U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

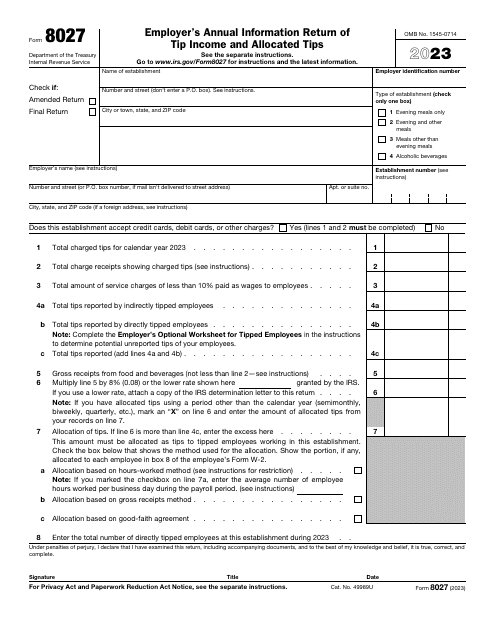

Every year, this form is filled out by employers wishing to report to the Internal Revenue Service (IRS) the receipts and tips their employee received, as well as to determine allocated tips.

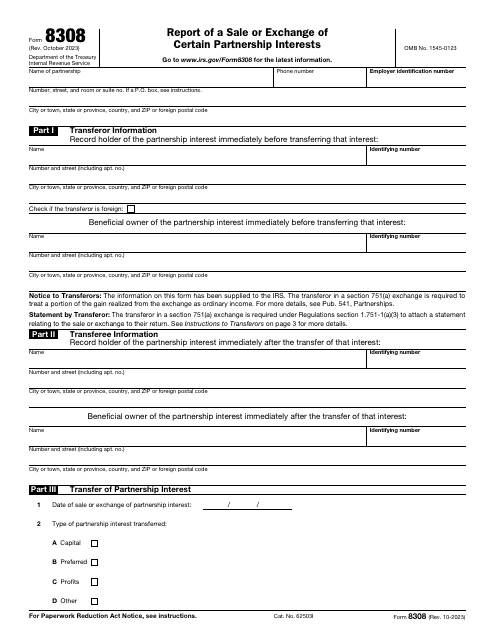

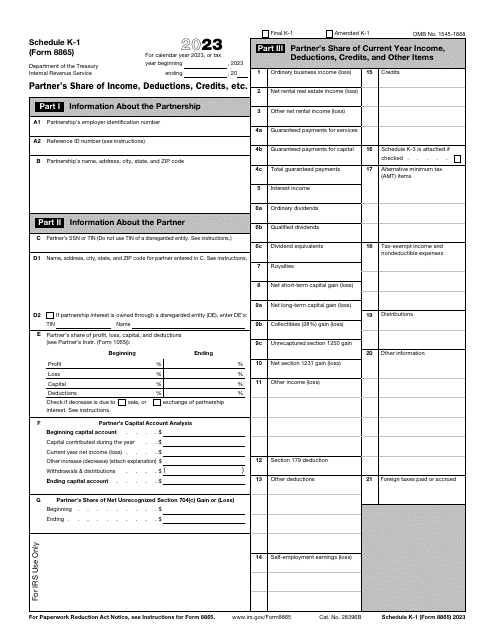

This IRS form is used by a partnership to report the exchange or sale by a partner of a partnership interest.

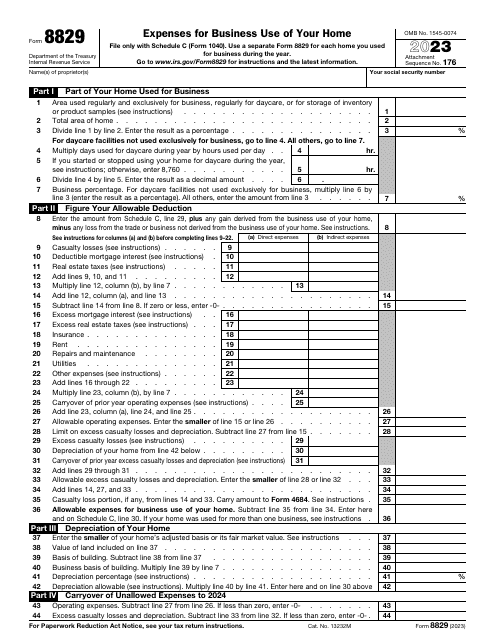

This is an IRS form used by taxpayers who work from home and want to inform tax organizations about the business expenses they wish to deduct from their taxes.

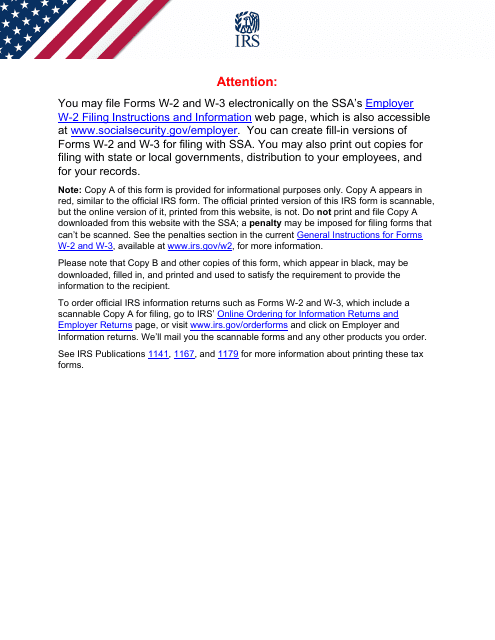

File this document with the Social Security Administration (SSA) if you are a payer or employer who needs to transmit a paper Copy A of forms W-2 (AS), W-2 (CM), W-2 (GU), and W-2 (VI) to the above-mentioned organization.

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

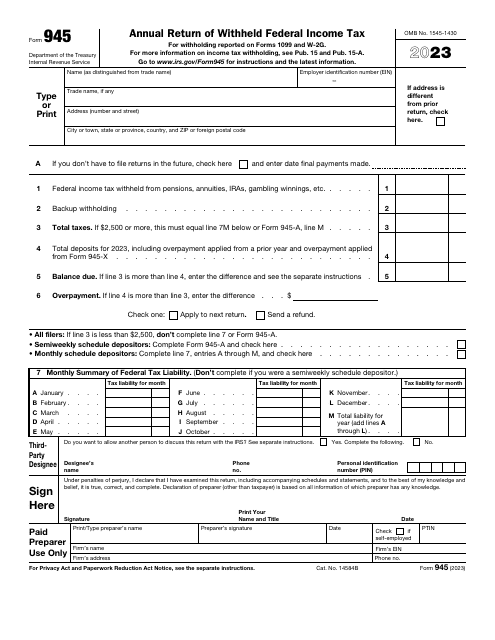

This is a fiscal form taxpayers are obliged to prepare and submit to provide information about nonpayroll payments subject to tax and confirm they are paying an accurate amount of tax for the last year.

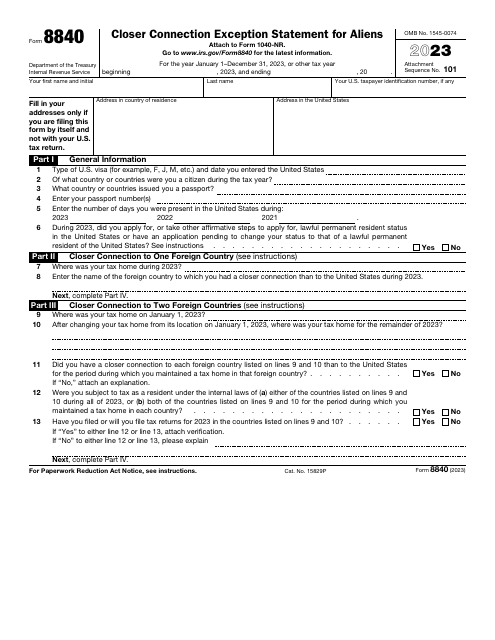

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.