U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

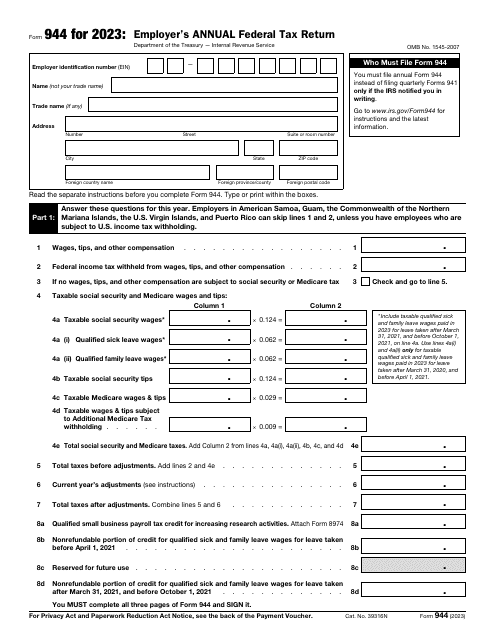

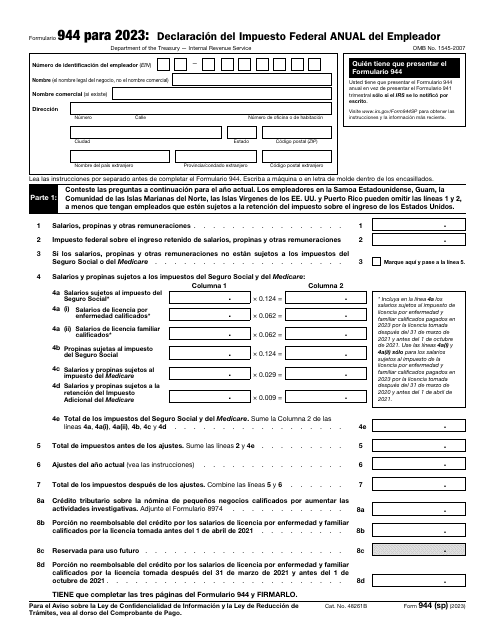

This is a fiscal document filled out by employers with a low annual tax liability to report their payroll activities to tax organizations.

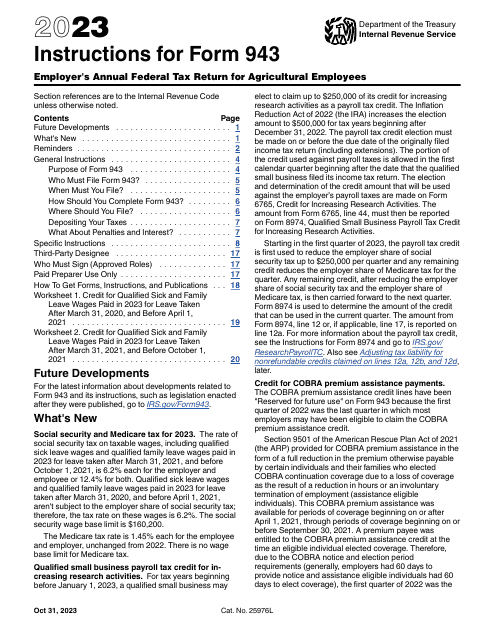

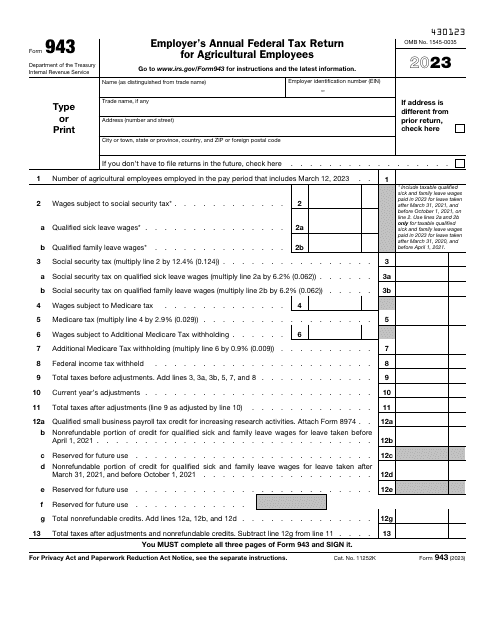

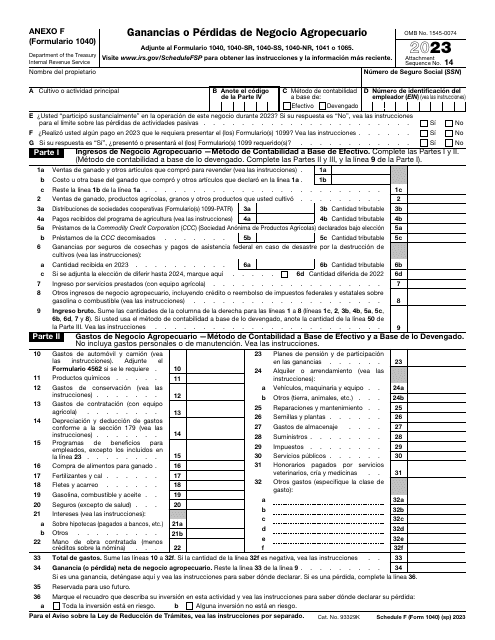

If you paid wages in the reported tax year to one or more farm workers, file this form for your annual federal tax return in case the wages you paid to your farmworkers were subject to the federal income, Medicare, or social security tax withholdings.

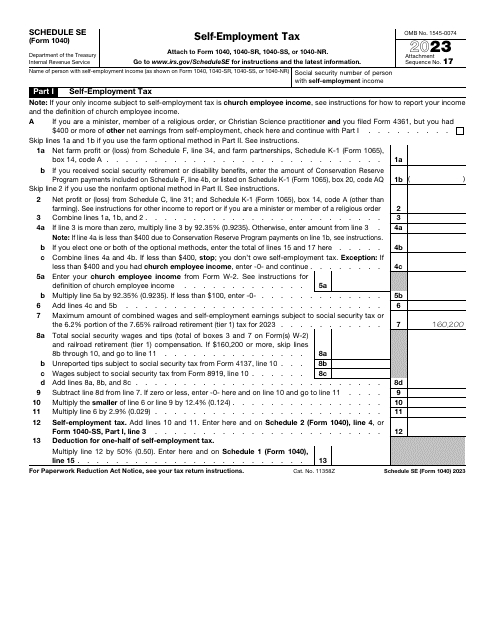

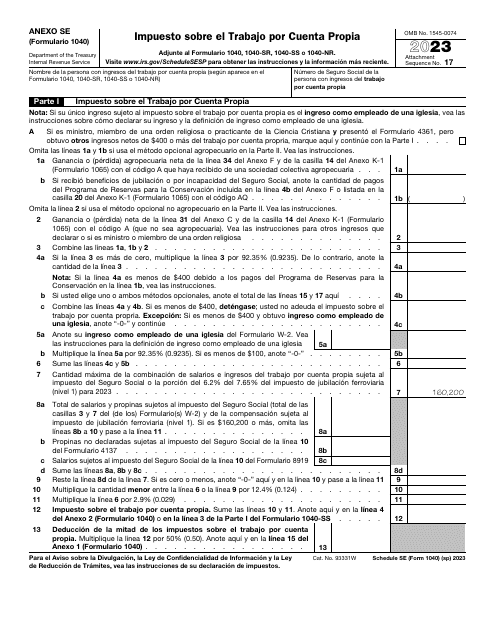

This is an IRS form that contains the breakdown of the self-employment tax the taxpayer figures out after analyzing their net earnings.

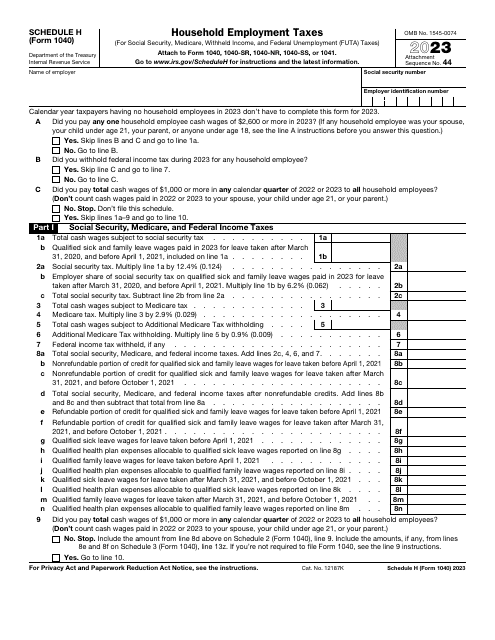

This is a supplementary document that has to be attached to a tax return, if the taxpayer employed people that worked in their house helping the owner to manage the place in a certain capacity.

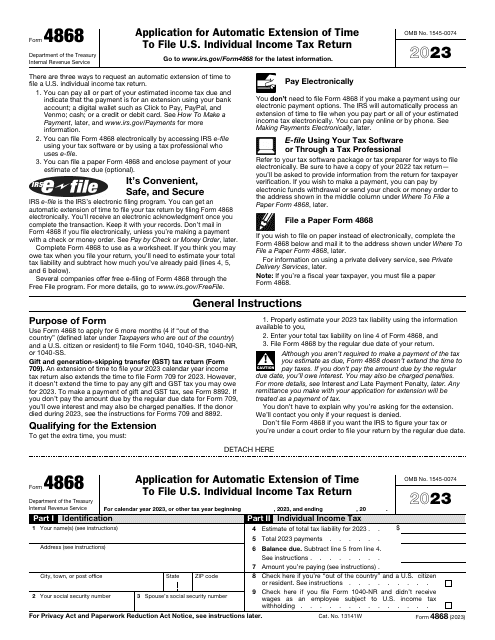

This is an IRS form that needs to be filled out to request an automatic extension to submit income tax return forms.

This is an IRS form that includes the details of an installment sale.

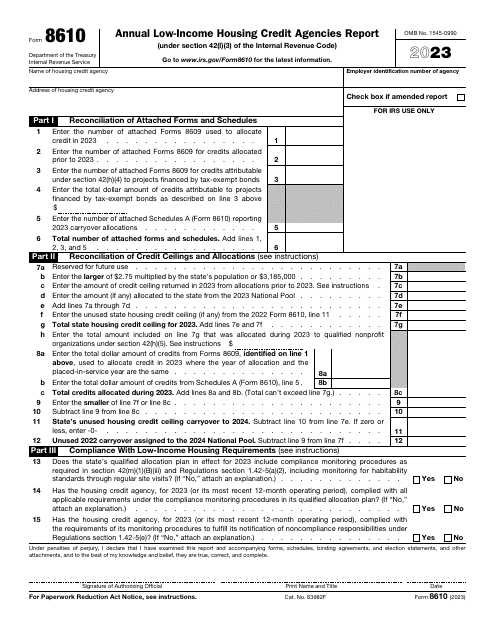

This is a formal IRS statement a housing credit agency is supposed to complete to inform the fiscal authorities about the total amount of housing credits their entity has allocated during the twelve months outlined in the form.

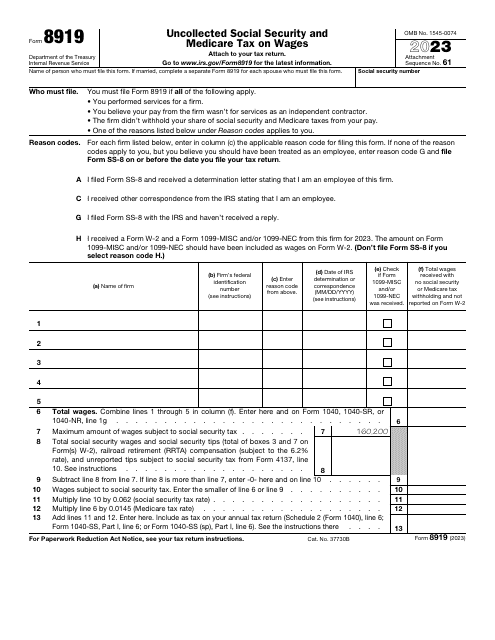

This is a formal report filed by an individual who believes they have to receive compensation in the form of social security and Medicare taxes.

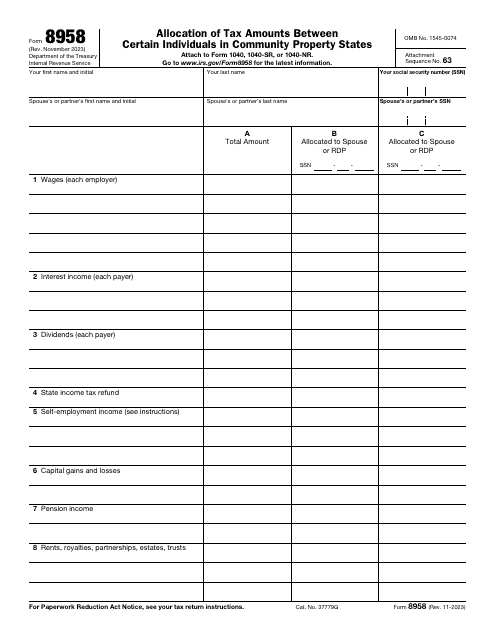

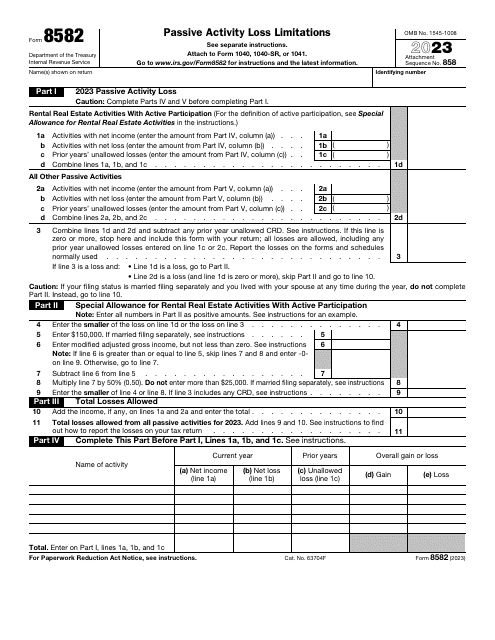

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

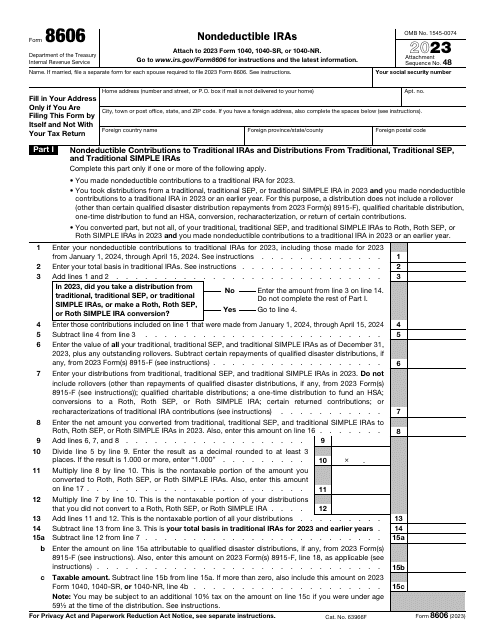

The purpose of this form is to provide the IRS with information on taxpayers who make nondeductible contributions to their Individual Retirement Account (IRA).

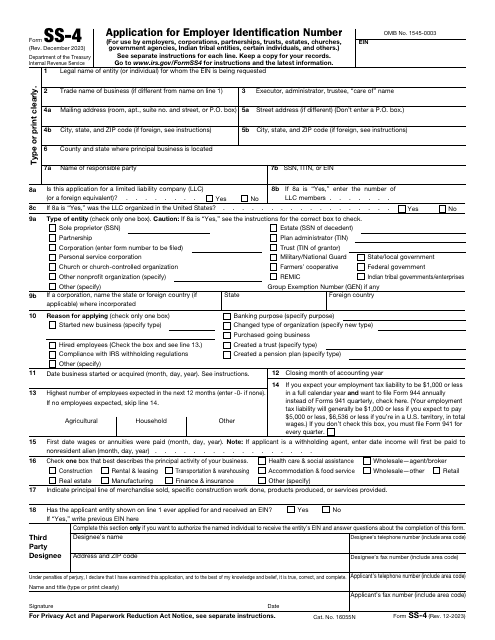

This is a fiscal document used by taxpayers - from sole proprietors to corporations - to ask tax organizations for a unique identification number.

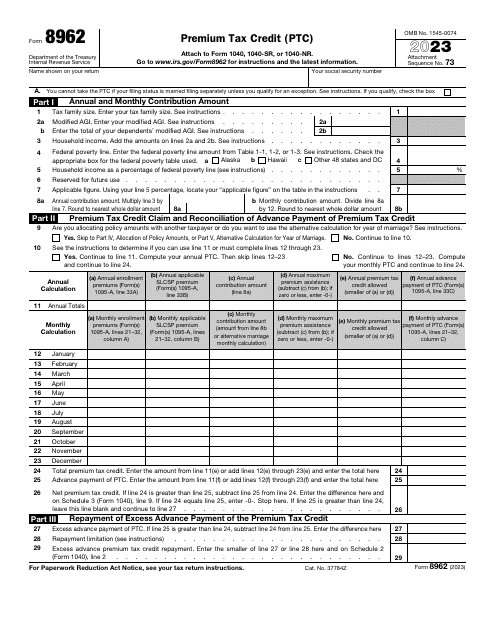

This is an IRS legal document completed by individuals who need to figure out the amount of their Premium Tax Credit and reconcile it with the Advanced Premium Tax Credit (APTC) payments made throughout the reporting year.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.