Tax Compliance Form Templates

Documents:

727

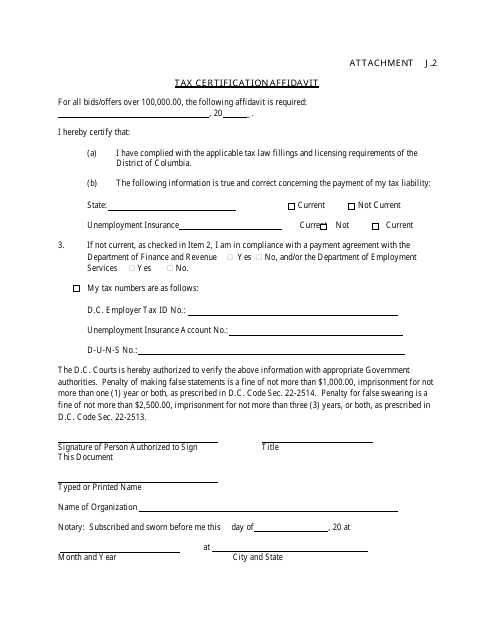

This document is for certifying tax information in Washington, D.C. It is used to confirm details related to tax obligations.

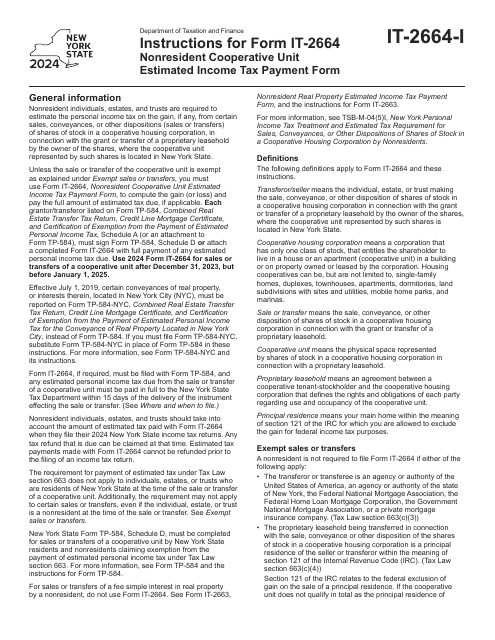

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

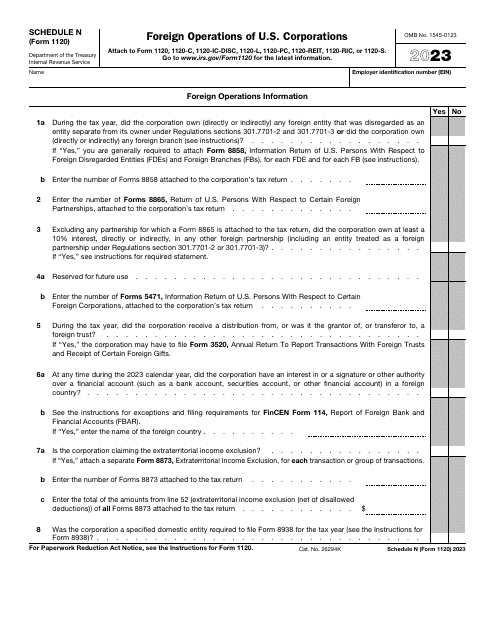

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

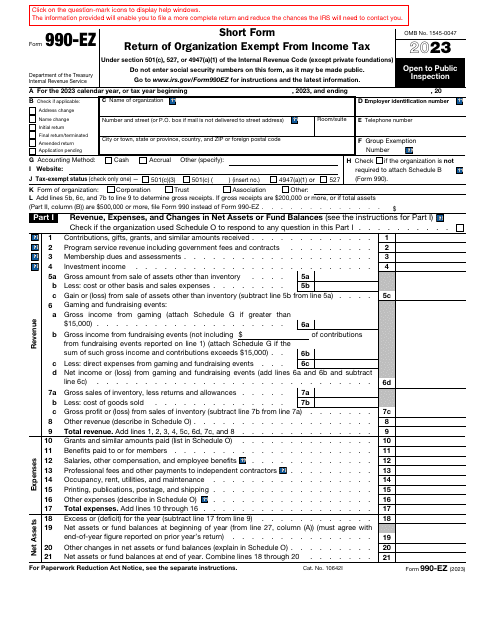

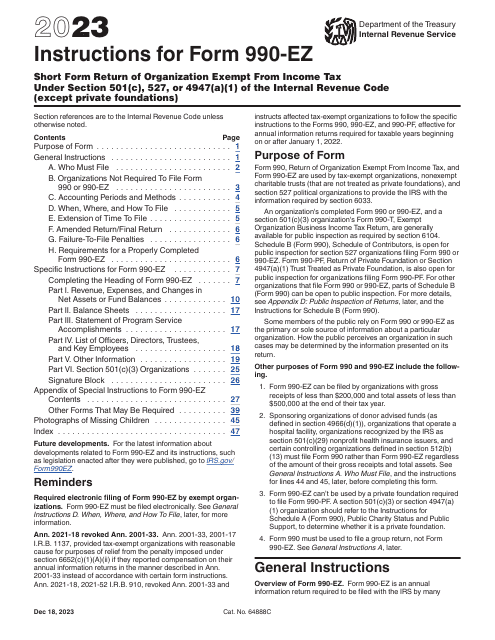

This is a fiscal form used by tax-exempt organizations required to inform tax organizations about their earnings, expenses, and achievements over the course of the year.

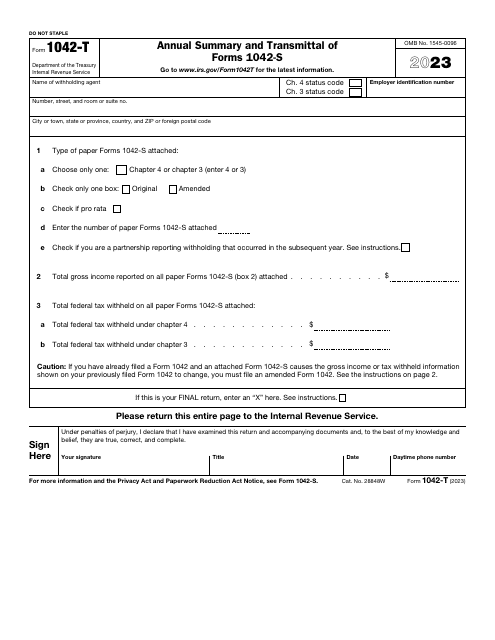

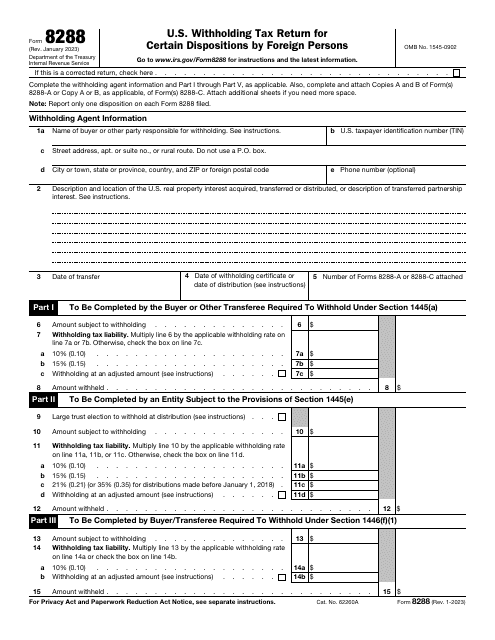

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

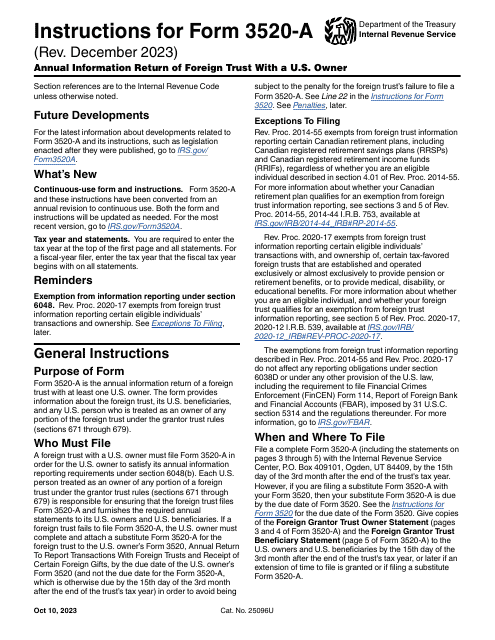

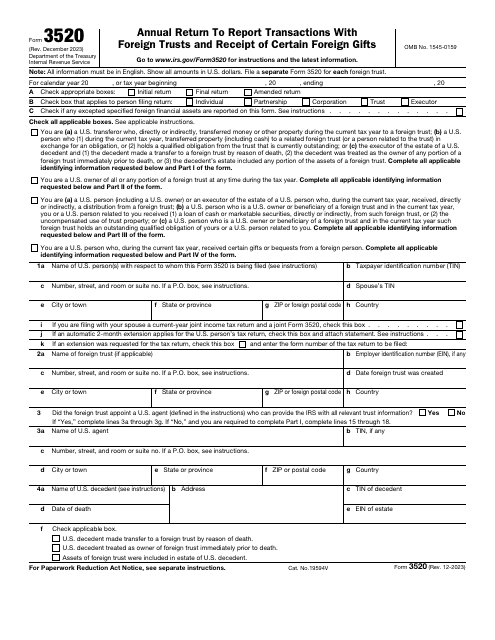

This form is a formal statement used by people and entities obliged to tell the fiscal authorities about the transactions they have had with foreign trusts throughout the year.

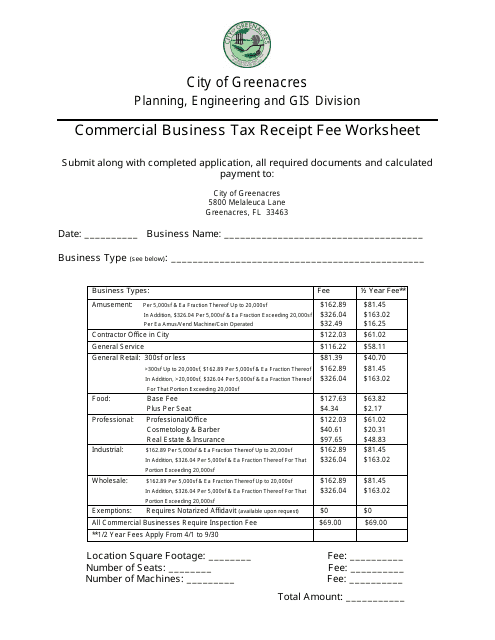

This document is used for calculating the fee for a commercial business tax receipt in the City of Greenacres, Florida.