Tax Compliance Form Templates

Documents:

727

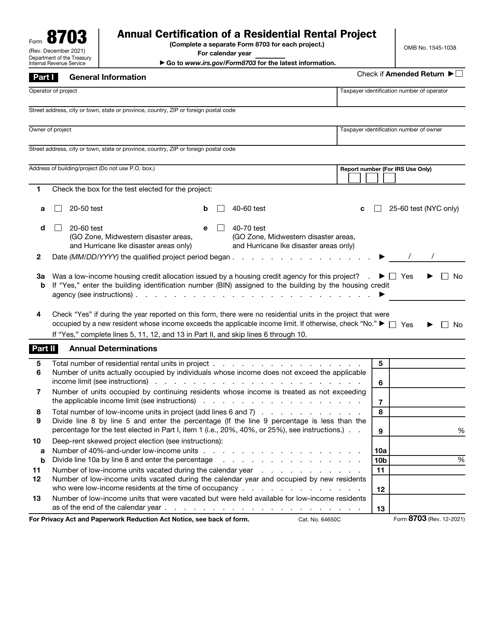

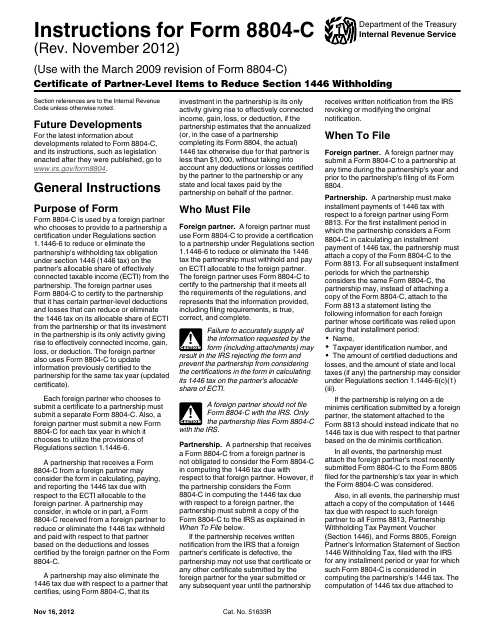

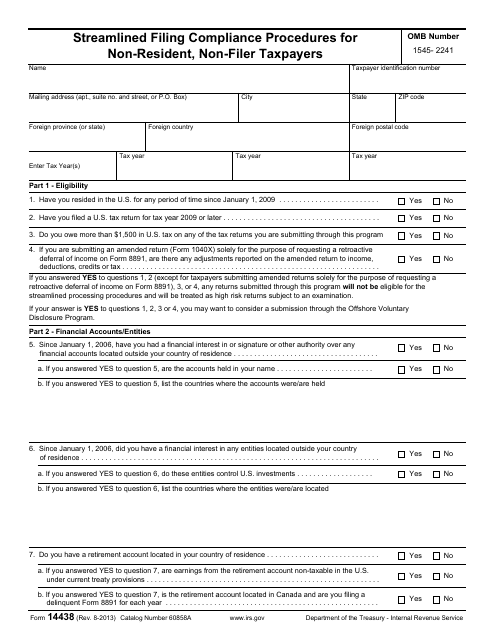

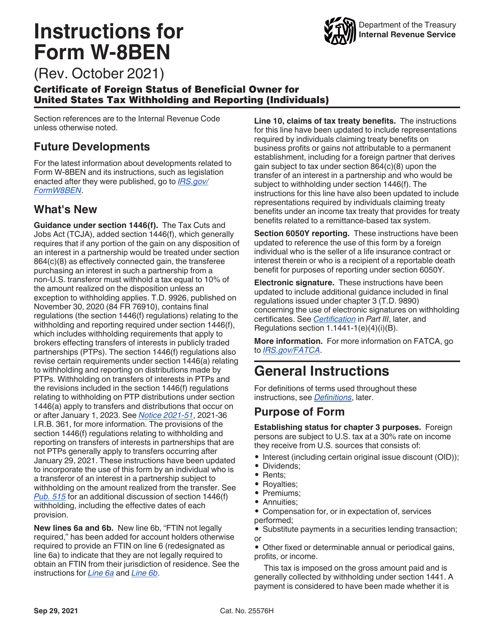

This form is used for reporting partner-level items that can reduce the amount of withholding tax under Section 1446.

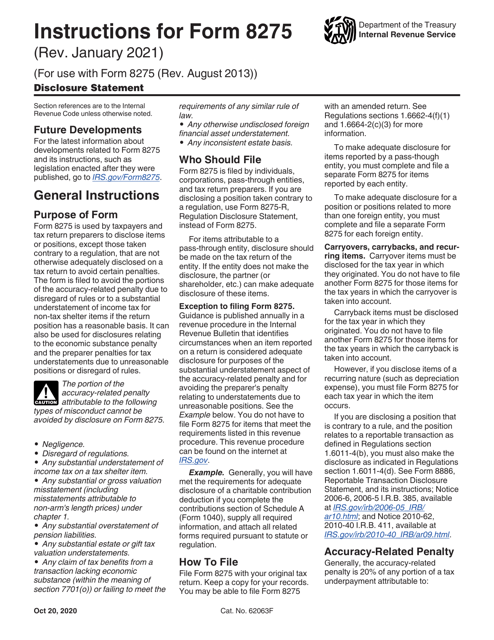

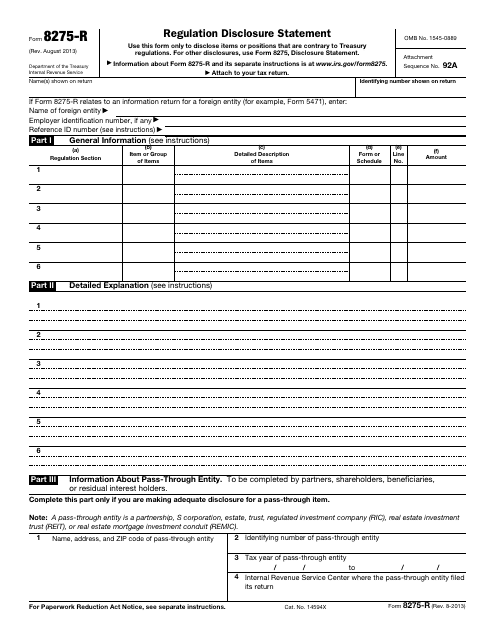

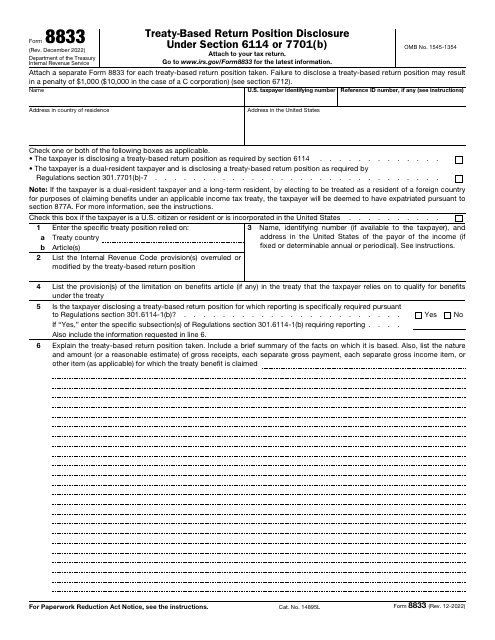

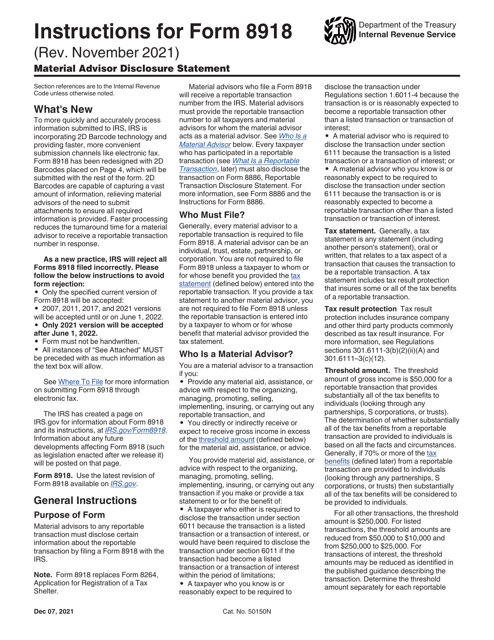

This document is used to disclose information about the regulations that apply to a tax return.

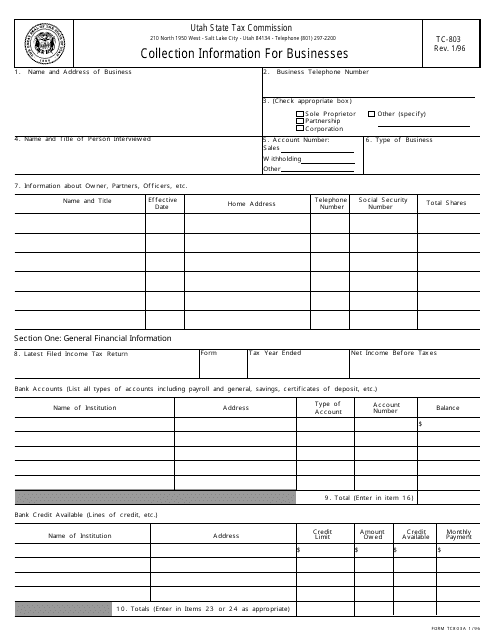

This form is used for businesses in Utah to provide collection information.

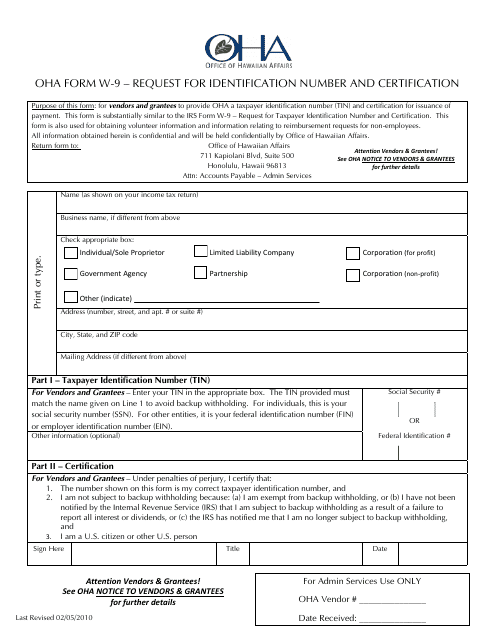

This Form is used for requesting identification number and certification in the state of Hawaii.

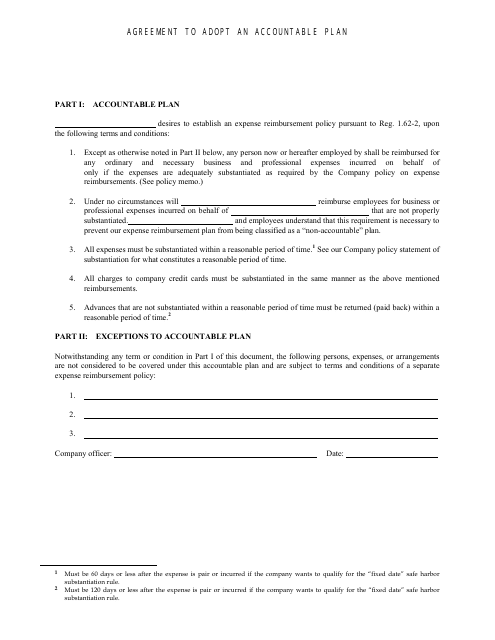

This document is used to establish an accountable plan for reimbursing business expenses incurred by employees.

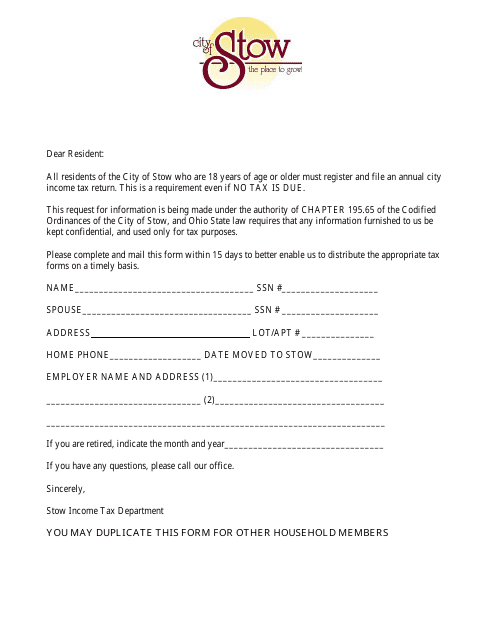

This Form is used for filing your income tax return in the City of Stow, Ohio.

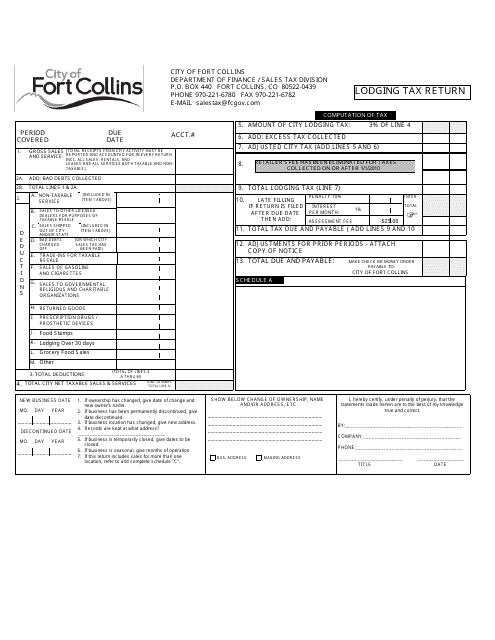

This document is used for filing a lodging tax return specifically for the city of Fort Collins, Colorado. It is required for individuals or businesses that provide lodging accommodations within the city and need to report and remit the applicable taxes.

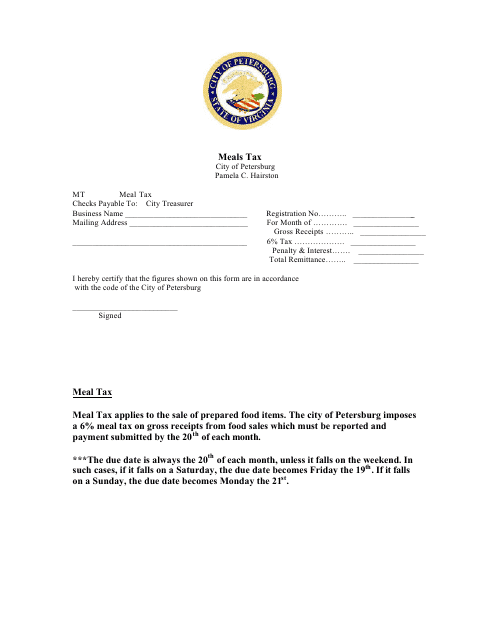

This form is used for reporting and paying the meals tax in Petersburg, Virginia. Businesses in the city that sell prepared meals are required to complete and submit this form to the local tax authority.

This form is used for reporting and remitting sales and use taxes to the City of Boulder, Colorado.

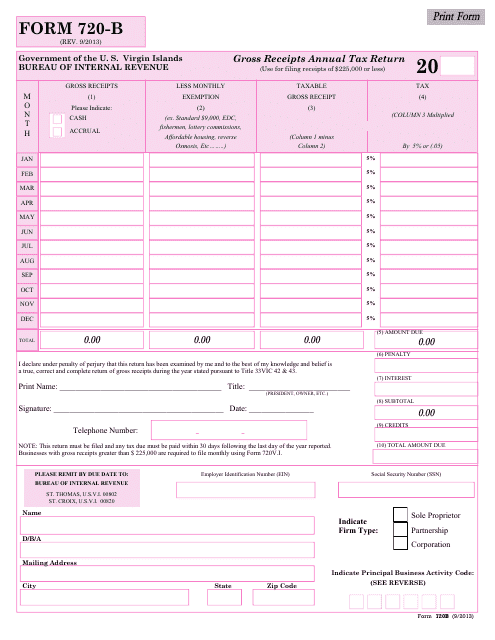

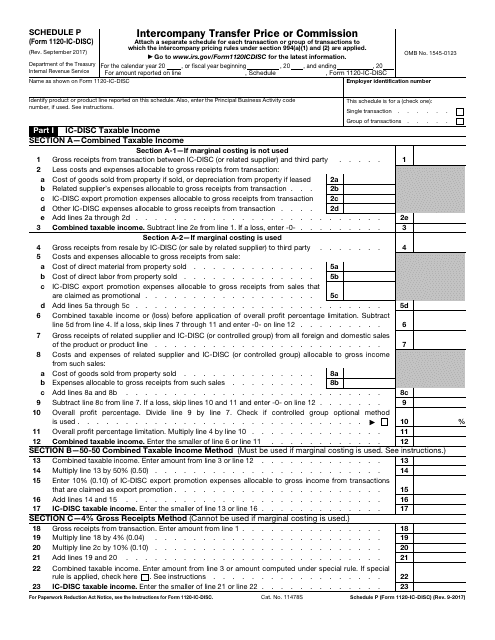

This Form is used for filing the Gross Receipts Annual Tax Return specifically for businesses operating in the Virgin Islands.

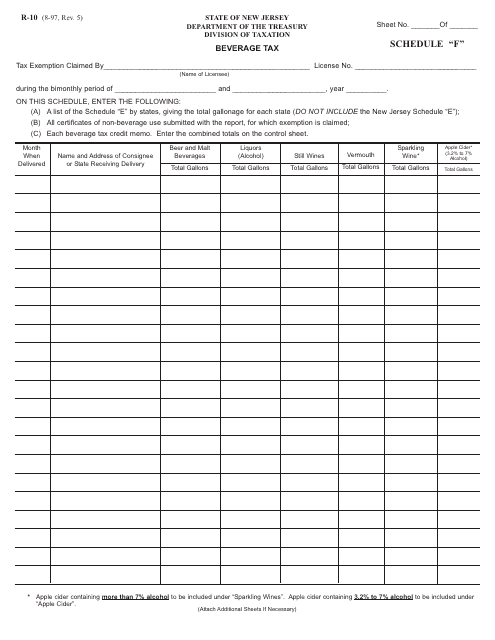

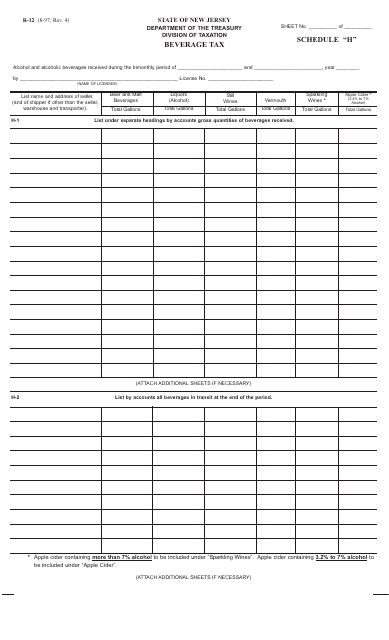

This form is used for reporting beverage taxes in New Jersey

This form is used for reporting and paying beverage taxes in the state of New Jersey.

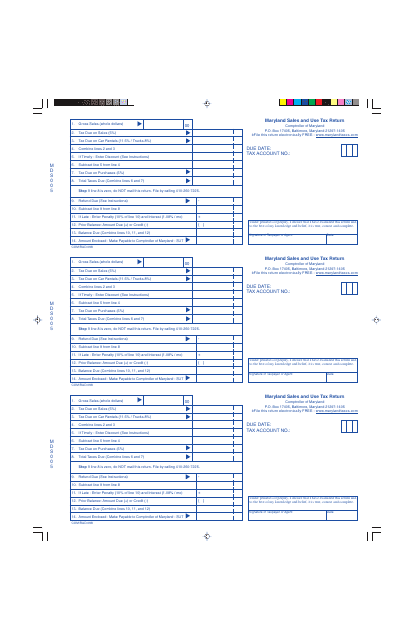

This document is used to report and remit sales and use tax in the state of Maryland. Businesses must submit this return to the Maryland Comptroller's Office to report the sales they have made and the corresponding sales tax collected.

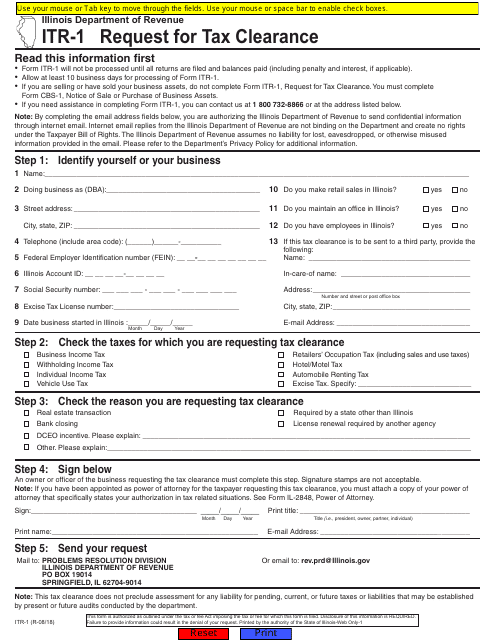

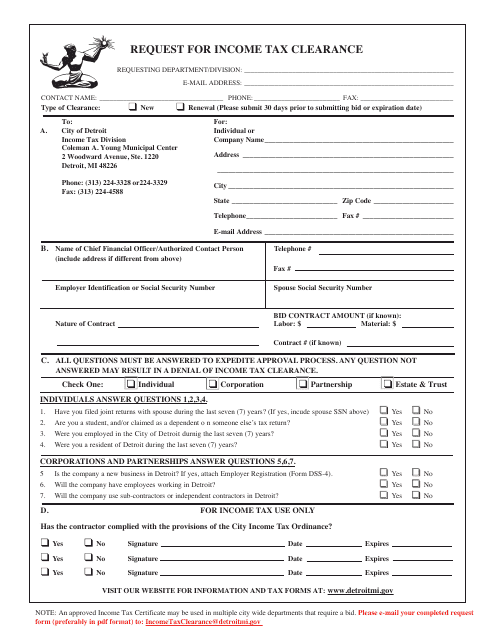

This form is used for requesting an income tax clearance in Detroit, Michigan. It is required to ensure all income taxes have been paid before certain transactions or activities can take place.

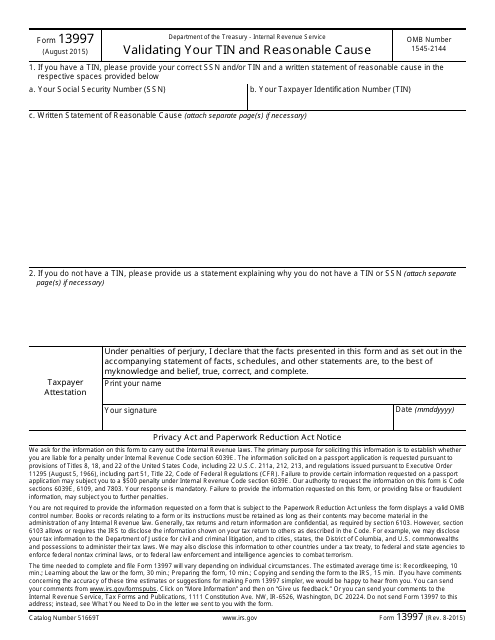

This Form is used for validating your Taxpayer Identification Number (TIN) and providing a reasonable cause explanation.

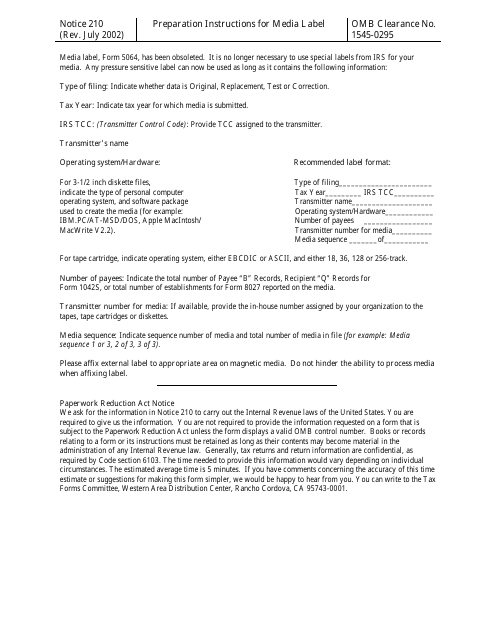

This document provides instructions for preparing media labels as required by the IRS for tax-related purposes.

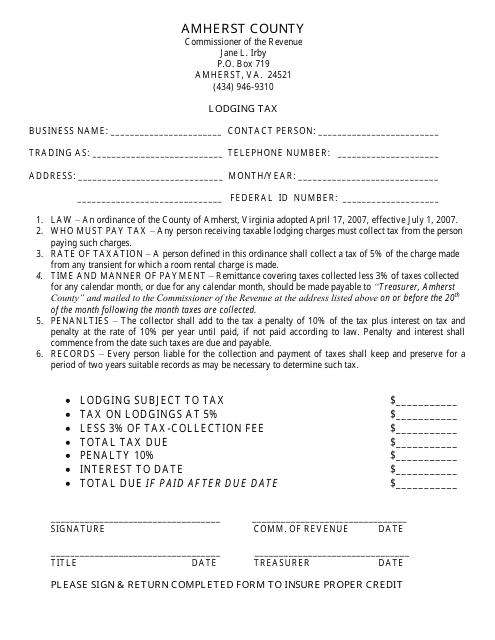

This form is used for paying lodging tax in Amherst County, Virginia.

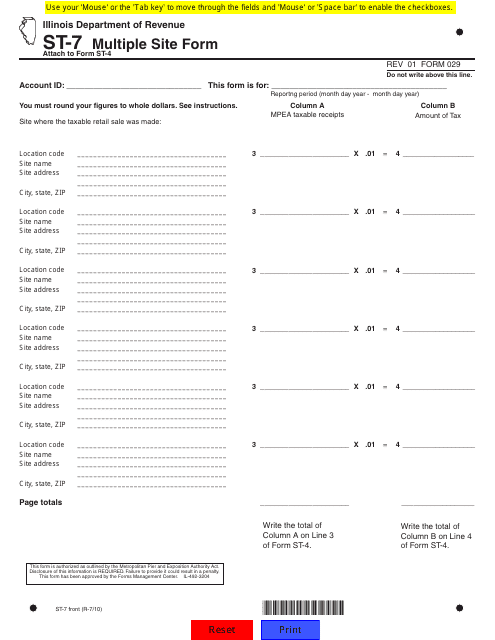

This form is used for reporting multiple sites in the state of Illinois. It helps businesses accurately report their sales and use tax liabilities for different locations within the state.

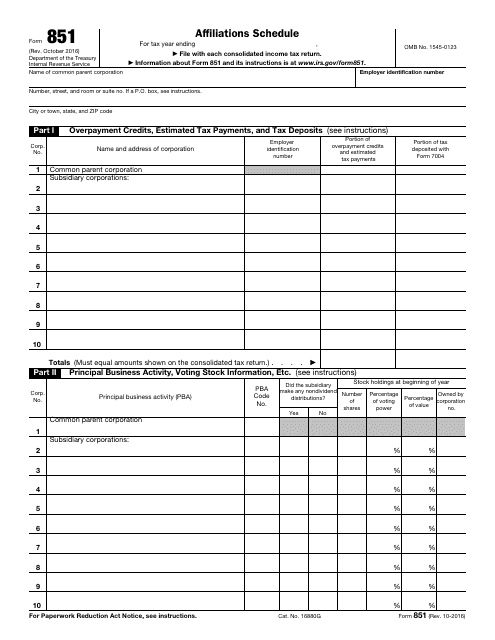

The purpose of submitting Form 851 is to report information about overpayment credits, estimated tax payments, and tax deposits, related to a common parent corporation and their subsidiary corporations.

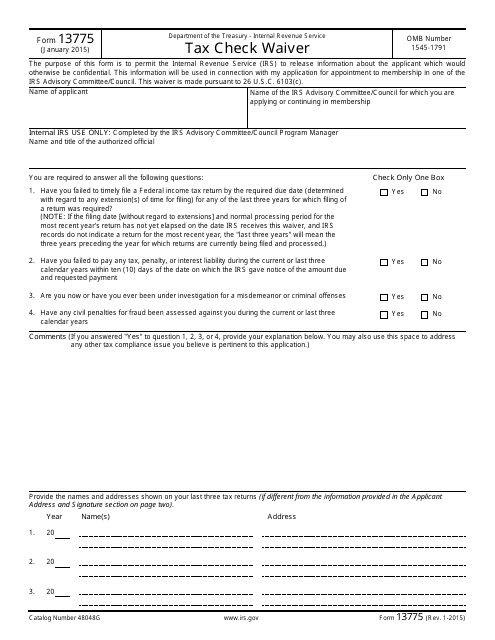

This form is used for requesting a waiver for tax checks from the IRS.

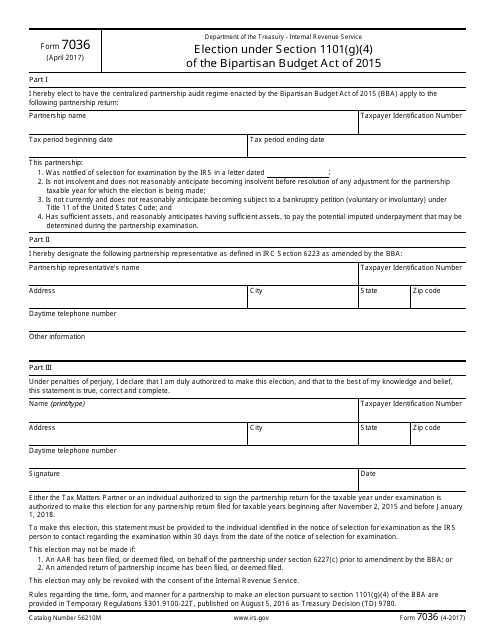

This form is used for making an election under Section 1101(G)(4) of the Bipartisan Budget Act of 2015.

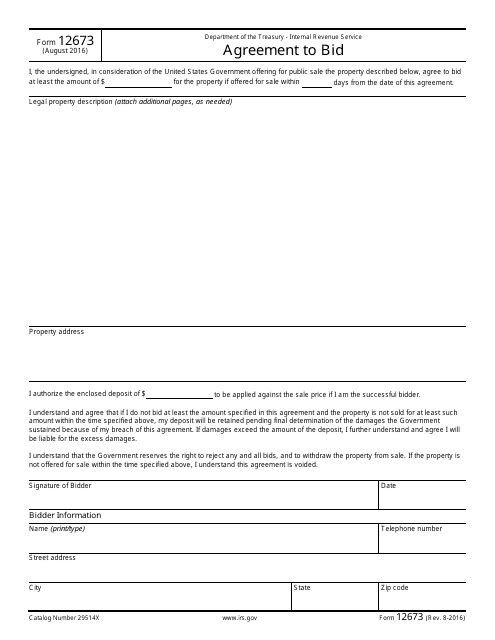

This form is used for taxpayers who want to enter into an agreement with the Internal Revenue Service (IRS) to participate in an auction or bidding process.

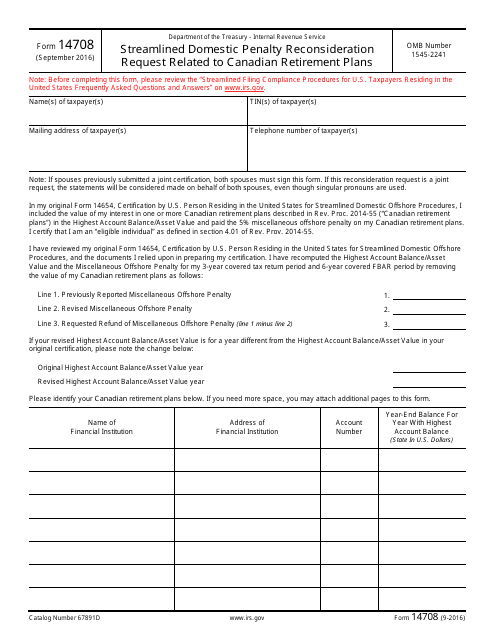

This document is used for requesting a reconsideration of penalties related to Canadian retirement plans under the Streamlined Domestic Offshore Procedures.

This Form is used for applying to adopt, change, or retain a tax year with the IRS. It is typically used by businesses or organizations that want to align their tax year with their fiscal year or have a specific reason for changing their tax year.