Tax Exempt Form Templates

Documents:

1303

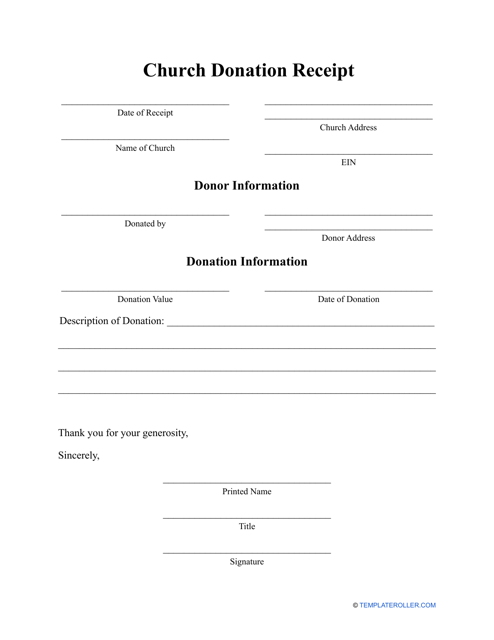

This type of template acts as a document that keeps a note of any donations that have been gifted to a church.

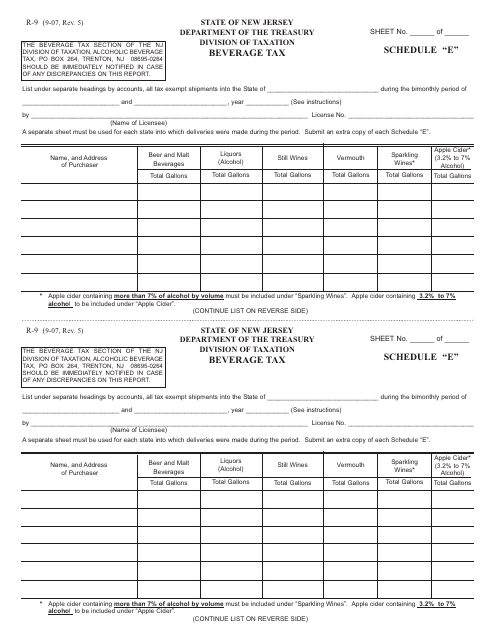

This form is used for reporting and paying beverage tax in the state of New Jersey.

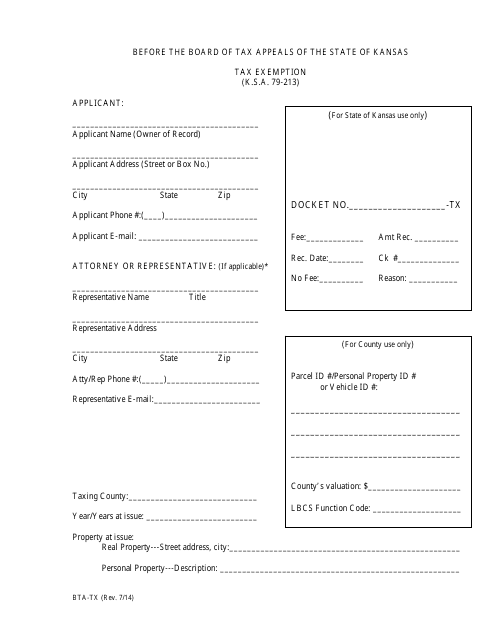

This Form is used for applying for a tax exemption in the state of Kansas.

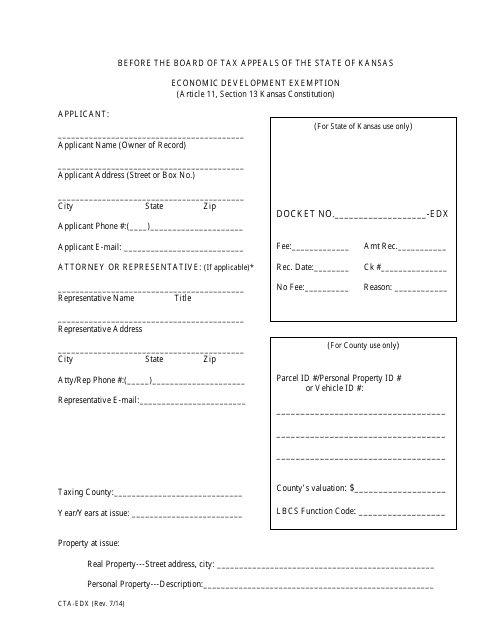

This type of document is used to apply for an economic development exemption in the state of Kansas. It allows businesses to potentially qualify for tax benefits and incentives in order to encourage job creation and investment in the local economy.

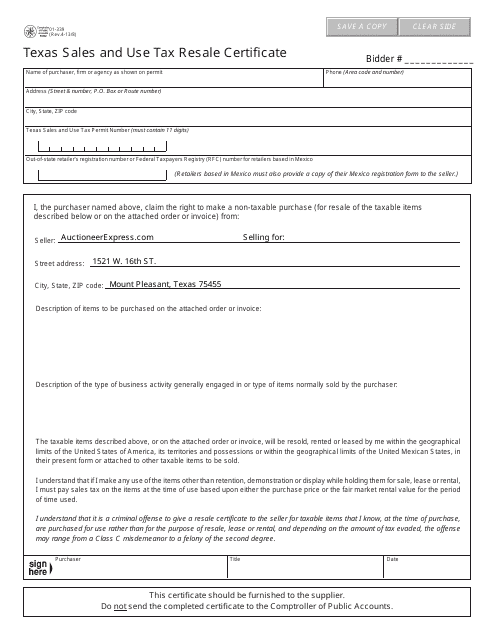

This is a legal form presented by a purchaser to a seller from whom the purchaser buys the goods with the purpose of resale in the state of Texas.

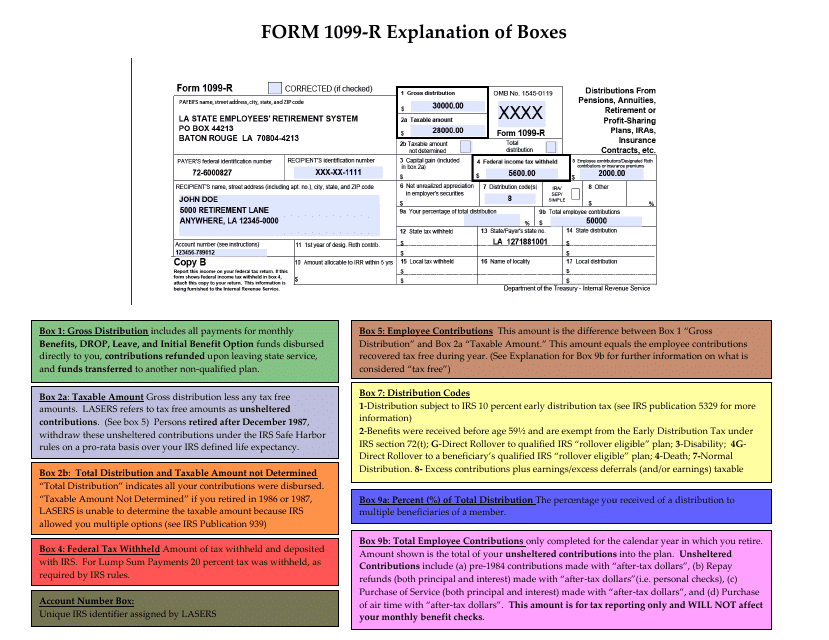

This document provides instructions for IRS Form 1099-R, which is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and other types of retirement accounts. The document explains the different boxes on the form and how to fill them out accurately.

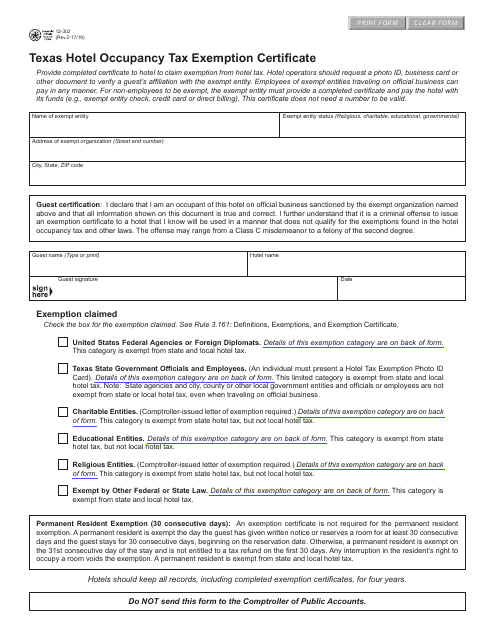

This form is used for requesting exemption from hotel occupancy tax in the state of Texas.

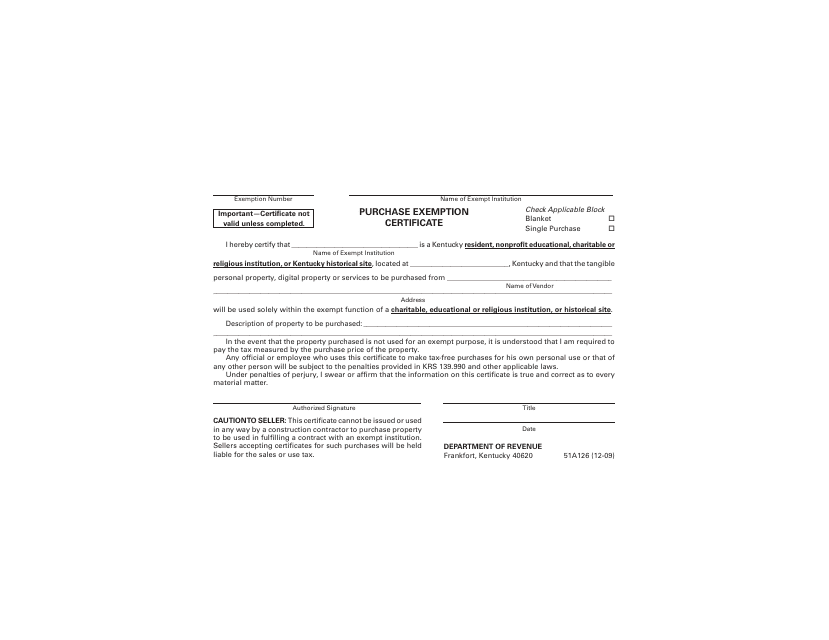

This form is used for requesting a purchase exemption certificate in the state of Kentucky. It allows individuals or businesses to claim an exemption from paying sales tax on specified purchases.

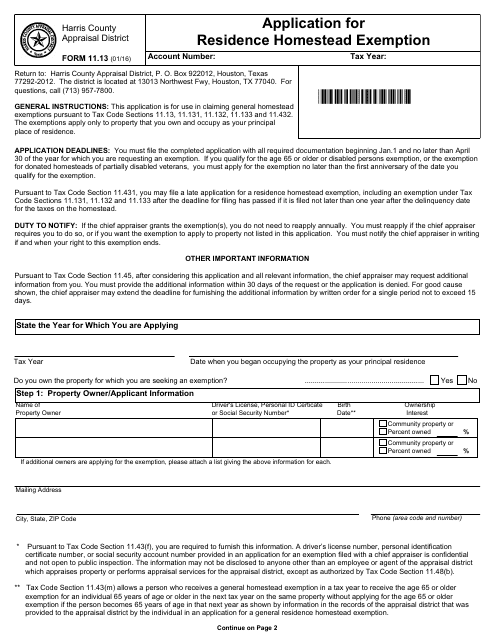

This Form is used for applying for a residence homestead exemption with the Harris County Appraisal District in Texas.

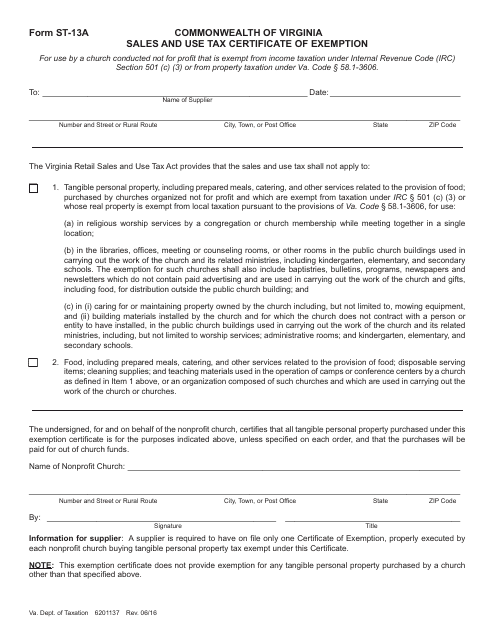

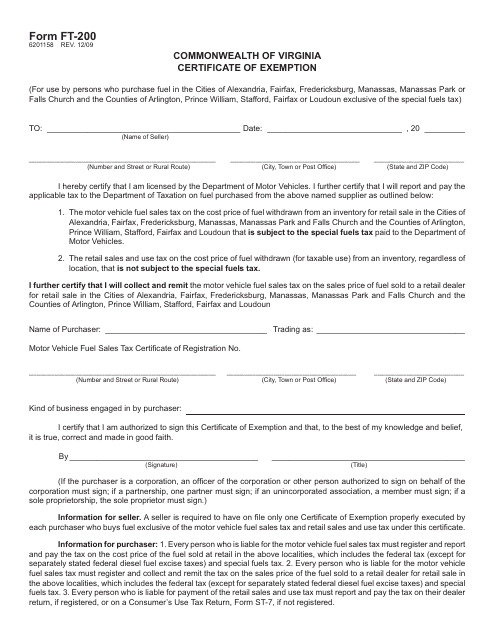

This document is used for claiming exemption from sales and use tax in Virginia. It is commonly used by individuals and organizations purchasing goods or services for certain exempt purposes.

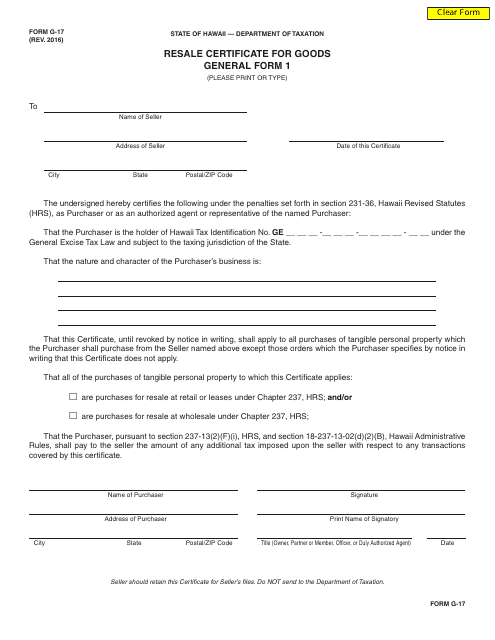

This form is used for applying for a resale certificate for goods in the state of Hawaii. It allows businesses to purchase goods for resale without paying sales tax.

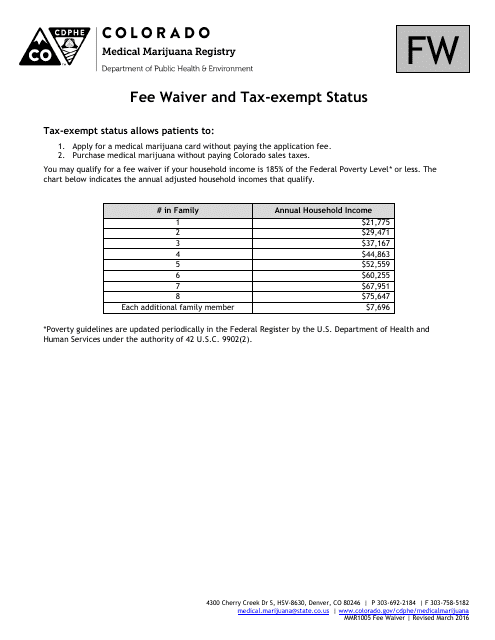

This document is used to request a fee waiver or tax-exempt status in the state of Colorado.

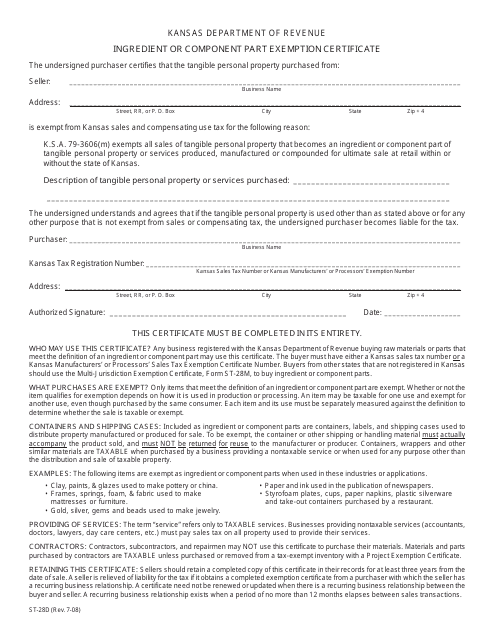

This document is used for claiming an exemption on certain ingredients or component parts in Kansas.

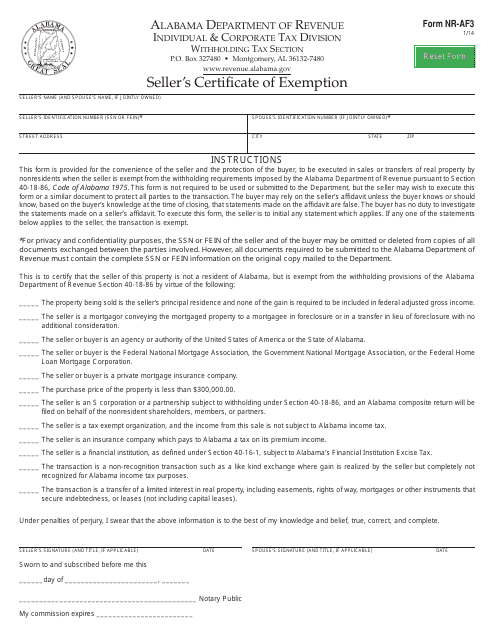

This form is used for sellers in Alabama to provide a certificate of exemption for certain transactions.

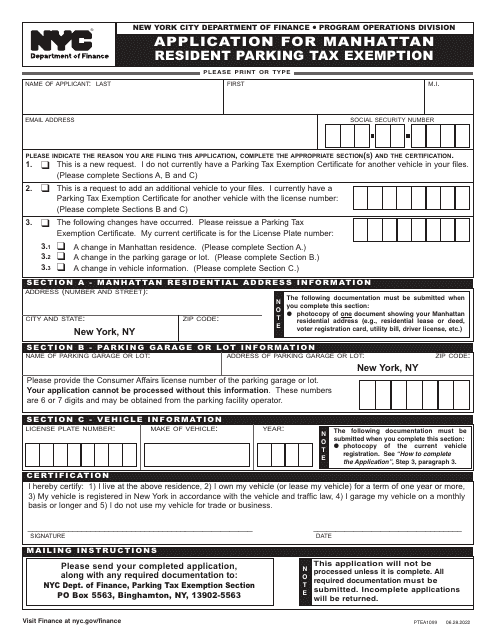

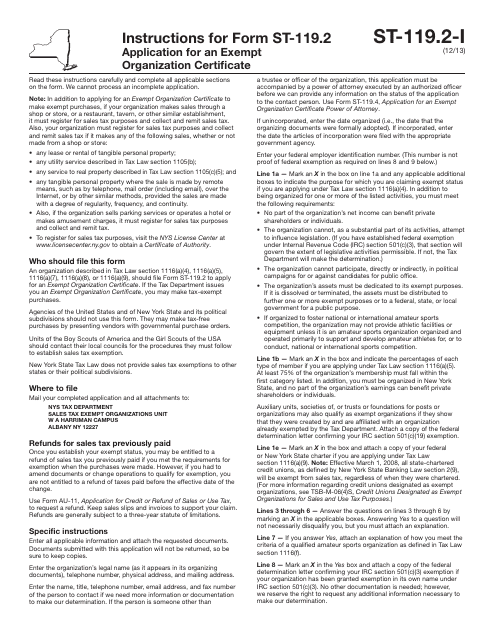

This document is used for applying for an Exempt Organization Certificate in New York.

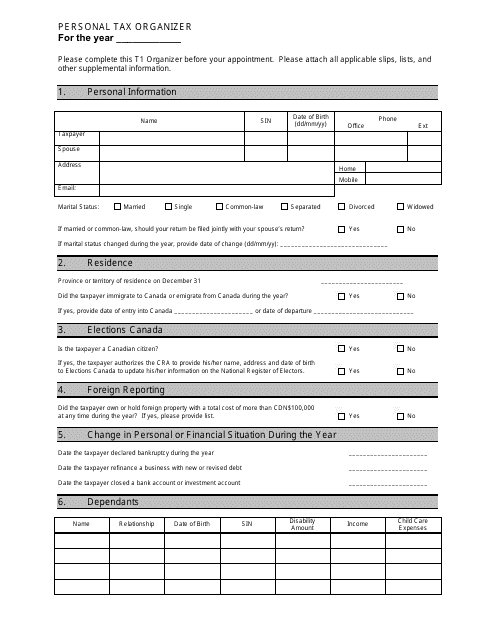

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

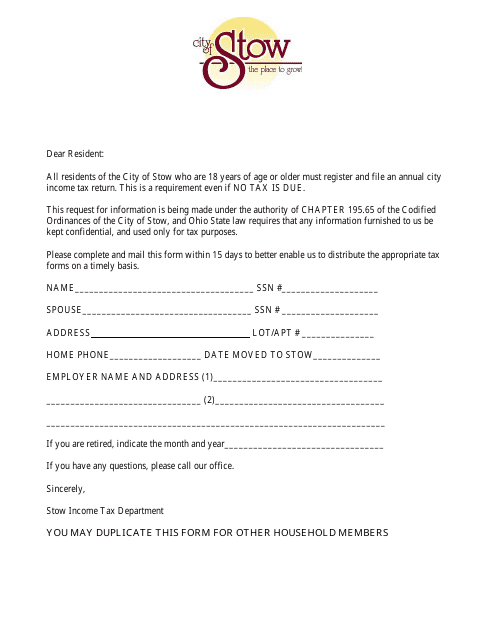

This Form is used for filing your income tax return in the City of Stow, Ohio.

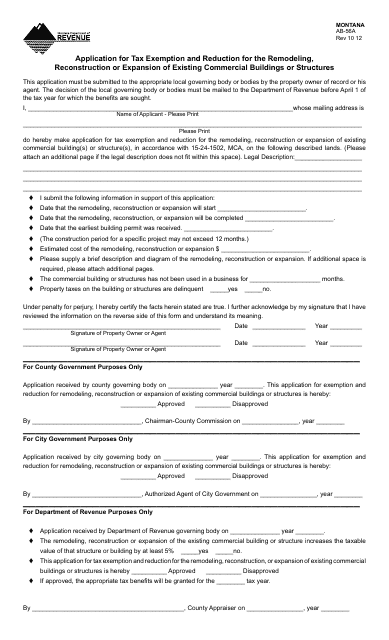

This form is used for applying for tax exemption and reduction for remodeling, reconstruction, or expansion of existing commercial buildings or structures in Montana.

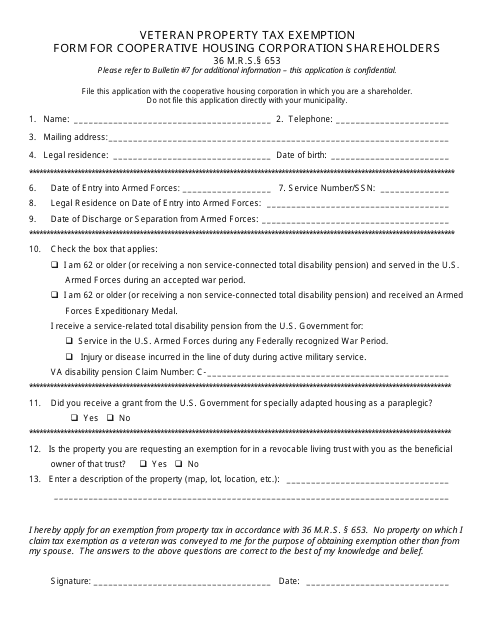

This form is used for cooperative housing corporation shareholders in Maine to apply for a veteran property tax exemption.

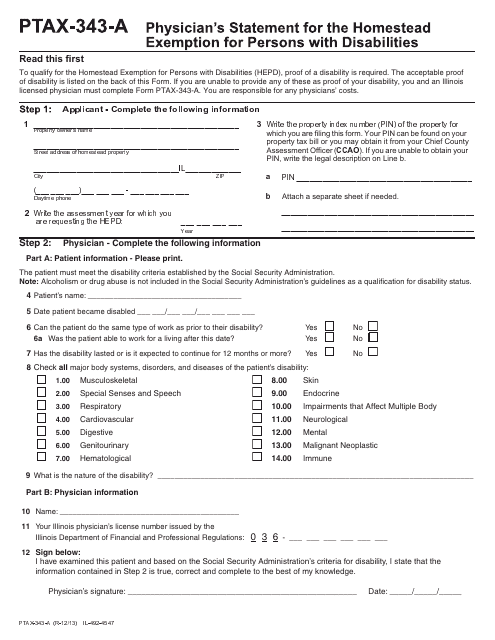

This form is used for applying for a tax exemption for persons with disabilities in the state of Illinois. Physicians need to complete this form to provide supporting medical information.

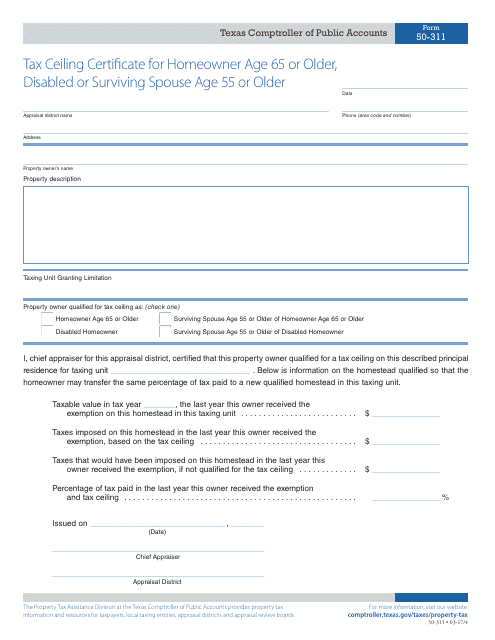

This form is used for homeowners in Texas who are age 65 or older, disabled, or surviving spouse age 55 or older to apply for a tax ceiling certificate. This document helps eligible individuals receive property tax relief.

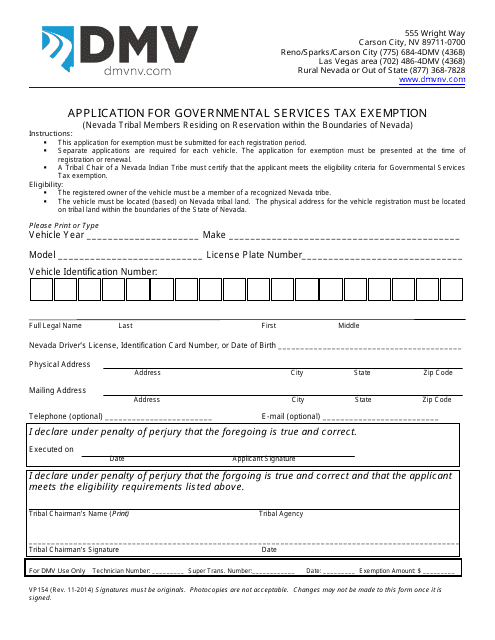

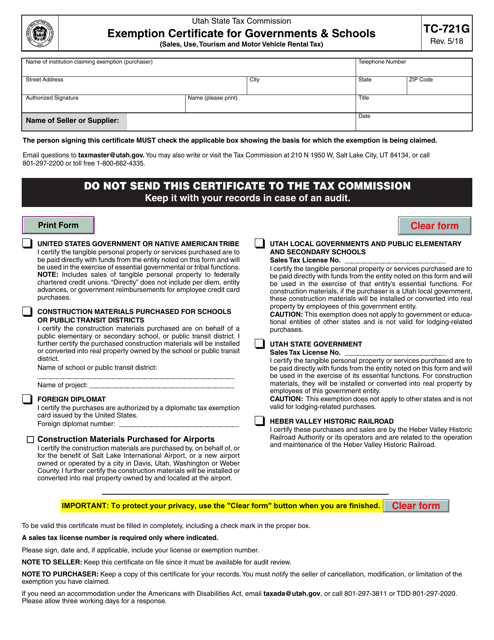

This form is used for applying for a tax exemption on governmental services in Nevada.

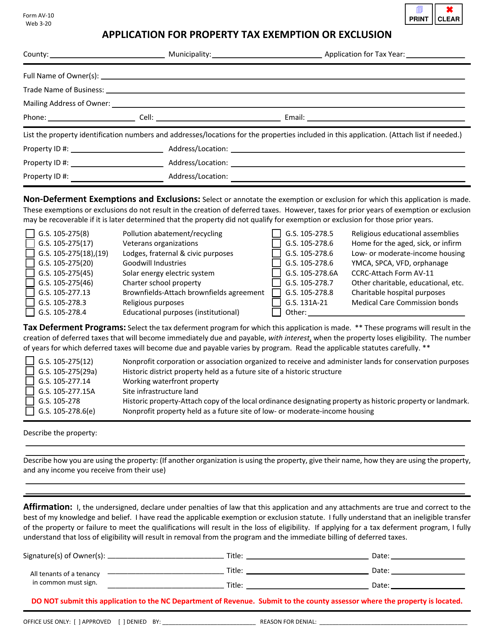

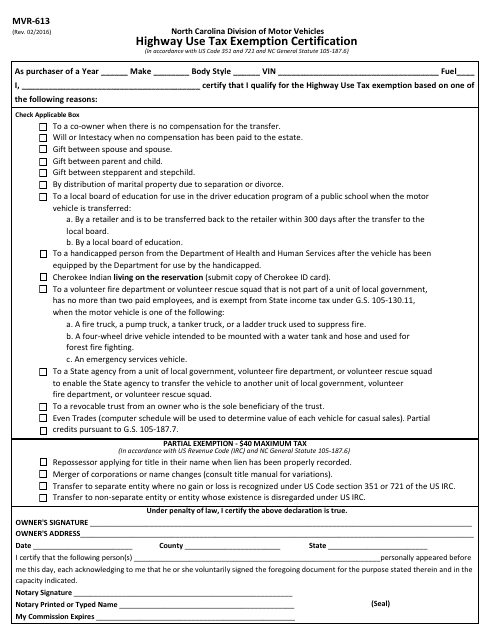

This form is used for certifying exemption from highway use tax in North Carolina.

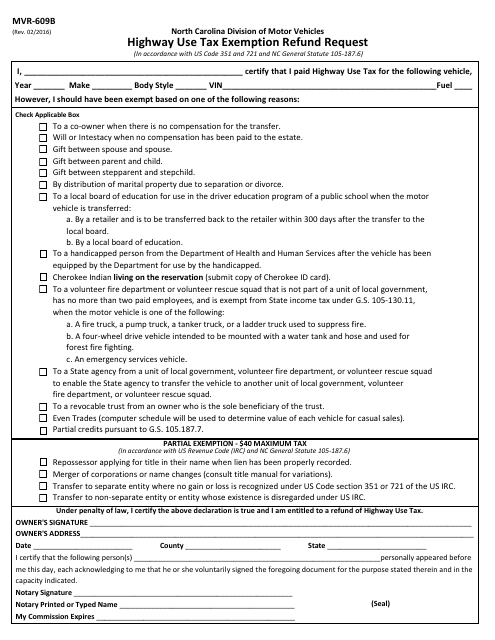

This form is used for requesting a refund of highway use tax exemption in North Carolina.

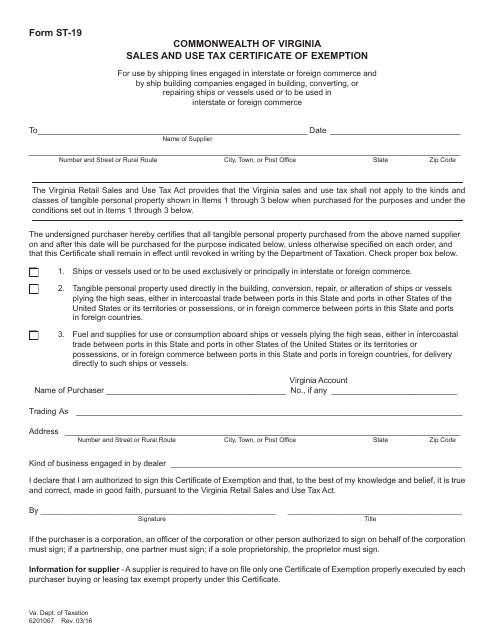

This form is used for businesses in Virginia to claim exemption from sales tax for shipping commerce.

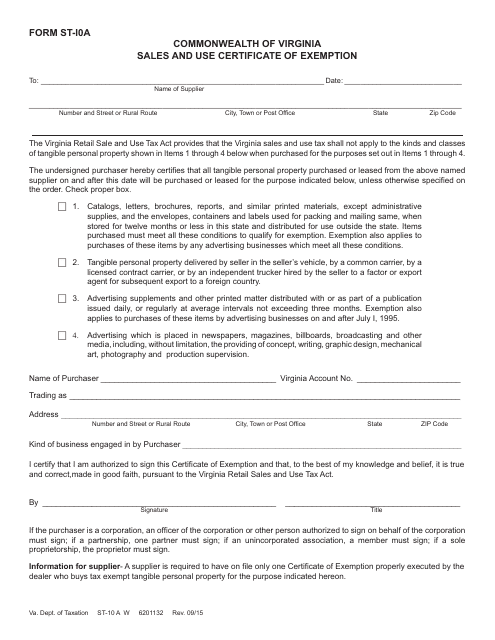

This form is used for applying for an exemption on sales tax for printed materials in the state of Virginia.

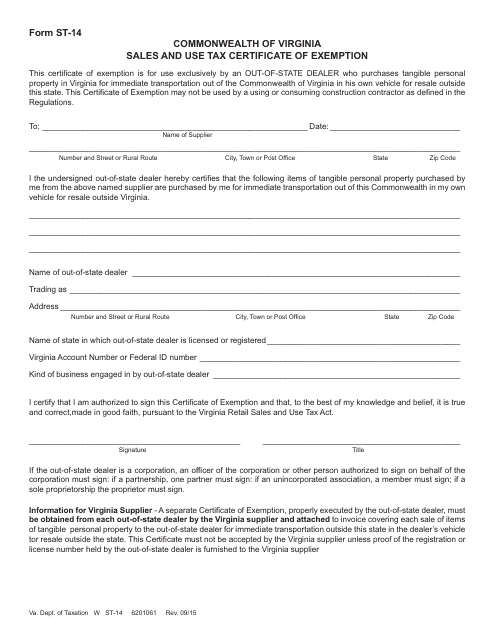

This form is used for Virginia residents who are out-of-state resale dealers to claim exemption from sales tax when purchasing goods for resale out of state.

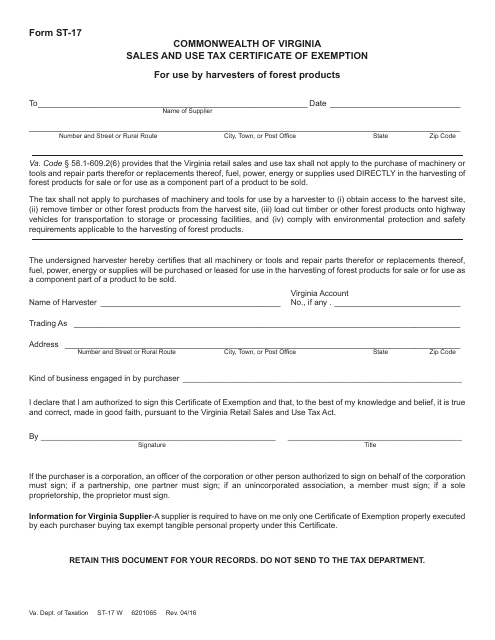

This form is used for obtaining a tax exemption certificate for forest harvesters in Virginia.

This Form is used for applying for a certificate of exemption in Virginia. It is a document that allows certain individuals or organizations to be exempt from certain taxes or fees in the state.

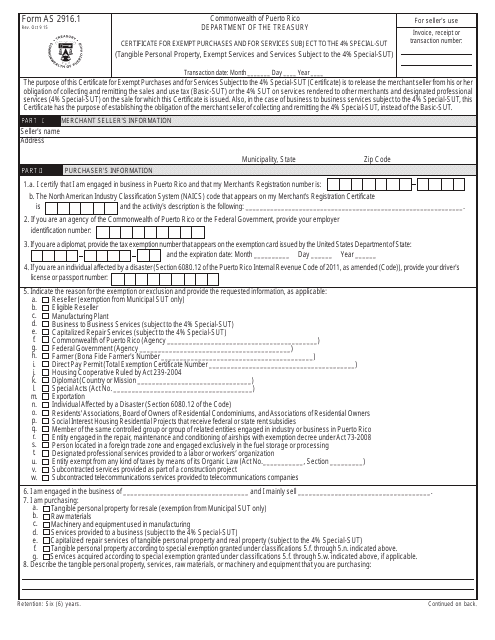

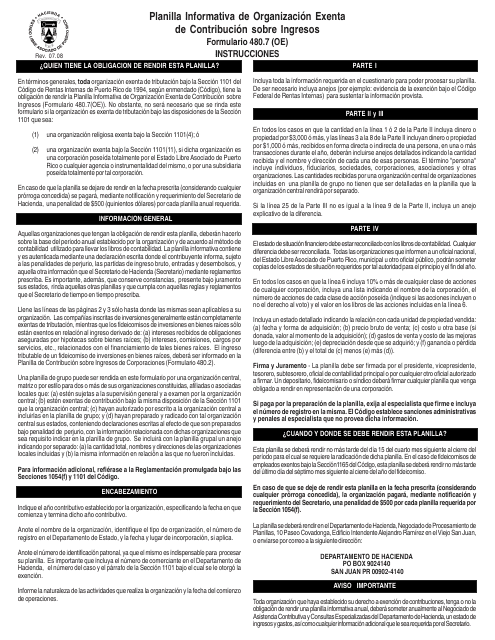

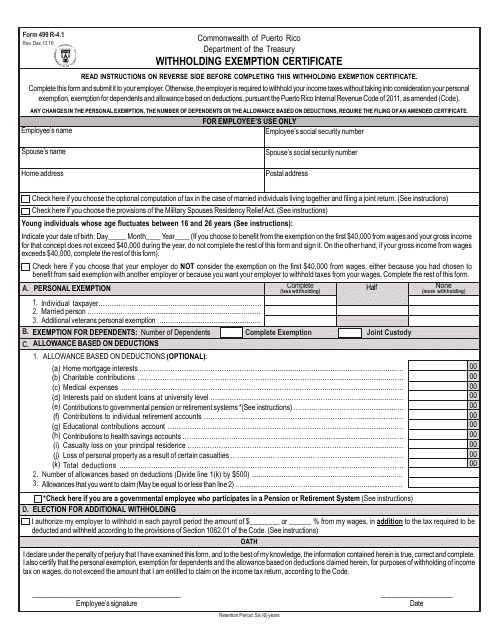

This document is used for claiming withholding tax exemption in Puerto Rico.

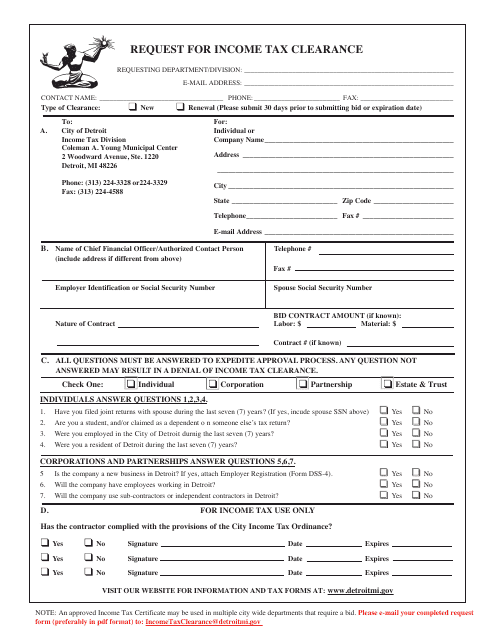

This form is used for requesting an income tax clearance in Detroit, Michigan. It is required to ensure all income taxes have been paid before certain transactions or activities can take place.

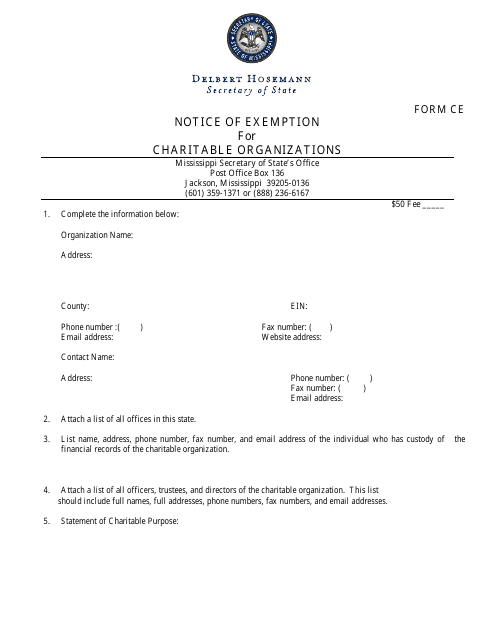

This form is used for charitable organizations in Mississippi to apply for an exemption from certain taxes.

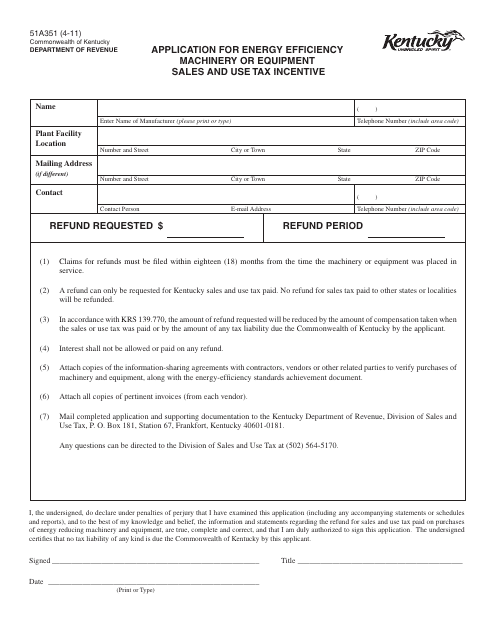

This form is used for applying for the Energy Efficiency Machinery or Equipment Sales and Use Tax Incentive in the state of Kentucky.