IRS 1065 Forms, Schedules and Instructions

What Are 1065 Tax Forms?

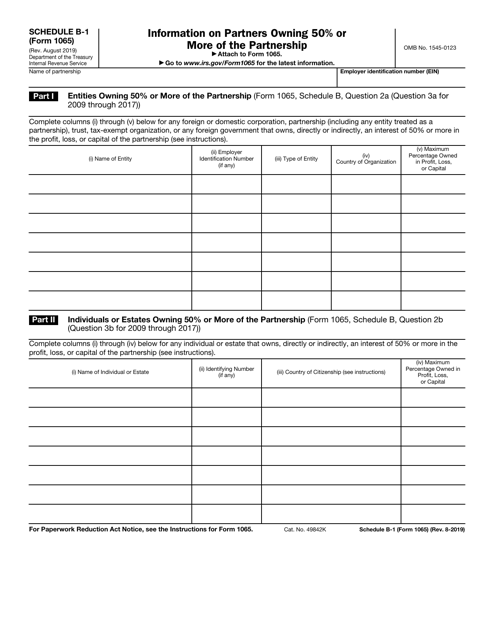

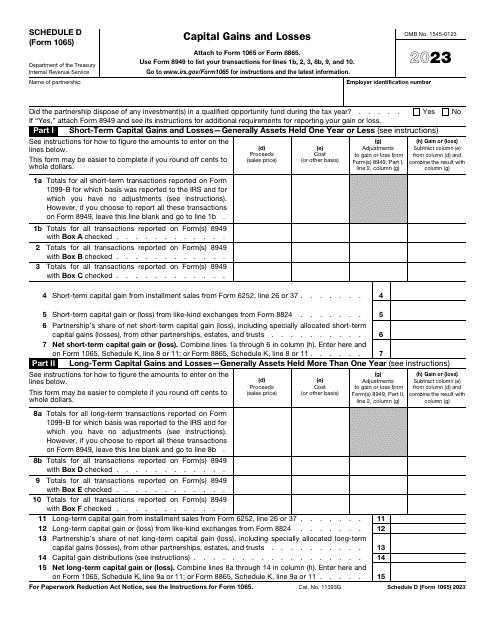

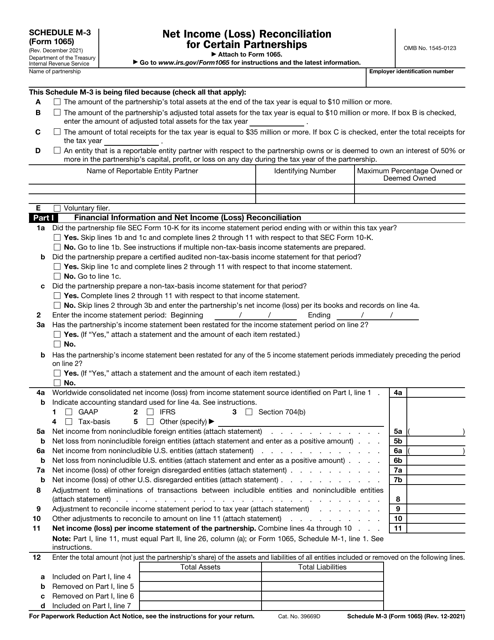

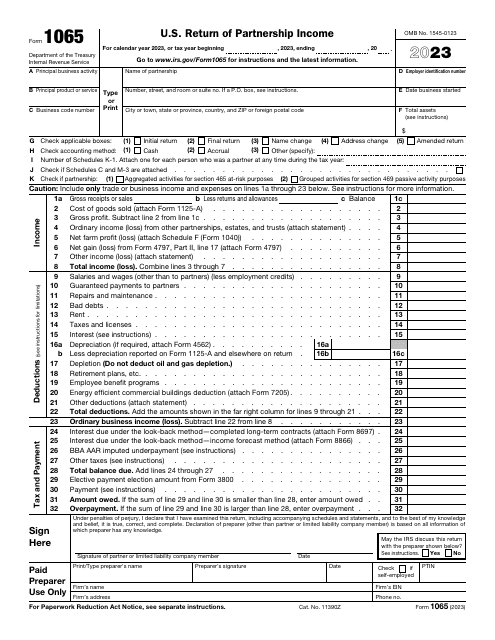

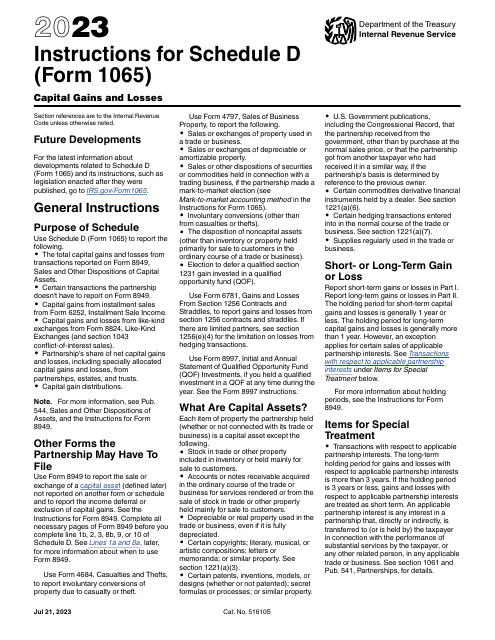

- IRS Form 1065, U.S. Return of Partnership Income, is a form used by the Internal Revenue Service (IRS) to receive information on income, deductions, credits, losses, gains, and other data about the operation of a partnership. A partnership means the business or trade relationship between people who want to work together, contribute skills, money, labor, property, and invest to share in the profits of the business. Schedule B-1, Schedule C, Schedule D, Schedule K-1, and Schedule M-3 are required for Form 1065;

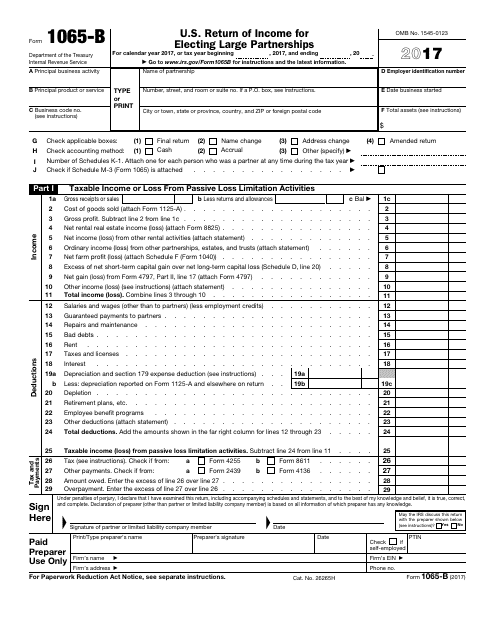

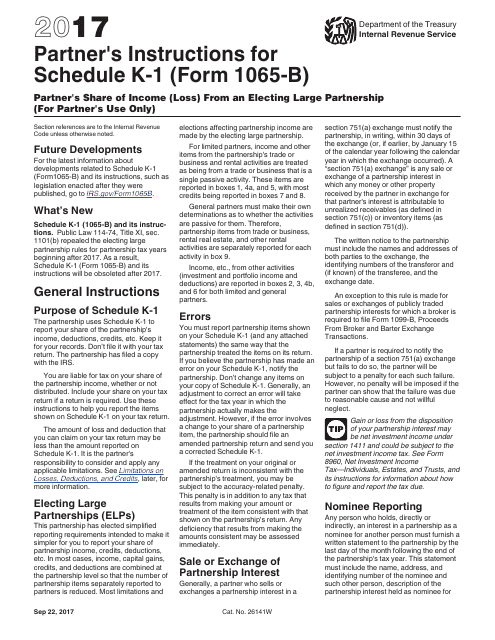

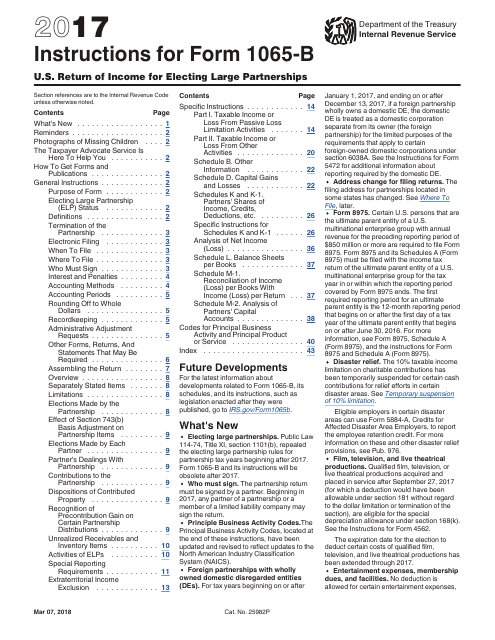

- IRS Form 1065-B, U.S. Return of Income for Electing Large Partnerships, is a related form that reports the gains and losses, deductions, income, and other data that outlines the performance of the electing large partnership. An electing large partnership means that the number of the partners equals or exceeds 100 during the preceding tax year and that a partnership has opted for the application of this condition. Schedule F and Schedule K-1 are required for Form 1065-B;

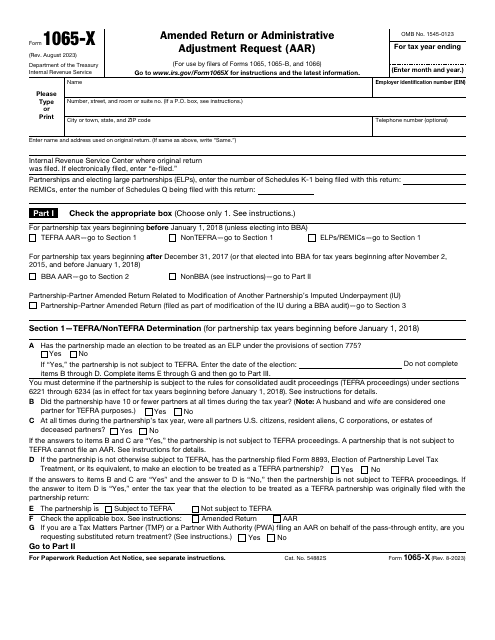

- IRS Form 1065-X, Amended Return or Administrative Adjustment Request (AAR), is a document used to correct items on the previously filed IRS 1065 Forms or Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return. Any partner is allowed to make an AAR in order to change the reporting of the items pertaining to the partnership. Attach the appropriate schedules to Form 1065-X to support the corrected items.

When Are Forms 1065 Due?

Forms 1065 and 1065-B are filed by the fifteenth day of the third month following the date its tax year ended. Form 1065-X is filed within three years after the date on which the partnership return is filed or the last day for filing the partnership return for the year.

Where Do I Mail 1065 Forms?

Mailing Addresses for Form 1065

- If the partnership is located in Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin, the total assets are less than $10 million, and Schedule M-3 was not filed, mail the form to the Department of the Treasury Internal Revenue Service Center Kansas City, MO 64999-0011.

- If the partnership is located in Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin, the total assets are $10 million or more and Schedule M-3 was not filed, send the form to the Department of the Treasury Internal Revenue Service Center Ogden, UT 84201-0011.

- If the partnership is located in Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming, send the form to the Department of the Treasury Internal Revenue Service Center Ogden, UT 84201-0011.

- If the partnership is located in a foreign country or U.S. possession, mail the form to the Internal Revenue Service P.O. Box 409101 Ogden, UT 84409.

Mailing Addresses for Form 1065-B

- If the partnership is located in the United States, file the form to the IRS Center, Ogden, UT 84201-0007.

- If it is located in a foreign country or U.S. possession, send the form to the IRS Center, P.O. Box 409101, Ogden, UT 84409.

- Form 1065-X must be mailed to the service center where you have filed the original return.

Related Articles

Documents:

18

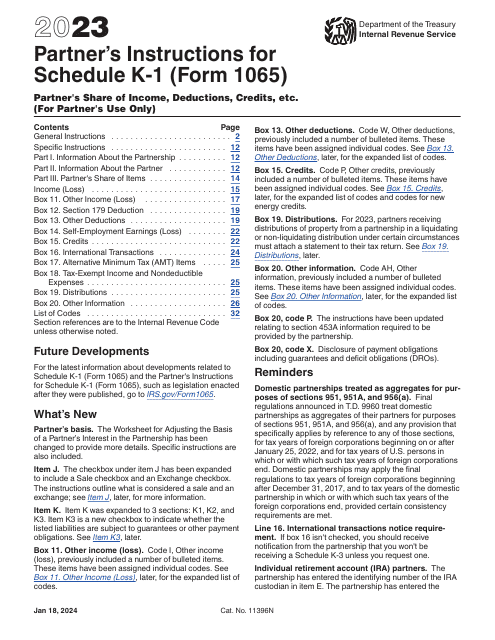

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

This is a fiscal statement used by partnerships and real estate mortgage investment conduits to fix the errors in previously filed IRS Form 1065, IRS Form 1065-B, IRS Form 1066.

This type of document provides instructions for completing Schedule C and providing additional information for filers of Schedule M-3 on IRS Form 1065.

Use this form to report information on deductions, credits, and income relevant to the operation of an electing large partnership (e.g. engaged in the business of farming) to the Internal Revenue Service (IRS).

This Form is used for reporting a partner's share of income or loss from an electing large partnership. It is specifically for the partner's use only.

This Form is used for reporting income and expenses of electing large partnerships in the United States.

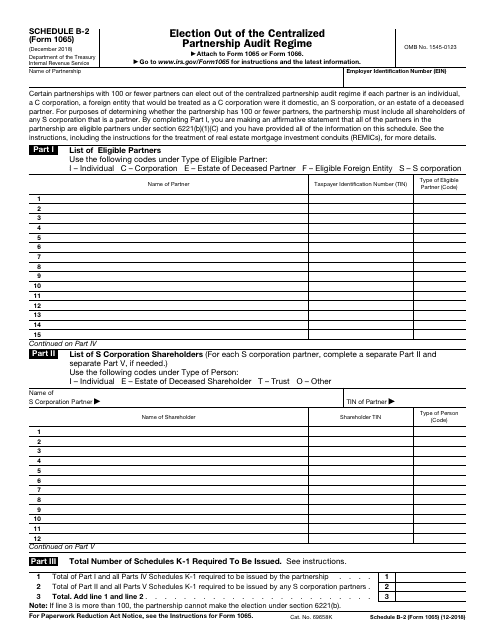

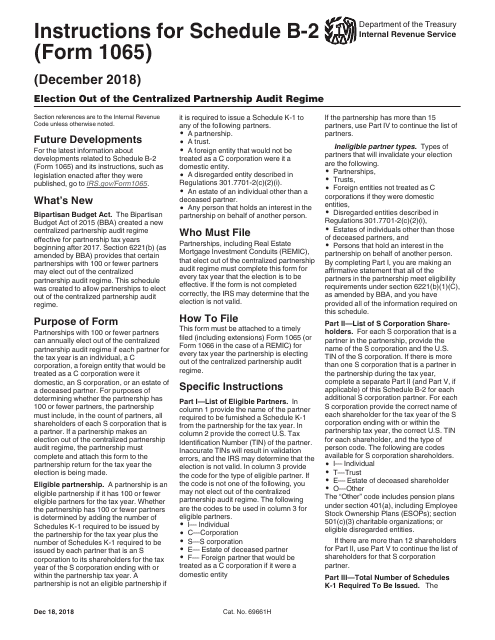

This is form is used by partnerships to inform the tax authorities they choose not to be subject to a partnership audit regime prescribed by current fiscal legislation.

Use this form to report information on deductions, credits, and income relevant to the operation of a partnership to the Internal Revenue Service (IRS).

This document provides instructions on how to complete IRS Form 1065 Schedule B-2, which is used for electing to opt out of the Centralized Partnership Audit Regime.

This document is used for making changes or corrections to a previously filed IRS Form 1065 (Partnership Return). It can be used to amend the partnership return or to request administrative adjustments.