Fill and Sign Ohio Legal Forms

Documents:

6111

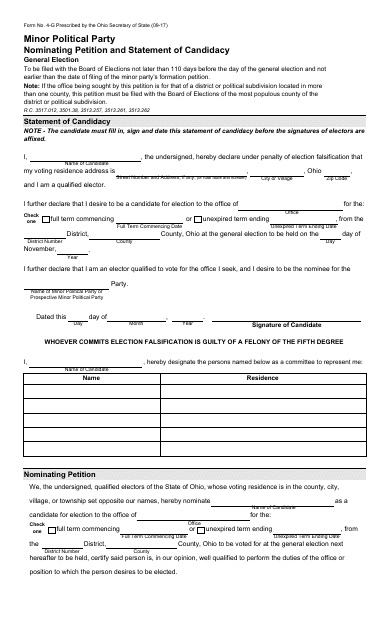

This form is used for minor political parties to submit a nominating petition for the general election in Ohio.

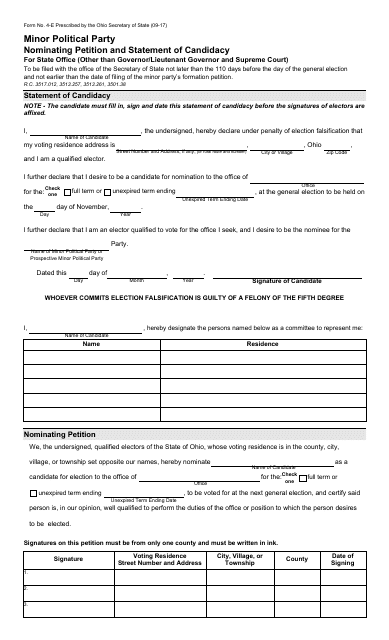

This form is used for minor political parties in Ohio to submit a nominating petition and statement of candidacy for state office, excluding the positions of governor, lieutenant governor, and supreme court.

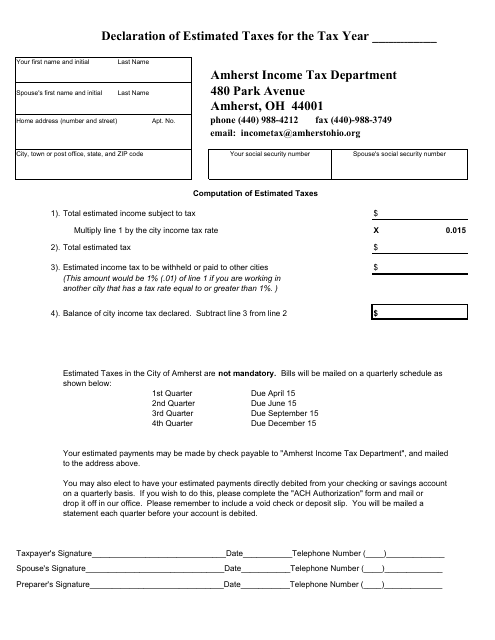

This document is used for declaring estimated taxes in the City of Amherst, Ohio. It helps individuals and businesses estimate the amount of tax they owe and make timely payments to the city.

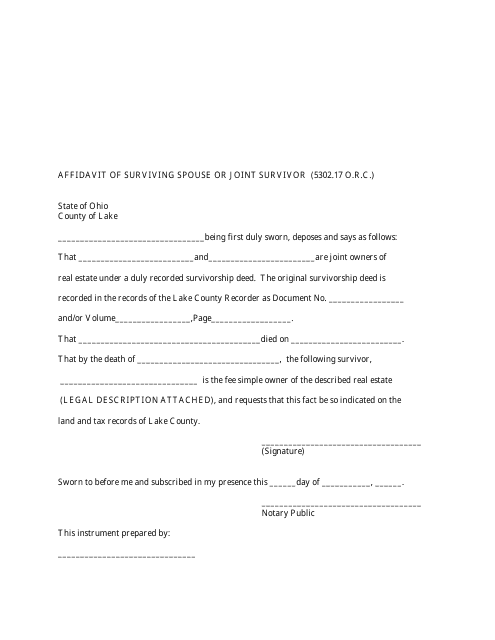

This form is used for the surviving spouse or joint survivor to provide a sworn statement in the County of Lake, Ohio.

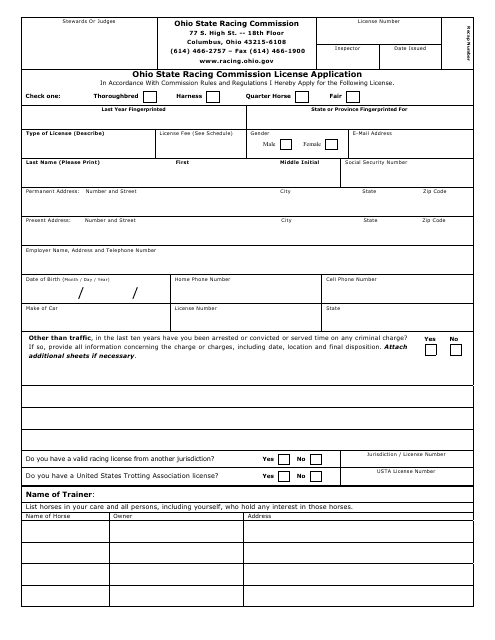

This Form is used for applying for a license with the Ohio State Racing Commission.

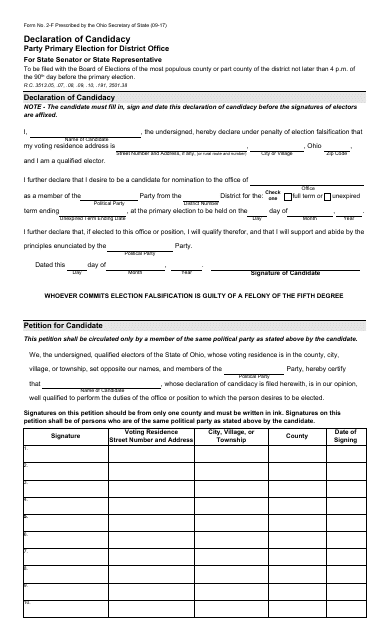

This form is used for declaring candidacy for the position of State Senator or State Representative in the Ohio party primary elections.

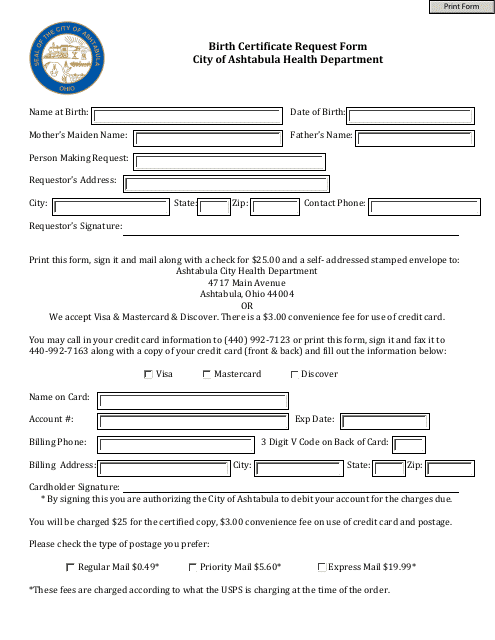

This form is used to request a birth certificate from the City of Ashtabula, Ohio.

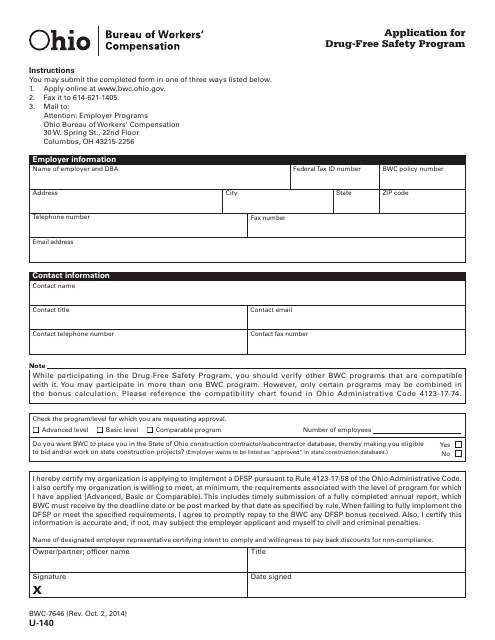

This form is used for applying to the Drug-Free Safety Program in Ohio.

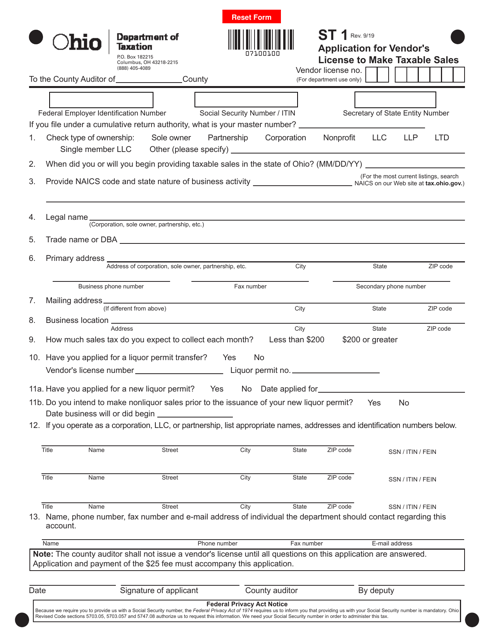

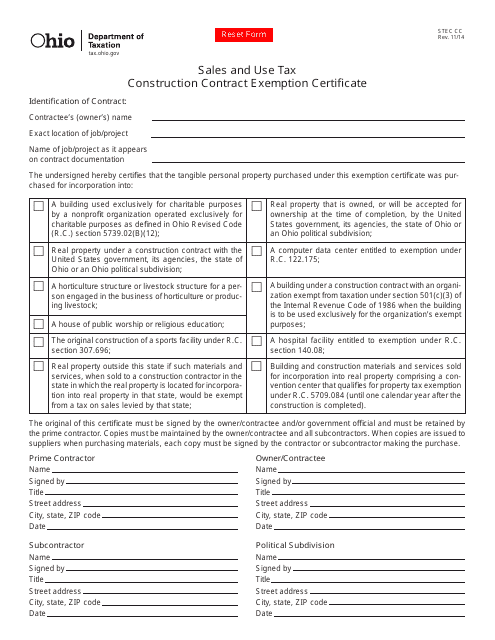

This form is used for claiming a sales and use tax exemption for construction contracts in Ohio. Contractors can use this certificate to exempt certain construction materials and services from sales tax.

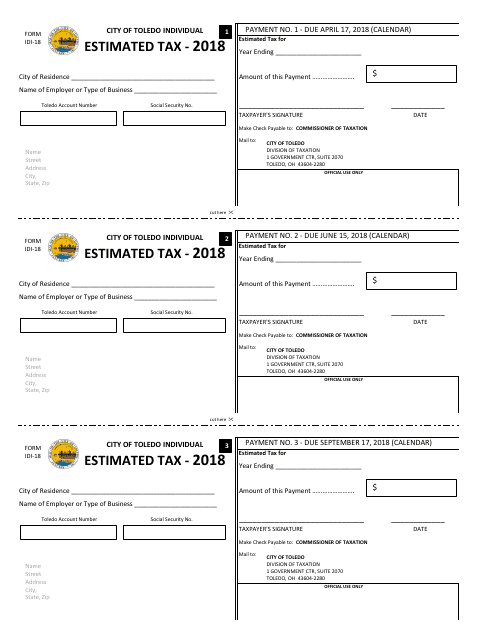

This form is used for individuals in Toledo, Ohio to submit their estimated taxes.

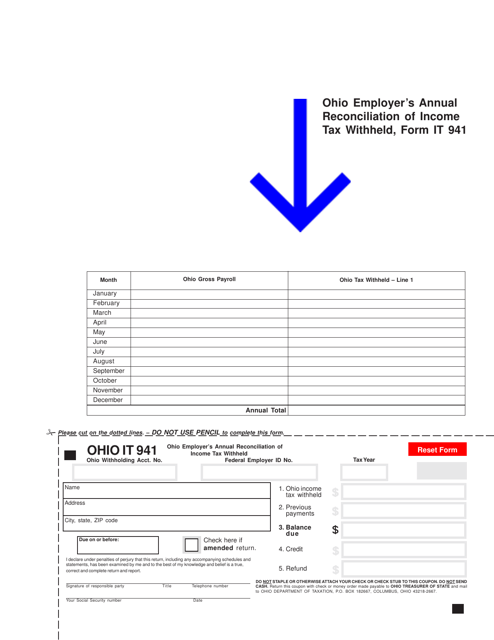

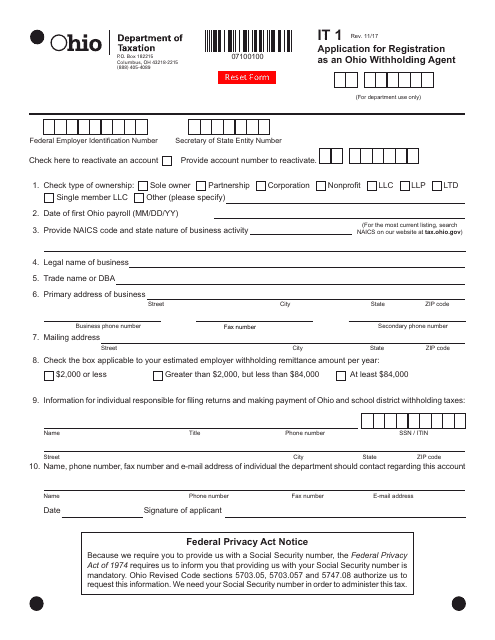

This form is used for applying to become a withholding agent in Ohio.

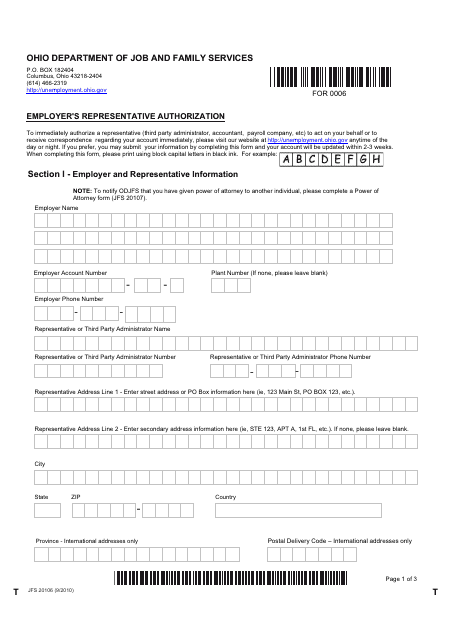

This form is used for employers in Ohio to authorize a representative to act on their behalf in matters related to unemployment compensation.

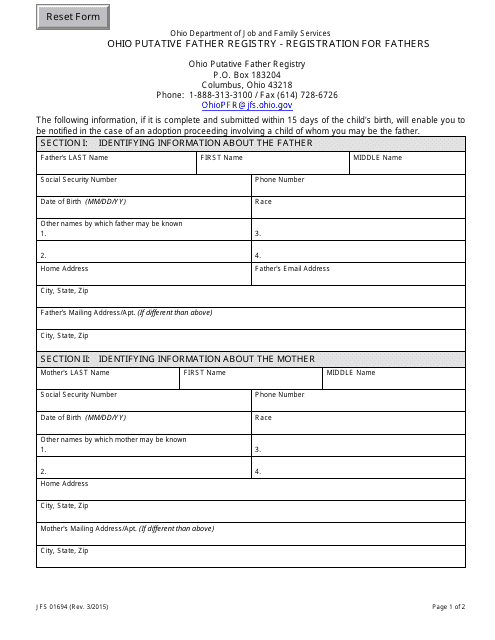

This form is used for registering as a father in Ohio's Putative Father Registry.

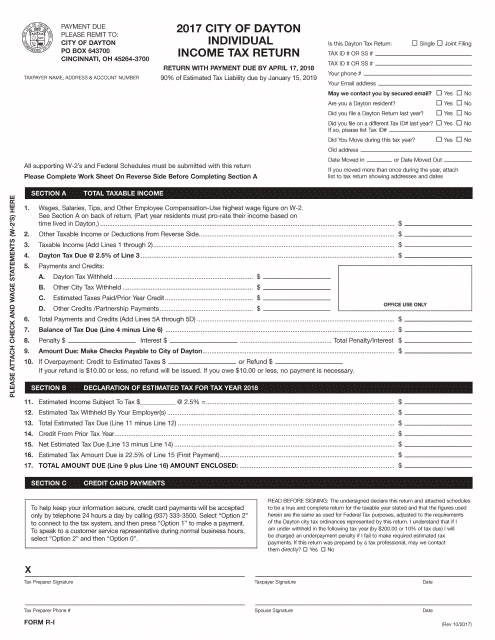

This form is used to report individual income tax return for residents of the City of Dayton, Ohio.

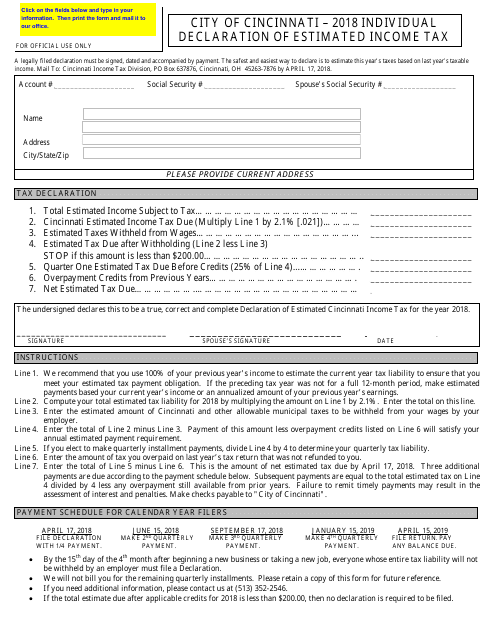

This document is used for individuals to declare their estimated income tax in the City of Cincinnati, Ohio. It is used to estimate and pay the amount of income tax owed to the city throughout the year.

This Form is used for filing income tax returns specifically for residents of the city of Brunswick, Ohio.

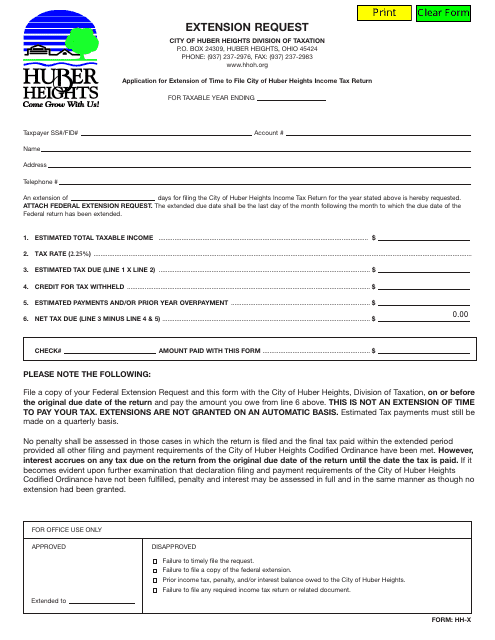

This form is used for requesting an extension of time for certain activities related to the City of Huber Heights, Ohio.

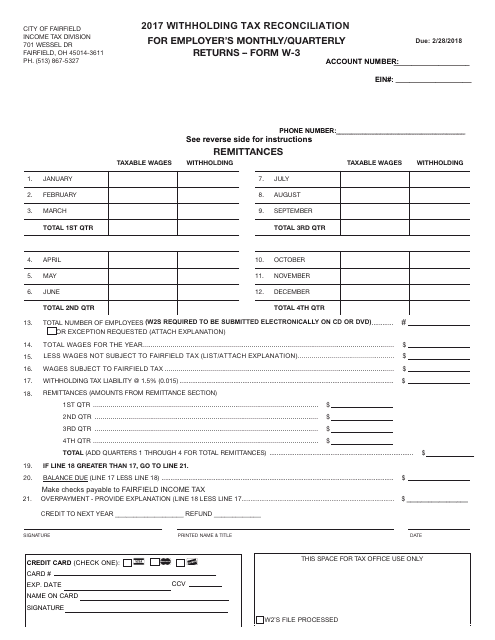

This form is used by employers in Fairfield, Ohio to reconcile withholding taxes from their monthly or quarterly returns. It helps ensure accurate reporting and payment of taxes to the city.

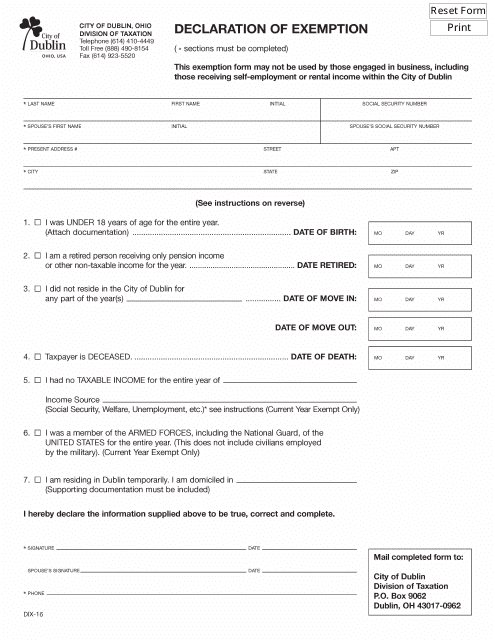

This form is used to declare exemption from certain taxes in the City of Dublin, Ohio.

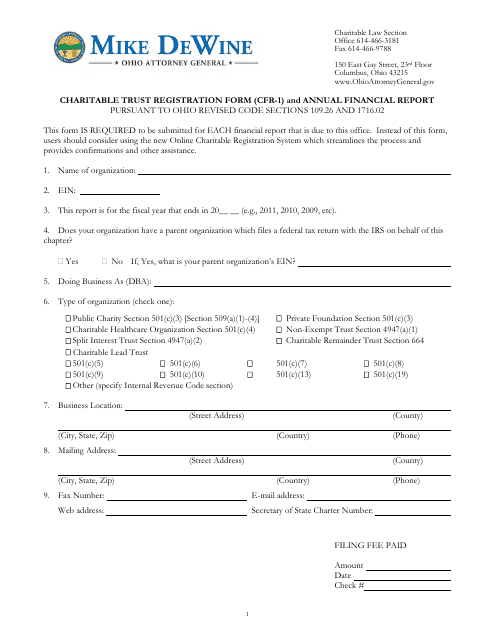

This form is used for registering and reporting financial information for charitable trusts in Ohio.

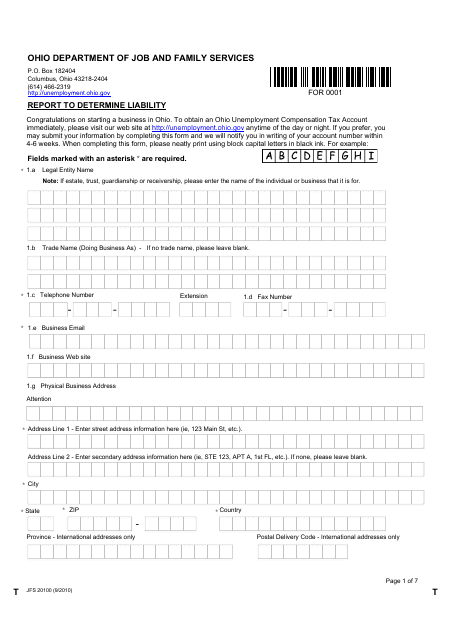

This Form is used for reporting and determining liability in the state of Ohio. It helps identify individuals or organizations that may be held responsible for certain actions or events.

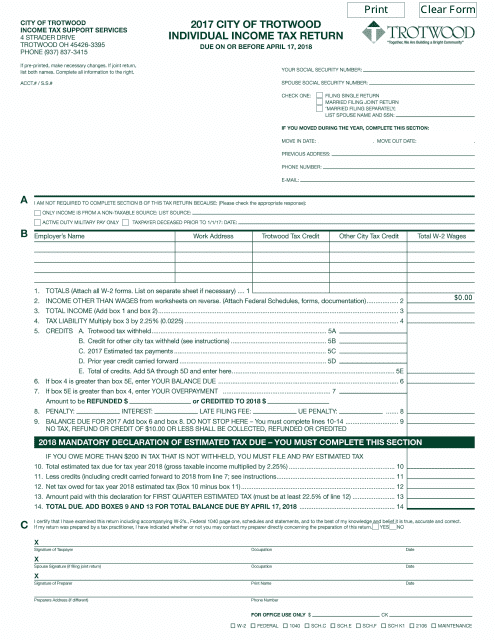

This form is used for filing individual income tax returns for residents of the City of Trotwood, Ohio.

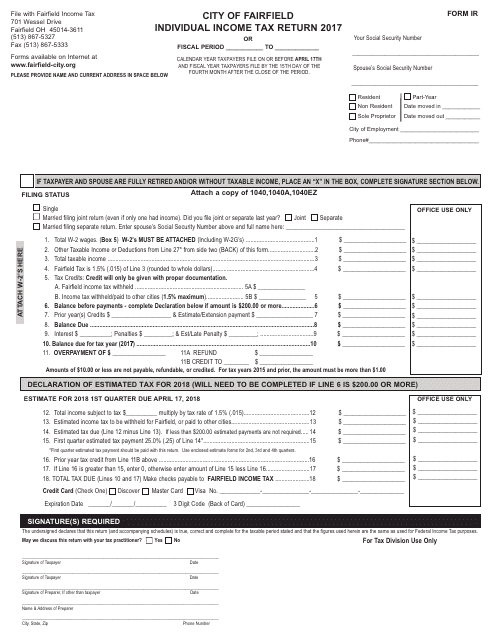

This form is used for filing an individual income tax return in the city of Fairfield, Ohio.

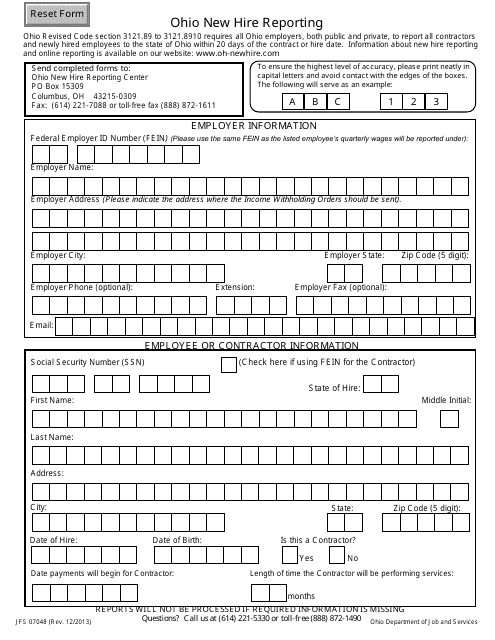

Ohio private and public employers may use this official form to inform the government about an individual recently hired by their business.

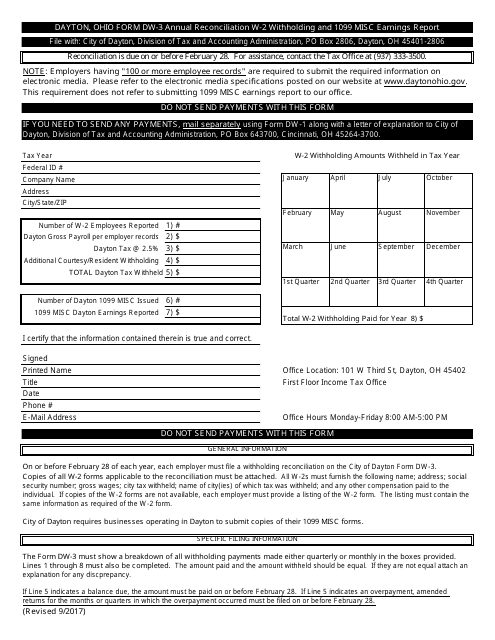

Form DW-3 Annual Reconciliation W-2 Withholding and 1099 Misc Earnings Report - City of Dayton, Ohio

This form is used for annual reconciliation of W-2 withholding and reporting 1099 miscellaneous earnings for residents of the City of Dayton, Ohio.

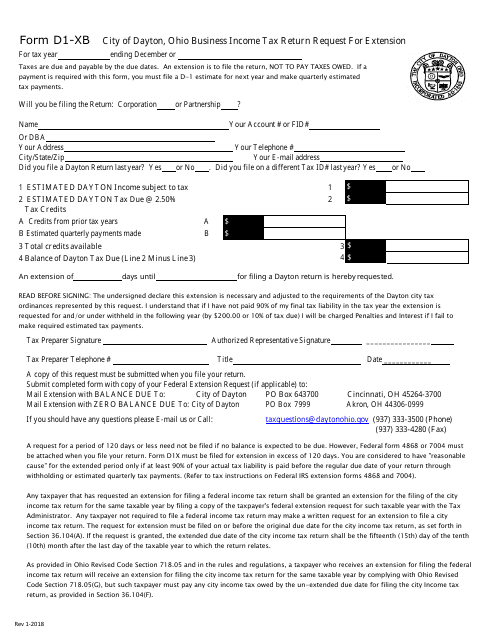

This form is used for requesting an extension to file the business income tax return for the City of Dayton, Ohio.

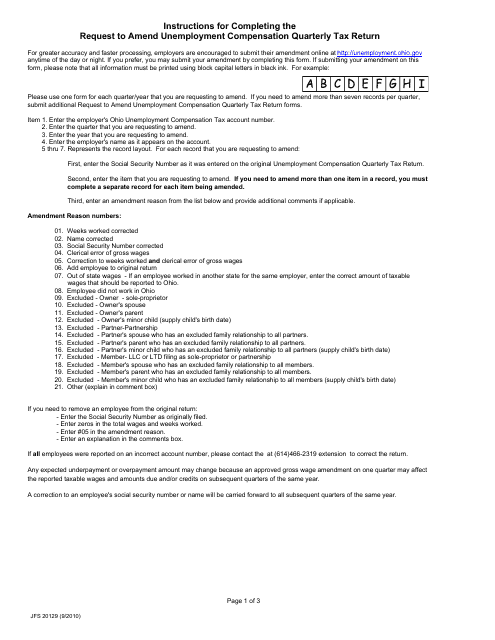

This form is used for requesting changes to the quarterly tax return for unemployment compensation in Ohio.

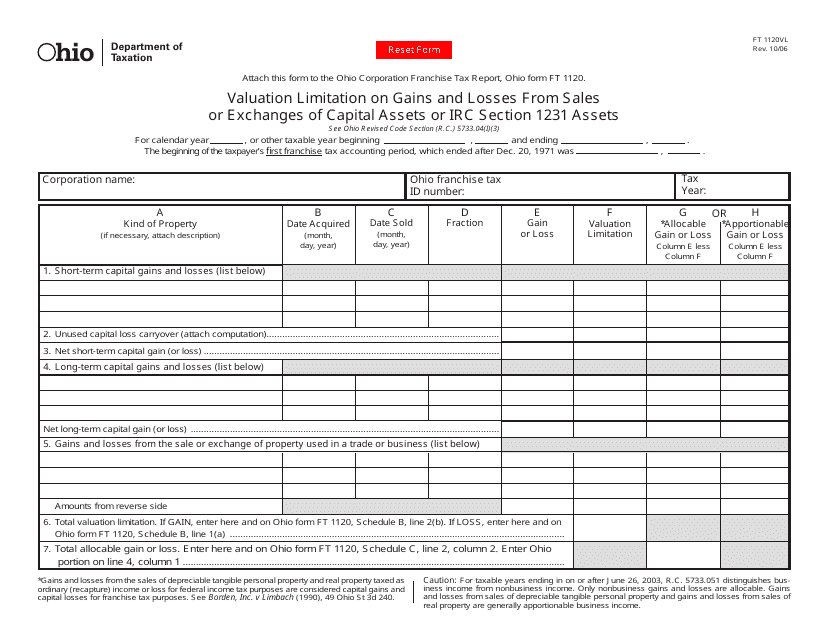

This form is used in Ohio to calculate the valuation limitation on gains and losses from sales or exchanges of capital assets or IRC Section 1231 assets.

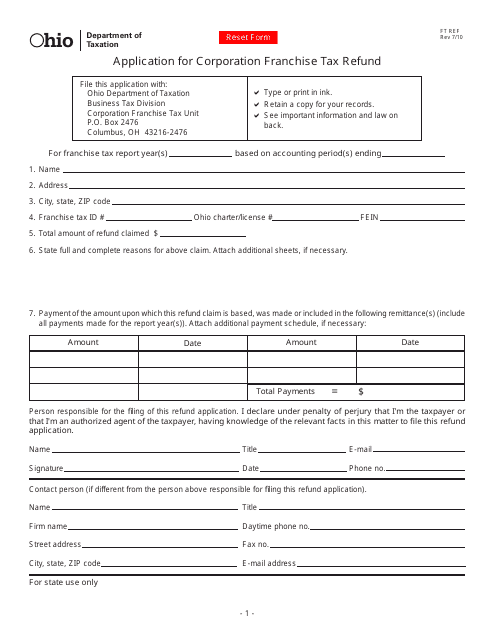

This Form is used for corporations in Ohio to apply for a refund of their franchise tax payments.

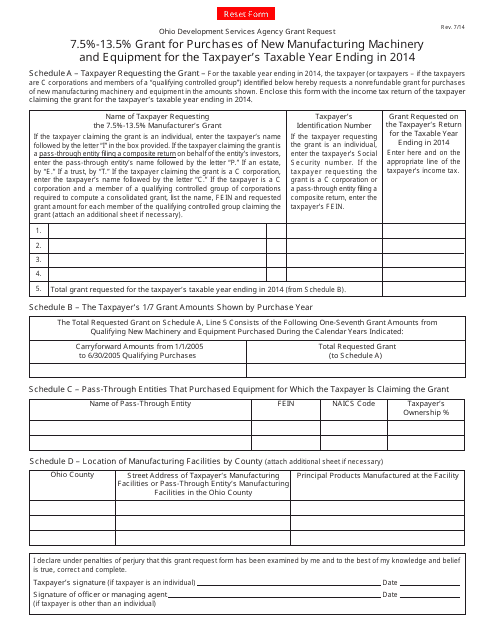

This form is used to apply for a grant of 7.5%-13.5% for the purchase of new manufacturing machinery and equipment in Ohio for the taxpayer's taxable year ending in 2014.

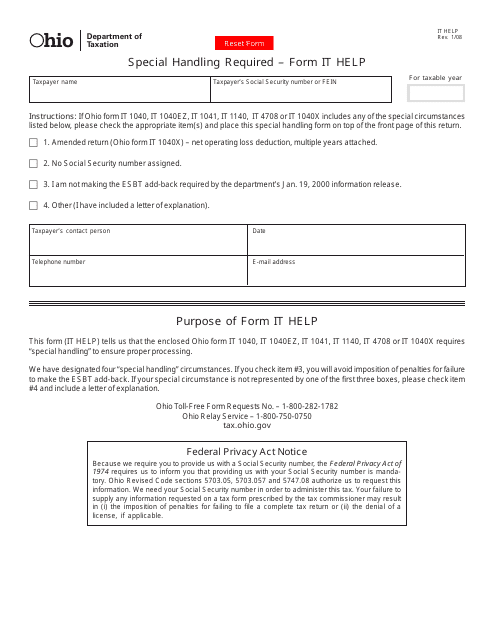

This Form is used for IT support requests from Ohio residents that require special handling.

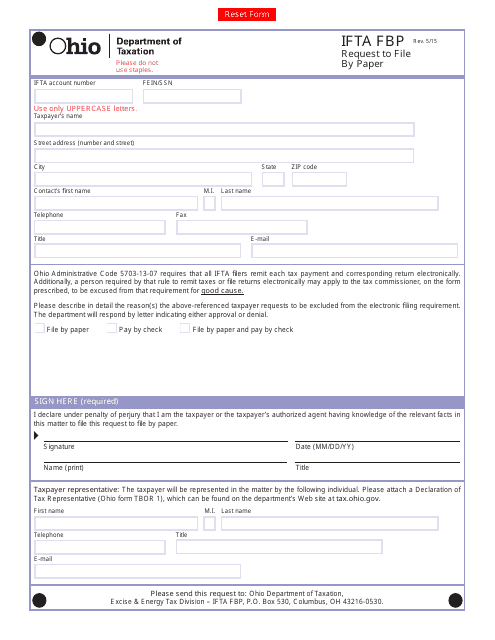

This form is used for requesting to file the International Fuel Tax Agreement (IFTA) Fuel Use Tax return by paper in the state of Ohio.

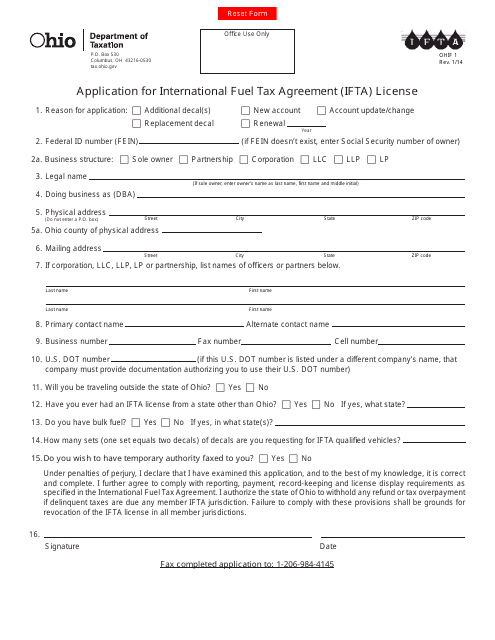

This Form is used for applying for an International Fuel Tax Agreement (IFTA) license in Ohio.

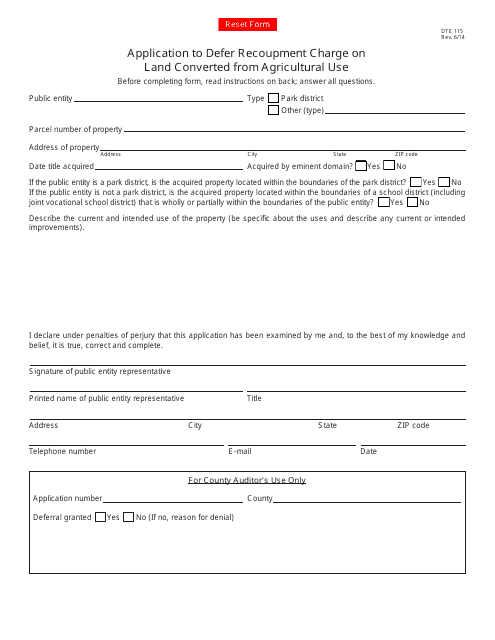

This form is used for applying to defer the recoupment charge on land that has been converted from agricultural use in Ohio.

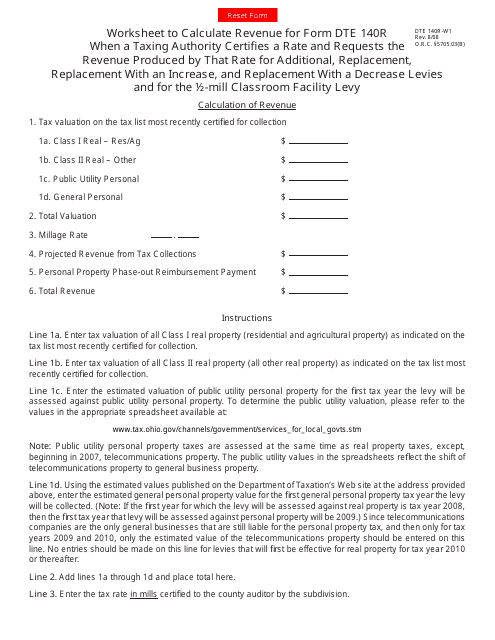

This form is used for calculating and reporting additional, replacement, increase, and decrease levies in Ohio, including the 1/2-mill classroom facility levy.