Tax Exempt Form Templates

Documents:

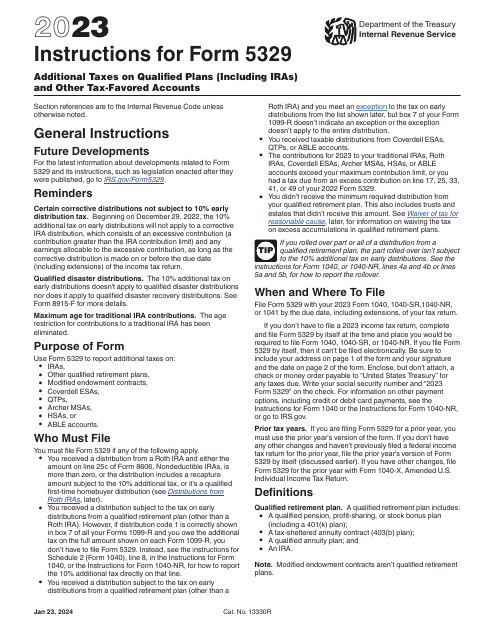

1303

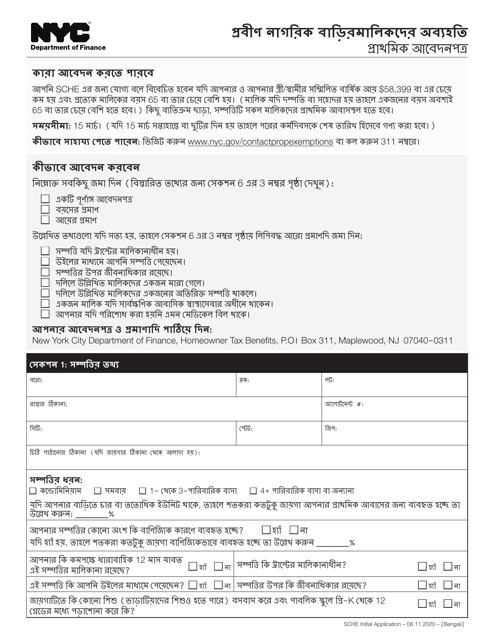

This document is for senior citizens in New York City who want to apply for a property tax exemption. It is available in the Bengali language.

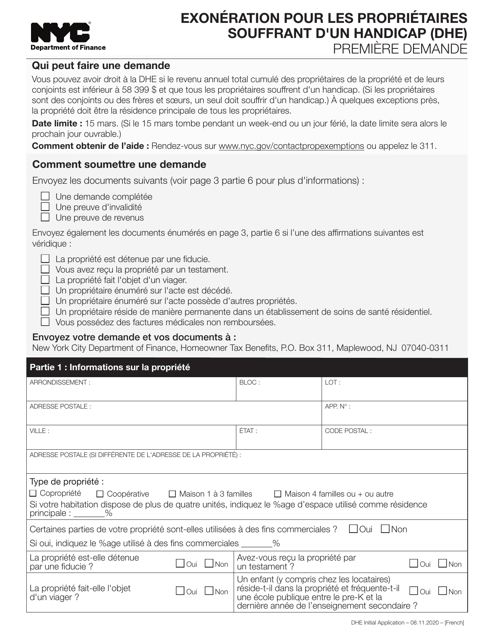

This document for applying for the Disabled Homeowners' Exemption in New York City. It is available in French.

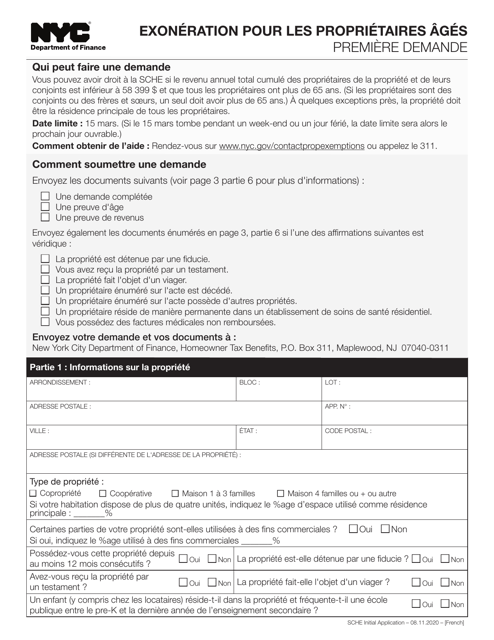

This document is used for applying for the Senior Citizen Homeowners' Exemption in New York City. It is available in French.

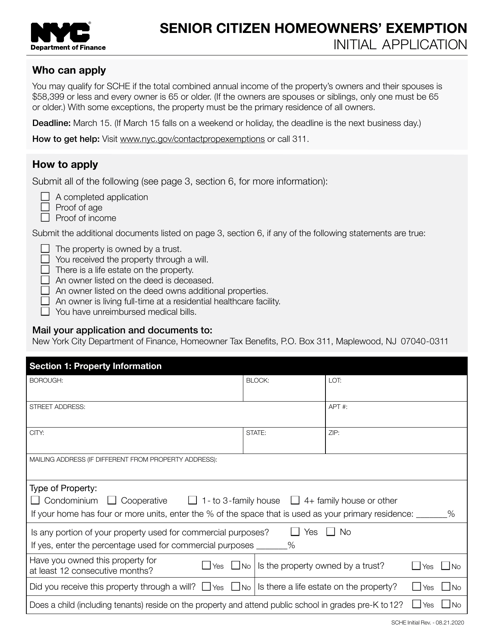

This document is for senior citizens in New York City who own a home and want to apply for a tax exemption. It is the initial application for the Senior Citizen Homeowners' Exemption.

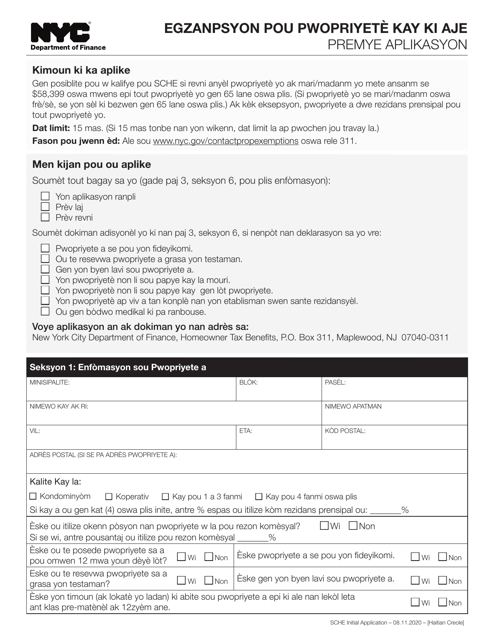

This Form is used for applying for the Senior Citizen Homeowners' Exemption in New York City, and is available in Haitian Creole.

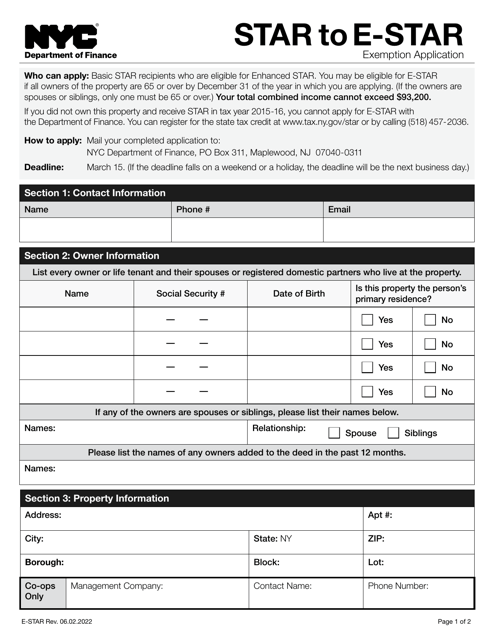

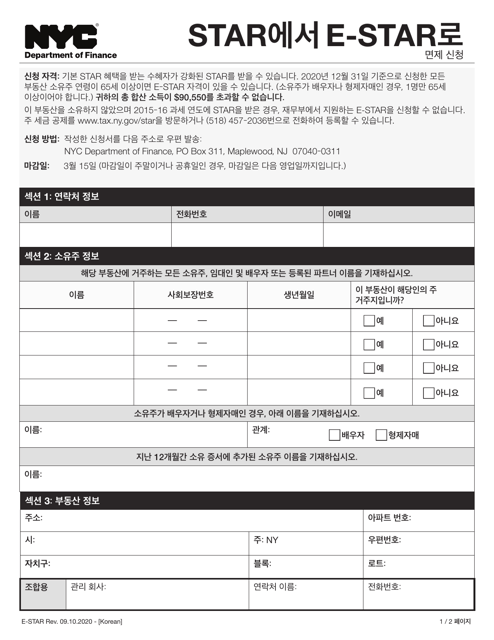

This document is an application form for the Star to E-Star Exemption in New York City, specifically for Korean speakers. The E-Star Exemption provides property tax relief for eligible homeowners.

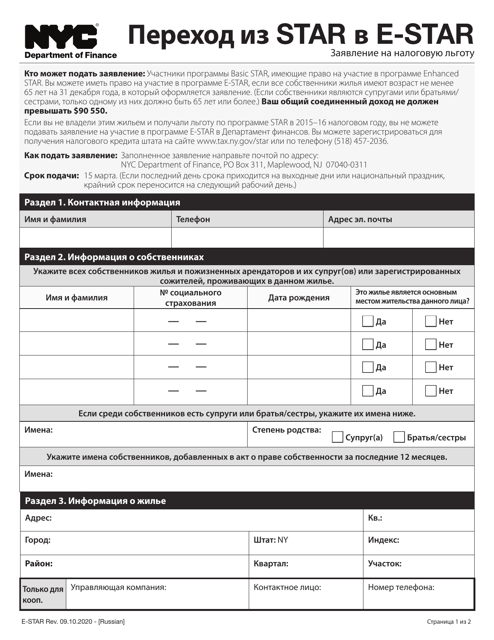

This document is an application for the Star to E-Star exemption in New York City, written in Russian.

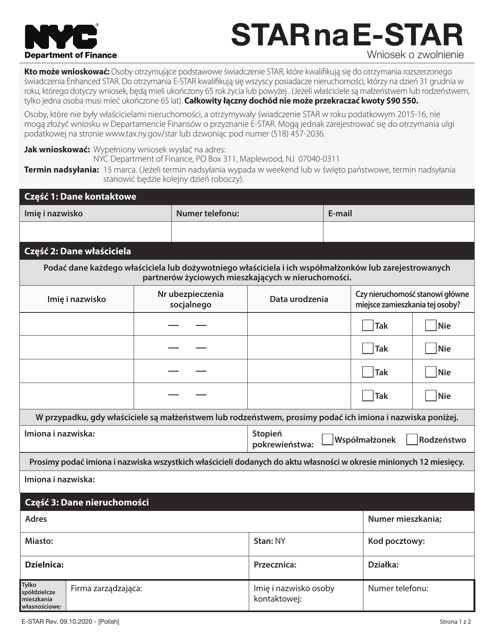

This Form is used for applying for the Star to E-Star Exemption in New York City for Polish-speaking residents.

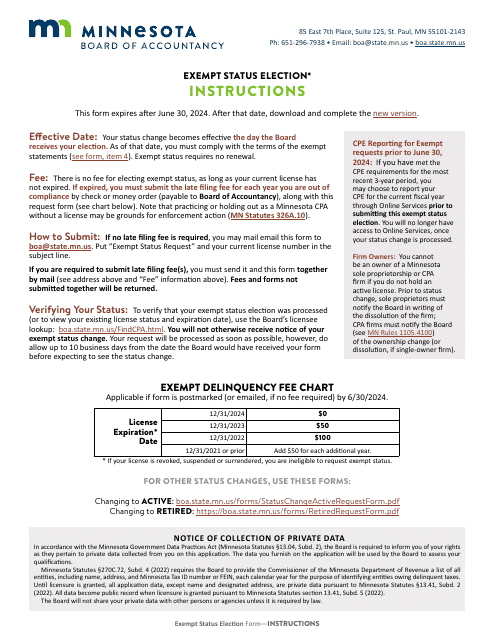

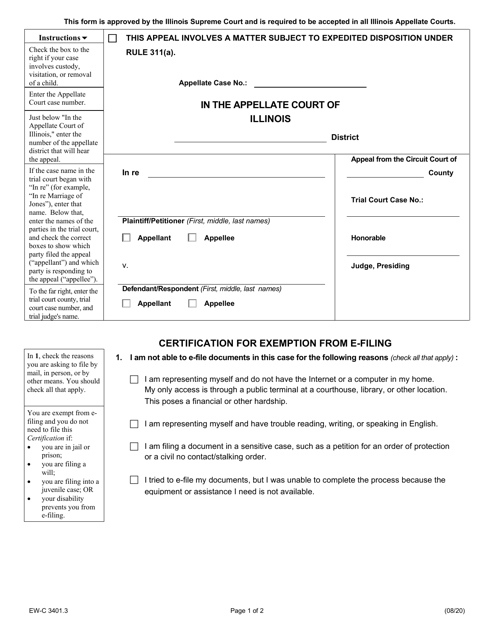

This form is used for certifying exemption from e-filing in the state of Illinois.

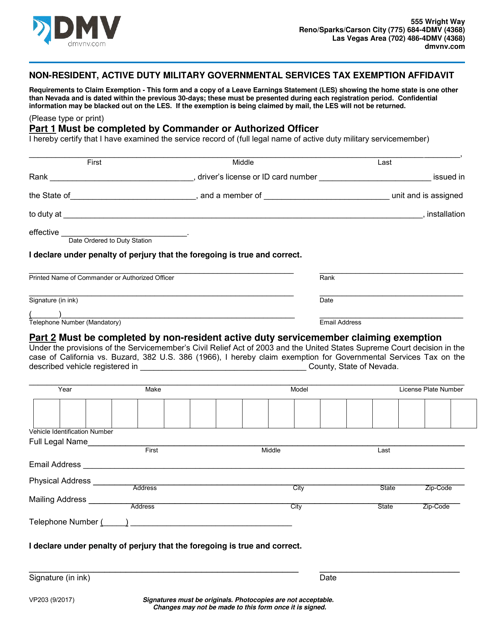

Form VP203 Non-resident, Active Duty Military Governmental Services Tax Exemption Affidavit - Nevada

This form is used for active duty military personnel residing in Nevada to claim exemption from governmental services tax.

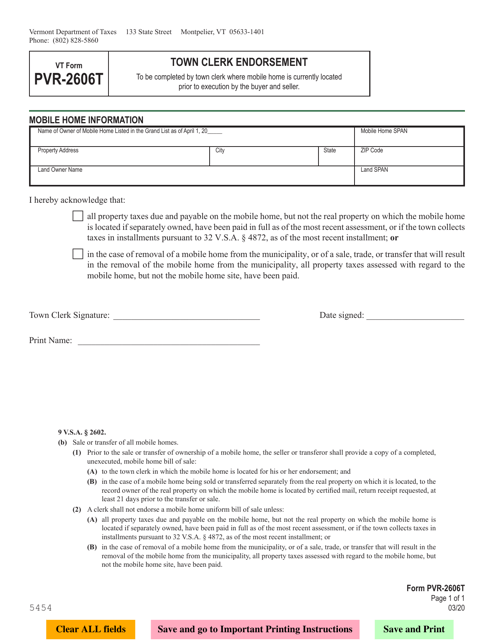

This form is used for obtaining the Town Clerk Endorsement in Vermont.

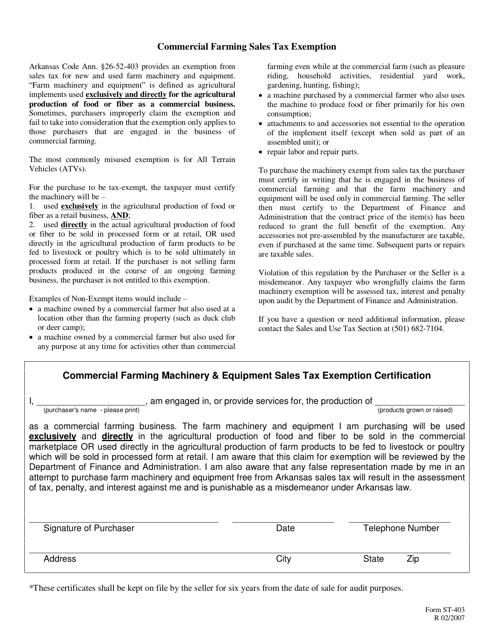

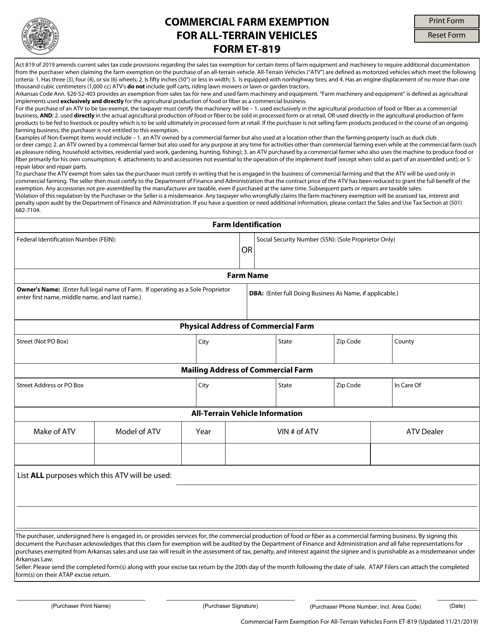

This form is used for applying for a commercial farm exemption certificate in Arkansas.

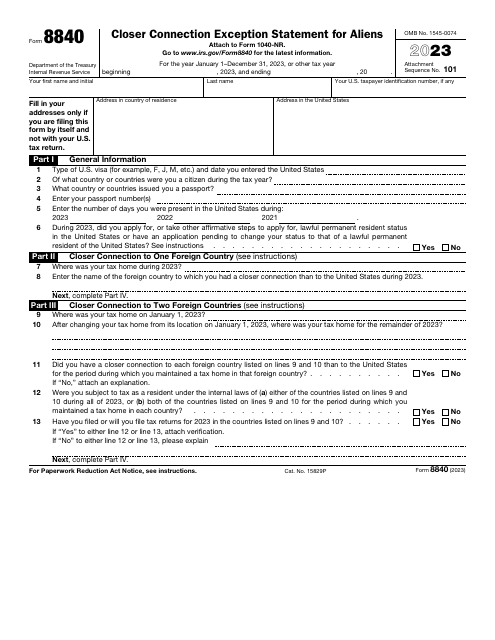

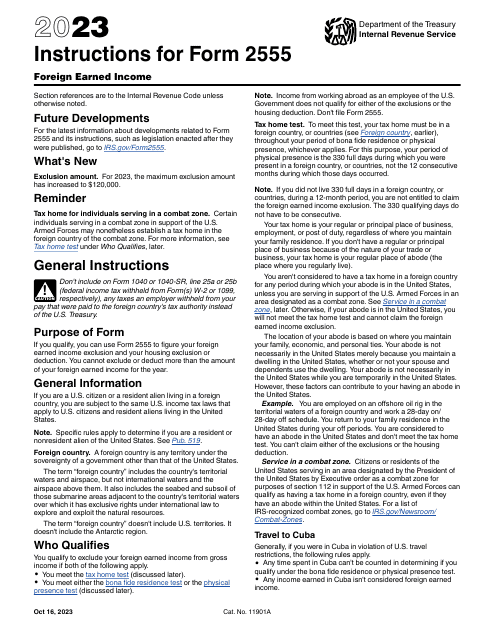

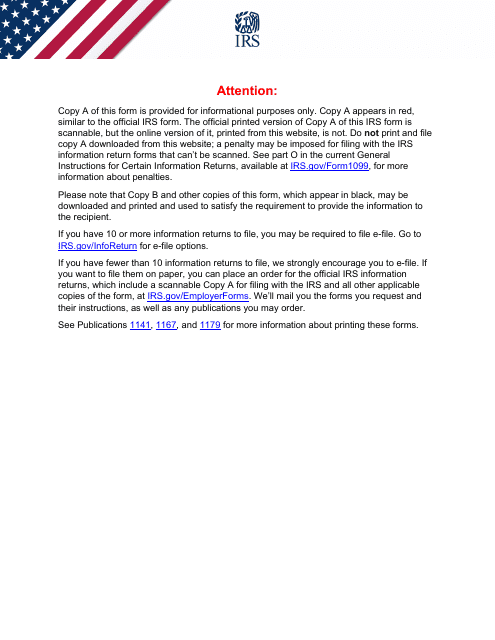

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.

This form is used for applying for a commercial farm exemption for all-terrain vehicles in Arkansas.

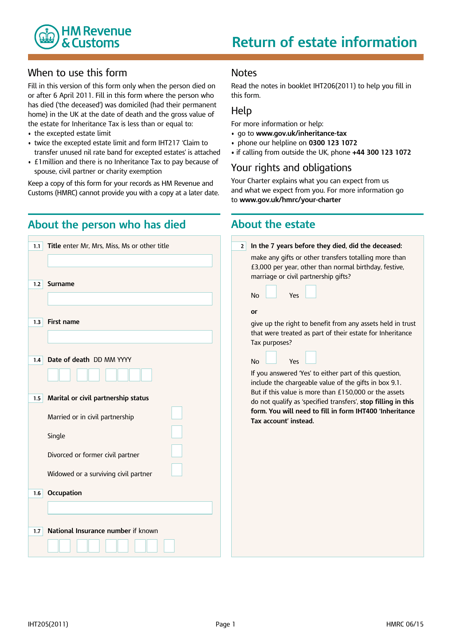

Individuals may prepare this supplemental document when they file an application for a grant of probate or a grant of letters of administration and have to confirm there is no inheritance tax due on the estate.

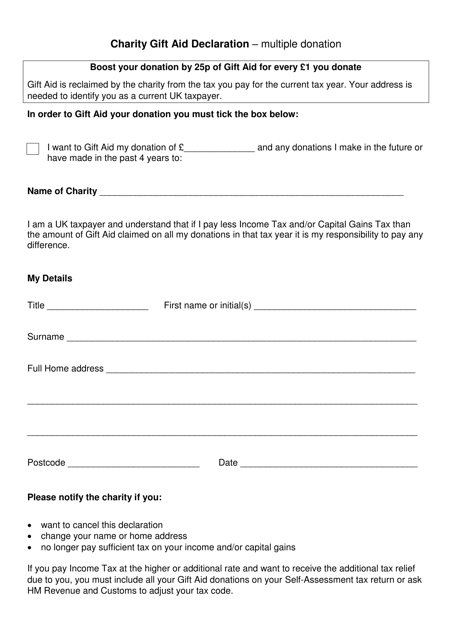

This document is used for multiple donations in the United Kingdom to declare Gift Aid and maximize the value of charitable contributions.

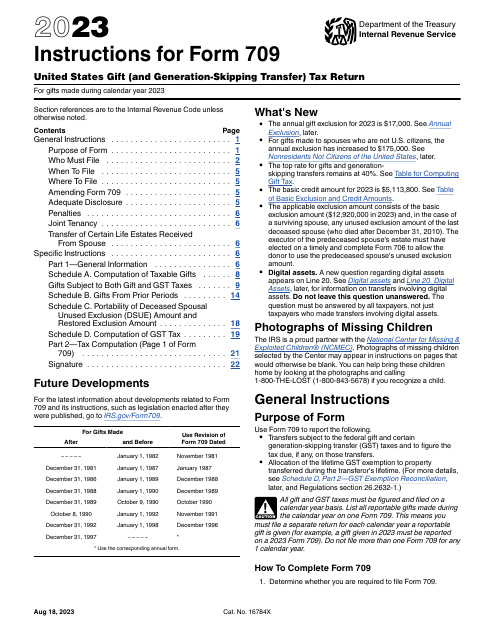

Instructions for IRS Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return, 2023

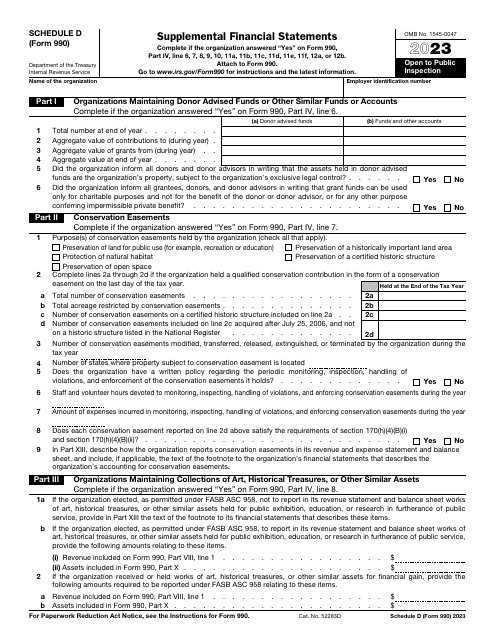

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.

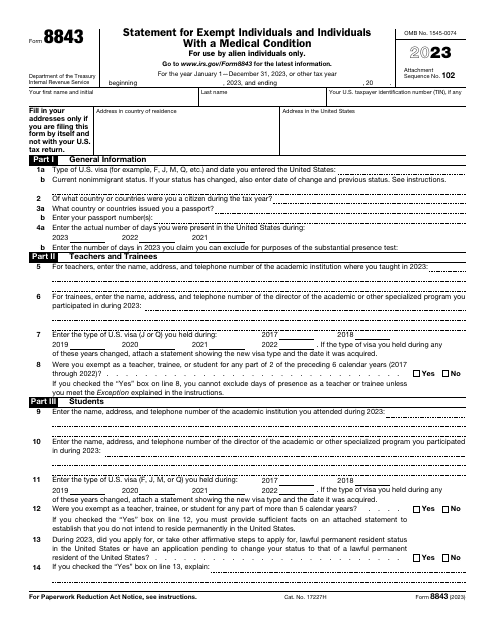

This is an IRS legal document completed by individuals who need to figure out the amount of their Premium Tax Credit and reconcile it with the Advanced Premium Tax Credit (APTC) payments made throughout the reporting year.