Tax Exempt Form Templates

Documents:

1303

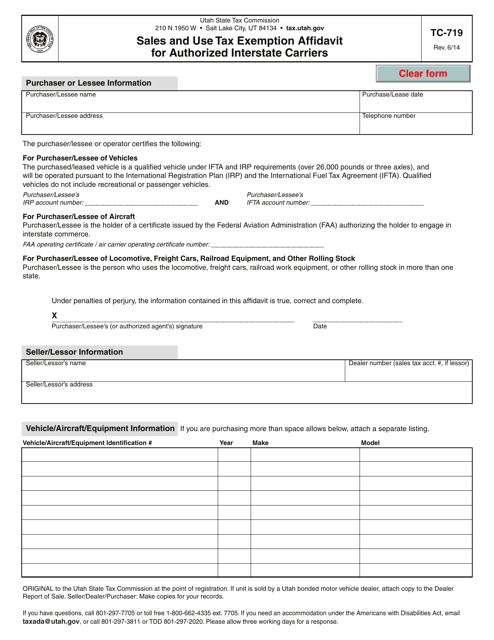

This form is used for authorized interstate carriers in Utah to apply for a sales and use tax exemption.

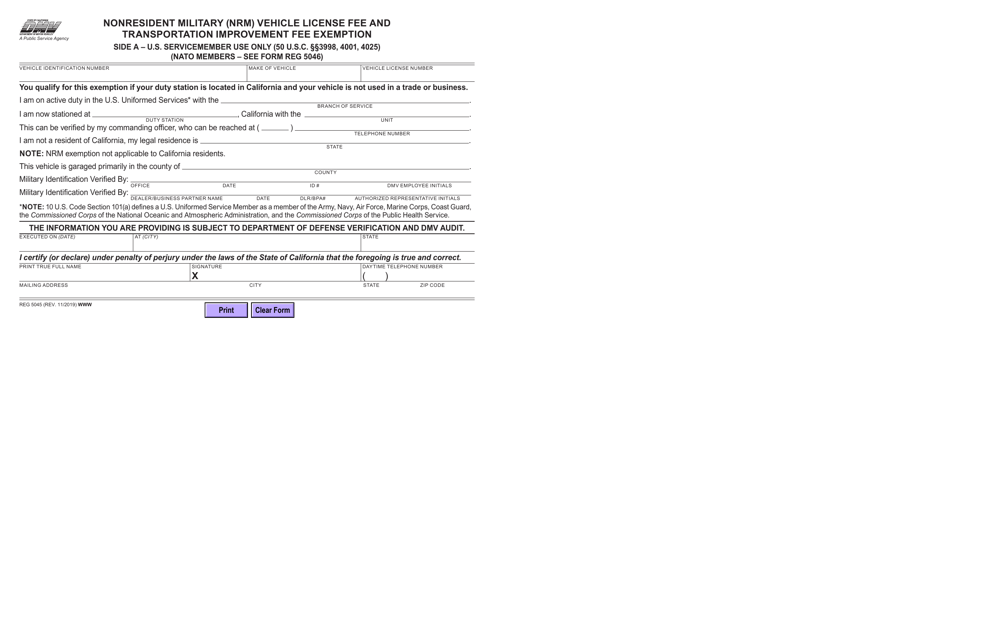

This Form is used for applying for exemption from vehicle license fee and transportation improvement fee for nonresident military personnel in California.

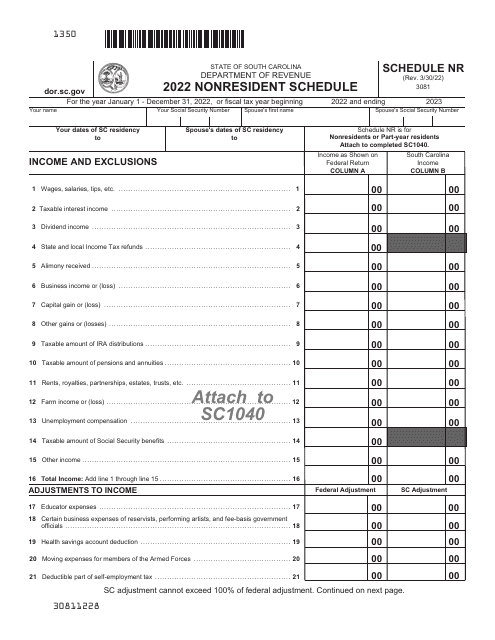

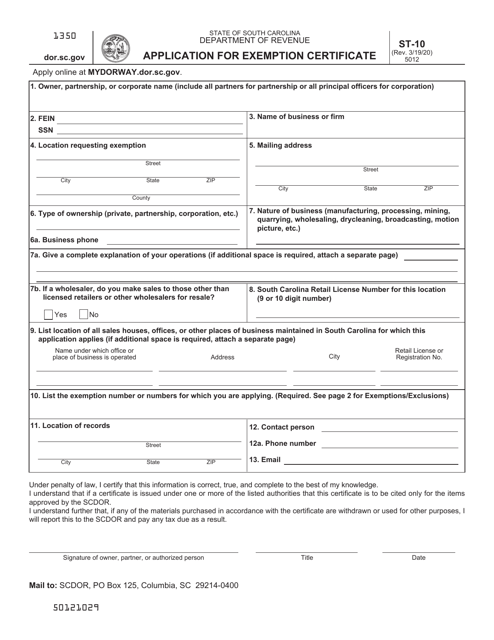

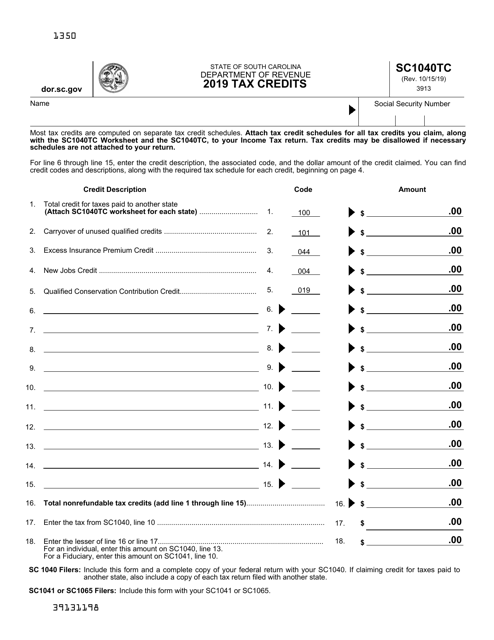

This form is used for applying for an exemption certificate in South Carolina.

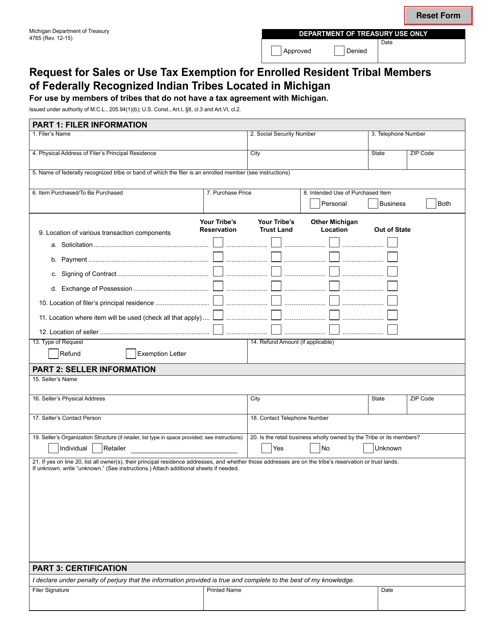

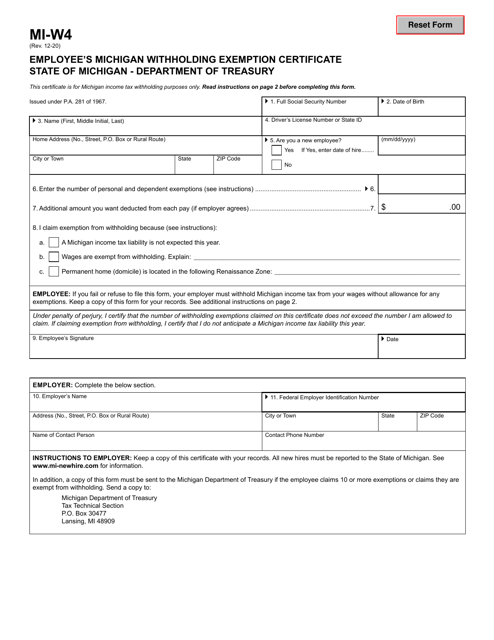

This form is used for requesting sales or use tax exemption for enrolled resident tribal members of federally recognized Indian tribes located in Michigan.

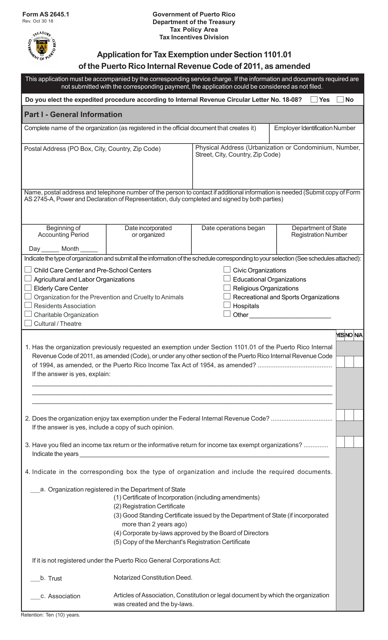

This Form is used for applying for tax exemption under Section 1101.01 of the Puerto Rico Internal Revenue Code of 2011, as amended in Puerto Rico.

This document provides tax information for motor vehicle dealers in Florida. It covers topics such as sales tax, registration fees, and dealer licensing requirements.

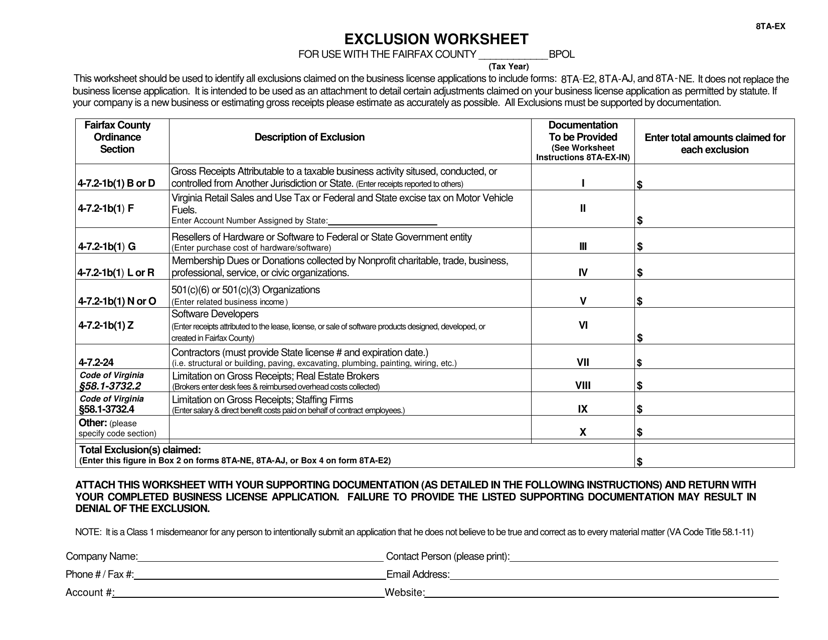

This form is used for calculating exclusions on real property taxes in Fairfax County, Virginia.

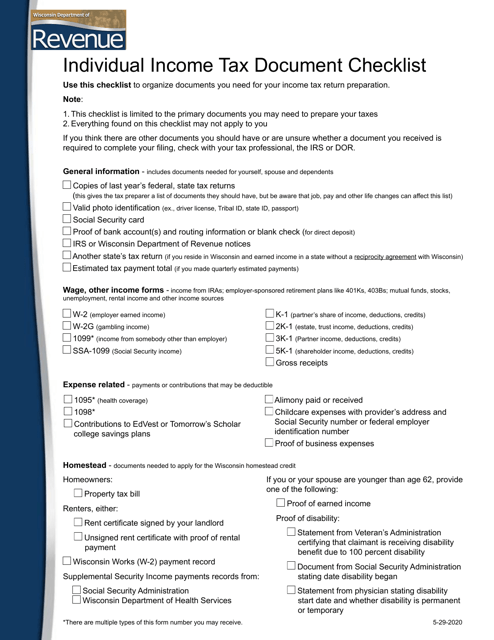

This document is a checklist for individuals filing their income tax in Wisconsin. It helps ensure that all necessary documents and information are gathered for accurate tax reporting.

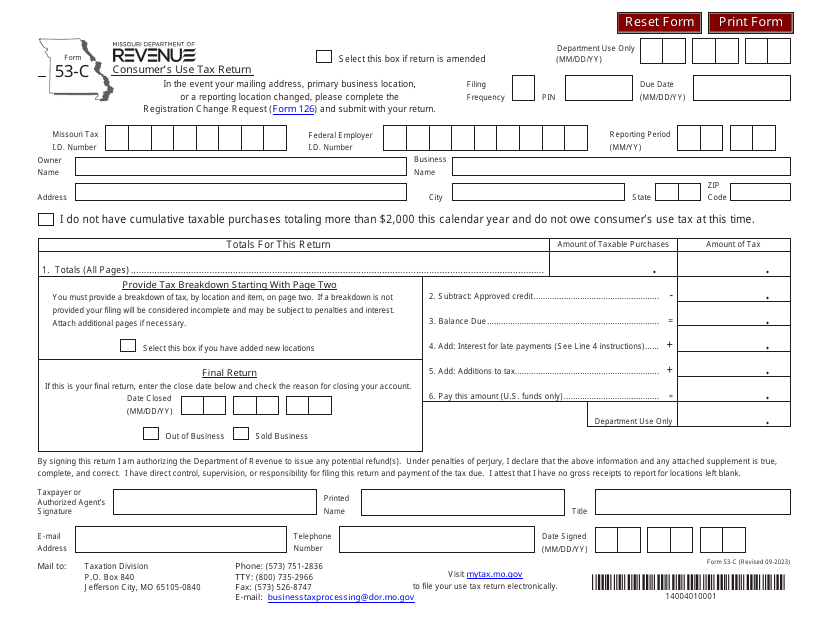

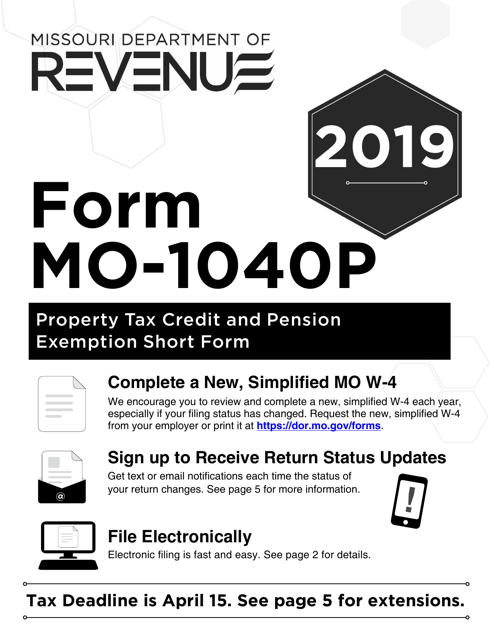

This Form is used for filing the individual income tax return and claiming property tax credit or pension exemption in Missouri.

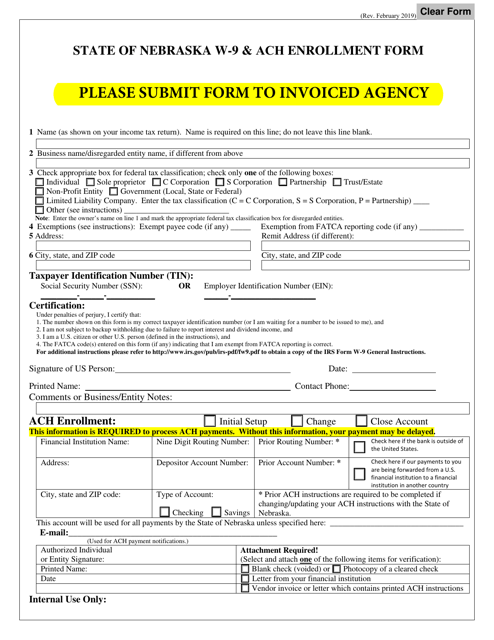

This form is used for the state of Nebraska to receive W-9 information and enroll in ACH (Automated Clearing House) payment.

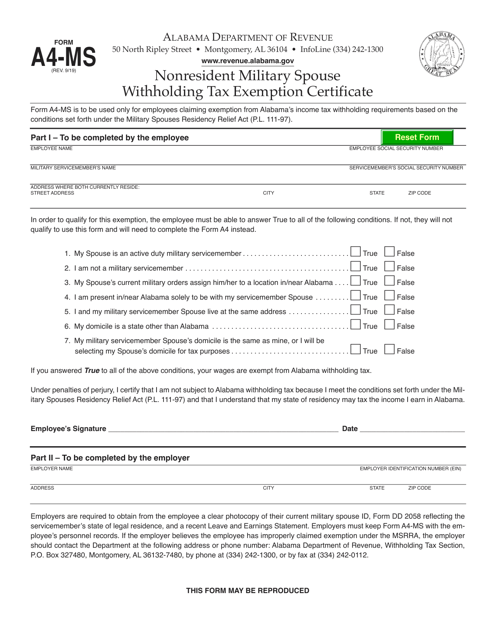

This form is used for nonresident military spouses in Alabama to claim a withholding tax exemption.

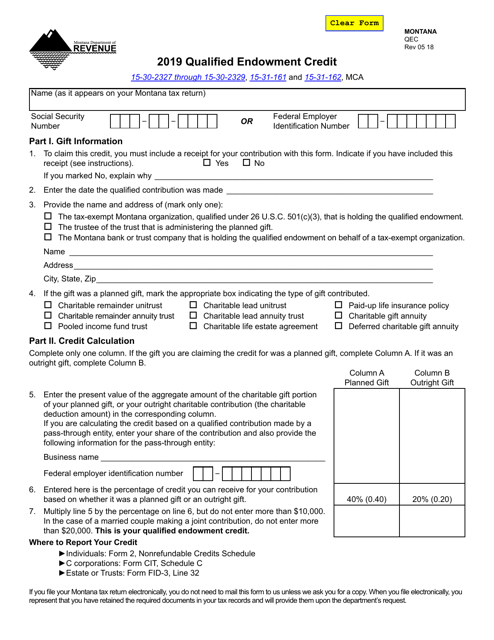

This Form is used for claiming the Qualified Endowment Credit in Montana. The credit is available to individuals and businesses contributing to qualified endowment funds.

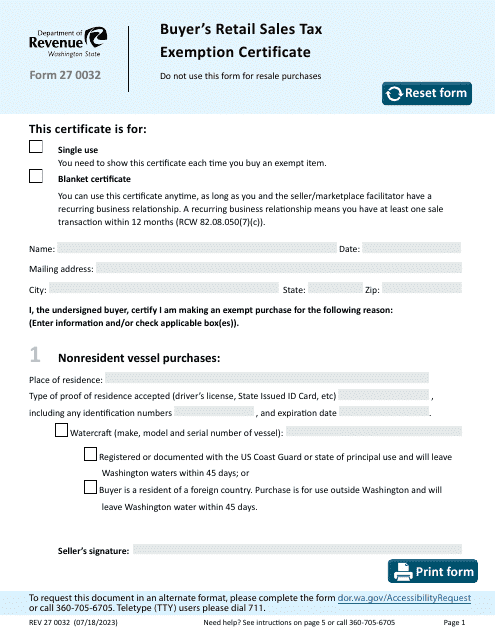

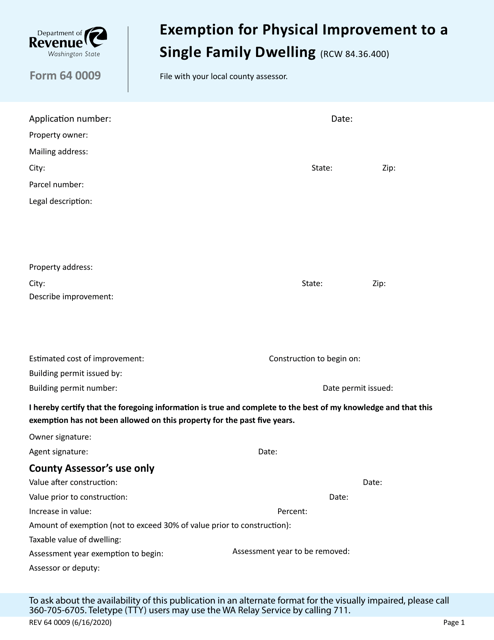

This Form is used for claiming exemption for physical improvement to a single-family dwelling in the state of Washington.

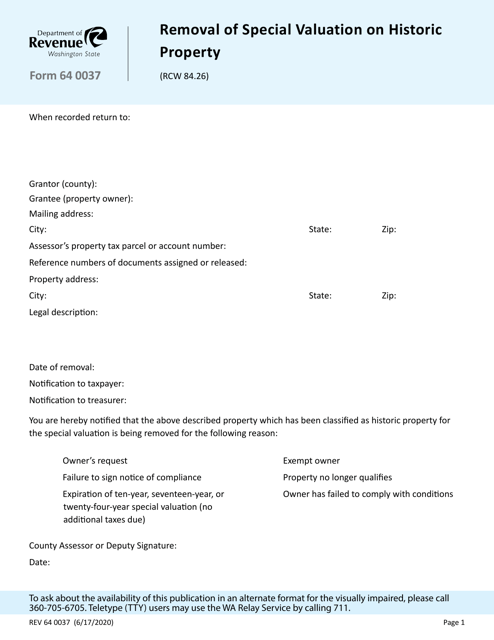

This Form is used for requesting the removal of special valuation on a historic property in Washington state.

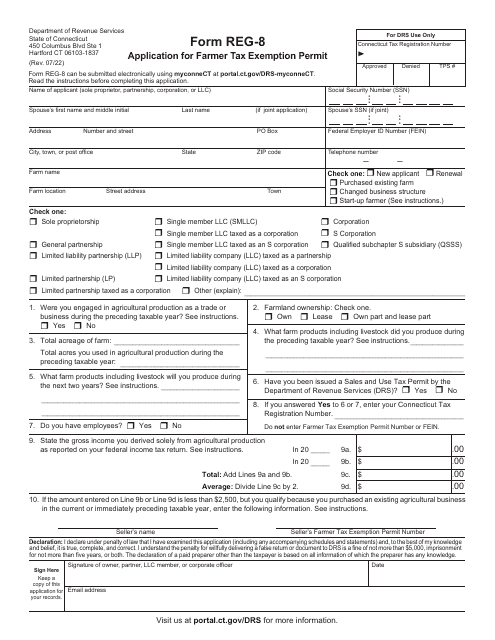

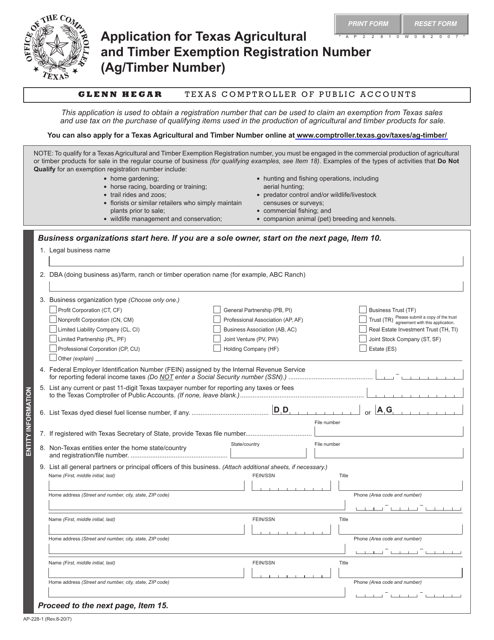

This form is used for applying for a Texas Agricultural and Timber Exemption Registration Number (Ag/Timber Number) in Texas.