Oregon Tax Forms and Templates

Documents:

168

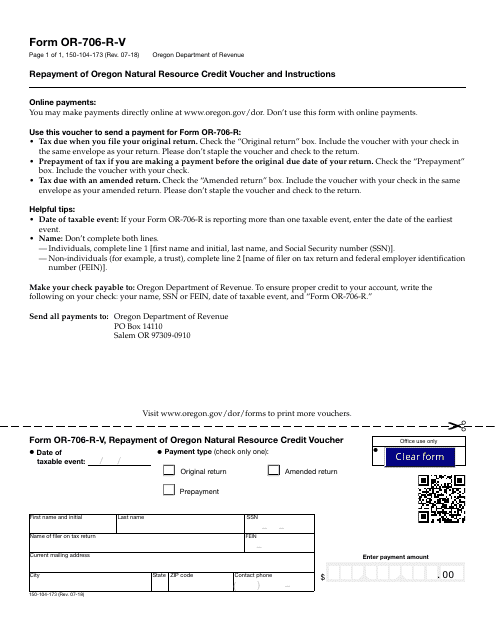

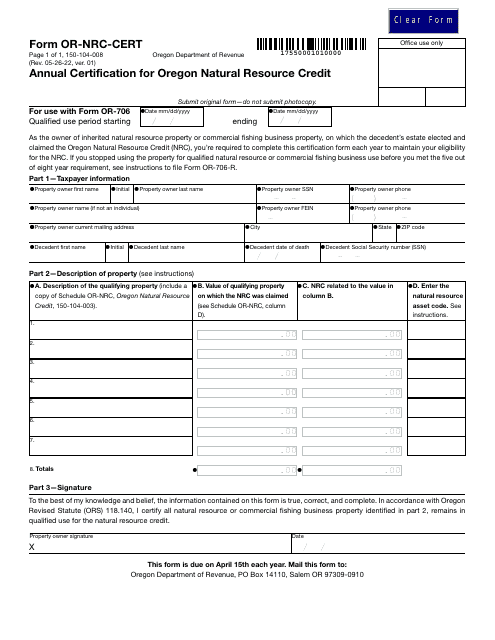

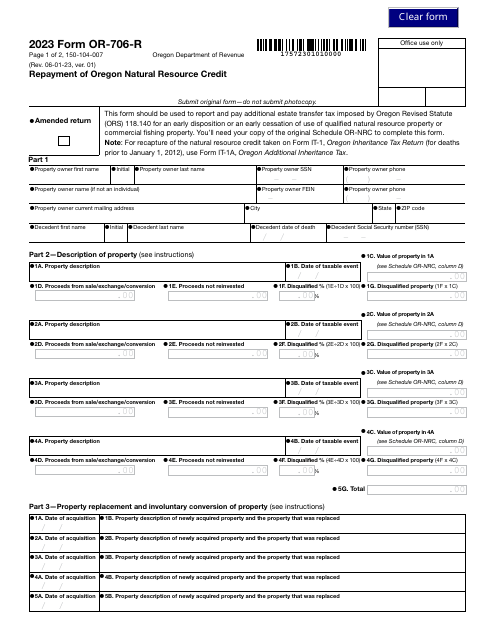

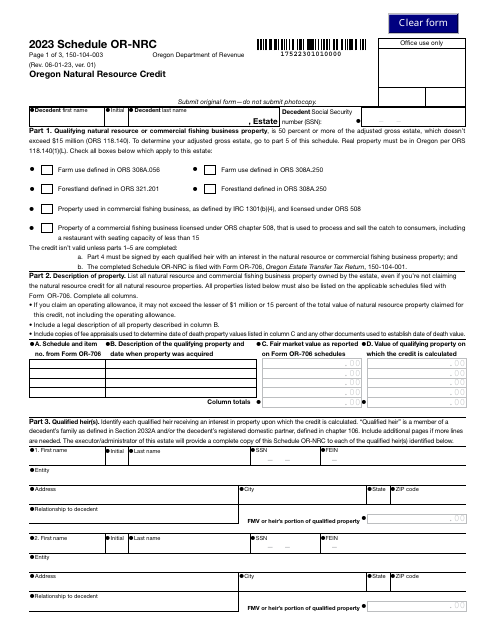

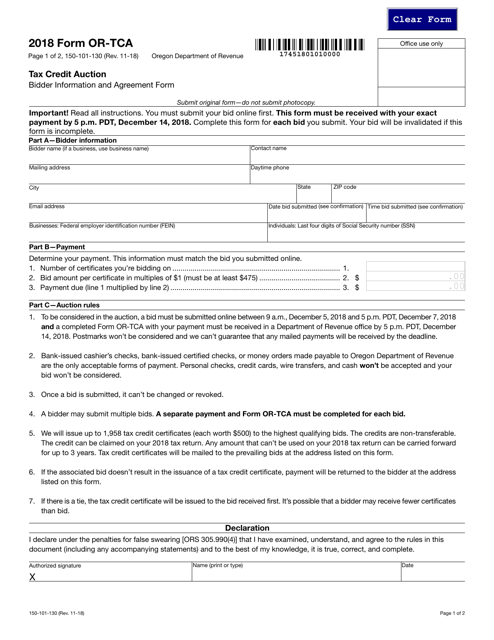

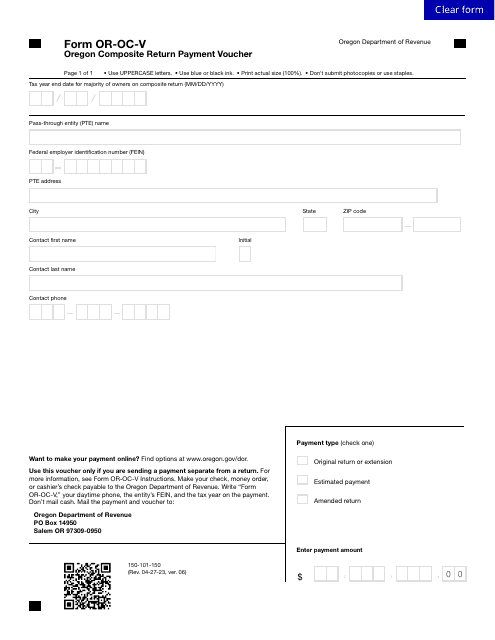

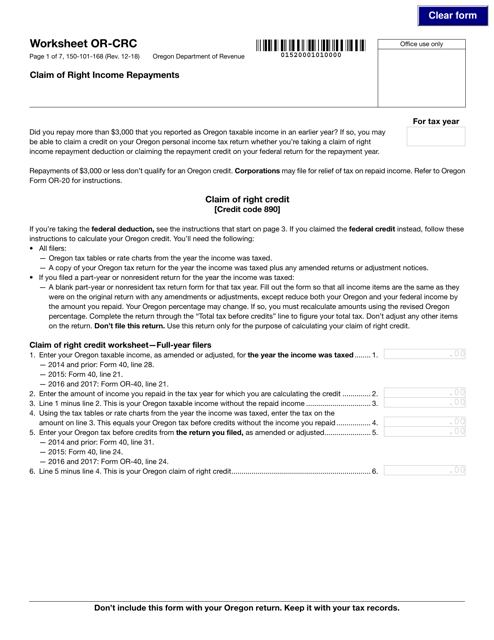

This form is used for requesting repayment of the Oregon Natural Resource Credit Voucher in the state of Oregon.

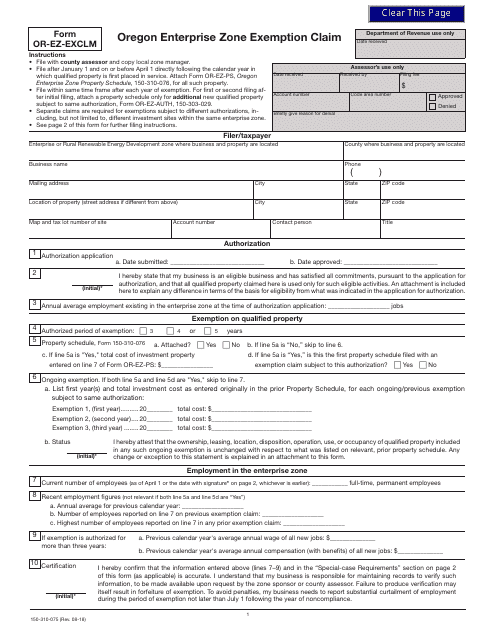

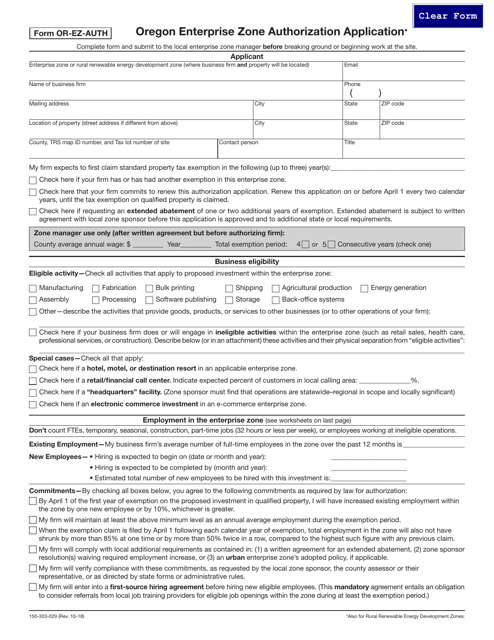

This form is used for claiming an enterprise zone exemption in Oregon. It is specifically for use by businesses to apply for tax incentives and benefits offered by the Oregon Enterprise Zone Program.

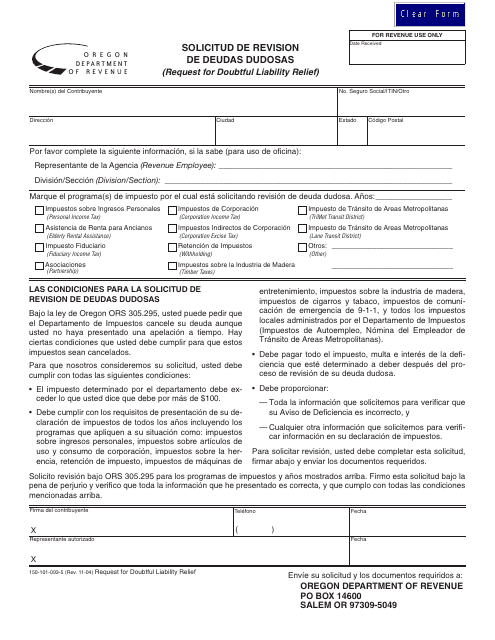

This Form is used for requesting a review of doubtful debts in Oregon. It is available in both English and Spanish.

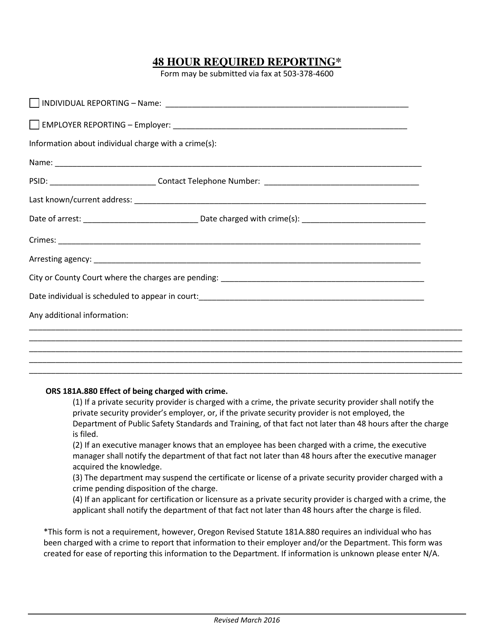

This form is used for reporting criminal charges in the state of Oregon. It is typically filled out by law enforcement officers or individuals who witness a crime and want to provide information to authorities. The form includes details about the incident, the individuals involved, and any evidence or witnesses.

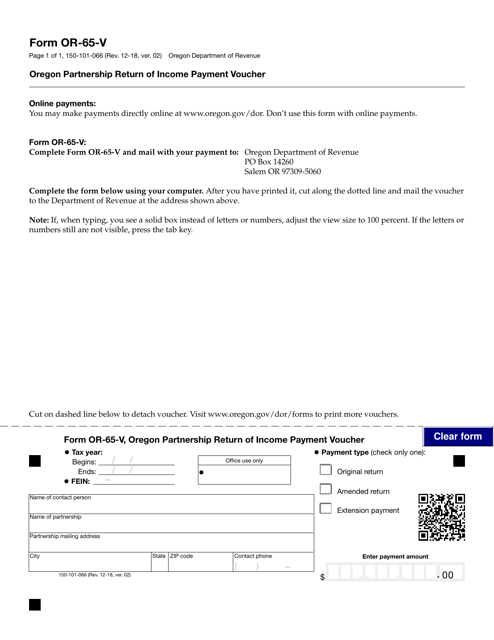

This form is used for making payment for Oregon Partnership Return of Income.

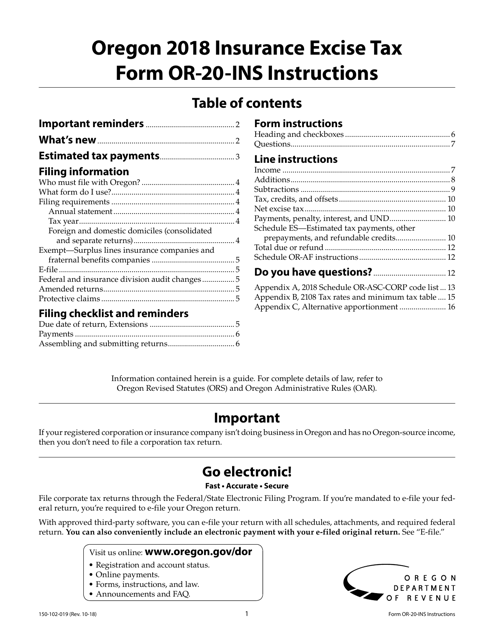

This Form is used for filing the Oregon Insurance Excise Tax Return in Oregon. It provides instructions on how to accurately complete the form and submit it to the appropriate tax authorities.

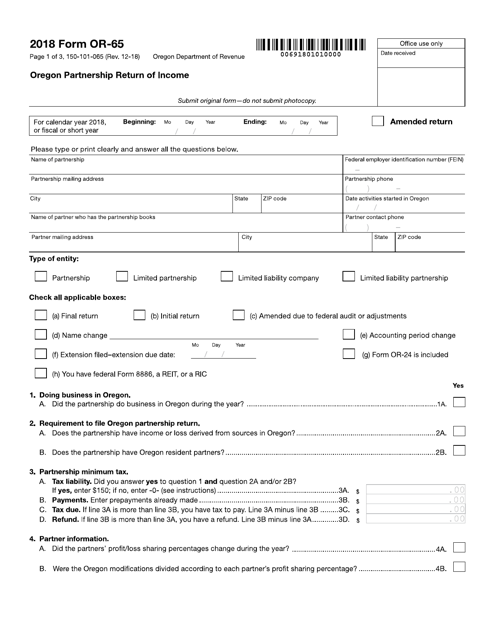

This form is used for filing the Oregon Partnership Return of Income for Oregon residents.

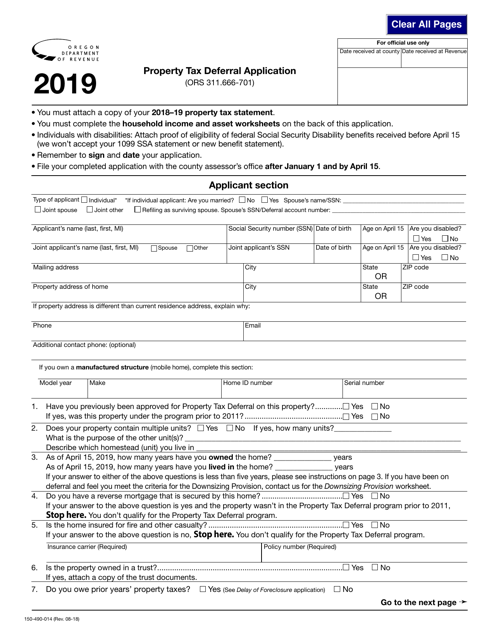

This form is used for applying for property tax deferral in Oregon for properties owned by qualified individuals or certain organizations.

This Form is used for applying for an Oregon Enterprise Zone Authorization in Oregon.

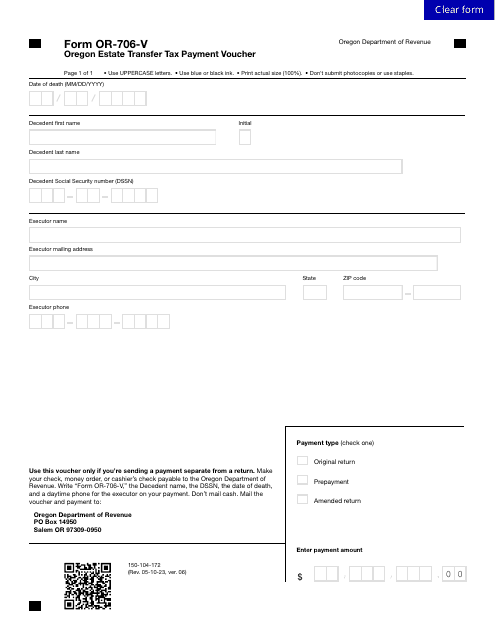

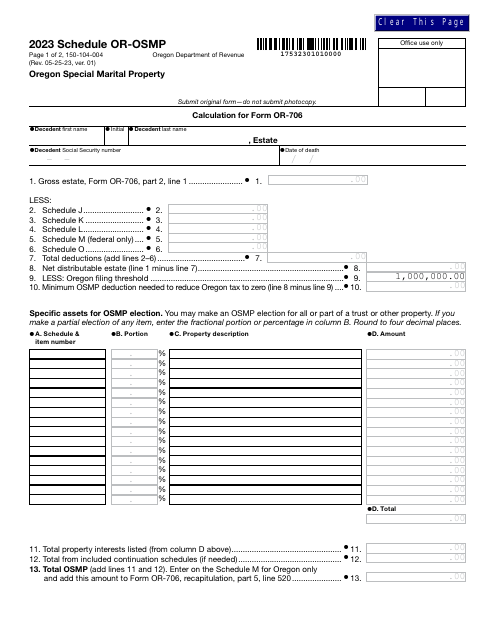

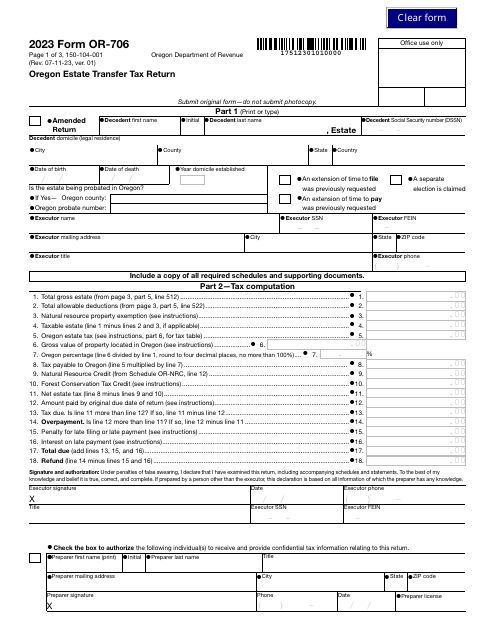

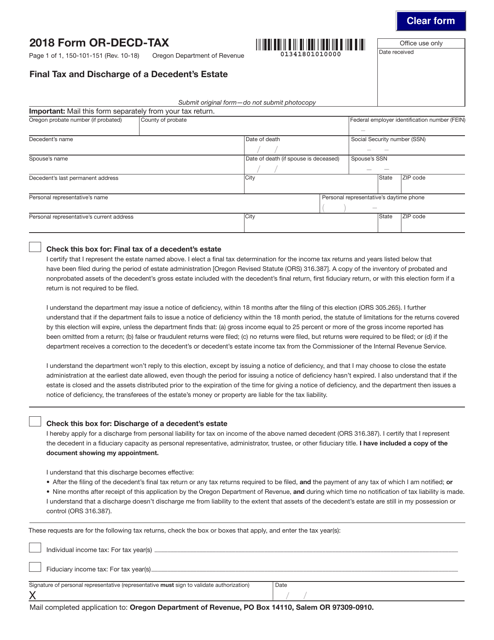

This form is used for the final tax and discharge of a decedent's estate in Oregon.

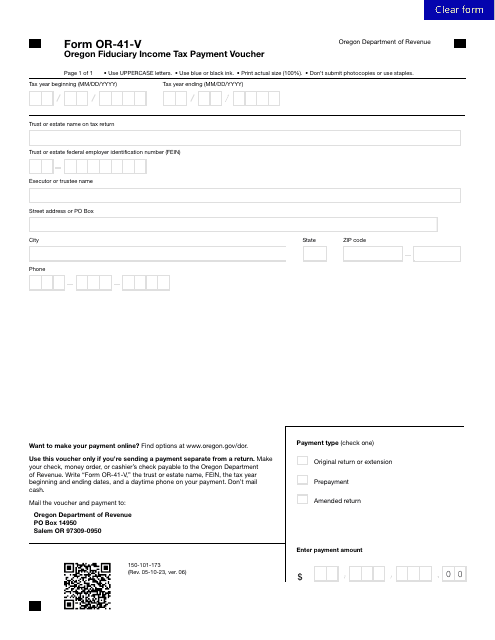

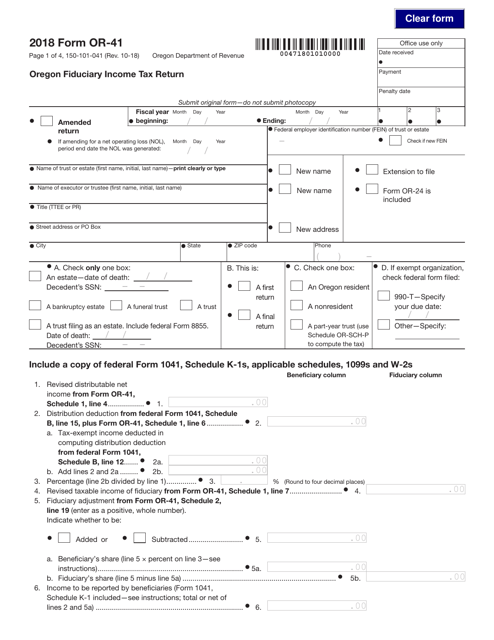

This Form is used for filing the Oregon Fiduciary Income Tax Return for individuals. It is specific to the state of Oregon.

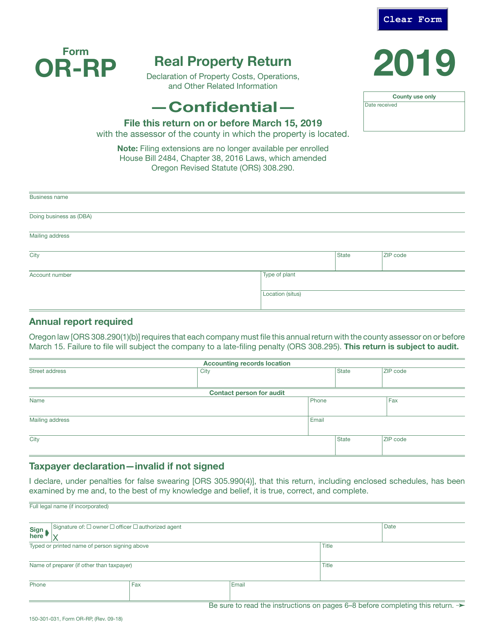

This form is used for filing a real property return in the state of Oregon. It is required by the Oregon Department of Revenue and must be completed by property owners to report their real estate holdings.

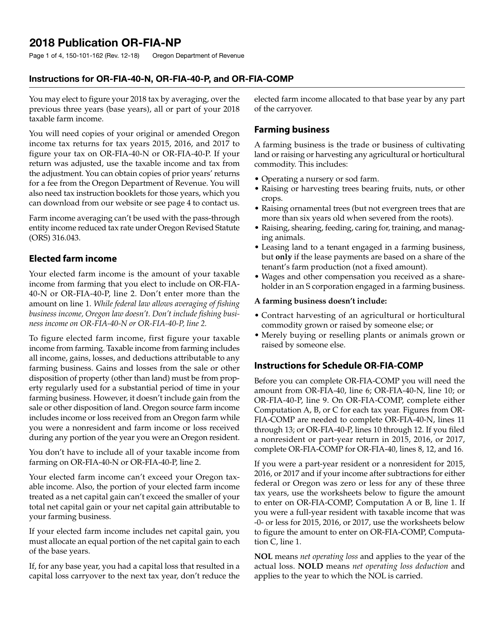

This form is used for filing publication or-Fia-Np in the state of Oregon.

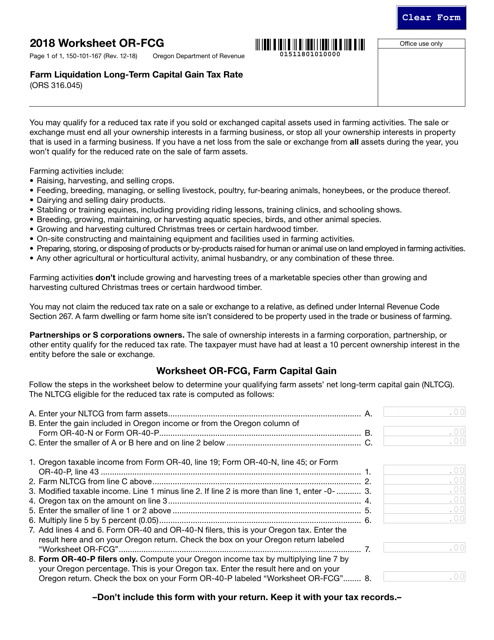

This form is used for calculating the long-term capital gain tax rate for farm liquidation in Oregon.

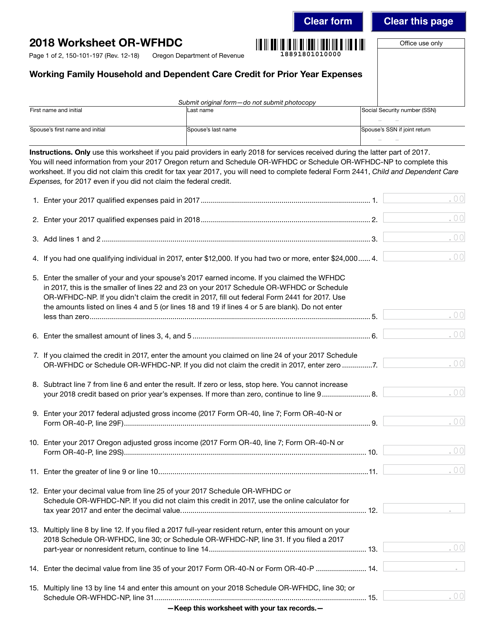

This form is used for claiming the Working Family Household and Dependent Care Credit for prior year expenses in the state of Oregon.