U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

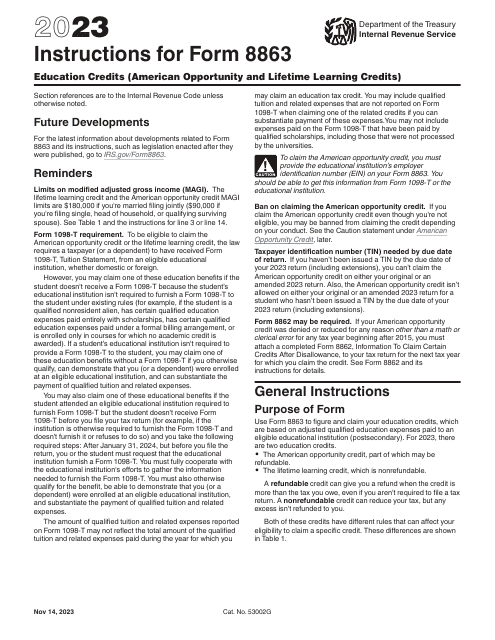

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

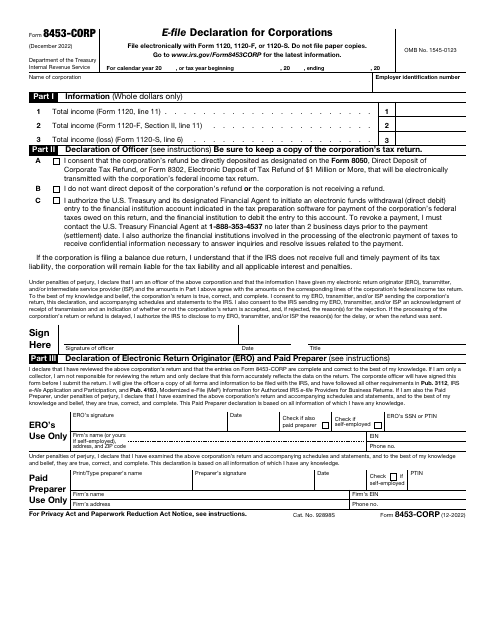

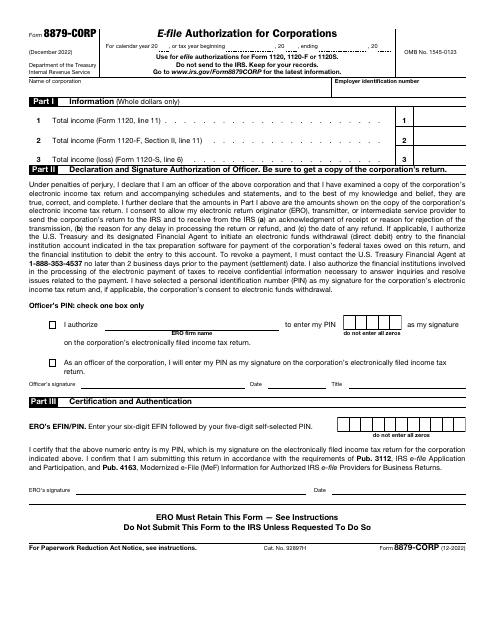

This Form is used for authorizing corporations to e-file their tax returns with the IRS.

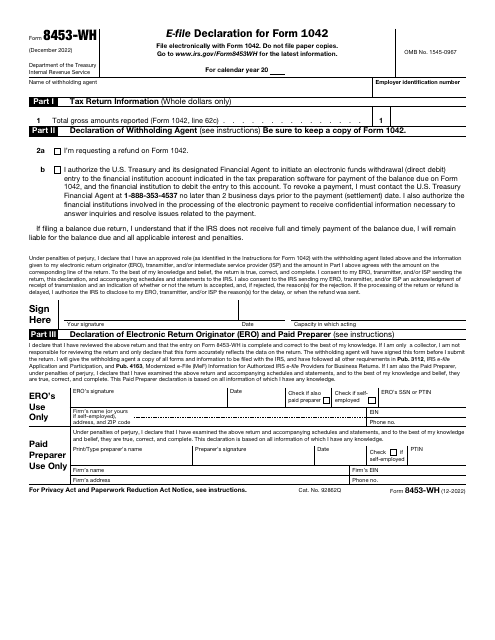

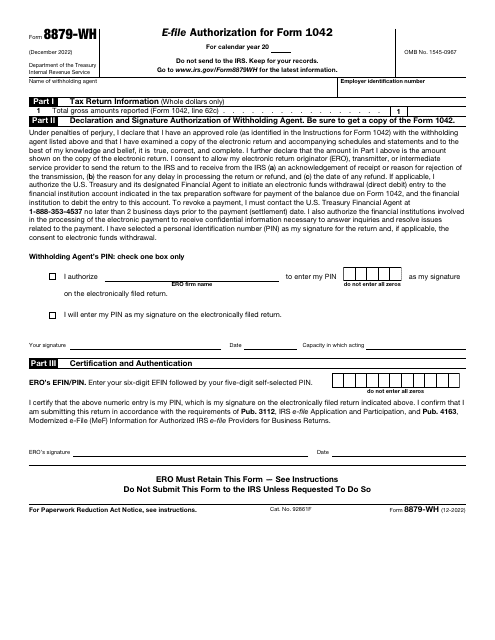

This form is used for authorizing electronic filing for Form 1042 to the IRS.

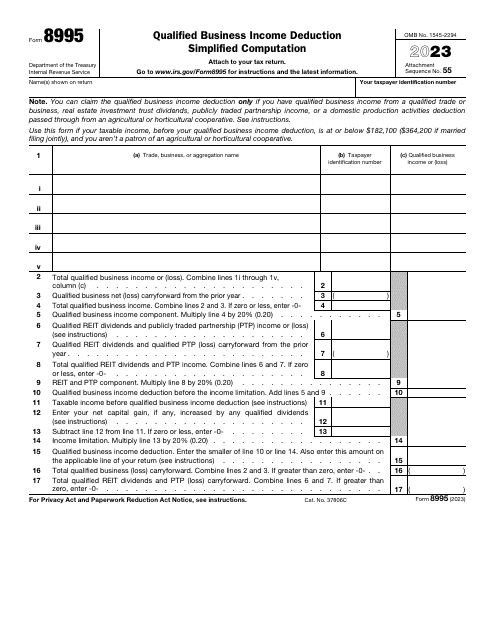

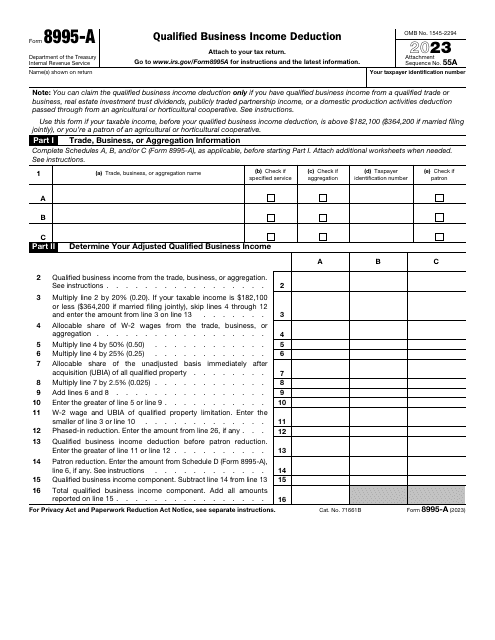

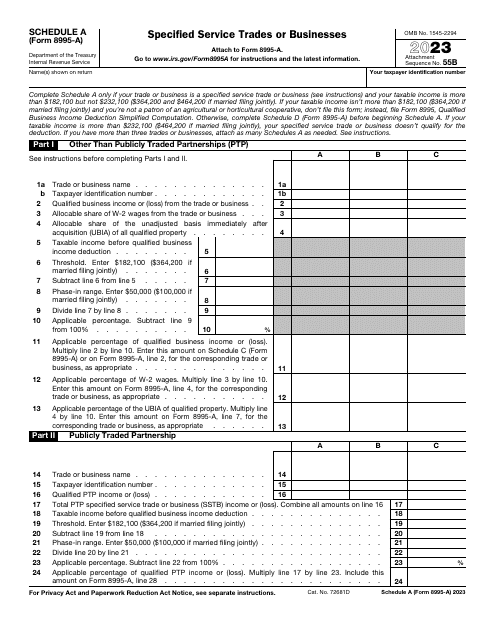

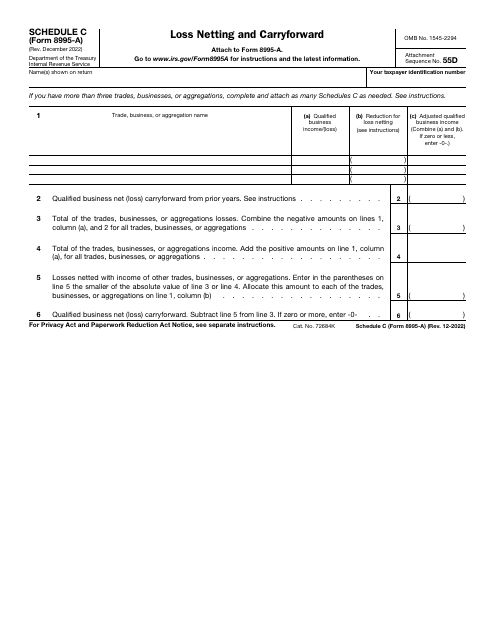

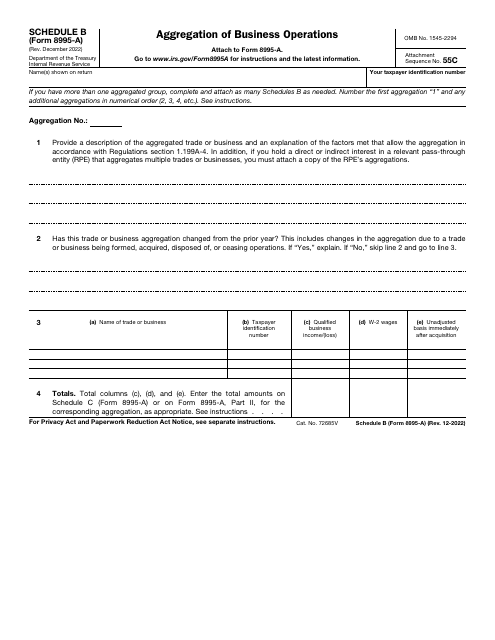

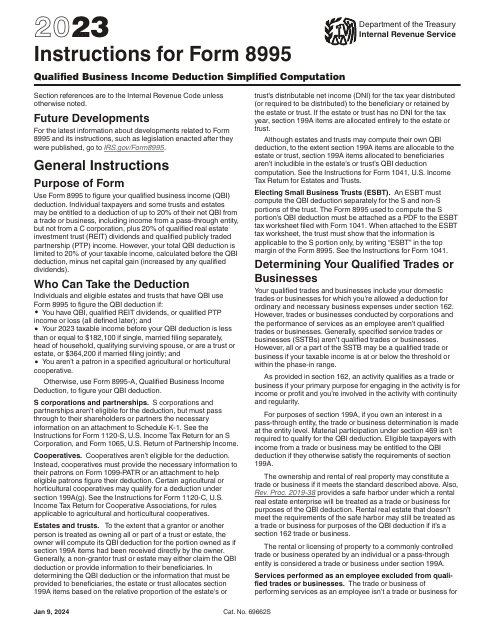

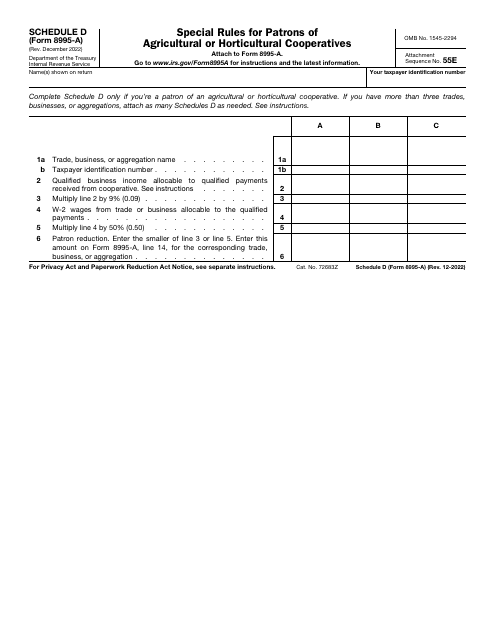

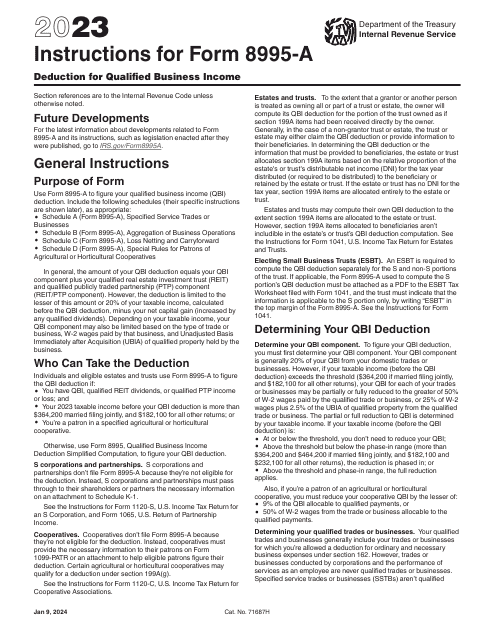

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.

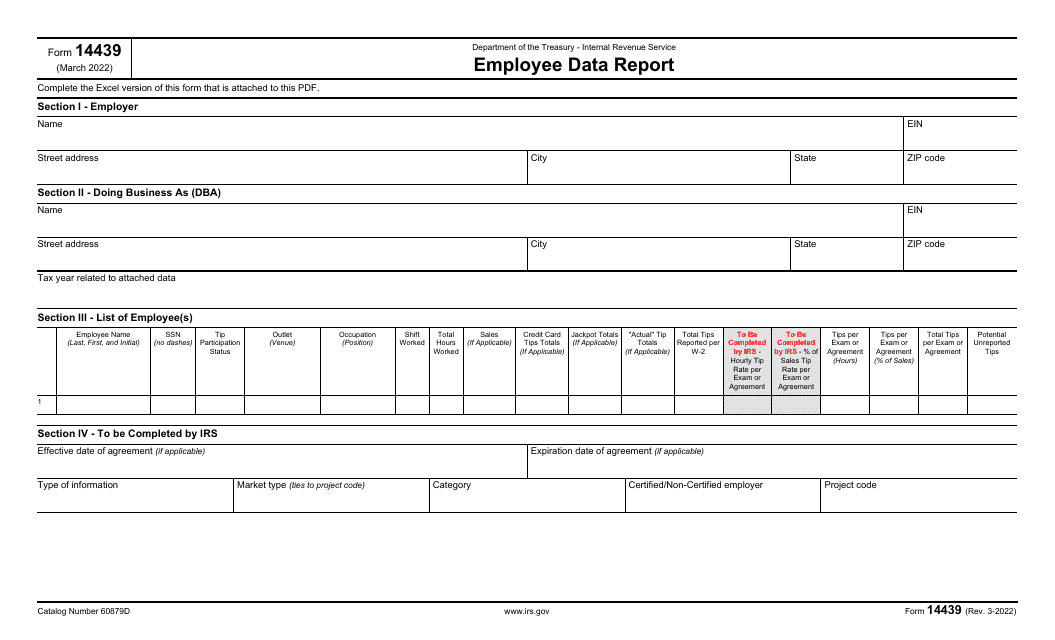

This form is used for reporting employee data to the IRS. It includes information such as employee names, social security numbers, and wages.

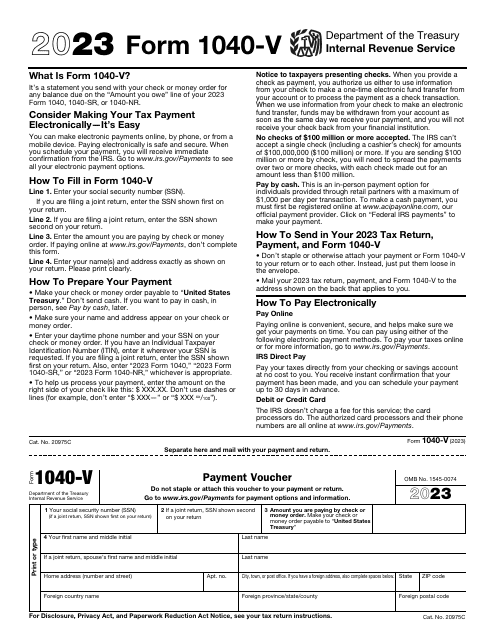

This is a supplementary document completed by taxpayers that chose to fulfill their financial obligations to fiscal organizations with the help of a check or money order.

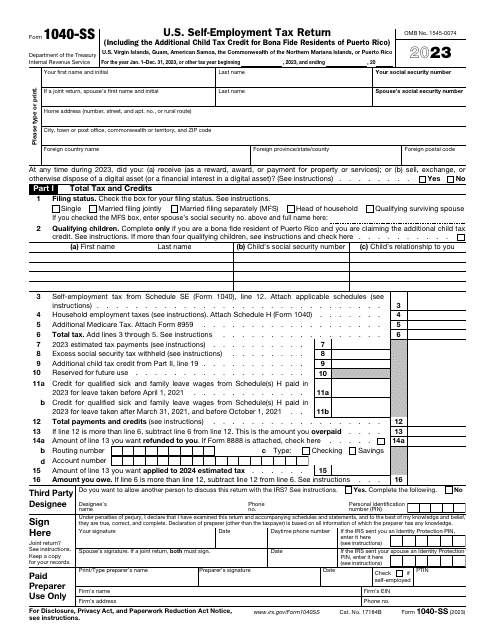

Use this document only if you are a resident of the United States Virgin Islands (USVI), Commonwealth of Puerto Rico, Commonwealth of the Northern Mariana Islands (CNMI), Guam, and American Samoa and wish to report your self-employment net earnings to the United States.

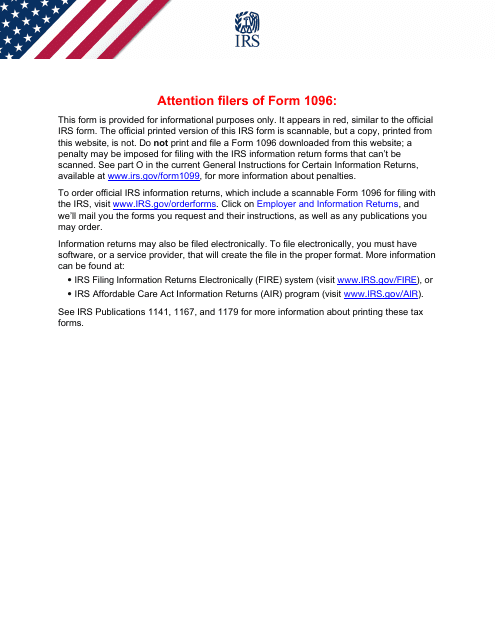

Use this document as a compilation or a summary information sheet to physically transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the Internal Revenue Service (IRS). If you opt to file the forms electronically, you are not required to submit a 1096 transmittal form.

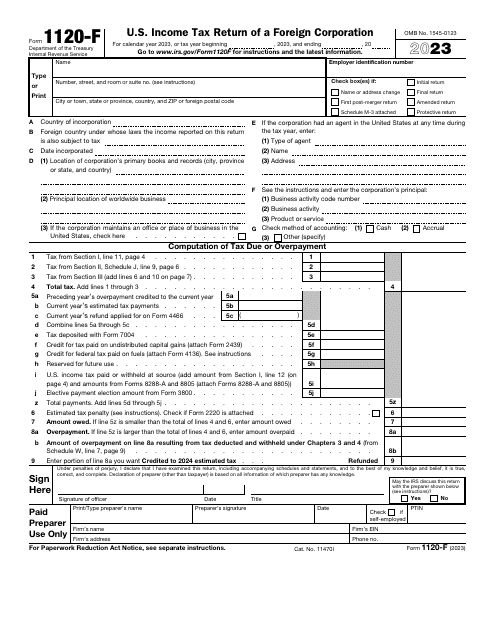

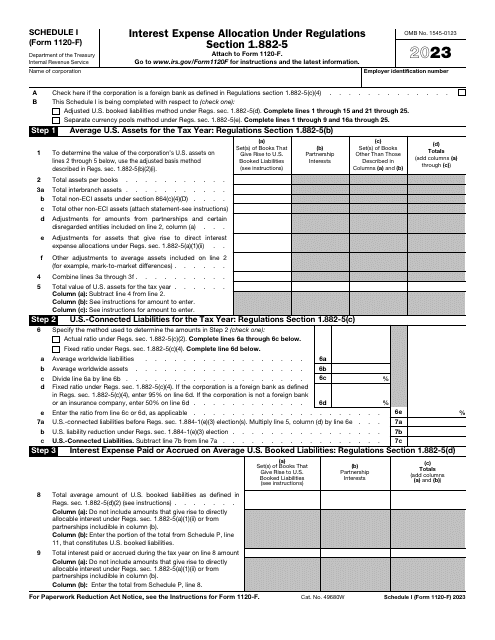

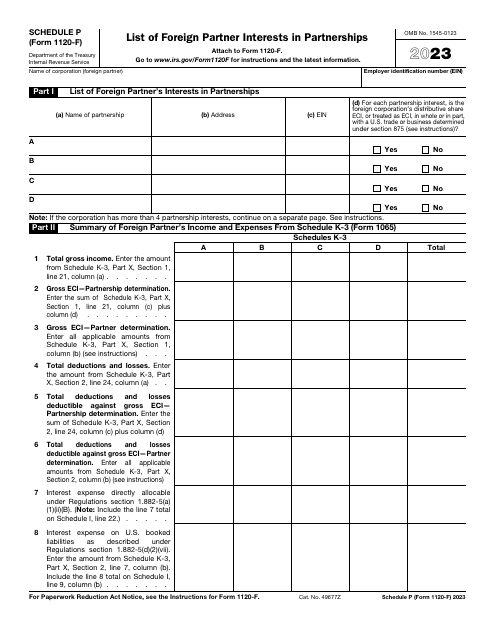

File this form if you are a foreign corporation and maintain an office within the United States in order to report your income, deductions, and credits to the Internal Revenue Service (IRS), as well as to figure your U.S. income tax liability.