain businesses or projects.

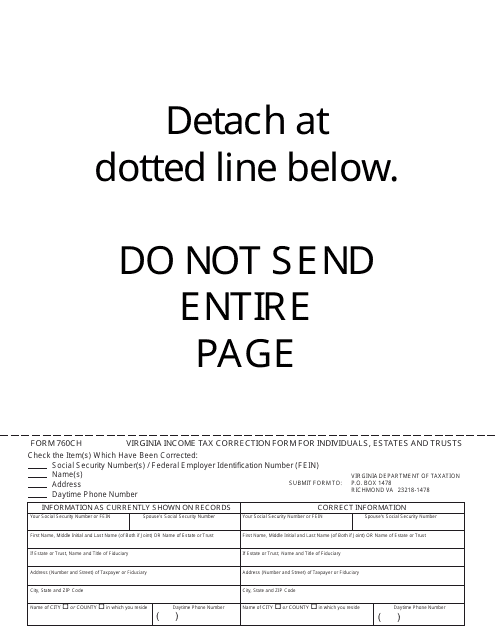

This form is used for correcting Virginia income tax filings for individuals, estates, and trusts in the state of Virginia. It is used to amend any errors or omissions made on previous tax returns.

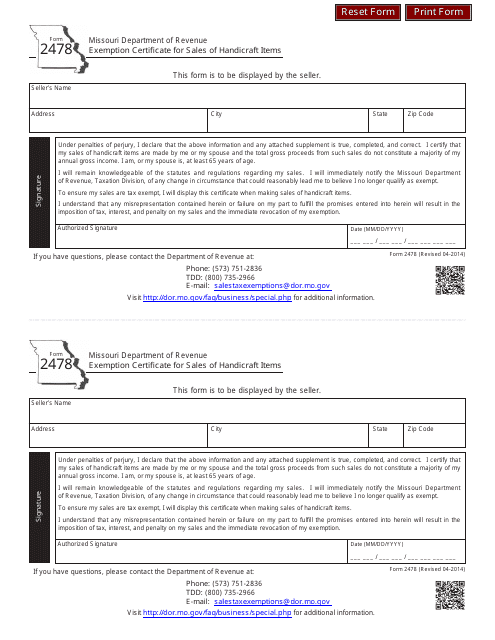

This document is used for obtaining an exemption certificate in Missouri for sales of handicraft items.

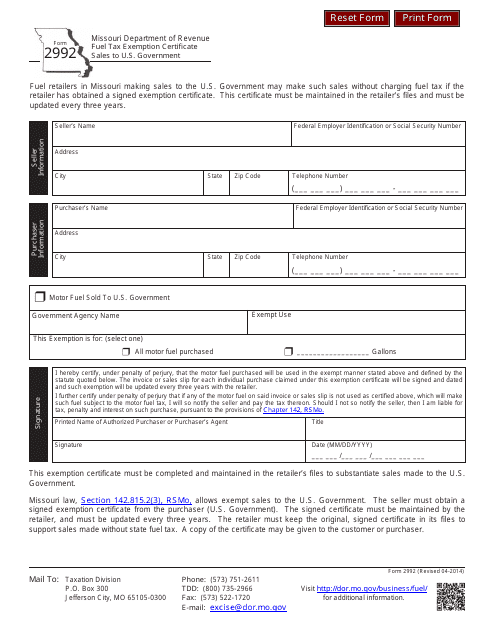

This form is used for claiming a fuel tax exemption on sales made to the U.S. Government in the state of Missouri.

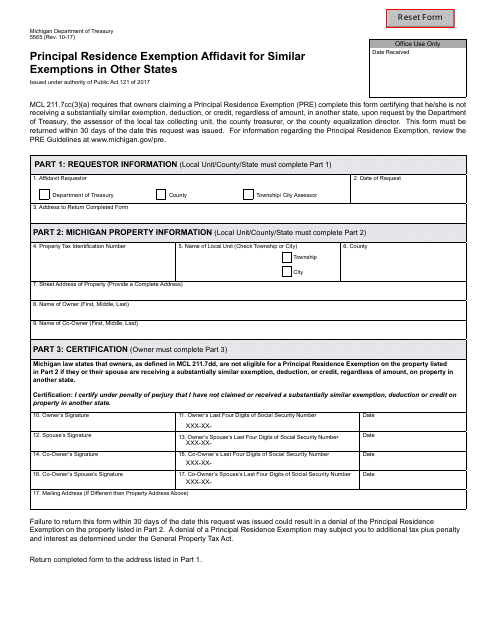

This document is used for claiming principal residence exemption in Michigan and exploring similar exemptions in other states.

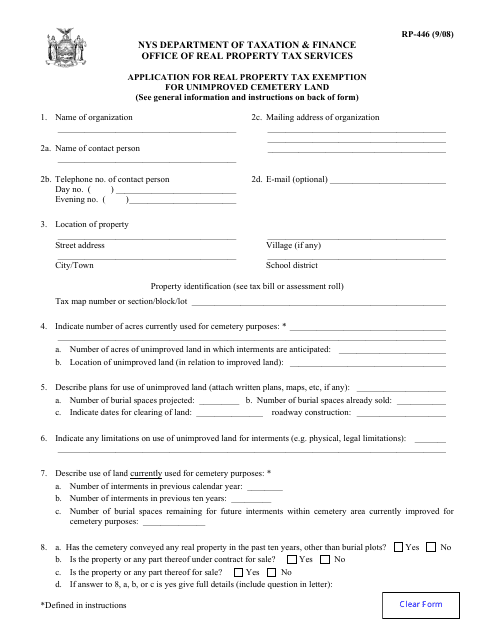

This form is used for applying for a real property tax exemption for unimproved cemetery land in New York.

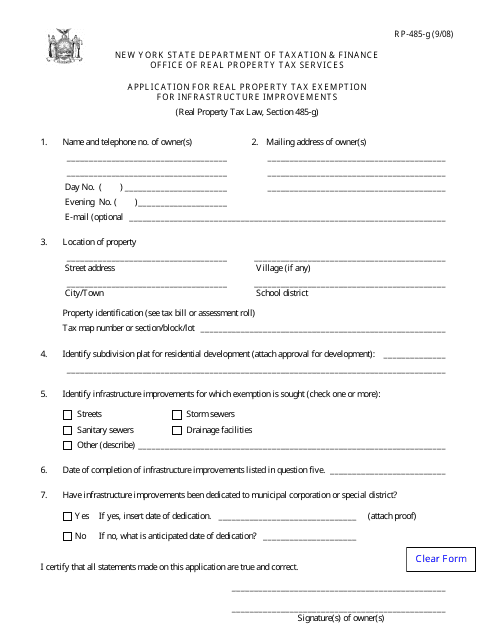

Form RP-485-G Application for Real Property Tax Exemption for Infrastructure Improvements - New York

This Form is used for applying for a real property tax exemption for infrastructure improvements in New York.

This Form is used for applying for a residential investment real property tax exemption in certain school districts in New York, specifically in Jamestown SD.

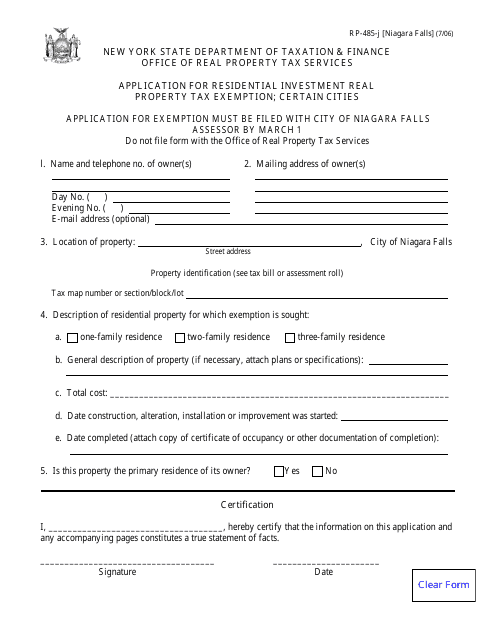

This Form is used for applying for a residential investment real property tax exemption in certain cities, specifically Niagara Falls, New York.

This form is used for applying for a residential investment real property tax exemption in the city of Syracuse, New York.

This Form is used for claiming exemption from sales and use tax in the state of Virginia.

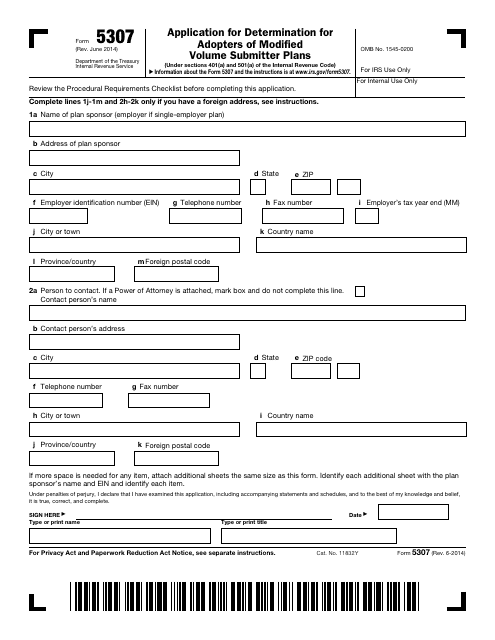

This Form is used for applying for determination for adopters of master or prototype or volume submitter plans with the IRS.

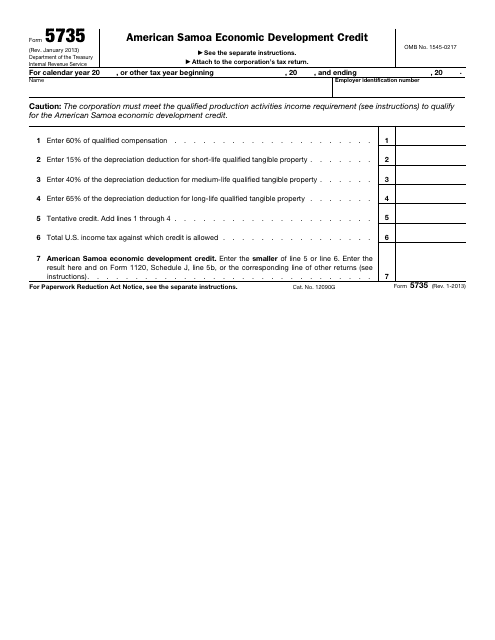

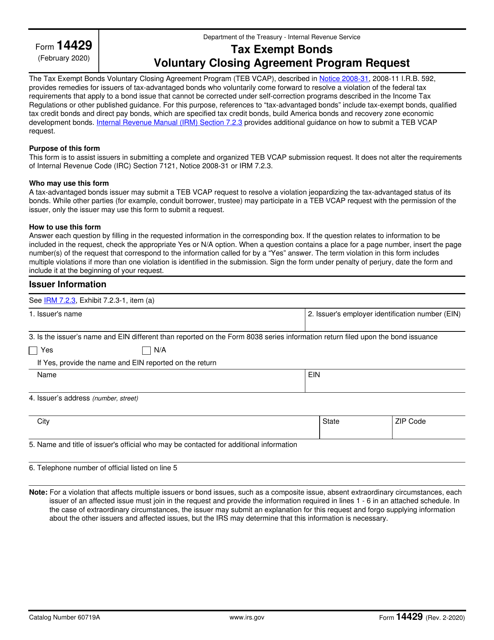

This form is used for claiming the American Samoa Economic Development Credit on your federal taxes.

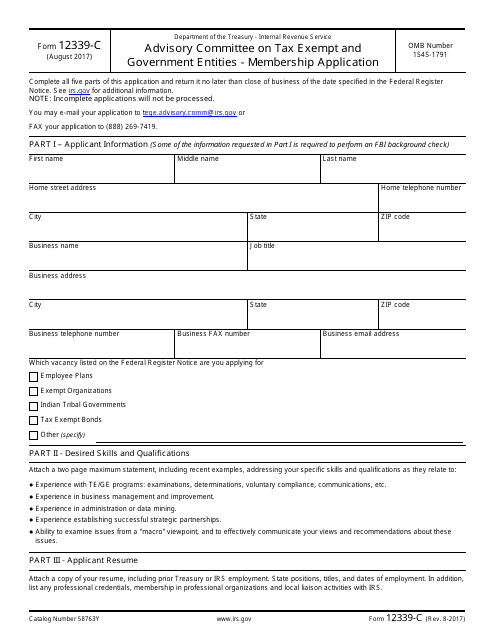

This form is used for applying to become a member of the Advisory Committee on Tax Exempt and Government Entities.

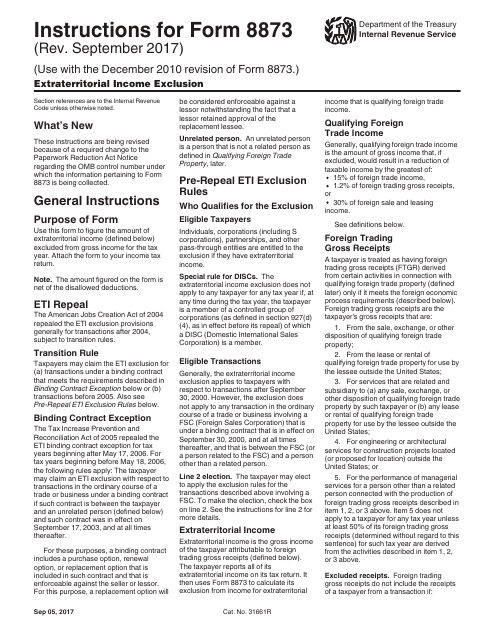

This form is used for reporting and claiming the extraterritorial income exclusion. It provides instructions on how to accurately complete IRS Form 8873.

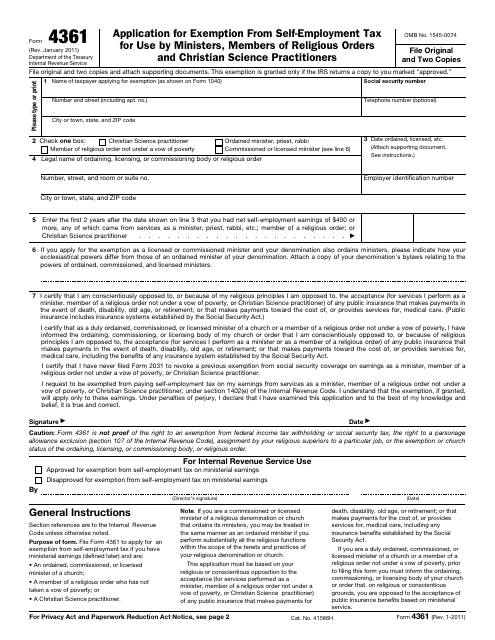

This is a fiscal form used by individuals who generate revenue through exercising their religious duties or profession and want to qualify for a self-employment tax exemption.

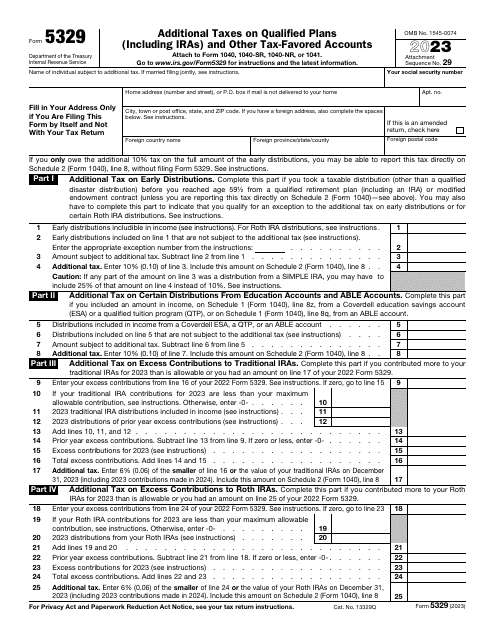

This is a fiscal document individual taxpayers need to prepare and file to demonstrate whether they need to pay the government penalties on education savings plans or retirement plans as well as a percentage of distributions they got throughout the tax year.

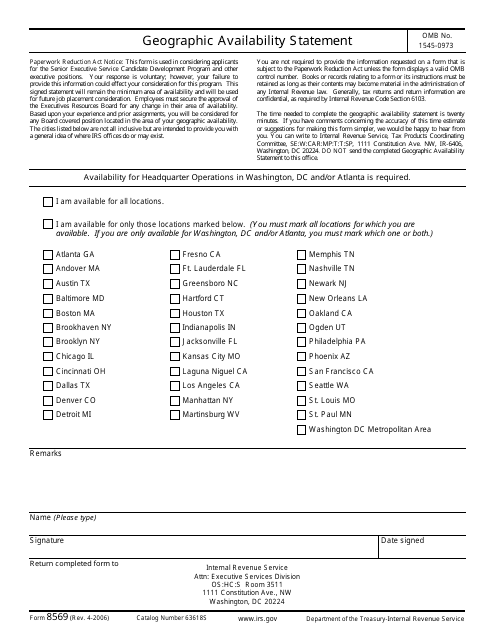

This form is used for providing information about the geographic availability of services provided by an organization to the Internal Revenue Service (IRS).

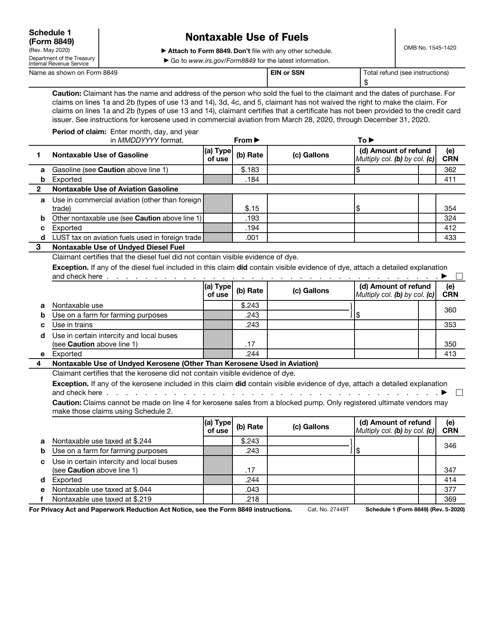

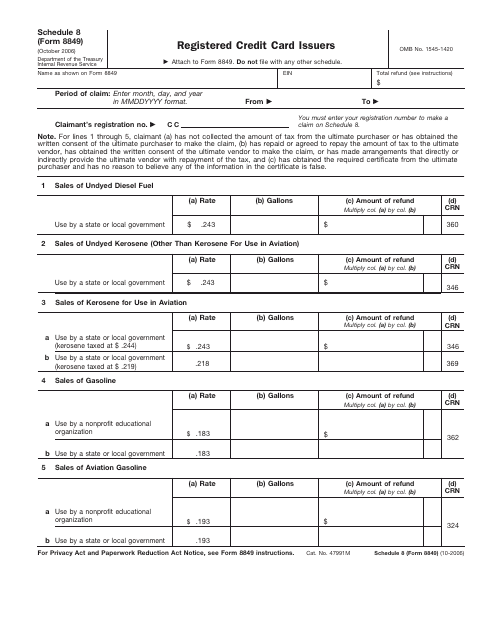

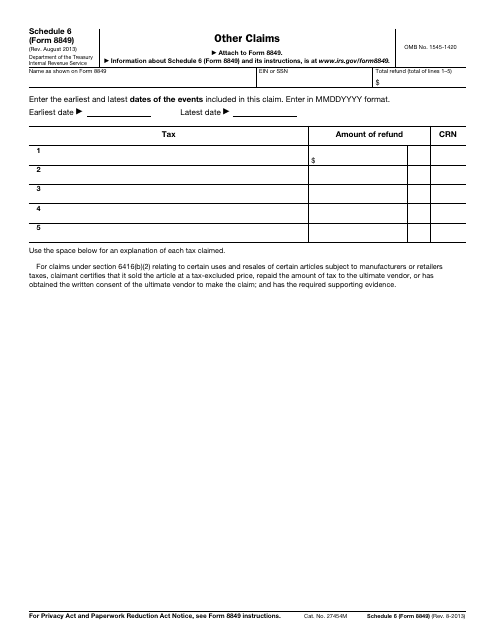

This Form is used for making other claims such as refunds for certain fuel-related taxes paid in error or excessive amounts.

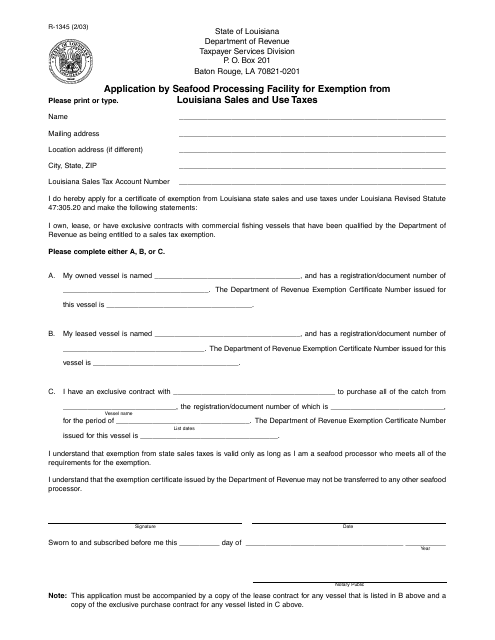

This form is used for seafood processing facilities in Louisiana to apply for an exemption from sales and use taxes. It helps these facilities save on taxes and streamline their business operations.

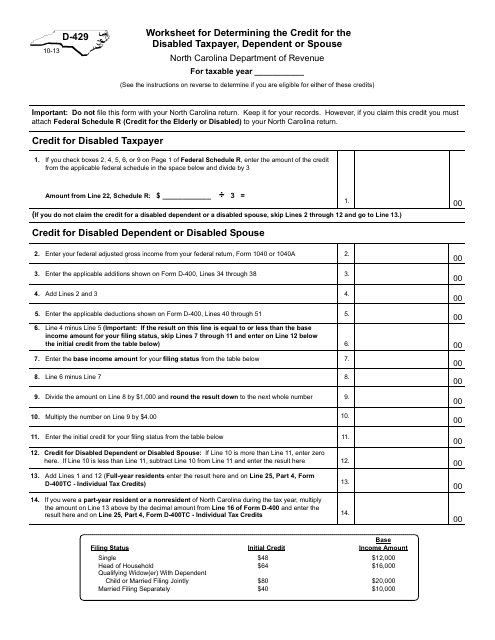

This Form is used for determining the credit for the disabled taxpayer, dependent or spouse in North Carolina.

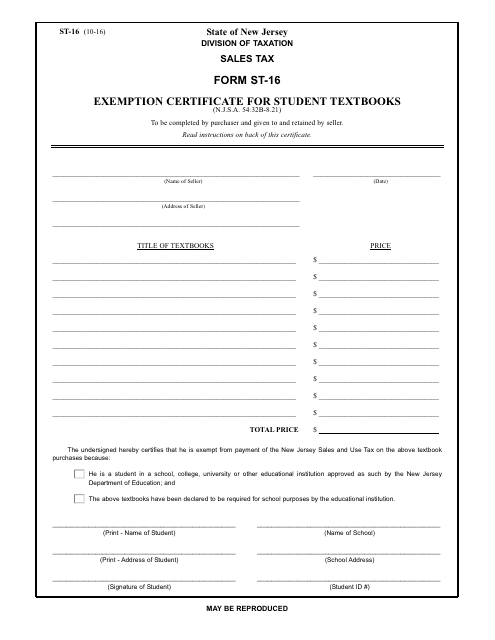

This form is used for requesting an exemption from sales tax on student textbooks in New Jersey.

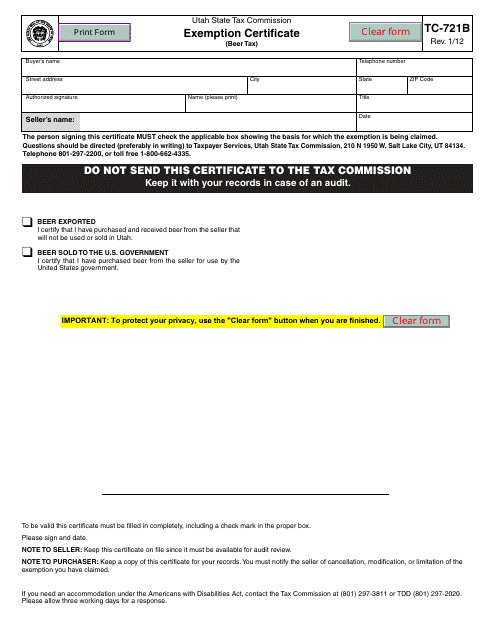

This form is used for claiming an exemption on beer tax in the state of Utah. Businesses can use this form to apply for a tax exemption on beer purchases.

![Form RP-485-I [JAMESTOWN SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/578/5786/578655/form-rp-485-i-jamestown-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york_big.png)

![Form RP-485-J [SYRACUSE] Application for Residential Investment Real Property Tax Exemption - City of Syracuse, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578658/form-rp-485-j-syracuse-application-for-residential-investment-real-property-tax-exemption-city-of-syracuse-new-york_big.png)