Fill and Sign Ohio Legal Forms

Documents:

6111

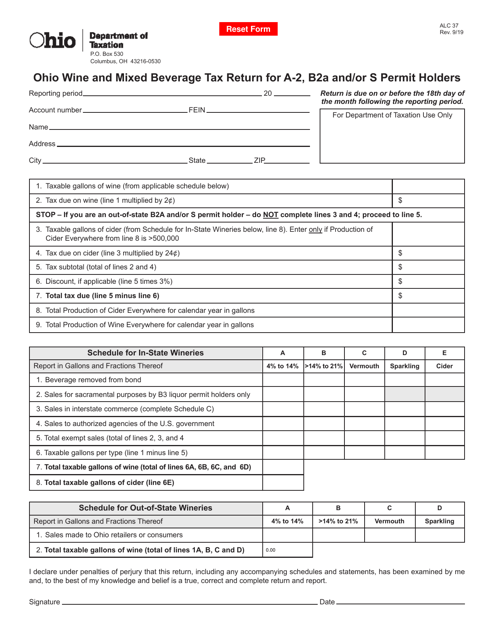

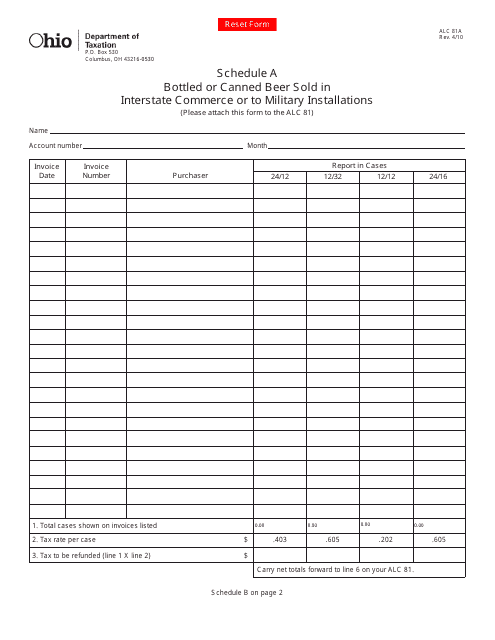

This form is used for reporting the sales of bottled or canned beer in Ohio that are sold in interstate commerce or to military installations.

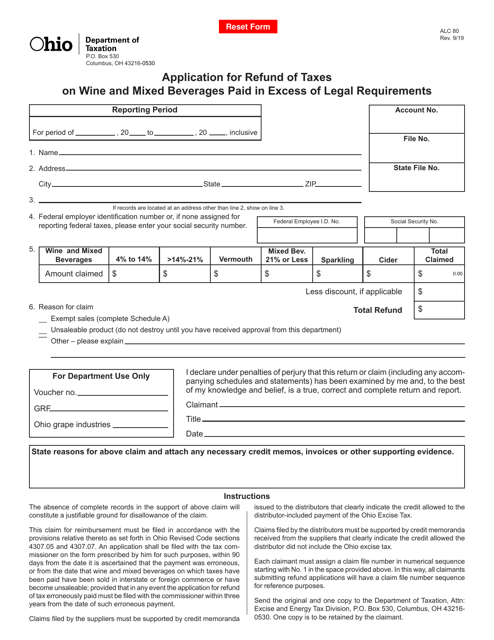

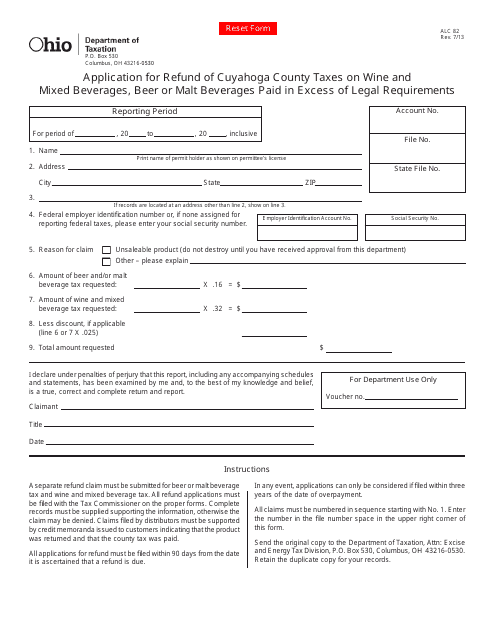

This form is used for applying for a refund of Cuyahoga County taxes on wine and mixed beverages, beer or malt beverages in Ohio.

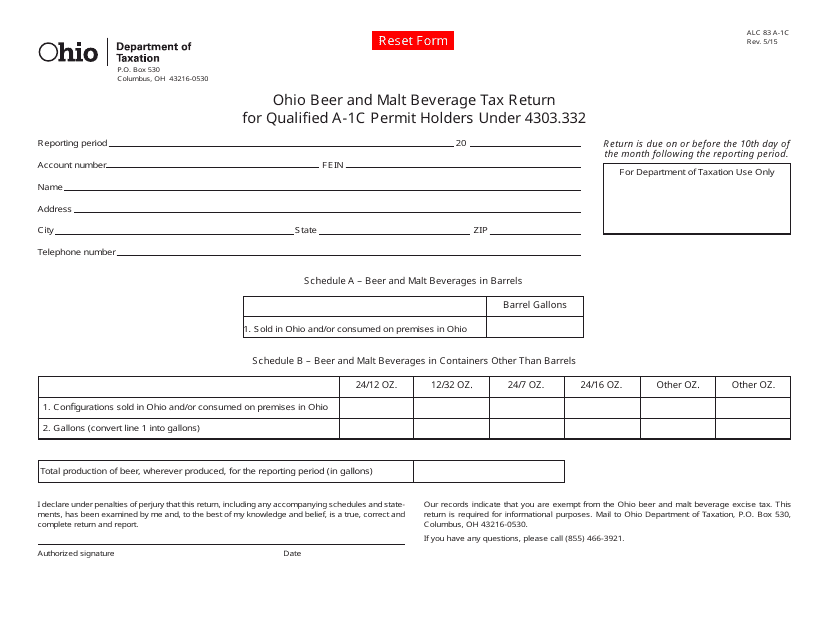

This type of document is used by qualified A-1C permit holders under Ohio law to file their beer and malt beverage tax return.

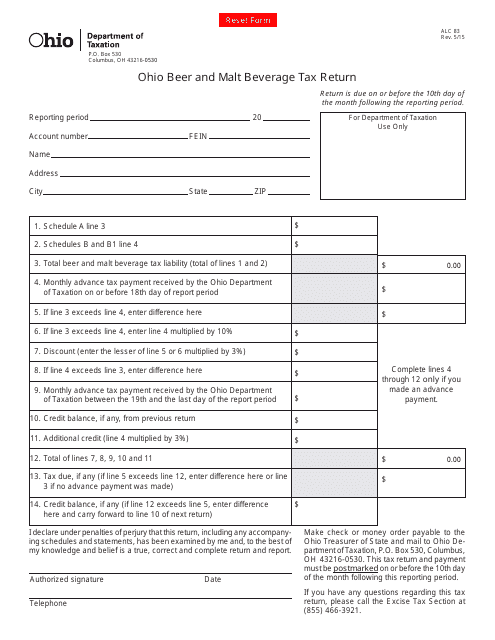

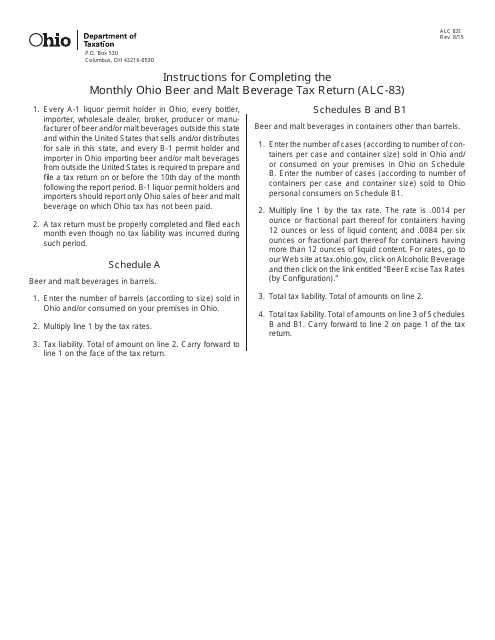

This Form is used for reporting and paying the taxes on beer and malt beverages in the state of Ohio.

This Form is used for reporting monthly beer and malt beverage taxes in Ohio. It is required by the Ohio Department of Taxation.

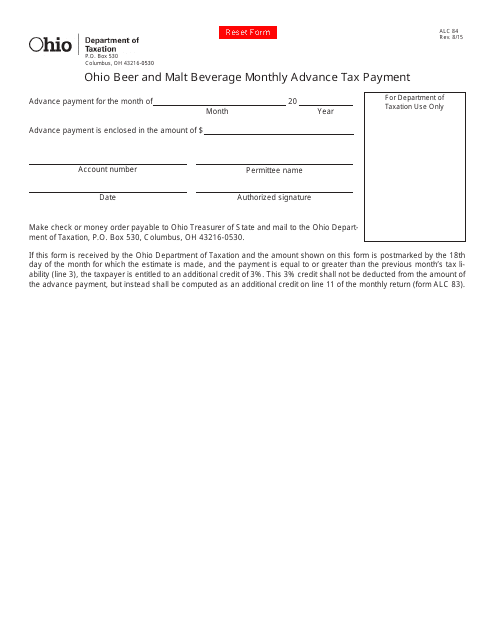

This form is used for making monthly advance tax payments for beer and malt beverage sales in the state of Ohio.

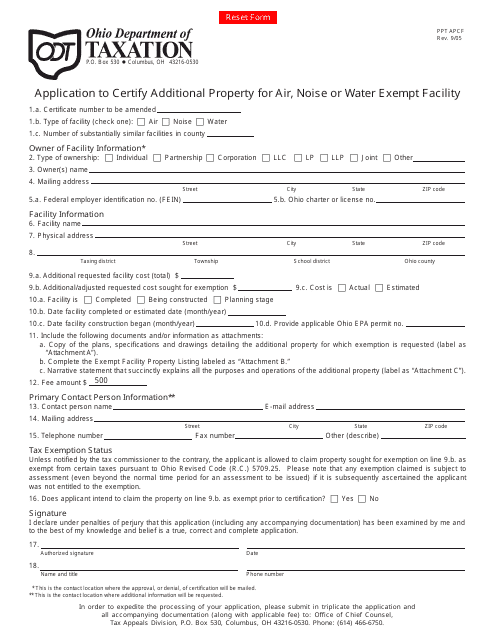

This form is used for applying to certify additional property for an air, noise, or water exempt facility in the state of Ohio.

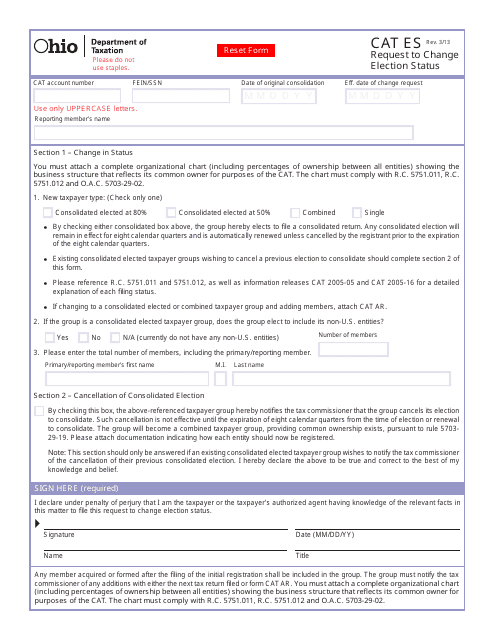

This Form is used for residents of Ohio to request a change in their election status.

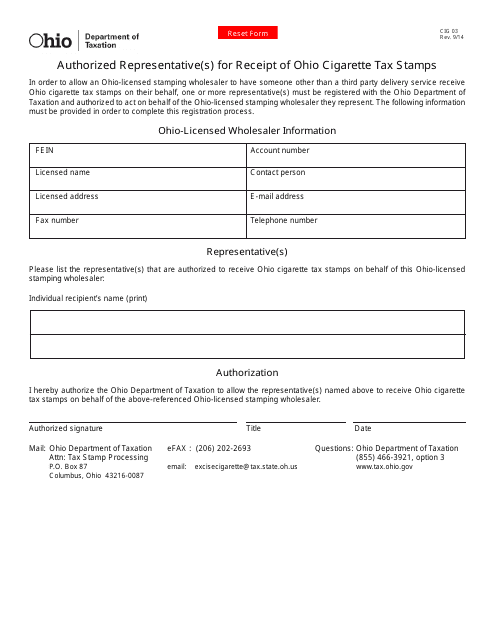

This document is used for designating authorized representatives to receive Ohio cigarette tax stamps.

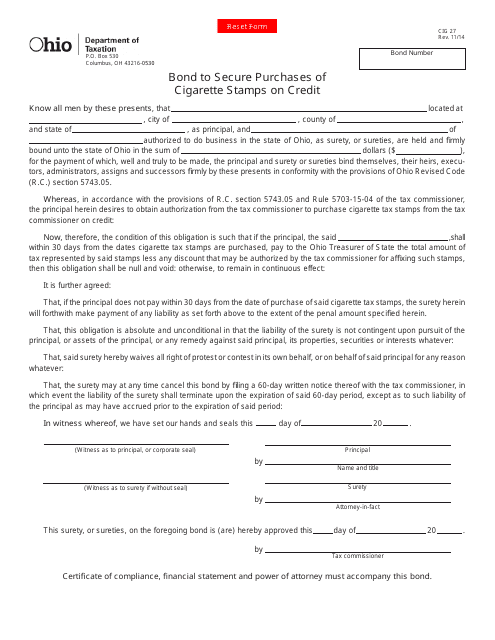

This form is used for securing credit purchases of cigarette stamps in Ohio. It is known as Form CIG27 Bond.

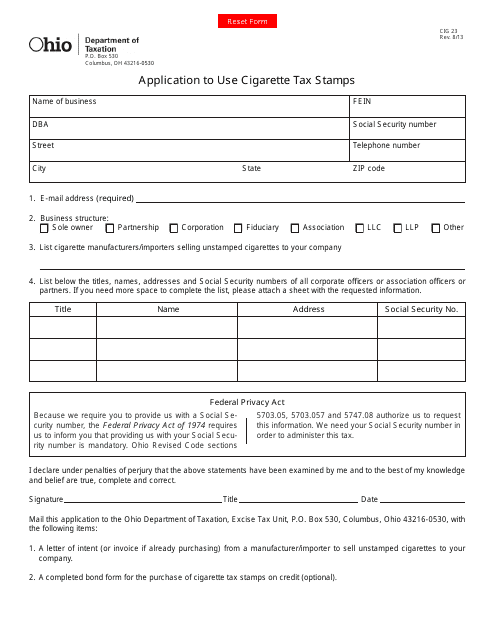

This Form is used for applying to use cigarette tax stamps in Ohio.

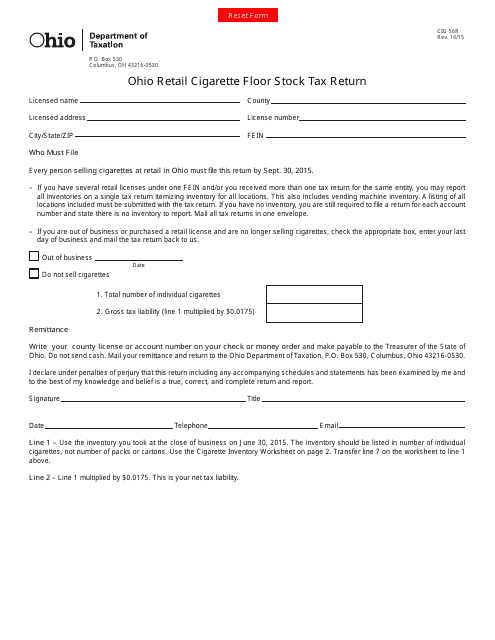

This form is used for reporting and paying the retail cigarette floor stock tax in the state of Ohio. Retailers of cigarettes must file this tax return to calculate and remit the required tax on their cigarette inventory.

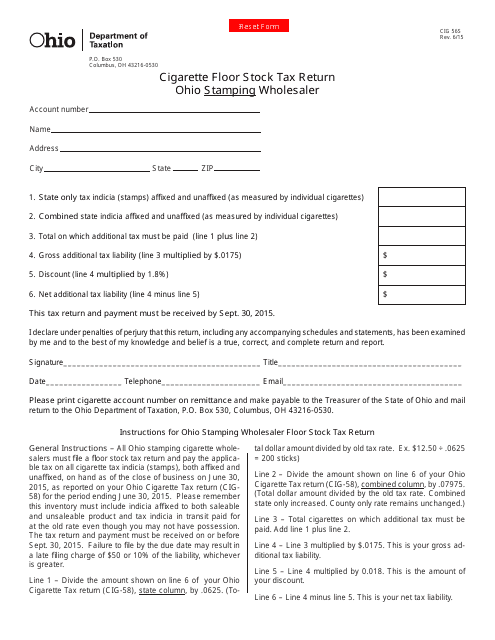

This Form is used for reporting and paying the Cigarette Floor Stock Tax for Ohio Stamping Wholesalers in Ohio.

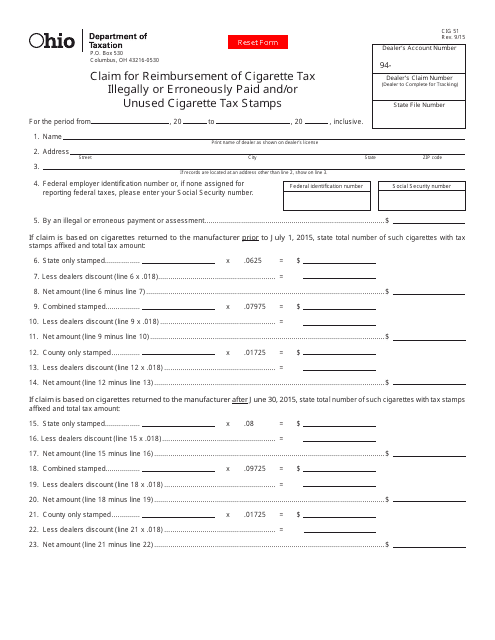

This Form is used for claiming reimbursement of cigarette tax illegally or erroneously paid and/or unused cigarette tax stamps in the state of Ohio.

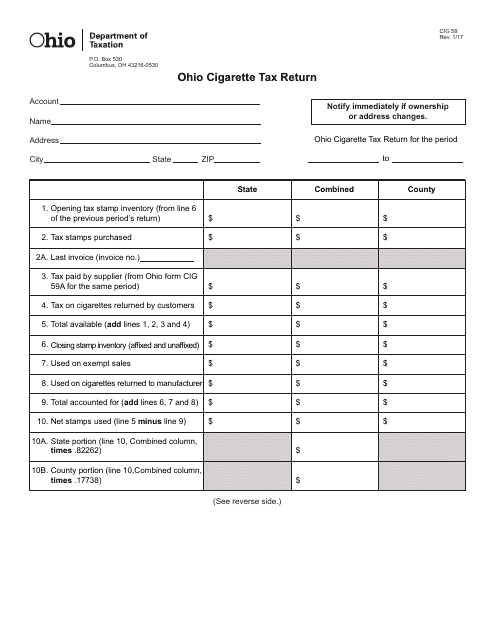

This Form is used for reporting and paying cigarette tax in the state of Ohio.

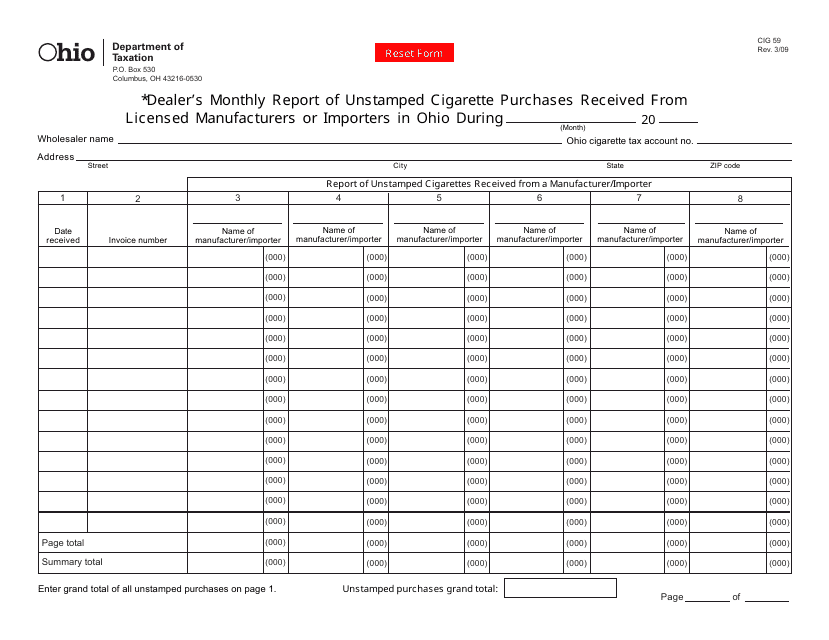

This form is used for dealers in Ohio to report the monthly quantity of unstamped cigarettes they have received.

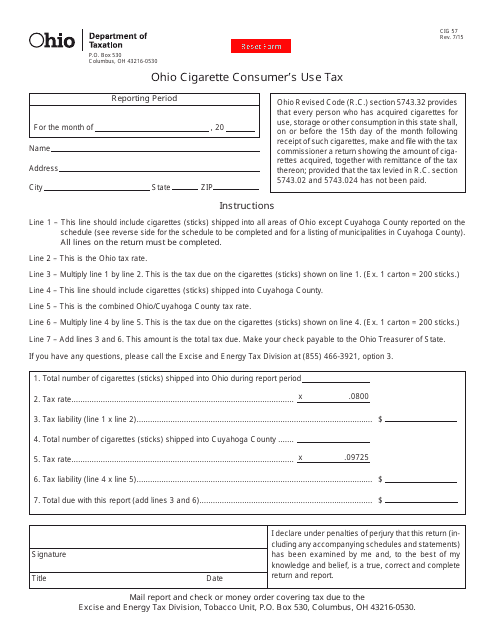

This Form is used for reporting and paying the Ohio Cigarette Consumer's Use Tax for consumers who have purchased cigarettes from out-of-state retailers.

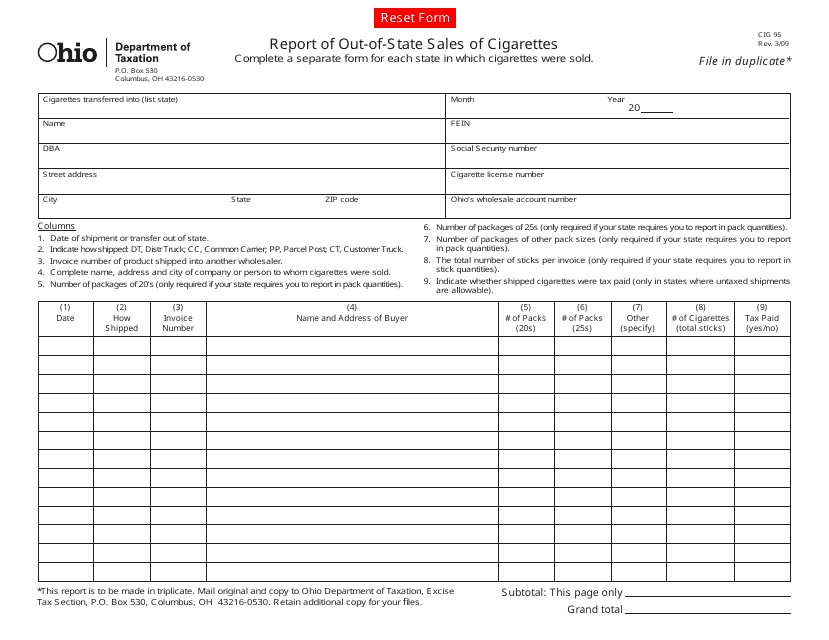

This form is used for reporting out-of-state sales of cigarettes in Ohio.

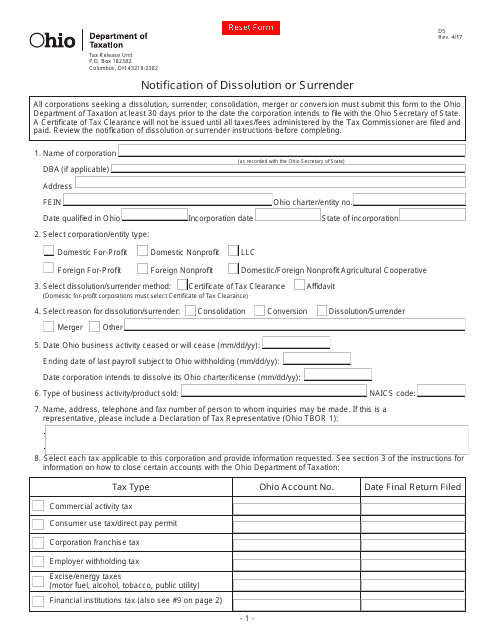

This form is used for notifying the state of Ohio about the dissolution or surrender of a business entity.

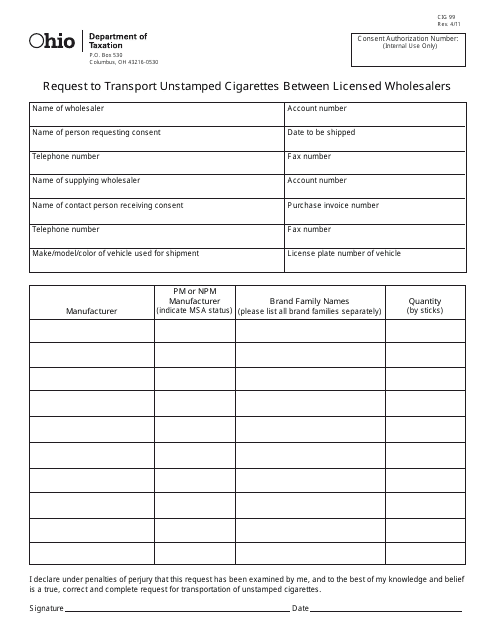

This form is used for requesting permission to transport unstamped cigarettes between licensed wholesalers in the state of Ohio.

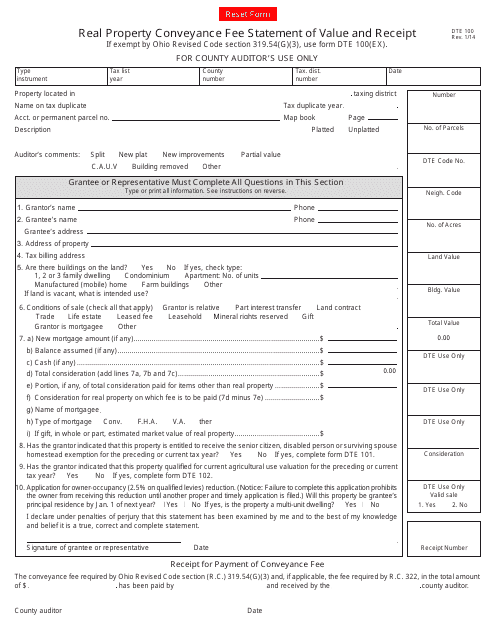

This form is used for reporting the value and receipt of real property conveyance fees in Ohio.

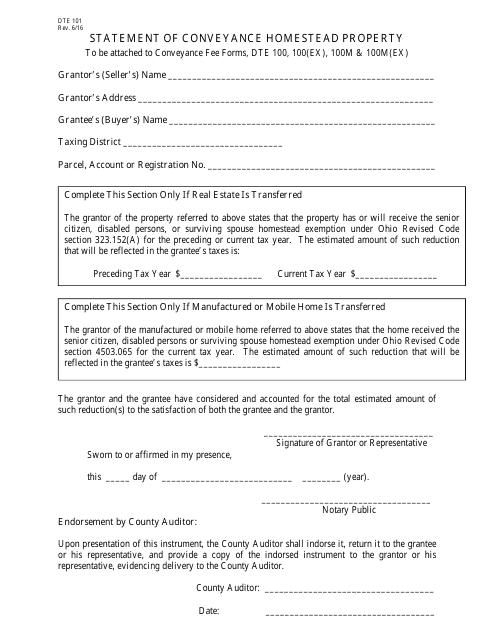

This form is used for submitting a statement of conveyance for homestead property in Ohio.

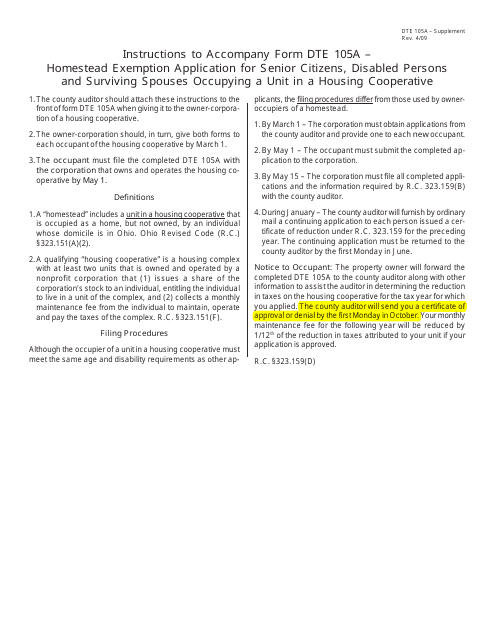

This form is used for applying for the Homestead Exemption in Ohio for senior citizens, disabled persons, and surviving spouses who live in a housing cooperative. It provides instructions on how to complete the application.

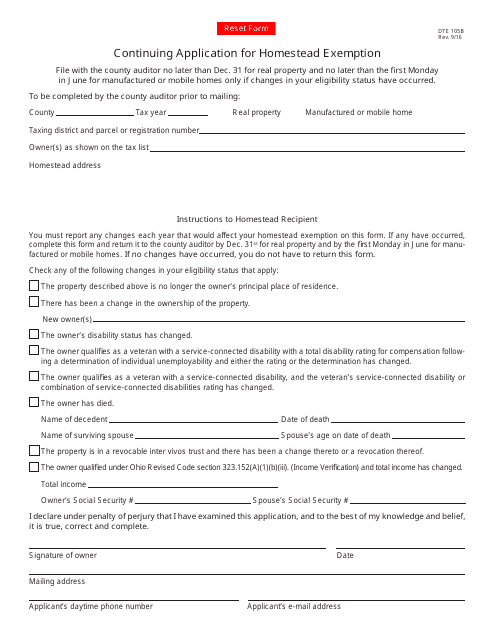

This form is used for applying for a continuing homestead exemption in the state of Ohio. It allows eligible individuals to continue receiving the benefits of the homestead exemption on their property tax.

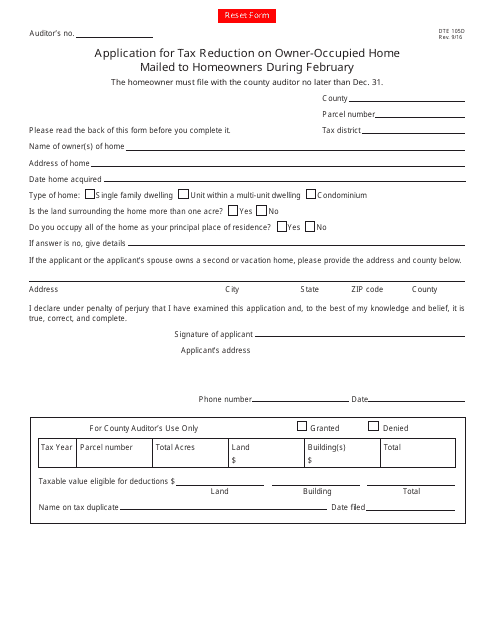

This form is used for applying for a tax reduction on owner-occupied homes in Ohio. It is mailed to homeowners during February.

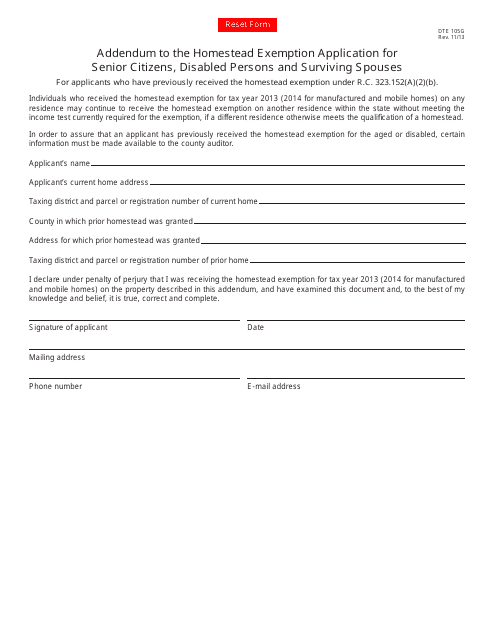

This form is used as an addendum to the Homestead Exemption Application for Senior Citizens, Disabled Persons, and Surviving Spouses in Ohio. It provides additional information and updates to the original application.

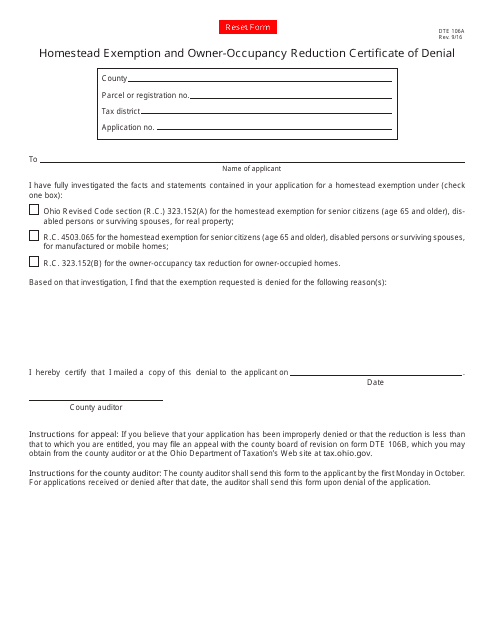

This Form is used for applying for the Homestead Exemption and Owner-Occupancy Reduction Certificate of Denial in Ohio.

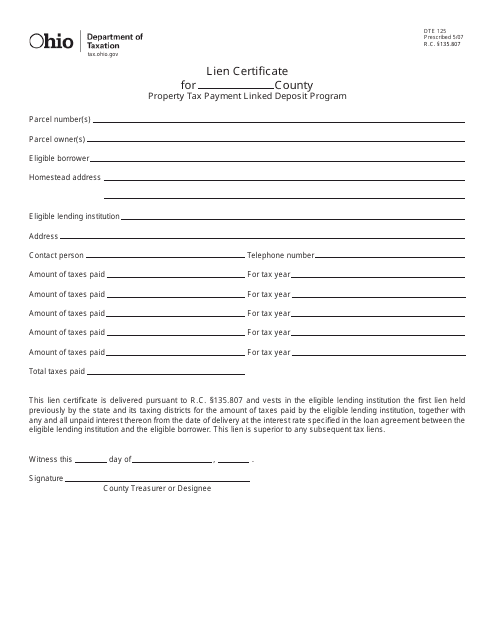

This form is used for applying for a lien certificate for the Property Tax Payment Linked Deposit Program in Ohio.

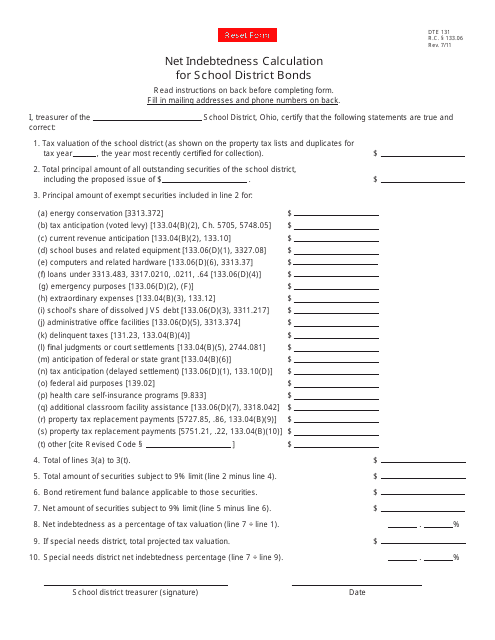

This form is used for calculating the net indebtedness of school district bonds in Ohio.

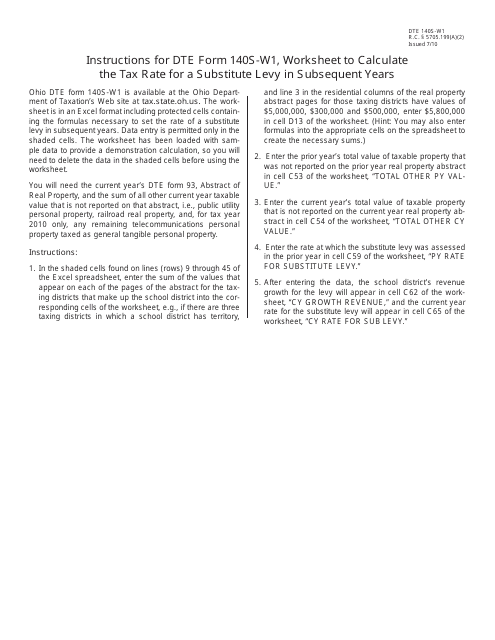

This document provides instructions on how to use Form DTE140S-W1 to calculate the tax rate for a substitute levy in subsequent years in Ohio.

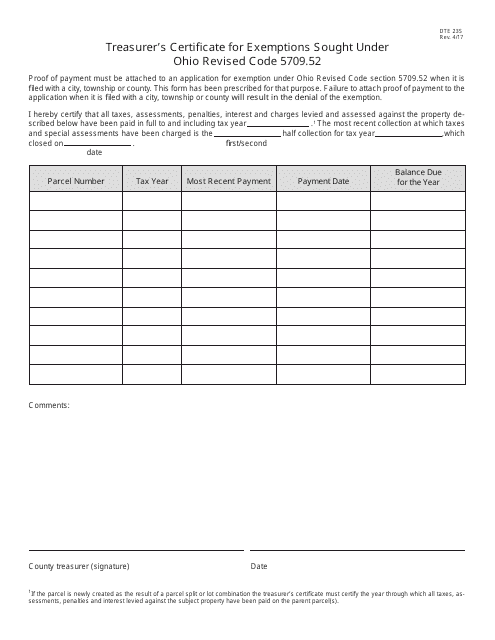

This form is used for requesting exemptions under Ohio Revised Code 5709.52 for treasurer certificate purposes in Ohio.

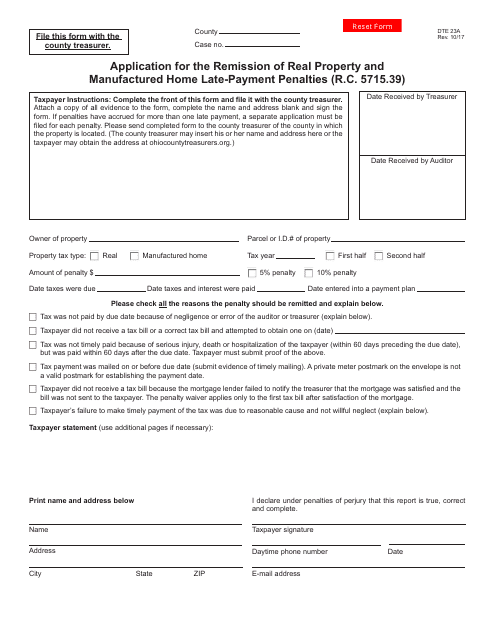

This form is used for applying for the remission of late-payment penalties for real property and manufactured homes in Ohio.

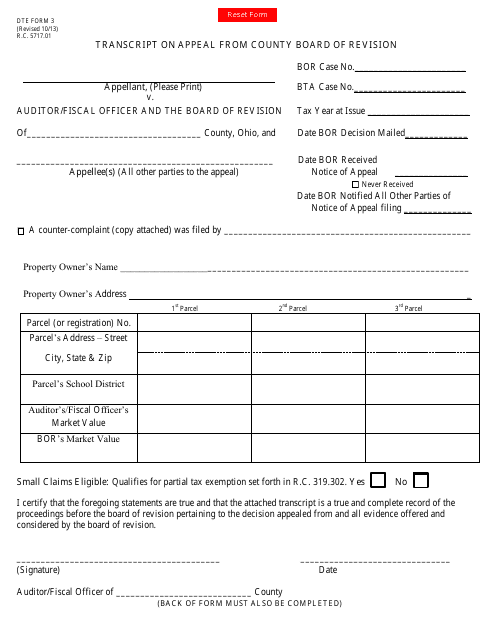

This form is used for filing a transcript of appeal from the County Board of Revision in Ohio.

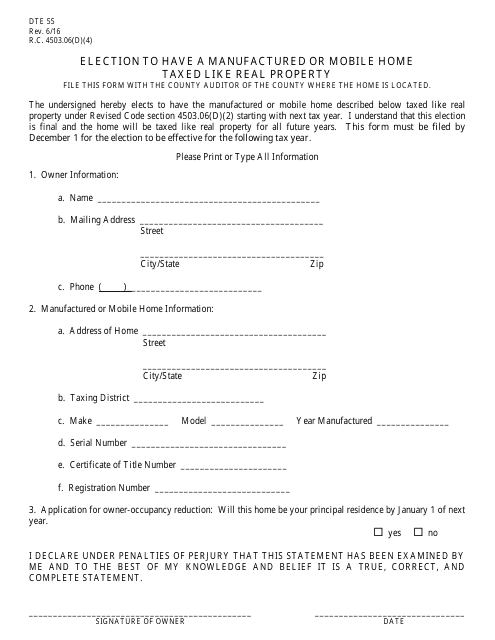

This form is used for electing to have a manufactured or mobile home taxed like real property in the state of Ohio.

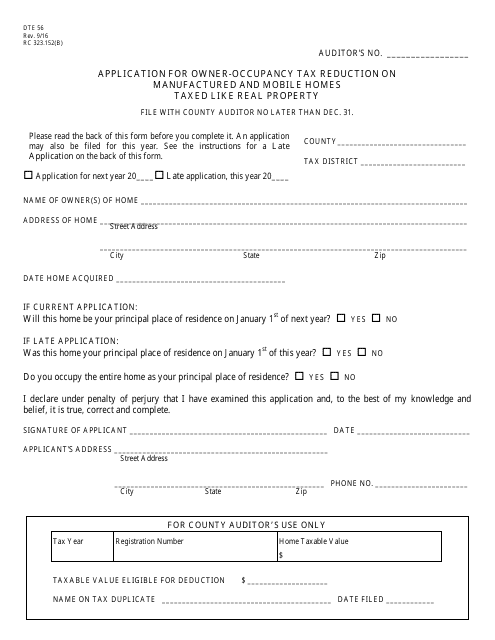

This form is used for applying for an owner-occupancy tax reduction on manufactured and mobile homes taxed like real property in the state of Ohio.

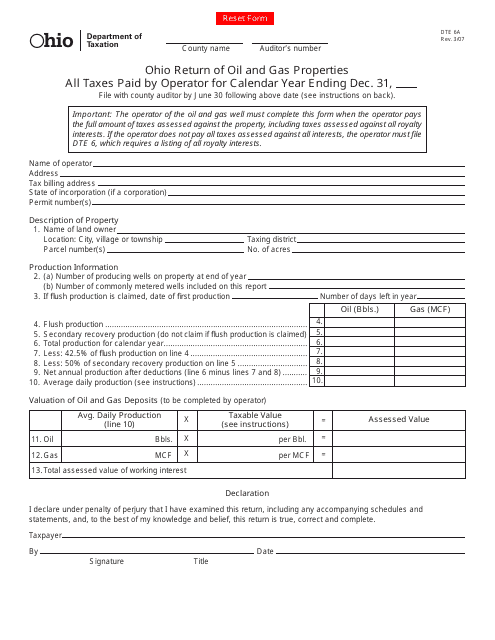

This form is used for reporting and calculating taxes paid by operators of oil and gas properties in Ohio.