Fill and Sign Ohio Legal Forms

Documents:

6111

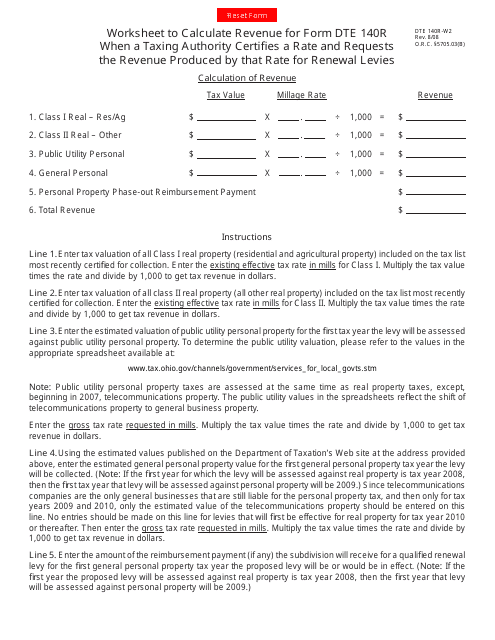

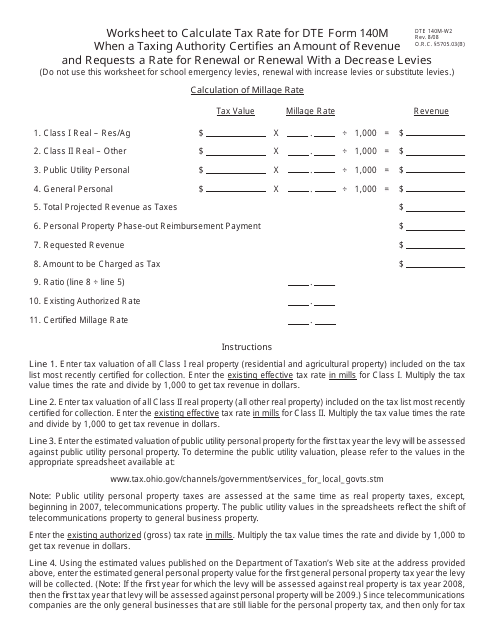

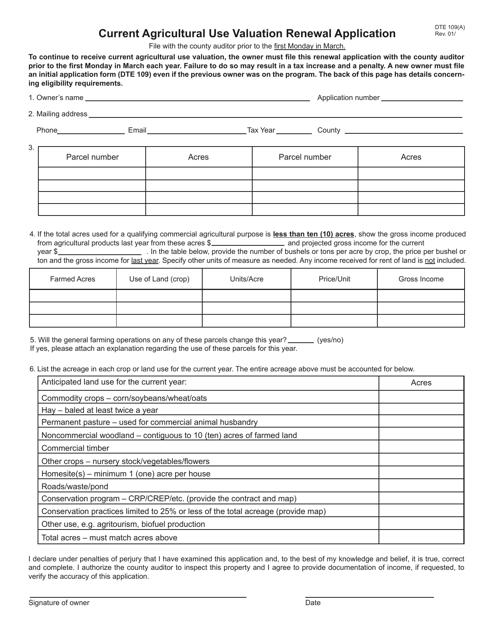

This form is used for completing the worksheet required for renewing levies in Ohio.

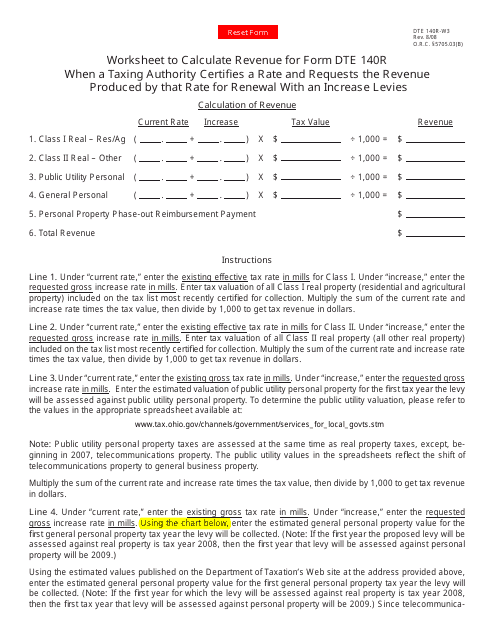

This form is used for completing the 140r Worksheet for Renewal With an Increase Levies in the state of Ohio. It is used by individuals or organizations to provide information about the increase in levies for renewal purposes.

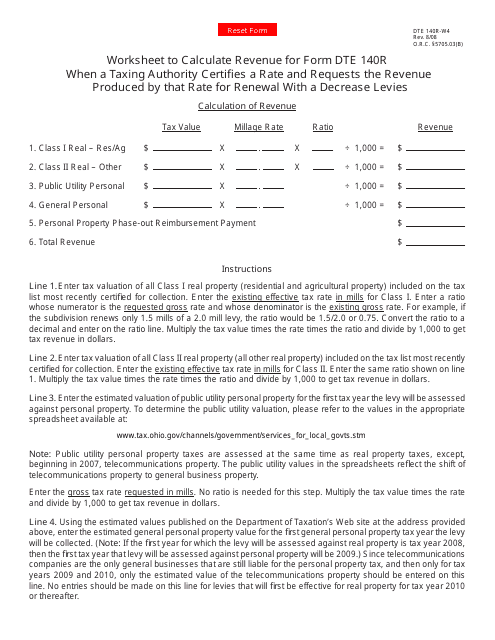

This form is used for calculating and reporting the renewal of levies with a decrease in Ohio. It is known as the DTE140R-W4 140r Worksheet.

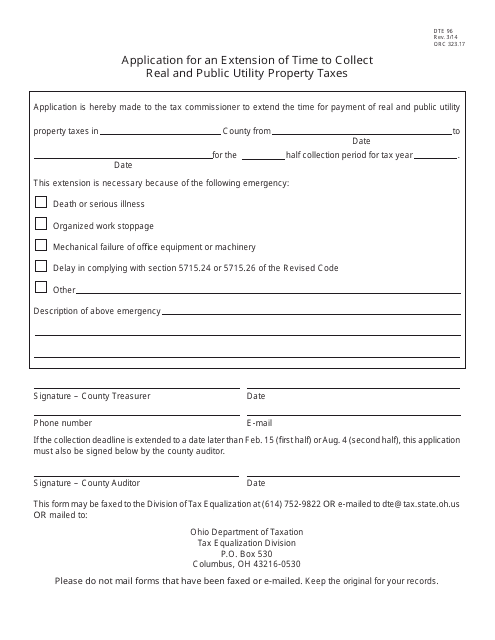

This form is used for applying for an extension of time to collect real and public utility property taxes in Ohio.

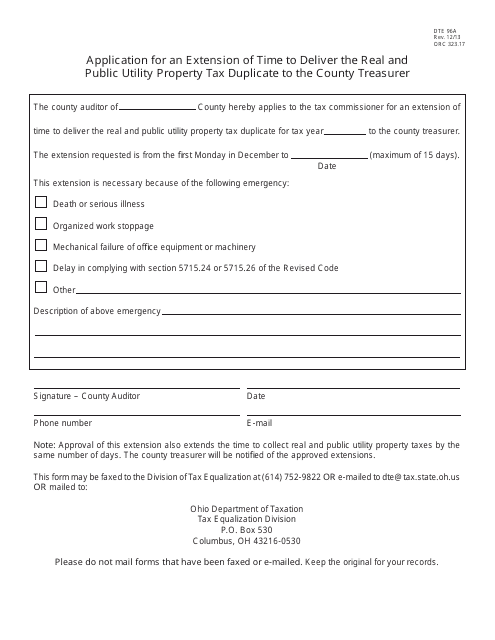

This form is used for applying for an extension of time to deliver the real and public utility property tax duplicate to the County Treasurer in Ohio.

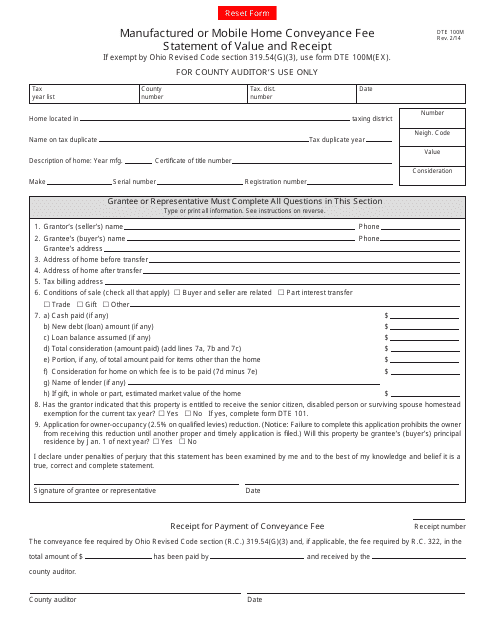

This form is used for reporting the value and payment of conveyance fees for the transfer of manufactured or mobile homes in Ohio.

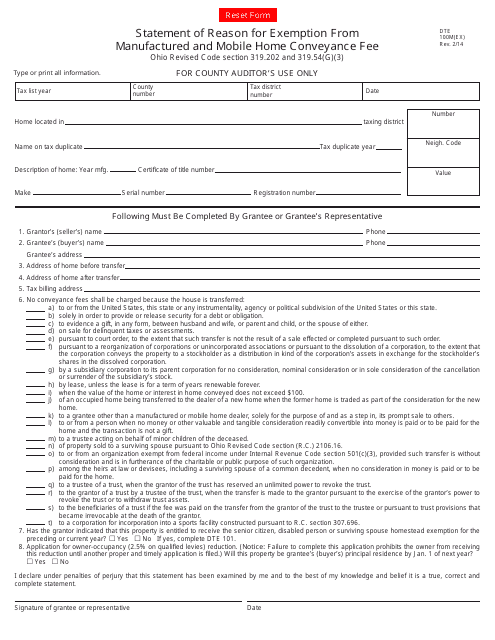

This Form is used for providing a statement of reason for exemption from the manufactured and mobile home conveyance fee in the state of Ohio.

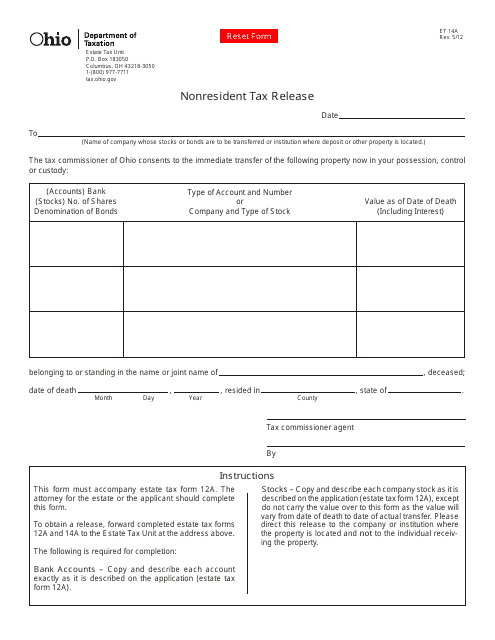

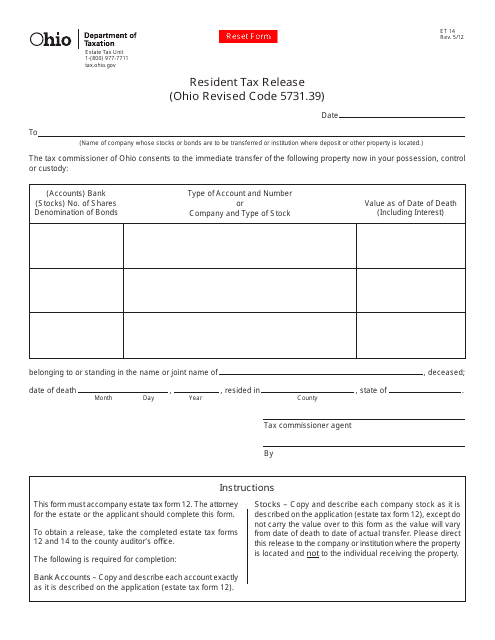

This form is used for nonresidents in Ohio to request a tax release.

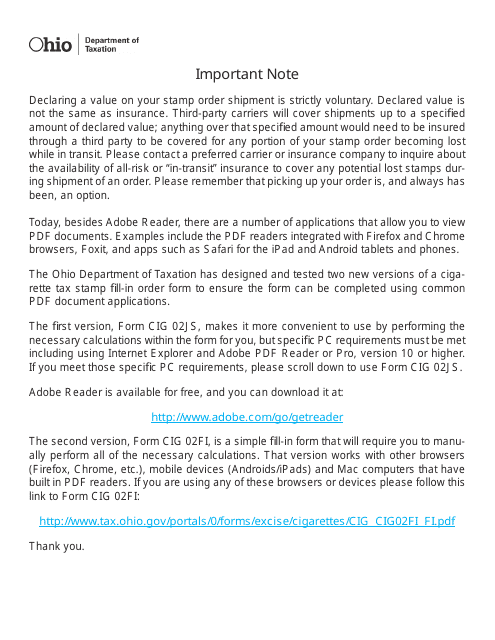

This Form is used for ordering cigarette tax stamps in Ohio.

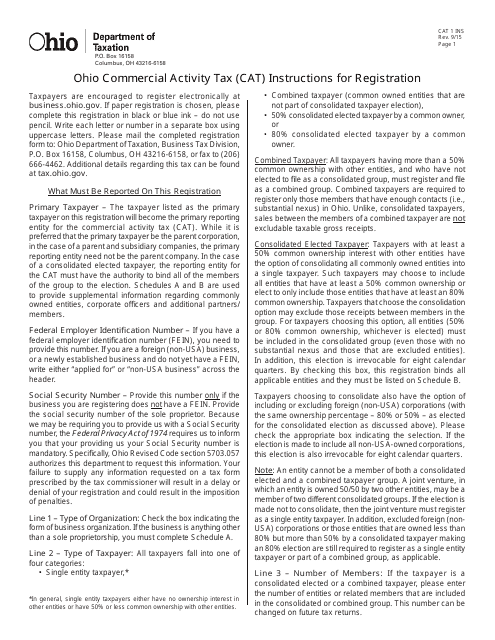

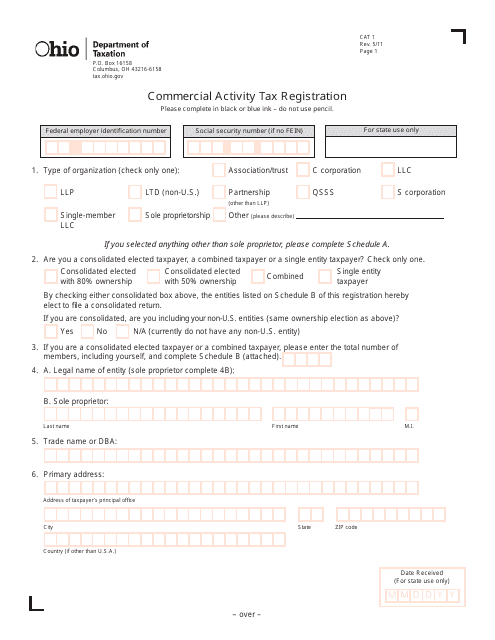

This Form is used for registering for the Commercial Activity Tax (CAT) in the state of Ohio. It provides instructions on how to complete the registration process and fulfill the tax obligations for businesses engaging in commercial activities in Ohio.

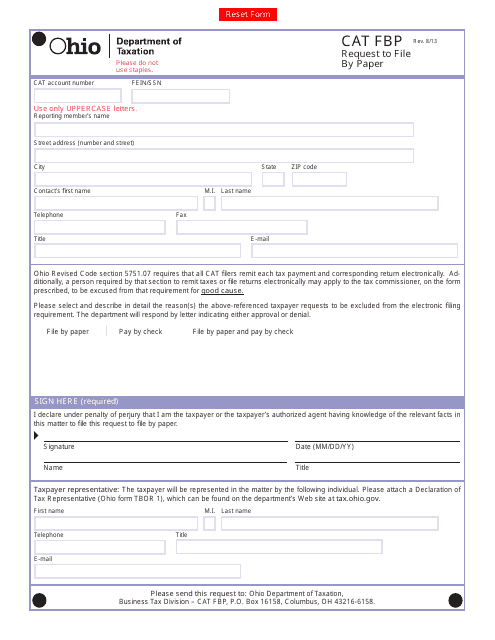

This Form is used for individuals in Ohio to request the option to file their federal tax return by paper instead of electronically.

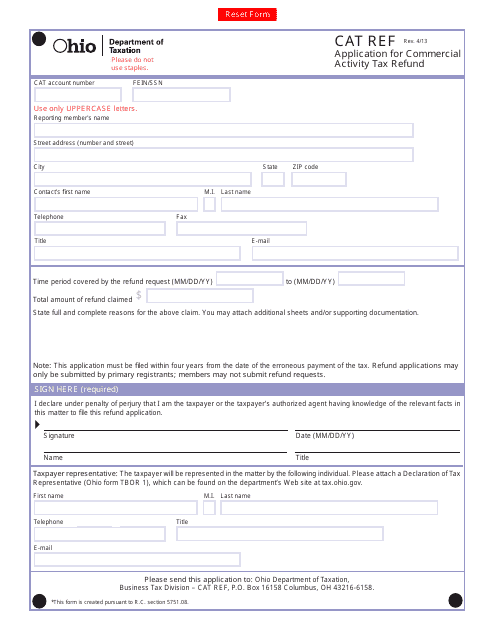

This Form is used for applying for a refund of Commercial Activity Tax in the state of Ohio.

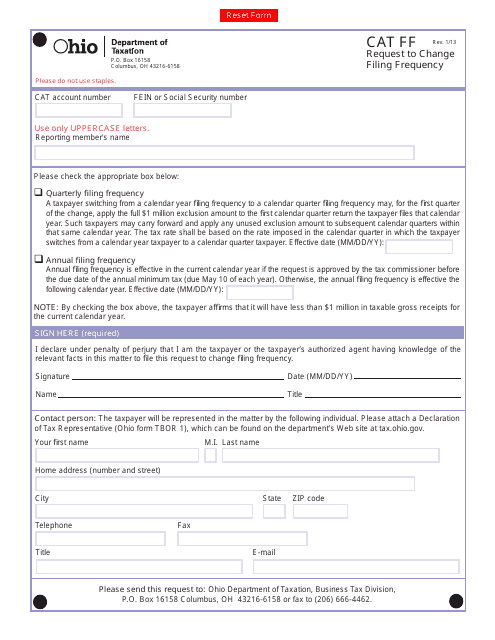

This form is used for requesting a change in filing frequency for the Commercial Activity Tax (CAT) in Ohio.

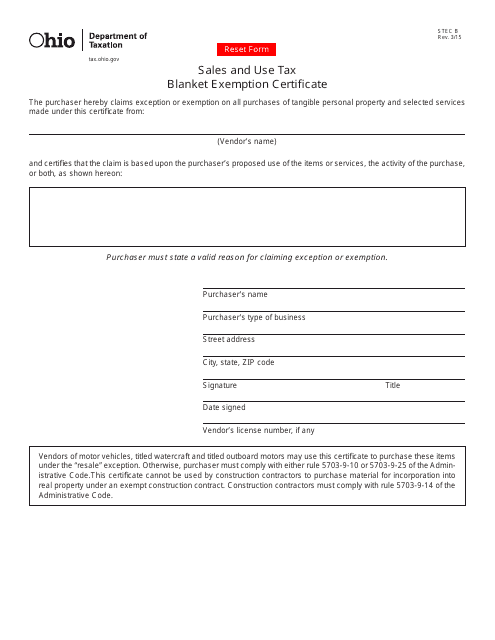

This form is used for applying for a sales and use tax exemption in Ohio for specific goods or services.

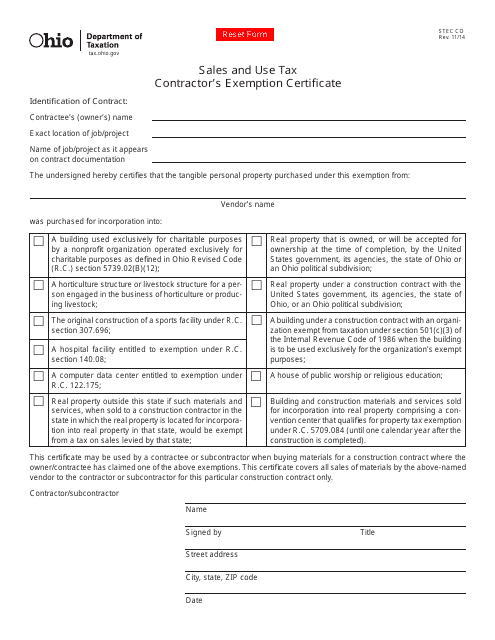

This Form is used for contractors in Ohio to declare their exemption from State of Ohio sales and use tax.

This is a legal document which is needed to gain tax exemption when buying merchandise to later resell in the state of Ohio.

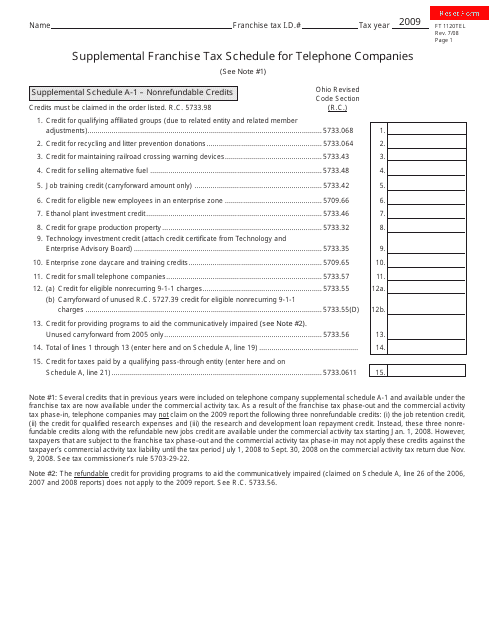

This form is used for Ohio telephone companies to report their supplemental franchise tax.

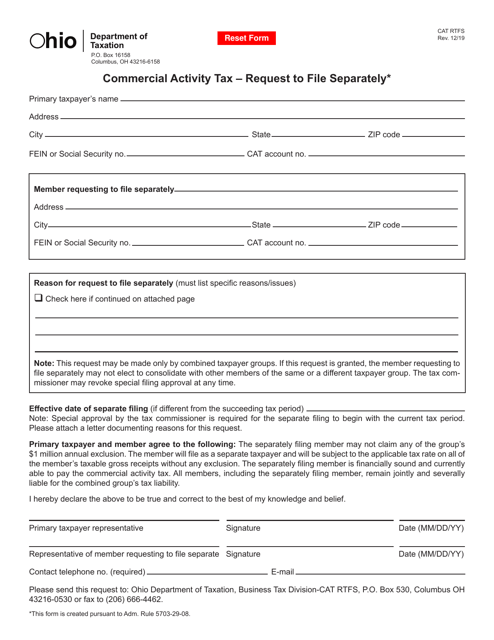

This Form is used for registering for the Commercial Activity Tax in the state of Ohio.

This form is used for calculating and documenting the necessary information for a property tax renewal or renewal with a decrease in levies in the state of Ohio.

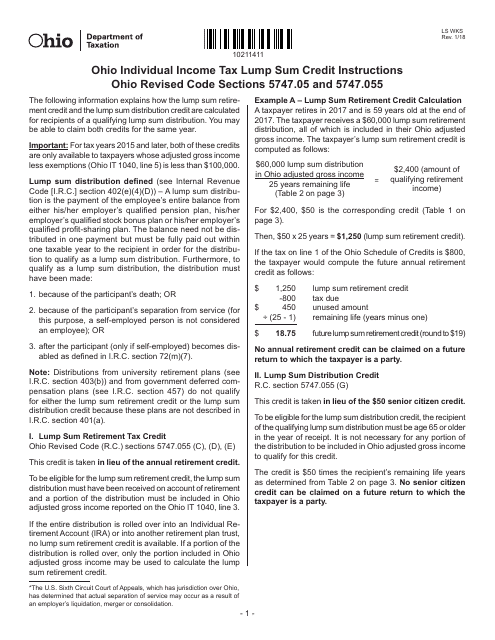

This document is a worksheet specific to Ohio residents. It is used for calculating the Lump Sum Retirement/Distribution Credit for taxes.

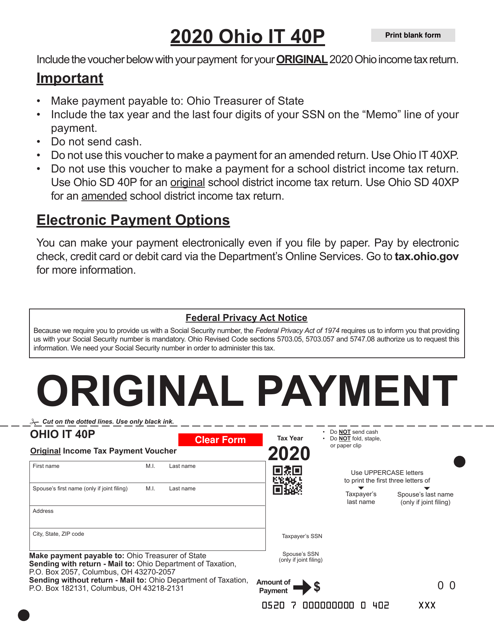

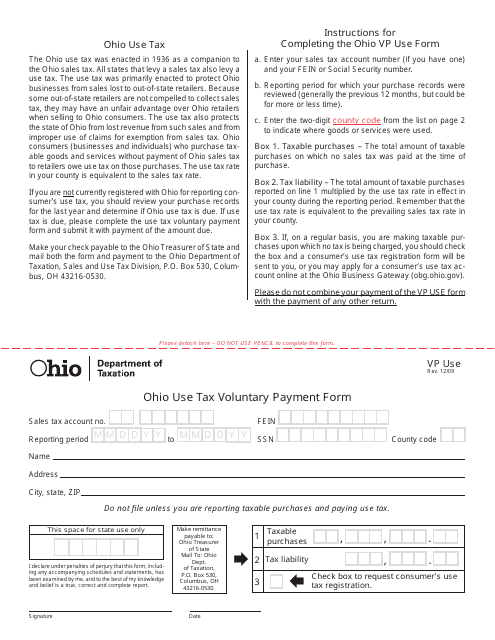

This Form is used for voluntarily paying Ohio Use Tax.

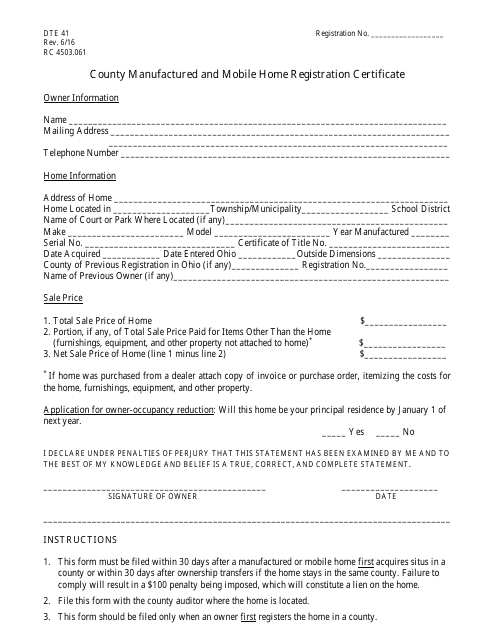

This is a registration form specifically for manufactured and mobile homes located in Ohio. It is used to obtain a registration certificate for these types of homes in the county.

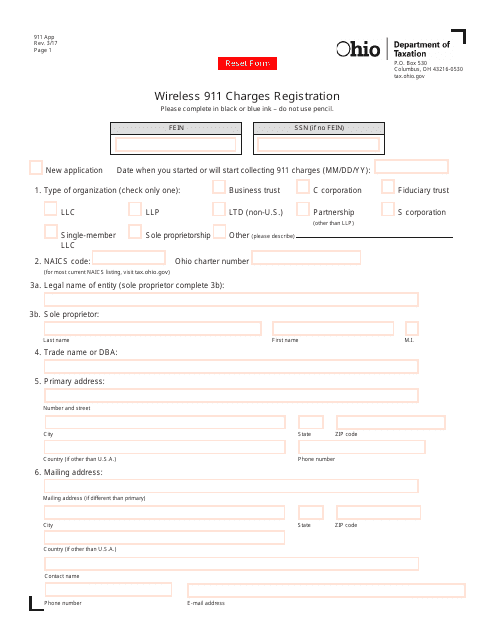

This form is used for registering wireless 911 charges in Ohio.

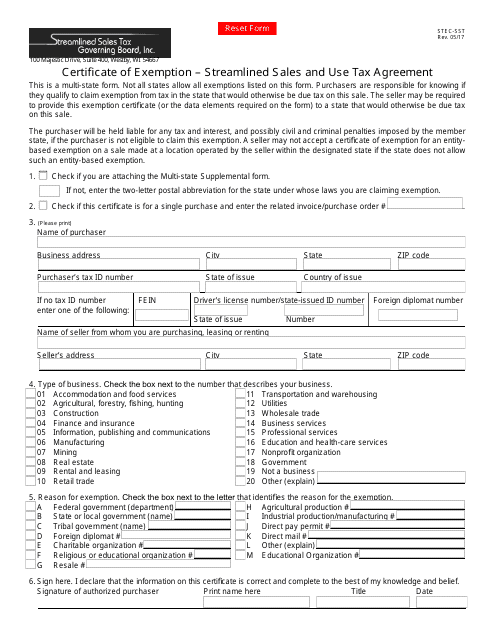

This form is used for Ohio residents or businesses to request a certificate of exemption from sales and use tax under the Streamlined Sales and Use Tax Agreement.

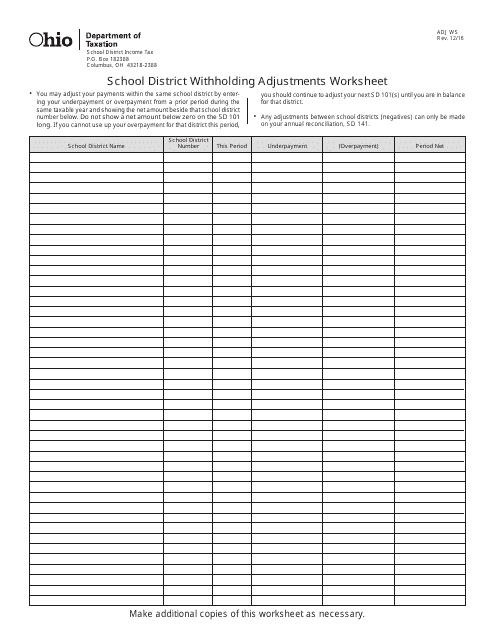

This Form is used for making adjustments to school district withholding in Ohio. It helps taxpayers calculate and report any necessary changes to their withholding amounts.

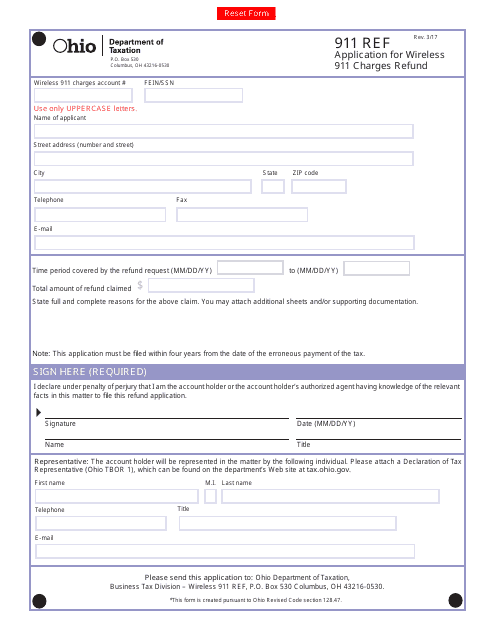

This form is used for applying for a refund of wireless 911 charges in the state of Ohio.

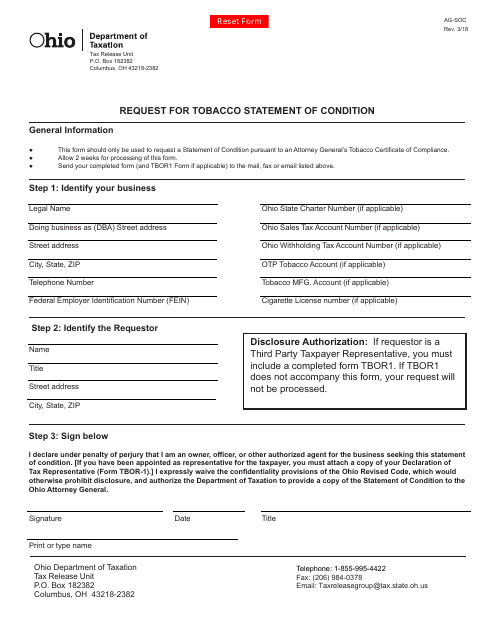

This form is used for requesting a tobacco statement of condition in the state of Ohio. It provides information on the condition of tobacco plants or crops.

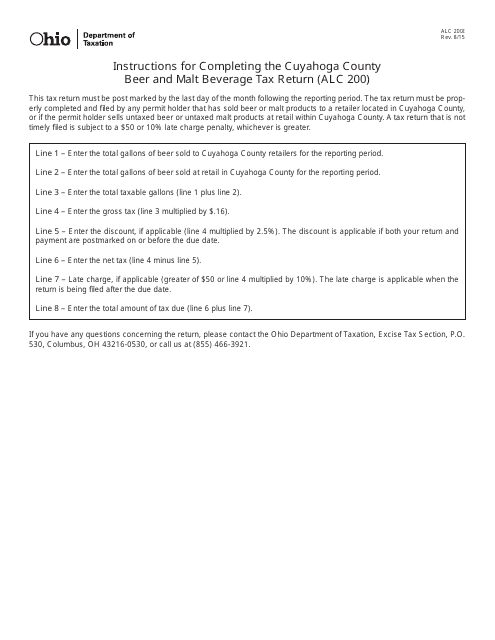

This Form is used for reporting and paying the beer and malt beverage tax in Cuyahoga County, Ohio. Beer distributors and retailers are required to fill out this form and submit it along with the corresponding payment to the county tax department. The form provides instructions on how to complete it accurately and where to send it.

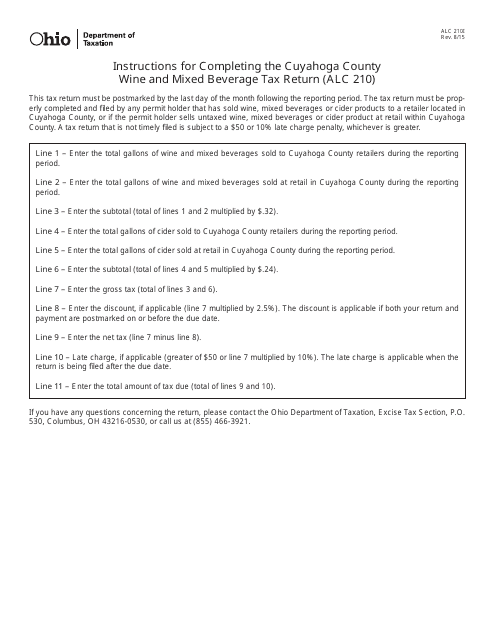

This document is for submitting the Wine and Mixed Beverage Tax Return for Cuyahoga County in Ohio. It provides instructions on how to fill out Form ALC210.

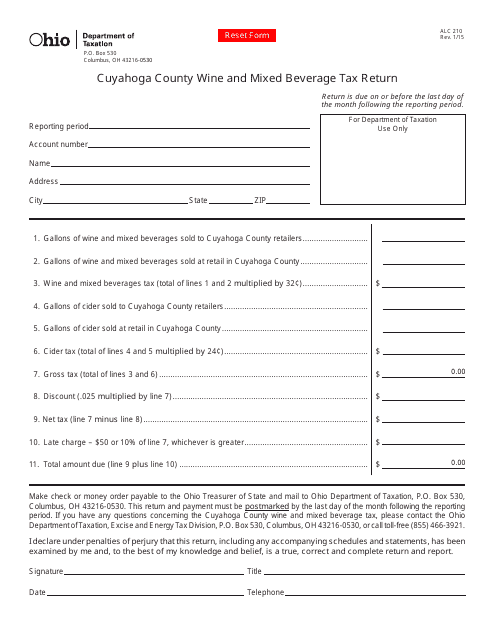

This form is used for reporting and paying wine and mixed beverage tax in Cuyahoga County, Ohio.

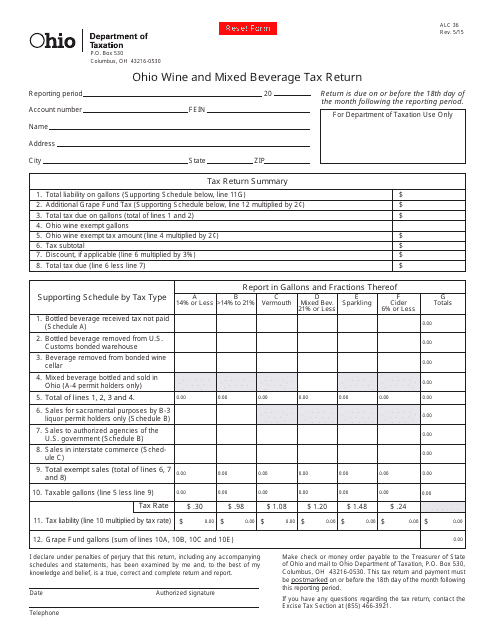

This form is used for reporting and paying taxes on wine and mixed beverage sales in the state of Ohio.

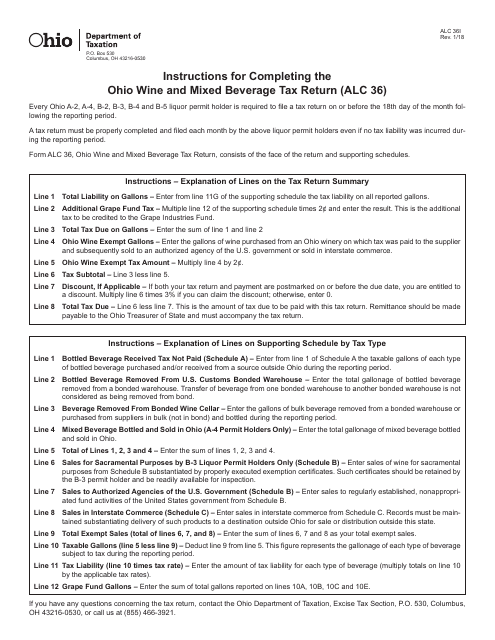

This Form is used for filing the Ohio Wine and Mixed Beverage Tax Return in Ohio. It provides instructions for completing and submitting the tax return.

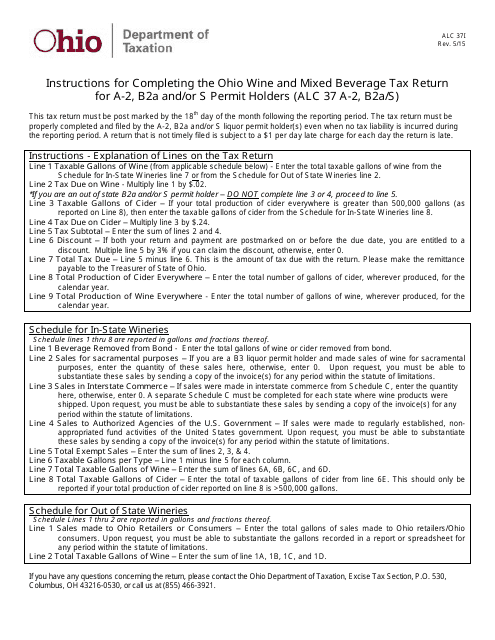

This Form is used for filing the Ohio Wine and Mixed Beverage Tax return for a-2, B2a and/or S permit holders in Ohio.