Oregon Tax Forms and Templates

Documents:

168

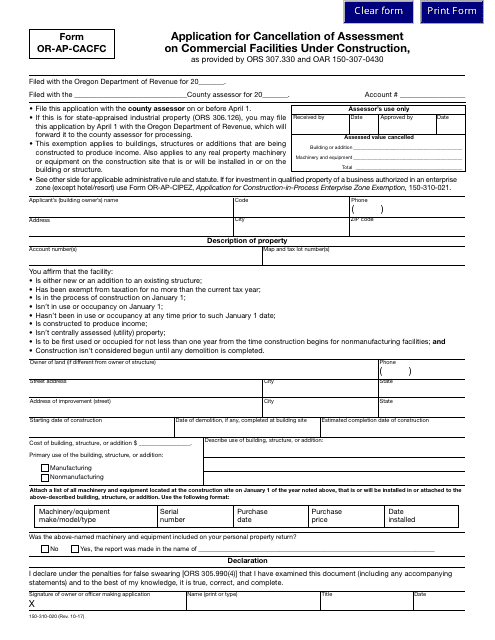

This form is used for applying to cancel the assessment on commercial facilities under construction in Oregon.

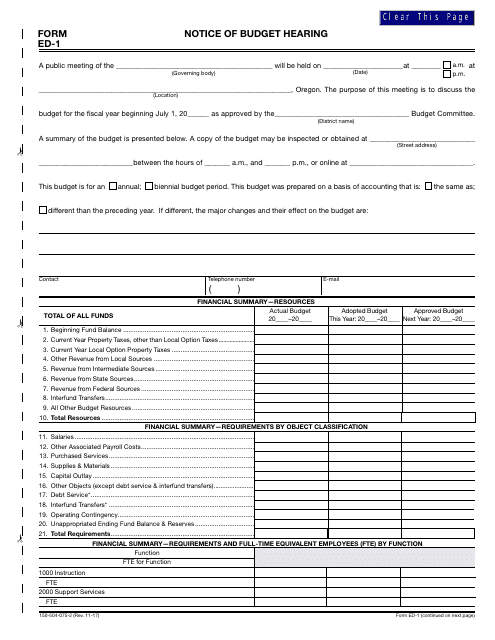

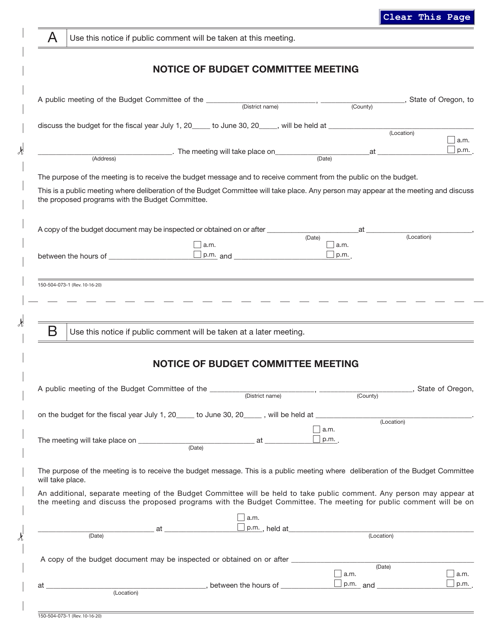

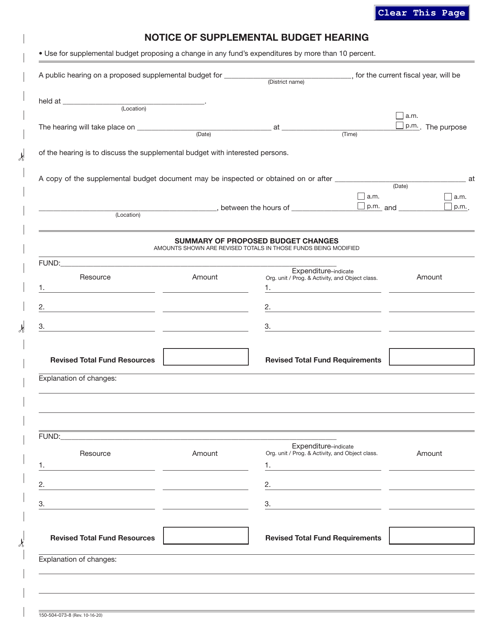

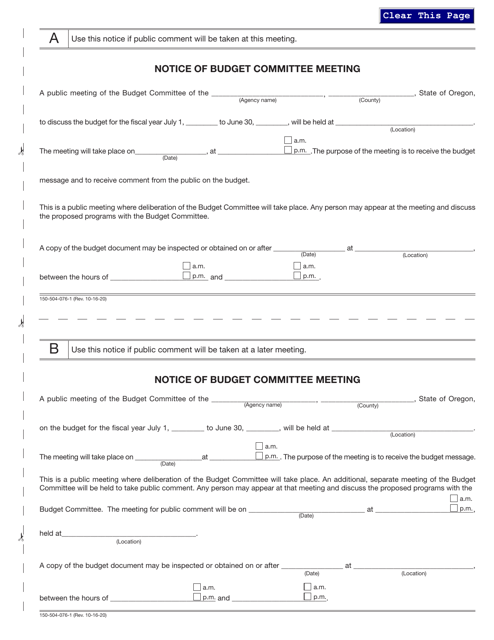

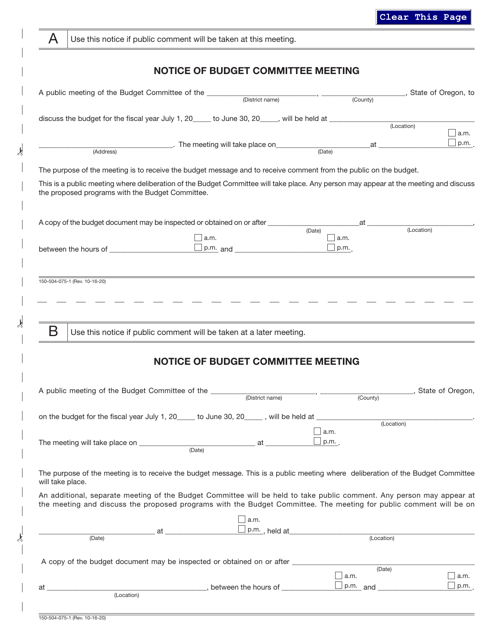

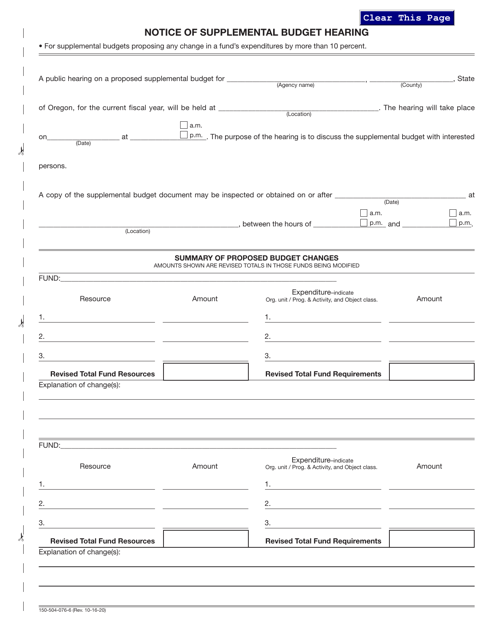

This form is used for notifying residents of Oregon about an upcoming budget hearing.

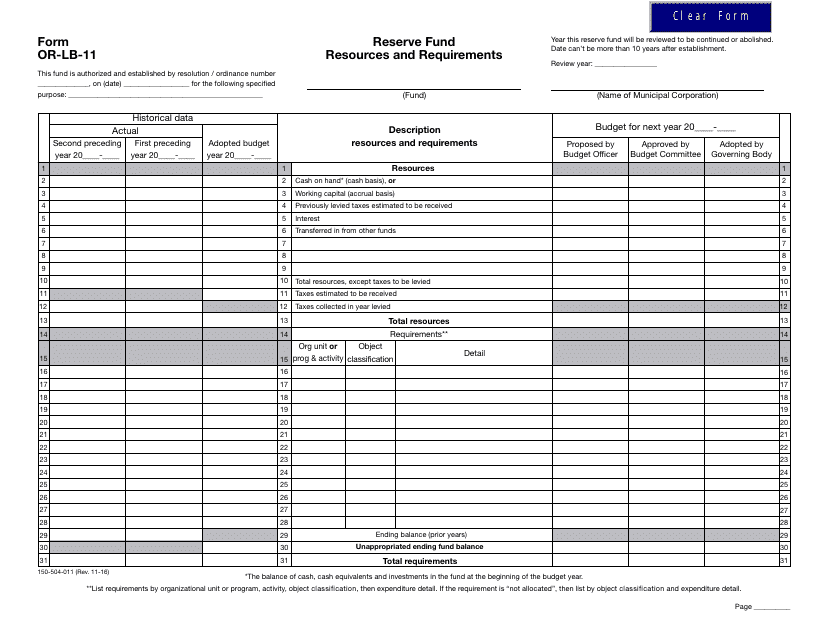

This Form is used for reporting and tracking the reserve funds of an organization in Oregon. It helps to manage and meet the financial requirements for maintaining a reserve fund.

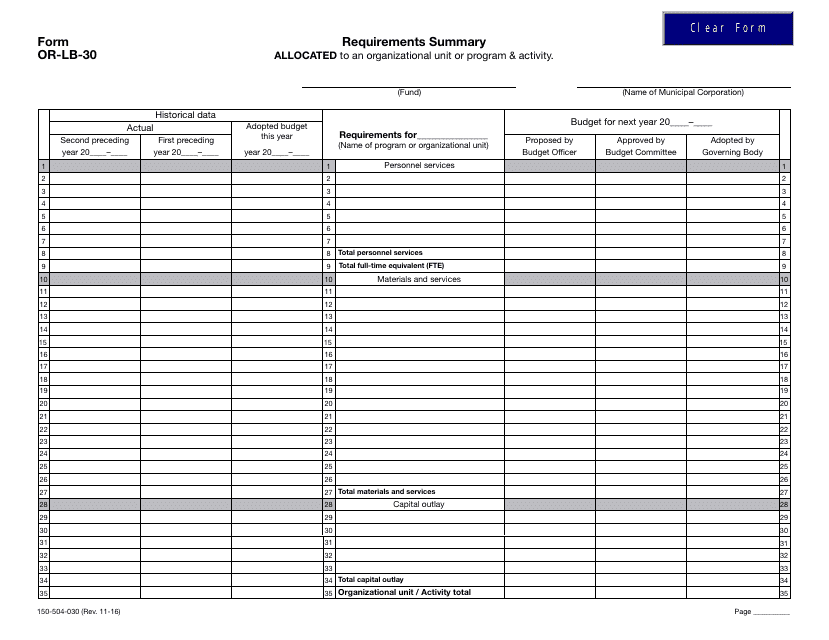

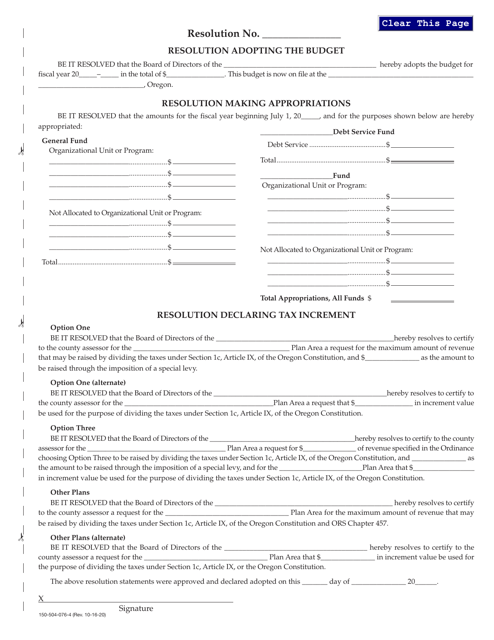

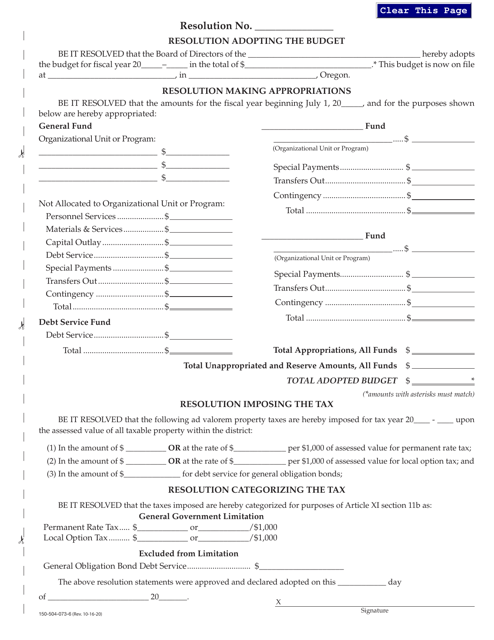

This form is used for summarizing the requirements that are allocated or not allocated to an organizational unit or program in Oregon.

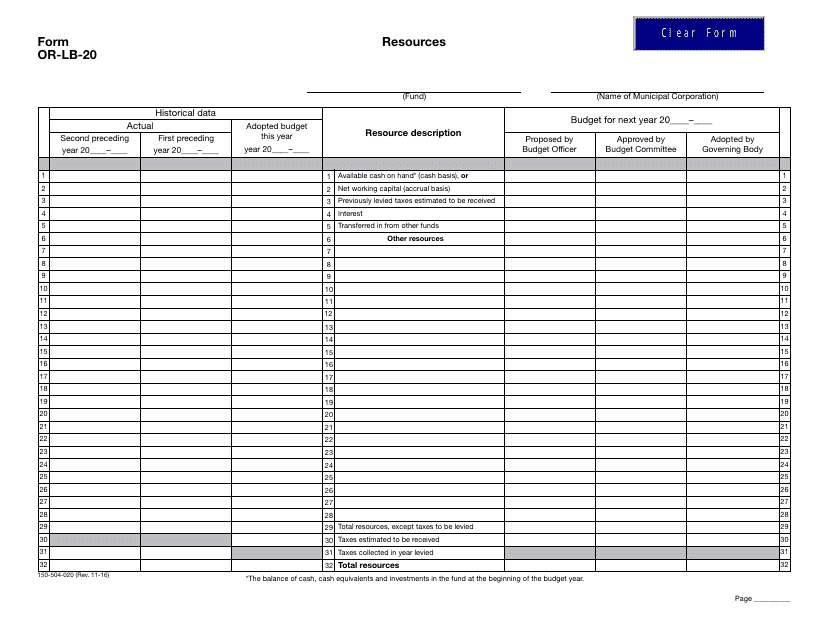

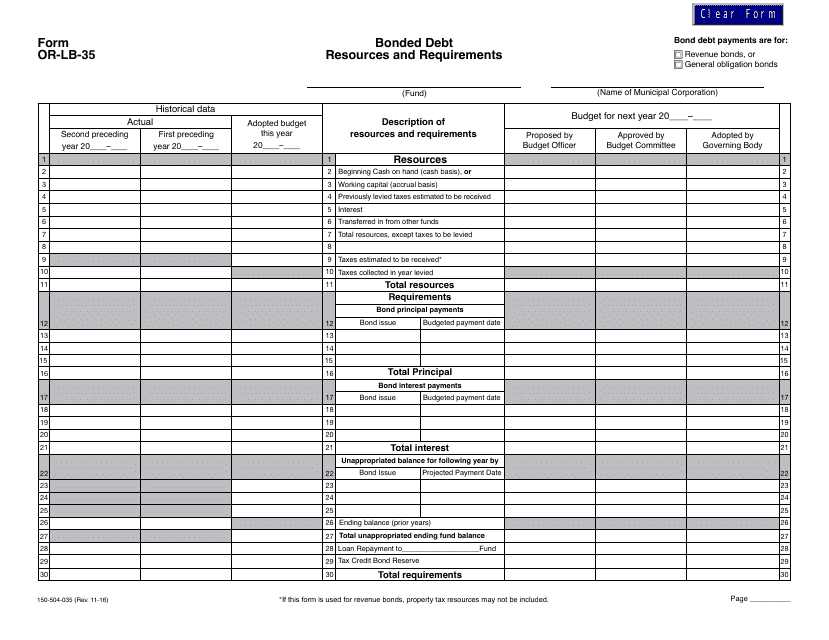

This form is used for accessing resources and understanding the requirements related to bonded debt in the state of Oregon.

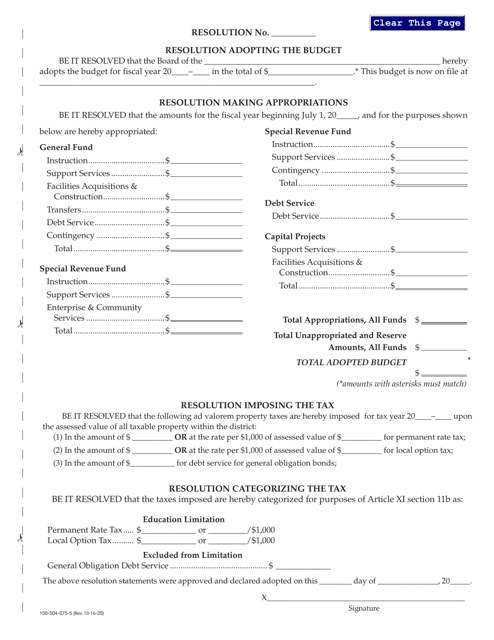

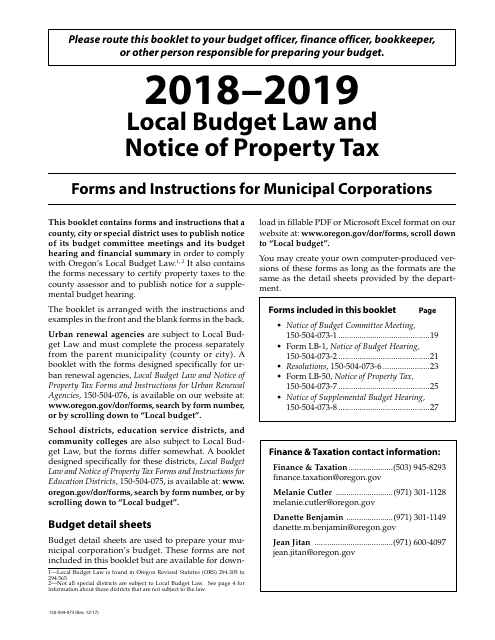

This Form is used for municipal corporations in Oregon to comply with the Local Budget Law and provide notice of property tax. It includes forms and instructions for filing.

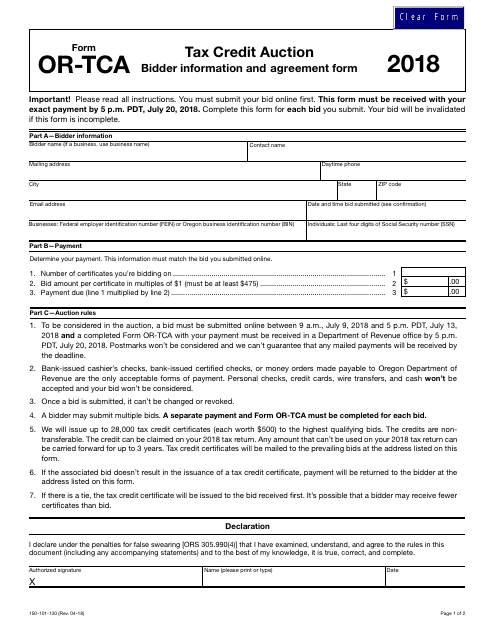

This form is used for participants in the Oregon Tax Credit Auction to provide their bidder information and agreement.

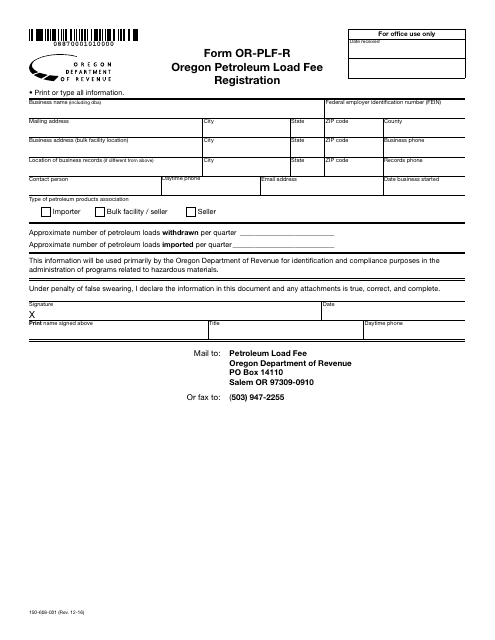

This document is used for registering and paying the petroleum load fee in the state of Oregon.

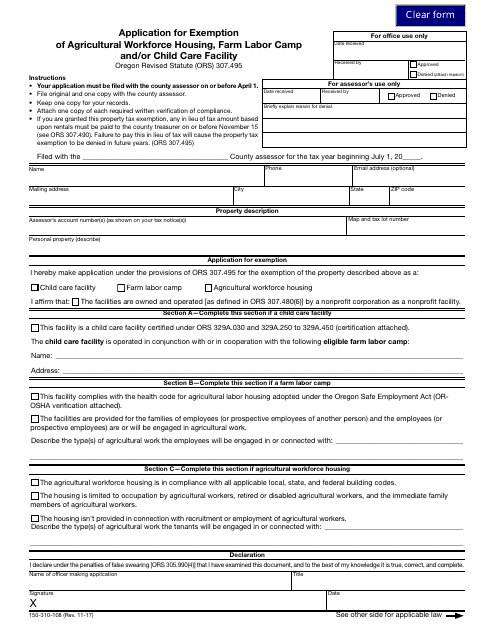

This Form is used for applying for exemption of agricultural workforce housing, farm labor camp, and/or child care facility in the state of Oregon.

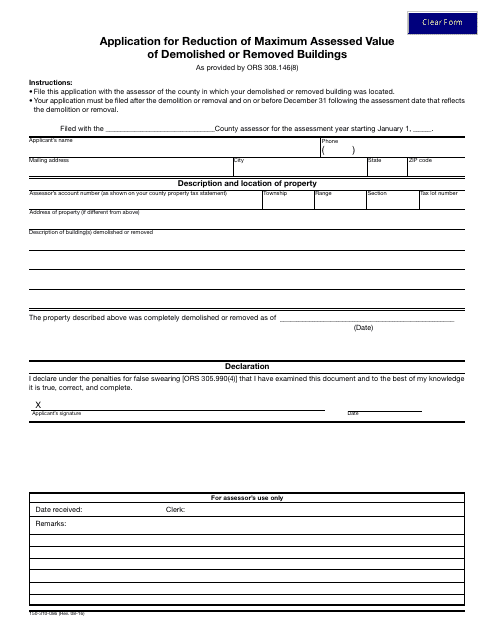

This form is used for applying to reduce the maximum assessed value of buildings that have been demolished or removed in Oregon.

This form is used for applying for a tax exemption on real and personal property in Oklahoma.

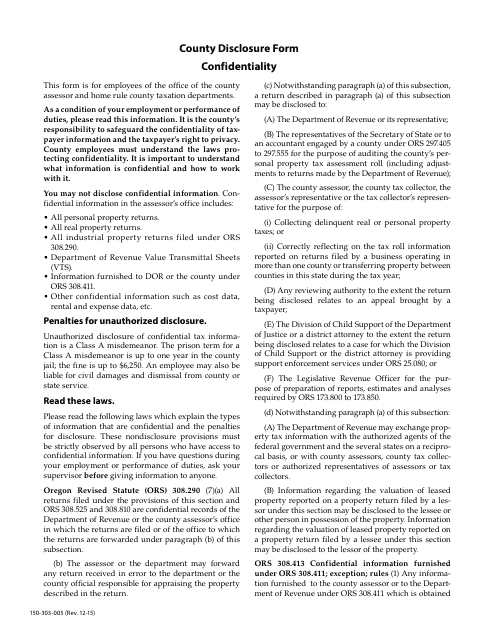

This form is used to disclose confidential information on a county level in Oregon. It also serves as a certificate of confidentiality.

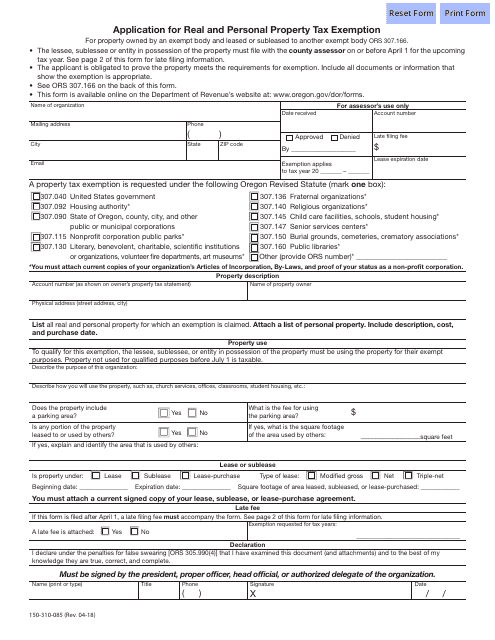

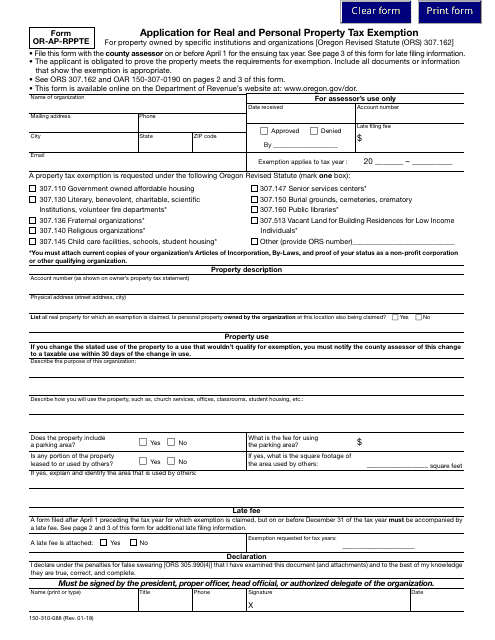

This Form is used for applying for a real and personal property tax exemption in Oregon.

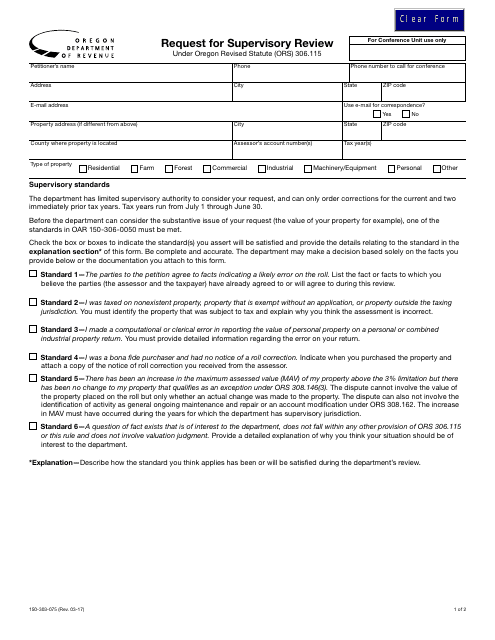

This Form is used for requesting a supervisory review in the state of Oregon.

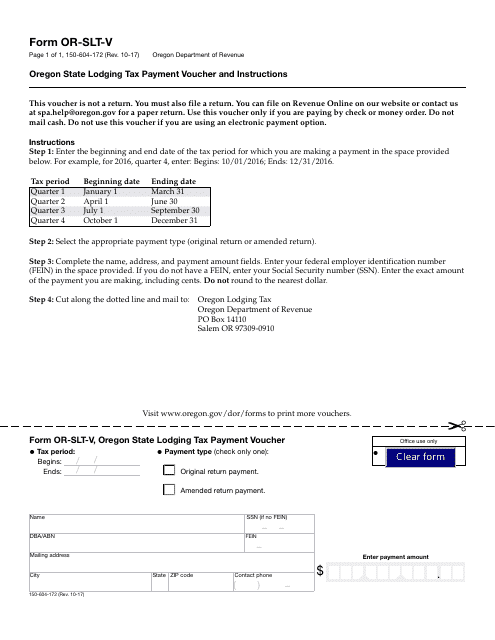

This Form is used for making lodging tax payments in the state of Oregon. It includes instructions on how to fill out the form and submit the payment.

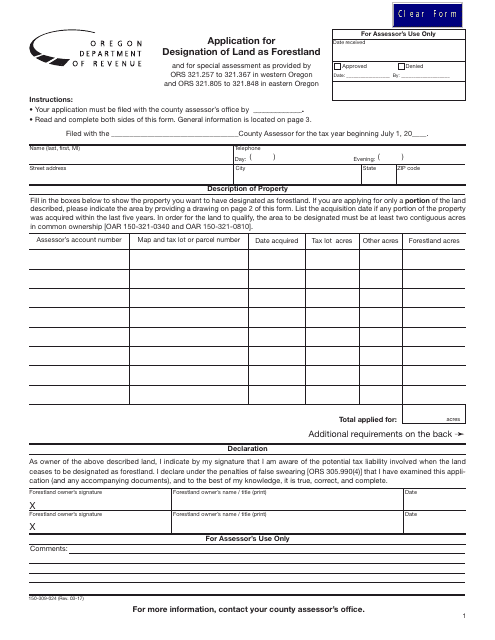

This form is used for applying to designate land in Oregon as forestland.

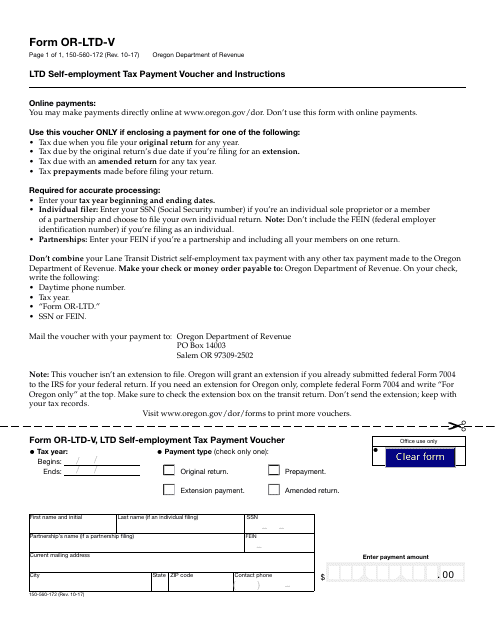

This Form is used for making self-employment tax payments in Oregon and provides instructions on how to fill it out.

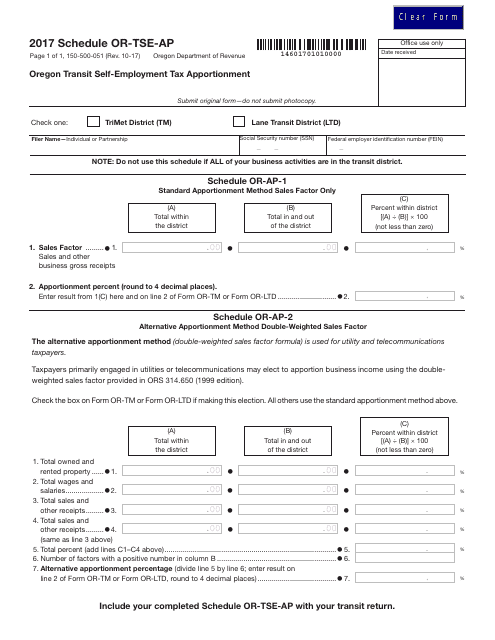

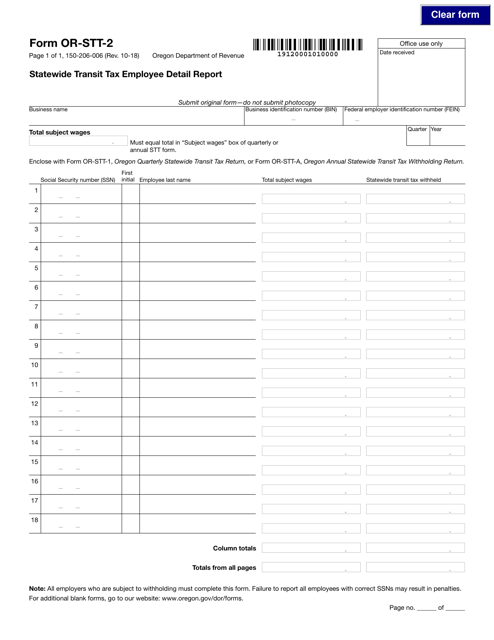

This document is used for apportioning self-employment tax for transit in Oregon.

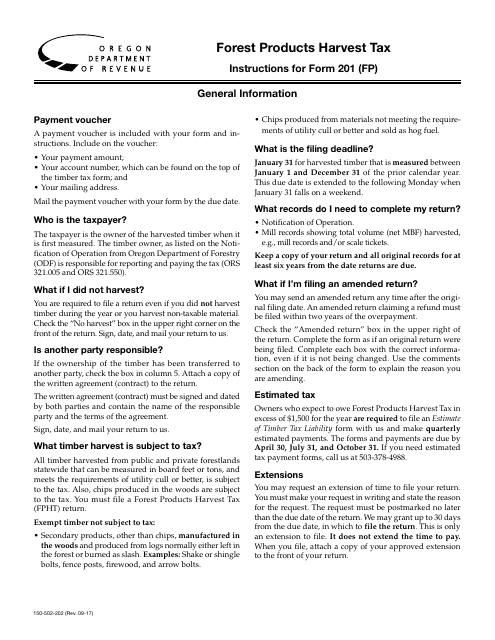

This form is used for reporting and paying the Forest Products Harvest Tax in the state of Oregon.

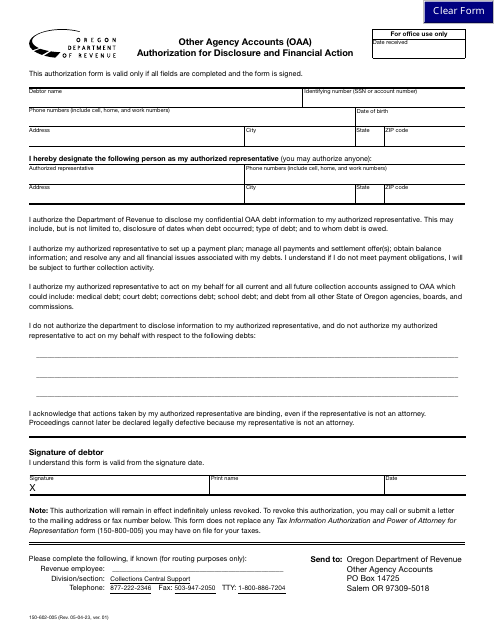

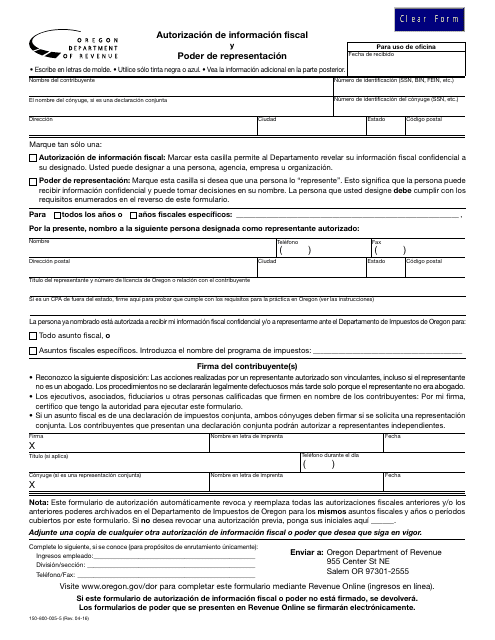

This type of document is an Authorization of Fiscal Information and Power of Representation form in Oregon, used to grant someone the authority to access and represent your tax information.

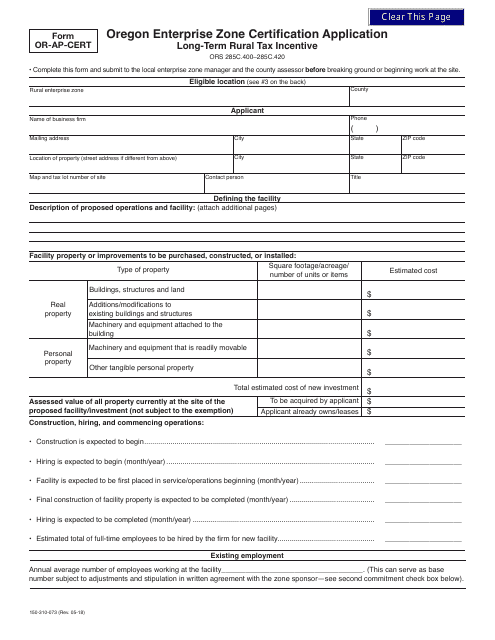

This document is used for applying for Enterprise Zone Certification in Oregon. It helps businesses determine their eligibility for certain tax incentives and benefits offered through the Enterprise Zone program.

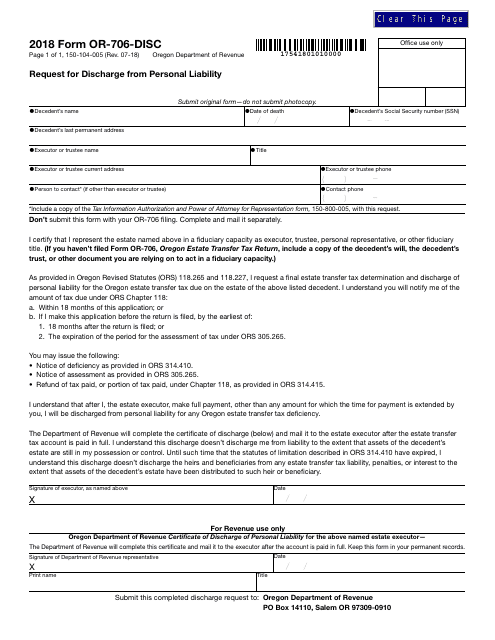

This Form is used for requesting discharge from personal liability in Oregon.