Tax Exempt Form Templates

Documents:

1296

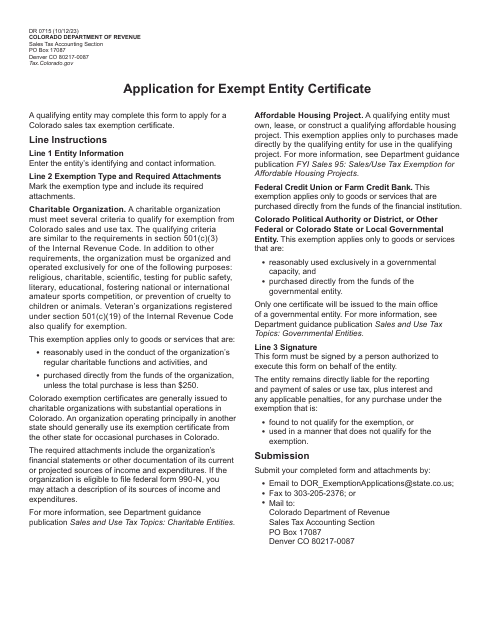

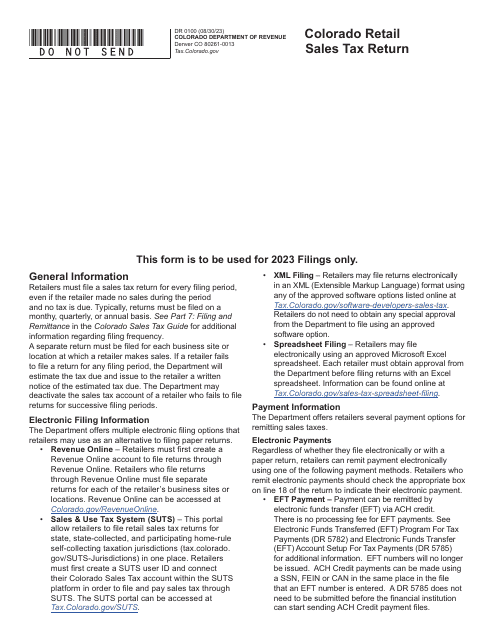

This form is required for any retail establishment within the state of Colorado and must be filed every quarter, even if no tax has been collected or no tax is due.

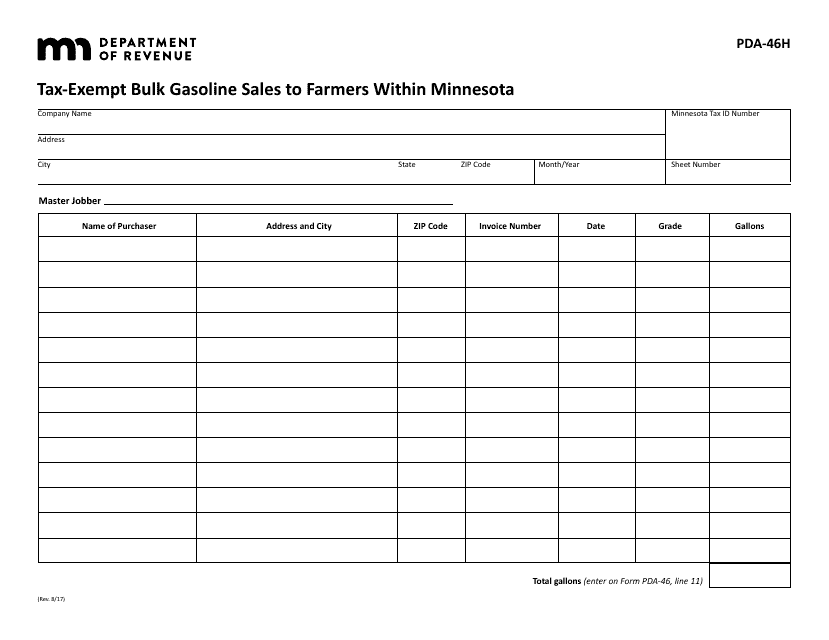

This Form is used for tax-exempt bulk gasoline sales to farmers within Minnesota.

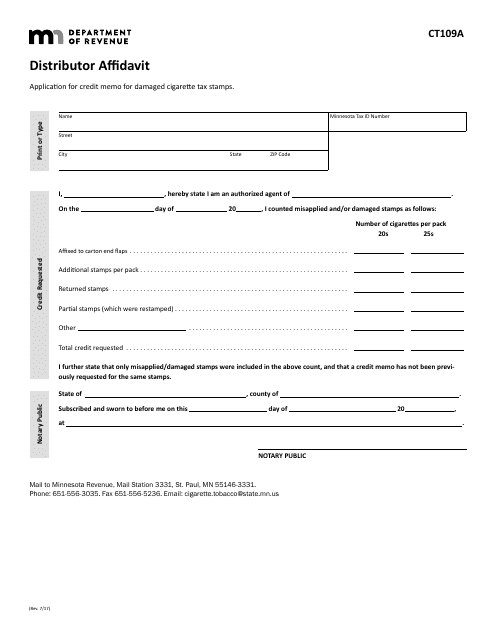

This Form is used for distributors in Minnesota to provide an affidavit.

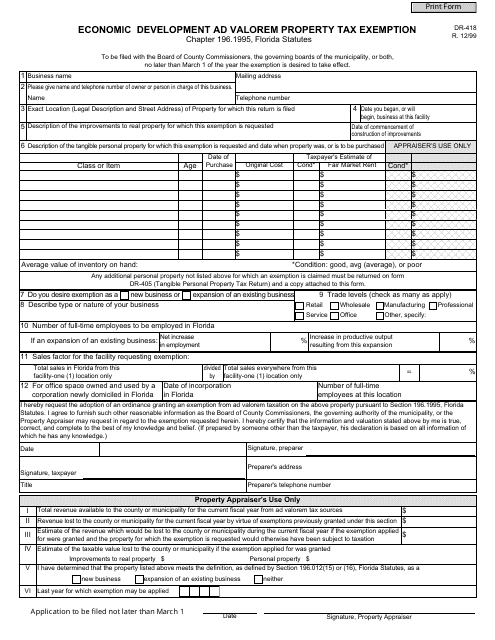

This form is used for applying for an economic development ad valorem property tax exemption in the state of Florida.

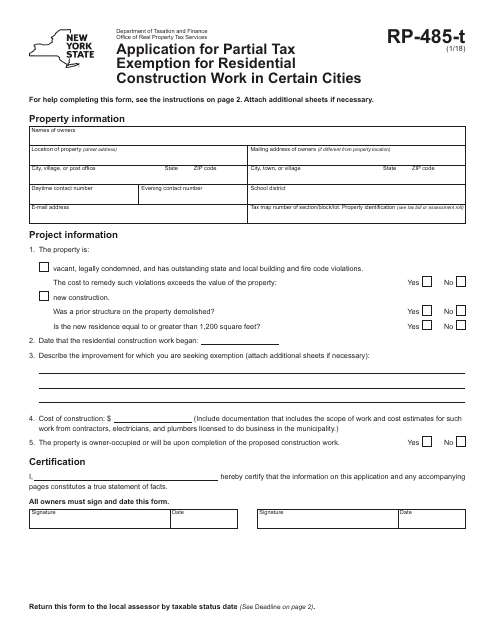

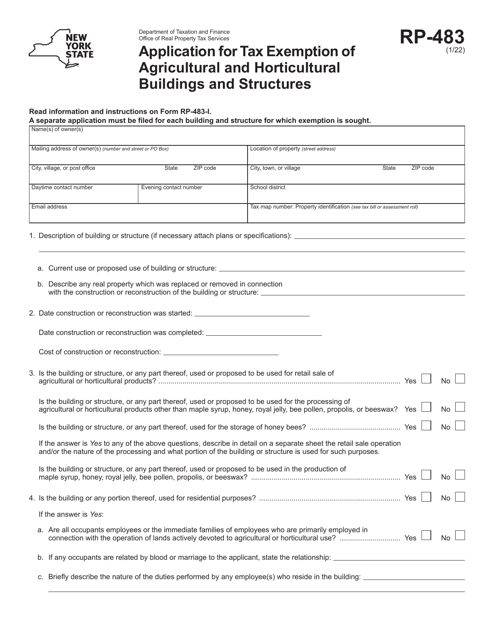

This Form is used for applying for a partial tax exemption for residential construction work in certain cities in New York. It allows individuals or businesses to request a reduction in property taxes for qualified construction projects.

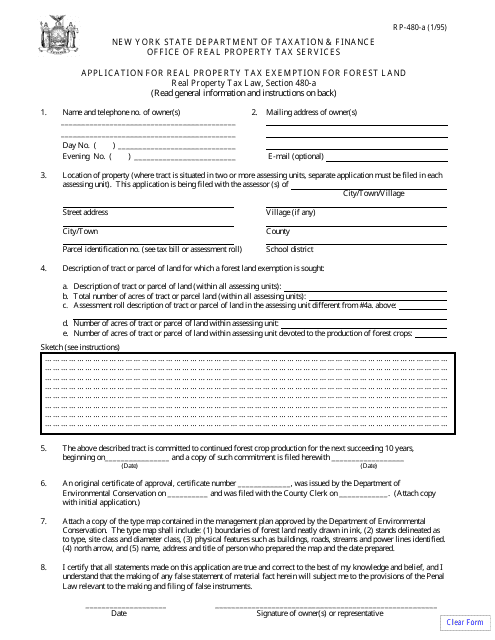

This Form is used for applying for a real property tax exemption for forest land in New York. It allows landowners to request a reduction in property taxes for qualifying forested areas.

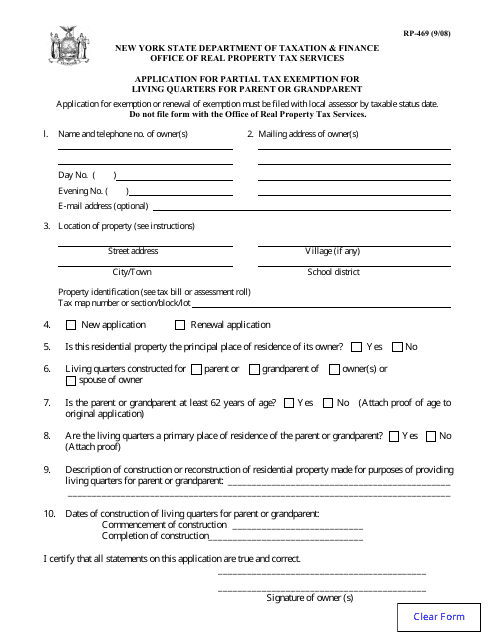

This form is used for applying for a partial tax exemption for living quarters for a parent or grandparent in New York. It allows eligible individuals to reduce their property taxes for housing their elderly family members.

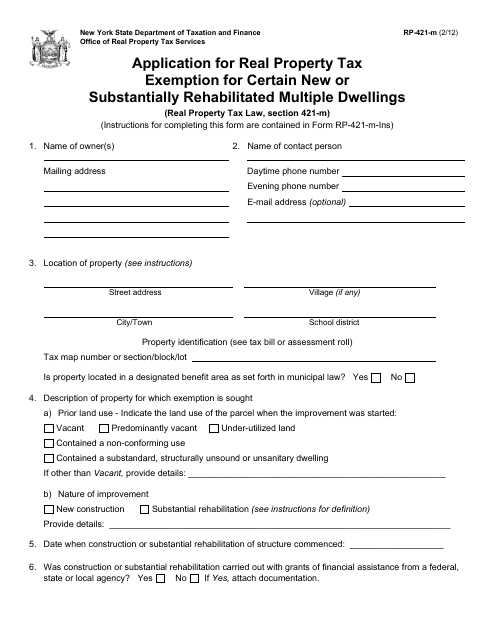

This form is used for applying for a real property tax exemption in New York for certain new or substantially rehabilitated multiple dwellings.

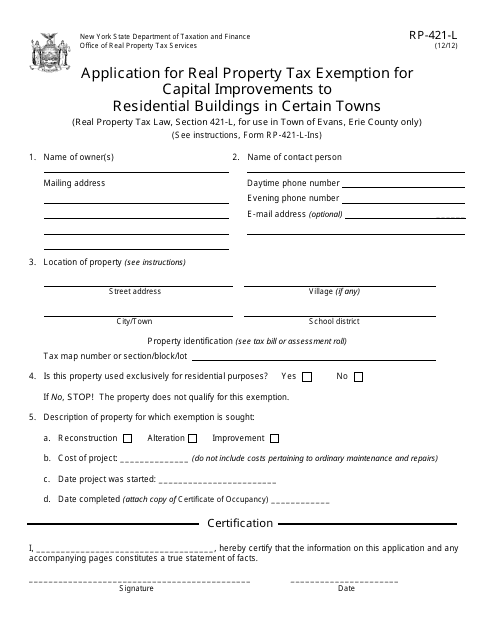

This form is used for applying for a real property tax exemption for capital improvements made to residential buildings in certain towns, specifically the Town of Evans, New York.

This form is used to apply for a real property tax exemption for capital improvements made to multiple dwelling buildings within certain cities, specifically the City of Buffalo, located in New York.

This form is used for applying for a real property tax exemption for capital improvements made to multiple dwelling buildings in certain cities, specifically Albany, New York.

This form is used for applying for a real property tax exemption for capital improvements made to multiple dwelling buildings within the cities of Lockport and Peekskill in New York.

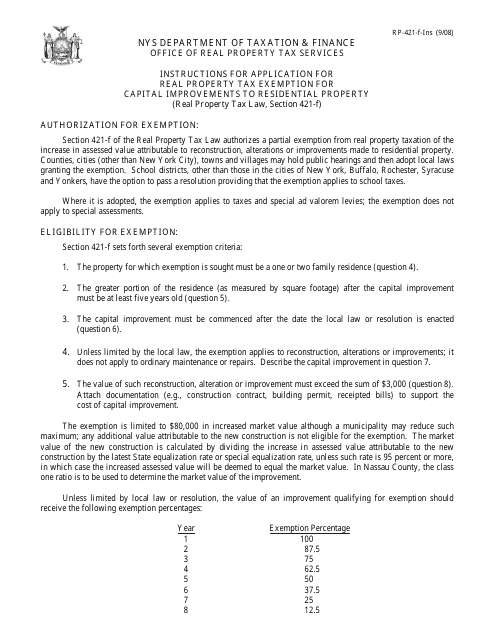

This Form is used for applying for a real property tax exemption for capital improvements made to residential property in New York. It provides instructions on how to complete the application and what documents are required.

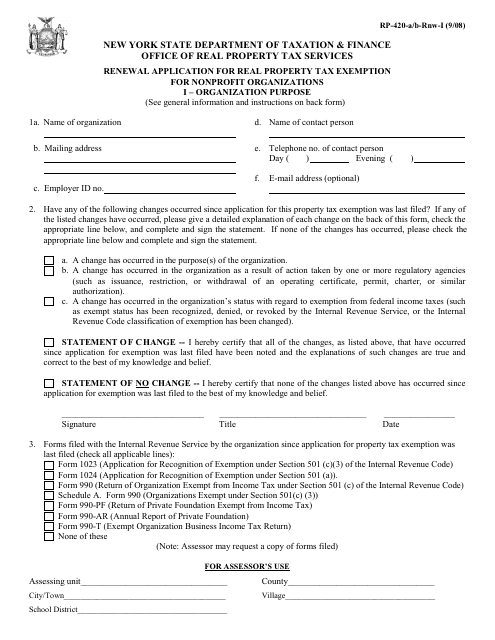

This form is used for renewing the real property tax exemption for nonprofit organizations in New York. It is specifically for organizations that have a new purpose.

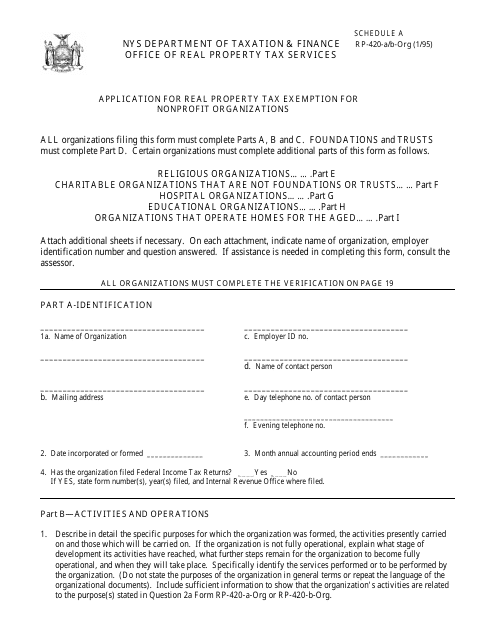

This Form is used for nonprofit organizations in New York to apply for a real property tax exemption.

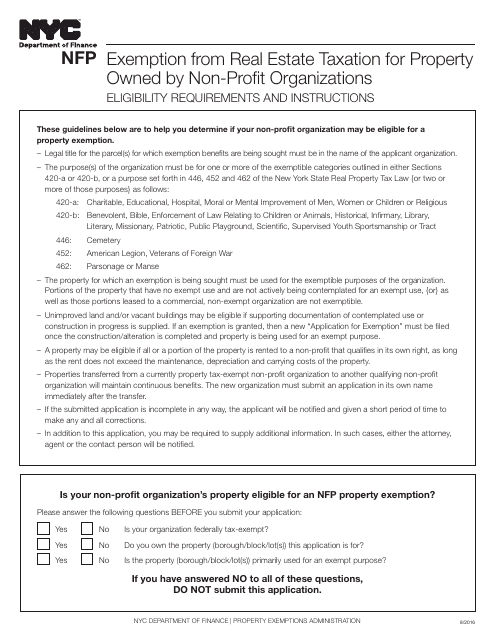

This Form is used for non-profit organizations in New York City to apply for exemption from real estate taxation for their properties.

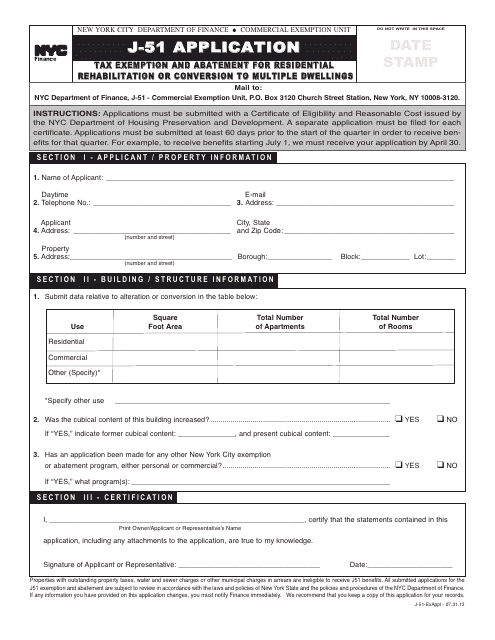

This form is used for applying for tax exemption and abatement for residential rehabilitation or conversion to multiple dwellings in New York City.

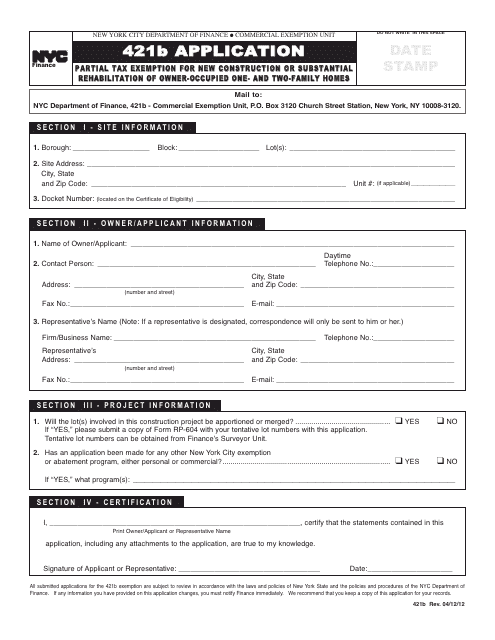

This form is used for applying for a partial tax exemption for new construction or substantial rehabilitation of owner-occupied one- and two-family homes in New York City.

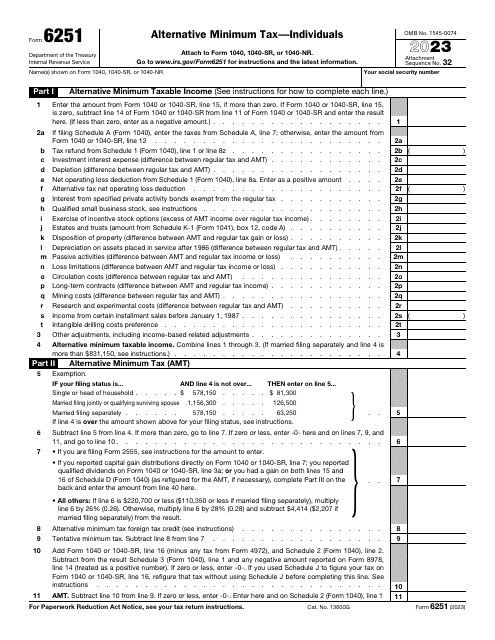

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

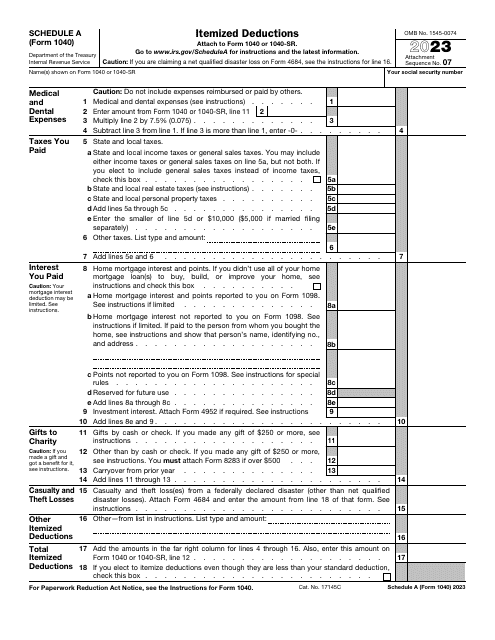

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

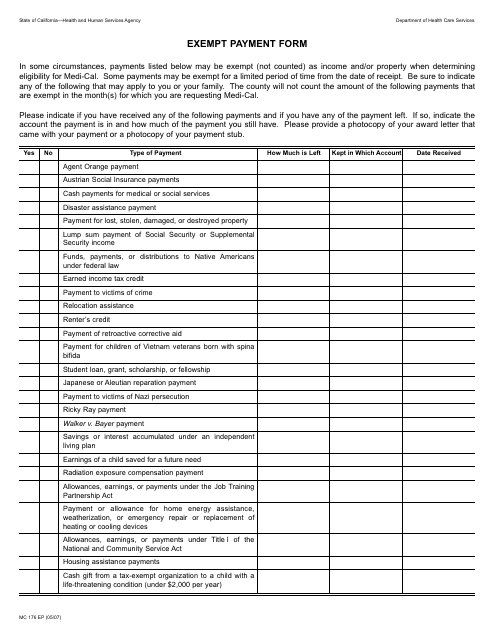

This form is used for reporting exempt payments made in California.

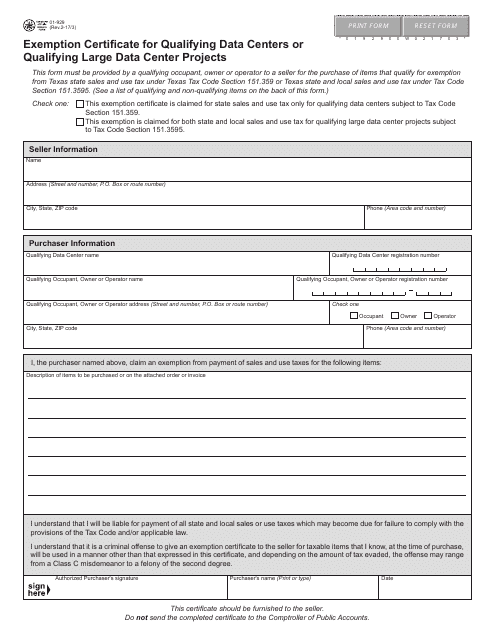

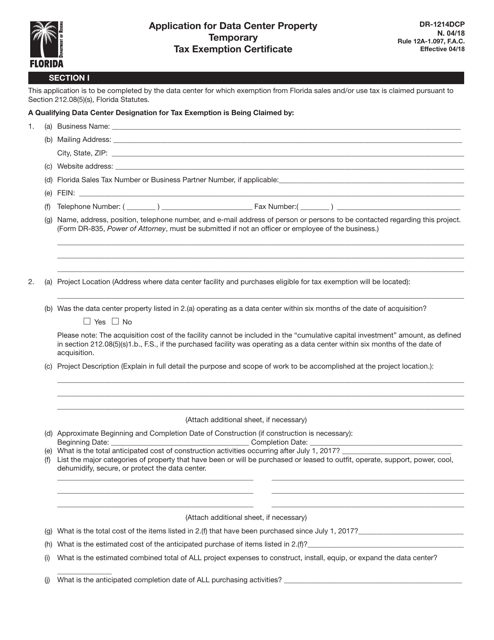

This document is used to apply for an exemption certificate for qualifying data centers or qualifying large data center projects in Texas.

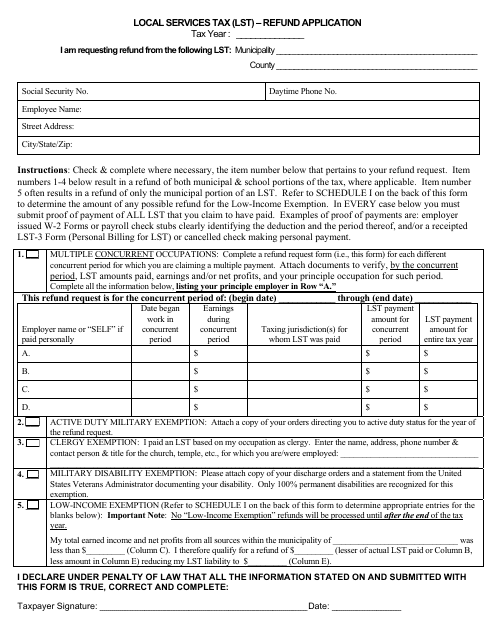

This Form is used for applying for a refund of the Local Services Tax (LST).

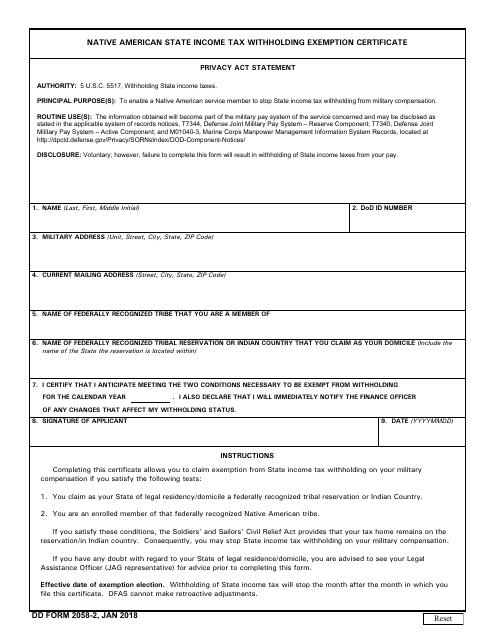

This is a document used by Native American service men and service women to claim state income tax exemption on their military pay.

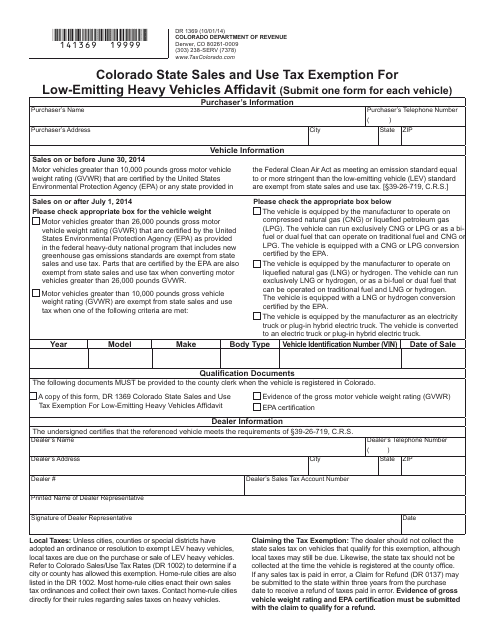

This form is used for claiming sales and use tax exemption in Colorado for low-emitting heavy vehicles. It is an affidavit that certifies the vehicle's eligibility for this exemption.

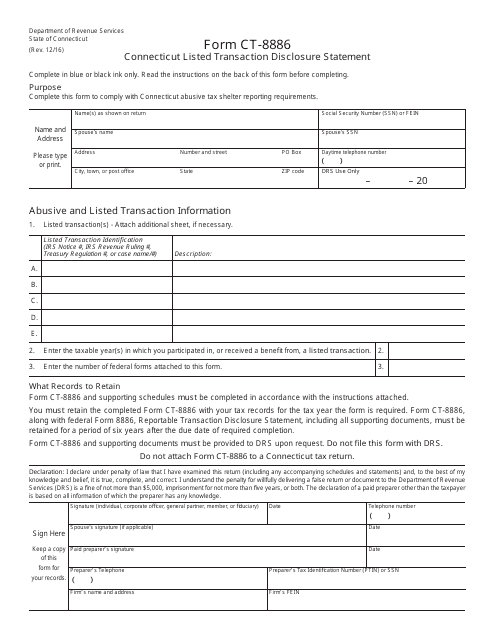

This Form is used for disclosing listed transactions in Connecticut.

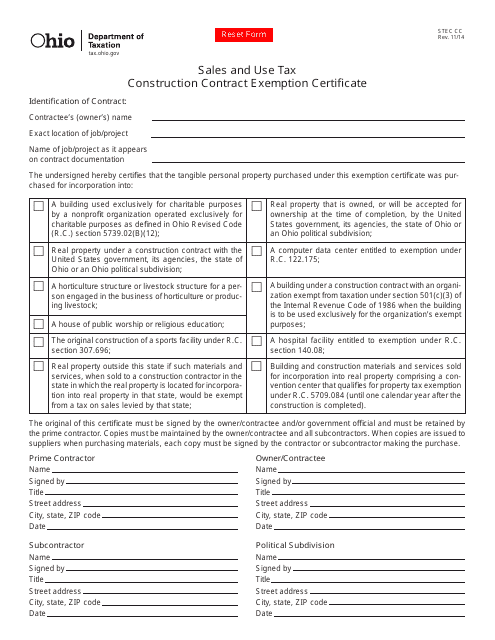

This form is used for claiming a sales and use tax exemption for construction contracts in Ohio. Contractors can use this certificate to exempt certain construction materials and services from sales tax.

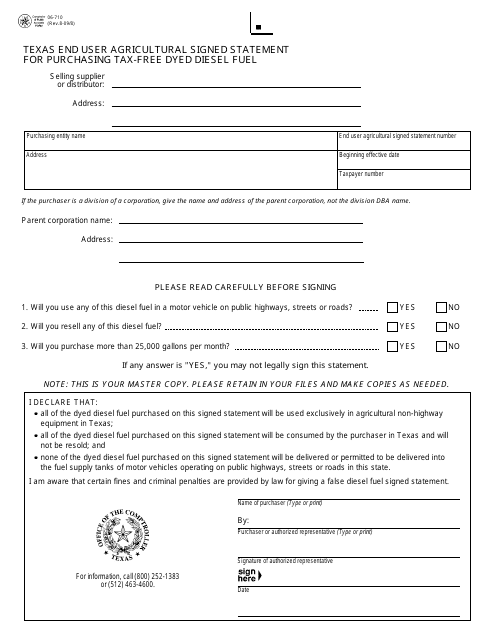

This form is used for Texas residents who are purchasing tax-free dyed diesel fuel for agricultural purposes. The form must be signed by the end user as a statement of eligibility.

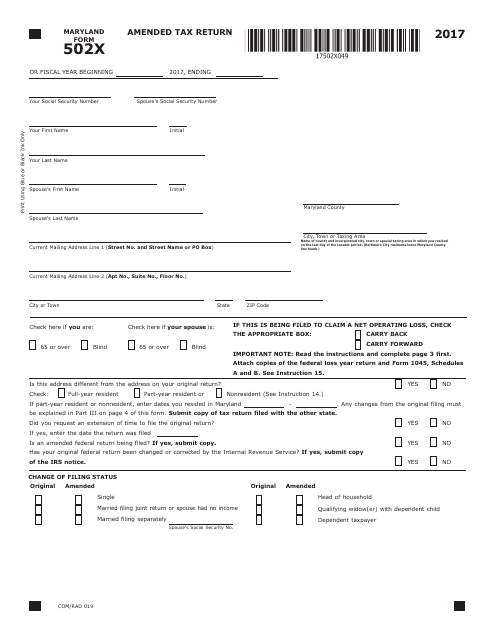

This form is used for filing an amended tax return in the state of Maryland.

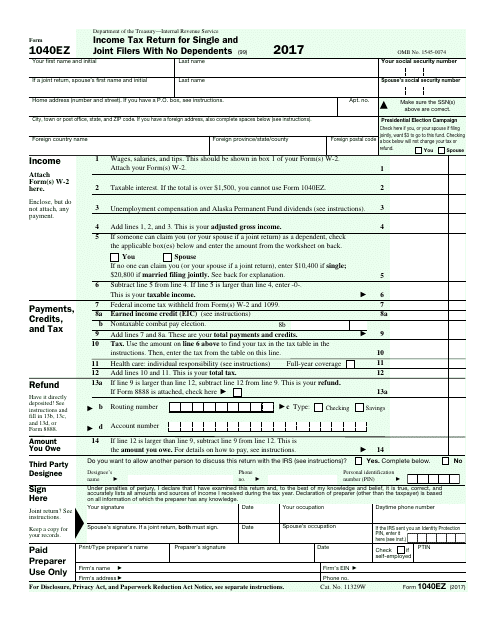

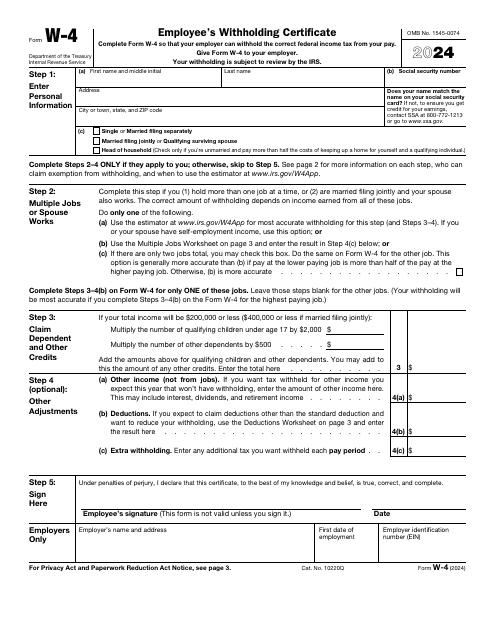

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

![Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349865/form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york_big.png)

![Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Albany, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349867/form-rp-421-i-albany-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-albany-new-york_big.png)

![Form RP-421-H [LOCKPORT/PEEKSKILL] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Cities of Lockport/Peekskiill, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349869/form-rp-421-h-lockport-peekskill-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-cities-of-lockport-peekskiill-new-york_big.png)