U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

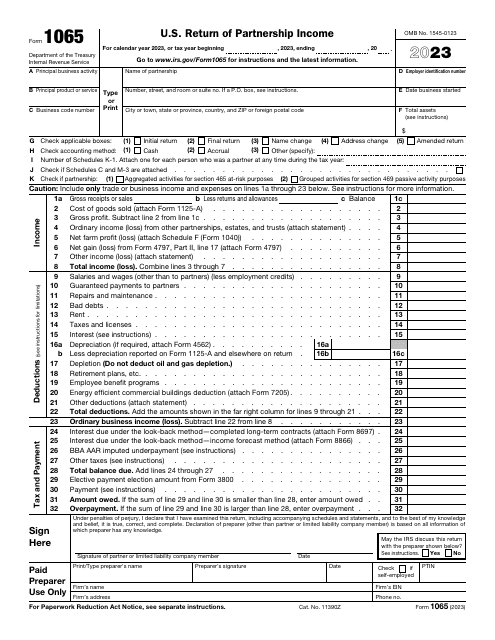

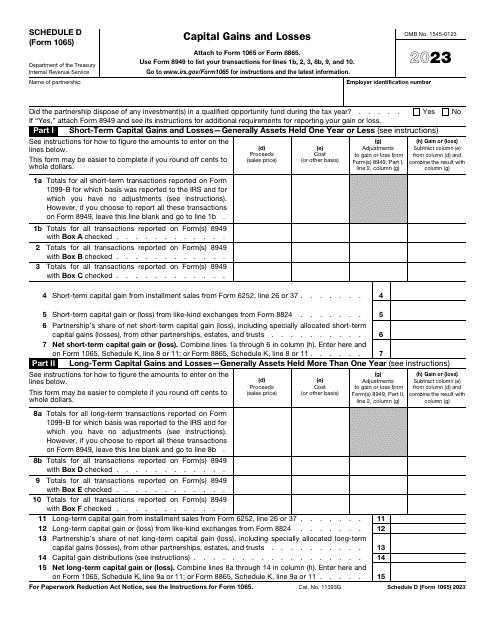

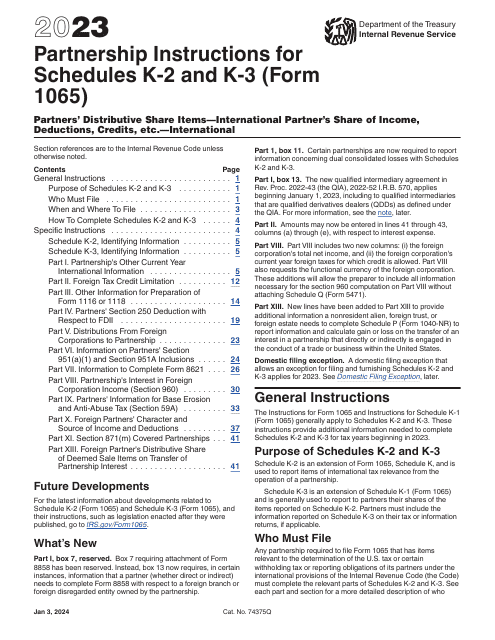

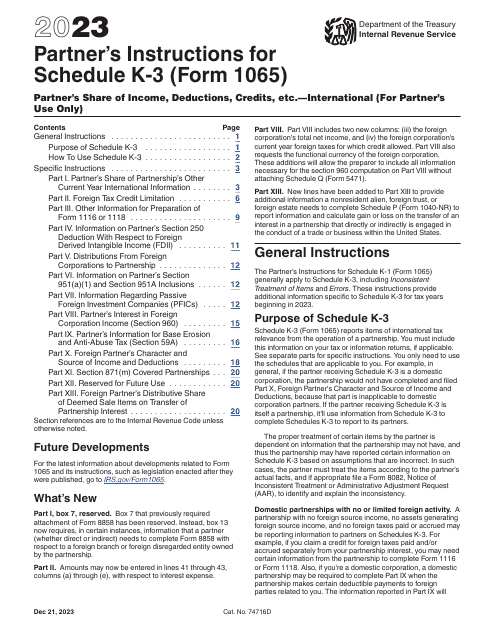

Use this form to report information on deductions, credits, and income relevant to the operation of a partnership to the Internal Revenue Service (IRS).

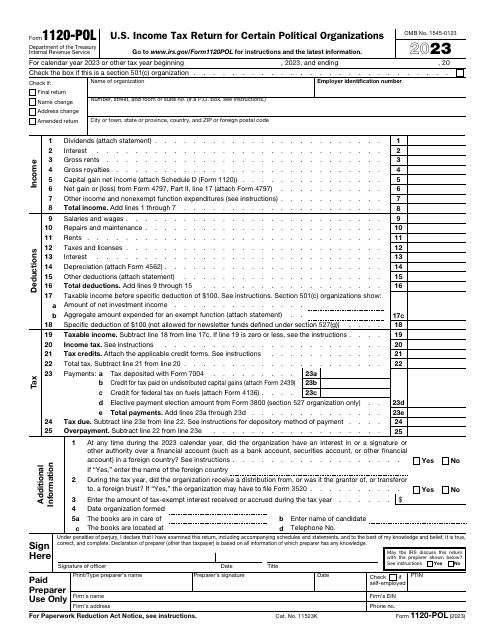

Use this form to inform the Internal Revenue Service (IRS) about the taxable income of your political organization, as well as about your tax liability according to Section 527.

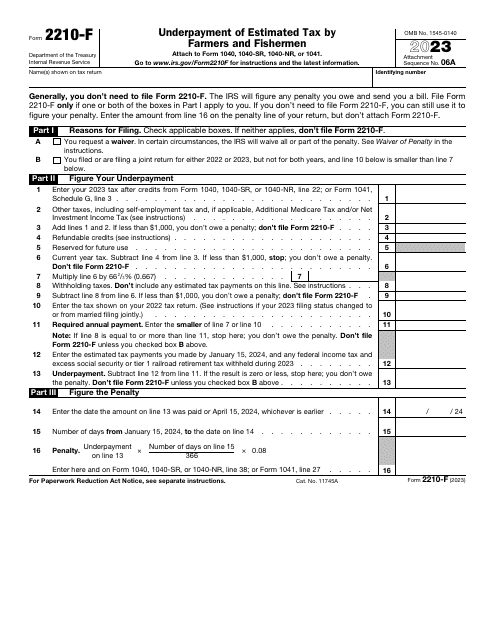

This is an IRS form completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations.

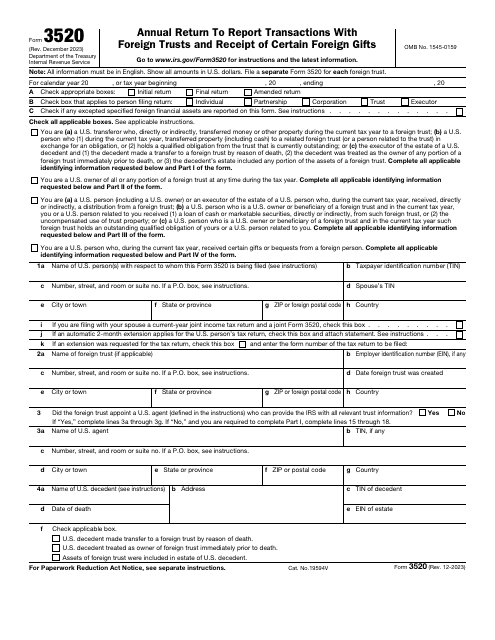

This form is a formal statement used by people and entities obliged to tell the fiscal authorities about the transactions they have had with foreign trusts throughout the year.

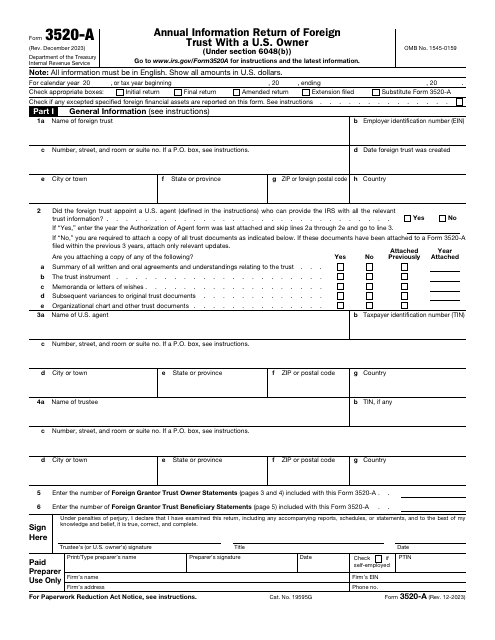

This document is submitted to the Internal Revenue Service (IRS) annually by foreign trusts with a U.S. owner to inform the IRS about the trust, its American beneficiaries, and any U.S. trust owner.

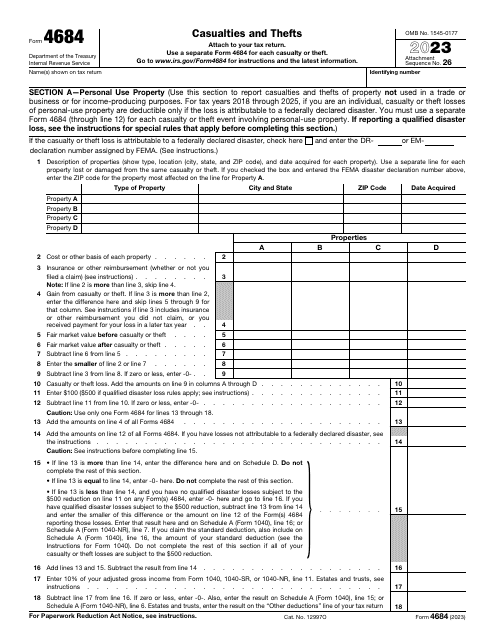

This is a formal statement prepared by a taxpayer who wants to confirm their right to receive a tax deduction upon property damage or loss they sustained if the reason for it was a casualty or theft.

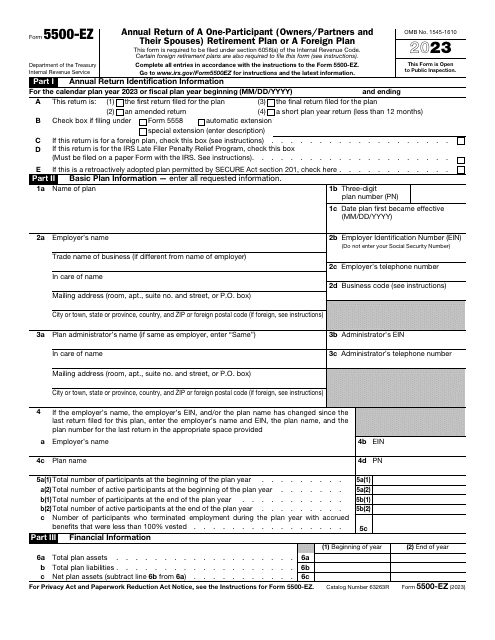

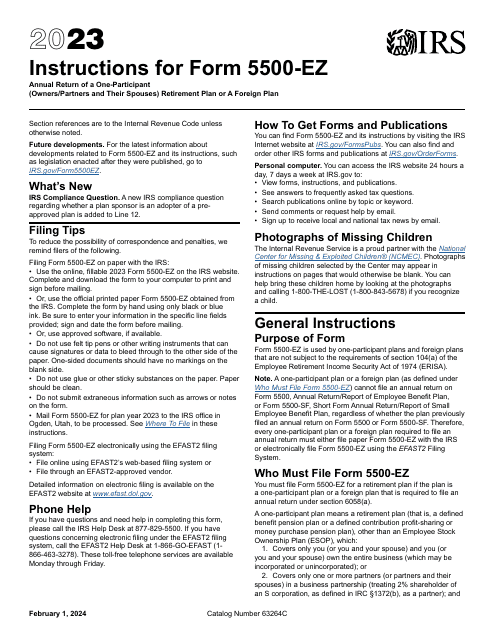

This form should be filled out by one-participant plans and by foreign plans. You are not required to file the form with attachments or schedules. File this form for an annual return if you do not file it electronically on a related Form 5500-SF.